Expert on Investment Attractiveness and Country Risk in Belarus

Before investing in this or that country, a competent investor always is interested in the magnitude of the country risk. Dr. Nikolai Trifonov, FRICS told about what it means and why country risk premium can be useful not only for investors but also for ordinary buyers of real estate.

What is country risk premium and how to calculate it?

A country risk premium (CRP) is a premium for the risk of investing foreign funds in an investment project in a particular country. It is associated with the loss (total or partial) of the project value due to general economic, financial, and socio-political factors in that country.

— Knowing the level of country risk of a particular country helps an investor assess the prospects for investing in a given direction. The country risk premium indicators are included in the formulas for evaluating the effectiveness of investment projects, as well as valuating any assets in that country, including business and real estate.

For the average real estate buyer, it is important to know the level of country risk premium in order to understand the price stability of an apartment or a house in a particular country in the international real estate market. Moreover, if he plans to sell the property in the future, this figure will help him assess how likely he will be able to benefit from such a sale.

Country risk level for Belarus

The Public Association “Belarusian Society of Valuers” has been calculating the country risk premium for Belarus since 2004.

— For almost 20 years, we have been analyzing and calculating the investment attractiveness of Belarus every month. The country risk premium is one of the most important indicators in these calculations. Simply put, the country risk is calculated based on the quotation of government securities in international markets. Belarus issues its fifteen-year Eurobonds (a type of long-term securities: Ed.), once listed in Europe. Bloomberg used to sell information on the value of those securities on international markets to the Ministry of Finance of Belarus (and the Belarusian Society of Valuers also received those figures). In addition, we studied public information on long-term U.S. government treasury constant maturities from the U.S. Federal Reserve System which is important because the premium is calculated against the U.S. dollar. As a result, the country risk for Belarus was calculated, roughly speaking, as the yield on Belarusian securities minus the yield on U.S. securities with the same maturity. In fact, according to a slightly more complicated formula, however, this explanation is sufficient to understand the overall picture.

