Annual Change in Housing Prices in EU Countries in the Second Quarter of 2025: What Is Happening in the Market

There is a catastrophic shortage of housing in Europe — the deficit is estimated at 9.6 million houses and apartments, and only 64% of the recommended volume is being built. Buyers understand this and rush to buy now, before prices rise even more, which only unwinds the spiral of growth. In this article, we will look at why some countries are breaking records for price increases, while others are standing still, and what the EU authorities plan to do about the housing crisis in the coming years.

Note. It should be borne in mind that this is an assessment by the CBRE consulting company, and not an official indicator of the European Union, however, it highlights the systemic problem of the lack of affordable housing in Europe and the slow resumption of construction.

Three Groups of Countries: Leaders and Laggards

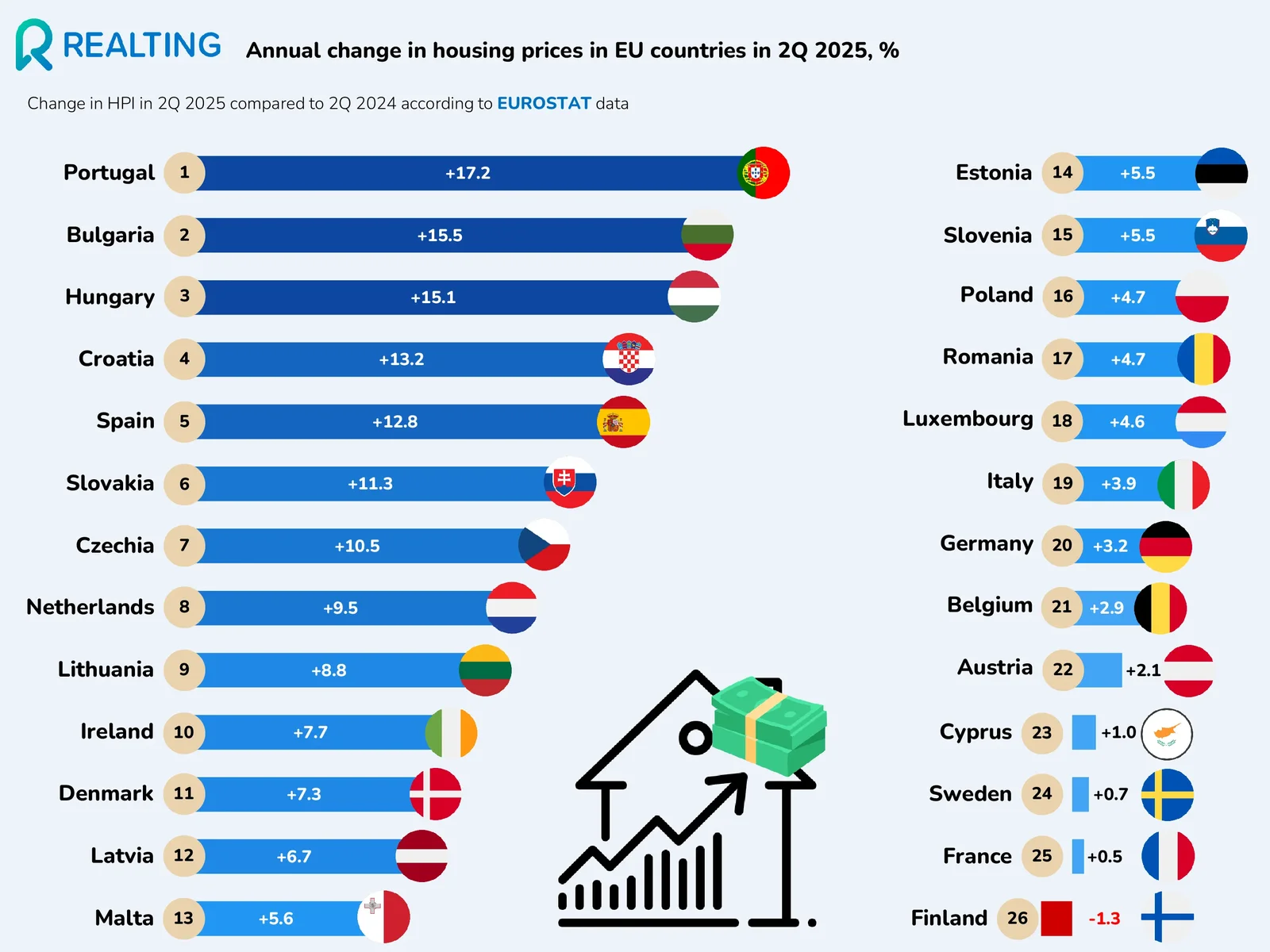

In the second quarter of 2025, housing prices in the EU rose by 5.4% year-on-year. However, the picture varies sharply across regions — Portugal leads with +17.2%, while Finland is the only country where prices fell.

