In the north of Montenegro, double growth is observed, coastal cities are stable. Analysis and trends of new buildings in Montenegro. Analytics from REALTING

Montenegro is a relatively young country whose main driver of the economy is tourism. Affordable real estate prices and a European lifestyle have begun to attract investors and expats to the country on the Adriatic Sea. Read about how the primary housing market in Montenegro developed in the latest REALTING analytics.

About construction, GDP, "golden passport" and mortgages

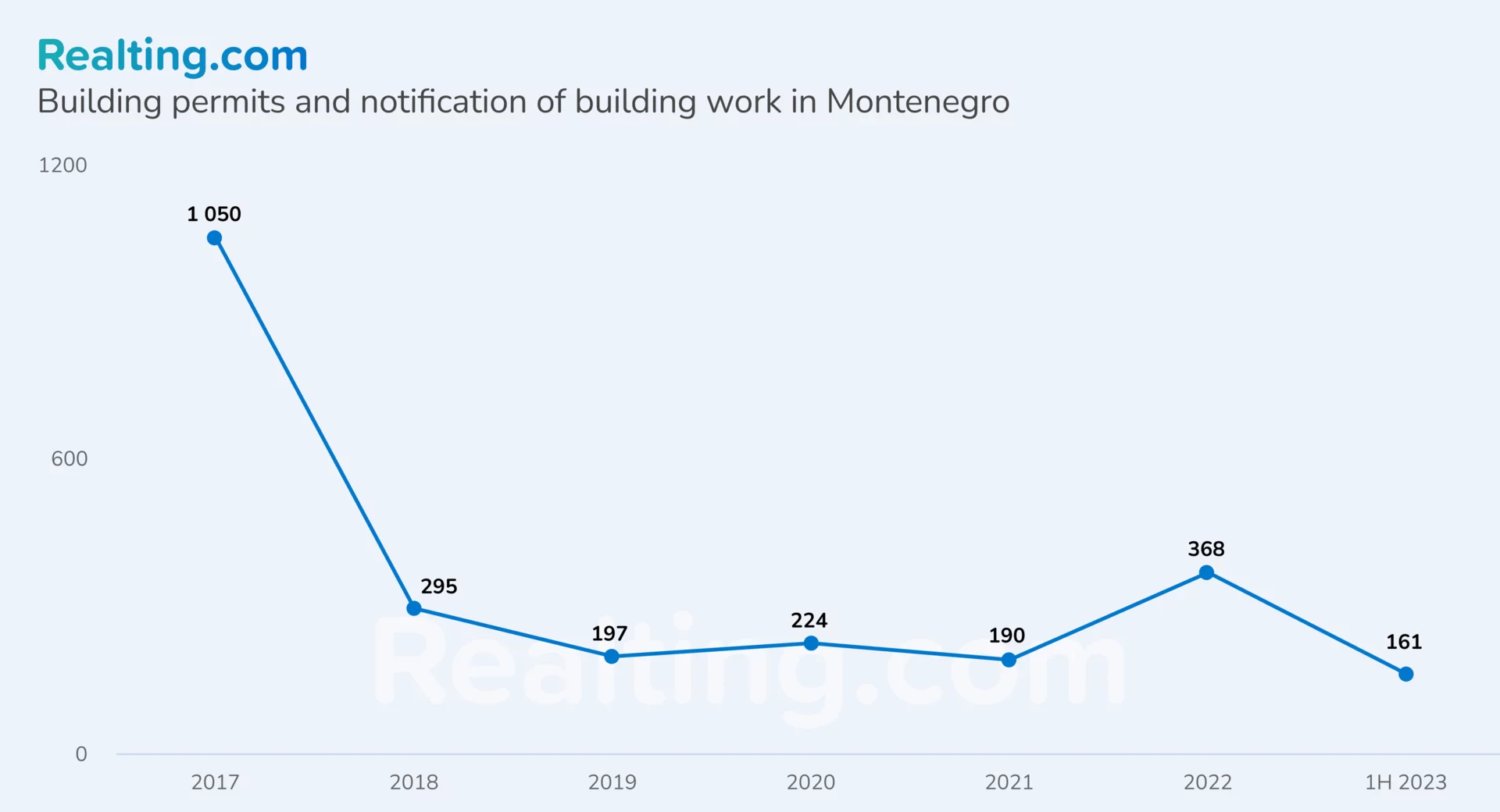

According to data from the Statistical Office of Montenegro, between 2017 and the first half of 2023, 2,485 building permits were issued in Montenegro, corresponding to 3,582 housing units. Moreover, 2017 became a record holder for the number of permits issued — 1050 per year. From 2018 to 2021, this figure in Montenegro did not exceed 300 permits annually.

