Real estate prices have doubled in 10 years. Analysis and trends of the Polish real estate market. Analytics from REALTING

High demand for housing became the main driver of the real estate market between 2013 and 2023. What happened in this period with housing prices, demand and supply in the real estate market of Poland read in the latest REALTING analytics.

State support programs and their impact on the Polish real estate market

Until recently, Poland was considered one of the most inexpensive countries in Europe. Comparing the value of real estate with some other European countries, real estate prices in Poland may indeed seem relatively low. Population growth due to migration, increased demand for goods and services, increased income due to the development of the IT sector affected the pricing of real estate in the country. REALTING analyzed what has been happening on the real estate market in Poland for the past 10 years and found out the trends of the first half of 2023.

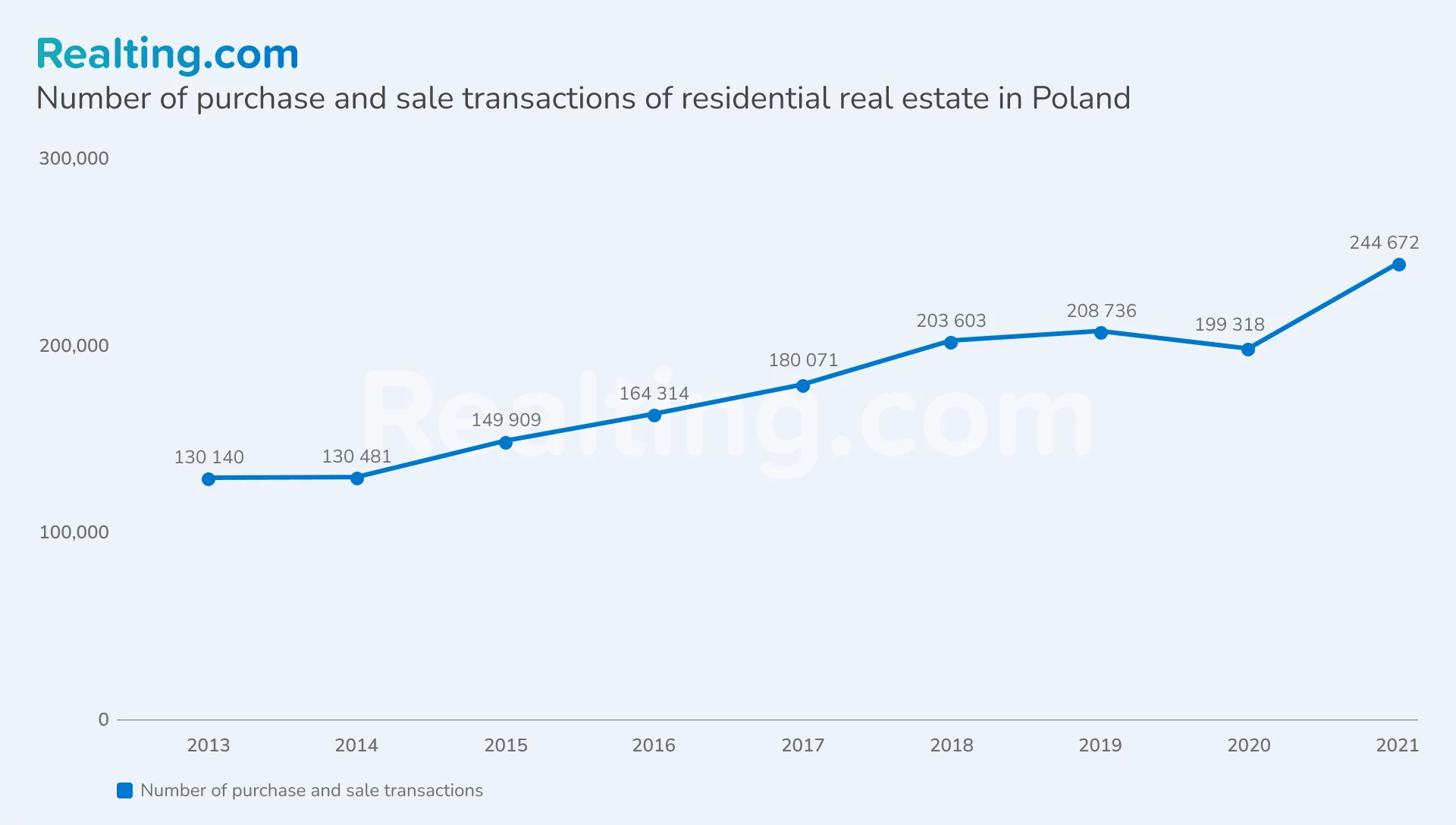

A notable increase in residential property transactions in Poland occurred in 2015: +15% compared to the previous period. The reform of the program "Mieszkanie dla Młodych" (Apartment for the young). The essence of the state program is to support young people to buy real estate on both primary and secondary markets. The state provided subsidies to repay part of the loan when buying the first real estate. The amount of the subsidy depended on many factors, including income, family composition, and the size of the property. Subsidies were paid by the State on the basis of a mortgage loan repayment over a period of time. The program was available for young people up to the age of 35 or 40 for single parents.

It was possible to buy an apartment under this program until 2018. It is obvious that the growth in the number of transactions more than 10% stopped annually for this reason and in 2019 was only 3%.

In 2020, the real estate market was expected to be affected by the COVID-19 pandemic. The cancellation or postponement of transactions, restrictions on viewing, as well as uncertainty and economic instability, contributed to a decline in real estate activity. As a result, the number of completed transactions fell by 5% compared to the previous period.

The relatively small decline in activity can be explained by the fact that the Polish Government has taken measures to stimulate the real estate market in the face of the pandemic. For example, interest-rate subsidy programs on mortgages and loans have been proposed.

