Paradoxes of the Housing Market in Poland: What is Happening in 2024

The Polish housing market in 2023 was characterized by high demand, which stimulated the growth of prices on the market. In 2024, demand and activity on the apartment market decreased, but prices continue to rise. This paradoxical situation, along with the expectation of the new credit program “Kredyt mieszkaniowy #naStart,” prompted us to analyze the current state of the Polish real estate market.

Supply and Demand

You can follow the trends of the Polish real estate market over the past 10 years in our analytics.

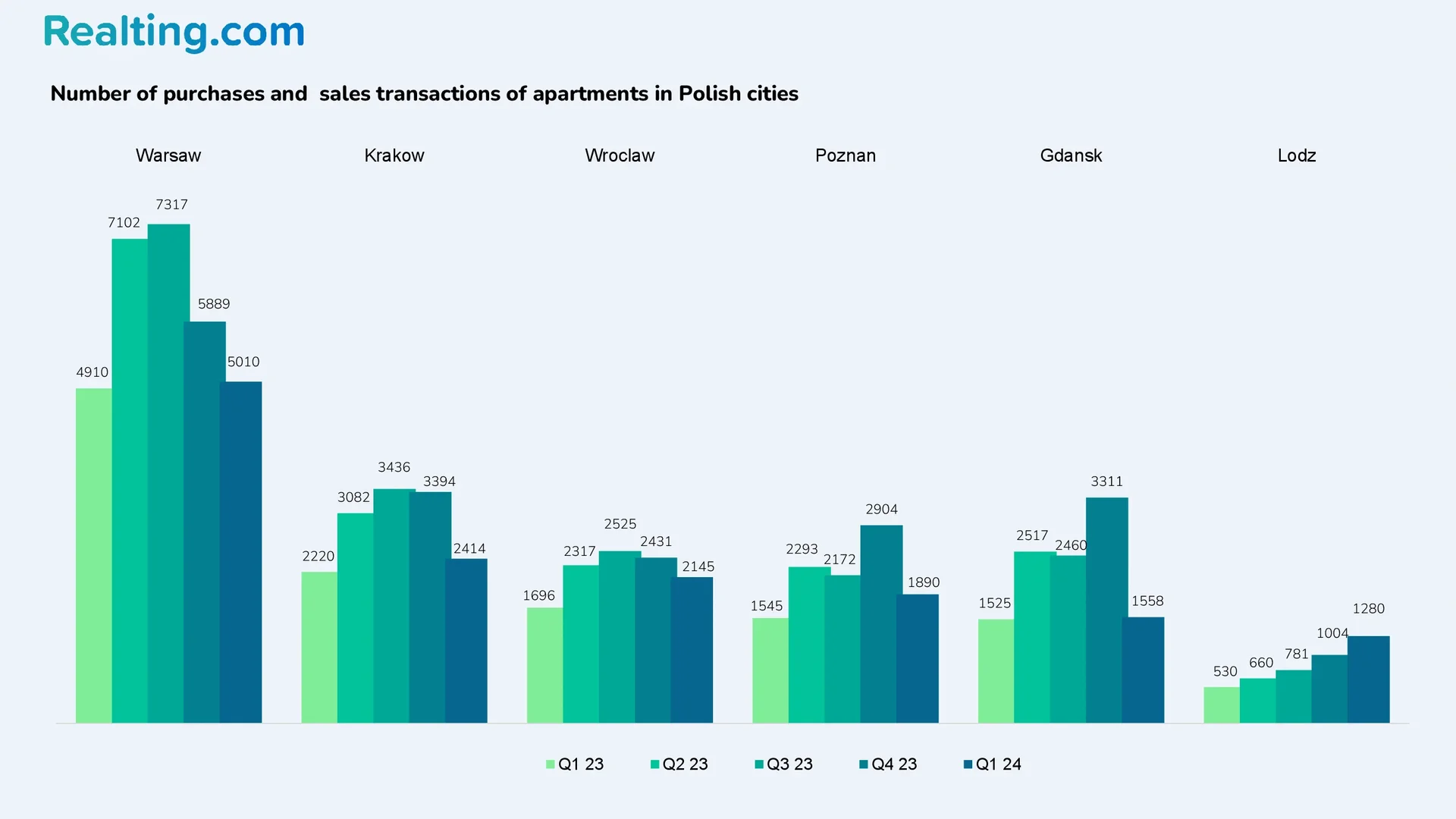

As for the current situation specifically, the National Bank of Poland published statistics on purchase and sale transactions with apartments in the largest Polish cities based on the results of the 1st quarter of 2024 — Warsaw, Krakow, Wroclaw, Poznan, Gdańsk, Lodz.

