In Which European Countries It’s Easiest to Save Up for an Apartment

Buying an apartment in Europe is a task that in some countries is solved in 4–5 years, while in others it stretches to 15 years or more. In this article, we will figure out where it is realistically possible to quickly become a homeowner, which countries’ capitals have turned into some of the most unaffordable markets in the region, and why national averages are often deceptive.

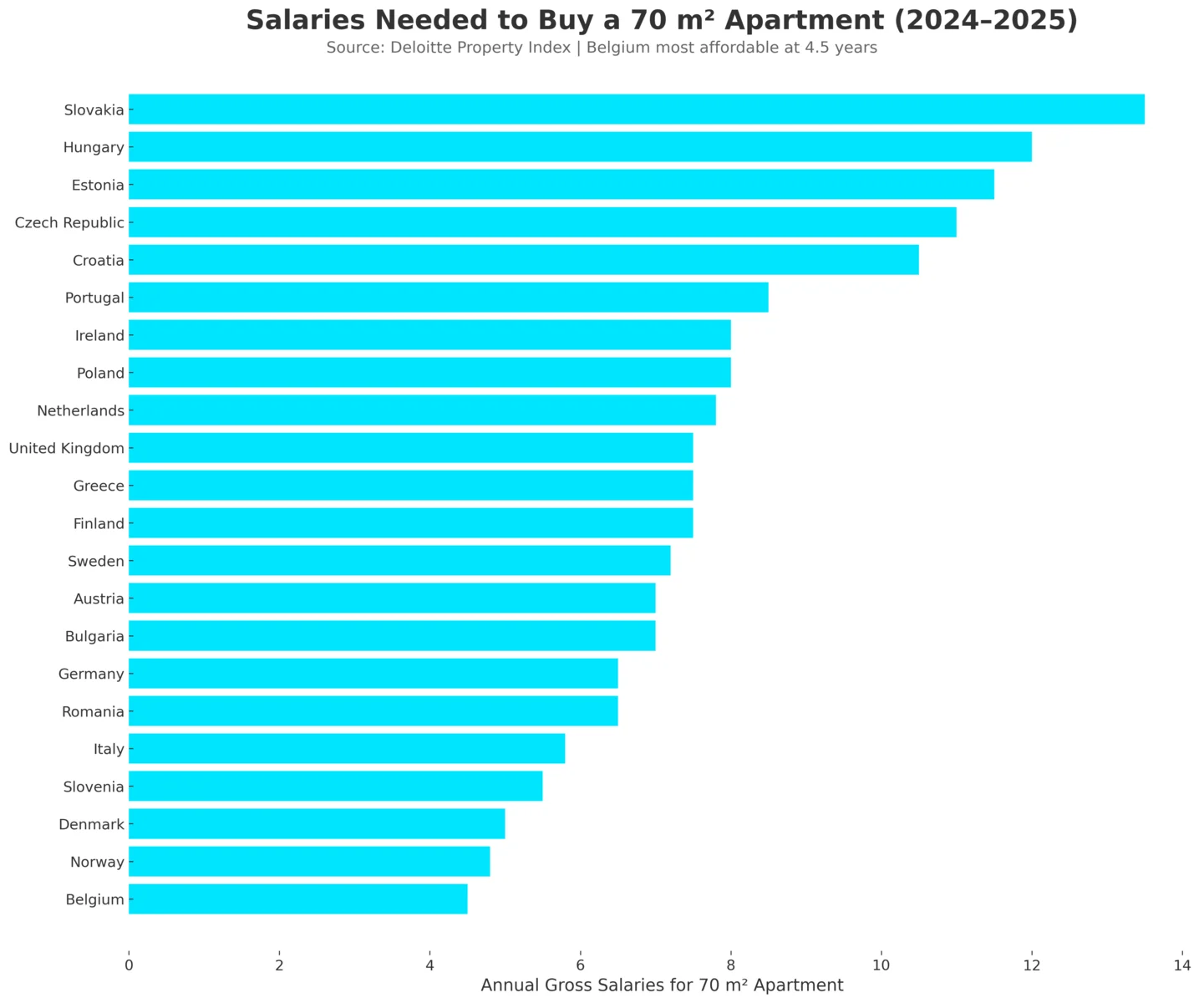

The material is relevant for the fourth quarter of 2025 and reflects the state of housing markets based on the latest available data, in particular, Deloitte Property Index 2024–2025, BestBrokers/Euronews Global Housing Affordability (2024–2025), and Geozofija Affordability Analysis (October 2025).

