Portugal's housing market: prices at their peak, activity on the rise

By the end of Q3 2025, Portugal ranked second among European Union countries in annual residential property price growth, with Hungary taking first place.

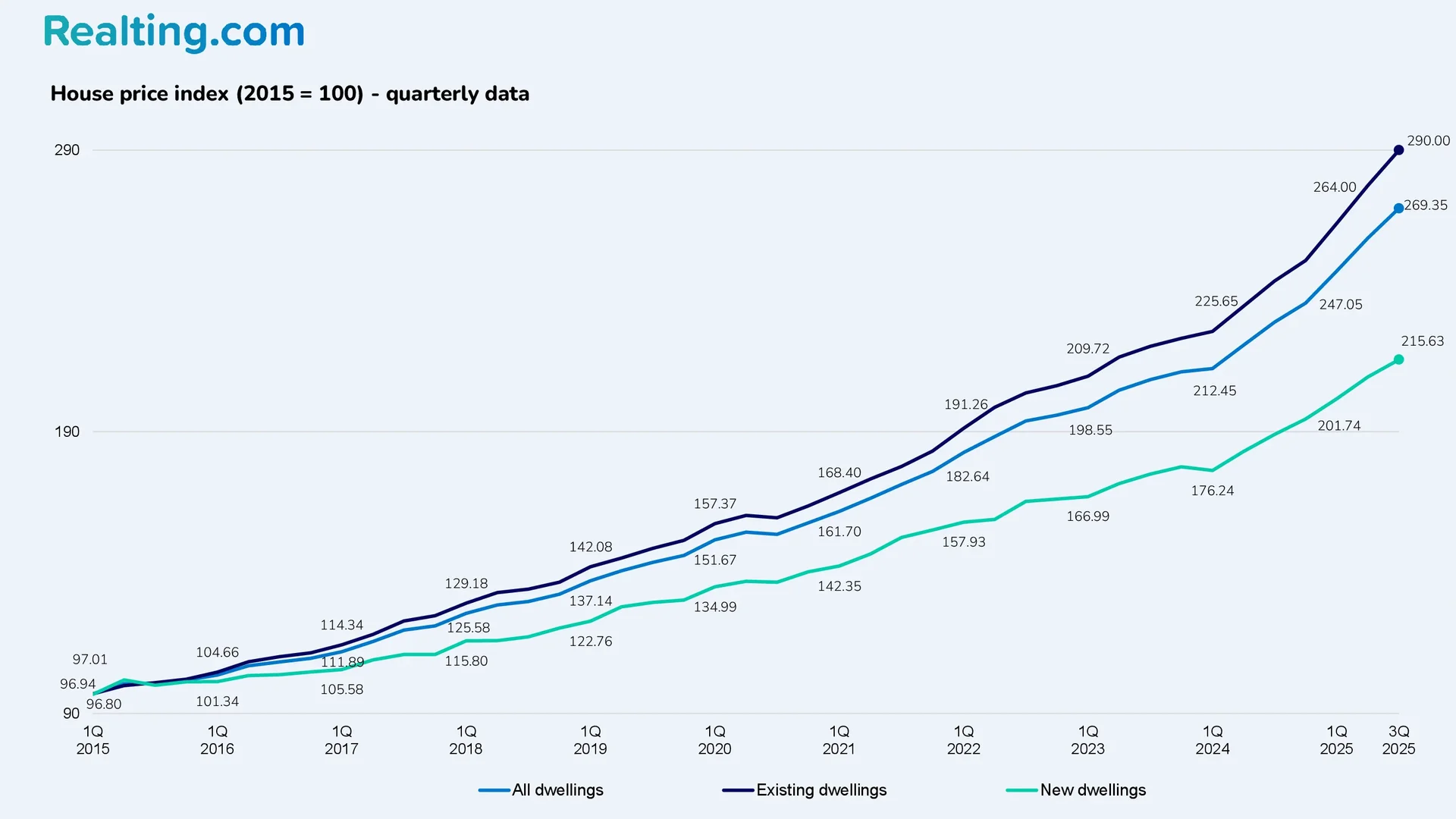

In Q3 2025, the residential real estate price index rose by 4.08% compared to Q2 2025 and by 17.68% compared to Q3 2024.

The price index for existing residential real estate rose by 4.52% on a quarterly basis and by 19.08% on an annual basis. The price index for new dwellings rose by 2.93% on a quarterly basis and by 14.07% on an annual basis.

