An Outstanding Start to the Year. Results of the First Quarter of 2025 in the Spanish Residential Real Estate Market

Before talking about the results of the Spanish residential real estate market in the first quarter of 2025, let’s talk a little about the equally outstanding results of the past year, 2024.

Key Indicators of the Spanish Real Estate Market in 2024 and Q1 2025

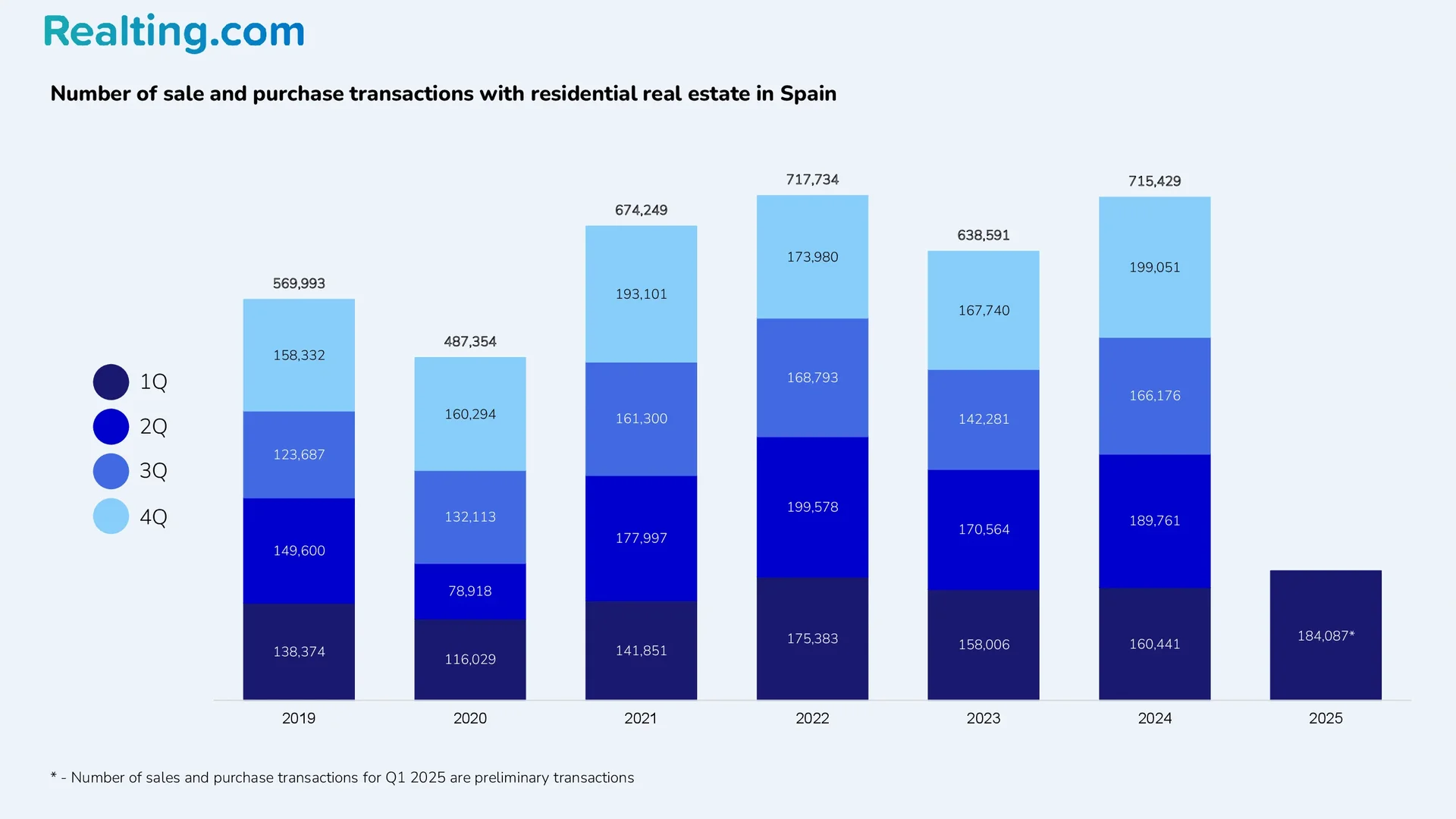

According to data from the Spanish Ministry of Transport, Mobility, and Sustainable Mobility, 715,429 residential property transactions were registered in the country in 2024, up 12% from 2023. Since 2007, 2024 has been the third-best year for housing transactions in Spain, behind only 2007, when almost 840,000 housing transactions were registered, and the post-pandemic 2022, when 717,734 transactions were registered.

As an interesting fact, we can add the following: until 2021, the number of housing purchase and sale transactions per year for 13 years did not exceed 600,000, and in 2013, there were only 300,568 purchase and sale transactions, which is an anti-record for the Spanish housing market.