So, in the first quarter of 2024, the apartment market showed a drop in demand. In five of the six largest Polish cities, the number of apartment transactions has significantly decreased compared to previous periods.

Data for the first quarter of 2024:

|

City |

Number of purchase and sale transactions |

Change by Q4 2023 |

Change by Q1 2023 |

|

Warsaw |

5010 |

-15% |

2% |

|

Krakow |

2414 |

-29% |

9% |

|

Wroclaw |

2145 |

-12% |

26% |

|

Poznan |

1890 |

-35% |

22% |

|

Gdansk |

1558 |

-53% |

2% |

|

Lodz |

1280 |

27% |

142% |

The drop in demand in the market and, as a result, the decrease in the number of purchase and sale transactions were expected — in January 2024, the acceptance of applications for the “Safe Credit 2%” program was stopped due to reaching the lending limit. The limit itself was reached back in December 2023.

The Safe Credit 2% program was in effect since July 2023 and triggered a large-scale increase in demand. The peak of the program was in Q4 2023: in total, during this period, 36% more apartment transactions were registered in the 6 largest cities of Poland than in Q4 2022.

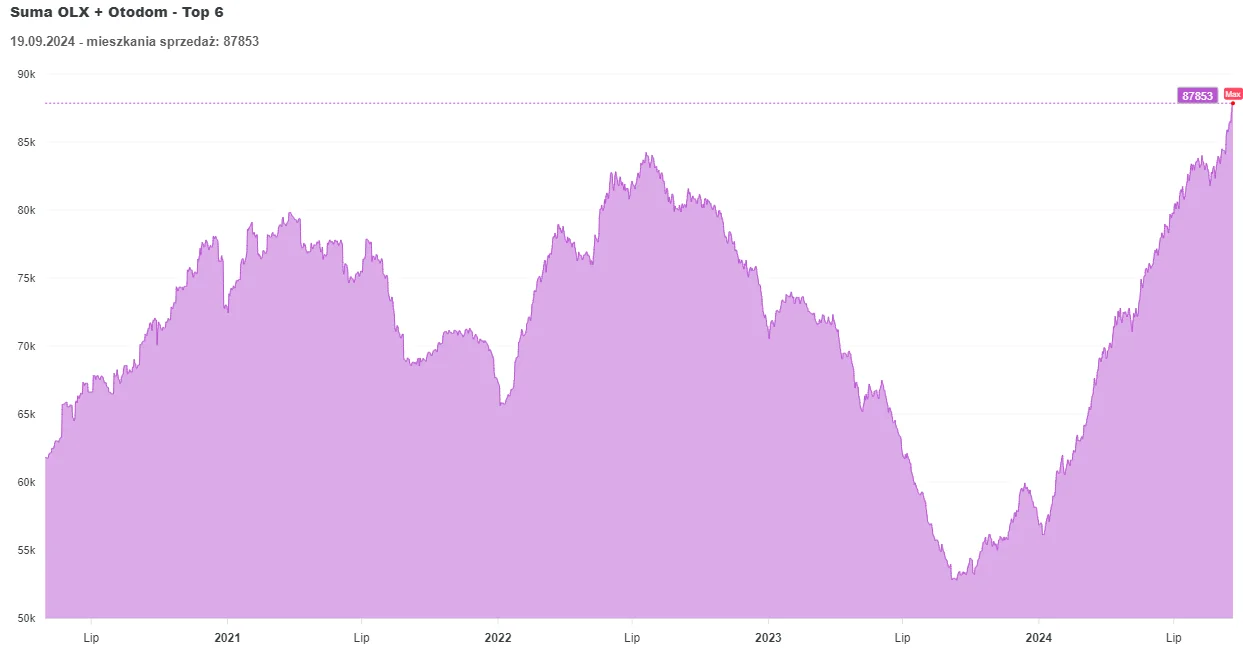

Narodowy Bank Polski has not yet published data on the number of apartment transactions in Q2 2024, but it can already be said that their number is unlikely to exceed last year's figure. There are several reasons for this: significantly reduced demand from buyers; high interest rates on housing loans; many potential buyers are “in standby mode” — they are waiting for the launch of the “Kredyt mieszkaniowy #naStart” credit program, which will be more modest than its predecessor.