The significant annual price growth is reflected in data from the Portuguese National Statistics Institute (Instituto Nacional de Estatística). These data reflect the median value of housing based on bank assessments at the end of December 2025, recording annual changes in housing prices in the country.

According to bank estimates, the median price of housing reached 2081 EUR/sq.m in December 2025, which is 19.12% higher than in December 2024. It should be noted that double-digit annual price growth has been observed for fifteen consecutive months.

Among the regions, traditionally, the highest median housing price is observed in Grande Lisboa (the capital agglomeration) – 3145 EUR/sq.m, Algarve – 2726 EUR/sq.m, Península de Setúbal – 2520 EUR/sq.m. The lowest price were observed in the subregions of Alto Alentejo – 1020 EUR/sq.m, Terras de Trás-os-Montes – 997 EUR/sq.m, and Alto Tâmega e Barroso – 984 EUR/sq.m.

In December, the median apartment price in Portugal stood at 2415 EUR/sq.m, which is 23.09% higher than a year earlier. Annual growth exceeding 20% has been observed for eight consecutive months.

In turn, the median house price in December settled at 1516 EUR/sq.m, with an annual growth of +14.67%.

Below are the bank estimates for apartments and houses in Portugal's largest cities as of December 2025.

|

City |

Bank assessment of the median price of apartments, EUR/sq.m |

Annual change |

Bank assessment of the median price of houses, EUR/sq.m |

Annual change |

|

Lisbon |

4556 |

+14.91% |

4698 |

+13.42% |

|

Porto |

3126 |

+15.91% |

3048 |

+32.06% |

|

Vila Nova de Gaia |

2361 |

+27.48% |

1877 |

+16.22% |

|

Braga |

1956 |

+21.26% |

1590 |

+9.35% |

|

Coimbra |

2174 |

+18.47% |

1436 |

+15.81% |

|

Funchal |

3028 |

+27.07% |

2277 |

+4.74% |

After examining bank estimates of median housing values, let's look at the average asking sale prices. According to Idealista, the leading Portuguese online real estate portal, the average price of residential properties listed for sale in December 2025 was 3019 EUR/sq.m, with asking prices at the national level rising by 6.79% over the year.

Below are the data on average asking sale costs for housing in Portugal's largest cities and their dynamics.

