Dutch Real Estate Market in REALTING Analytics: +11% Sales and Record Price Growth in 300 Municipalities

For the Dutch real estate market, 2024 year was a turning point. After three years of decline, home sales rose by 11% and prices reached record highs in 300 municipalities. What caused this sharp increase?

In this article, we will take a detailed look at how prices have changed buying a home in the Netherlands, which types of real estate have become the most popular and in which cities the growth was most noticeable. You will learn why townhouses are leading in sales, how the decrease in mortgage rates has affected the market and what to expect in 2025.

Sales on the Dutch Housing Market are on the Rise

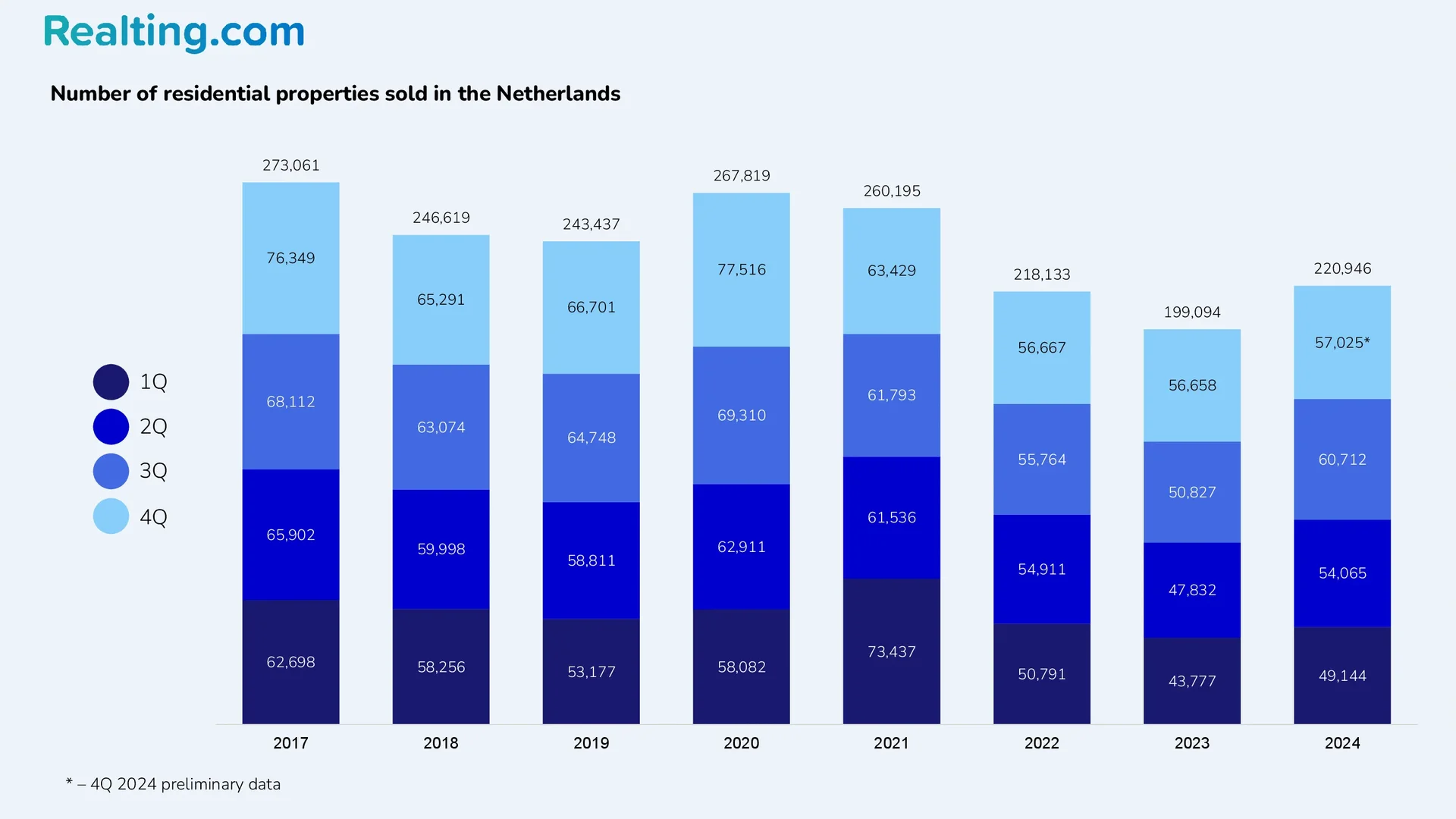

The Dutch residential property market has been showing a decline in activity for three years (from 2021 to 2023). According to data Statistics Netherlands, if 260,195 residential properties were sold in 2021, then 199,094 properties were sold in 2023.

The slowdown in the Dutch market between 2021 and 2023, as in many European Union countries, was driven by rising borrowing costs, which in turn were driven by the increase in the European Central Bank’s base rate.

The Dutch housing market showed an increase in sales in 2024. A total of 220,946 residential properties were sold in the Netherlands in 2024, which is 11.0% more than in 2023.

