Real Estate in the Netherlands: Where to Buy for Maximum Profit? Prices and Forecasts

The Dutch real estate market is soaring again. Over the past year, prices have risen by more than 10%, and the average house now costs €472,000. The good news — mortgage rates have fallen to 3.19%. The bad news — there is a catastrophic shortage of housing, with nearly 400,000 homes simply missing from the market.

In this article, we break down exactly what is happening in Dutch cities, how much you can actually earn from renting, and whether it’s worth waiting for prices to drop or better to buy now.

General Market Situation

As of June 2025, the average house price reached €472,000, up 10.2% compared to the previous year. Economists forecast continued growth until the end of the year, expecting prices to reach €488,000–€520,000.

The real estate market growth is driven by several factors:

- Falling mortgage rates. In November 2023, rates reached 4.55%, and by 2025 they are expected to drop to 3.19–3.5%.

- Strong labor market. Unemployment remains low, and wages, for example, rose by 6% in 2024.

- Housing shortage. Supply of new properties is limited, while demand continues to grow.

Property prices increasingly depend on the energy label. The price difference between a high-rated home (label C) and a low-rated one (label G) can reach 12%, or around €50,000 per property.

Since 2024, all new homes must meet the highest energy-efficiency standards. Homes with energy labels F or G must be upgraded to at least label C by 2030.

