Is It Worth Investing in Croatian Real Estate: Price Growth, Mortgage Boom and Forecasts

Croatia has recently been one of the EU leaders in housing price growth — in Q2 2025 it took 3rd place among EU countries for quarterly price growth (behind Luxembourg and Portugal) and 4th place for annual growth (the podium went to Hungary, Bulgaria, and Portugal). In this article, we will look at what is happening on the market by region, where housing is rising in price the fastest, and how the new lending rules changed the situation after the summer.

General Housing Price Dynamics

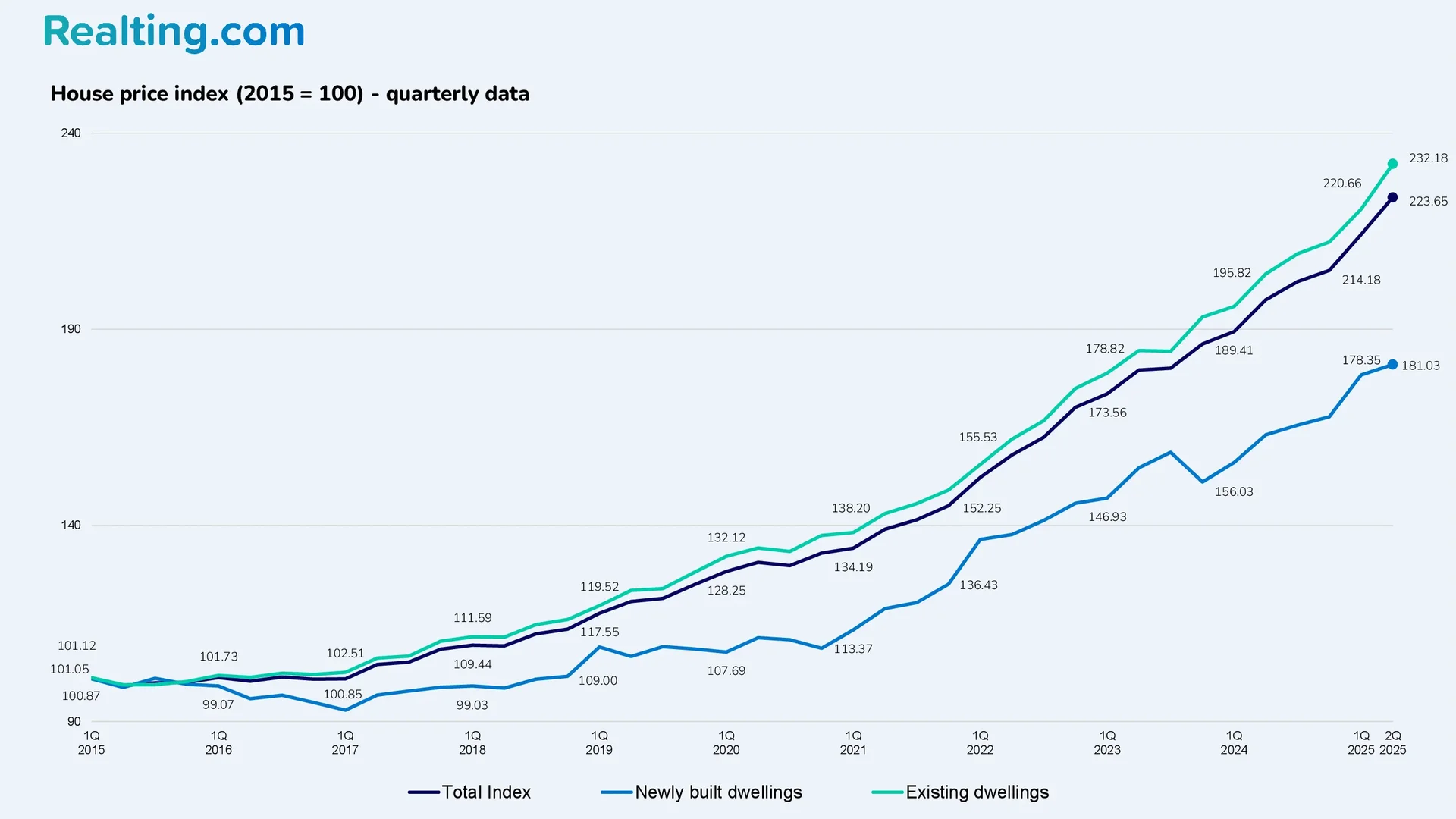

According to the results of Q2 2025, prices on housing in Croatia rose 4.42% quarter-on-quarter (compared to Q1 2025) and 13.22% year-on-year (compared to Q2 2024) — these are the figures from the Croatian Bureau of Statistics.

