What’s Happening with Housing Prices in Germany in 2025: Q2 Results

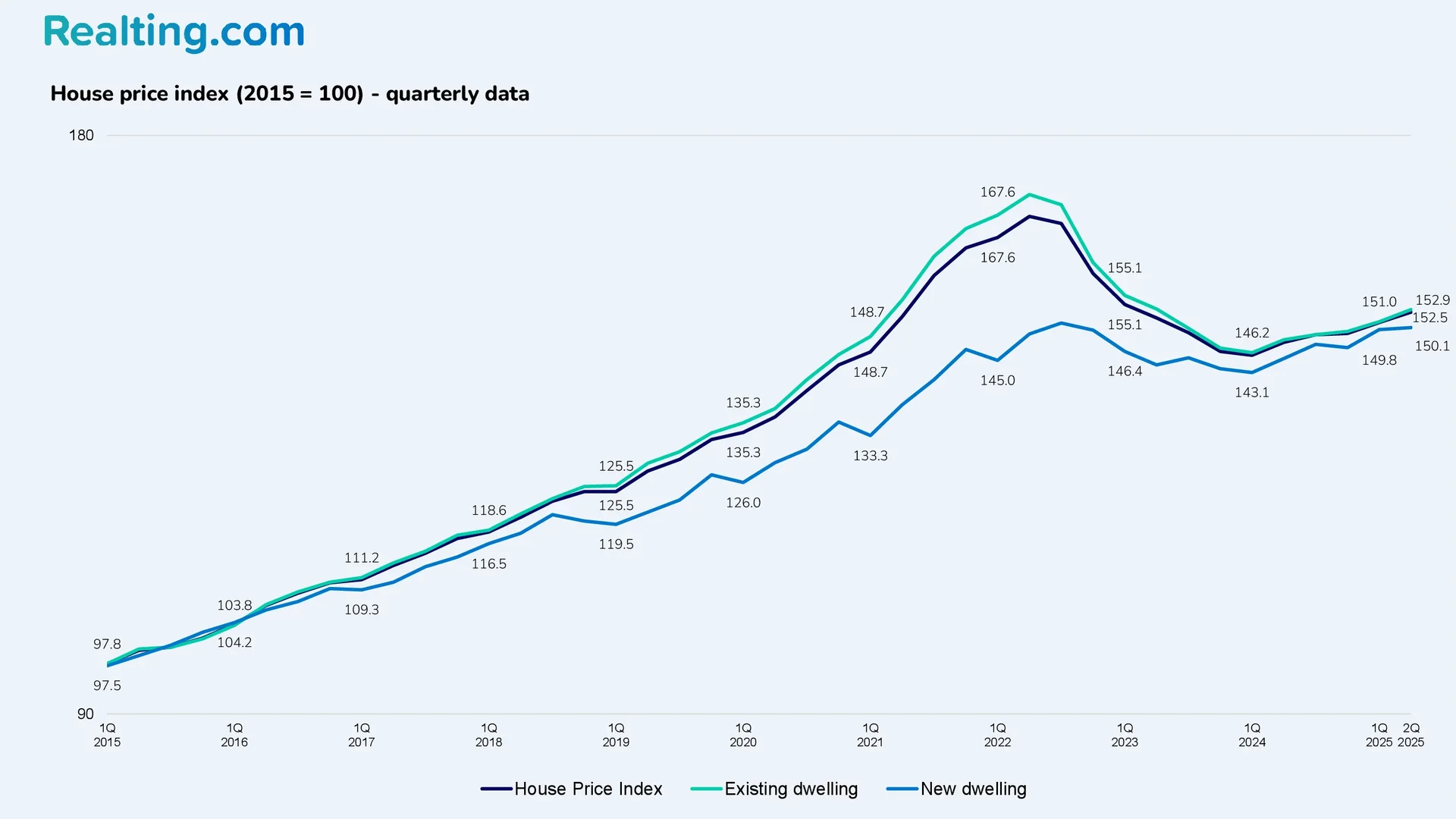

Housing prices in Germany are demonstrating moderate growth for five consecutive quarters, as evidenced by statistics on changes in the Destatis (Federal Statistical Office of Germany) residential property price index.

Price Growth Dynamics: Quarterly and Annual Indicators

As of Q2 2025, housing prices in Germany rose by 1.1% compared to Q1 of this year and by 3.2% compared to Q2 2024.