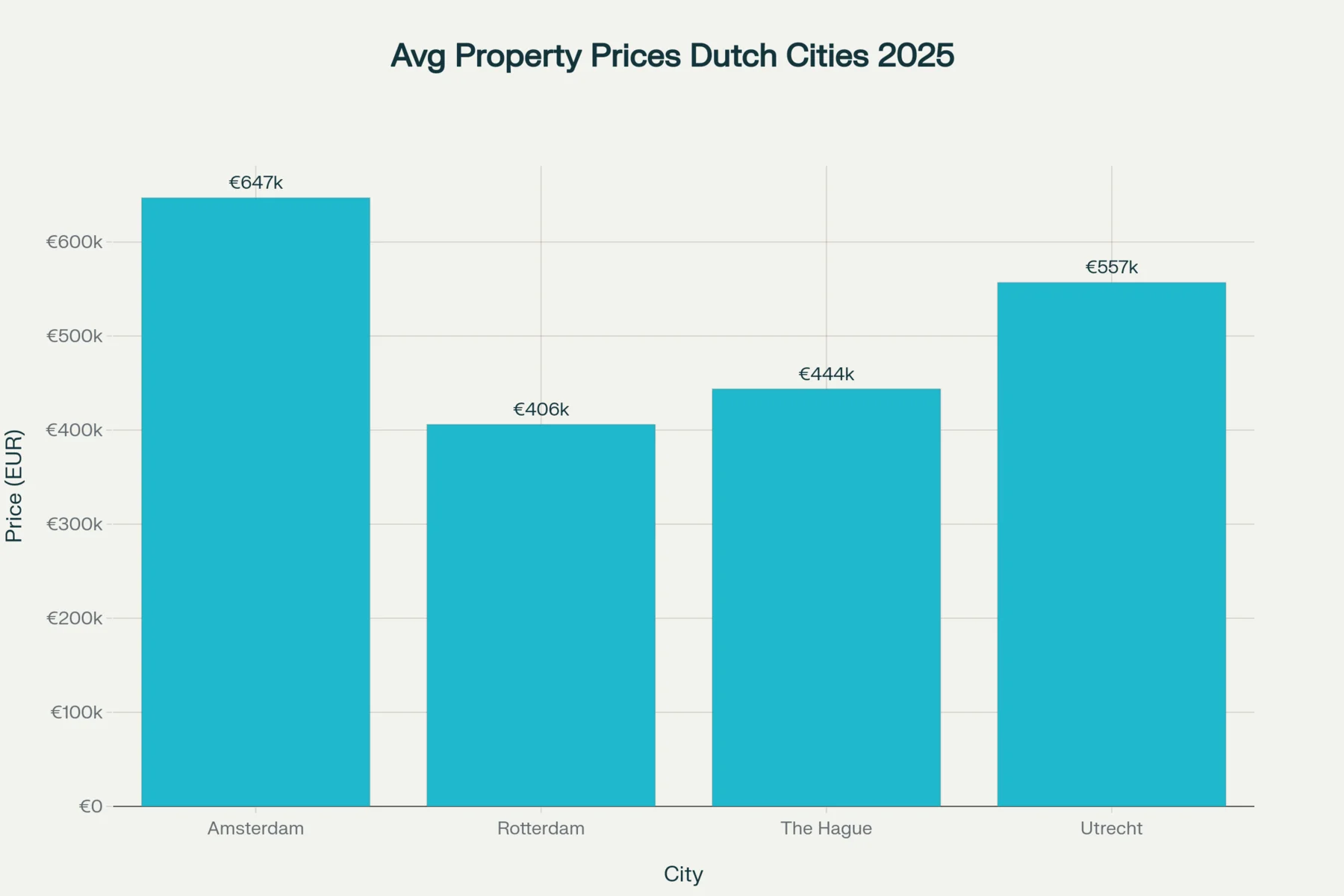

Real Estate Prices in the Netherlands by City

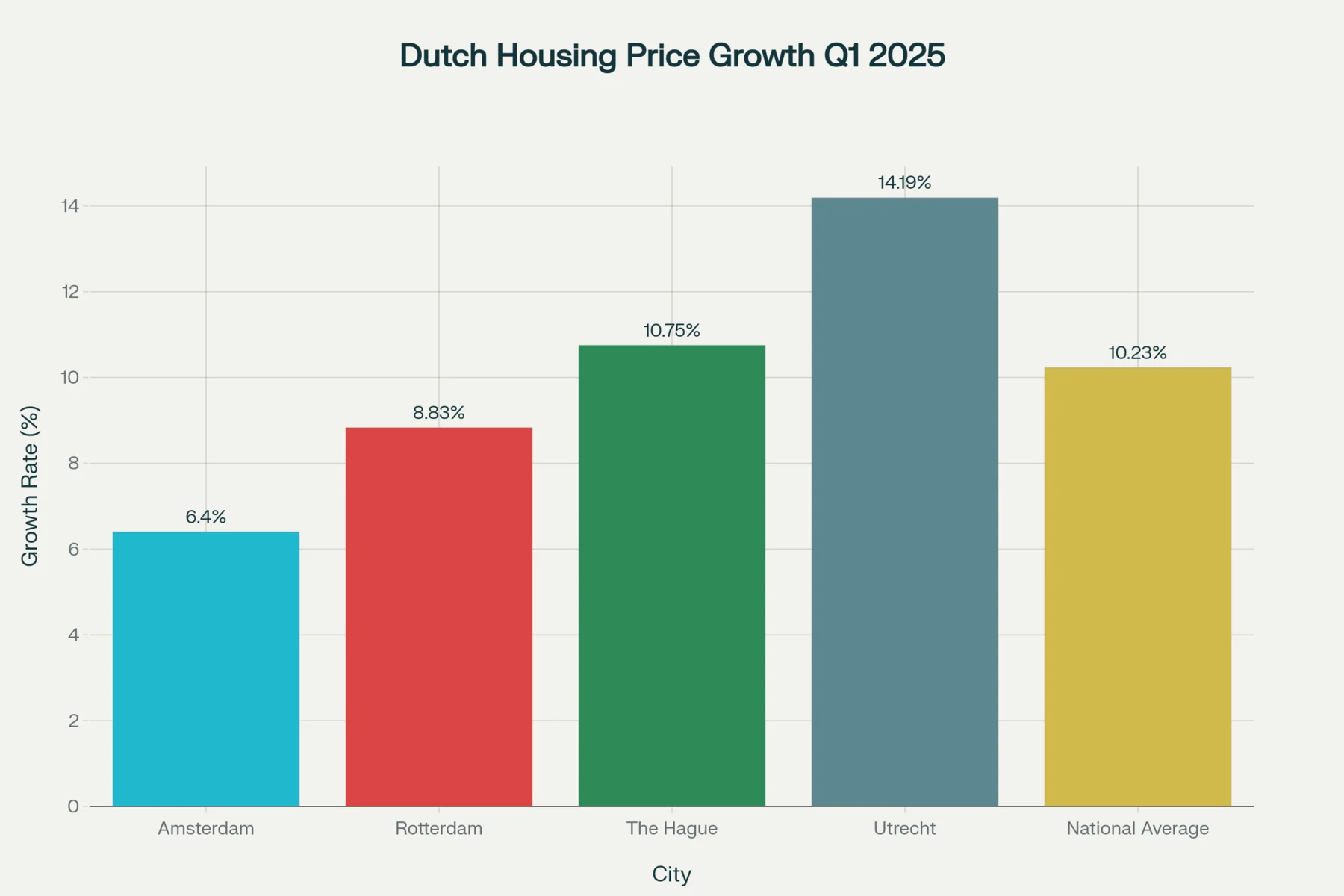

Property prices in the Netherlands vary significantly by region. Amsterdam remains the most expensive city, with prices ranging from €630,000 to €664,000. However, price growth here is the most moderate — just 6.4% annually.

Rotterdam is one of the most affordable major cities. The average house price here is €406,000 — 14% below the national average. The city is actively developing: its economy grows by 8.83% per year.

Utrecht shows the most impressive growth rates — 14.19% year-on-year (varies by quarter). The average price here is €557,000.

The Hague falls into the mid-price segment (€444,000–€480,000). The market grows by 10.8% annually.

The provinces with the fastest growth are Groningen (12.1% in Q1 2025), Drenthe (12.66%), and Overijssel (12.36%).

As of September 2025, prices per square meter in the main Dutch cities:

|

City |

Price per m² |

|

Amsterdam |

€8,000–€11,000 |

|

The Hague |

€6,500–€8,000 |

|

Utrecht |

€7,000–€9,500 |

|

Rotterdam |

€5,000–€7,000 |

Sales Volumes and Market Activity

