Romania Real Estate Market: Analysis of Prices, Rental Yields and Investment Opportunities

The Romanian real estate market has experienced rapid growth and offers interesting opportunities for investors. Over the past year, prices have risen by 14%. The average price per square meter is now €1,710, ranging from €1,940 to €2,363 in top cities like Cluj-Napoca, and reaching up to €3,500–€4,000 for premium complexes. Meanwhile, rental yields remain at 6–7.7%, twice the European average. While this sounds attractive, there are nuances: construction is not keeping up with demand, mortgage rates are around 5.5%, and transaction volumes began to decline in 2025.

In this article, we will examine the current state of the Romanian real estate market and explore real prices in different cities, from the affordable Iași to the expensive Cluj-Napoca. Along with it, we will figure out how much you can earn from rentals, what the mortgage conditions offered by banks are, and whether foreigners should consider Romania for investments.

Price Dynamics Around the Country

Housing prices in Romania continue to rise rapidly. According to Eurostat data, the housing price index (HPI) reached 162.38 points in the second quarter of 2025 (base year 2015 = 100). This represents a 4.72% increase from a year earlier. For comparison, the index rose by 3.9% in the third quarter of 2024. Thus, the acceleration of this trend is evident.

At the national level, the situation is even more impressive. The average price per square meter of an apartment in 2025 was €1,710, up 14% from the previous year. Prices for new residential properties in Romania are rising faster than those for existing properties: prices for new builds rose by 6.8%, while prices for existing houses rose by only 2.4%.

Let's Go Through the Regions

Prices in different cities vary greatly. This is due to economic activity and demand.