The situation is similar when breaking down new and existing (secondary) residential properties. Prices on the secondary market in Q2 2025 increased by 1.3% quarter-on-quarter and by 3.2% year-on-year. Prices for new housing (recently built) gained 0.2% compared to the previous quarter and 3.2% compared to Q2 of the previous year.

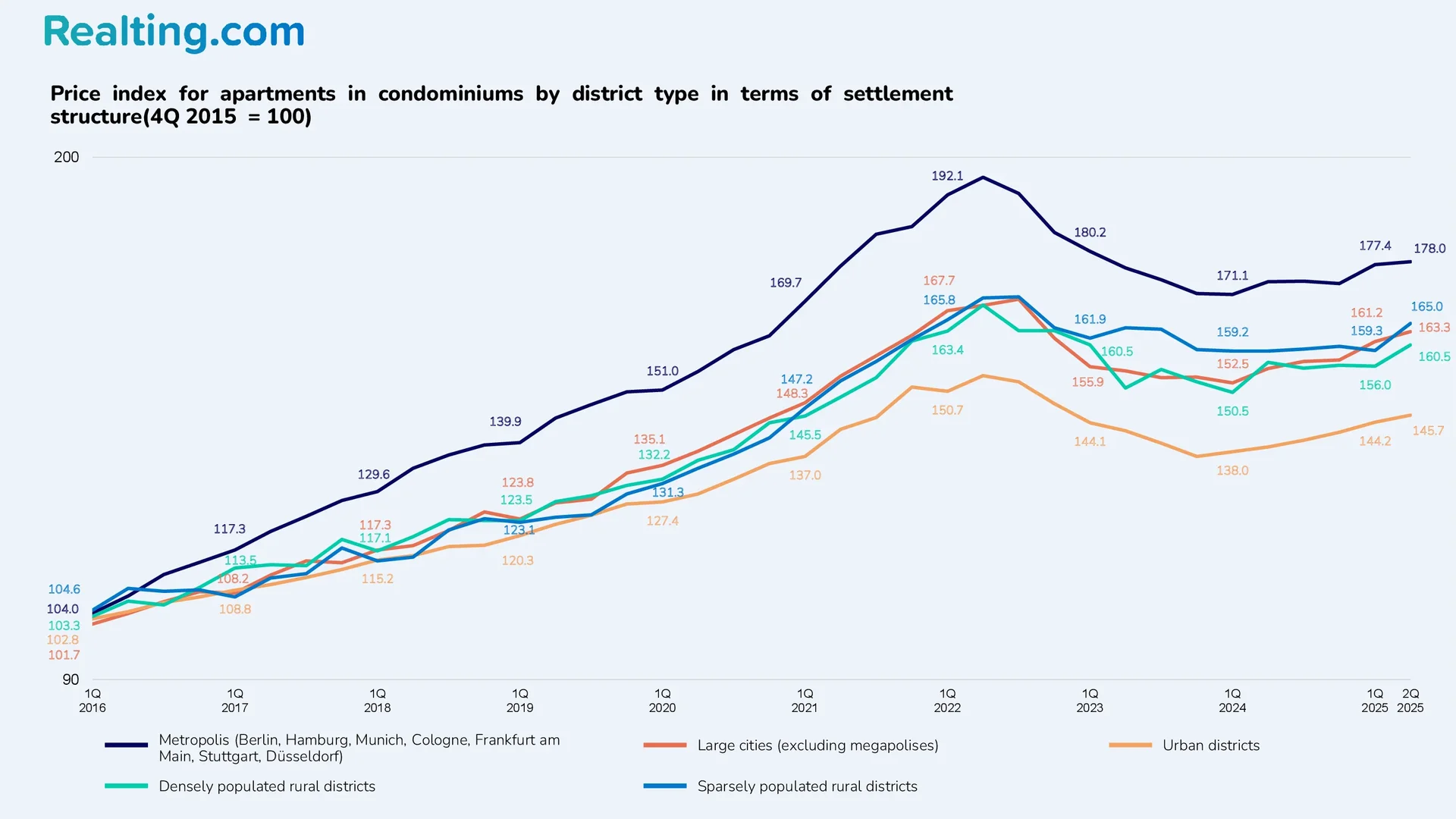

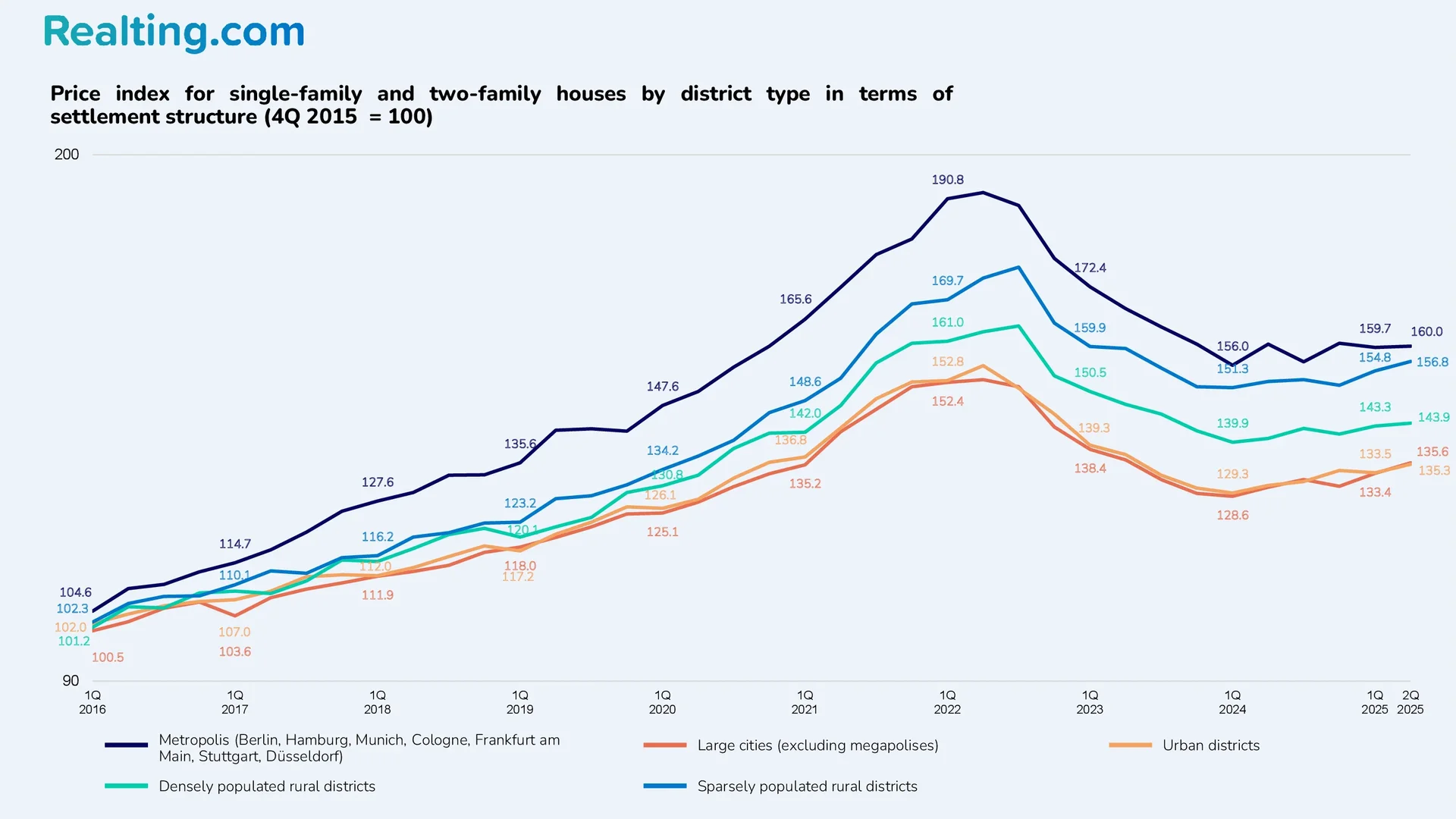

Destatis publishes price indices for apartments in multi-family buildings, as well as for single-family and two-family houses, categorized by district types based on population density.

There are five district groups in total:

- Megacities (Germany’s 7 largest cities: Berlin, Hamburg, Munich, Cologne, Frankfurt am Main, Stuttgart, Düsseldorf).

- Large cities (excluding megacities).

- Urban districts.

- Rural districts with densification trends.

- Sparsely populated rural districts.