In conditions when demand on the market was declining, the number of offers for sale of flats was growing. According to the OLXDATA platform, in the 6 largest Polish cities, the number of advertisements for the sale of flats on the Otodom.pl and Olx.pl websites reached record levels in September 2024.

Prices for Apartments in New Buildings and on the Secondary Market

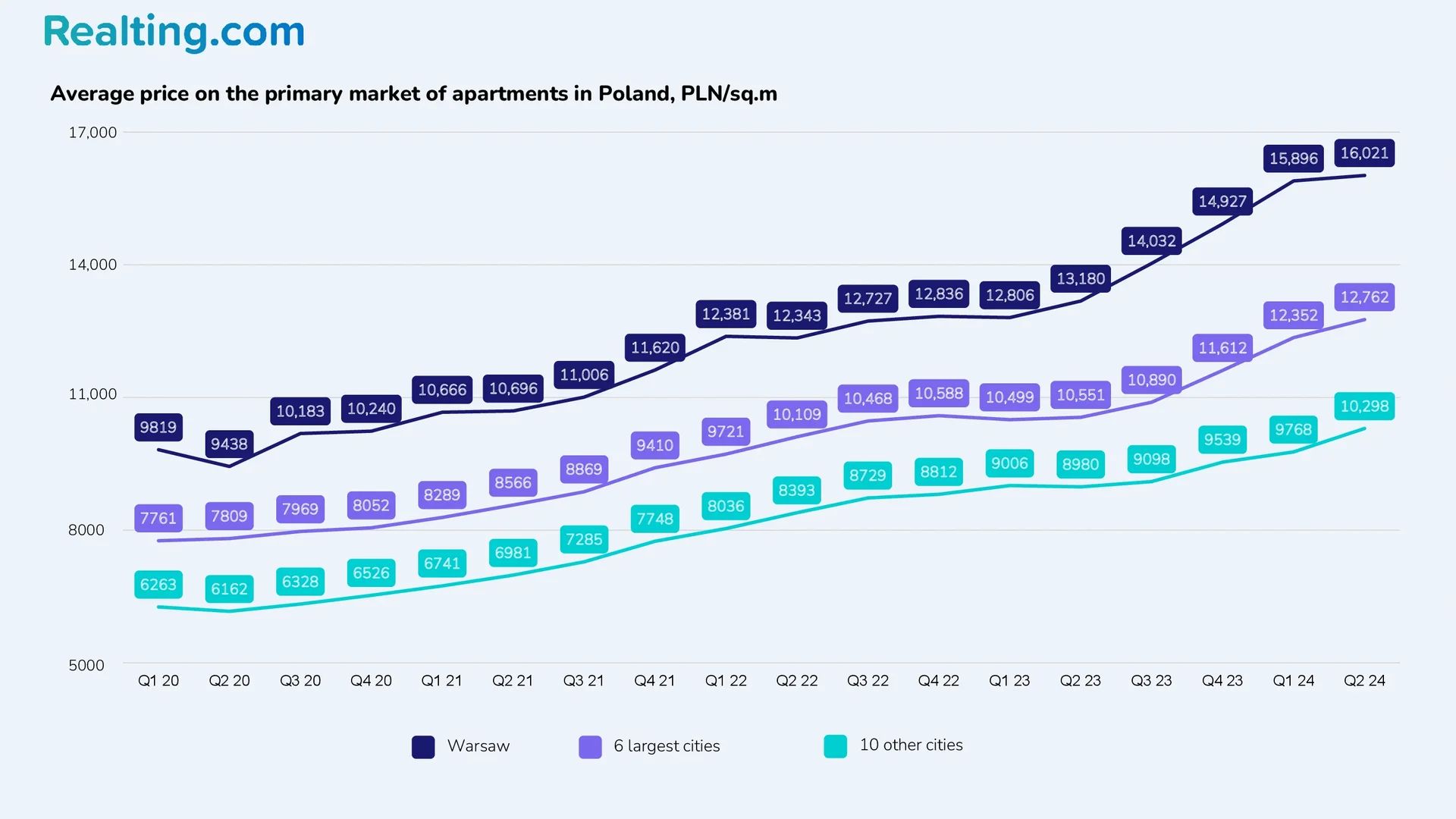

According to Narodowy Bank Polski, data on the average price per square meter are aggregated into the following groups:

- Warsaw.

