«If you want to buy a housing in the mortgage — it is better to postpone these plans.» How the situation in the Czech real estate market is changing

How have real estate prices changed in the Czech Republic? What kind of housing is in the greatest demand? Who invests most in the Czech market? All the answers — in this article.

In this difficult time of shifts in all global processes, the situation in the real estate market in the Czech Republic (as well as everything in this world) is changing. Its expert opinion on how exactly these changes and what they lead to, shared with us Viktoria Kostebelova, director of the Czech real estate and development company KV Property s.r.o.

«The flow of historic foreign investment has virtually stopped»

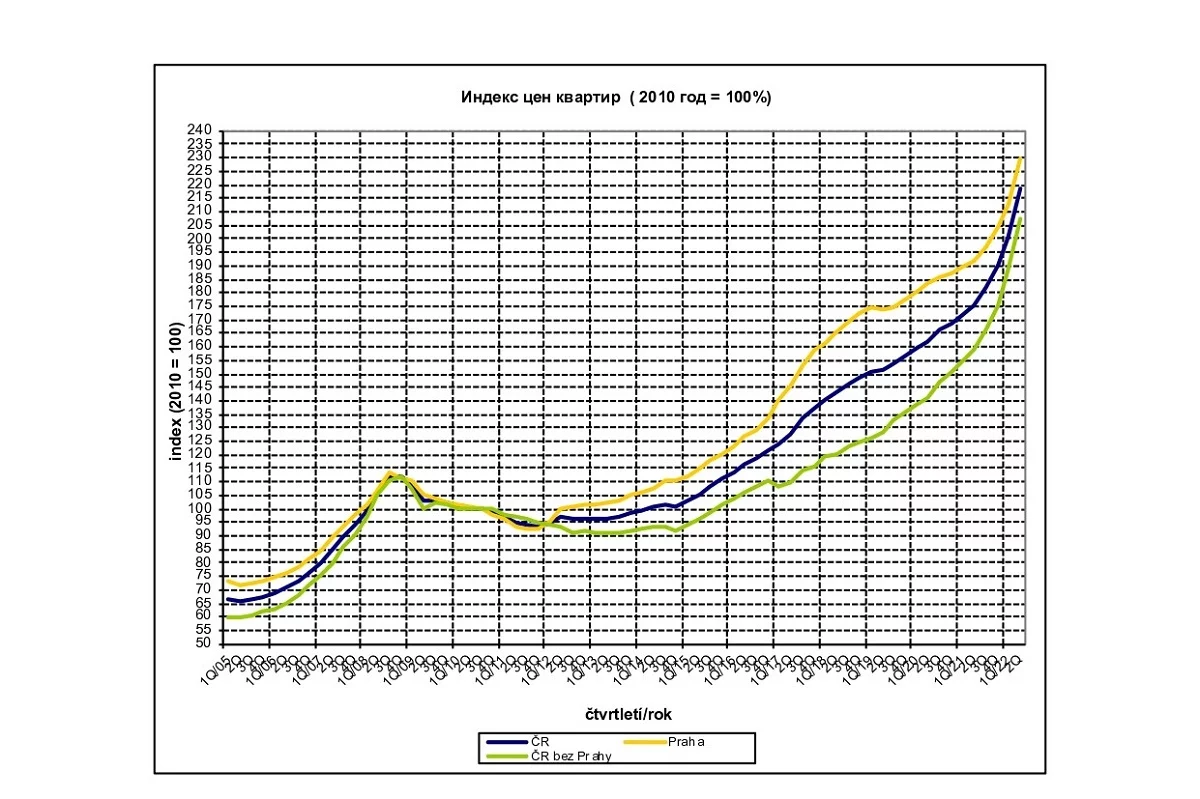

— The Czech real estate market has been growing rapidly since 2010. On average, the growth is 13% per annum. The most successful year for real estate owners was 2021: during this period, apartments in the Czech Republic rose in price by 18%, land — by 21%. Demand was so high that we had dozens of people calling us with the desire to see the object. Often we even had to hold auctions, selling the apartment to the highest bidder. Low mortgage rates contributed to the high demand for real estate. Many people with little money invested in real estate to ensure a steady income.