Top European countries where housing is most affordable

Let’s talk about the countries that provide the best conditions in this regard.

Belgium

In Belgium, an apartment of 70 m² can be purchased on average for 4–5 annual salaries. The country occupies one of the leading places in Europe in terms of housing affordability.

The main factor is the automatic wage indexation system. When inflation exceeds the set threshold (CPI), the nominal salary increases. In 2025, the indexation will be 3.58 %, taking into account 1.48 % in 2024. This helps families maintain purchasing power.

A stable mortgage market and strict stress-test standards accelerate the process of transition to ownership.

Denmark

For an apartment of 70 m² in Denmark, it takes approximately 5 years of average gross incomes. According to the BestBrokers 2024–2025 study, buying a house of 100 m² requires about 114 net monthly salaries — the best indicator in the global sample (ahead of Norway and the USA).

The secret of success:

- High and stable incomes (median salary €50,000+).

- Well-developed system of mortgage bonds (boliger bnd), regulated rates.

- Thought-out urban planning policy and supply of new apartments.

Norway

Despite one of the highest costs of living in the world, the combination of very high salaries and relatively moderate real estate prices allows purchasing an apartment of 70 m² for 5 annual incomes.

The Norwegian market remains one of the most comfortable for local buyers. The average nominal salary exceeds €65,000 per year, which allows quick saving even with high absolute housing prices.

Slovenia and Italy (except tourist centres)

For apartments of 70 m², it takes approximately 5–6 annual incomes.

Important clarification: in Italy, there is a big difference between major cities (Rome, Milan: 8–10 years) and the provinces. In non-tourist regions (Apulia, Basilicata, Calabria in the south), housing is noticeably more affordable (4–5 years).

List if Italian Apartments for Sale

Romania

Here the combination of low prices per m² (€1710–1862/m² according to Deloitte 2024–2025 and Global Property Guide) and growing but still relatively low salaries (€15,000–18,000 per year) gives the following result: about 6–7 gross annual incomes for an apartment of 70 m².

This is one of the best affordability indicators in Eastern Europe for the local population, although absolute prices are lower than in Western Europe.

Bulgaria

According to Deloitte, by 2025, Bulgaria will remain one of the most affordable countries in the European Union. Saving up for an apartment of 70 m² will take only 6–8 years. Construction boom and low interest rates contribute to an active market.

List of Bulgarian Apartments for Sale

Global Leaders Outside Europe

According to BestBrokers/Euronews (2024–2025):

USA — a house of 100 m² costs about 76 net monthly salaries (approximately 6.3 years of theoretical savings). High incomes and a stable mortgage market make the USA affordable compared to European capitals.

South Africa — a house of 100 m² costs about 66–71 net monthly salaries (approximately 5.5–6 years). This makes South Africa one of the most advantageous markets globally in terms of the property price-to-income ratio.

Countries with Average Affordability (6–9 Years of Income)

For a number of developed markets, buying an apartment of 70 m² or a comparable house costs 6–9 annual incomes.

Sweden and Finland

Recent European studies point to 6–10 annual incomes depending on the city. In Helsinki and Stockholm, affordability is higher (8–10 years), and in regional cities, better (6–7 years).

Important nuance: OECD 2025 shows that in Sweden, housing costs amount to 17.9 % of average income (against OECD average 18.5 %) — this indicates a relatively balanced market.

The quality of infrastructure and social services is one of the best in the world, which compensates for lower affordability than in Denmark.