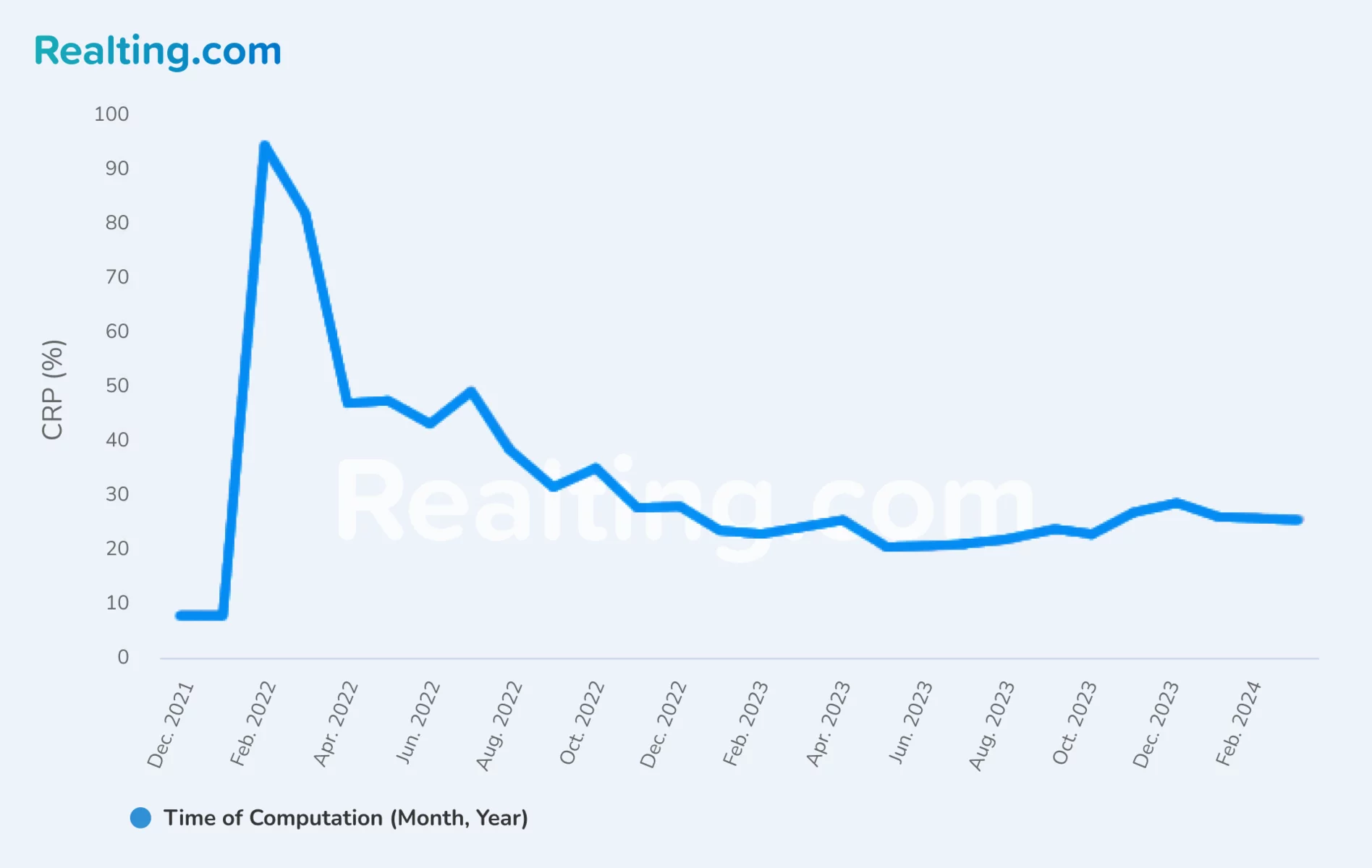

An interesting fact is that, in the beginning of 2020, the level of country risk for Belarus was hardly affected. At that time, the country risk premium was estimated at about 8%. This is not the best indicator, but it is quite acceptable. Bloomberg categorizes such countries as B by the level of risk. By comparison, in the U.K., it's about 1-2%, and that's Category A. And in the U.S., the country risk premium on the dollar is zero, because that is where dollars are printed.

At the same time, February 2022 was a turning point for the country risk indicators of Belarus. According to our calculations, the index jumped to 94.5% in just one month (based on data from the Frankfurt Stock Exchange). For the real estate market, this meant that Belarusian real estate instantly depreciated.

Since that year, the European stock exchanges stopped dealing with Belarusian securities, which means that it became much more difficult to calculate the country risk indicators for Belarus. However, I began to focus on the Asian platforms, where securities are still quoted, albeit at a large discount. Based on this data, we can say that the country risk for Belarus is decreasing and at the beginning of 2024 it was about 25%. One can say that the economic situation is improving, but it is necessarily to understand that 25% is still a very dangerous indicator, as the financiers believe. It is the zone of default. To put it very simply, you can invest in such a country only for 4 years, and what will happen next is unpredictable. If the indicator is 90% or higher, it is dangerous to invest even for one year.

Author

Prof. Nikolai Trifonov is the Fellow of Royal Institution of Chartered Surveyors, the Full Member of the International Academy of Engineering, the Foreign Member of the Russian Academy of Engineering, the Honorary Appraiser of the Republic of Kazakhstan, teaches real estate appraisal at the Belarusian State Economic University, the author of manuals "The Valuation Theory" and "Comprehensive Real Estate Valuation". In 1994, he founded the Belarusian Real Estate Guild, which united the largest private and state participants in the real estate market and privatization. In 1996, Nikolai created and headed the public association "Belarusian Society of Valuers", which is a member of International Valuation Standards Council (IVSC). In the period 1998-2005 Nikolai was elected and reelected as Board Member of European Real Estate Society (ERES), Director at Large – Responsible for Central & Eastern Europe.