— The Czech real estate market has been growing rapidly since 2010. On average, the growth is 13% per annum. The most successful year for real estate owners was 2021: during this period, apartments in the Czech Republic rose in price by 18%, land — by 21%. Demand was so high that we had dozens of people calling us with the desire to see the object. Often we even had to hold auctions, selling the apartment to the highest bidder. Low mortgage rates contributed to the high demand for real estate. Many people with little money invested in real estate to ensure a steady income.

Over the past six months the situation has changed to some extent: the demand for the purchase of apartments has calmed down a bit, although it is still quite high. The average price of an apartment in Prague today is about 4.900 €/m2, an increase of 8% over the year. In Brno, apartments can be purchased for 3.800 €/m2, in Karlovy Vary for 2.100 €/m2.

Several factors influence the cooling of the real estate market:

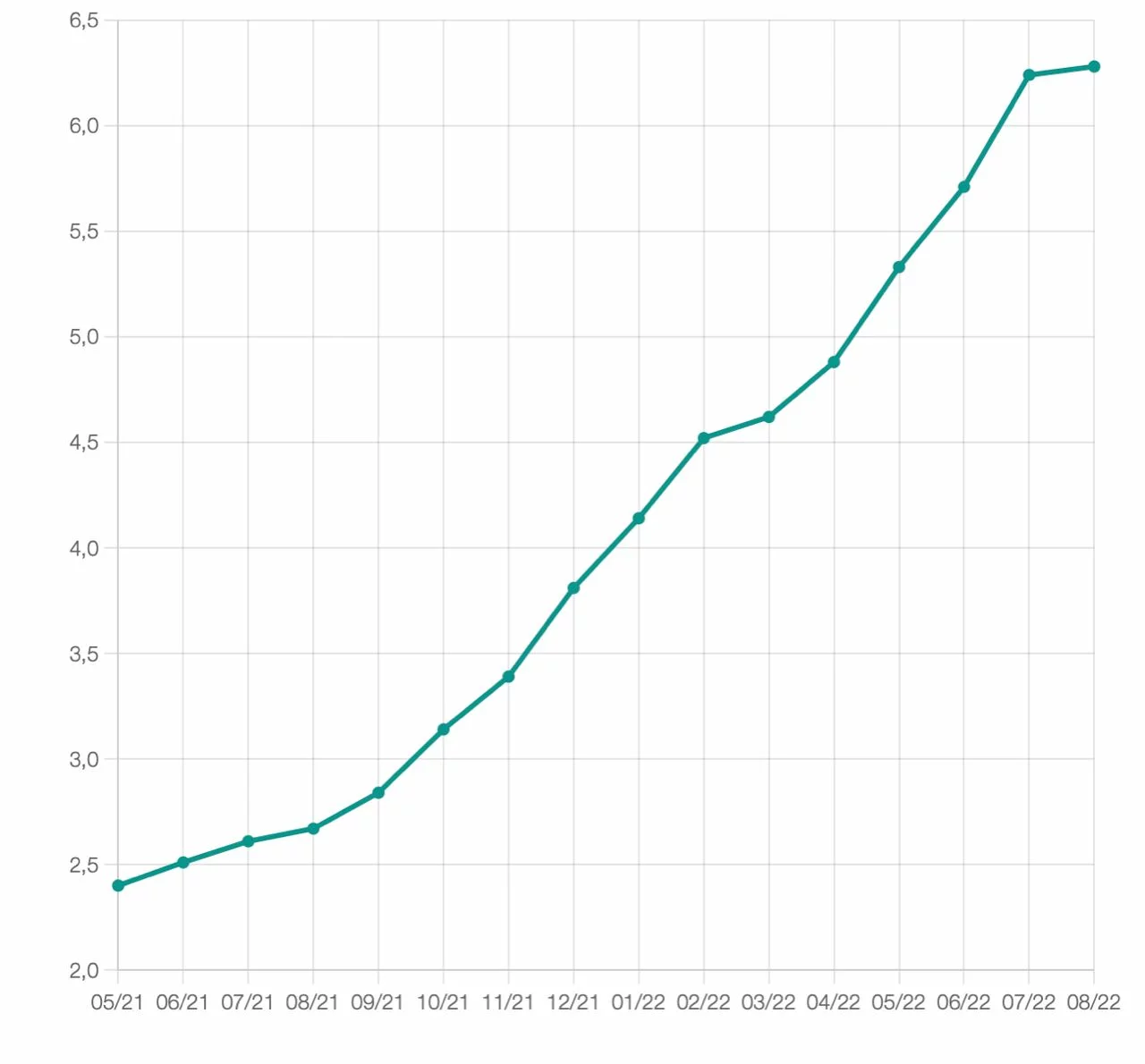

1) Significant increases in mortgage lending rates. According to Hypoidnex, mortgage rates rose from 2.4% in January 2022 to 6.8% in August 2022. Accordingly, it’s not exactly prudent to take out a mortgage to buy real estate right now.

2) The strengthening of the koruna in relation to the euro. This reduced the attractiveness of real estate investments for our European neighbors.

3) The war in Ukraine. Because of the conflict, the flow of historical foreign investment from Russia, Ukraine, and Kazakhstan has virtually stopped.

Mortgage rates rise in 2022 according to Hypoidnex

Nevertheless, there is a demand and it is quite high. Many people do not need a mortgage and consider real estate as a reliable investment to preserve and increase capital. As the practice showed, it makes sense: this year the value of securities, stocks, bonds and cryptocurrencies is going down significantly, while real estate prices keep growing. Therefore, in the nearest future real estate will be the safest harbor for investments.

«Almost half of Prague’s housing is rented out»