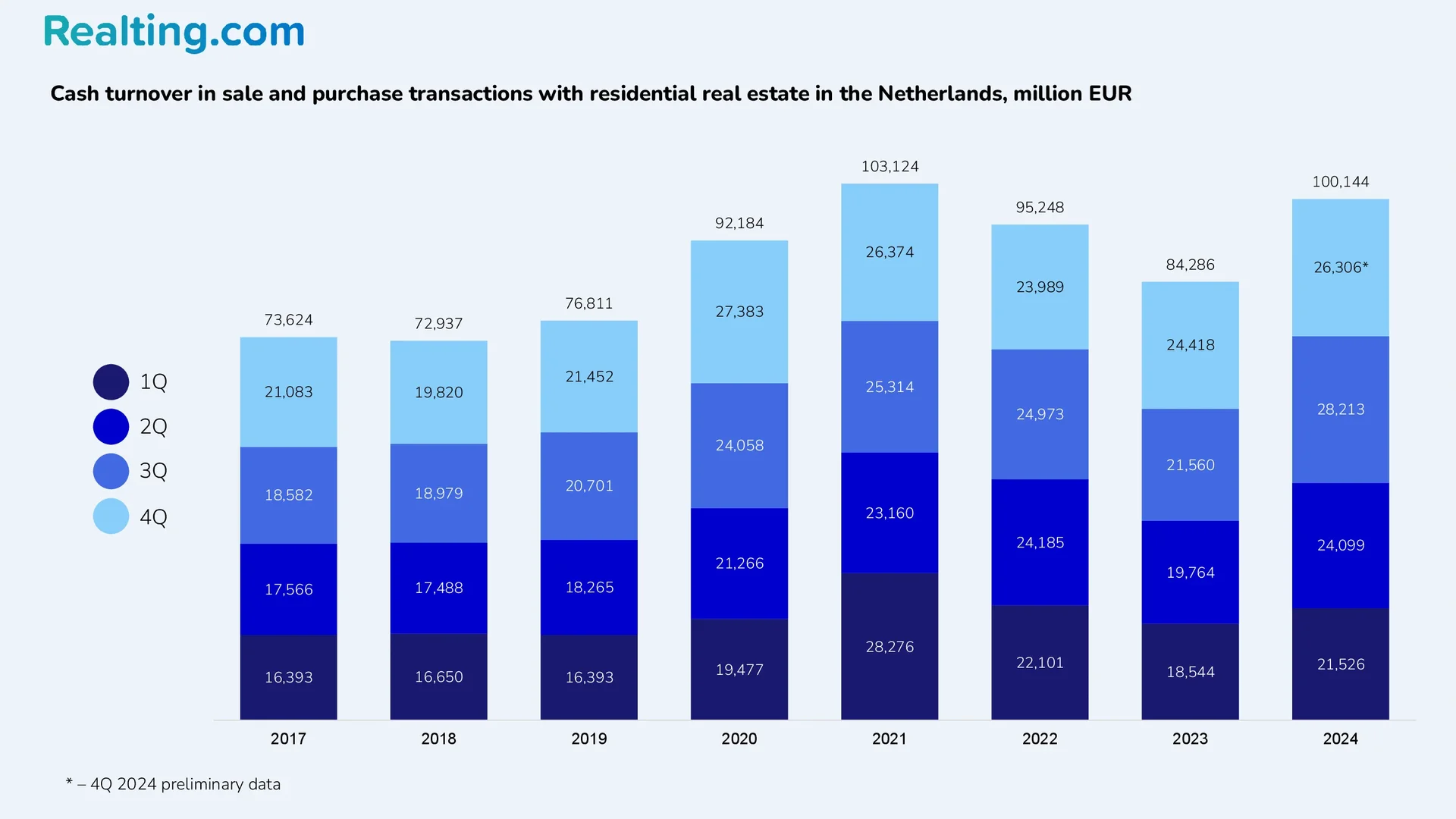

The turnover in residential real estate purchase and sale transactions at the end of 2024 amounted to more than EUR 100.14 billion, which is 18.8% more than the previous year.