- Six largest Polish cities, not counting Warsaw (Gdansk, Gdynia, Krakow, Lodz, Poznan, Wroclaw).

- Ten analyzed cities (Bialystok, Bydgoszcz, Katowice, Kielce, Lublin, Olsztyn, Opole, Rzeszow, Szczecin, Zielona Gora).

Apartment prices continue to rise on both the secondary and primary markets. According to the results of the 2nd quarter of 2024, the average price on the primary market in Warsaw was 16,021 PLN/sq.m (approx. 3,724 EUR/sq.m) - this is 1% more than in the previous period and 22% more than in the 2nd quarter of last year. Read more in our detailed real estate price analytics in the Polish capital.

In the group of six cities, the average price per square meter increased by 21% over the year, reaching 12,762 PLN/sq.m (approx. 2967 EUR/sq.m) in Q2 2024 – an increase of 3% compared to Q1 2024.

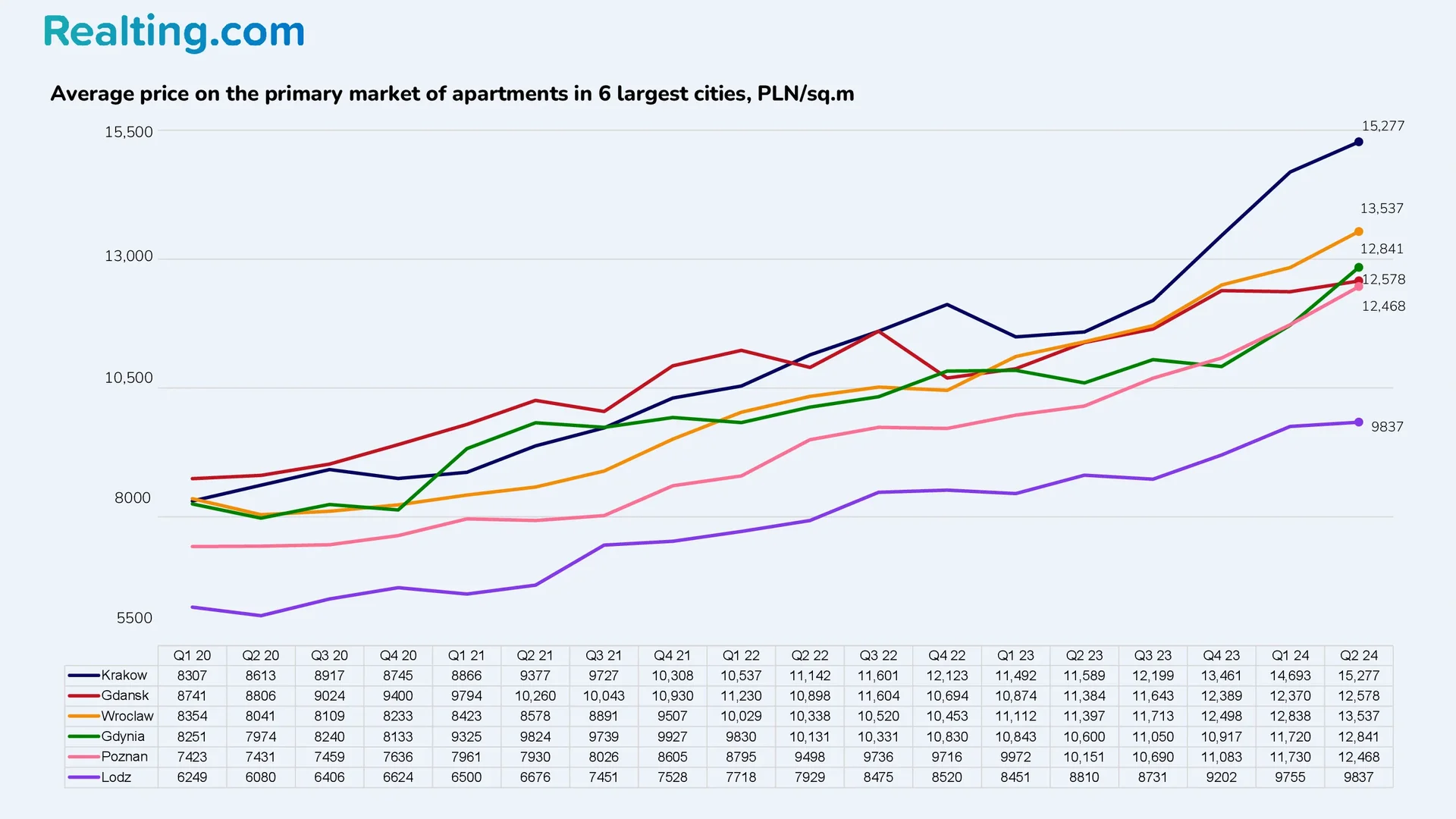

The city with the most expensive square meter in this group is Krakow - 15,277 PLN / sq.m (about 3,552 EUR / sq.m). Over the year, the average price per square meter has grown by 32% — this is the largest annual price increase in Q2 2024; if we talk about quarterly growth, then compared to Q1 2024, it was 4%. The city with the lowest average price per square meter in the group is traditionally Łódź — 9837 PLN/sq.m (about 2,287 EUR/sq.m), +1% compared to the previous quarter and +12% compared to Q2 last year.

Below is data on how the average price per square meter of apartments on the primary market has changed in the group of 10 analyzed cities.