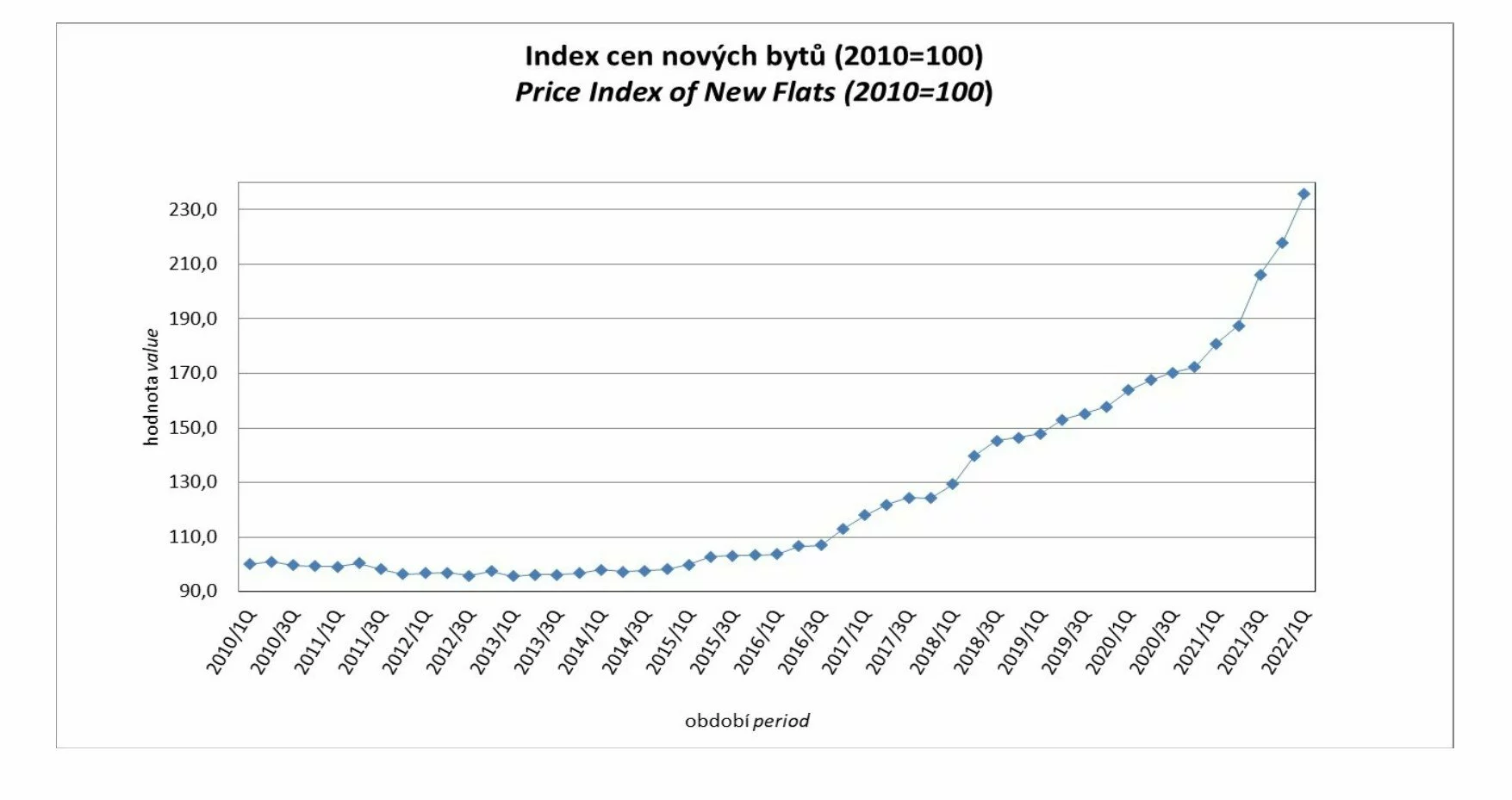

— New home prices are rising steadily. The Czech Statistical Office’s graph clearly shows how new apartment prices began to climb in 2016 and are still rising. On average, it is 18% per year.

There are several reasons for this intense growth:

- In the Czech Republic, customer demand for new apartments consistently exceeds the supply.

- There are few new buildings in the Czech Republic compared to other European countries. This is due to the conservative construction law of the Czech Republic, aimed to protect the country’s natural and cultural monuments. Therefore, it is very difficult for a developer to obtain a permit for construction or reconstruction, and this process is quite time-consuming (on average, it takes about 3 years).

- Since 2021 began a strong increase in the cost of construction, some building materials rose in price by 120% — this was instantly reflected on the price of new buildings.

- Since the beginning of 2022, the central bank interest rate in the Czech Republic has been rising. Loans for developers are becoming very expensive. This will also have an impact on prices.

Most likely, the market for new buildings will slow down — developers will not start new projects (will wait for cheap money); current projects will certainly be completed, while reducing prices for new buildings are unlikely to be (most probably, we can talk about installment payment).