Broken down by existing housing (secondary market) and recently built housing (new-builds), the situation is as follows:

- Prices for existing residential real estate in Q2 2025 rose 5.22% quarter-on-quarter and 13.75% year-on-year.

- Prices for recently built housing added 1.50% compared to Q1 2025 and almost 11% compared to Q2 2024.

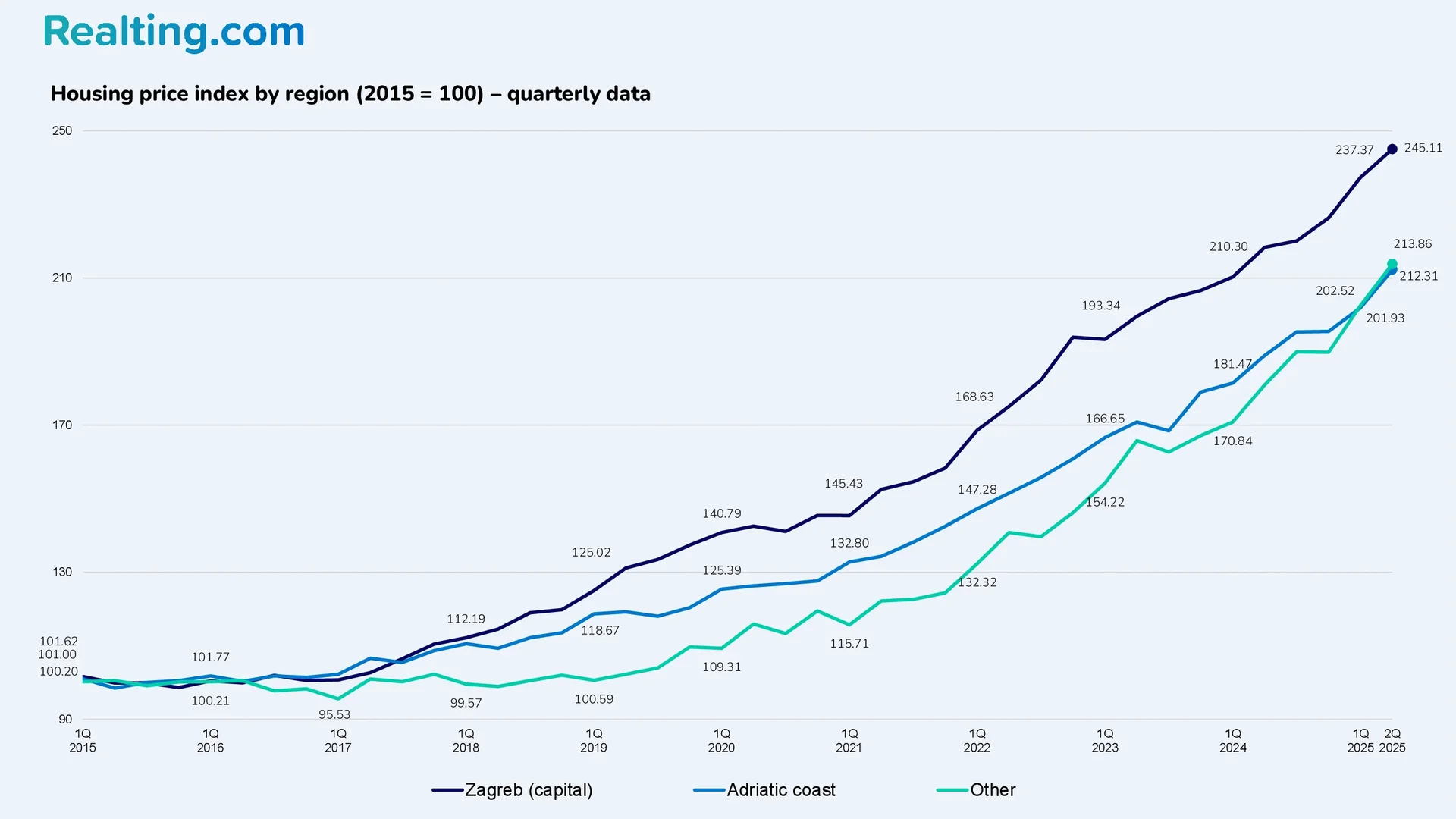

The Croatian Bureau of Statistics also provides the Housing Price Index by territory. According to it, prices in the capital rose 3.26% in Q2 2025, while annual growth was 12.23%.