Structure of the Dutch real estate market

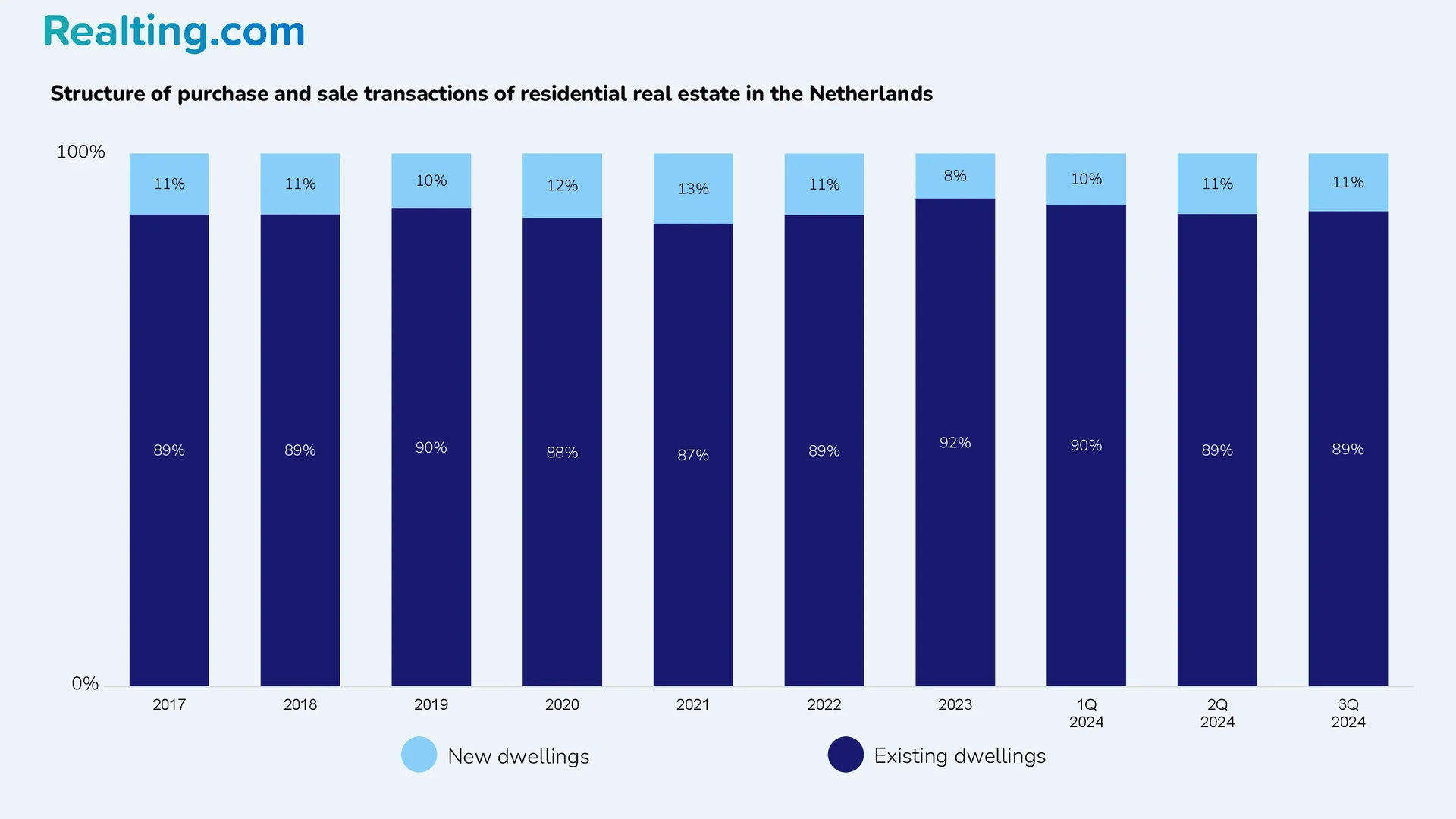

From 2017 to 2022, the share of new housing in purchase and sale transactions varied from 10% to 13%. In 2023, the share of new housing in transactions was only 8%. As for 2024, there are no final data for this period yet, but in the 1st quarter of 2024, the share of new housing in transactions was 10%, and in the 2nd and 3rd quarters — 11%, respectively.

According to Statistics Netherlands, the most popular type of housing to buy in the country is a townhouse. In the 4th quarter of 2024, 41.3% of all residential properties sold were townhouses — 23,515 townhouses. Next in descending order were apartments (35.4%), detached houses (13%), and semi-detached houses (9.4%).

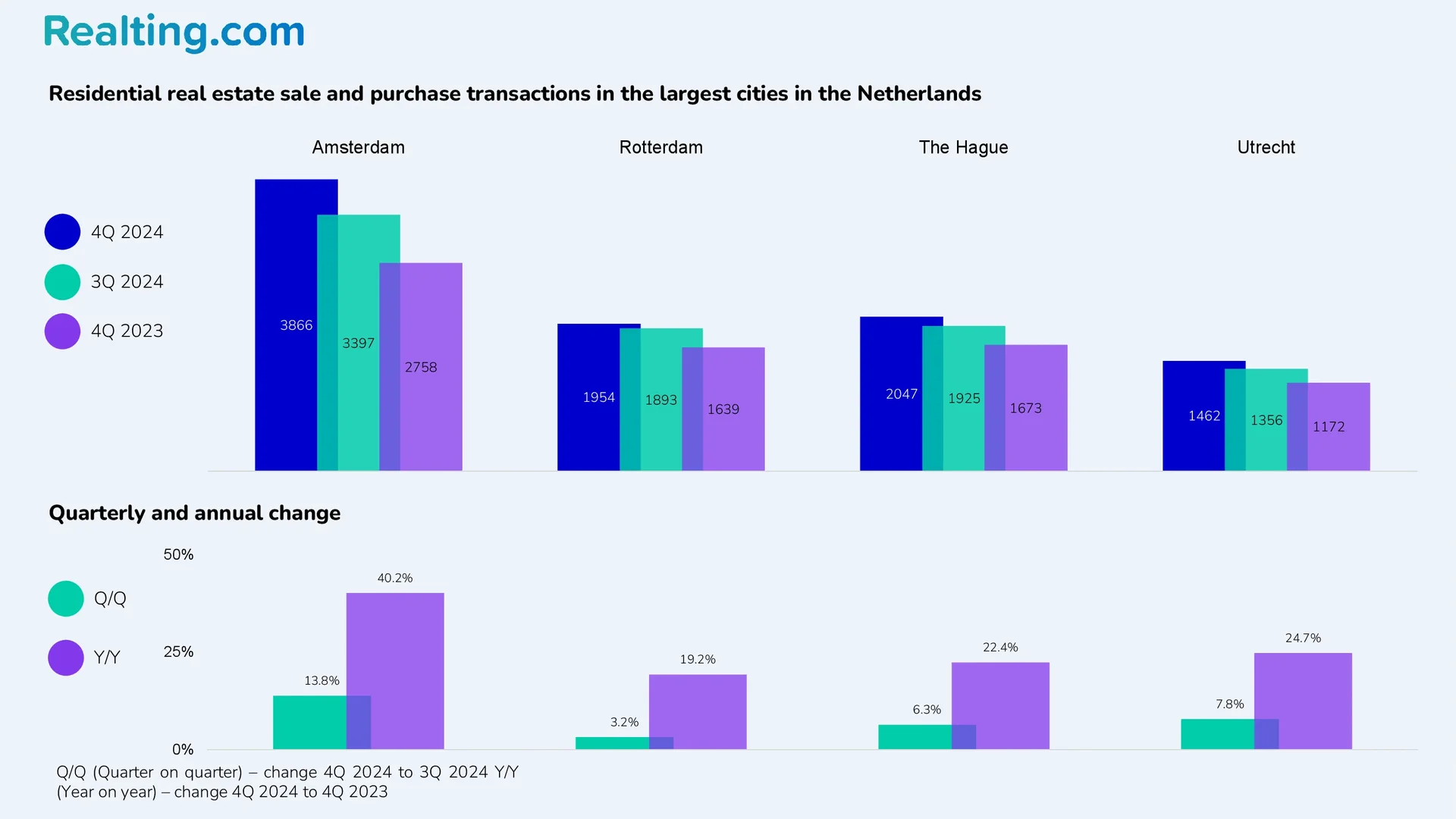

The four largest cities in the Netherlands recorded a significant increase in the number of purchase and sale transactions in Q4 2024 compared to the same period last year.

Thus, in Amsterdam, 3,866 purchase and sale transactions were registered in Q4 2024, which is 40.2% more than in Q4 2023. In Rotterdam, 1,954 transactions were registered in Q4 of this year (+19.2% compared to Q4 2023), in The Hague — 2047 transactions (+22.4%), in Utrecht — 1462 (+24.7%).