|

City |

Average cost in sales offers, EUR/sq.m |

Annual change |

|

Lisbon |

5995 |

+4.84% |

|

Porto |

3885 |

+4.86% |

|

Vila Nova de Gaia |

2820 |

+0.89% |

|

Braga |

2149 |

+8.81% |

|

Coimbra |

2256 |

+7.79% |

|

Funchal |

3861 |

+9.01% |

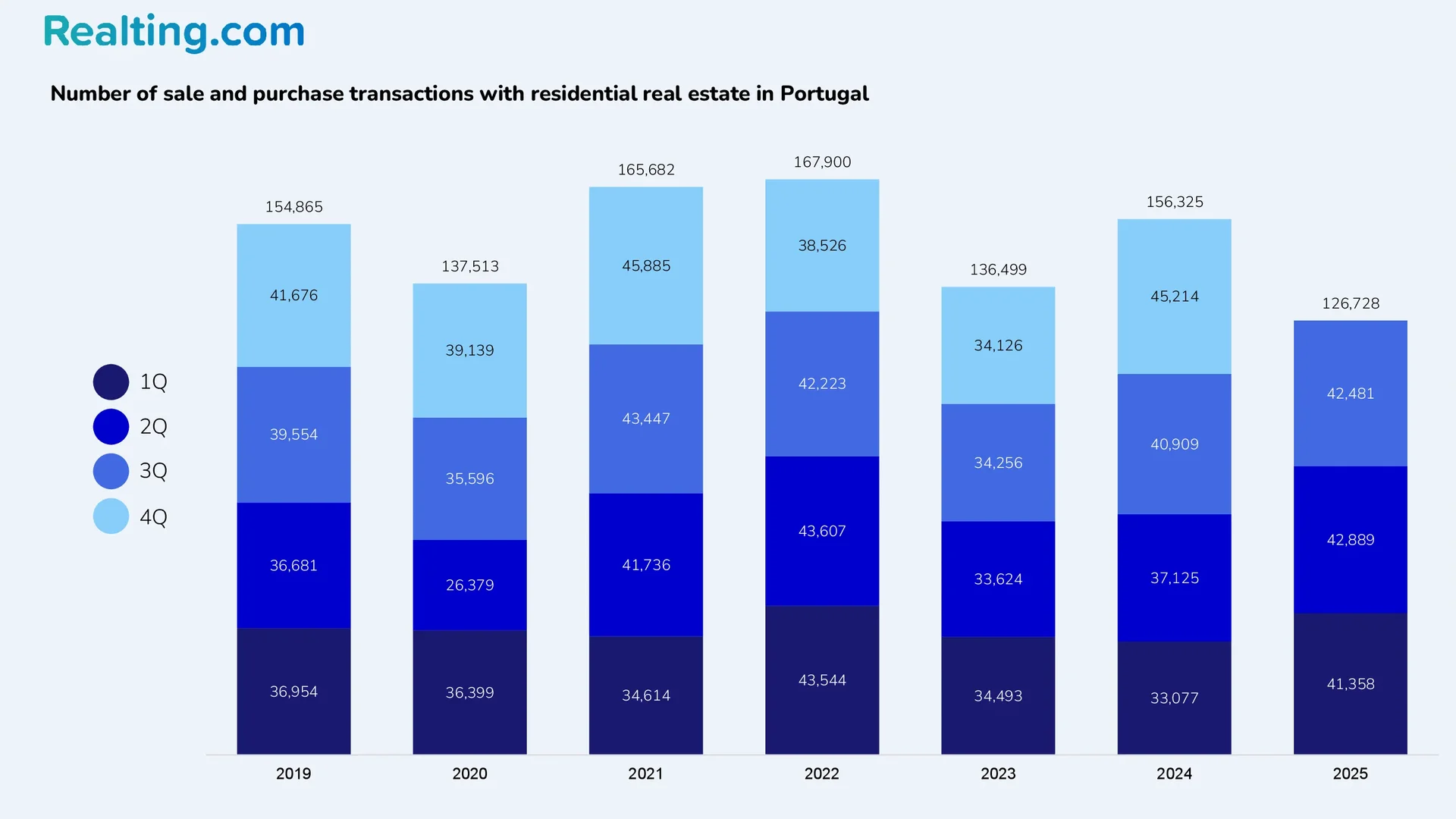

The fundamental reason for the noticeable rise in housing prices in Portugal is the high market activity, as evidenced by the number of transactions. According to the most recent data from Portugal’s National Institute of Statistics as of February 2026, in Q3 2025, 42,481 residential property purchase and sale transactions were completed in the country. This represents a 0.95% decrease compared to the previous quarter and a 3.84% increase compared to Q3 2024. In total, from the first to the third quarter of 2025, 126,728 transactions were recorded, which is 14.06% more than in the same period of 2024.

Data for the last quarter of 2025 have not yet been published, but it can already be stated that the total number of housing transactions in 2025 will not only exceed the 2024 figures but also surpass the record result of 2022, which was 167,900 transactions. For reference, from the first to the third quarter of 2022, 129,374 transactions were completed, which is only 2.09% more than in the same period of 2025.

