From Peak to Trough: How the Finnish Real Estate Market Has Changed in 5 Years

The Finnish residential real estate market has managed to reach its peak and activity over the past 5 years, and then show an impressive decline. Let's consider what results it ended 2024 with, as well as what it began 2025 with.

A Brief Analysis of the Finnish Market in Recent Years

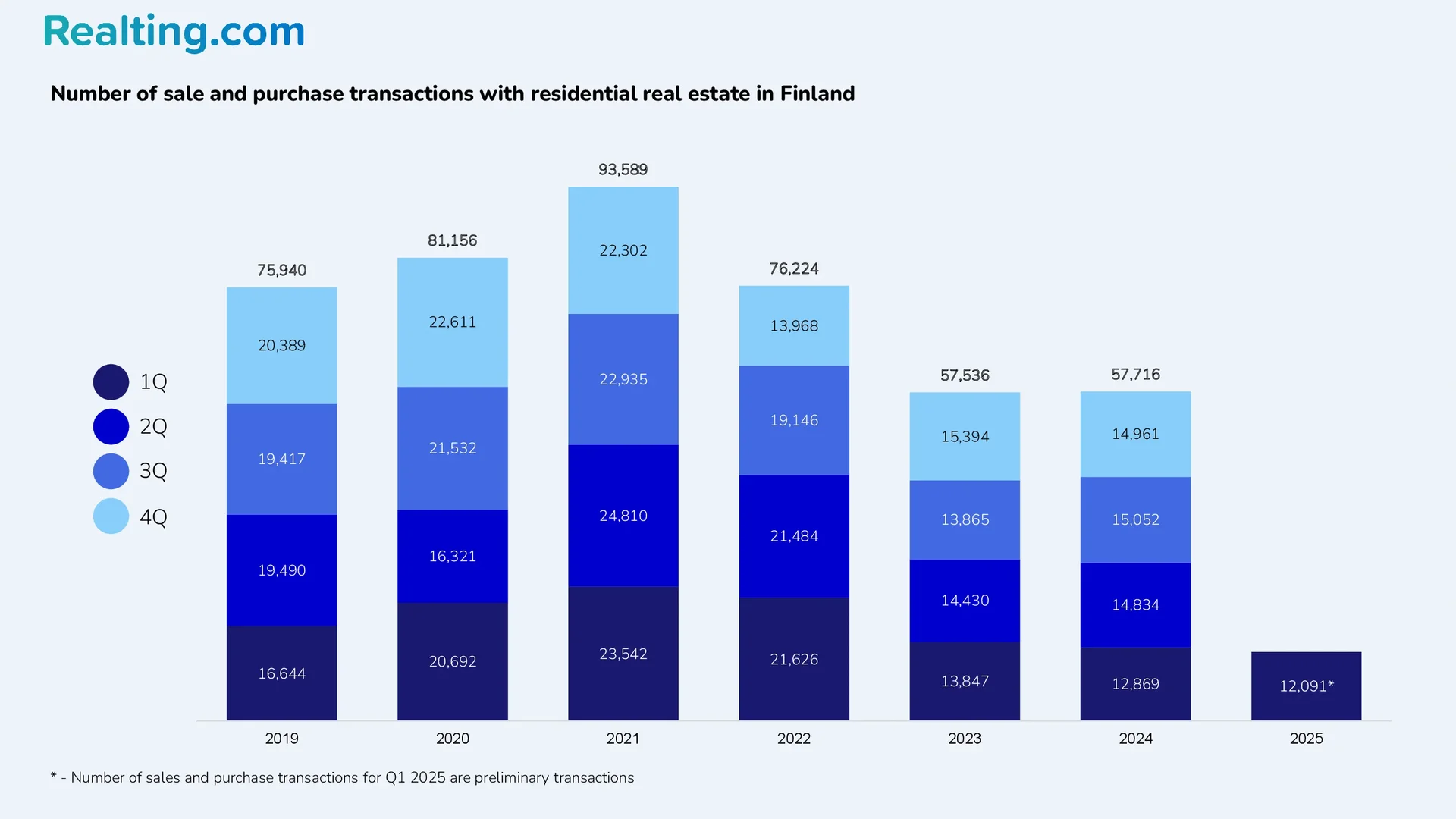

According to data from Statistics Finland, from 2015 to 2019, there were an average of 73,240 residential property purchase and sale transactions in Finland each year. However, in 2020, the number of residential property transactions increased significantly, reaching 81,156 purchase and sale transactions by the end of the year.

In turn, 2021 set a record for the number of transactions on the residential real estate market in Finland – 93,589 purchase and sale transactions. This result was possible due to the following factors: low interest rates on loans, a high level of activity in the construction of new buildings in previous years, and the general economic well-being of the country. Housing prices, which were characterized by moderate growth in most large cities during this period, also played a role.

High demand, coupled with low interest rates on loans, was one of the reasons that led to the acceleration of inflation. It is worth noting that this situation was observed in almost all countries of the European Union and the Eurozone. From mid-2022 to early 2024, interest rates on loans grew: at the peak of growth, interest rates were four times higher than interest rates in the first half of 2020. A decline in the construction sector also began: the number of issued building permits decreased significantly, which in the future led to a noticeable decrease in sales of new housing.

The above events resulted in 18.6% fewer housing transactions being registered in 2022 than in 2021. Although the housing market in 2022 showed a noticeable decline, the result of 76,224 transactions still exceeded the results of 2015-2019.

However, already in 2023, the number of housing transactions dropped to 57,536 transactions, which is a quarter lower than in 2022. 2024 showed similar results compared to 2023: 57,716 purchase and sale transactions were registered at the end of 2024. Such an impressive drop in market activity can be described as nothing less than the “bottom of the housing market.”

For the Finnish residential property market, 2025 has started with 12,091 sales transactions in Q1 2025 (according to Statistics Finland) – 19.2% less than in Q4 2024 and 6% less than in Q1 2024. It is important to add here: the data for Q1 is preliminary and may change upwards over time.

Already now, some experts in the Finnish real estate market say that the total number of transactions for the first quarter of 2025 exceeds the figure for the first quarter of last year. Confidence in such statements is added by the fact that the volume of mortgage loans issued in the first quarter of 2025 exceeds the figures for the first quarter of 2024 and the first quarter of 2023. It should also be noted that since April 2024, there has been a gradual decrease in interest rates on housing loans.

Credit is still expensive for the majority of the population, and weak economic growth, coupled with general uncertainty in both the economic and political situation, is forcing the population to take a wait-and-see approach to purchasing housing. It is too early to talk about the recovery of the Finnish residential property market, but there are already noticeable trends towards moderate to moderate growth in sales in the coming quarters of this year.