As a result, in 2021, more than 240 thousand transactions were registered. Compared to 2020, the increase was 23%. And if we compare the indicator with 2013, the number of transactions committed increased by 1.9 times.

After the pandemic crisis, the economic situation began to improve gradually. The reduction in unemployment has increased purchasing power and interest in real estate. Real estate demand was also boosted by the National Bank of Poland, which maintained low interest rates, making loans available to potential buyers. Typical mortgage conditions in Poland in 2021 include: loan size from 60% to 90% of the real estate value, interest rates from 2% to 5% per annum, loan term 20-25 years. At the same time, official data for 2022 and the first half of 2023 have not yet been published.

In Poland, there are quite a lot of programs for financing housing, and it is still possible to take an affordable mortgage, even for foreign citizens (with a residence permit and a confirmed source of income). So, for example, the program to buy the first apartment for young people "Mieszkanie bez wkładu własnego" (Mortgage without a down payment) is a mortgage, the essence of which is that commercial banks provide mortgage on their own terms, and the State Bank guarantees for the borrower the whole or a part of the down payment.

By the way, in July 2023 in Poland, a new housing program «Pierwsze Mieszkanie» (First apartment), which is focused on people under 45 years old, who do not have property came into force. The program works in two directions: the first is a safe loan with a conditional 2%, i.e., the first home loan subsidy system; the second is a housing account which helps to save for the purchase of housing. Most likely, the program will affect the final number of transactions in 2023.

High inflation and rising cost of living in Poland

Before considering the price of a square meter of housing in Poland, it is worth taking into account the change in the price level in the country’s economy. The consumer price index is published by Główny Urząd Statystyczny. The index allows the analysis of changes in the cost of living, respectively, and reflects the standard of living of the population. This is also one of the most used inflation indicators. Thus, in 2022 prices increased by 14.4% compared to last year.