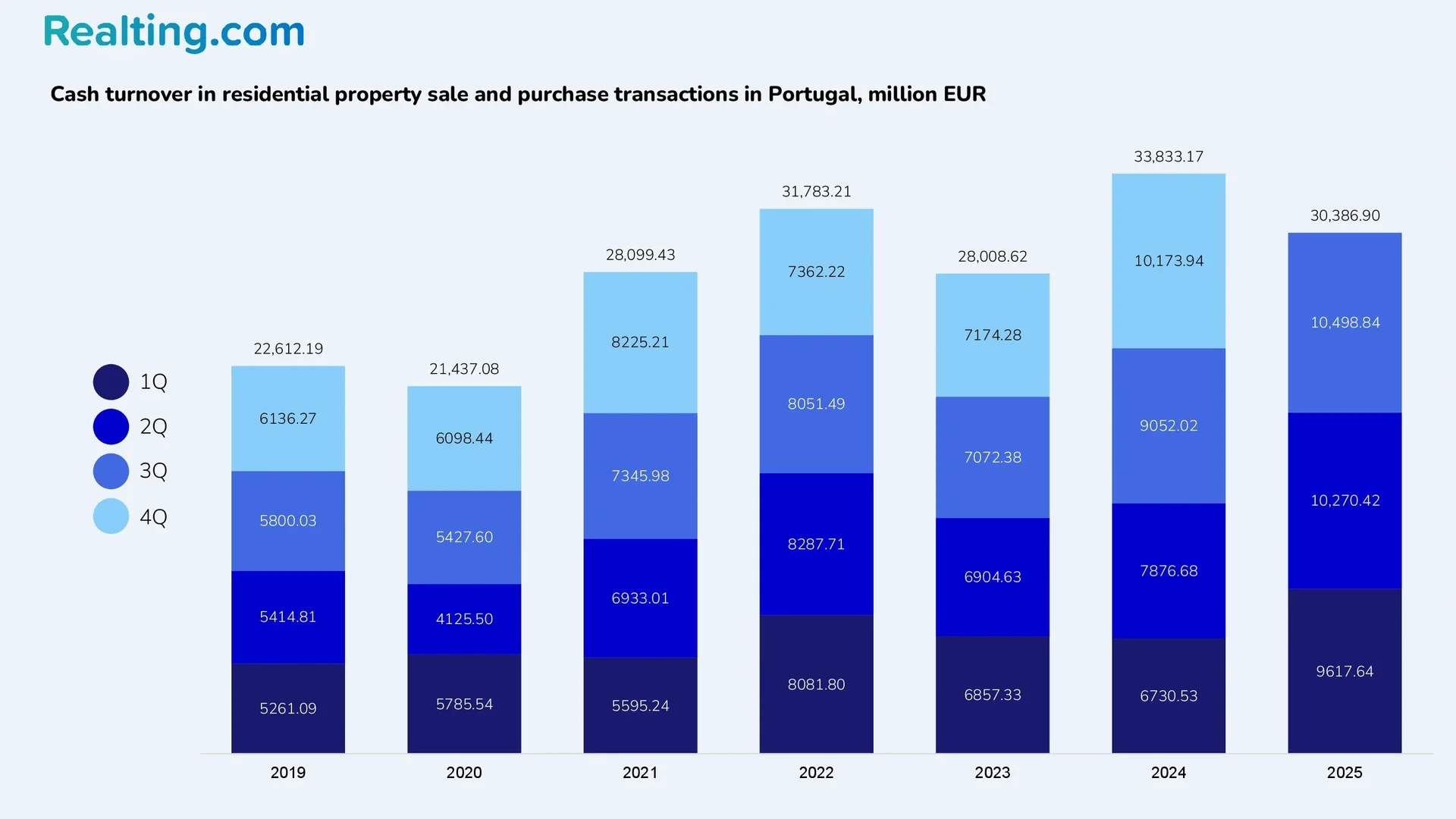

The cash turnover in dwelling transactions in Q3 2025 amounted to 10,498.84 million EUR, which is 2.22% higher than in Q2 2025 and 15.98% higher than in the same period of 2024. The total cash turnover for the first three quarters of 2025 reached 30,386.90 million EUR (almost 30.39 billion EUR), representing a 28.44% increase compared to the first three quarters of 2024.