Structure of the Finnish Residential Property Market

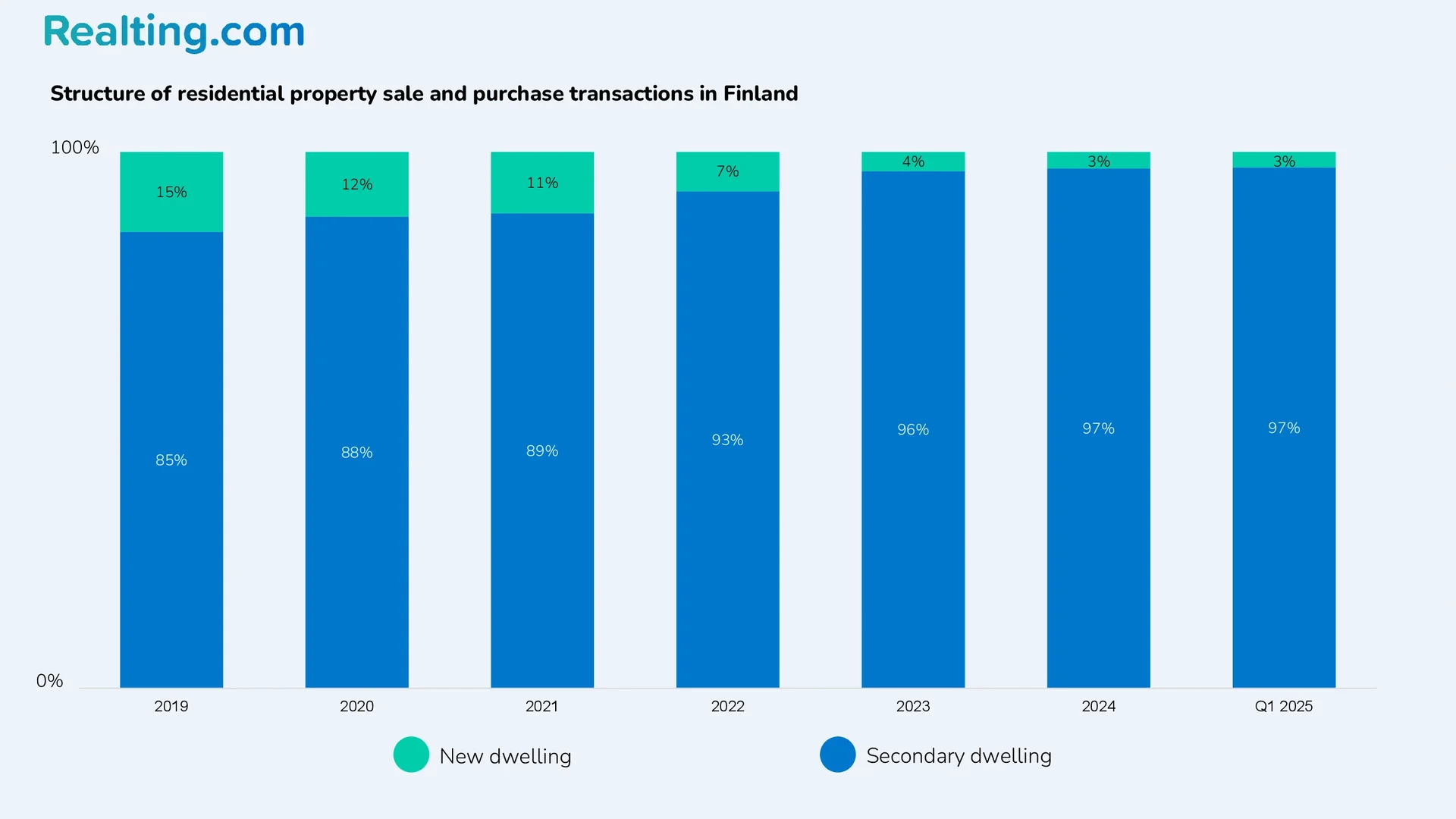

Up until 2021, the share of new residential real estate in sales transactions exceeded 10%, and in 2019 it was 15%. Since 2021, the number of building permits issued in Finland has been decreasing, and new housing sales have also decreased. If in 2020–2021 the average quarterly number of new housing transactions exceeded 2,500 transactions, then in 2022 this figure dropped to 1,400 transactions, and in 2023 and 2024 it was less than 500 transactions.

As a result, in 2023 and 2024, the share of new housing in purchase and sale transactions was 4% and 3%, respectively. In the first quarter of 2025, 345 transactions with new housing were registered, which is 3% of all purchase and sale transactions in the quarter.