New-Build Market: Prices and Sales Volumes

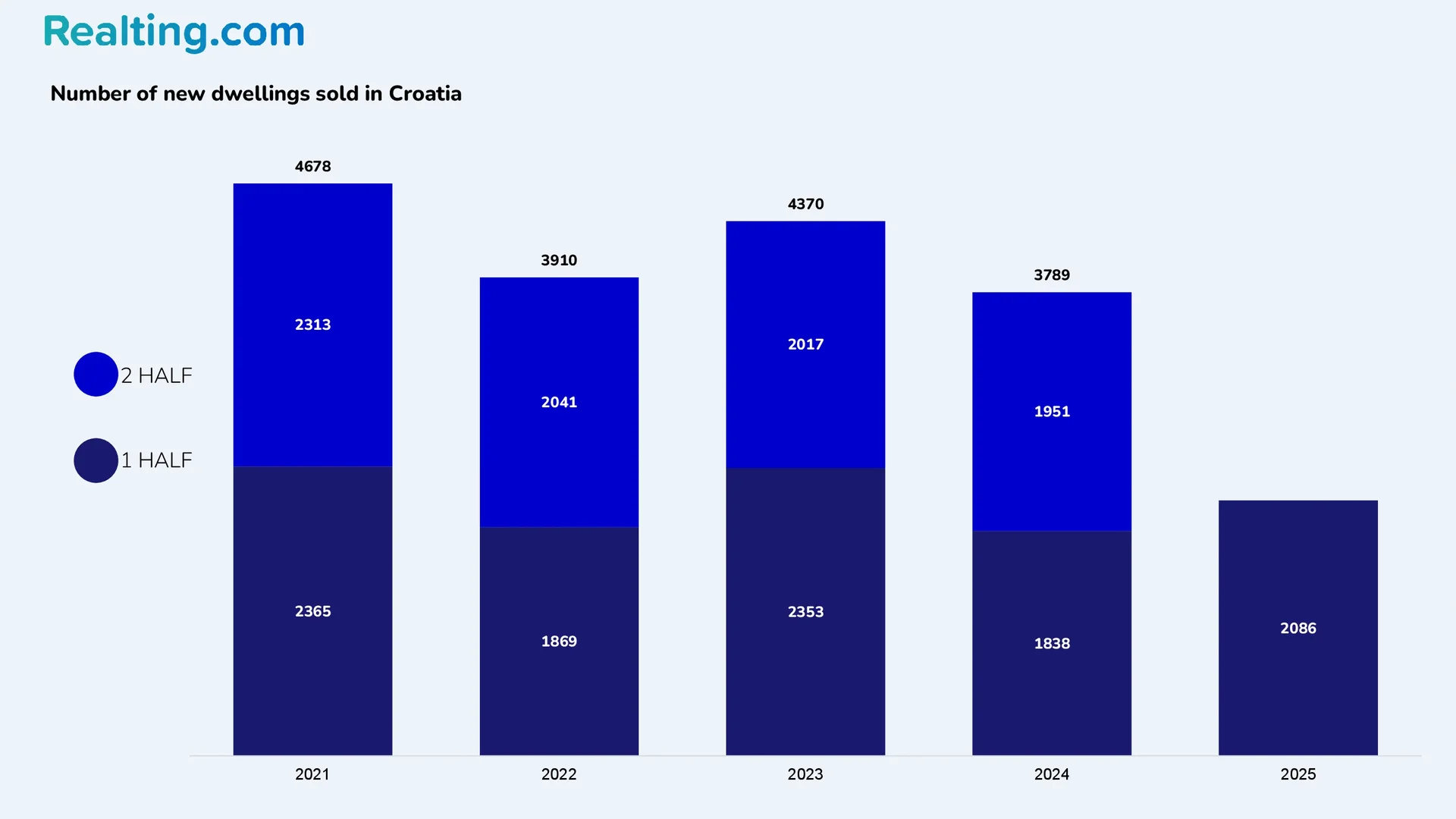

According to the Croatian Bureau of Statistics, in the first half of 2025, 2,086 new housing units were sold in the country — 6.92% more than in the second half of 2024 and 13.49% more than in the first half of 2024. More than half of the new housing in the first half was sold in Zagreb — 1,205 units (58% of the total), the best result for the capital in the last 3 years.