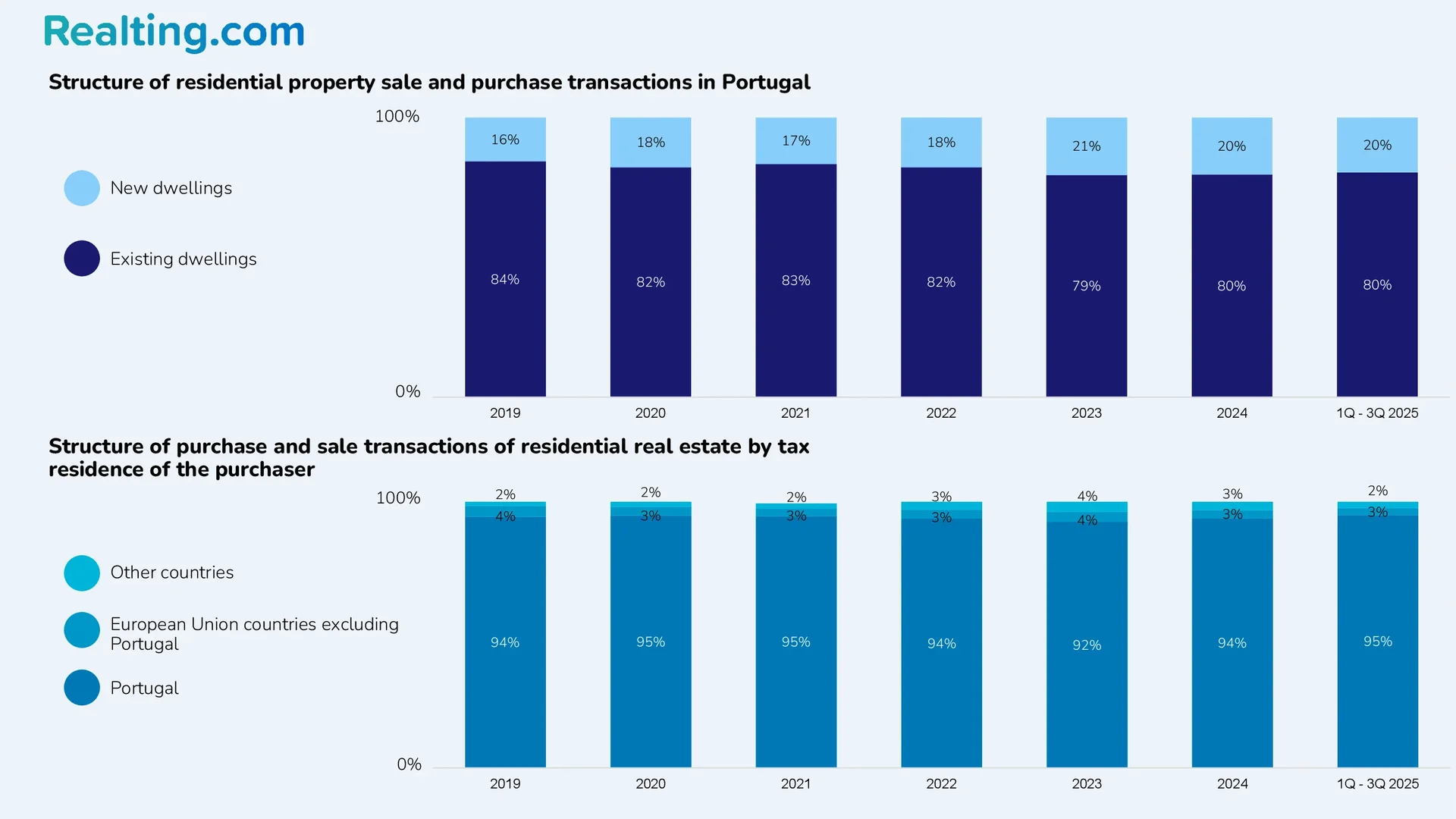

The share of new housing in purchase and sale transactions in 2024 was 20%. During the period from the first to the third quarter of 2025, the share of new housing remained at the same level.

The share of transactions involving new housing varies significantly depending on the region of Portugal. Below is a table showing the number of transactions with new and secondary housing by region of the country for Q3 2025.

|

Region |

Total number of transactions (share) |

Number of new housing transactions (share) |

Number of transactions with existing housing (share) |

|

Norte |

12,542 (100%) |

3021 (24.1%) |

9521(75.9%) |

|

Centro |

7152 (100%) |

1430 (20%) |

5722 (80%) |

|

Oeste e Vale do Tejo |

4073 (100%) |

789 (19.4%) |

3284 (80.6%) |

|

Grande Lisboa |

7759 (100%) |

1190 (15.3%) |

6569 (84.7%) |

|

Península de Setúbal |

4190 (100%) |

687 (16.4%) |

3503 (83.6%) |

|

Alentejo |

2333 (100%) |

282 (12.1%) |

2051 (87.9%) |

|

Algarve |

2983 (100%) |

613 (20.5%) |

2370 (79.5%) |

|

Região Autónoma dos Açores |

697 (100%) |

124 (17.8%) |

573 (82.2%) |

|

Região Autónoma da Madeira |

752 (100%) |

137 (18.2%) |

615 (81.6%) |

Approximately 95% of all housing transactions from the first to the third quarter of 2025 were carried out by tax residents of Portugal. Another 3% of transactions were made by residents of other EU countries (excluding Portugal), while the remaining 2% were by citizens of other countries. Overall, the share of domestic buyer activity has remained stable at 94–95% from period to period, with the only exception being 2022, when this share dropped to 92%.