|

City |

Average price (€/m²) |

Premium districts |

Annual growth |

|

Cluj-Napoca |

€2000–€2363 |

€3500–€4000 |

+15.7% |

|

Bucharest |

€1862 |

€2000–€2500 |

+15.0% |

|

Timișoara |

€1700 |

~€1900 |

+11.7% |

|

Constanța |

€1766–€1838 |

~€2200 |

+17.84% |

|

Iași |

€1300–€1500 |

~€1800 |

+38.52% |

|

Brașov |

€1600–€1800 |

~€2000 |

moderate |

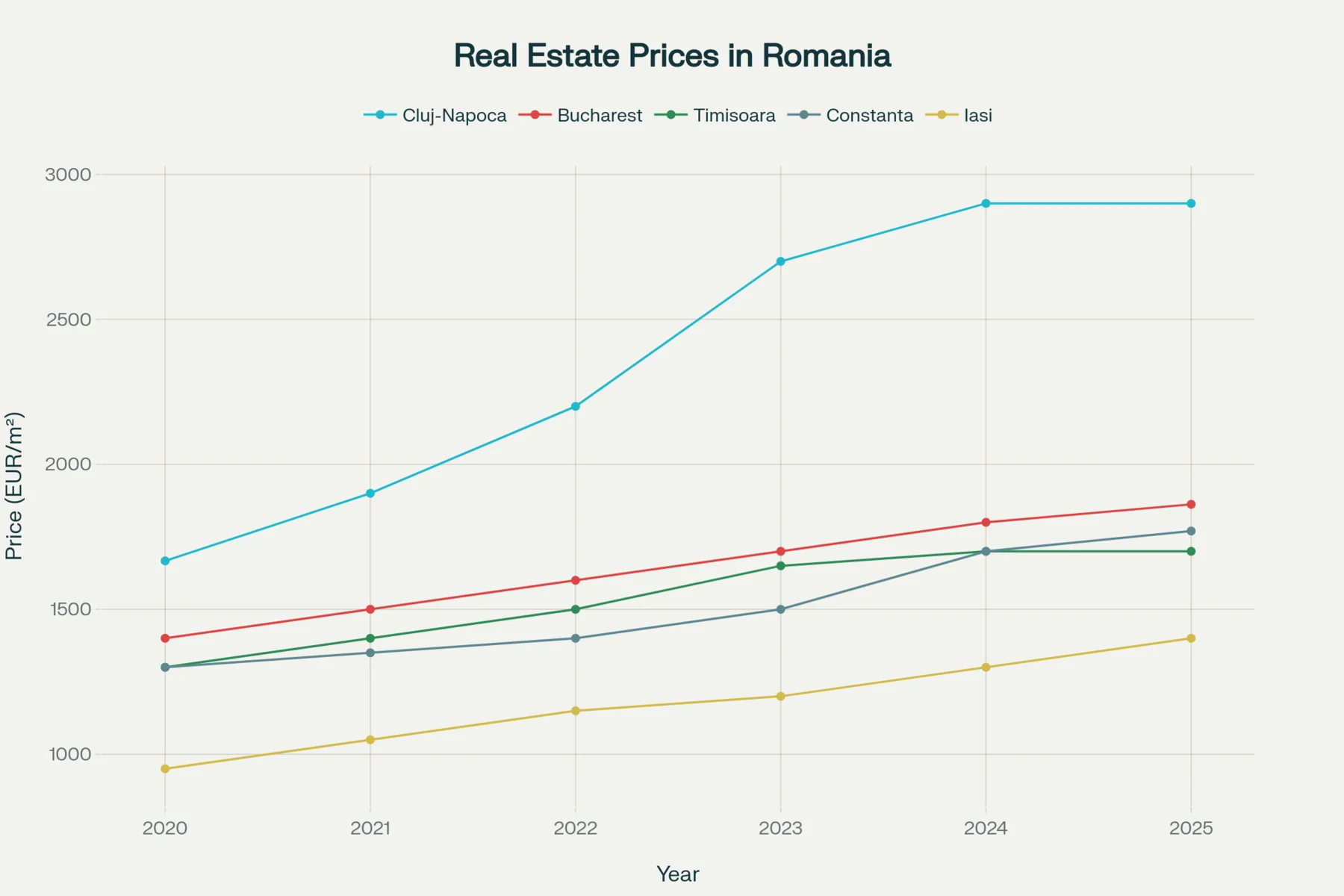

Cluj-Napoca shows the most impressive growth, becoming the most expensive real estate market in the country. Over the past five years, prices there have risen by 80%, from about €1667 per sq. m to the current range of €2000–€2363 per sq. m. The cost of housing in premium complexes in the city center reaches €3500–€4000 per square meter.

Bucharest takes second place with noticeable price growth across different districts. Annual growth was 15%.

Dynamics of average real estate prices by main cities of Romania (2020-2025)

Real Estate for Sale in Bucharest

What is Driving the Market

Construction problems

The main problem in the market is the decrease in supply. The number of issued permits fell by 20.7% in 2023 and by 14.9% in 2022. There was a slight increase of 2.9% in 2024 (to 35,667 permits), but this is still significantly below the 2021 peak.

The situation began to improve in the first half of 2025: the number of permits for residential facilities grew 4.4% compared to last year, reaching 24,821 from January to August. However, there was a local decline of 12.2% year-on-year in April 2025, indicating the trend's instability. Recovery to historical highs will take time.

Construction costs rise

Construction costs have increased significantly. The total cost of civil construction ranges from €600 to €1,500 per square meter, depending on the project's complexity and quality. Implementing green building principles, such as BREEAM or LEED certification, adds 10–20% to the cost.

Labor shortage

The shortage of skilled workers keeps wages high and increases construction costs. This issue remains critical, especially given the number of infrastructure projects alongside housing construction.

Demand and transaction volumes

Following a decline in 2023, the Romanian housing market experienced a revival in 2024. According to the National Cadastre Agency (ANCPI), nearly 169,000 houses were sold in 2024.

However, the situation changed in 2025. Colliers analysts noted a 9% drop in transactions during the first four months compared to the same period in 2024. In Bucharest, the decline was even more pronounced at 12%.

This slowdown is due to high inflation, limited access to credit, and rising construction costs. Additionally, the cancellation of tax benefits for construction workers in January 2025 increased labor costs, reduced developers' profits, and fueled growth in real estate prices.

Rental Market in Romania

Buying housing becomes less affordable for the middle class every year. In response, the demand for rentals is growing. In 2024, rental prices increased by an average of 15% compared to 2023. As of November 2025, the rental market remains active, though rates have begun to stabilize.

Rental rates by cities (as of November 2025):

|

City |

Studio (€) |

2-bedroom (€) |

3-bedroom (€) |

|

Cluj-Napoca |

420 |

600 |

749 |

|

Bucharest, District 1 |

from 750 |

— |

— |

|

Brașov |

375 |

500–640 |

640 |

|

Timișoara |

— |

550 |

— |

|

Constanța |

360–800 |

— |

— |

|

Iași |

— |

550 |

— |

|

Arad |

230 |

359 |

435 |

Cluj-Napoca is the most expensive city for rental. Here, studios cost an average of €420, two-bedroom apartments — €600, and three-bedroom apartments — €749.

In Bucharest, prices vary greatly depending on the district. The most expensive is District 1, where the average rental cost is €791. In districts 4 and 6 in the southwest, prices are lower: €527 and €515, respectively.

Arad is the most affordable city for rental. Here, studios cost €230, two-bedroom apartments — €359, and three-bedroom apartments — €435.

How Much Do Investors Earn

Romania offers some of the most profitable rental yields in Europe. According to the Global Property Guide, the average gross rental yield in Romania is 6.33%. In Bucharest, the yield was even higher at 7.73% in the second quarter of 2025.

In other cities, yields are lower. In Constanța, it is about 5.86–6.45%; in Iași, it is about 6.18% for studios; and in Cluj-Napoca, it is 4.2–4.8% due to high property prices.