The inflation rate after the exclusion of food and energy prices is a more objective indicator, as it shows the trends in the prices of goods and services, which are relatively strongly influenced by the monetary policy of the Central Bank. The inflation rate in the Russian Federation is very high. The 2022 consumer price index, after excluding food and energy prices, was 109.1%.

| Year | Consumption price index | Consumption price index after excluding food and energy prices |

|---|---|---|

| 2013 | 100,9 | 101,2 |

| 2014 | 100 | 100,6 |

| 2015 | 99,1 | 100,3 |

| 2016 | 99,4 | 99,8 |

| 2017 | 102 | 100,7 |

| 2018 | 101,6 | 100,7 |

| 2019 | 102,3 | 102 |

| 2020 | 103,4 | 103,9 |

| 2021 | 105,1 | 104,1 |

| 2022 | 114,4 | 109,1 |

According to Narodowy Bank Polski price growth slowed by June 2023.

| Month | Consumption price index, % (previous month’s change) | Consumption price index after excluding food and energy prices, % (previous month’s change) |

|---|---|---|

| January 2023 | 2,5 | 0,9 |

| February 2023 | 1,2 | 1,3 |

| March 2023 | 1,1 | 1,3 |

| April 2023 | 0,7 | 1,2 |

| May 2023 | 0,0 | 0,4 |

| June 2023 | 0,0 | 0,3 |

Primary market is more popular, but people are actively bargaining in the secondary market