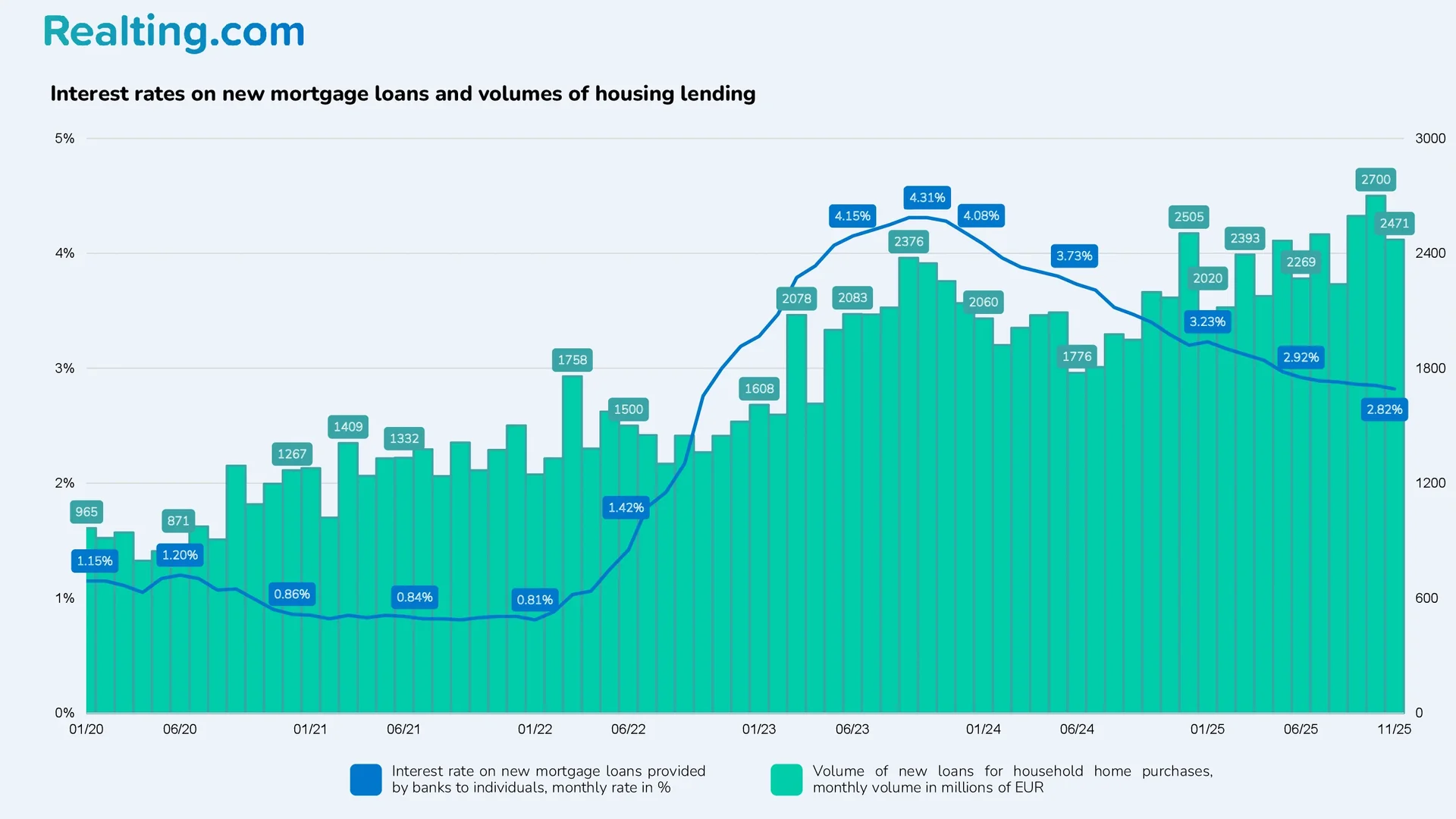

A notable factor driving high market activity is bank lending. After mortgage rates peaked in the second half of 2023, they began to decline. Over the past two years, a downward trend in interest rates has been observed on the market. In December 2025, according to data from the Bank of Portugal’s Statistical Portal (BPstat), interest rates on new mortgage loans settled at 2.84%. The reduction in rates has increased the predictability of borrowing conditions for potential buyers, thereby encouraging them to turn to borrowed funds more frequently.

The growing interest in lending is confirmed by the latest data from the European Central Bank (ECB). In Portugal, from January to November 2025, households were granted housing purchase loans totaling 25.95 billion EUR, which is almost 4 billion EUR more than in the same period of the previous year.

Summary

2025 was a year of sustained price growth and exceptionally high buyer activity for Portugal's housing market. The key drivers of price increases included strong demand from domestic buyers, rising real household incomes, active lending amid falling interest rates, government support, and the persistent shortage of new housing construction. It is expected that in 2026, Portugal's housing market will retain its investment appeal and continue to grow, though the pace of growth is likely to slow.