Number of residential property sales and purchases in Spain

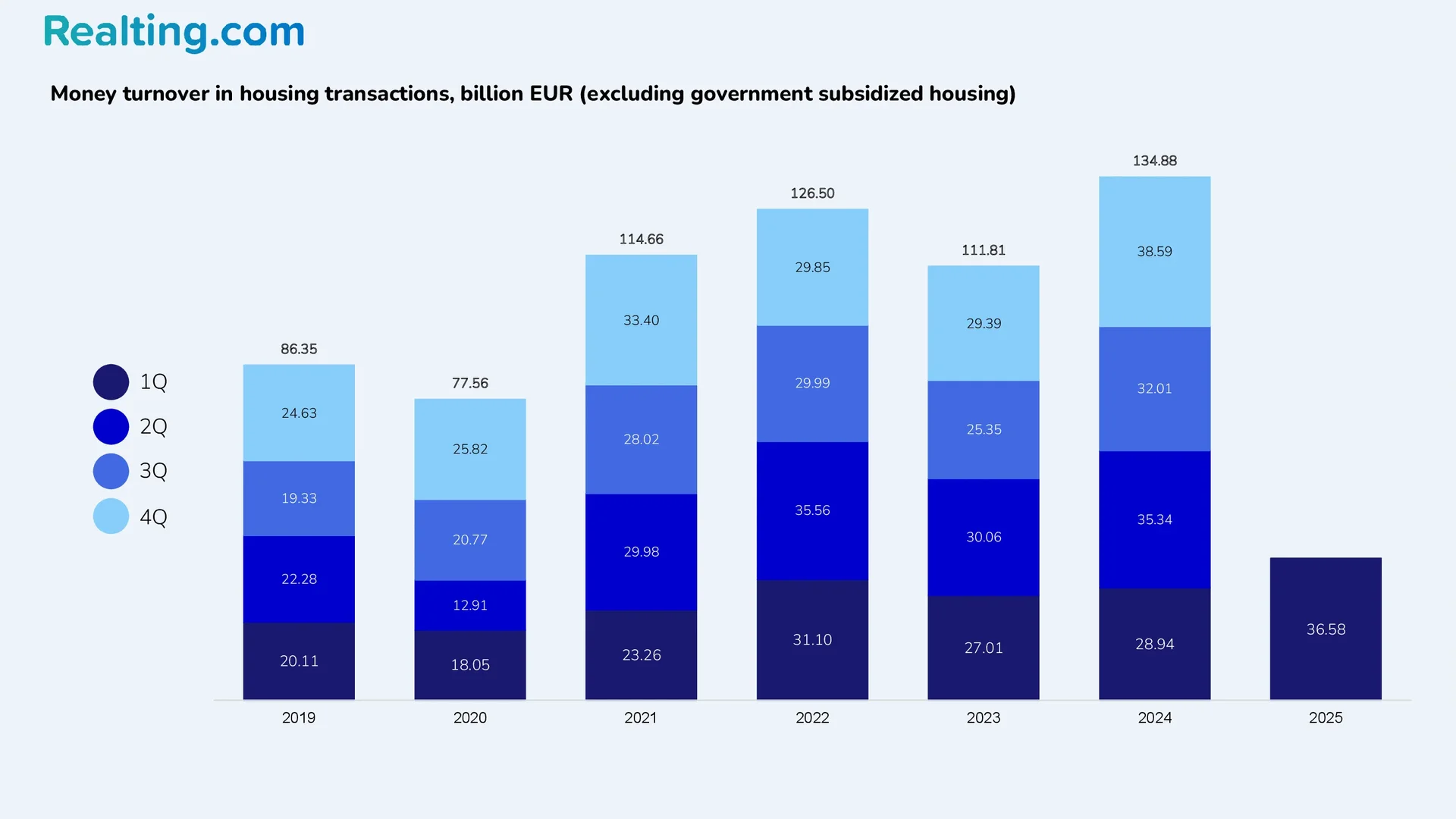

The total cash turnover in housing transactions at the end of 2024 amounted to EUR 134.88 billion, which is 20.6% more than in 2023 and 6.6% more than in 2022.

Cash turnover in residential property sales and purchases in Spain, billion EUR (excluding state subsidised housing)

The growth in demand and activity in the Spanish housing market in 2024 was stimulated by the following factors: GDP growth and the rise of the Spanish economy, a decrease in the inflation rate. This improved the purchasing power of the population and gave confidence in making such expensive purchases; a gradual decrease in interest rates on mortgages also plays an important role. A separate factor can be called the rise in housing prices, which acts as a kind of motivator when deciding to buy a home.

The above factors stimulated buyer activity in the Spanish housing market in Q1 2025. Thanks to this, Q1 2025 showed the best result in terms of the number of housing transactions at the beginning of the year since 2008 (that is, the best result among all first quarters since 2008). In total, 184,087 purchase and sale transactions were registered in Q1 2025, which is 7.5% less than in Q4 2024 and 14.7% more than in Q1 2024.

The turnover in housing transactions in Q1 2025 was EUR 36.58 billion, down 5.2% from Q4 2024 and up 26.4% from Q1 2025.

