Apartment Prices in Poland in Q2 2025 — Analysis

In the second quarter of 2025, Poland’s residential real estate market entered a phase of relative stability. Declining interest rates on mortgage loans revived demand, and apartment prices stopped rising at such a rapid rates for the first time in the last two years. This created conditions in which interest in purchasing housing intensified, especially among those who had postponed transactions due to high borrowing costs.

Revival of Mortgage Lending in Poland

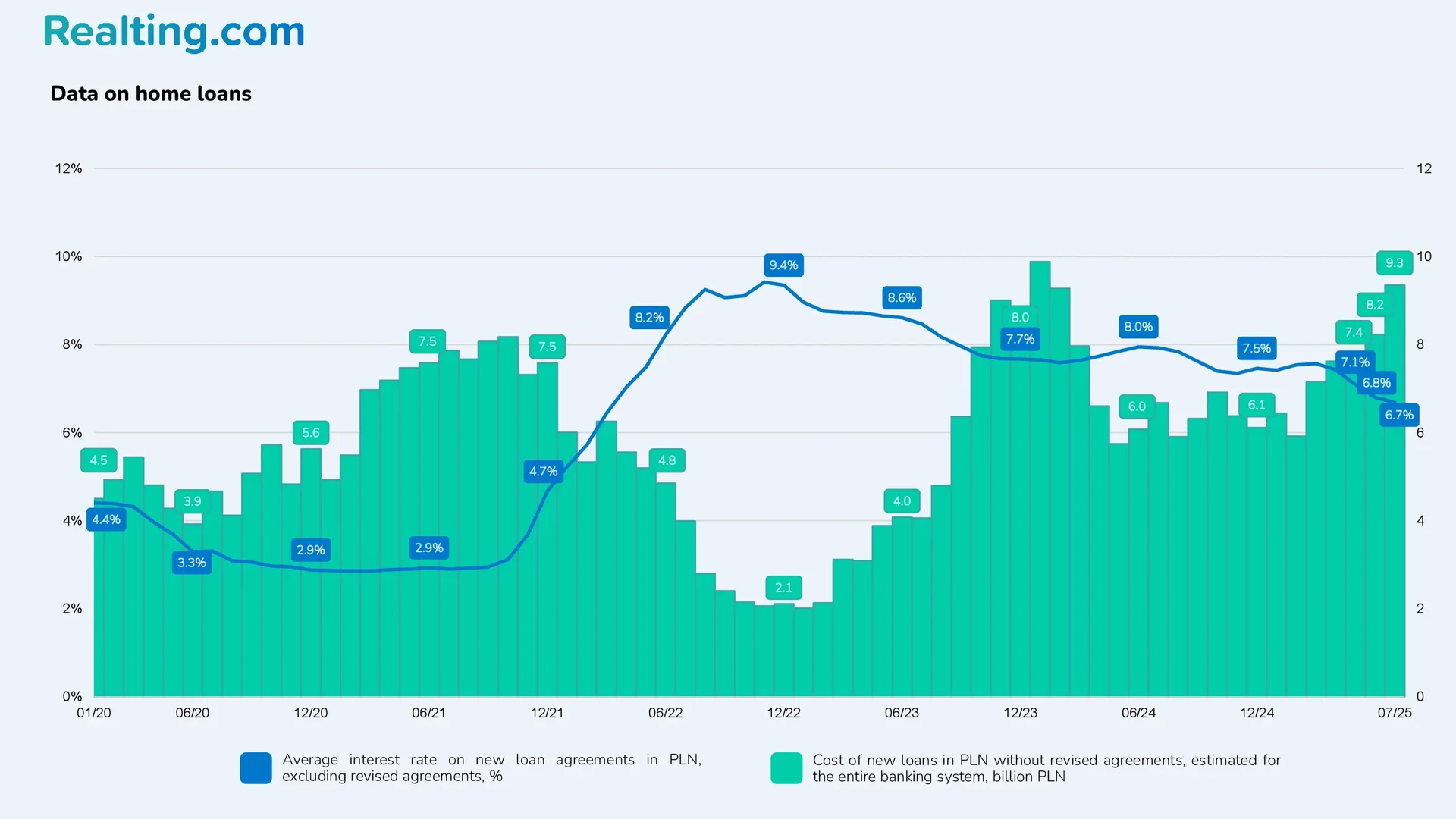

According to data from the National Bank of Poland (NBP), interest rates on loans decreased several times in Q2 2025. It is likely that several more rate cuts will occur in Poland by the end of the current year. The reduction in loan rates has noticeably revived the mortgage lending market. Starting from March this year, the volume of loans issued for home purchases has been growing.

According to NBP data, the value of newly issued loans for the entire country’s banking system in Q2 2025 amounted to 23.3 billion zloty (PLN), which is 19.2% more than in Q1 2025 and 26.3% more than in Q2 last year. In July 2025, banks issued mortgages worth 9.4 billion zloty (PLN), which is 40% more than in July 2024.

Given the declining interest rates, loan issuance volumes will continue to grow; by the end of this year and the beginning of next, the volume of new housing loans could approach the levels of Q1 2024, when loans totaling a record amount for the market were issued.

Dynamics of Housing Prices in Poland: Stabilization After Growth

While demand for mortgages is growing, the housing market is seeing price stabilization — a situation that cannot help but inspire optimism among potential buyers, which should soon lead to increased activity in the housing market.