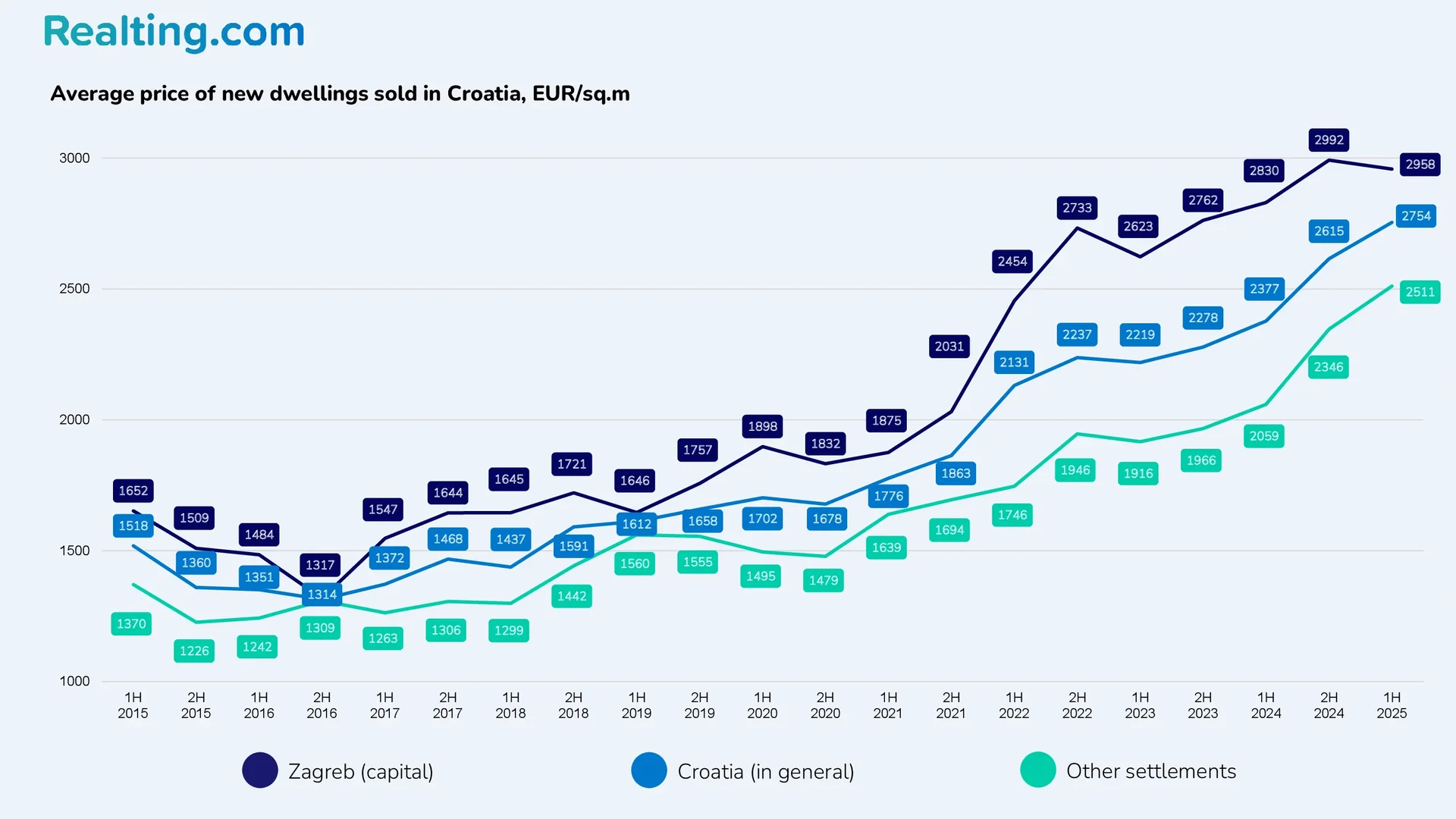

The average price of new housing in the first half of 2025 in Croatia was 2,754 EUR/sq.m, which is 5.32% higher than in the previous half-year and 15.86% higher than in the first half of 2024. Over 10 years, the average price of new housing in the country has risen by 81.40%. It is worth noting that the average price of new housing in the capital is only 7.41% higher than the national average.

Average price of new housing in the first half of 2025 in Croatia:

|

Region |

Average price, EUR/sq.m |

Change vs H2 2024 |

Change vs H1 2024 |

Change over 10 years (vs H1 2015) |

|

Croatia (overall) |

2754 |

+5.32% |

15.86% |

+81.40% |

|

Zagreb (capital) |

2958 |

-1.14% |

4.52% |

+79.04% |

|

Other settlements in the country |

2511 |

+7.03% |

21.95% |

+83.22% |

Housing Prices in Croatia by County

Administratively, Croatia is divided into 20 counties — županije; the capital, Zagreb, is a separate county.

The highest residential real estate prices are observed in the counties located on the Adriatic coast. According to the portal Nekretnine.hr, the average housing price in Split-Dalmatia County and Primorje-Gorski Kotar County in October 2025 was 4,209 EUR/sq.m and 4,055 EUR/sq.m, respectively. The county with the lowest average housing price is Virovitica-Podravina County, where the average prices are more than 5 times lower than in Split-Dalmatia County. Below is a map with the average asking price for housing by all counties of the country.

10.25/01.25 – change in the average asking price for housing in October 2025 vs January 2025.

Y25/Y24 – change in the average asking price for housing in October 2025 vs October 2024.

Y25/Y22 – change in the average asking price for housing in October 2025 vs. October 2022.