Leaders in growth:

Portugal (+17.2%), Bulgaria (+15.5%), and Hungary (+15.1%) form a separate category. These are countries where demand for housing significantly outpaces supply. In Portugal, prices are rising due to consistent demand from foreigners and the limited availability of housing in desirable locations. It is worth noting that the aggregated index of the National Bank of Hungary (MNB House Price Index) shows slightly different figures: +17.9% YoY in 2025 Q2 and +5.1% QoQ for the country as a whole. But this is normal, as Eurostat and MNB use different indicators.

Middle segment :

Croatia (+13.2%), Spain (+12.8%), Slovakia (+11.3%), and Czechia (+10.5%) are showing steady growth. These countries attract investment from more developed EU economies and demonstrate healthy housing demand.

Minimal growth:

France (+0.5%), Sweden (+0.7%), and Cyprus (+1%) have virtually stagnant markets. Germany (+3.2%) and Italy (+3.9%) also show sluggish growth — these are economies with already high prices and low demand for further price increases.

Countries with negative growth:

Finland is the only country with a decline in prices (-1.3%) year-on-year.

Main Reasons for Growth and Declines: Demand vs. Supply

The imbalance in supply remains the primary driver. Europe is short approximately 9.6 million housing units (3.5% of the total housing stock), and new construction reaches only 64% of the required level. This shortage has persisted for decades and is exacerbated by demographic factors and construction constraints.

The role of interest rates. The European Central Bank has been lowering key interest rates since June 2024, following a series of increases in 2022-2023. From June 2024 to June 2025, the ECB deposit rate was reduced eight times, from 3.75% to 2.00%. Earlier, in mid-2023, the deposit rate was about 4.00%, and the basic refinancing rate (MRO) was higher — about 4.25%. This decrease has significantly made mortgages more affordable, which has stimulated renewed demand for housing, despite continued price increases.

Restoration of buyer confidence. After a drop in demand in 2022–2023, buyers have returned to the market. They are rushing to make purchases before prices rise further — this creates a vicious cycle that further fuels price increases.

Portugal as an Exception

Portugal is a special case. Growth there is driven not only by a housing shortage but also by foreign migration, urban improvements, and policies to attract investors. In August 2024, the IMT Jovem program was introduced, which exempts young Portuguese citizens (up to 35 years old) from property transfer tax when purchasing their first home. This has boosted demand from local buyers.

In August 2024, Portugal introduced an exemption program for young home buyers (up to 35 years old) from the Real Estate Transfer Tax (IMT) and stamp duty on the purchase of the first permanent home. This measure is aimed at supporting young families and stimulating demand for affordable housing. The benefits apply to the purchase of a first home and have specific limits on the cost of the facility. It is important to clarify that we are talking specifically about taxes on the purchase of real estate, and not about the annual property tax.

Over 15 years (2010–2025), prices in Portugal have risen by 141%, which is significantly less than in Hungary (+277%) or Estonia (+250%). However, in Portugal, the gap between wage growth and price growth is wider: between 2015 and 2024, the price index increased by 143%, while average wages rose by only 36%.

Finland: Why Are Prices Falling?

Finland is the only EU country with declining prices (-1.3%). The reasons include an oversupply of new construction in previous years, a drop in housing demand, and more conservative buyer behavior. This serves as a reminder that housing markets do not grow uniformly everywhere.

Political Response: The EU Affordable Housing Plan

In October 2025, the European Council made an important decision — it called on the European Commission to develop an ambitious Affordable Housing Plan for the EU. The plan is due to be presented in early 2026 and will include a housing strategy and measures to combat homelessness.

At the national level:

- Slovenia launched a public rental housing program with €1 billion in investments through 2034.

- In Spain, there has been an increase in the number of housing permits in 2024-2025, reaching the highest levels since 2008. The total number of permits in 2024 exceeded 125,000, while the upward trend continues in the first months of 2025.

However, experts are skeptical: turning policy plans into a real increase in housing supply will take years.

What Is the Outlook — Will Growth Continue?

In the second quarter of 2025, the European housing market demonstrated that the structural imbalance between demand and supply remains the primary driver of prices. Lower interest rates have provided some support but have not resolved the underlying problem. Prices will continue to rise in countries with insufficient housing supply (Portugal, Hungary, Bulgaria) and stagnate in countries where already high prices suppress demand (France, Germany, Sweden).

A political response exists, but its results will not be visible until 2026–2027 at the earliest. In the meantime, young Europeans in many countries face a difficult dilemma: save for years to buy a home or wait for a market correction that may never occur.