Housing Loans in the Netherlands

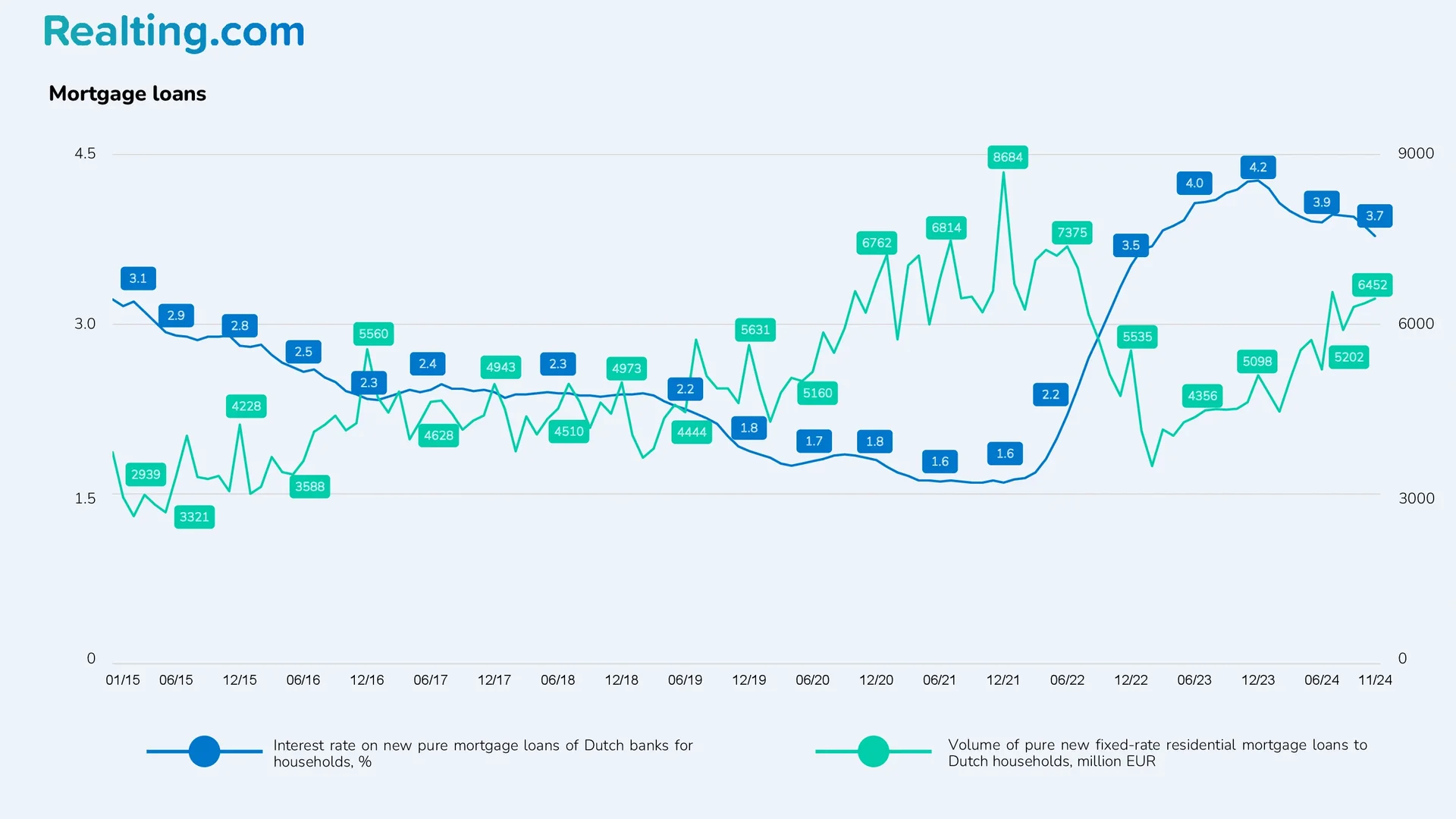

Interest rates on new housing loans for the population have been falling throughout 2024 — data Central Bank of the Netherlands (De Nederlandsche Bank) At the end of November 2024, the average interest rate on new mortgages for the population was 3.78% — in turn, in November 2023, the interest rate was 4.26%.

The gradual reduction in rates encourages the population to take out loans to buy housing. If in January 2024 the volume of new fixed-rate housing loans issued to Dutch households amounted to EUR 4777 million, then in November 2024 it was already EUR 6452 million (which is 35.1% more than in January). The reduction in loan rates and the increase in the number of loans issued will inevitably stimulate demand and activity in the housing market.

