Investing in New Buildings in Cambodia with a Return of 8–13%

Cambodia is rapidly becoming one of the most attractive real estate markets in Southeast Asia. Steady annual GDP growth of 7% and liberal legislation make the country a magnet for investors from abroad. In this article, we will talk about current trends in the Cambodian new-build market, the main cities for investment, and also analyze a promising project in Sihanoukville.

What is the Cambodian Real Estate Market Like at the Moment?

The Cambodian real estate market is booming, especially in the new-build segment. Over the past 10 years, the country has made impressive progress: economic growth, infrastructure development, and an influx of foreign tourists.

The country’s GDP has been growing by 7% annually for 10 years, which creates a favorable environment for real estate investments. The demographic factor plays a special role — the average age of the population is only 25 years old, which makes Cambodia one of the youngest nations in the world.

This demographic feature guarantees a stable demand for housing in the long term, so investors will have the opportunity to both sell and rent real estate. Moreover, investors have the opportunity to 100% own apartments in condominiums.

Which Cities are Promising in Terms of Real Estate Investments?

Phnom Penh is the capital of Cambodia and its economic center. Residential complexes and commercial real estate are actively developing here. The average cost per square meter in new buildings varies:

- Budget segment: $1200—$1500.

- Mid-range segment: $2100—$2500.

- Premium class: $3000—$3500.

Phnom Penh is attracting investors with plans to build a metro and the new Techo International Airport opening in 2025. This will likely push prices up by 10-15% in the coming years.

Sihanoukville is a coastal city that is turning into a world-class resort. Average price per square metre:

- Budget segment: $1700.

- Mid-range segment: $2200.

- Premium class: $3500.

Sihanoukville is ideal for investment in tourist real estate, especially apartments for short-term rentals, with yields of 8-11% per annum.

Siem Reap is located near Angkor Wat, with land prices starting from $50 per sq. m.

Kep and Kampot are promising areas with rental yields of about 7.88%.

Chroy Changvar is a developing area of Phnom Penh with yields of 6.82%.

What Types of Real Estate are in Demand in Cambodia

The most popular properties in the Cambodian market are:

- Condominiums are especially popular among foreign investors and young professionals. This segment provides the easiest transactions for foreigners.

- Houses with plots (Borey) are preferable for families, especially in suburban areas. However, this segment has certain limitations for foreign investors.

- Commercial real estate — offices, cafes, and retail space in strategic locations, show stable demand and good profitability.

What Foreign Investors Need to Know

Foreigners can purchase apartments in condominiums without restrictions, receiving full ownership (Hard Title). This is a fundamental difference from many other countries in the region, where foreigners only receive the right to long-term lease.

Land acquisition is directly limited but is possible through a long-term lease of up to 99 years or the creation of a local company.

Taxes

Property taxation in Cambodia remains quite lenient:

- Stamp duty is 4% of the property value.

- Certain properties are exempt until the end of 2025.

- Capital gains tax has been introduced but its application has been deferred until the end of 2025.

- There are no additional taxes on the transfer of rights.

Mortgages and alternative lending

Local banks provide mortgage loans, but the terms may be less attractive than in developed markets. Developer programs serve as an alternative. For example, large developers offer loans at 10% per annum after the completion of the property, with a down payment of 20% and interest-free installments until construction is completed.

Return on Investment and Market Development Prospects

The rental profitability analysis shows attractive indicators:

- Phnom Penh: 6.96% per annum.

- Sihanoukville: 8-11% per annum.

- Kep and Kampot: 7.88% per annum.

- Chroy Changvar: 6.82% per annum.

Of course, the yield will vary depending on the type of property, location, and quality of property management.

Experts predict a moderate increase in property prices in the next 5-10 years. Areas with active infrastructure development, such as Kandal and southern Phnom Penh, are considered particularly promising.

The opening of the new Techo International Airport in 2025 should give a significant boost to development, improving transport accessibility and attracting additional investment.