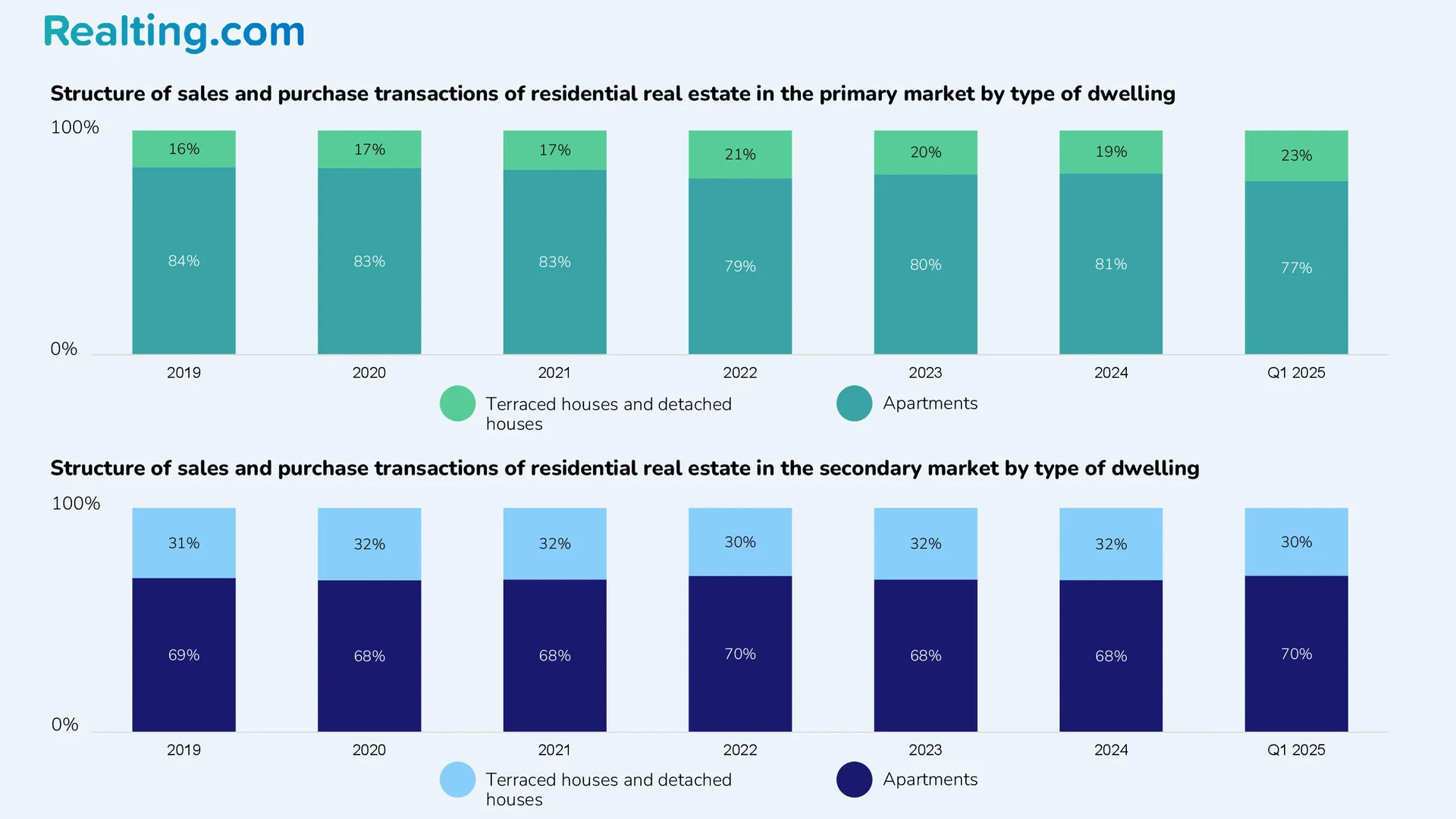

In the structure of both the primary and secondary housing markets, apartments predominate.

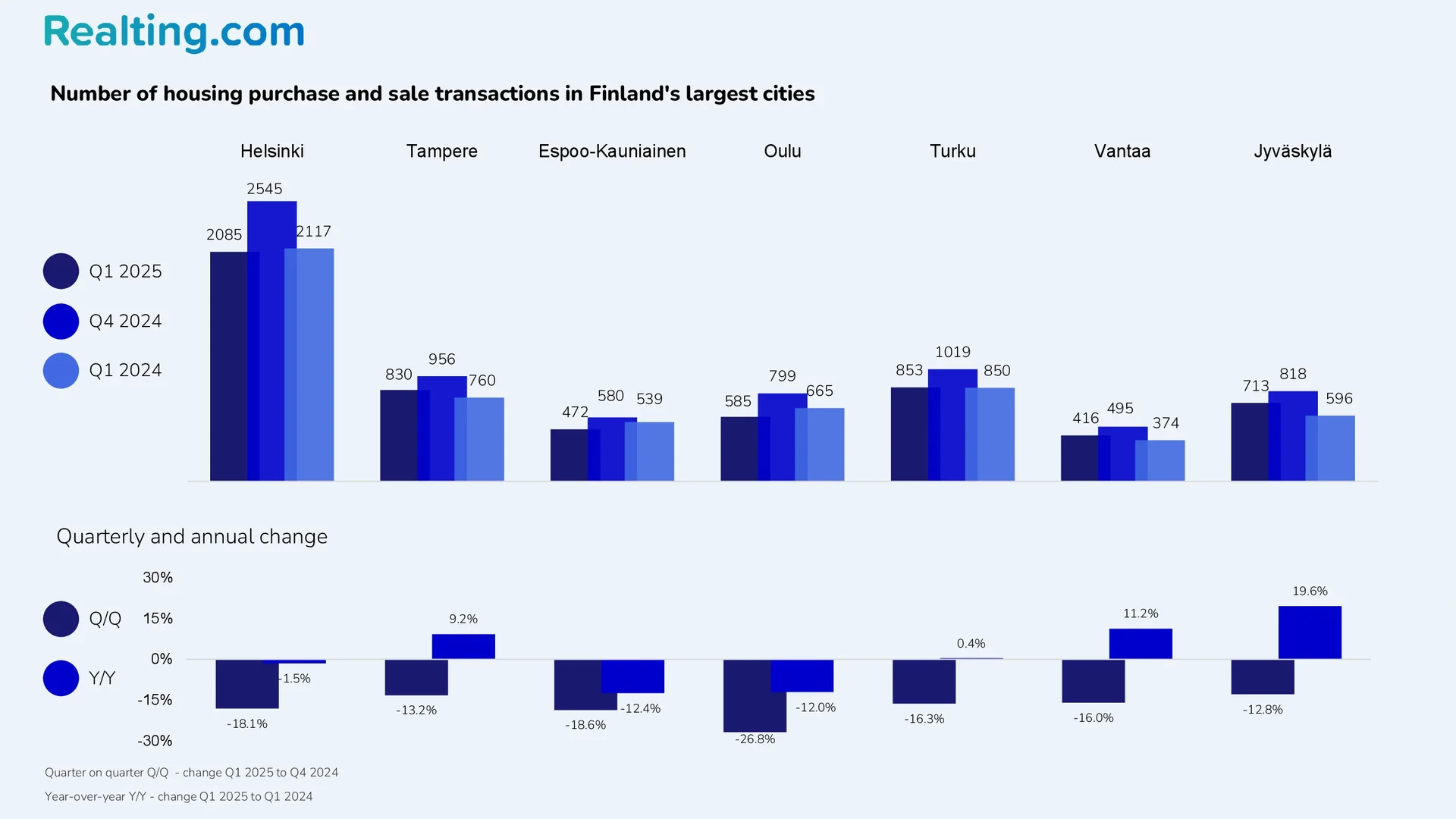

The leader in the number of residential property purchase and sale transactions is traditionally the capital – 2085 purchase and sale transactions were registered in Helsinki in the first quarter of 2025, which is 2.5 times more than in Tampere, the city that showed the second result in the number of residential property purchase and sale transactions.