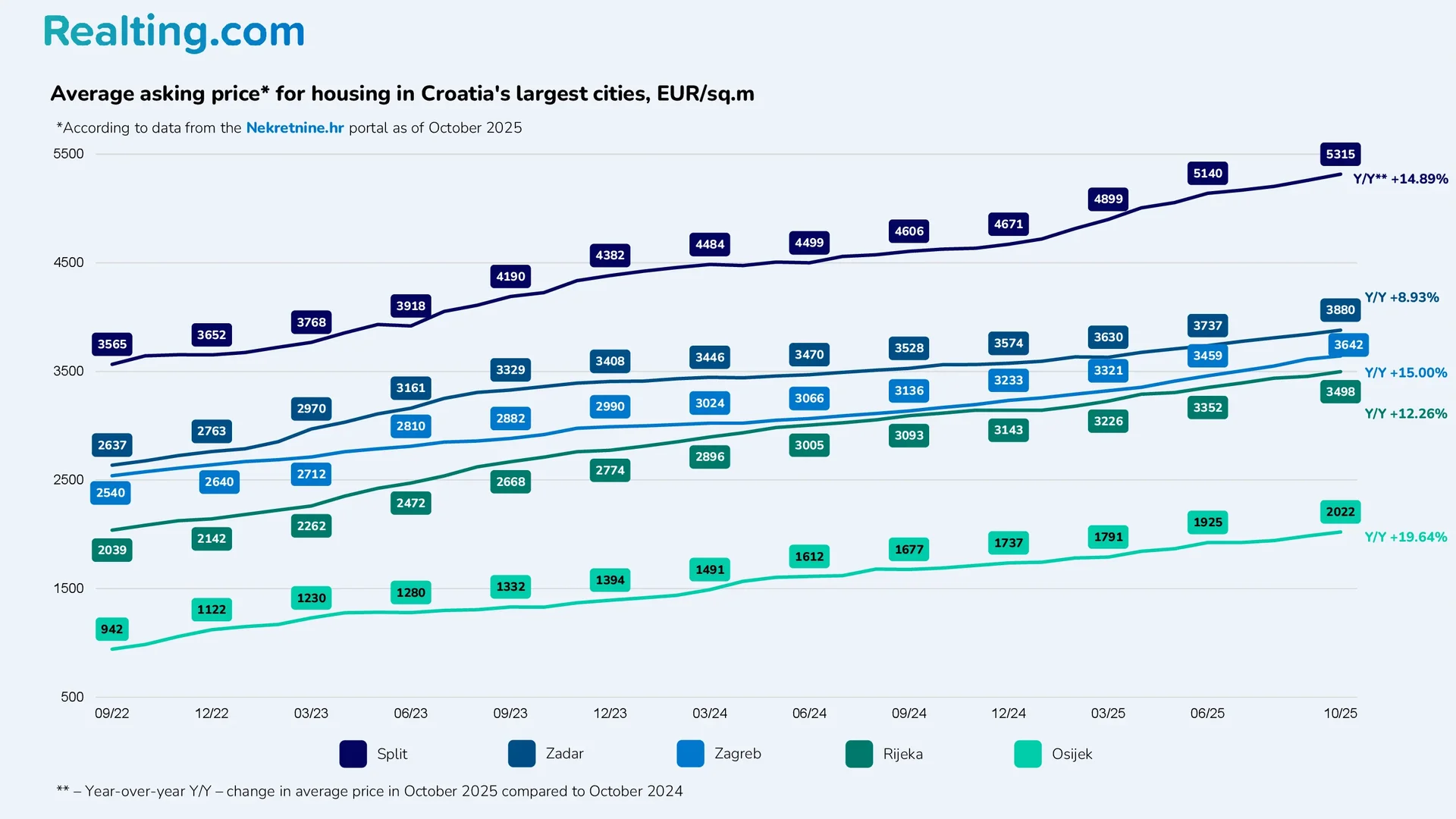

Among the most populous cities, the highest average housing price is in Split — the country’s second-largest city and the centre of the Dalmatia resort region. The average asking price in October 2025 here reached 5,315 EUR/sq.m. Below is a chart with the average asking price for housing in the five largest cities in Croatia.