Considering exclusively the primary real estate market, it is worth considering that the state of the country’s economy has a significant impact on investment in housing construction.

Real GDP growth of 4.7% in 2017, a growing tourism sector, as well as the reduction of administrative barriers and faster processing of construction applications led to an increase in demand for square meters, which required the construction of new housing to respond to it.

GDP growth of 5.1% and 4.1% continued in 2018 and 2019, respectively, and a sharp drop of more than 3 times in the number of building permits issued is likely due to the government's initiative to simplify the process of implementing new projects. Since 2018 in Montenegro, it is not necessary to obtain a special permit to start construction or use land. To begin construction, the developer only needs to prepare a construction report, an approved project and other relevant documents. After completion of construction, instead of obtaining a special permit to use the facility, you only need to register the new building in the land registry. The permitting regime continues to apply to the most complex construction projects.

For a country where tourism is one of the main sectors of the economy, international restrictions on movement and border closures have become a serious challenge — the decline in GDP was 15%. COVID-19 affected the housing construction sector a year later — the implementation of many projects was postponed.

The “Citizenship by Investment” program, which came into force in 2019, and was closed at the end of 2022 according to the recommendations of the European Union, played a significant role in influencing the real estate market. Those wishing to obtain Montenegrin citizenship had to deposit €100 thousand into the government investment fund, as well as purchase real estate worth from €250 thousand to €450 thousand, depending on the region. It was assumed that all funds should be used to develop infrastructure in the country. At the moment, the government of Montenegro has updated the terms of the program and plans to obtain approval from the European Union.

By the way, if there are not enough funds, then buying real estate with a mortgage is not the easiest process for a foreigner. Most often, the loan amount is no more than half of the value of the property. Mortgage lending is not available for all types of real estate, but only for new buildings from large developers. However, there are exceptions. The loan term for foreigners does not exceed 10 years. The rate is 7-10%, the maximum loan amount is €900 thousand. It is more difficult for entrepreneurs to get a mortgage, because banks try to reduce their risks as much as possible.

The most expensive housing by the sea and in the capital, the largest growth is in the north