The real estate market is coming back to life. In the first five months of 2025, the number of transactions reached 90,000 — up 15.8% compared to the previous year. This growth is partly due to investors selling previously rented properties. The reason is new tax rules and the Affordable Rent Act introduced on July 1, 2024.

The housing shortage remains a critical problem affecting the market. In 2024, the Netherlands had a shortage of around 396,000 homes — the first decline after three years of growth, but only by a modest 5,000 units.

Thus, the shortage stands at 4.8% of the total housing stock. The government has set a target to reduce the shortage to 2%, which will require building an additional 226,000 homes.

Construction rates do not meet the targets. In 2024, approximately 69,000 homes were built or converted — more than in 2023. However, the government aims to build 100,000 new homes annually, a goal that has not yet been reached.

According to ABF Research, the housing shortage will gradually decrease. By 2031 it will be 3.9% of the total housing stock, and by 2040 it will fall to 2.2%.

Mortgage Rates

Mortgage rates have become more affordable. Current conditions:

- 5 years: 3.19–3.20% (lowest rate in July 2025)

- 10 years: 3.42–3.50%

- 20 years: 3.65–3.85%

- 30 years: 3.85%

- Variable rate: 3.43–3.65%

Banks are expected to continue lowering rates, following the European Central Bank. By the end of 2026, the ECB deposit rate may fall to 1.5%.