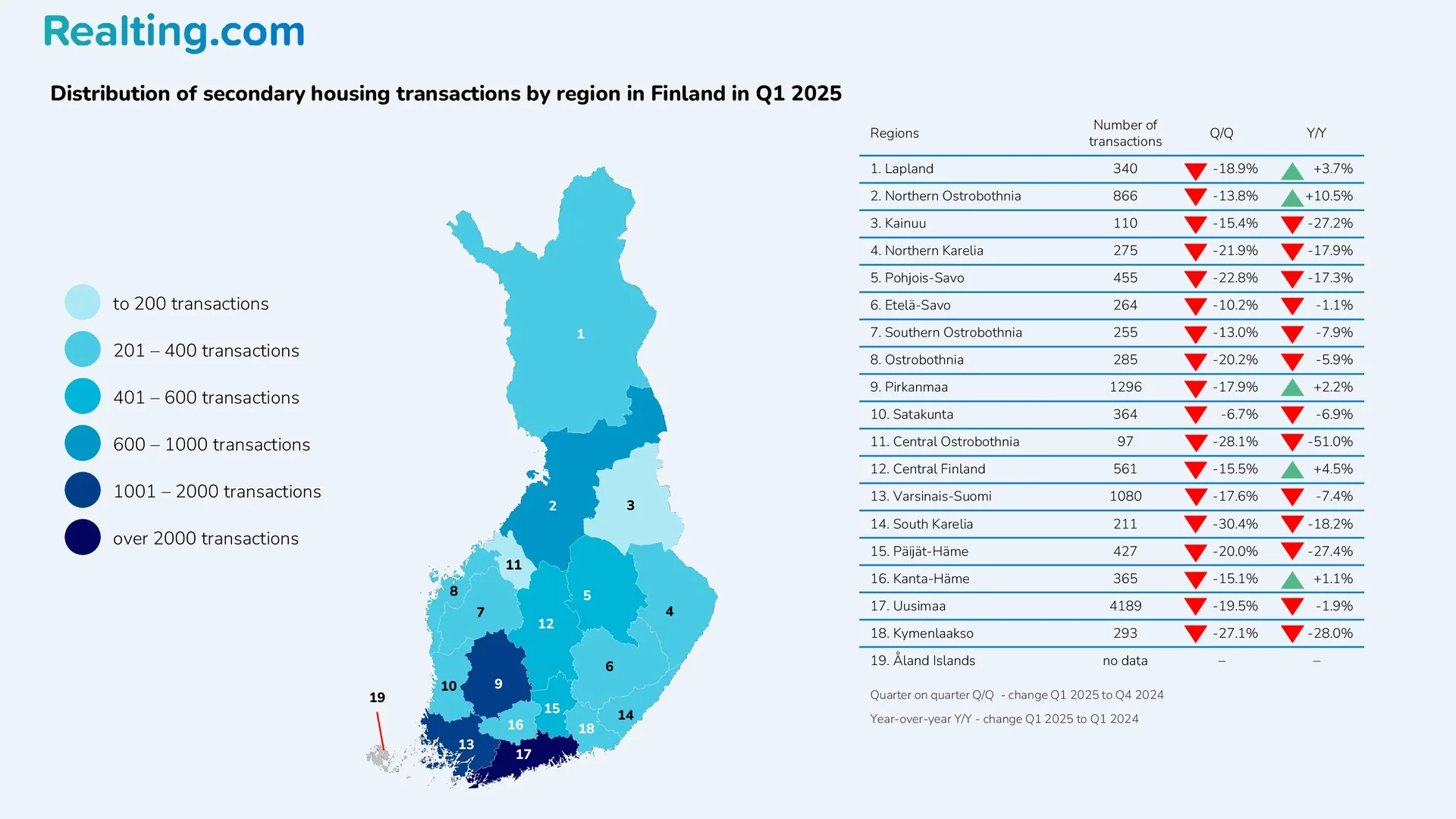

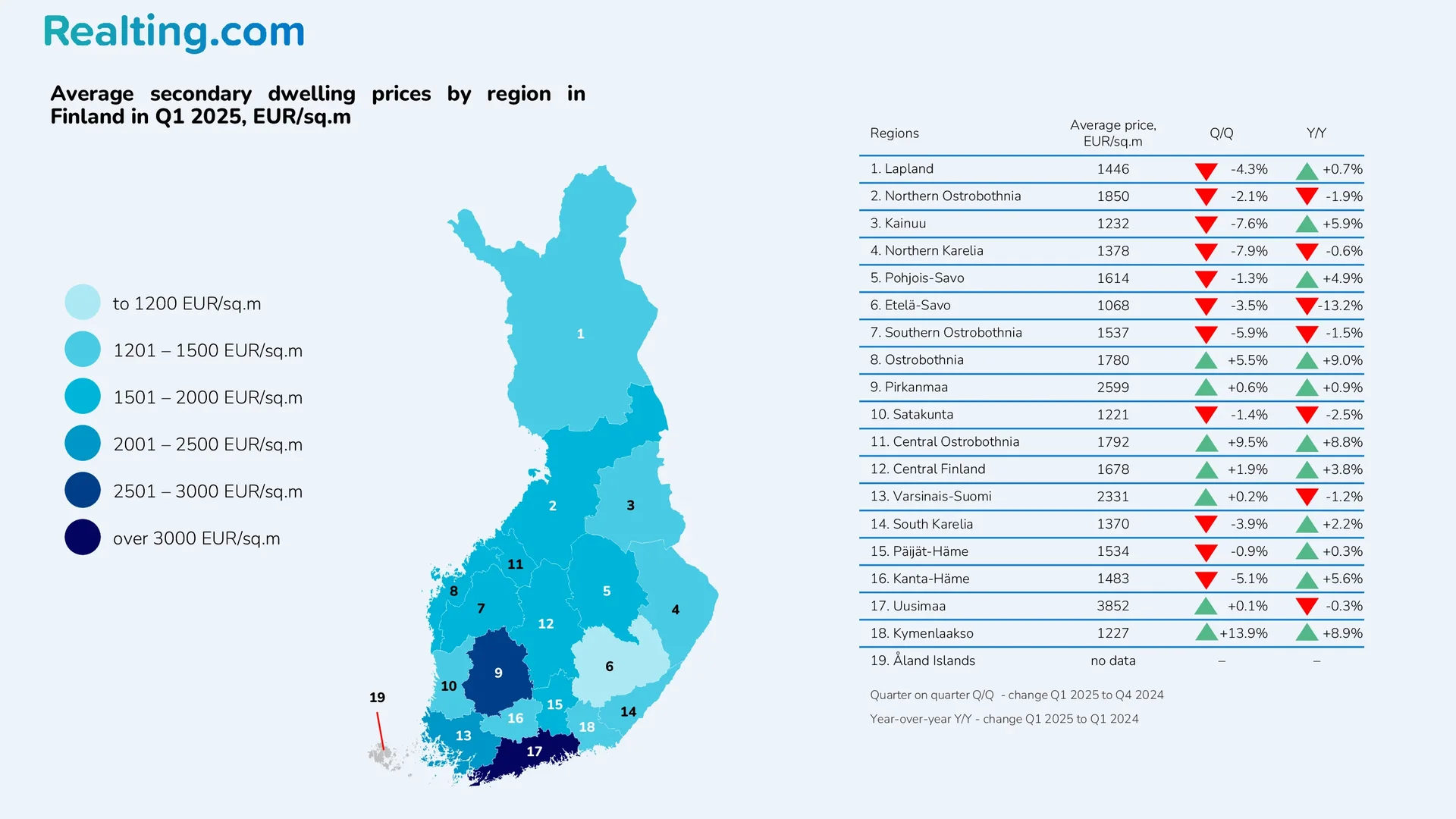

Statistics Finland also provides data on the number of secondary market transactions by region in Finland. The region with the largest number of secondary market transactions is Uusimaa, with 4,189 purchase and sale transactions registered in Q1 2025. Uusimaa is a region that includes the country's capital, the most populous and economically developed city in Finland, so it consistently ranks first in terms of the number of secondary market transactions.

The region with the fewest transactions is Central Ostrobothnia, with only 97 transactions on the secondary market in Q1 of this year. This region is second to last in terms of population and area, with the Åland Islands region coming in last (no data on the number of transactions in this region is available).