|

City |

Average price per square meter, PLN/sq.m |

Change by Q4 2023 |

Change by Q1 2023 |

|

Bialystok |

10,129 |

+4% |

+19% |

|

Bydgoszcz |

8940 |

-1% |

3% |

|

Katowice |

11,508 |

+8% |

+25% |

|

Kielce |

9446 |

+10% |

+12% |

|

Lublin |

10,772 |

+9% |

+20% |

|

Olsztyn |

9153 |

+4% |

+14% |

|

Opole |

10,428 |

+2% |

+18% |

|

Rzeszow |

9514 |

-1% |

+9% |

|

Szczecin |

12,199 |

+8% |

+12% |

|

Zielona Gora |

8299 |

+7% |

+11% |

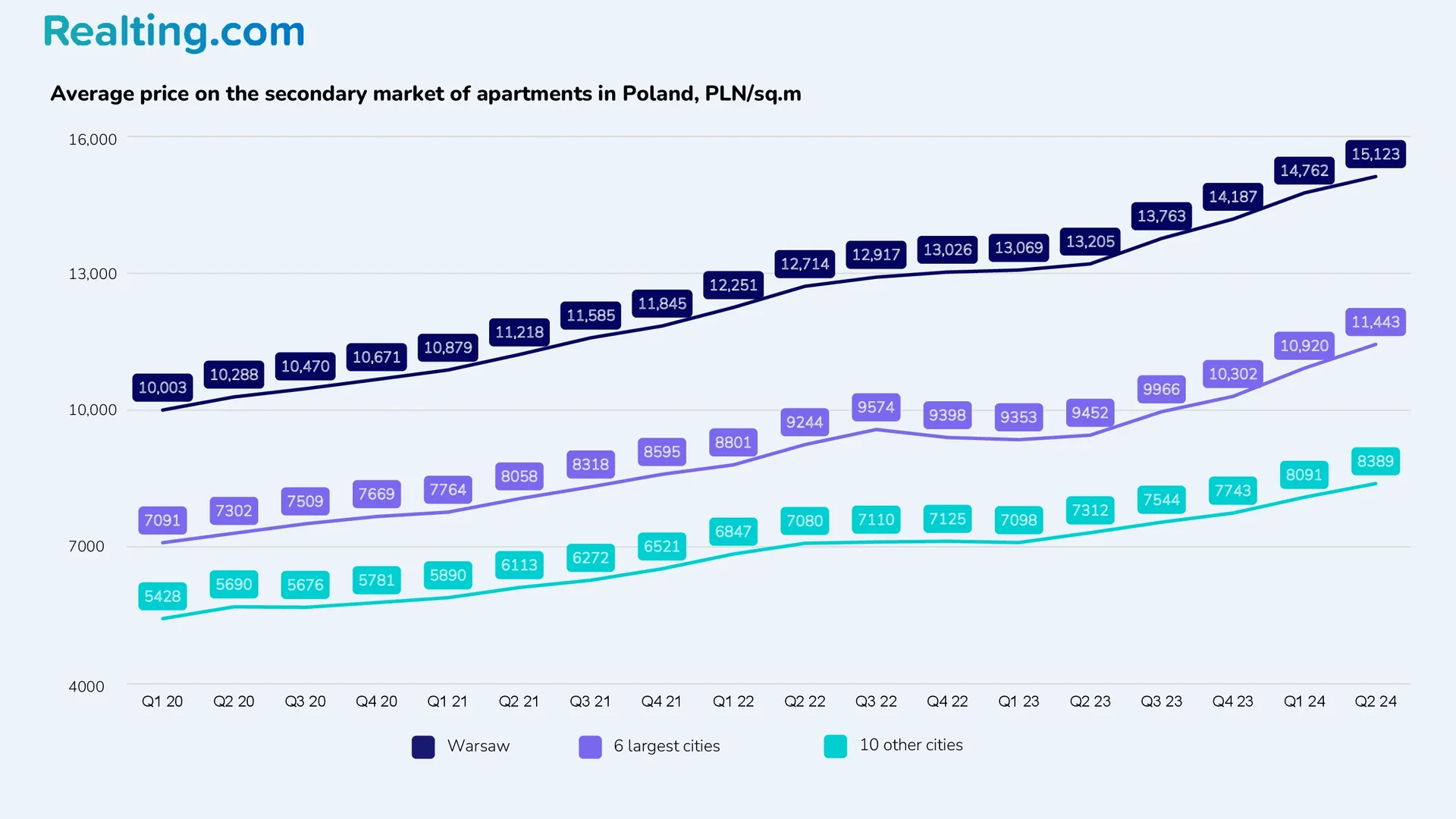

The average price per square meter on the secondary market in Warsaw in Q2 2024 was 15,123 PLN/sq.m (around 3,516 EUR/sq.m) – 2% more than in Q1 2024 and 15% more than in Q2 2023.

For the group of six cities, the average price on the secondary market was 11,443 PLN/sq.m (approx. 2660 EUR/sq.m) – an increase of 5% compared to the previous quarter, and +21% compared to the same period last year.