Structure of the Spanish Housing Market

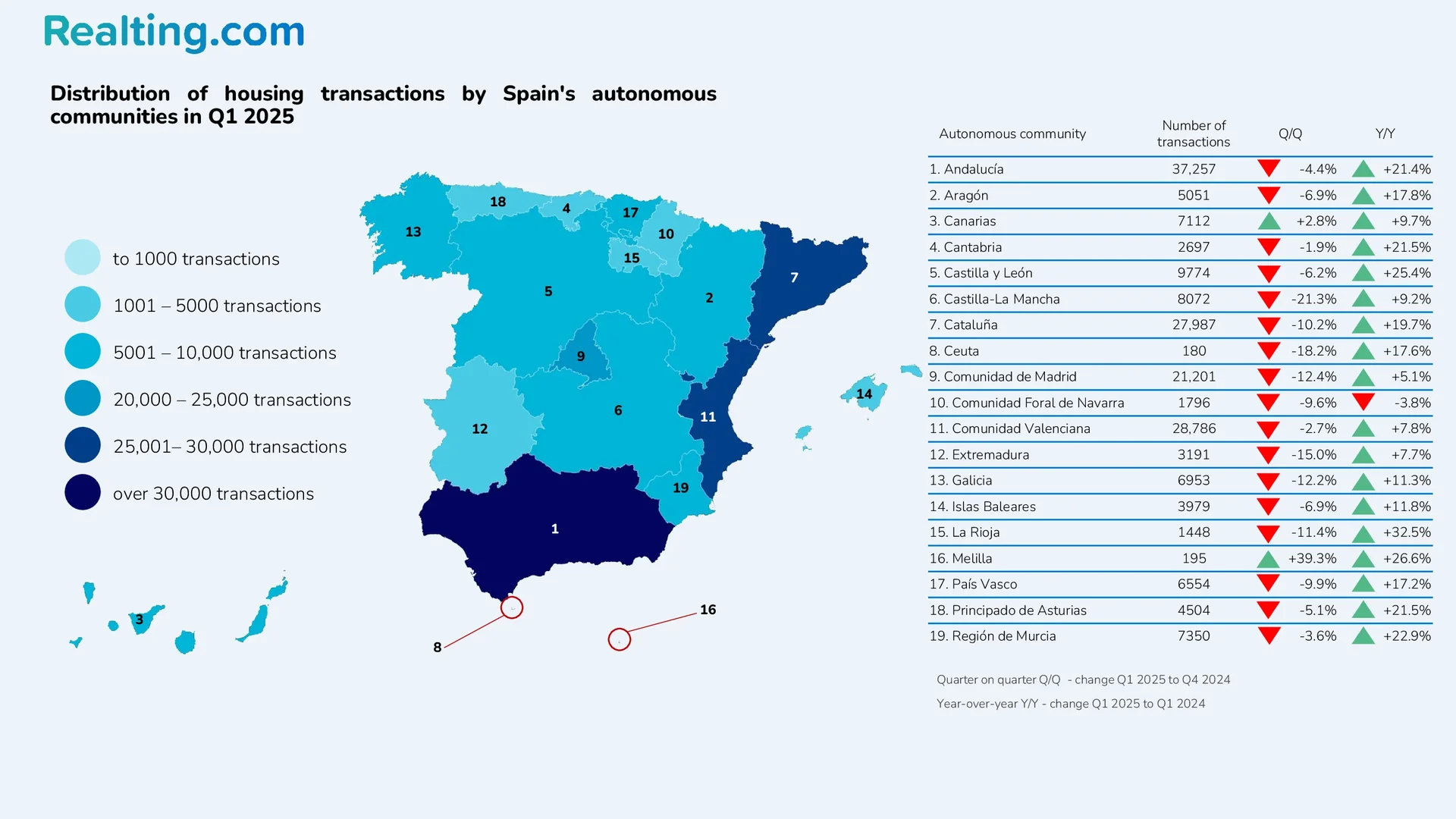

Distribution of housing transactions by Spain's autonomous communities in Q1 2025

Most often, housing transactions are carried out in the following autonomous communities of Spain: Andalusia, Valencia, Catalonia, and the autonomous community of Madrid. In total, these four autonomous communities registered just over 115 thousand transactions in the first quarter of 2025 — this is 63% of all housing transactions in the country.

The fewest residential property transactions are recorded in two autonomous cities located in Africa: Ceuta is a city located on the northern coast of Africa (directly opposite Gibraltar), Melilla is a city located on the Mediterranean coast of Africa and bordering Morocco. In Q1 2025, 180 residential property transactions were recorded in Ceuta and 195 transactions in Melilla.