Pricing Features in Megacities and Large Cities

Apartment prices in Germany rose in all districts in Q2 of this year. However, prices in the megacity group showed the smallest quarterly growth among all district groups — an average of just +0.3% compared to the previous quarter (and +2.4% compared to the same quarter last year). The cost of apartments in large cities (excluding megacities) rose by an average of 1.3%, with annual growth at 5%. In urban districts, quarterly price changes averaged +1%, and annual changes +4.8%.

In rural districts with densification trends, prices in Q2 2025 were on average 2.9% higher than in Q1 2025 and 2.4% higher than in Q2 2024. In sparsely populated rural districts, apartment prices rose by an average of 3.6% both quarter-on-quarter and year-on-year.

Single-family and two-family houses also saw price increases, though more modest than for apartments. The maximum growth was recorded in large cities (excluding megacities) — as of Q2 2025, prices averaged +1.6% compared to Q1 this year and +3.9% relative to Q2 last year.

House prices in urban districts rose by an average of 1.3% quarter-on-quarter and 3.4% year-on-year. In megacities, however, house prices barely changed — averaging +0.2% compared to Q1 and −0.2% compared to Q2 2024.

In the group of rural districts with densification trends, house prices rose by an average of 0.4% compared to Q1 2025 and 2.3% compared to Q2 2024. In sparsely populated rural districts, prices averaged +1.3% quarter-on-quarter and +2.8% year-on-year.

Among Germany’s largest cities, the cost per square meter of apartments saw the strongest annual growth in Mainz (+7.1%), Cologne (+6.67%), and Leipzig (+5.65%) — according to data from the immowelt.de portal as of late September 2025. Of these three cities, only Cologne ranks in Germany’s top five most expensive cities for buying an apartment.

Top German Cities with the Most Expensive Apartments and Houses

As of late September 2025, the top five* largest cities with the highest apartment costs in Germany are as follows:

|

№ |

City |

Min price, EUR/sq.m |

Avg. price in sales Listings, EUR/sq.m |

Max price, EUR/sq.m |

Annual avg. price change |

|

1 |

Munich |

4,971 |

8,186 |

15,435 |

+2.56% |

|

2 |

Hamburg |

3,252 |

5,997 |

11,994 |

+4.84% |

|

3 |

Frankfurt am Main |

2,678 |

5,547 |

10,993 |

+2.34% |

|

4 |

Potsdam |

2,561 |

5,152 |

9,183 |

+2.20% |

|

5 |

Cologne |

2,582 |

4,977 |

9,467 |

+6.67% |

Berlin* | 2,569 | 4,857 | 9,565 | +1.31%

*Berlin did not make the ranking but was added as the capital city. Ranking based on immowelt.de portal statistics.

When it comes to average house prices, the segment leaders in annual price growth are Mainz (+11.57%), Saarbrücken (+9.85%), and Schwerin (+8.28%).

The top 5* largest German cities by average cost per square meter for houses as of late September 2025:

|

№ |

City |

Min. price, EUR/sq.m |

Avg. price in sales Listings, EUR/sq.m |

Max. price, EUR/sq.m |

Annual avg. price change |

|

1 |

Munich |

3,891 |

9,728 |

19,456 |

+3.81% |

|

2 |

Stuttgart |

2,638 |

6,277 |

12,298 |

+3.07% |

|

3 |

Düsseldorf |

2,110 |

5,266 |

10,531 |

+7.58% |

|

4 |

Hamburg |

2,544 |

5,140 |

10,280 |

+1.06% |

|

5 |

Cologne |

2,549 |

4,997 |

9,995 |

-1.23% |

Berlin* | 2,064 | 4,575 | 9,149 | +2.03%

*Berlin did not make the ranking but was added as the capital city. Ranking based on immowelt.de portal statistics.