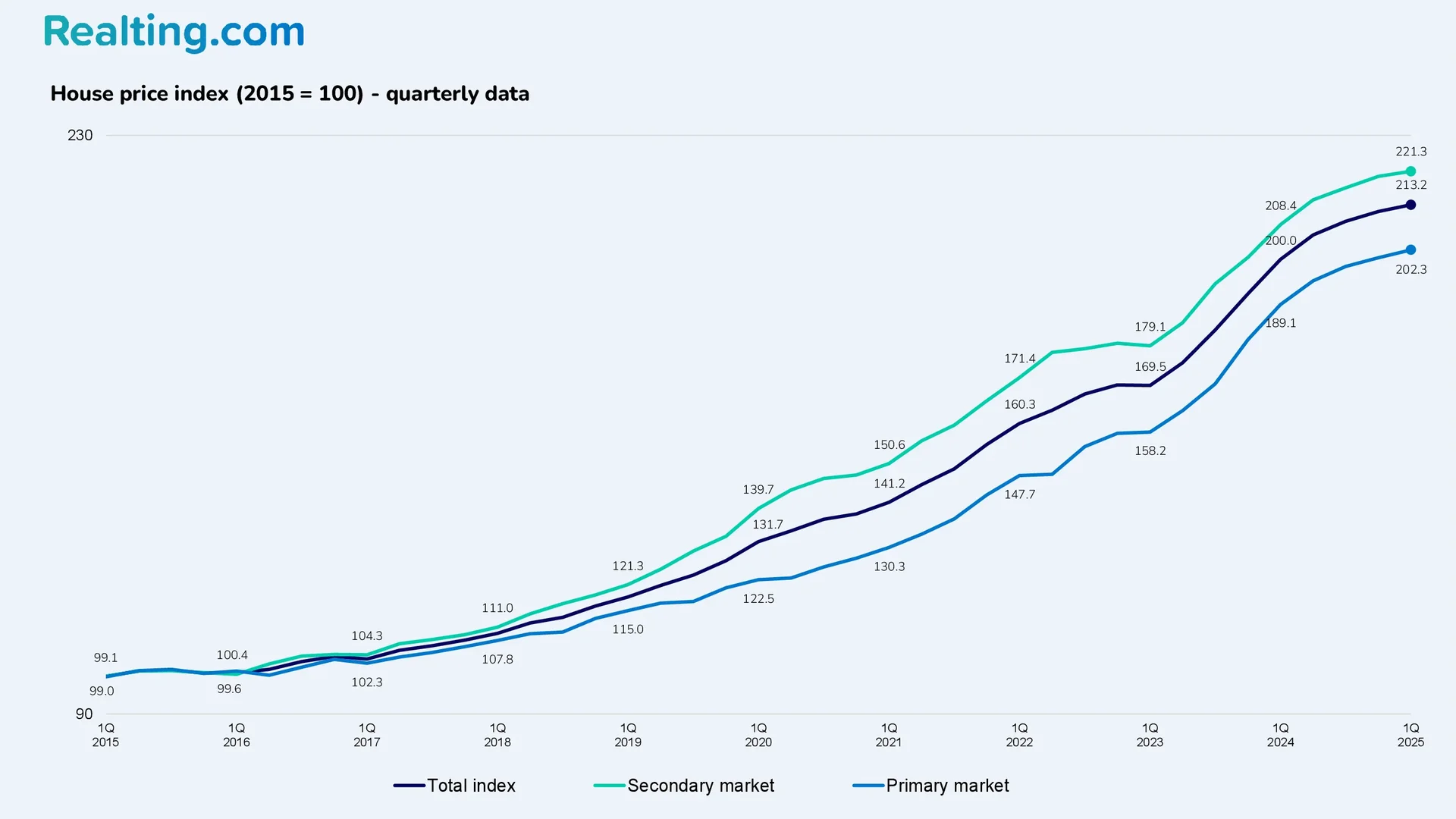

As of September 2025, Poland’s Central Statistical Office (GUS) has not yet published data on the housing price index for Q2 2025, so we will provide the indices from the beginning of the year.

From Q2 2023 to Q2 2024, housing prices in the country grew by an average of 4% quarterly, after which the growth rates noticeably slowed, and by the second half of 2024, prices grew by an average of 1.4% quarterly. In turn, in Q1 2025, residential real estate prices in Poland increased by 0.8% compared to the previous quarter (compared to the same period in 2024, prices rose by 6.6%).

The situation is similar across the primary and secondary housing markets. For the primary market, quarterly growth was +0.9%; for the secondary, +0.5%; annual growth for the primary and secondary markets was +7.0% and +6.2%, respectively.

In apartment sales transactions, according to the National Bank of Poland's (NBP) Residential Real Estate Price Database, quarterly price declines were noted in 4 out of 6 major Polish cities in Q2 2025. The largest decline in the average price per square meter was recorded in Poznań — -4.9% compared to Q1 2025; in Warsaw, average prices on the secondary market fell by 1.7%, in Kraków by 1.4%, and in Wrocław by just 0.4%. In Gdańsk and Łódź, average apartment prices rose by 0.5% and 0.6%, respectively.

On the primary apartment market, the situation differs. In Warsaw, the average price of apartments on the primary market remained virtually unchanged — -0.1% compared to the previous quarter. In Kraków, the average price per square meter rose by a "modest 0.3%"; in Wrocław, prices increased by +5.4%; in Gdańsk, by +1.4%; in Poznań, by +1.1%; and in Łódź, by +2.8%.