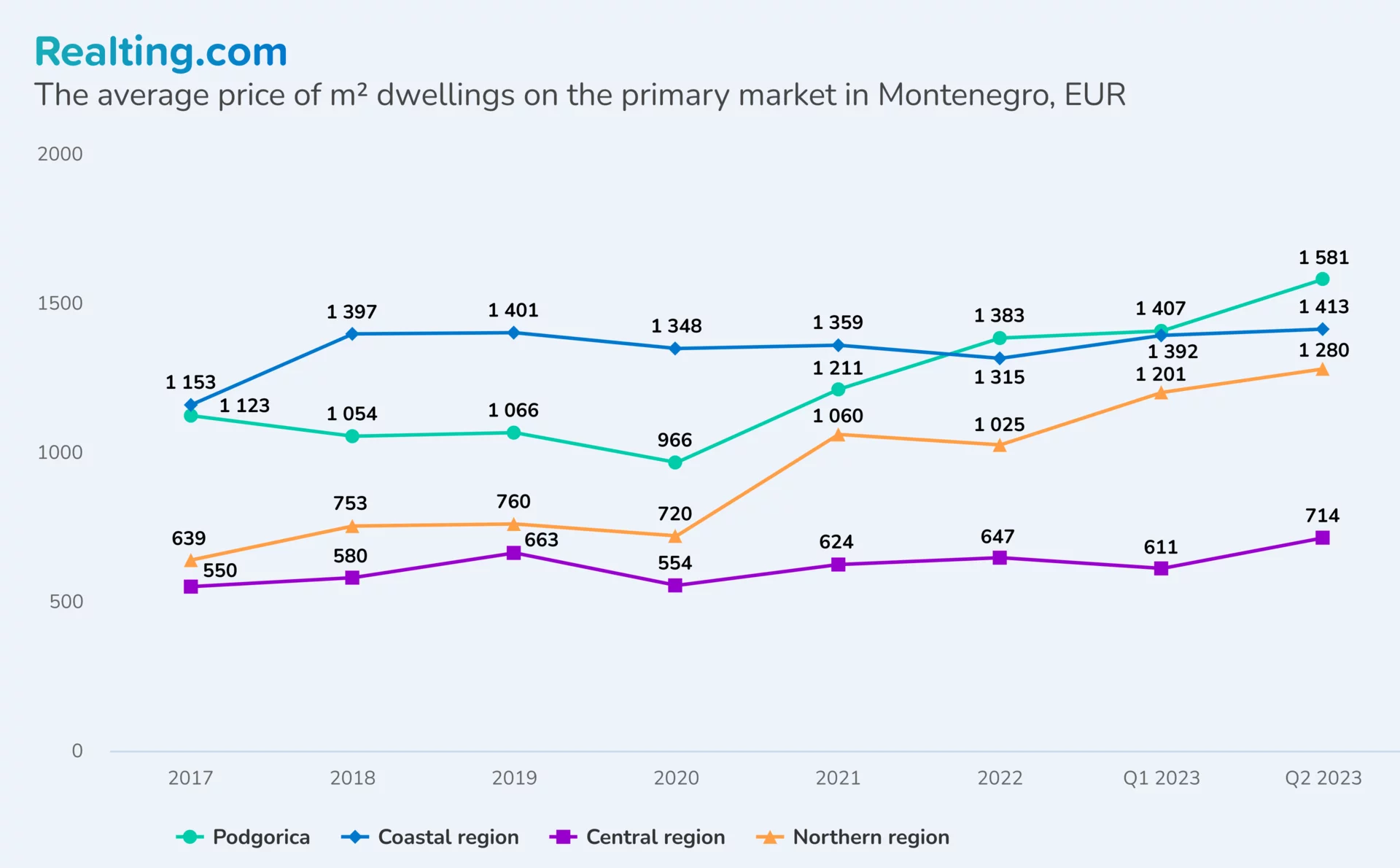

In accordance with the Statistical Office of Montenegro, data on the average price of sq.m. is aggregated into the following groups:

- Coastal region: Bar, Budva, Herceg Novi, Kotor, Tivat and Ulcinj.

- Central region: Cetinje, Danilovgrad, Niksic, Tuzi and Zeta.

- Northern region: Andrivica, Berane, Bjelo Polje, Gusinje, Kolasin, Mojkovac, Petnica, Plav, Pljevlja, Plzine, Rozaj, Shavnik and Zabljak.

Purchase and sale transactions on the primary market include transactions between the developer and the buyer in relation to residential buildings and premises in the territory of Montenegro.

The highest average price per sq.m among all analyzed cities, which was established in the 2nd quarter of 2023 on the primary real estate market, is in the capital of Montenegro – €1,581/sq.m. The average price increased by 2% compared to the previous quarter, and compared to 2017, the price increased by 40%.

The coastal region can be characterized as one of the most stable in the country - over 5 years the average price grew by 22%. At the end of the 2nd quarter of 2023, the average price was set at €1,413/sq.m. The most significant change over the entire analyzed period occurred in 2018 - the price increased by 21%, then fluctuations amounted to no more than 6% per year.

The central region is the most affordable for purchasing real estate, taking into account the increase in average prices by 17% over the last quarter, a meter of housing will cost €714/sq.m. By the way, during the pandemic in 2020, the cities of the Central region suffered the most - the average price fell by 16% from the previous year. In other regions, the price decreased by 4-9%.

The northern region has doubled the price of sq.m over 5 years – to €1,280/sq.m in the 2nd quarter of 2023. Moreover, the revival in the market in 2021 helped to achieve this value - the average price increased almost 50% over the year.

If we talk about the features of the primary market, then it is worth considering that the price is determined by the real estate developer and depends on construction costs, location, layout, and also includes the cost of the land plot, the use of modern technologies, and construction according to modern standards. In some cases, in the primary market, the buyer may be able to influence the planning or finishing process.

The price on the secondary market is determined exclusively by the owner and is more flexible in relation to demand and external factors, i.e. the price can be set based on current market requirements, the condition of the property and personal preferences.

It would be wrong to judge the real estate market in Montenegro as a whole, as well as the prospects for investment, based only on data on new buildings. However, taking into account the fact that Montenegro is a potential member of the European Union, it is worth considering that in the future all sectors of this state will be influenced by trends in European countries. Montenegro's ability to adapt to new standards and regulatory requirements will be critical. Undoubtedly, the real estate sector will be positively influenced by a potential increase in demand from foreign investors, infrastructure development, including the renewal of the transport network, as well as the development of tourism infrastructure thanks to EU support. Therefore, it is likely that the capital, as well as the tourist cities of Montenegro, can be considered a profitable asset even in the medium term.

Frequently asked questions

Is it possible to obtain citizenship if you buy real estate in Montenegro?

Can a foreigner get a mortgage in Montenegro?

Where is the best place to buy real estate in Montenegro?

Author

Providing readers with quality analysis on global trends in the real estate market.