Prices on the Finnish Residential Property Market

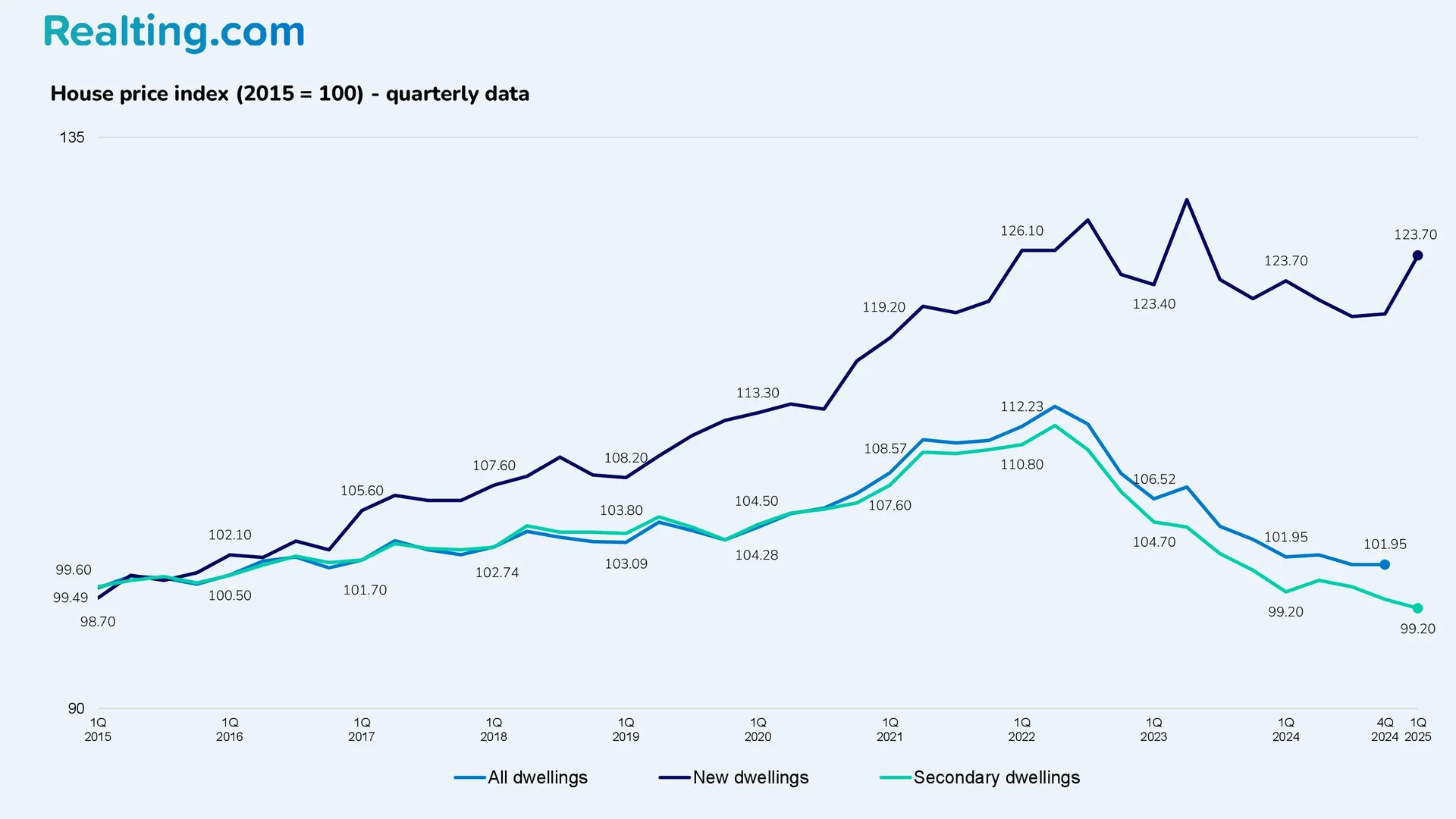

According to the Statistical Office of the European Union data, Finland is the country where the house price index has changed the least since 2015.

According to the Statistical Office of the European Union, the residential property price index in Q4 2024 decreased by 1.9% compared to Q4 2023; compared to Q3 2024, the price index remained unchanged.

New and existing home price index:

- The existing residential property price index in Q1 2025 was set at 97.90, down 0.7% from the previous period and down 1.3% from Q1 2024.

- The New Home Price Index in Q1 2025 was 125.70, up 3.8% from Q4 2024. Over the year, the New Home Price Index has increased by 1.6%.

Let's take a closer look at the level of residential property prices in Finland according to Statistics Finland.

Average Prices on the Primary Residential Property Market in Finland

Let's start with the primary market. The National Statistical Institute of Finland provides average prices of residential real estate on the primary market for Greater Helsinki (the capital region that includes the cities of Helsinki, Vantaa, Espoo, and Kauniainen); the whole country, excluding Greater Helsinki; and the whole country. Prices are given for apartments and townhouses (the average price for townhouses is also relevant for detached houses).