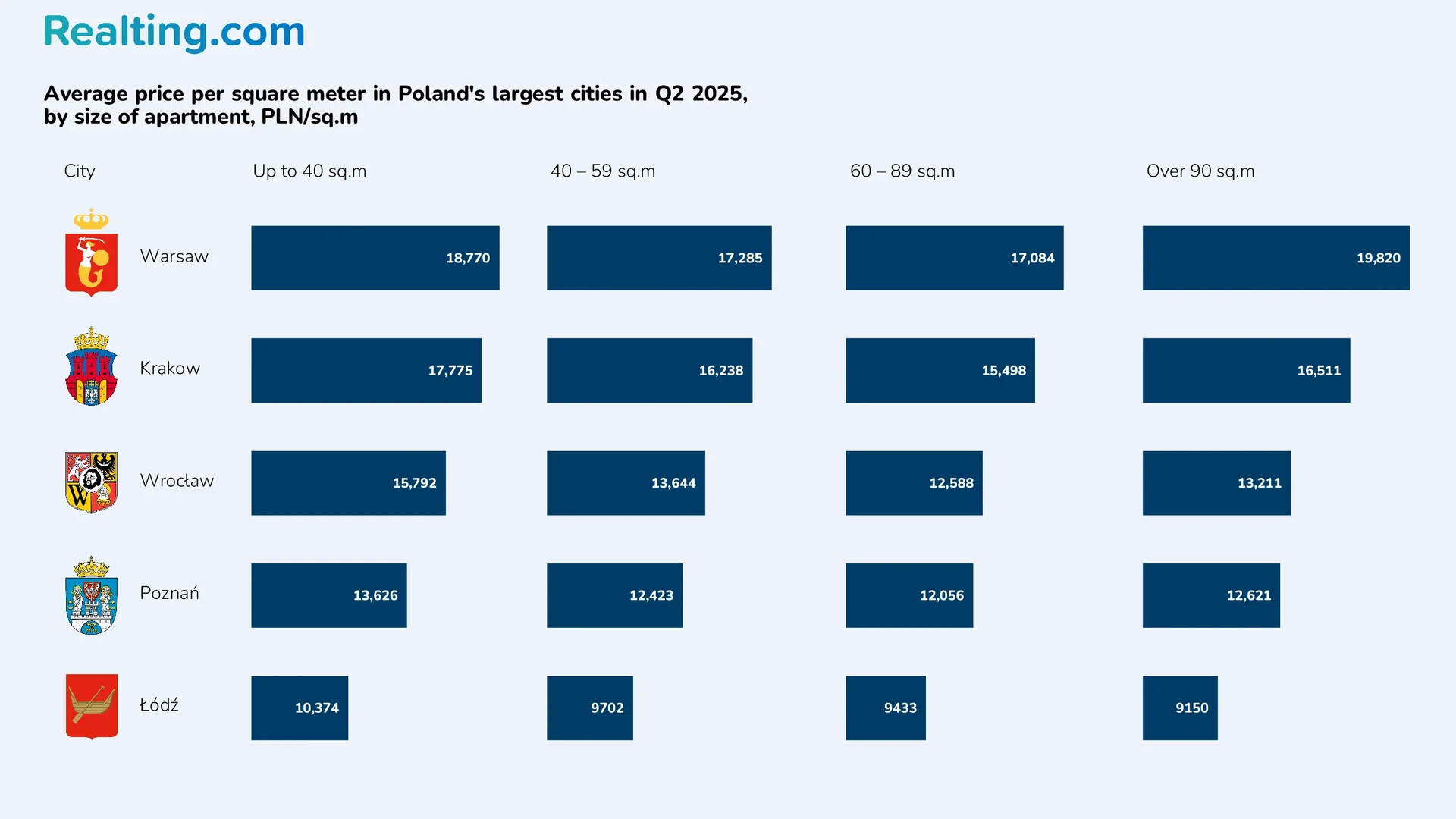

Below, we provide the average cost per square meter in apartment sales offers in Poland's 5 largest cities, based on Otodom portal data for Q2 2025.

As mentioned earlier, in Q2 2025, Poland's residential real estate market was marked by price stabilization and a revival in mortgage lending. If interest rate reductions continue, demand in the housing market will grow. The second half of 2025 could become a period when demand and activity in the Polish residential real estate market begin to recover, though this may lead to a new wave of housing price increases in the future.

Frequently Asked Questions

How have mortgages changed in Poland in 2025?

According to National Bank of Poland (NBP) data, the volume of new mortgages in Q2 2025 grew by 19.2% compared to the previous quarter and by 26.3% year-on-year.

Are apartment prices in Poland rising in 2025?

Growth rates have slowed: in Q1 2025, prices rose by only 0.8% compared to the previous quarter. On the secondary market in Warsaw, Kraków, and Poznań, price declines were even recorded.

Which Polish cities saw housing price increases in Q2 2025?

Price growth was noted in Gdańsk (+0.5% on the secondary market), Łódź (+0.6%), as well as on the primary market in Wrocław (+5.4%), Łódź (+2.8%), and Gdańsk (+1.4%).