Real Estate Market 2025: Year Results and Forecasts for 2026 from Agency Directors from Different Countries

What was the outgoing year like for the international real estate market? The answer will change depending on the point on the map, so to get some kind of cross-section, it is best to familiarize yourself with the real experience of people who work “in the field” every day. We asked directors of real estate agencies from different countries to honestly tell how 2025 was for them, what changed in their markets and what they expect from the coming 2026.

Kirill Egorov, head of overseas real estate agency “Estabro”, Indonesia:

— I would characterize 2025 as a working and transitional year for the Indonesian real estate market. We saw a noticeable shift in focus of developers and agencies from the Russian-speaking audience and CIS market towards international, primarily English-speaking demand. The market itself has changed significantly: the transaction cycle for Russian-speaking and English-speaking buyers has almost equalized — this is a serious shift compared to 2022–2023, when CIS clients made decisions much faster. Today, developers are increasingly focusing on the requirements of European, Australian and American investors, adapting contracts and financial models to their expectations, while maintaining competitive payment plans.

The second key trend of the year is a noticeable tightening of regulation. The Bali market began to move from a largely spontaneous model to a more systemic and legal one. In 2025, we saw the suspension of a number of constructions due to problems with permitting documentation, and new projects began to be launched only after receiving the full package of permits.

This led to a shift in focus of agencies and investors from “on paper” projects to facilities with real construction stage and confirmed background. Demand for developers with track record, completed projects and clear history for investors has grown significantly. Overall, this is a healthy change: the market is becoming more mature, and investors who carefully look at documents and conduct full due diligence are entering it.

If we talk about results and expectations, the main result of the year is the transition of the market to a more regulated and sustainable legal field. Few new developers appeared, there were only a few loud launches, among which the launch of the Aura project by Samolet Property Group stands out especially. Most operating developers this year focused on fulfilling previously taken obligations, rather than on the mass launch of new projects.

In 2026, we expect the market to exit this transitional period: active progress on current constructions, completion of problematic facilities, emergence of successful cases and, as a result, growth in trust. Already now we see reviving demand both from foreign investors and from buyers from CIS countries, and we expect that next year will be more saturated in terms of the number of transactions and overall market development dynamics on Bali.

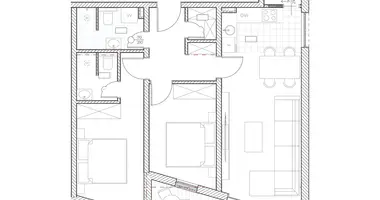

Selection of residential properties in Indonesia

Natalia Zaitseva, CEO and realtor Etalon Estate Group, Poland:

— For the real estate business in Poland, this year was not about speed and not about the number of transactions. It was about the quality of decisions. About consistency, analytics and the ability to work with numbers, not with expectations.

The market as a whole remained stable, but demand became noticeably more conscious. There were fewer impulsive purchases, and interest shifted towards investment-understandable objects — those where the logic of profitability and risk is clear even before the transaction. By the end of the year, against the backdrop of lower mortgage rates, buyer activity grew, but already at a different level of maturity.

Separately, I note the growing interest in overseas real estate. Local clients are increasingly looking beyond the Polish market, considering alternative, including atypical destinations — not because of fashion, but because of diversification and strategic thinking.

This year clearly showed: the market has ceased to be equal for everyone. Independent transactions without experience more and more often led to legal and financial mistakes. Where the market used to forgive, today it demands professionalism. And clients felt this well.

In 2026, I would like to see a market in which price is formed by the quality of the object, its location and the real economics of the transaction — and not by negotiation tactics or the emotional background of the news. A market that values not the loudness of statements, but the depth of expertise.

For me, the main result of the year is obvious: real estate in Poland remains a reliable asset, but only in the hands of those who know how to work with it professionally. The market has grown up. And, as a practitioner, I consider this its healthiest and most important achievement.

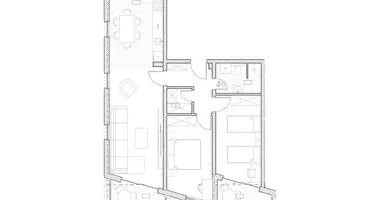

Selection of residential properties in Poland

Slava Maevski, founder of MD Realty in Montenegro:

— 2025 became a year of transformation. The market entered it with the inertia of previous years, but over time it became clear that the usual scenarios no longer work. Activity decreased, clients began to make decisions more slowly and consciously. For us, this year became a time of rethinking, not quick deals — we were adjusting processes, filtering demand, looking for new growth points. In such periods, the market may not grow externally, but it noticeably matures internally. I would like to believe that we are maturing along with it.