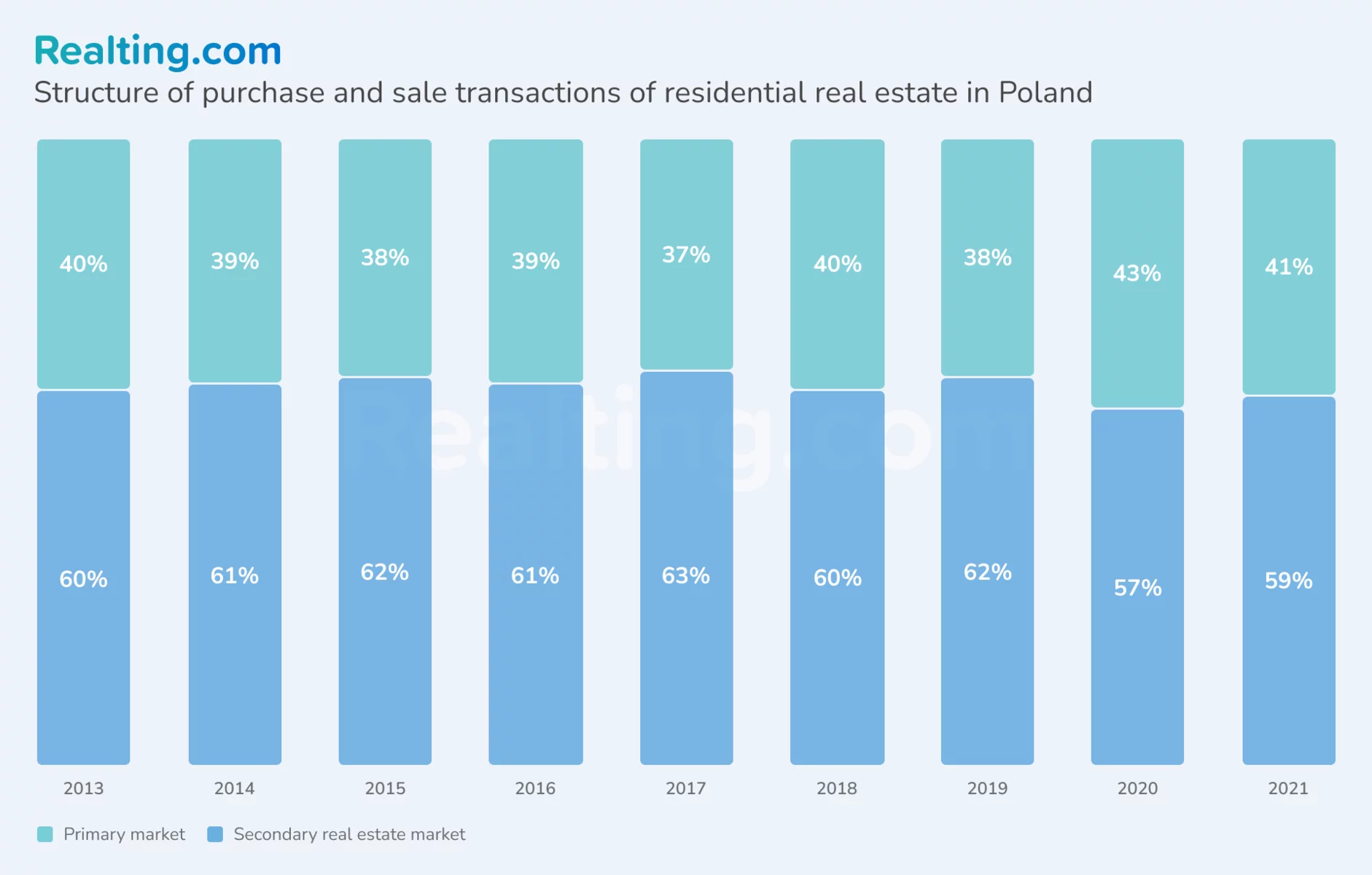

From 2013 to 2021 there is a constant situation in the structure of transactions on the readiness of the property: about 60% of transactions are made with properties of the secondary market and 40% with new properties.

Buying an apartment on the primary market has certain advantages: firstly, it is a brand new construction project with protected areas, parking lots and green areas, secondly — the absence of a property transfer tax. But most often purchase from the developer implies no repair in the property.

The secondary market offers a bigger variety of properties, including old and new developments. However, properties from the old housing stock often no longer meet the requirements of buyers because of the poor quality of construction. The purchase of a property from a secondary housing stock entails certain legal risks, as well as, until recently, the payment by the buyer of a property transfer tax amounting to 2 percent of its market value. Since August 31, 2023, this tax is eliminated, which will allow the buyer to save several thousand zlotys.

It is impossible not to note that the prices per sq. m on the primary market are higher than on the secondary market. And in Warsaw, the cost of sq. m. in apartments on the primary market will be only 8% more expensive than the secondary market. For comparison: in a group with 10 cities, a new project will be more expensive than an old by 23%, and in a group with 6 cities — by 14%. And in Warsaw, this trend was not always observed. From 2017 to 2021, the secondary market was more expensive on average by 3%, and in 2022 prices per meter were at about the same level.

Novelty and modern state attracts customers. Apartments in new residential complexes meet modern requirements and standards: modern layout, innovative technologies, new heating, ventilation and air conditioning systems. Secondary housing stock often requires restoration or reconstruction. This implies significant financial investments from owners.

However, many old buildings in Poland have historical significance and are of interest not only in terms of housing, but also as part of the national and cultural heritage, adding to the uniqueness and atmosphere that attract some people.

There is also more flexibility in the secondary market in price negotiations, especially if the seller is interested in a quick deal or is willing to consider the buyer’s proposals. This is confirmed by figures: on the primary market, the discount on trading for the total of 2Q2023 was 4% in Warsaw, 8% in the other two groups of cities. The secondary market is ready to reduce the price by 15% in the capital, by 14% in 6 major cities and by 8% in the remaining ten.