Residential property prices in Dutch cities

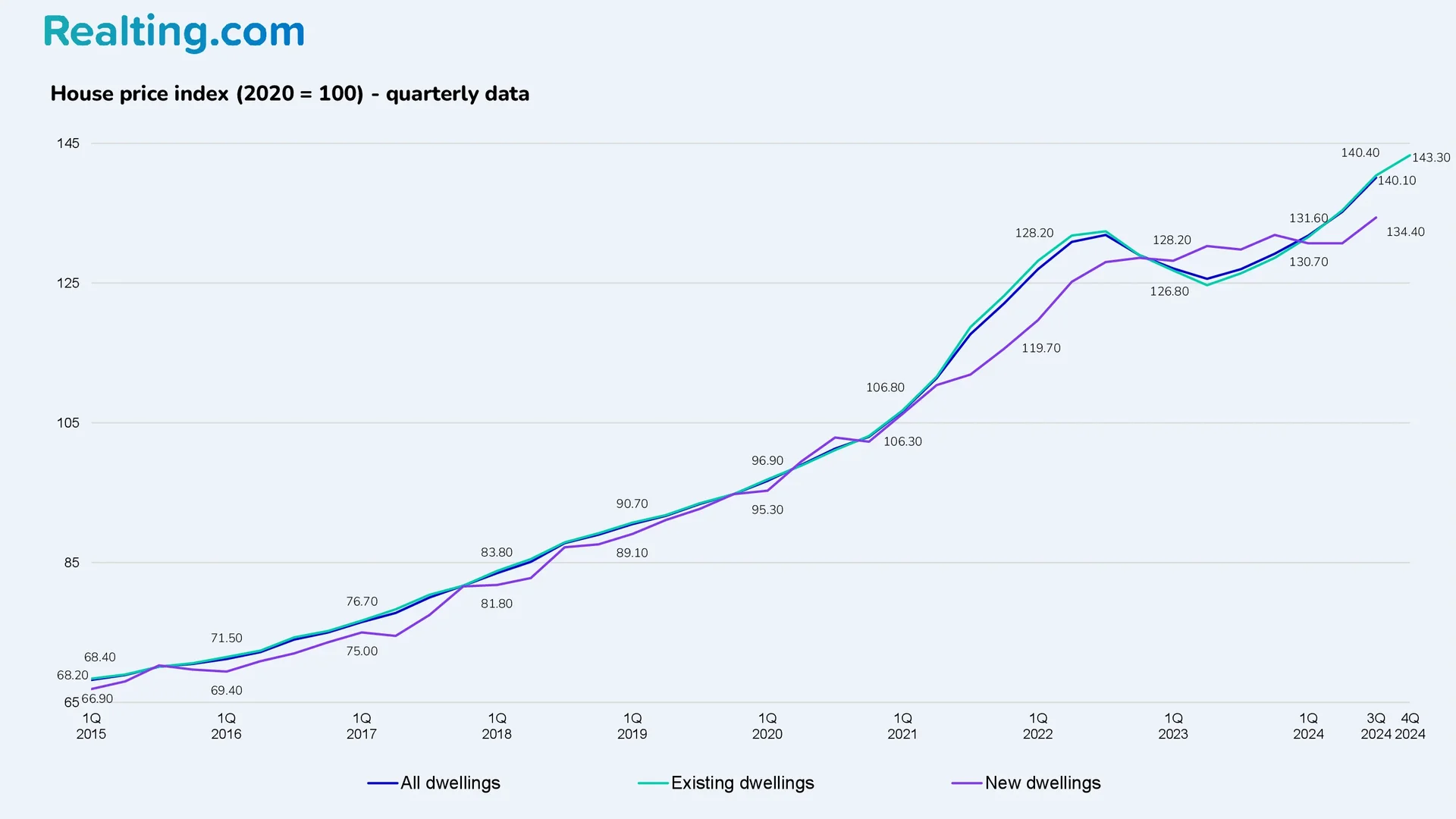

According to Statistics Netherlands, residential property prices in the country rose from 2013 to Q3 2022. Then, for almost 4 quarters, the house price index fell. And since Q3 2023, house prices have maintained their upward trend.

Considering that the market is currently seeing an increase in demand and activity, which is supported by a reduction in mortgage rates, we can say that in 2025 prices will also continue to trend upward.

At the end of Q3 2024, the Dutch residential property price index was 140.1, up 3.6% from the previous quarter and up 10.3% from Q3 2023.

If we talk about how the price index changed in terms of new and existing housing, the situation is as follows:

- The new home price index for Q3 2024 was 134.4, up 2.9% from Q2 2024 and up 3.6% from a year ago.

- Existing Home Price Index at 3-quarter of 2024 was 140.4, which is 3.7% more than in the previous period, and 11.1% more than in the 3rd quarter of 2023. The Statistical Office also cites the existing housing price index for the 4th quarter of 2024 — 143.3, which is 2.1% more than in the 3rd quarter, and 11.4% more than in the 4th quarter of 2023.

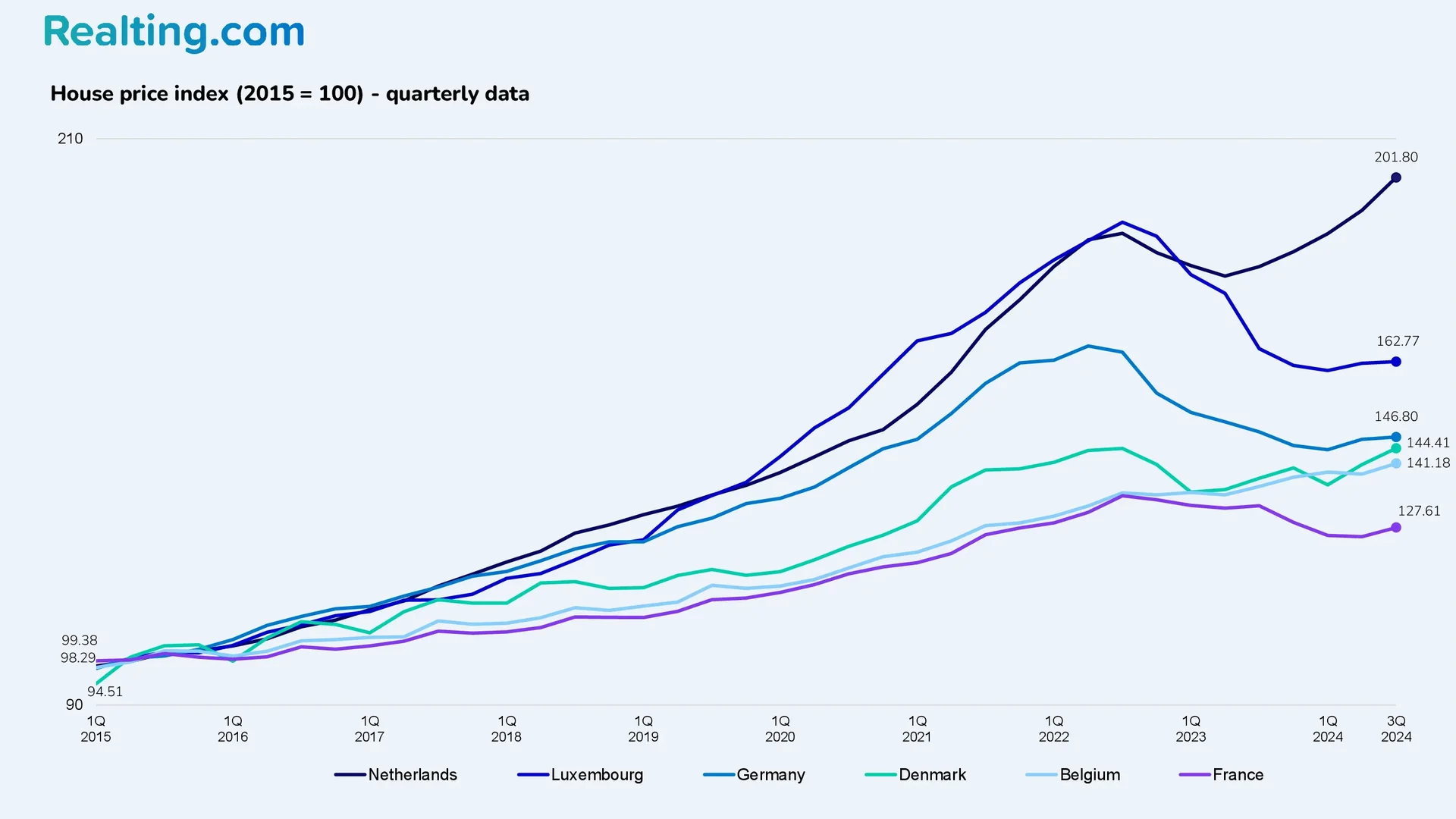

It is worth noting the following: if we consider how prices for residential real estate have changed in the Netherlands and in neighboring countries, the Netherlands is the absolute leader in terms of price growth in the housing market.