The annual gross income from renting a €200,000 property in Bucharest is €12,000–€16,000 (6–8%) in the first year.

Taxes and Maintenance Costs

In Romania, both local residents and foreigners pay a fixed 10% tax on real estate rentals. On average, operating expenses reduce gross income by 1.5–2 percentage points, including both mandatory and additional costs. After taxes and expenses are deducted, the net income is usually 5–6%.

Mortgage Market and Financing Conditions

The Romanian mortgage market is growing actively. In the first half of 2025, new mortgage loans accounted for about 40% of all bank loans, reaching €10.7 billion (in Romanian lei), which is 24% more than in 2024.

The average mortgage loan size during this period increased to €64,000 (in 2024 it was €62,000). Residents of Cluj-Napoca took especially high amounts — an average of €89,250, 17% more than a year earlier.

Interest Rates and Down Payment Size

In the first half of 2025, average fixed rates on new mortgages in Bucharest were around 5.45%. In the second half of the year, they may rise to 5.95%. This increase is due to continued inflation growth. The National Bank of Romania maintains the key rate at 6.5%, which also affects loan interest rates.

The reference consumer price index (IRCC) is expected to rise to approximately 6% in the fourth quarter of 2025, up from the current 5.55%. Nevertheless, monthly payments remain below the peak values recorded in summer 2024.

Minimum down payments are typically 15–25% for Romanian residents and 20–30% for foreign buyers.

Commercial Real Estate

Romania is experiencing a boom in commercial real estate investment. As of August 2025, key developers had invested over €1.5–2 billion in 17 large-scale projects. These initiatives will create 887,400 square meters of modern commercial space by 2027.

Commercial Properties for Sale in Romania

Investments are distributed as follows:

- Retail segment: €970 million — 388,000 sq. m. Among major projects — Cluj Mall (130,000 sq. m) and Rivus Cluj (120,000 sq. m).

- Industrial segment: €367 million — 367,100 sq. m.

- Office segment: €330 million — 132,300 sq. m.

Office Market

The Romanian office market is recovering. In the first half of 2025, €126 million was invested in the market. However, demand for offices remains cautious this year. Low rental demand is expected, and the vacancy rate may decrease.

The market is experiencing a dual situation. Modern, energy-efficient buildings in desirable locations continue to attract tenants. Less competitive properties are facing difficulties.

Industrial-Logistics Segment

Industrial and logistics real estate remain leaders in the commercial segment. In the first half of 2025, more than 417,000 sq. m of industrial space was leased, which is 22% higher than in 2024. Two-thirds of demand comes from the retail sector and the consumer goods sector.

In the first nine months of 2025, 339,600 sq. m of new space was put into operation, of which 191,600 sq. m — logistics parks and industrial zones. Major developers such as VGP and Logicor continue to actively expand their portfolios.

Rental rates remained stable: from €4.5 to €5 per sq. m per month in major cities and from €3.8 to €4.5 in regional centers.

Retail Segment

The retail sector is preparing for significant growth. Major shopping centers are planning large-scale expansions by 2027–2028. In the first half of 2025, the retail segment led in investment volume and attracted €163 million — this is 42% of all deals.

How a Foreigner Can Buy Housing in Romania

Romania welcomes foreign investment in real estate. However, there are certain rules:

- EU and EEA citizens can freely buy any real estate, including land, on the same terms as local residents.

- Citizens of other countries can acquire apartments, houses, and commercial properties without restrictions, but they cannot directly own land. However, this restriction can be bypassed by purchasing real estate through a Romanian company.

The main laws regulating these issues include Law No. 312 on the acquisition of property by foreign citizens from 2005, the Civil Code, and other regulations.

Transaction costs during deals usually amount to 5–7% of the property value for both EU citizens and third countries, and include transfer taxes, court fees, and agency commissions.

Forecast for the Romanian Market for 2025-2029

Short-term forecast (2025–2026)

After several years of rapid growth, the market will stabilize. Due to high interest rates and fiscal pressure, a decrease in demand and a reduction in the number of transactions are expected. However, a recession like the one in 2009–2010 is not anticipated.

Prices in major Romanian cities are expected to rise by about 5% in the first half of 2025. This indicates the preservation of bullish trends despite the slowdown in transaction volumes.

Long-term forecast (2027+)

In the long term, the main factors remain favorable. The residential real estate market is expected to grow by 3.79% annually (CAGR 2025-2029), reaching a transaction volume of $8.73 billion by 2029. Commercial real estate will also grow, but more slowly — by 1.62% per year (CAGR 2025-2029).

Major cities continue to face housing shortages and overcrowding, yet demand for property purchases remains high compared to pre-pandemic levels. Commercial real estate, especially retail and industrial properties, has significant growth potential due to regional development and infrastructure investments.

Author

I am responsible for editorial work. I write expert interviews and guides.