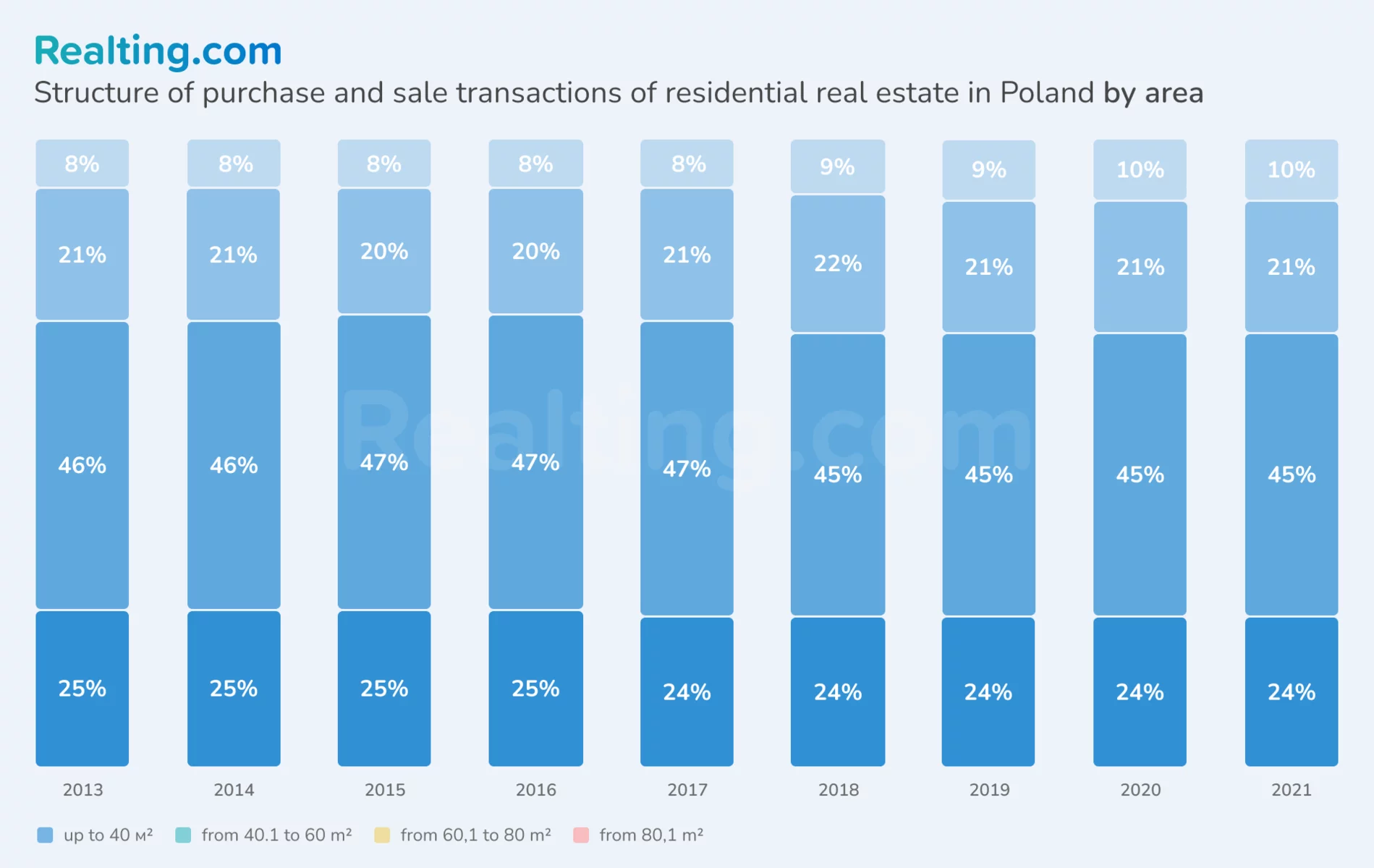

Most often, buyers preferred apartments with an area of 40 to 60 sq.m. The second most popular apartments are with an area of less than 40 sq.m. Behind them are properties with an area of 60 to 80 sq.m. The least popular properties are from 80 sq.m. and the situation has not changed significantly during the entire period under analysis.

Price increase and the cost per square meter on the Polish primary real estate market

According to Narodowy Bank Polski, data for calculating the average price of sq. m is aggregated into the following groups:

- Warsaw

- 6 biggest cities (Gdansk, Gdynia, Krakow, Łódź, Poznań, Wrocław)

- other 10 analized cities (Białystok, Bydgoszcz, Katowice, Kielce, Lublin, Olsztyn, Opole, Rzeszczów, Szczecin, Zelena-Góra).

*I quarter: December, January, February,

II quarter: March, April, May,

III quarter: June, July, August,

IV quarter: September, October, November.