The year was not easy. First, global economic uncertainty directly affected buyer activity — people became more cautious with large investments. In addition, the market adapted to new rules: changes in Montenegro’s legislation added a pause, especially for foreign buyers.

Separately, it is worth noting the European vector. The country’s movement towards the EU is a strategically strong and correct step, but at the current stage it temporarily cooled the interest of part of buyers from CIS countries, who previously were among the most active. But this is a normal process of changing the structure of demand, not a crisis.

The main thing is that the market has become more honest and rational. Prices stopped growing by inertia, more quality offers appeared, especially in the investment segment and on the secondary market.

In essence, in 2025 the rules of the game changed: the market stopped forgiving mistakes and spontaneous decisions and began to work according to a more rational, balanced model. For some, the year turned out to be painful, but for investors who know how to count and look ahead — on the contrary, it opened new opportunities. It is during such periods that deals are formed that in a few years look the most profitable.

I look at 2026 with restrained optimism. There is a feeling that the market will gradually begin to recover positions and return to growth — calmer and more sustainable, without the previous overheating.

At the same time, in my opinion, the investment segment will remain especially promising: projects under construction at adjusted prices, quality secondary market objects, as well as situations of quick entry and exit. Now some owners are leaving the market, and new buyers are just starting to enter — and it is in this gap that a rare chance arises to earn on the right timing.

Despite the cyclical nature of the market, Montenegro retains a very strong foundation. This is a combination of sea and mountains, mild climate, nature, coziness and consistently high tourist demand.

For many clients, buying real estate here is not just numbers and profitability. Montenegro is a country where you want to live, relax and return to. And it is this human factor, in my opinion, that in the long term supports the market much stronger than any short-term fluctuations.

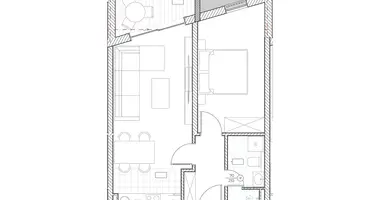

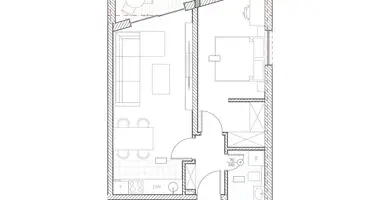

Selection of residential properties in Montenegro

Elias Marino, founder of Geo Estate real estate agency, Georgia:

— For me, 2025 was marked by the birth of new ideas and bold decisions. In particular, together with the Realting team, we drew public attention to the acute problems of Batumi: ecology, shortage of parking spaces and lack of infrastructure for electric vehicles. As a result, we developed an innovative project: an automatic modular parking for 1000 car spaces, including Tesla Supercharger express charging stations, vertical facade landscaping and a solar power plant on the roof.

The trend towards sustainable development and social responsibility has not bypassed large projects:

- On the artificial island of Batumi (84 hectares), almost half of the territory (49%) is given over to parks and recreational zones, and internal movement will be carried out by electric transport.

- In the project of the UAE developer Eagle Hills, planned on the territory of the Ponichala Nature Reserve (about 600 hectares), a philosophy of development with respect for nature and heritage will be implemented. This involves preserving all old-growth trees and maintaining the natural habitat of animals and plants.

In 2026, I would like to see more ambitious and environmentally oriented projects in Georgia. The outstanding example is Elwood by Sobha in Dubai. Imagine: in one of the hottest points on the planet, where the temperature does not drop below 30°C even at night, more than 10,000 trees from all over the world are planned to be brought into the desert to recreate 7 great forests of the world, including the ancient cedars of Yakushima forest and baobabs from South Africa.

In conclusion, I want to emphasize that in order to strengthen Georgia’s image as an open and hospitable state, as well as to create a favorable investment and migration climate, it would be appropriate to raise the level of friendliness and hospitality on the part of border control employees towards expats from post-Soviet republics and citizens of countries such as Vanuatu. Such an approach will become a practical embodiment of the archaic principle of Georgian culture: “A guest is a messenger of God.”

Selection of residential properties in Georgia

Peter Pollak, CEO of IC-REAL real estate agency in Croatia:

— The real estate market in Istria, the peninsula in northern Croatia with its tourist hotspots Rovinj, Poreč, Medulin, Pula, and Labin / Rabac, consolidated significantly in 2025.