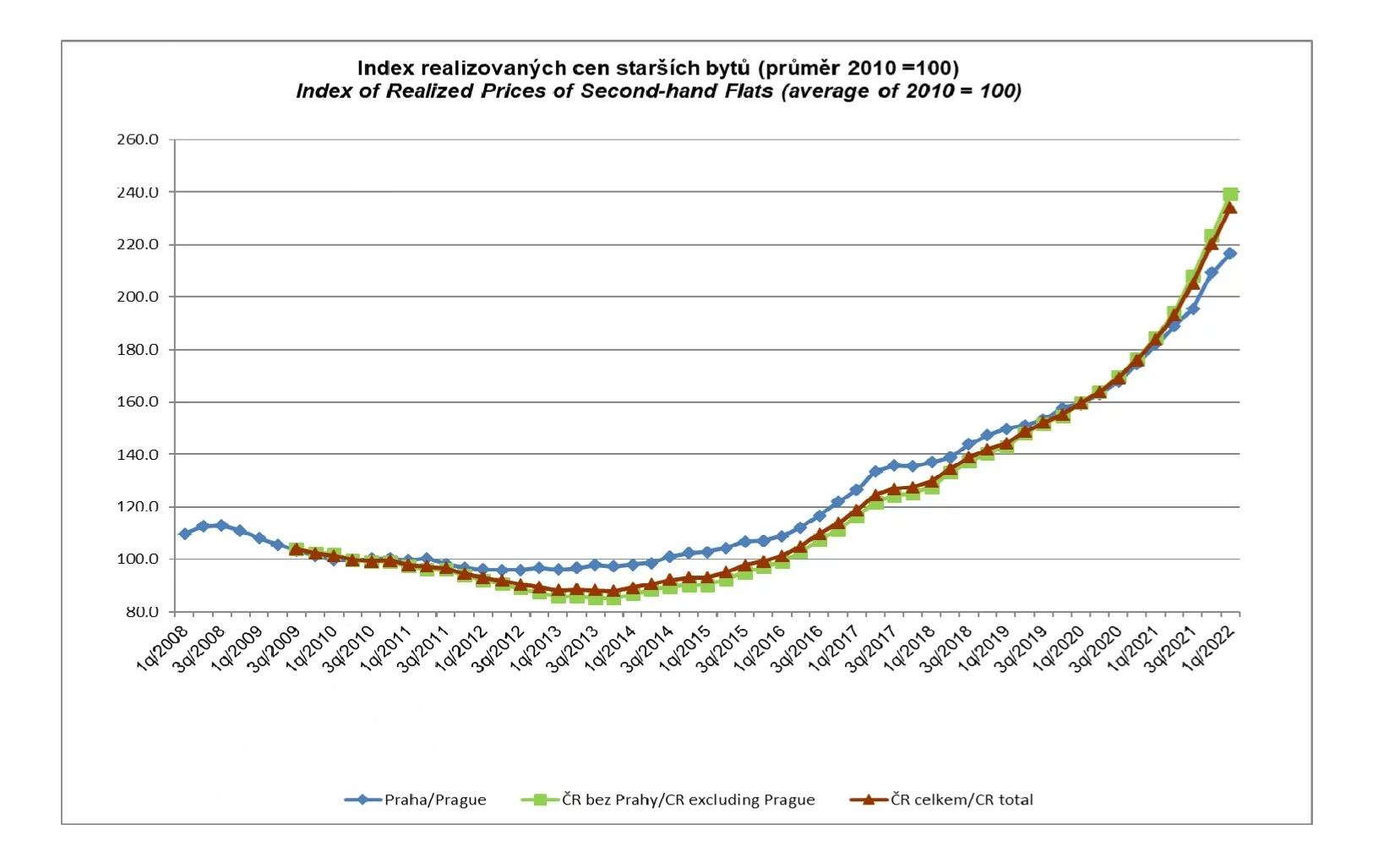

As for secondary housing, this market has also shown tremendous growth all along (about 18% per year). This information is confirmed by the graph of the Czech Statistical Office. The growth trend continued in the first half of 2022, but this process is no longer as active.

Now about the rental market. Czech families used to prefer living in their own apartments and houses, but now they are increasingly leaning toward rented housing. The influx of refugees from Ukraine has also greatly increased the demand for rent. To understand the scale: almost half of Prague’s housing is rented, both long-term and short-term.

It is logical that the cost of renting property in the last six months has increased significantly. At the moment in Prague to rent a one-room apartment costs about 700 €/month, two-room — 850 €/month, and three-room about 1000 €/month. In Karlovy Vary — 400 €, 550 € and 650 € respectively. Income from long-term rentals is about 3-4% per annum.

The market of short-term rentals is now rising quietly, but I do not see great prospects for this area: the authorities in Prague are likely to go the classical way and will accommodate tourists in the hotel, while complicating the process of allowing apartments for short-term rentals. So today I would not advise to buy an apartment with a view to short-term rentals. It is better to consider an investment in income-generating housing for the long term.

«Luxury real estate is being purchased less frequently»

— The events in Ukraine, rising gas and electricity prices, falling stock prices, uncertainty in the economy, inflation — all this has certainly affected the Czech real estate market and its investment potential. And now I will tell you how.

Those people who do not have a lot of capital, postponed the purchase of apartments for the future, preferring to live in rental housing and save money if possible.

Investors with medium capital save money from inflation by investing in small apartments (mostly in Prague) and renting them out. Another popular option: investments in CMIF (closed-end mutual investment funds) — these are mutual funds that own and manage a profitable house or shopping center, and the unit holders through the ownership of the portion own a certain percentage (and, accordingly, the income from the rental and sale of this real estate).

The activity of large investors has significantly increased: the demand for investments in income houses and agricultural land has soared. The interest is due to the fact that large investors understand the possible further fall in stocks and invest in income houses and land, which will rise in value. For example, profitable houses in Prague can be bought for about 4.000€/m2 — the rental income will be about 3% per year. In addition, in 2022 it is expected that the prices will grow by 8%. Accordingly, investment in an income house will bring the investor a guaranteed capital protection and 11% annual return.