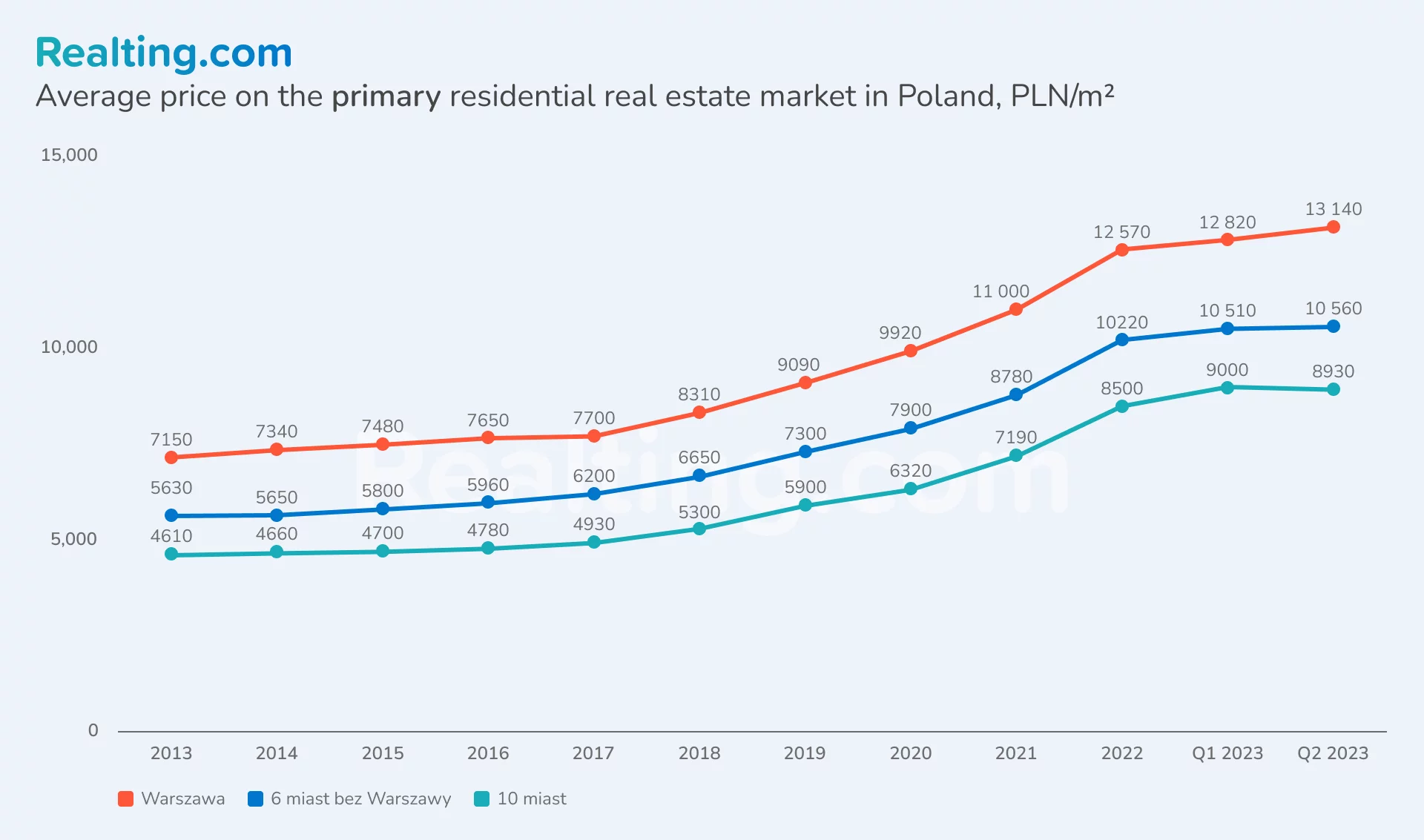

The highest average price per square meter among all the cities analyzed, which was established in the result of the 2nd quarter of 2023 on the primary real estate market, in the capital of Poland — 13 140 zl/sq. m (or $3 087/sq.m at the National Bank of Poland Rate on 31.05.2023), and the cost of a square can reach 23 thousand zlotys per meter ($5000/sq.m). The increase in the average price compared to the last quarter was 2%, and compared to 2013, the price increased 1.8 times.