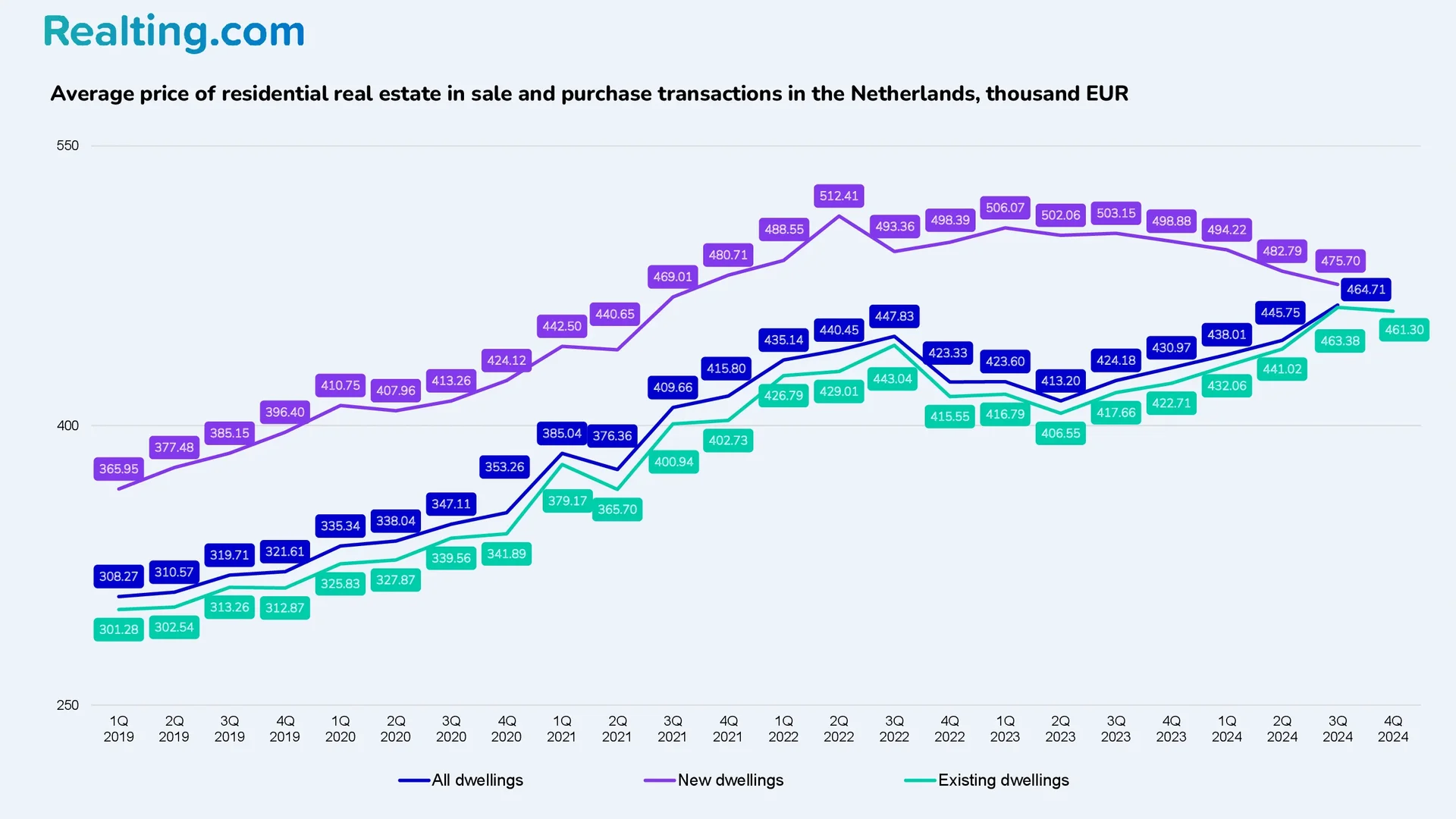

When it comes to the specific cost of residential property in the country, Statistics Netherlands provides the following data:

- The average price of residential real estate in purchase and sale transactions in Q3 2024 was EUR 464,708, which is 4.3% more than in Q2 2024 and 7.8% more than in Q3 2023.

- The average price of new residential real estate in purchase and sale transactions was EUR 457,700. Compared to the previous period, the price decreased by 1.5%, compared to the 3rd quarter of 2023, the decrease was 5.5%.

- The average price of existing residential real estate at the end of 2024 (based on the results of the 4th quarter of 2024) was EUR 461,301, which is 0.4% less than in the 3rd quarter of 2024 and 9.1% more than in the 4th quarter of 2023.