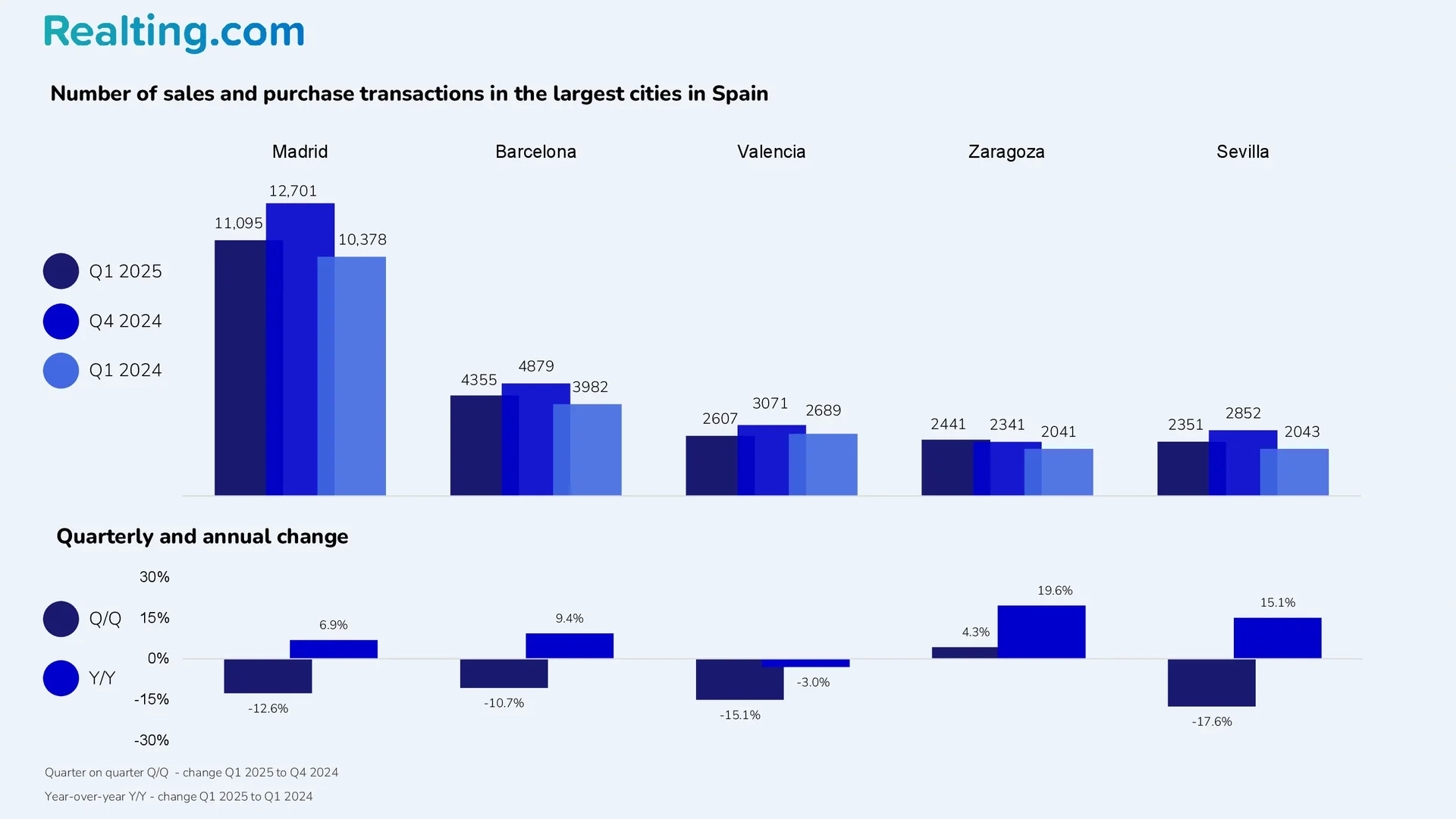

Among the largest cities in Spain, the leader in the number of residential property transactions is traditionally the country’s capital, Madrid. In Q1 2025, 11,095 purchase and sale transactions were recorded in Madrid, which is 12.6% less than in the previous quarter and 6.9% more than in Q1 2024. Madrid is followed by Barcelona, which is more than 2.5 times behind, with 4,355 transactions registered in Q1 of this year — 10.7% less than in Q4 2024 and 9.4% more than in Q1 of the same year.