After the boom of recent years, especially during the COVID-19 pandemic, the market has normalized – or rather, it is still in the process of normalizing. Sales have declined sharply, particularly demand from buyers in Germany and Austria. The strong demand from these countries in recent years was a major factor in the sharp price increase! Prices are currently still falling, as many sellers' price expectations remain unrealistic.

The reasons for the now lower demand are manifold: many prospective buyers from the EU have already invested in real estate in Istria and are not buying countless more properties. German and Austrian banks have become very restrictive in granting loans for real estate purchases. And the economic crisis in Germany is further contributing to the problem; people no longer have the funds to invest in their own property in the holiday paradise of Croatia.

Tourism in Istria increased again in 2025 – by 2% this year. The shoulder seasons, in particular, still offer many opportunities for investors and landlords to expand their businesses. In the summer, with so many tourists, "fewer tourists" often means "more quality." There are simply too many people – a problem not only in Istria/Croatia, but also in some parts of Italy and Spain.

When I say that the market for German and Austrian buyers has become more constructive, I also mean that they are increasingly looking for houses built to their own specifications – that is, land and a dream house built according to plans. And quality is particularly valued – in terms of location and construction. The sheer number of run-of-the-mill houses with pools and cheap basic amenities is no longer attractive to anyone as a second home. There is too much supply on the market, and many second-rate properties that do not meet customer expectations are still being built.

For us, this market development means we want to rise to the challenge. In spring 2026, together with Austrian manufacturers, we will be launching exclusive solid wood houses in Istria. These are individually designed and built residential and holiday homes with approximately 80% Austrian added value – where quality and functionality perfectly match the price-performance ratio. This entire model is particularly attractive for investors in the holiday rental market – because construction can be completed very quickly! Every customer has the opportunity to have their dream house built in their dream location at a reasonable price! Or even a larger apartment building with several units. An ecologically sustainable concept using wood as a building material – better than brick and concrete!

Selection of residential properties in Croatia

Alexander Ufnarovsky, CEO of Estate-Service24, Germany:

— 2025 became a year of stabilization for the German real estate market after the sharp correction of previous years. After the decline of 2022–2024, the market gradually adapted to new conditions — high interest rates, tighter financing requirements and changed behavior of investors and buyers.

In the residential real estate segment, demand has shifted towards quality: energy-efficient houses, new buildings, good locations. Old stock with low energy class sold worse and often at a discount. The rental market remained tense: shortage of housing, rising rental rates in major cities and university centers.

Investors’ priorities are objects with long-term leases, reliable tenants and regions outside the “top-7 cities”.

We expect that in 2026 the market will finally adapt to the new interest rate environment, participants will act more confidently, transaction volumes will begin to grow moderately, although it is still far from the levels of 2021. We are not talking about a “boom”, but about healthy, structured growth.

Unlike more volatile markets (Spain, Portugal, Eastern Europe), Germany is almost independent of short-term foreign speculative flows. Even in correction years, the market demonstrated the absence of sharp collapses, high legal protection of property, predictability of regulation. Therefore, German real estate is traditionally perceived as a tool for capital preservation and obtaining stable income in the long term.

Selection of residential properties in Germany

Akmal Rustami, Head of External Affairs, International Relations & CIS Investors at Umed properties, UAE:

— In 2025, the real estate market in the UAE became more mature and dynamic. Now every broker remaining in the Emirates must not only convince investors of the attractiveness of their projects, but also be aware of global initiatives such as D-33 Agenda and Dubai 2040 Urban Master Plan.

The real estate market opened new horizons. Abu Dhabi launched many large projects, Ajman became fully accessible, many waterfront properties appeared, and Umm Al Quwain also opened up for investors. We actively work in these emirates, while Dubai developers are actively expanding into Ras Al Khaimah.

Main results of 2025:

- Prices for studios in Dubai, which are already approaching one million dirhams (about $274,000), will continue to grow in 2026.

- Competition in the market is very high in all emirates.

- The UAE remains the most stable, safe and economically sustainable state both in the Middle East and in the world.

We expect that in 2026 the flow of investors from Africa, Eastern Europe, Canada, Great Britain and the USA will significantly increase. The market will continue to grow, and almost all emirates will be open for investment, which is very beneficial for investors. We also expect that from 2026 the focus will shift to townhouses and villas, as an increase in relocations is anticipated.

Selection of residential properties in UAE

Author

I am responsible for editorial work. I write expert interviews and guides.