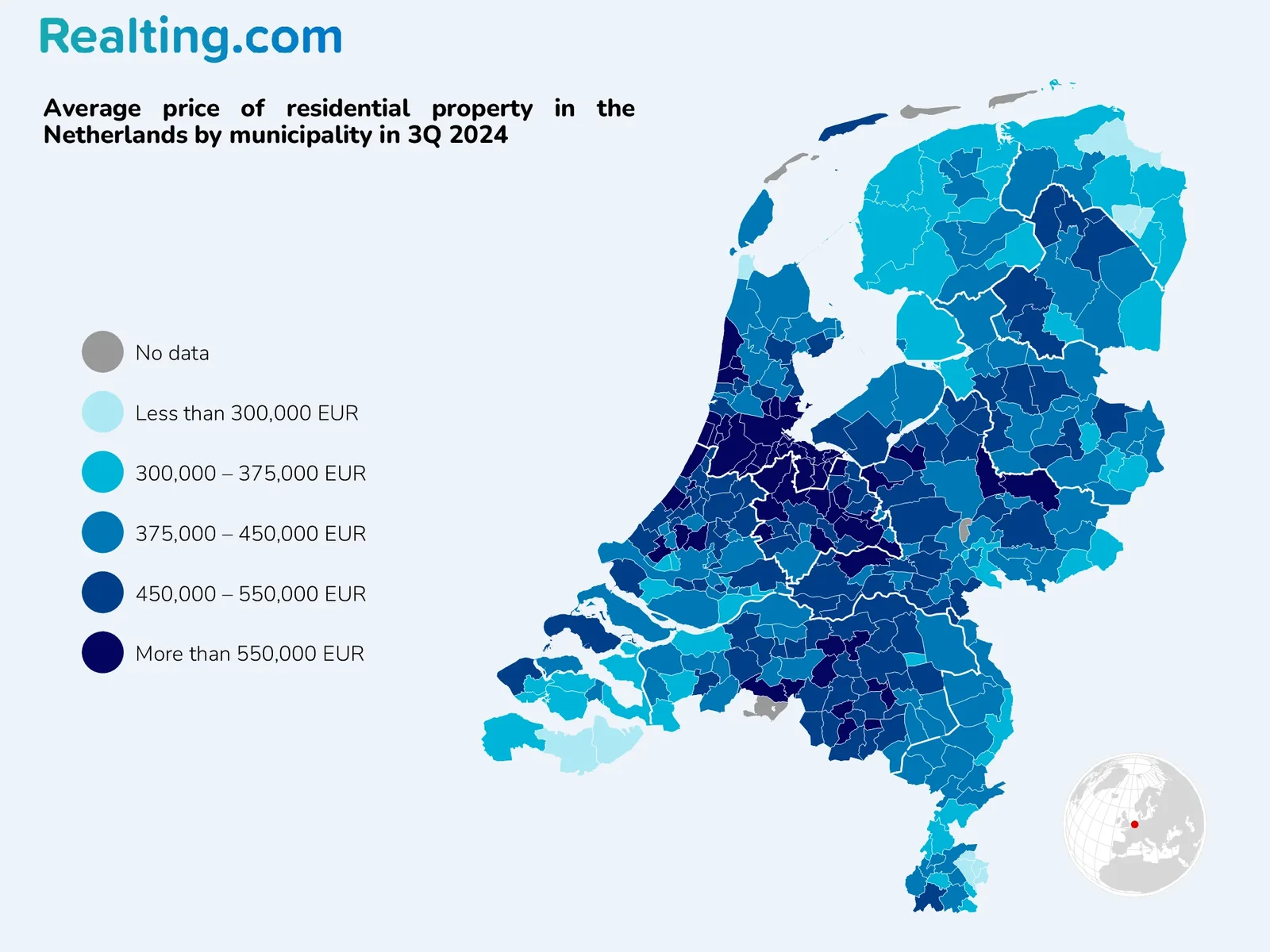

Cadastre, Land Registry and Mapping Agency of the Netherlands (Kadaster) provides the following theses on average prices for residential real estate in the country based on the results of the 3rd quarter of 2024:

- In more than 300 of 342 municipalities, the average purchase price was higher than a year ago.

- In 57 municipalities, the average price of residential property was EUR 550,000 or more. Never before have there been so many.

- In 198 municipalities, the average price of residential property was below the national average.