Number of housing purchase and sale transactions in the largest cities in Spain

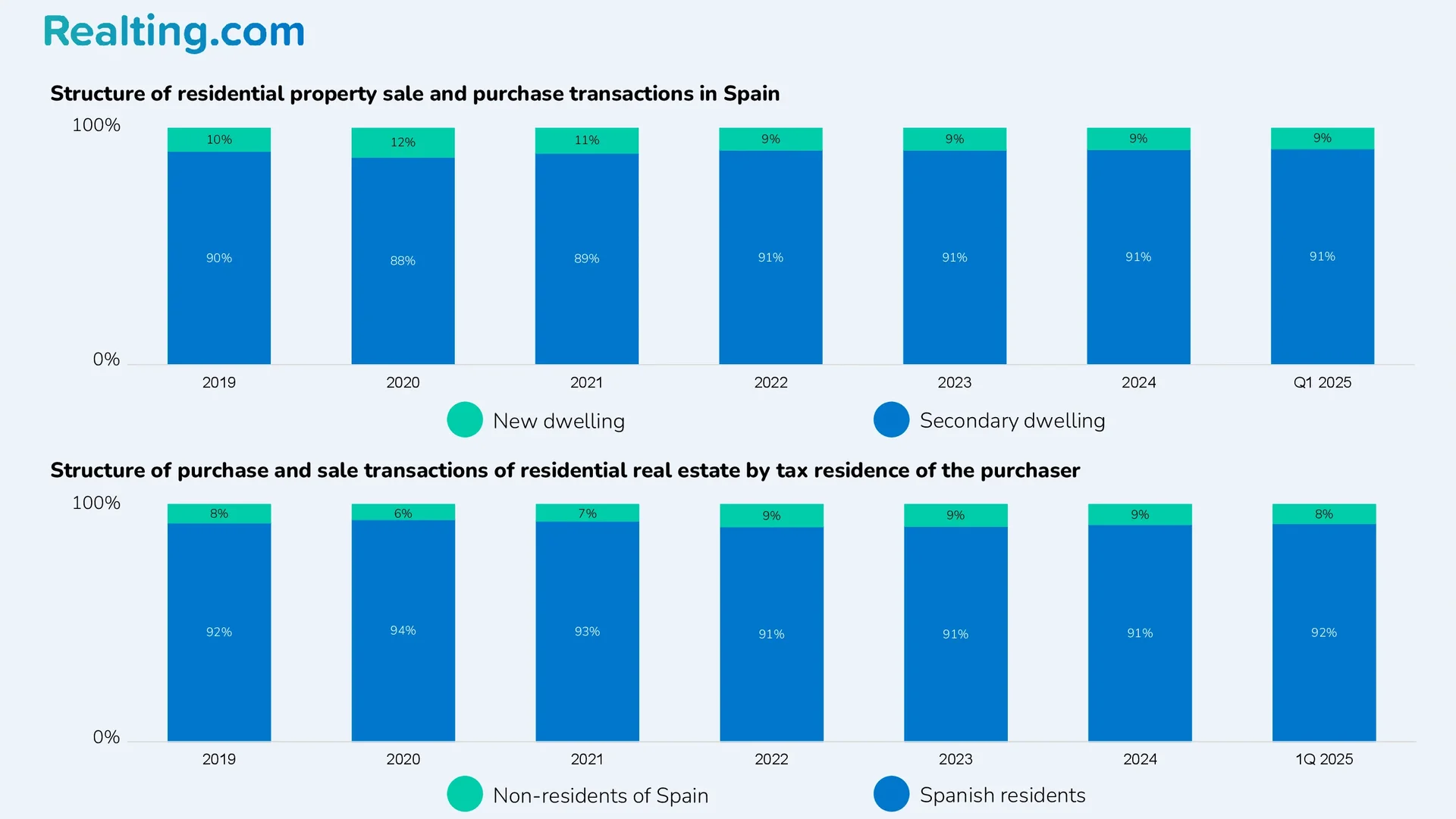

Over the last three years, the share of new homes in residential property sales and purchases in Spain has been 9%. In Q1 2025, the share of new homes also amounted to 9% of all transactions in the country, with 16,170 transactions. The highest share of new homes in transactions in Q1 2025 was recorded in the following autonomous communities: Navarre — 23% of all transactions in the community, Cantabria — 13%, Anadalucia — 11% of all transactions. The autonomous communities with the lowest share of new homes in transactions in Q1 2025 were Estemadura and the Canary Islands — 4% and 6% of all housing transactions, respectively.

Structure of residential property sale and purchase transactions in Spain

In 2024, 60,822 residential property transactions were carried out by non-residents of Spain, which is 9% of all transactions in the country. The share of purchase and sale transactions carried out by non-residents of Spain has been at the level of 9% of all transactions in the country in the last 3 years, while in 2020 and 2021 it was 6% and 7%, respectively.

In the 1st quarter of 2025, 8% of all housing transactions were carried out by non-residents of Spain. In the 1st quarter of 2025, non-residents of Spain (in 94% of cases these were foreign citizens) most often bought residential property in the following autonomous communities: in the Balearic Islands — 22% of all transactions; Canary Islands — 21%, Valencia — 19%, Murcia — 14% of all transactions. It is worth adding that in the Valencian Community, non-residents of Spain carried out 5,580 housing transactions, representing 37.3% of all residential property transactions carried out by non-residents of Spain in the first quarter of 2025.