At the same time, luxury real estate is bought less often. The exception is the luxury real estate in Karlovy Vary, which deserves special attention.

Karlovy Vary is a resort town, where influential and wealthy people of Russia purchased real estate. Beautiful apartments in the resort center of the city hospitably welcomed their owners for several months of the year. The travel ban during Covid, and then the war in Ukraine, made adjustments in the lives of the apartments and their owners. Now it is not known when the owners of the apartments can come to Vary, so many of them sell their luxury apartments together with furniture, chandeliers, curtains, marble and expensive plumbing. Prices for such apartments are very favorable: about 3,000 €/m2 (taking into account that the seller has spent several times more on its purchase and finishing). These luxury apartments are bought with pleasure by our European neighbors, mainly Germans.

«About 20% of real estate in the Czech Republic is owned by foreigners»

— The most successful and safest regions for investment are Prague and Brno. Prague is a business center: representative offices of European, American, Chinese companies are open here. Brno is an industrial center of the Czech Republic, so there are many jobs there. Due to high real estate prices in Prague and Brno, developers and buyers have also begun to build and buy real estate in smaller Czech cities such as Pilsen and České Budějovice — these are cities with developed industry, good infrastructure and excellent universities.

By the way, about 20% of real estate in the Czech Republic belongs to foreigners. A large part of them — the Slovaks. Traditional foreign buyers of real estate in the Czech Republic were Russians and Ukrainians. War and sanctions have made adjustments, and now there is no influx of investment from these buyers.

The largest investors in the Czech market are Germans — they own industrial, logistics facilities, residential buildings and commercial spaces. Germans annually invest several billion euros in the Czech real estate market: investors include automobile concerns (Volkswagen, BMW), as well as pension and savings funds of Germany.

Chinese investment is also gaining momentum: Over the past three years, Chinese firms have made multi-million dollar investments in hotels, retail spaces and apartment buildings in major Czech cities. The Czech market is also attractive to Israeli investors: AFI Europe is building excellent apartment buildings, Coast Capital Partners is developing unique luxury apartment buildings in Prague, and Daramis is building student dormitories in Pilsen.

Potential buyers are attracted to the Czech real estate market by a variety of things:

- Czech Republic — a country with favorable taxation: when buying a property you do not pay taxes (in Germany, for example, the buyer pays 3.5 to 6.5% of the price); if you get income from renting, you pay 15% of your income (in Germany, a progressive taxation, reaching 48% of rental income); if you own the property for more than 10 years, you will be exempt from income tax when selling.

- A foreigner has the same rights to buy and own any real estate as Czech citizens.

- A foreigner can be 100% founder and director of a legal entity in the Czech Republic.

- Czech banks are willing to give loans in order to buy real estate for legal entities, in which the founder is a foreigner.

- Owning and managing your own real estate is a business based on which the Czech Republic grants a residence permit.

- The Czech Republic is a country that recognizes two citizenships, i.e. you do not have to renounce your own citizenship to obtain the citizenship of the Czech Republic.

About the future of the market. Today the situation in the world is changing every day, so it is not easy to make any clear predictions. But I will try to outline some contours.

In large cities, such as Prague and Brno, residential real estate prices will continue to rise, but it will not be as active as before: I think up to 10% per annum. In smaller cities, such as Karlovy Vary or České Budějovice, the price increase may stop for a while, for some luxury apartments there may be a slight decrease in price.

In 2022 the Czech mortgage market will continue to have high rates (up to 9% per annum), which will gradually decline in 2023 and is projected by the Central Bank to reach 4% in 2024. So if you want to buy a house with a mortgage — it is better to postpone these plans until 2024.

As for rental housing, prices will still increase slightly, but their growth will definitely be less than the rate of inflation.

The general prognosis is as follows: due to rising energy prices, utility bills will increase significantly, so many people will learn to save money. Also, the demand for renewable energy sources and for proper insulation and recuperation of houses will greatly increase. In short, the coming year will not be the easiest, but if approached wisely, this period can also be profitable and successful.

Do you want to buy an apartment in the Czech Republic? Go to the section «Property in Czech Republic» and choose the option that suits you.