Case Study: Pre-Sale of Time Square 10 in Sihanoukville

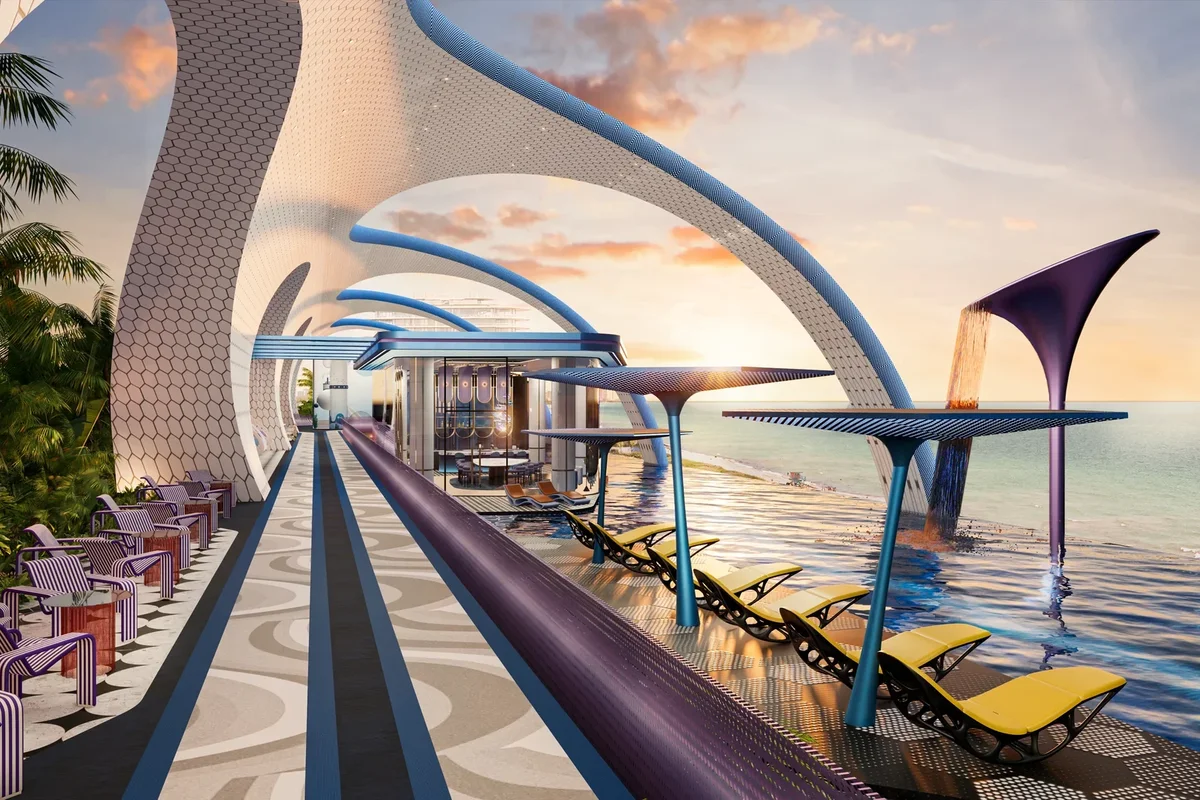

Time Square 10 is a large-scale resort complex from a trusted Cambodian developer, Megakim World Corp. The project consists of three 39-story towers with a total of about 1,000 apartments, located 3 minutes from Otres Beach in Sihanoukville.

Time Square 10 offers a developed infrastructure:

- Infinity pool on the roof (39th floor).

- Sky bar and restaurant.

- Beach club.

- Fitness center and yoga studio.

- Children’s play area.

- SPA center.

- 24-hour reception.

The project boasts proximity to the sea, a new port, a casino, and an international airport.

All apartments are rented with a clean finish, including an equipped kitchen and bathrooms. A design package with furniture and appliances is available for an additional $3,000–6,000.

The management company takes on the full cycle of leasing and maintenance for a 10% commission.

Layouts and Pricing Policy

The project includes three towers: Ocean Diamond, Ocean Gold and Ocean Crystal, 39 floors, 1000 units.

Ocean Diamond (the tower closest to the sea):

- 1 Bedroom Apartments (40-53 sq. m.): from $41,391.

Ocean Gold (central tower):

- 1-Bedroom Apartments (50 sq. m.): from $56,721.

- 2-Bedroom Apartments (73-90 sq. m.): from $81,290.

- 3-Bedroom Apartments (113 sq. m.): from $125,630.

Ocean Crystal (distant tower overlooking the sea):

- 2-Bedroom Apartments (100 sq. m.): from $113,325.

- 3-Bedroom Apartments (140 sq. m.): from $158,655.

- 4-Bedroom Apartments (205-215 sq. m.): from $254,820.

All apartments are rented out fully finished, including kitchens and bathrooms. A design package with furniture and appliances can be purchased for $3,000—$6,000. This increases their attractiveness to tenants and reduces investor costs.

Purchase Conditions and Profitability Forecast

Flexible payment plan includes:

- Initial payment: 20%.

- Installment: 30% until completion of construction (2028).

- Remainder: 50% upon receipt of keys or on credit at 10% per annum.

Discounts of up to 10% are provided for early payment. It is possible to pay in cryptocurrency (USDT, BTC, ETH, BNB).

Expected return on short-term rental:

- 1 bedroom: from $8,000 net per year.

- 2 bedrooms: from $9,000-10,000 per year.

- ROI: 7.5-13% per annum, excluding growth in cost.

The potential for growth in the value of apartments before the completion of the project is estimated at 20–30%.

Risks and Measures to Minimize Them

The average construction period for new buildings in Cambodia is 2–4 years, but delays are possible due to weather conditions and administrative procedures.

Megakim World Corp minimizes these risks by the following:

- Construction using own funds without attracting loans.

- Cooperation with international architects and contractors.

- Experience in implementing 5 completed projects.

The following guarantees are provided to foreign investors:

- Direct contracts with the developer.

- Support from international lawyers.

- Registration in the Cambodian cadastre.

- Full ownership (strata-title).

If you are looking for high-yield assets and want to diversify your portfolio, the Cambodian real estate market is a great opportunity. However, before making any investment decisions, we recommend consulting with relevant experts.

Author

I am responsible for editorial work. I write expert interviews and guides.