Dynamics of Real Estate Prices by Province

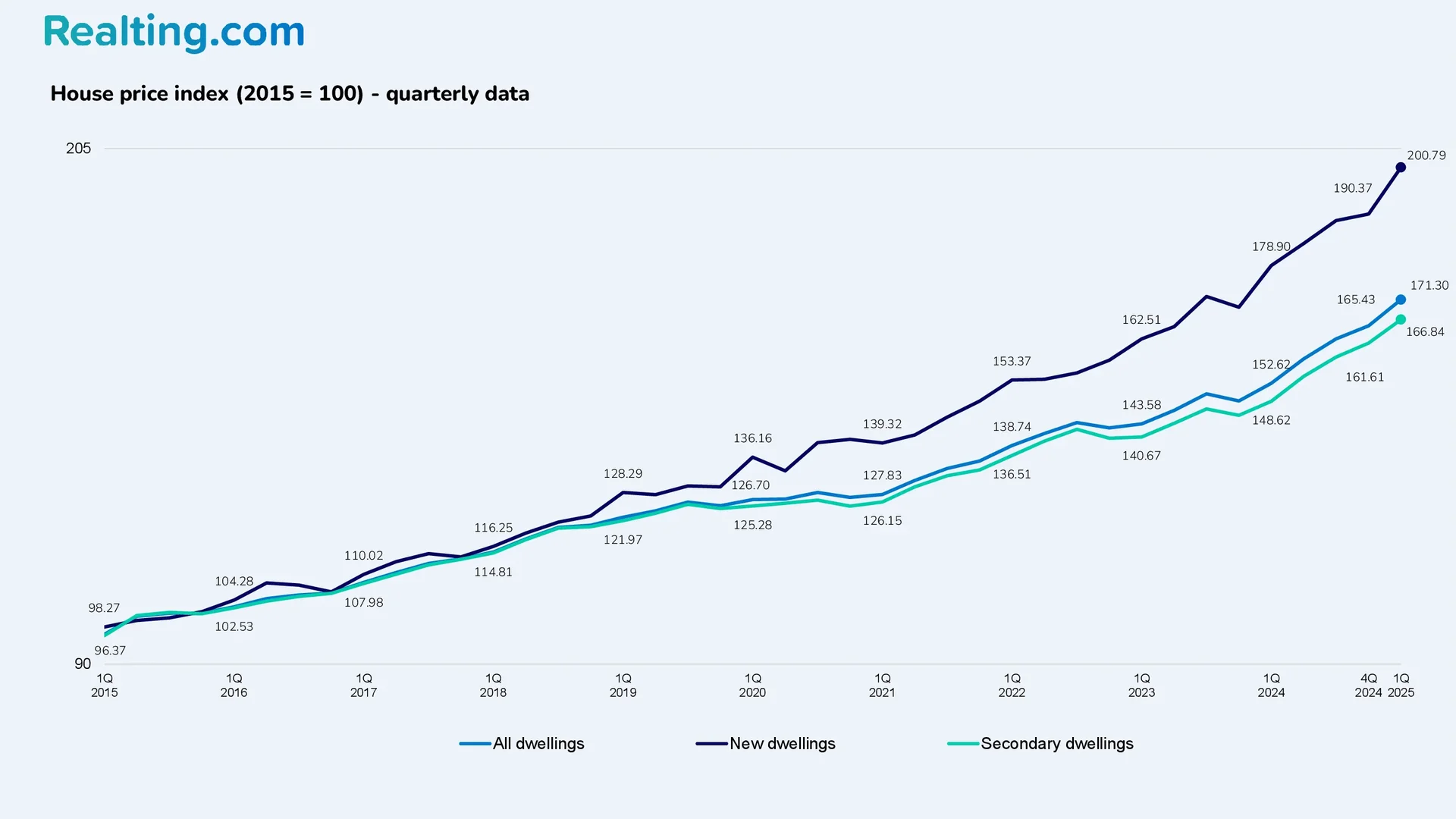

According to the National Statistics Institute of Spain (Instituto Nacional de Estadística), in the first quarter of 2025, the residential property price index was set at 171.3, up 3.5% from the previous quarter. Over the year, the price index has increased by 12.2%.

Price indexes for new and existing housing in the first quarter of 2025:

- The New Home Price Index in Q1 2025 was 200.79, up 5.5% from Q4 2024 and up 12.2% from Q1 2024;

- The Existing Home Price Index in Q1 2025 was 166.84, up 3.2% quarterly and 12.3% annually.

House Price Index (2015 = 100) - quarterly data

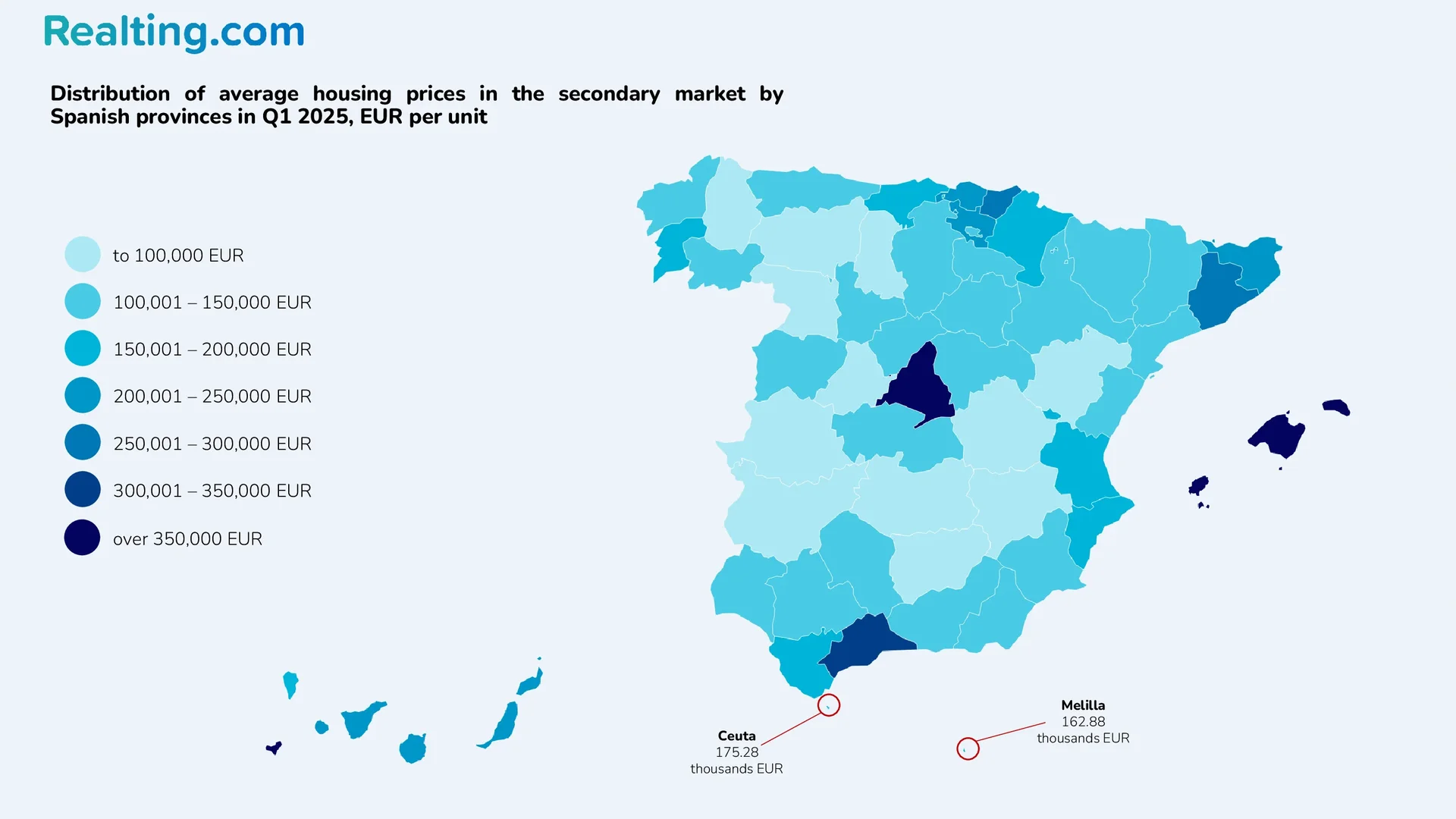

In the secondary housing market in Q1 2025, 47 of the 50 provinces of Spain recorded year-on-year growth. The autonomous cities of Ceuta and Melilla also recorded an annual increase in average prices. The annual increase in average prices on the secondary market varies from 0.7% to 26.9% depending on the province.