United Kingdom and the Netherlands

Country-wide coefficients are around 7–8 annual incomes, but in London and Amsterdam, affordability is significantly worse.

Amsterdam requires 15.4 annual salaries and enters the top-3 least affordable cities in Europe alongside Prague (15.0) and Athens (15.3). Less than 2 % of homes are affordable for the average household in the Netherlands.

Portugal

On gross salary, the indicators look moderate (8–10 years); however, when using net incomes, the result is substantially worse: about 200+ net monthly salaries, or approximately 16.7 years, making Portugal one of the outsiders in Europe.

Reason: sharp price increase in Lisbon and coastal areas against the background of foreign buyer activity and programs like Golden Visa. Eurostat (November 2025) shows that Portugal has the highest price growth in the EU — +17.2 % in the second quarter of 2025.

In the provinces (Porto, Covilhã), housing is substantially cheaper than in the capital.

Poland

Buying an apartment in Poland of 70 m² requires about 8 annual incomes country-wide. In Warsaw and a number of large cities (Kraków, Wrocław) prices have grown especially quickly in recent years, worsening affordability for locals.

Ireland (improving trend)

According to MyHome.ie, and Bank of Ireland (Q1–Q3 2025):

- Median house price: €426,000.

- Average annual income: €53,000.

- Coefficient: ~8 annual incomes.

A few years ago, the situation was worse (10–12 years), so here we can speak of moderate improvement. However, housing remains expensive compared to most EU countries.

The Most Problematic Markets in Europe for Housing Affordability

Now let’s move to countries where affording housing will already be much harder.

Czechia and Prague as a capital with extreme unaffordability

Deloitte and a number of specialized indices unanimously rank Czechia among the countries with the lowest housing affordability in Europe:

- Country-wide: buying a new apartment in Czechia of 70 m² requires more than 10 annual incomes.

- Prague stands out especially: approximately 15.0 annual salaries are required for an apartment of 70 m² in new construction. Prague consistently enters the top-3 least affordable markets in Europe alongside Amsterdam (15.4) and Athens (15.3).

The situation deteriorated sharply over the past year. Prague was third in unaffordability with an indicator of 13.3 years in 2023; in 2024, the indicator jumped by 1.7 years to 15.0.

Athens and Greece: capital vs provinces

With Greece, the situation is dual.

Country-wide, the coefficient “price of 70 m² apartment / annual income” is worse than in Northern Europe, but far from extreme values.

However, in Athens, buying such an apartment requires approximately 15.3 annual salaries, making the capital one of the most unaffordable in Europe alongside Amsterdam (15.4) and Prague (15.0).

Central and Eastern Europe

According to Deloitte (2025) and independent reviews, a stable group of “difficult markets” is recorded in Central and Eastern Europe: Slovakia, Hungary, Estonia, Serbia, Croatia.

Slovakia

One of the least affordable countries in Europe. Deloitte 2025 shows:

- Bratislava: 12.9 annual salaries.

- Košice: 14.2 annual salaries (higher than the capital!).

Hungary

In the country, the saving periods for an apartment vary from 9 to 15 years, with a strong disparity between Budapest (14–15 years) and provinces (7–8 years).

Estonia, Serbia, Croatia

Numbeo and local sources show that these countries require 9–12 annual incomes to save for housing (Tallinn — 11.5 years according to Numbeo). Croatia showed 7.9 % price growth in 2024–2025, Serbia actively attracts regional investors.

What to Remember When Using Any Rankings

Geographical disparity

When assessing housing affordability, it is important to take into account differences between capitals and other cities.

Different research methodologies

Each company uses its own approaches when compiling rankings.

Real expenses do not match theory

In practice, people usually combine several ways to acquire housing: personal savings, a mortgage, and sometimes family help.

Market dynamics change quickly

Over the past two–three years, significant changes have occurred.

It should be borne in mind that the ratings are regularly updated, so the situation in these markets may change.

Author

I am responsible for editorial work. I write expert interviews and guides.