Rental Market and Yields

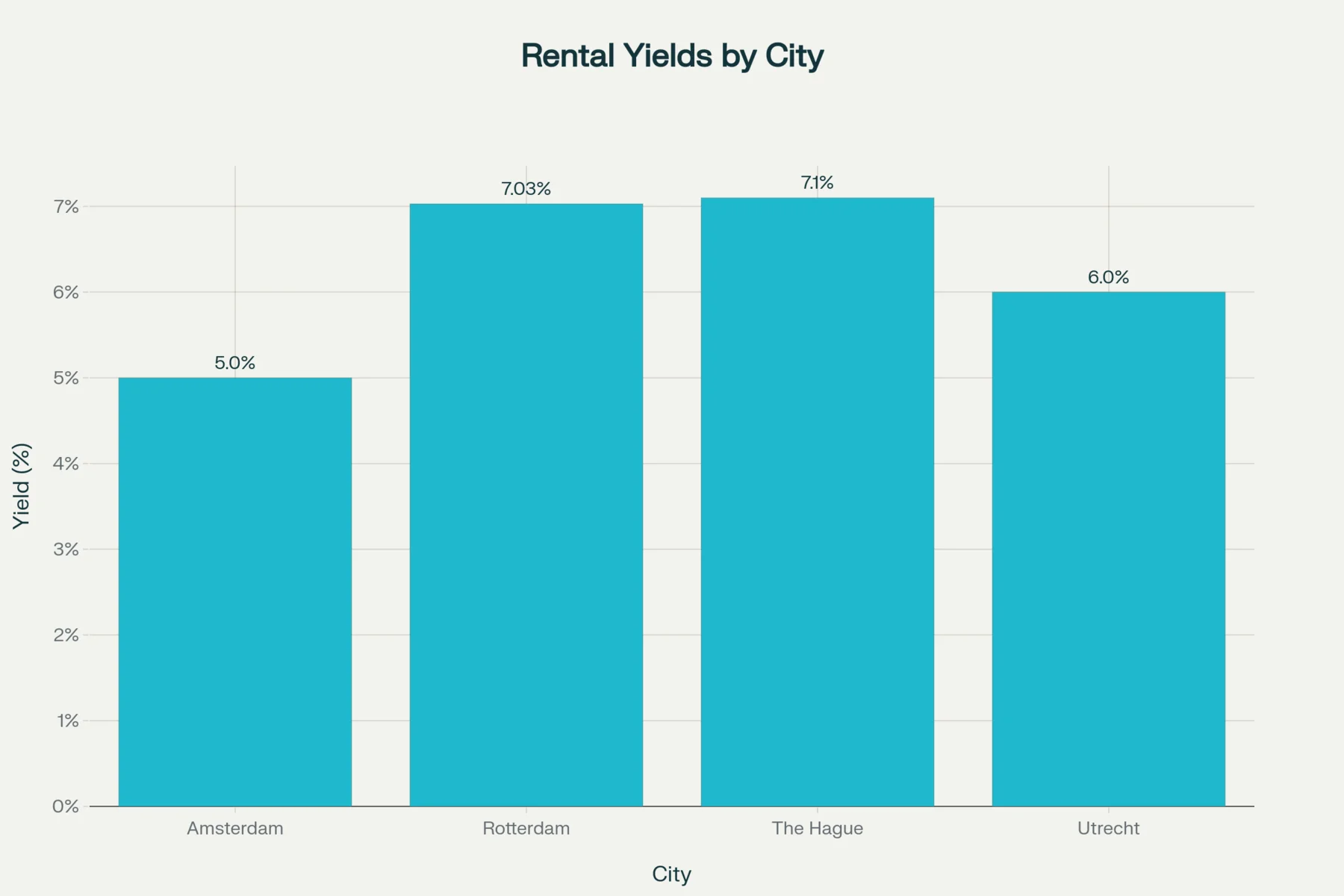

The rental market offers attractive prospects for investors, though with noticeable regional differences:

|

City |

Gross yield |

Net yield |

|

Amsterdam |

5.0% |

3.0–3.5% |

|

Rotterdam |

7.03% |

5.0–5.5% |

|

The Hague |

7.10% |

5.0–5.5% |

|

Utrecht |

5.5–6.5% |

3.5–4.5% |

Rotterdam and The Hague are the most profitable cities for rental investment. Amsterdam attracts high rental demand, but gross yield is lower (5.0%) due to high purchase prices. After deducting taxes, maintenance, and management costs, net yield is typically 1.5–2.0% lower than gross.

Rental Prices in the Netherlands by City

Average rental rates in 2025:

Amsterdam:

- Room: €700–€1200

- Studio: €1500–€2000

- 1-bedroom apartment: €2200

- 2–3-bedroom apartment: €3500–€4500

Rotterdam:

- Room: €600–€900

- Studio: €1000–€1400

- 1-bedroom apartment: €1300–€1600

- 2+ bedroom apartment: €1800–€2800

Utrecht:

- Room: €600–€1000

- Studio: €900–€1600

- 1-bedroom apartment: €1400–€1700

- 2+ bedroom apartment: €2200–€3200

Forecasts and Outlook

In 2025, prices are expected to rise by 7–9%. ABN AMRO raised its forecast to 8.7%, taking into account continued wage growth.

In 2026, growth of 3% is expected, but only if household incomes stop rising. Transaction volumes are likely to decline, especially after investor sell-offs end.

Long-term prospects (10–20 years) look optimistic. Structural factors point to continued price growth:

- Persistent housing shortage (~400,000 homes)

- Steady population growth and urbanization

- More stable price growth rates than in previous years

Author

I am responsible for editorial work. I write expert interviews and guides.