According to the Ministry of Transport and Sustainable Mobility of the Government of Spain, the highest growth was recorded in the following provinces and autonomous communities: Ceuta (+26.9% compared to Q1 2024), the autonomous community of Madrid (+21.2%), Toledo (+20.6%), Malaga (+19.6%), the province of Guadalajara (+19.2%).

In 3 provinces, a decrease in prices was noted in annual terms: the province of Zamora (-0.1%), Zaragoza (-1.3%), Jaen (-6.5%).

Distribution of average house prices in the secondary market by Spanish provinces in Q1 2025, EUR per unit

Provinces with the highest average prices in secondary market purchase and sale transactions in Q1 2025:

- Autonomous Community of Madrid — 358.06 thousand EUR for housing.

- Malaga — 328.89 thousand EUR for housing.

- Gipuzkoa — 286.65 thousand EUR for housing.

- Barcelona — 258.53 thousand EUR for housing.

- Vizcaya — 236.23 thousand EUR for housing.

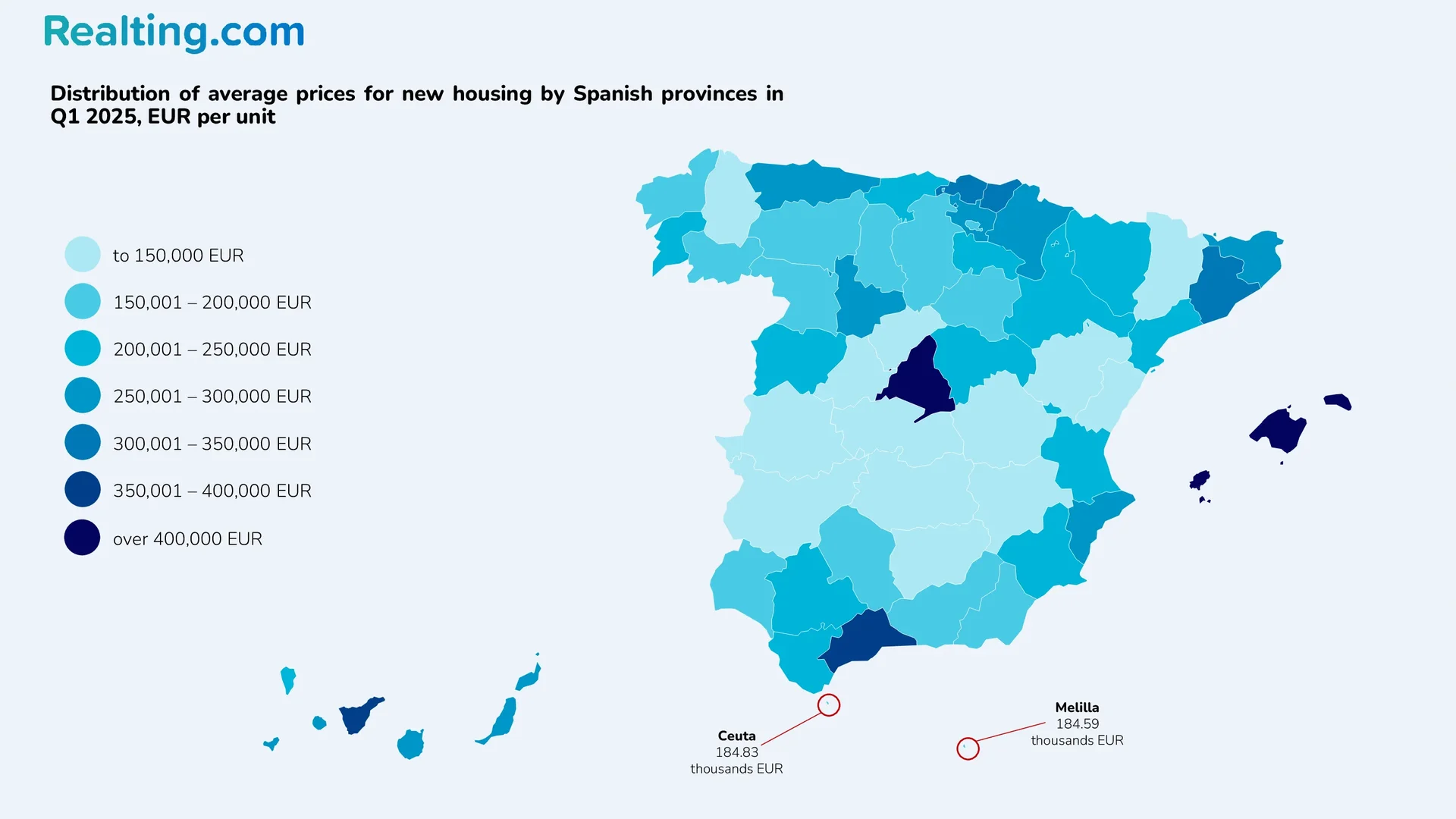

Speaking about the average prices of new housing in purchase and sale transactions in the first quarter of 2025, the situation is as follows: out of 50 provinces and 2 autonomous cities, 24 provinces recorded a decrease in average prices year-on-year (change in average price in the first quarter of 2025 compared to the first quarter of 2024). The remaining provinces recorded an increase.

Distribution of average prices for new housing by Spanish provinces in Q1 2025, EUR per unit

Provinces with the highest average prices for new residential property sales transactions in Q1 2025:

- Autonomous Community of Madrid — 462.31 thousand EUR for housing.

- Malaga — 398.04 thousand EUR for housing.

- Santa Cruz de Tenerife — 355.76 thousand EUR for housing.

- Barcelona — 328.71 thousand EUR for housing.