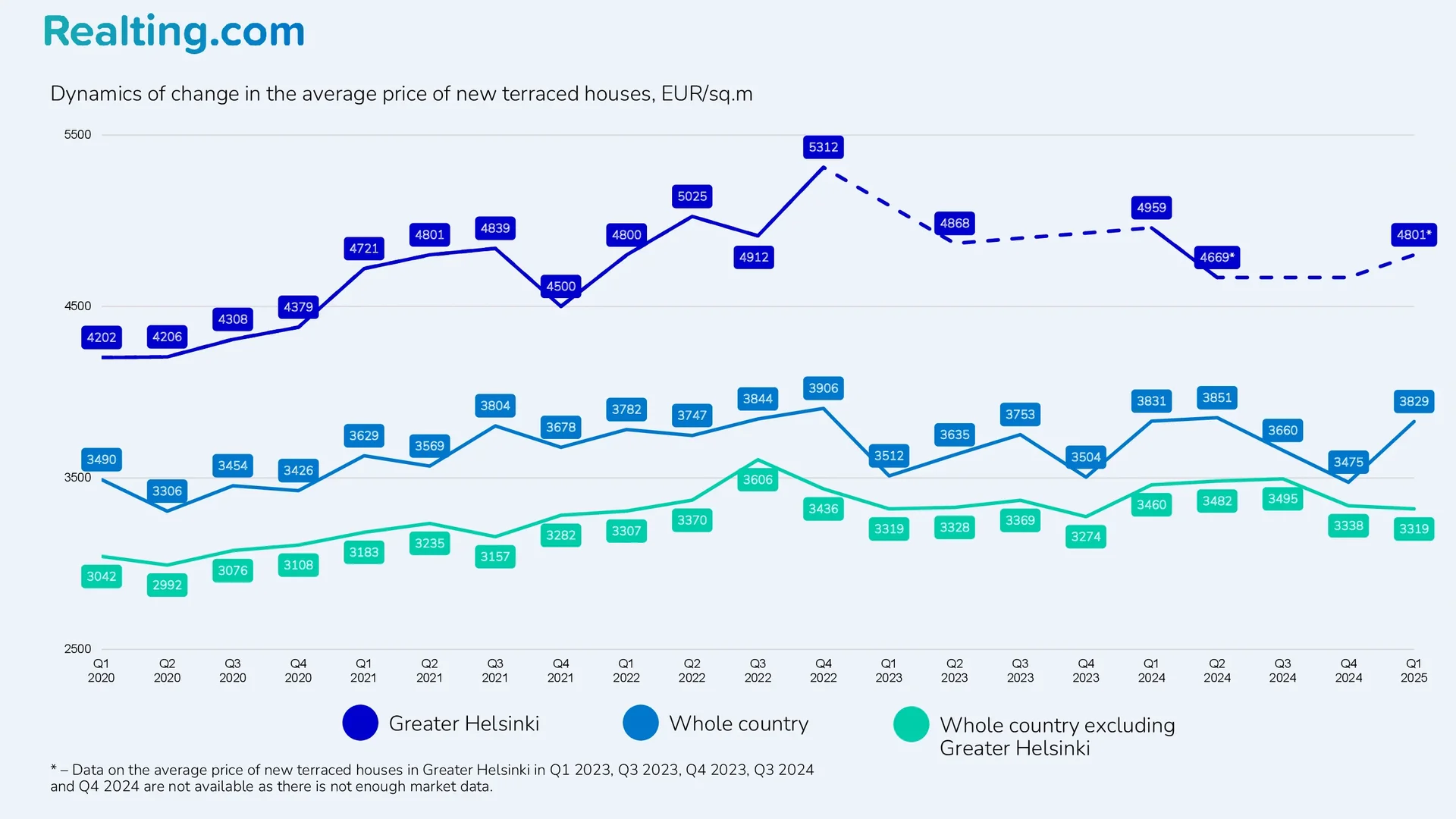

Average price of townhouses on the primary market

|

Average price, EUR/sq.m in Q1 2025 |

Change by Q4 2024 |

Change by Q1 2024 |

Change to Q1 2020 |

|

|

Greater Helsinki |

4801 |

- |

-3.2% |

+14.3% |

|

The whole country |

3829 |

+10.2% |

-0.1% |

+9.7% |

|

The whole country, except Greater Helsinki |

3319 |

-0.6% |

-4.1% |

+9.1% |

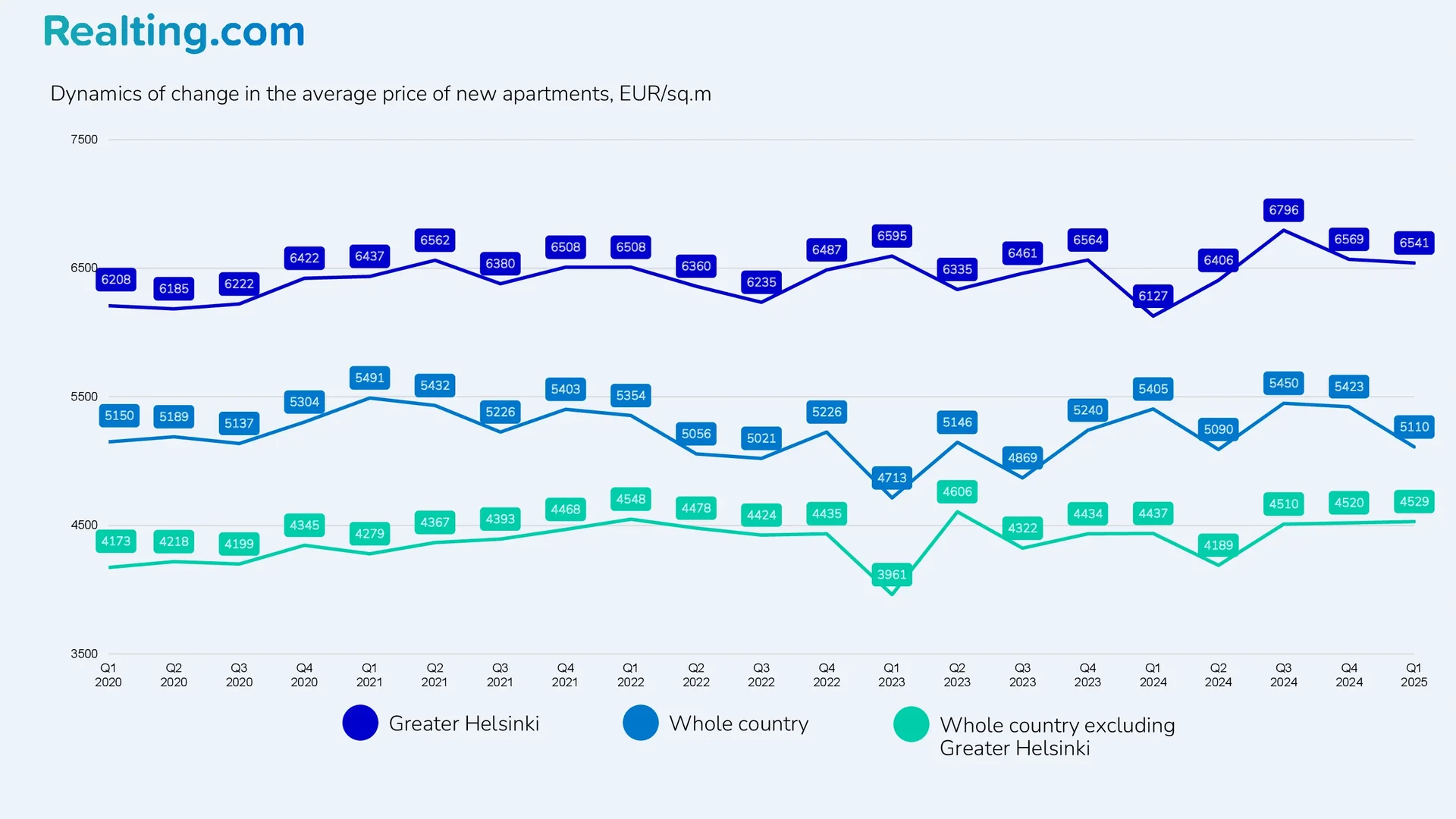

Average price of apartments on the primary market

|

Average price, EUR/sq.m in Q1 2025 |

Change by Q4 2024 |

Change by Q1 2024 |

Change to Q1 2020 |

|