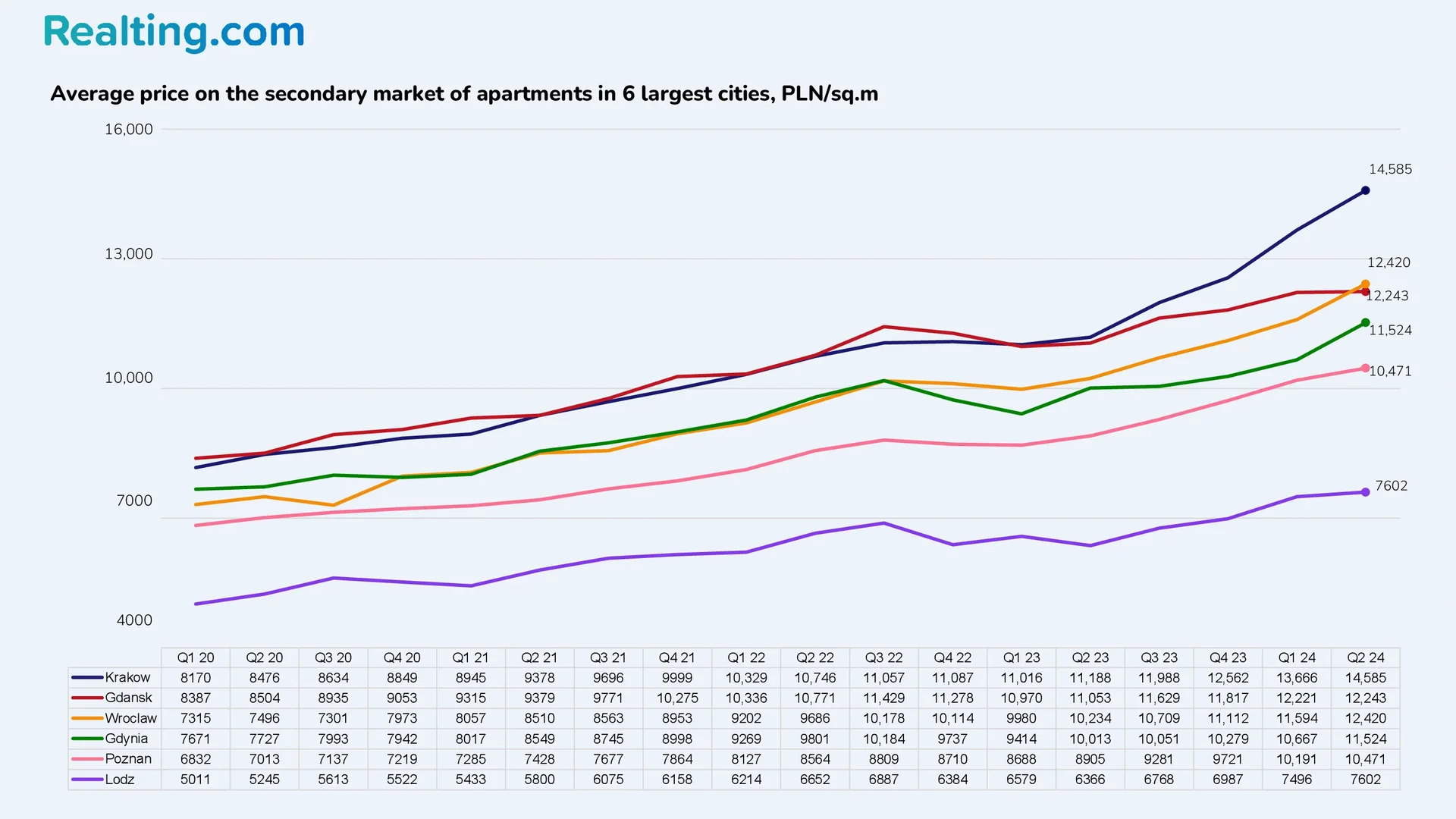

The highest average price per square meter in this group is traditionally recorded in Krakow – 14,585 PLN/sq.m (approx. 3,391 EUR/sq.m), +7% compared to Q1 2024, and +30% compared to Q2 2023. The lowest average price is in Łódź – 7,602 PLN/sq.m (approx. 1,767 EUR/sq.m), which is 1% more than in Q1 2024, and 19% more than in Q2 2023.

Below is data on how the average price per square meter of apartments on the secondary market has changed in the group of 10 analyzed cities.

|

City |

Average price per square meter, PLN/sq.m |

Change by Q4 2023 |

Change by Q1 2023 |

|

Bialystok |

8939 |

+6% |

+15% |

|

Bydgoszcz |

7333 |

+1% |

+12% |

|

Katowice |

7536 |

0% |

+16% |

|

Kielce |

7979 |

+9% |

+23% |

|

Lublin |

9278 |

+5% |

+13% |

|

Olsztyn |

8000 |

+4% |

+11% |

|

Opole |

8527 |

+7% |

+21% |

|

Rzeszow |

10,110 |

+7% |

+17% |

|

Szczecin |

8620 |

-2% |

+12% |

|

Zielona Gora |

7491 |

+5% |

+15% |

Conclusion

Analysis of the Polish real estate market in the first half of 2024 points to the following key trends:

- Decreased demand: five out of six largest Polish cities have seen a significant decrease in the number of apartment sales and purchases compared to previous periods.

- Supply growth: the number of advertisements for apartments for sale in major cities has reached record levels.

- Continued price growth: despite the decline in demand, apartment prices continue to rise in both the primary and secondary markets.

- Regional differences: there are significant differences in price dynamics between cities, with Krakow showing the largest price increases.

- The impact of government programs: the end of the “Safe Credit 2%” program has had a noticeable impact on the market, and the expectation of the new “Kredyt mieszkaniowy #naStart” program is forcing many potential buyers to take a wait-and-see attitude.

- Record prices in Warsaw: the capital remains the most expensive market, with prices reaching 16,021 PLN/sq.m on the primary market.

These trends indicate a transitional period in the Polish real estate market. Despite the decline in demand, the steady growth in prices indicates the continued attractiveness of real estate as an investment asset. The future development of the market will largely depend on economic policy, interest rates and the implementation of new government support programs.