Key Factors Influencing Prices in Germany in 2025

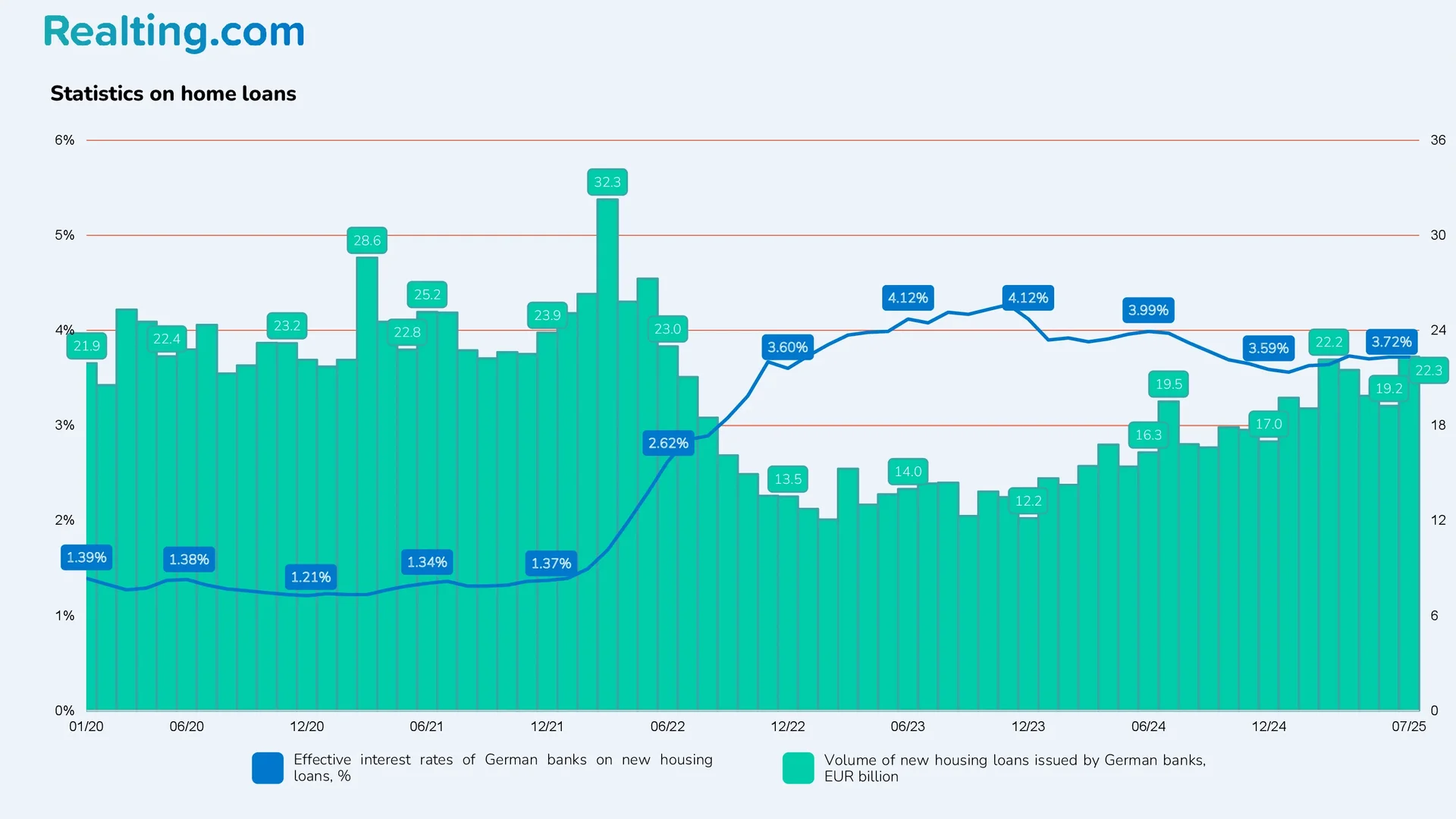

The residential real estate market in Germany is currently showing a trend of moderate price growth that began in Q2 2024. It’s worth noting that from Q3 2022 through Q1 2024, the country experienced a period of decline. The market can now be described as stabilizing, with moderate price growth indicating sustained acceptable demand for home purchases. Demand for housing in Germany can also be gauged from mortgage issuance statistics.

According to the Deutsche Bundesbank (German Federal Bank), in Q2 2025, new housing loans totaling approximately €60.6 billion were issued in Germany — 25% more than in Q2 2024 and nearly 50% more than in Q2 2023 (from late 2022 through early 2024, new housing loan volumes in Germany were at relatively low levels compared to previous years). Notably, the start of growth in loan volumes coincides with the start of housing price growth — Q2 2024.

Summary

Despite ongoing economic challenges, Germany’s real estate market in Q2 2025 shows a stable recovery with moderate growth in apartment and house prices nationwide. The dynamics are particularly evident in large cities and developing districts, where demand is supported by limited supply and increasing mortgage activity.

Analysts forecast continued moderate growth in subsequent quarters, while investors and buyers should consider regional specifics and market segmentation.