|

Greater Helsinki |

6541 |

-0.4% |

+6.8% |

+5.4% |

|

The whole country |

5110 |

-5.8% |

-5.5% |

-0.8% |

|

The whole country, except Greater Helsinki |

4529 |

+0.2% |

+2.1% |

+8.5% |

Average Prices on the Secondary Residential Property Market in Finland

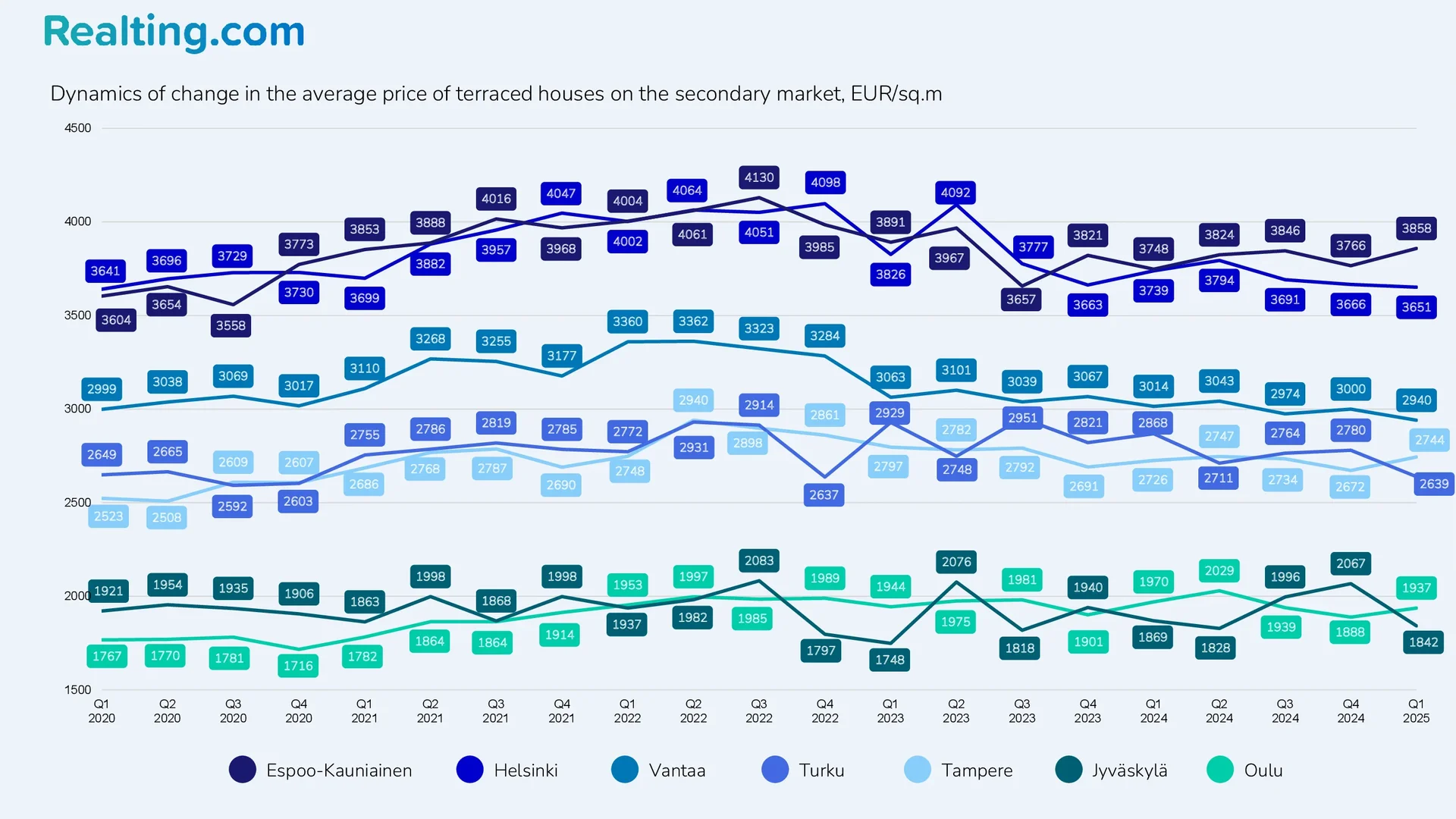

The most expensive townhouses by average price per square meter over the past six quarters have been sold in the cities of Espoo and Kauniainen, which are located west of Helsinki and are part of the Greater Helsinki agglomeration.

Average price of townhouses on the secondary market:

|

Average price, EUR/sq.m in Q1 2025 |

Change by Q4 2024 |

Change by Q1 2024 |

Change to Q1 2020 |

|

|

Espoo-Kauniainen |

3858 |

+2.4% |

+2.9% |

+7.0% |

|

Helsinki |

3651 |

-0.4% |

-2.4% |

+0.3% |

|

Vantaa |

2940 |

-2.0% |

-2.5% |

-2.0% |

|

Turku |

2639 |

-5.1% |

-8.0% |

-0.4% |

|

Tampere |

2744 |

+2.7% |

+0.7% |

+8.8% |

|

Jyvaskyla |

1842 |

-10.9% |

-1.4% |

-4.1% |

|

Oulu |

1937 |

+2.6% |

-1.7% |

+9.6% |

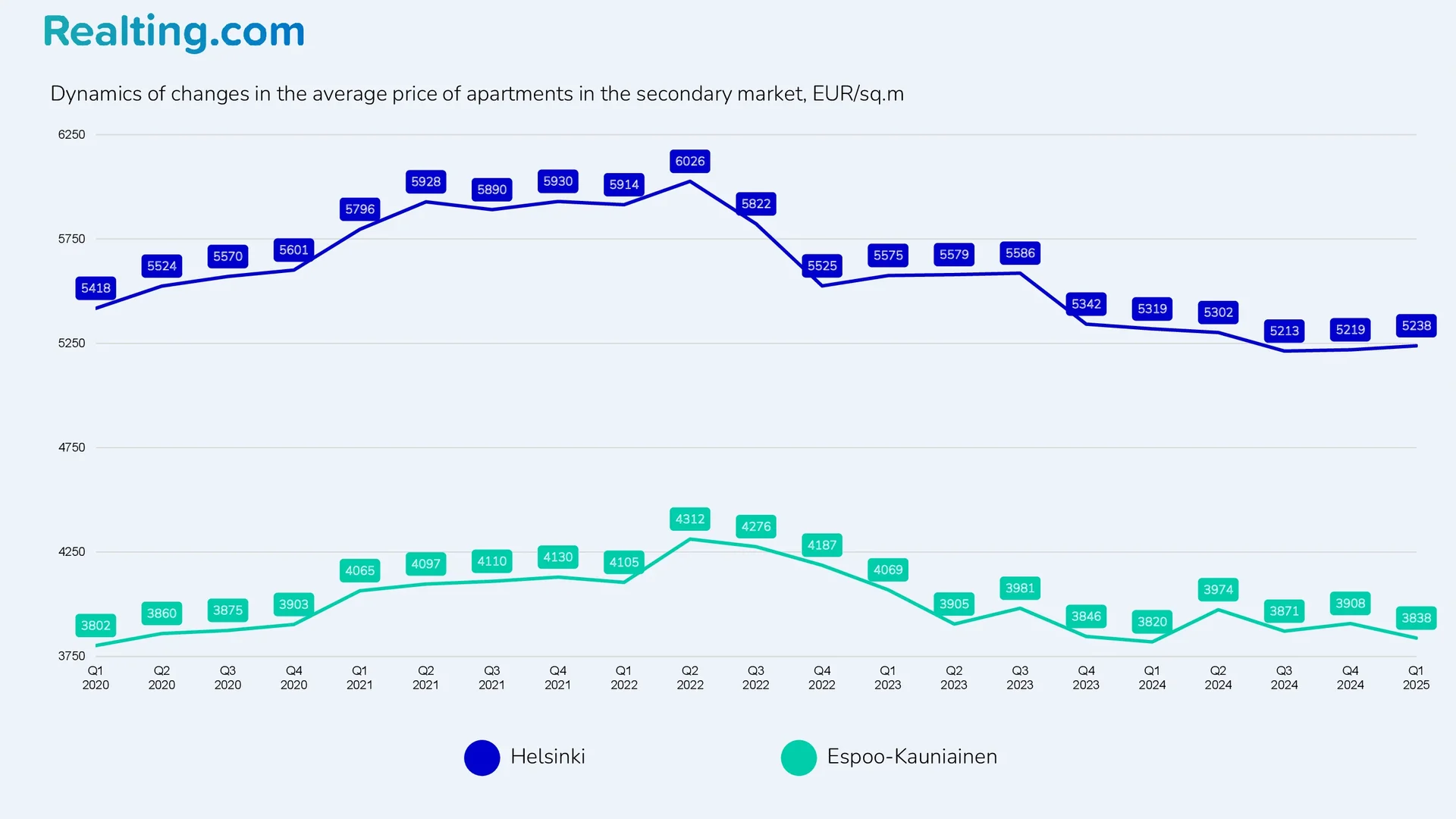

The average price per square metre in secondary market apartment sales and purchase transactions in Helsinki in the first quarter of 2025 is 1.4 times higher than in Espoo and Kauniainen, which rank second among Finland's largest cities in terms of average price per square metre.

Let us note the following: The peak of prices on the apartment market occurred in the second half of 2021 and the first half of 2022, when the activity on the market was at its highest. Thus, the average price per square meter of apartments on the secondary market in Helsinki during this period exceeded 5900 EUR/sq.m, and at the peak it reached 6000 EUR/sq.m.

Average price of apartments on the secondary market:

|

Average price, EUR/sq.m. in Q1 2025 |

Change by Q4 2024 |

Change by Q1 2024 |

Change to Q1 2020 |

|

|

Helsinki |

5238 |

+0.4% |

-1.5% |

-3.3% |

|

Espoo-Kauniainen |

3838 |

-1.8% |

+0.5% |

+0.9% |

|

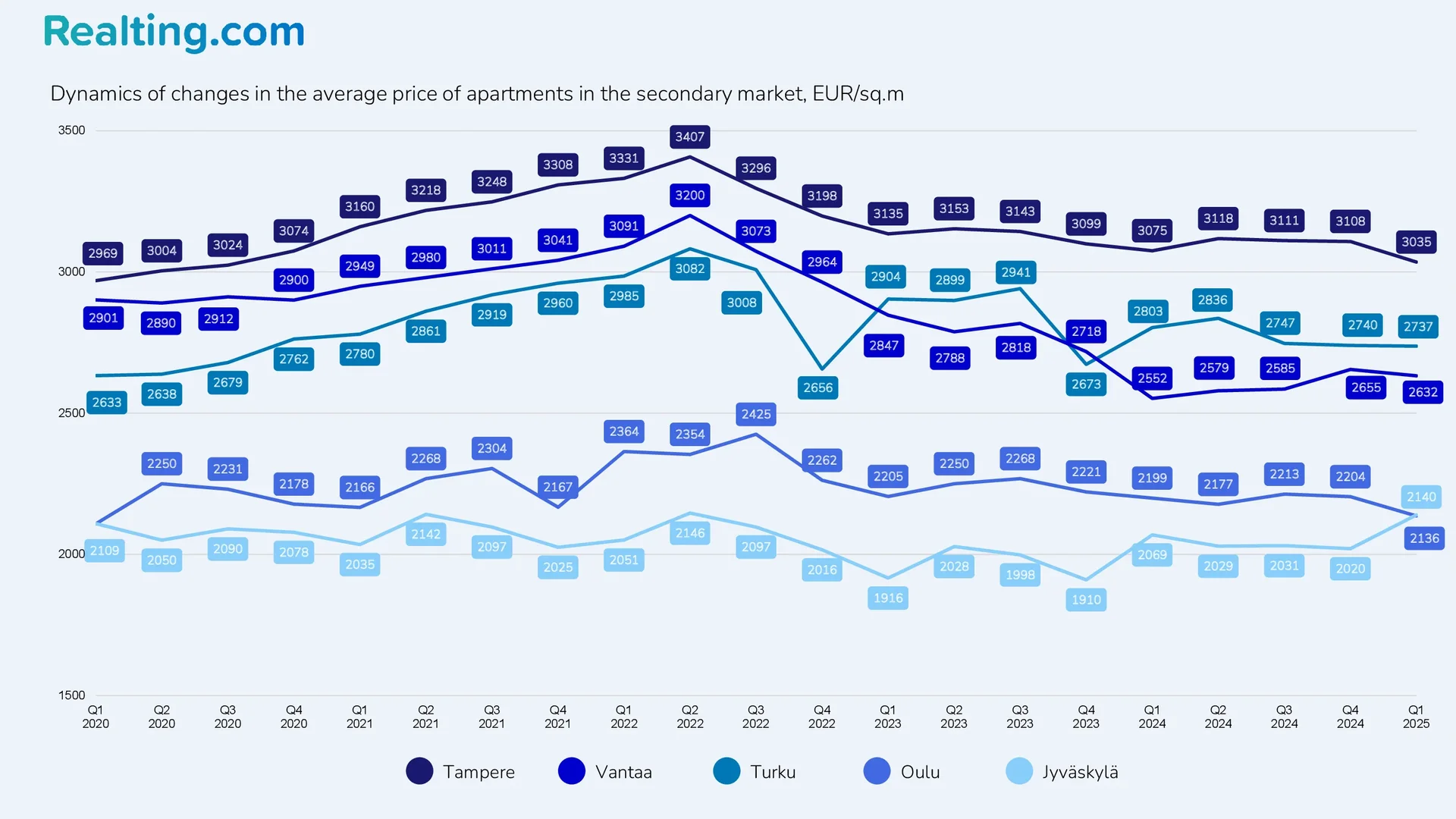

Tampere |

3035 |

-2.3% |

-1.3% |

+2.2% |

|

Vantaa |

2632 |

-0.9% |

+3.1% |

-9.3% |

|

Turku |

2737 |

-0.1% |

-2.4% |

+3.9% |

|

Oulu |

2136 |

-3.1% |

-2.9% |

+1.3% |

|

Jyvaskyla |

2140 |

+5.9% |

+3.4% |

+1.5% |

What's the Bottom Line?

The Finnish property market has experienced a full cycle over the past five years, from record growth in 2021 (93,589 transactions) to the current “bottom” with a 38% drop in activity compared to the peak. High interest rates on loans and economic uncertainty continue to hold back buyer activity.

However, the first signs of stabilization are already visible: the volume of mortgage loans issued in the first quarter of 2025 exceeded the figures for previous years, and interest rates began to gradually decline from April 2024.

For buyers: this is a time of opportunity – prices have stabilized or even decreased in most cities, especially noticeable in Turku (-8% per year for townhouses) and Helsinki (down from a peak of 6,000 to 5,238 EUR/m² for apartments).

Forecast: a moderate market recovery is expected in the second half of 2025, provided interest rates continue to decline and the economic situation improves. A full recovery to 2021 levels will take several years.