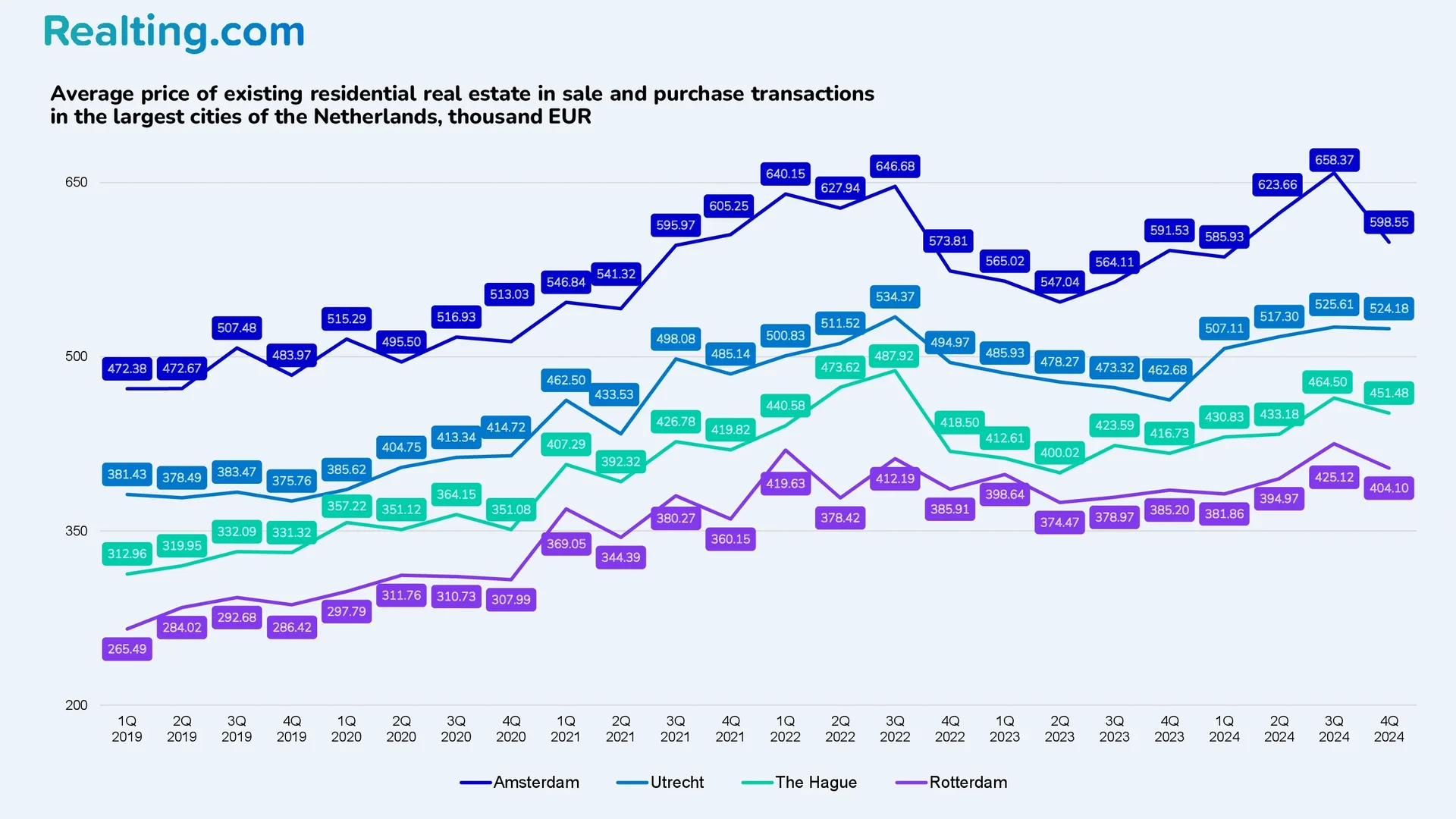

In Q4 2024, average prices for existing residential properties in purchase and sale transactions in the four largest cities in the Netherlands showed a decrease compared to Q3 2024. However, when compared to Q4 2023, an increase was recorded.

|

City |

Average price of existing residential property, EUR |

Change by Q3 2024 |

Change by Q4 2023 |

|

Amsterdam |

598,551 |

-9.1% |

+1.2% |

|

Utrecht |

524,184 |

-0.3% |

+13.3% |

|

Hague |

451,475 |

-2.8% |

+8.3% |

|

Rotterdam |

404,099 |

-4.9% |

+4.9% |

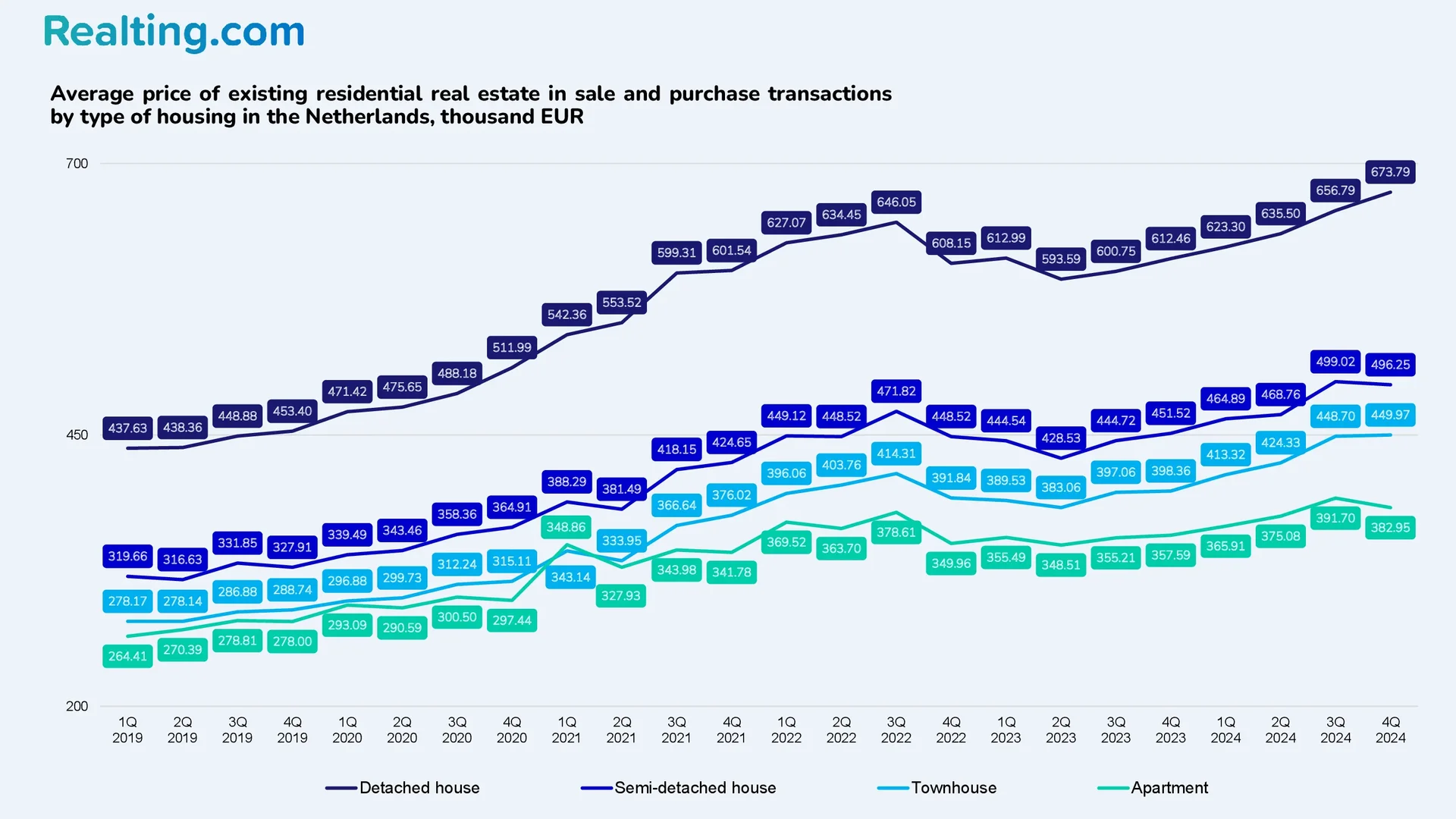

Average price of existing residential properties in purchase and sale transactions by type of property in the Netherlands.

|

Type of housing |

Average price of existing residential property, EUR |

Change by Q3 2024 |

Change by Q4 2023 |

|

Detached house |

673,790 |

+2.6% |

+10.0% |

|

Apartment in a semi-detached house |

496,246 |

-0.6% |

+9.9% |

|

Townhouse |

449,965 |

+0.3% |

+13.0% |

|

Apartment |

382,953 |

-2.2% |

7.1% |