- Gipuzkoa — 318.66 thousand EUR for housing.

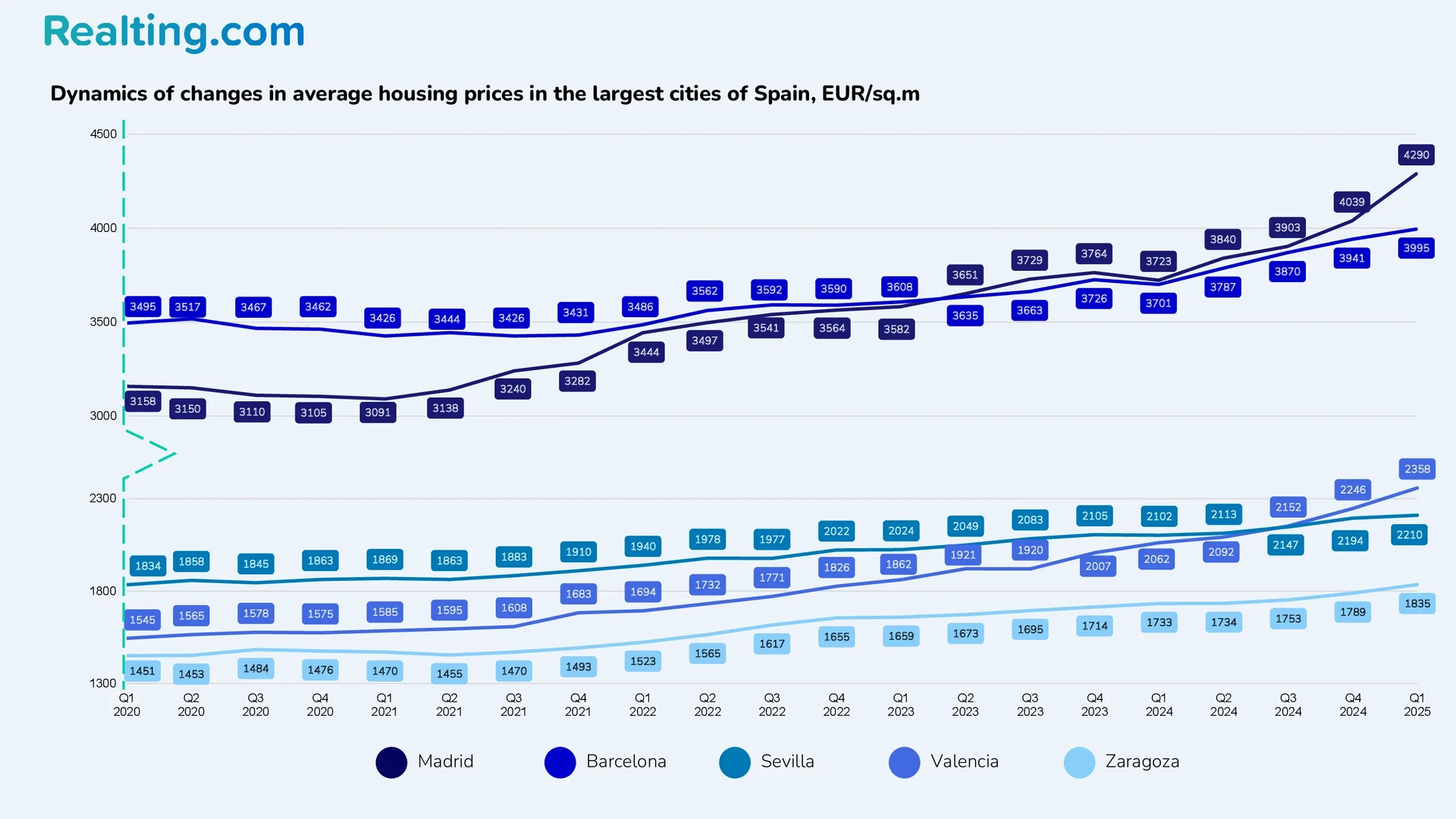

Average house prices in Spain’s five largest cities increased both quarterly and year-on-year in Q1 2025.

Thus, according to the Tinsa platform, which specializes in valuation and consulting in the real estate sector, in the capital of Spain, Madrid, in the 1st quarter of 2024, the average price per square meter was 3723 EUR/sq.m, and by the end of the year — in the 4th quarter of 2024 — the average price per square meter exceeded 4000 EUR/sq.m and amounted to 4039 EUR/sq.m. According to the results of the 1st quarter of 2025, the average price was 4290 EUR/sq.m, the quarterly growth was 6.2%, and the annual growth was 15.2%.

Dynamics of changes in average housing prices in the largest cities of Spain, EUR/sq. m

|

City |

Average price, EUR/sq.m in Q1 2025 |

Change by Q4 2024 |

Change by Q1 2024 |

|

Madrid |

4290 |

+6.2% |

+15.2% |

|

Barcelona |

3995 |

+1.4% |

+7.9% |

|

Valencia |

2358 |

+5.0% |

+14.4% |

|

Sevilla |

2210 |

+0.7% |

+5.1% |

|

Saragosa |

1835 |

+2.6% |

+5.9% |

The Spanish residential property market is currently booming. In 2025, the housing market will continue to grow, which will be characterized as active. It will be supported by high demand from potential buyers, and will be stimulated by the favorable economic situation in the country, as well as gradually decreasing interest rates on mortgages. Housing prices in Spain have increased significantly in recent years (this is especially noticeable in the capital and coastal provinces), and in conditions of increased demand, prices will continue to rise throughout 2025.