In the group of 6 largest cities there was no change from the first quarter of 2023 and the average price of the meter was 10 560 zl/sq. m (or $2,481/sq m), and in the remaining 10 cities analyzed there was a fluctuation within 1%, as a result — 8,930 zl/sq. m (or $2,098/sq.m). If we look at the dynamics for 10 years, prices in these groups have almost doubled.

In 2023, the price per meter of housing in Warsaw on the primary market is 25% more expensive than in such cities as Gdansk, Gdynia, Krakow, Łódź, Poznan, Wrocław, and 47% more expensive than in Białystok, Bydgoszcz, Katowice, Kelce, Lyublin, Olyn, Zczecin Zczech, Zczecin Szczecin Szew. This is due to the fact that the capital of Poland is the largest and one of the most densely populated cities in the country with limited space for new construction projects, especially in the central areas. Warsaw offers many opportunities for work, business, investment and development. Consequently, the high demand for housing by business people, IT representatives, specialists from international companies, as well as limited supply, exerts pressure on prices.

Cities such as Gdansk, which attracts its coasts, Krakow and Wrocław — historical and cultural regions, are centers of attraction for tourists and can be considered promising for investment.

The most notable increase in prices on the primary market in all groups of cities began in 2018 — by 7-8%. Further "jumps" occurred in 2021 and 2023 — an increase of 11 to 14% and 14 to 18%, respectively. The recovery was most likely the result of the removal of covid restrictions and the realization of deferred demand.