A Few Words About Housing Loans

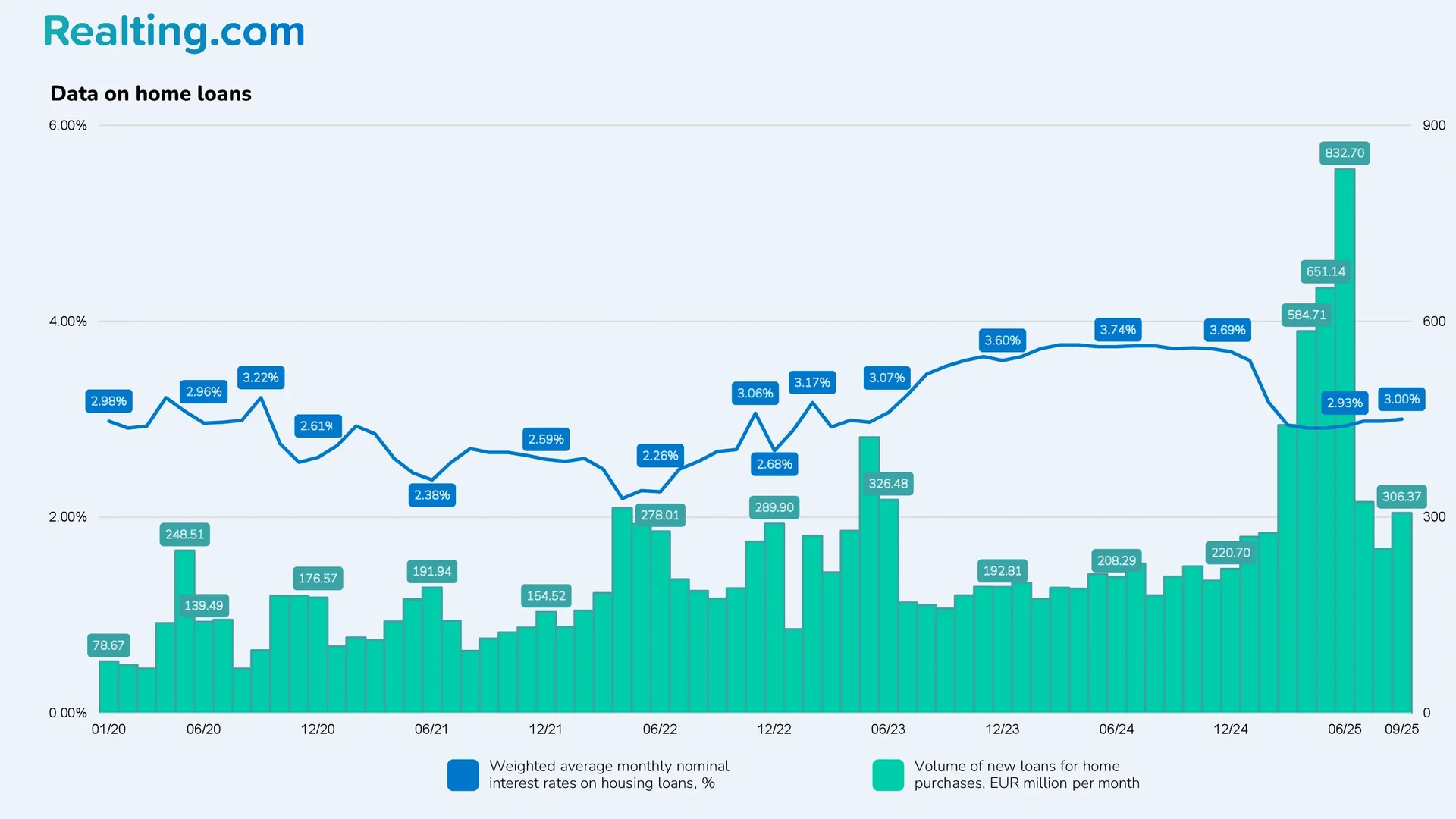

According to the Croatian National Bank (Hrvatska narodna banka), the weighted average nominal interest rate on housing loans in the country as of September this year is 3%. It is worth noting that in January the rate was 3.60%.

From January to September 2025, new housing loans were issued in Croatia for a total amount of €3.94 billion — an absolute record. For comparison, in the same period of 2024, housing loans worth €1.79 billion were issued — 2.2 times less. The record month was June 2025, when loans worth €832.7 million were issued.

When discussing record volumes of new housing loans, it's important to note that, according to the Croatian National Bank's methodology, refinancing a loan also falls under the category of new loans.

Several factors converged to create the record boom in the Croatian lending market:

- First, there was a significant reduction in housing loan interest rates at the beginning of 2025.

- This rate cut triggered a massive wave of refinancing, which is statistically categorized as a new loan.

- On July 1, 2025, the National Bank introduced strict macroprudential restrictions. The new rules narrow the circle of borrowers — many no longer qualify due to income or down payment requirements.

- The fear of not qualifying under the new conditions pushed people to speed up their loan applications before the new rules took effect.

- Housing transactions accelerated — many deals originally planned after July 1, 2025, were completed in advance.

- Banks also expedited loan approvals, actively promoting fixed rates and simplified procedures to stay ahead of the new restrictions.

- Tax benefits for first-time buyers further motivated people to buy during this period.

After July 1, the volume of newly issued loans dropped sharply because the new rules took effect, the refinancing effect was exhausted, and transactions with borrowed funds originally planned for later had already been completed.

In Summary

In 2025, the Croatian real estate market demonstrated impressive dynamics, but its growth was largely accelerated artificially. Record mortgage volumes, mass refinancing, and pre-restriction hype created an effect similar to that of a compressed spring — most of the transactions that would have occurred over the course of a year and a half happened in just a few months. After July 1, when strict macroprudential requirements took effect, activity naturally declined. Now, many potential buyers simply do not qualify due to their income, nor can they gather the increased down payment.

What's next? Prices are unlikely to fall sharply. Demand for housing in coastal regions remains stable, thanks to tourism and interest from foreign buyers. The supply shortage has not gone away. However, growth rates will almost certainly slow down. The market is entering a stabilization phase with fewer speculative purchases and easily accessible loans and more deliberate decisions. For investors, this means the era of rapid, double-digit gains is likely over. Now, it's more important to choose the right locations and calculate real yields than to wait for price appreciation.