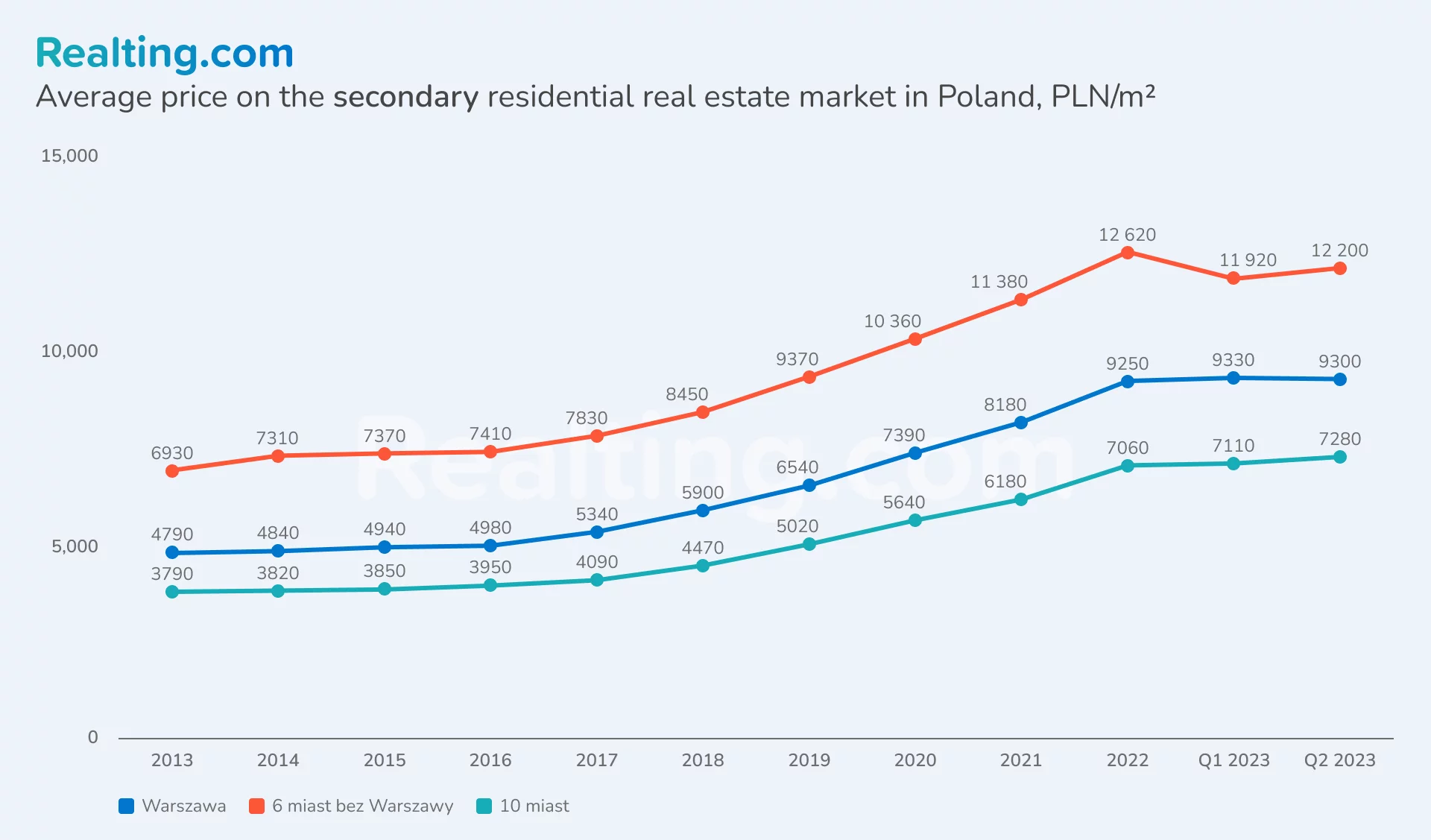

Secondary market demand is smaller, but prices are still rising

In the secondary real estate market of Poland there is a similar situation: Warsaw traditionally shows the most expensive "meter of housing" for a total of 2 sq. 2023 — 12 200 zl/sq. m ($2,866/sq.m). In 2022, the highest price in the capital of sq.m. — zl 12,620 zl/sq. m ($2,965/sq.m). The average price in Q2 2023 fell by 3% compared to the record.

In the 6 largest cities of Poland in 2022 the average price of sq. m was set at 9,250 zl/sq. m ($2,173/sq.m). There have been no significant changes since then.

And in the last analyzed group of cities the cost of a meter is 7280 zl/ sq. m ($1710/ sq.m) — +3% by 2022.

As in the primary market, prices began to rise in 2018 and peaked in 2022-2023. Since the beginning of the analysis period, prices in Warsaw increased 1.8 times, in the other two groups 1.9 times.

By the way, during the period of active growth since 2018, the price of the meter increased most in the last group of 10 cities – Białystok, Bydgoszcz, Katowice, Kelce, Lublin, Olsztyn, Rzeszczyń, Szczecin – by 63%. In 2nd place 6 largest cities – Gdansk, Gdynia, Krakow, Łódź, Poznań, Wrocław – +58%. The smallest increase in the price of Warsaw – +44% since 2018.

In recent years, the real estate market in Poland has shown stable growth, and not only in the capital region and large cities. In general, the real estate market in Poland can be described as developing, oriented towards the construction of new projects and the purchase of own housing due to incentives from the state. Thanks to stable economic growth and high European living standards, the demand for real estate is growing rapidly, both from local residents and from foreign citizens. Moreover, high rent and strict conditions of landlords can stimulate the demand for the purchase of their own apartment, not only Polish citizens, but also expats.

*The calculations were made on the basis of data of Główny Urząd Statystyczny on the number of transactions of purchase and sale of residential real estate, as well as on the basis of data of Narodowy Bank Polski on the average price of sq.m. of residential real estate.

*According to Narodowy Bank Polski, the primary real estate market includes transactions made in the open market, where the seller is a legal entity and the average price for 1 sq.m. is not less than 2000 PLN.

Author

Providing readers with quality analysis on global trends in the real estate market.