Sustainability and stability. Expert calculated Country Risk Premium for Indonesia

The country risk premium shows market players how high the risks of acquiring real estate in a given country are in the current situation. According to the latest data, in Indonesia, these indicators are at a steady low level. Read more in the article.

World Bank upgrades Indonesia to the «upper-middle-income countries» status

The Republic of Indonesia due to its unique geographical location and climatic conditions is of great interest for foreigners for short and long term residence, including buying real estate. It is located near the equator on the islands between the Pacific and Indian Oceans.

Indonesia, together with Turkey, South Korea, Mexico and others, is among the most economically promising developing countries, the so-called "group of eleven". Over the past 15 years, international tourism has grown steadily, primarily due to visitors from the nearest countries: Singapore, Malaysia, Australia, China and Japan.

Indonesia’s gross national income per capita has increased significantly over the past year. In this regard, the World Bank recently decided to upgrade Indonesia to the status of a «upper-middle-income-country». Sustainable work of dozens of companies-developers, developing residential and office real estate in various urban and resort areas of the country.

Indonesia Country Risk Premium

One indicator of a country’s investment attractiveness is the country risk premium (CRP), usually calculated on the basis of the yield of government securities on the world markets. The Government of the Republic of Indonesia issues a wide range (over 40) of long-term government bonds denominated in United States dollars. In addition, issued government bonds in euros and Indonesian rupees. These securities are successfully quoted on all stock exchanges.

Since the purpose of the study is to assess the investment attractiveness of the country from the point of view of real estate, the most long-lived securities were chosen for the calculations, so that their life span was comparable to the economic life of real estate.

The calculations were based on Indonesian government bonds maturing in March 2071, April 2070, September 2061, September 2052, March 2052, March 2051, October 2050, and February 2050, which are denominated in US dollars. The yield during the last year was about the same, so the longest-lived bond maturing in March 2071 was chosen for accurate calculations. It is rated BBB by Fitch.

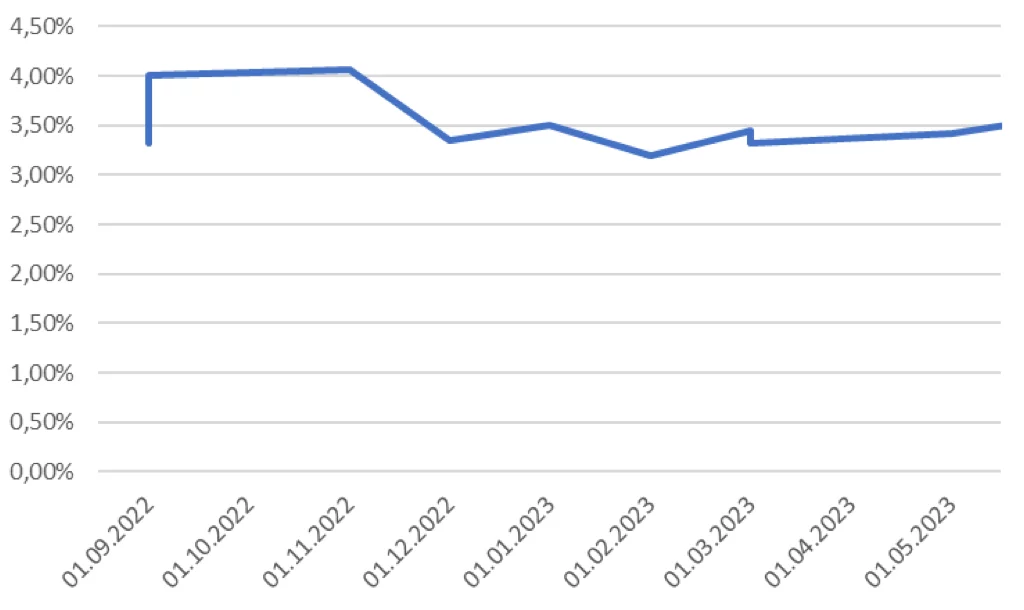

The country risk values of Indonesia for the last year are shown in the graph below. The values obtained are consistently low, about 3.5%. As at 31 August 2023 for Indonesia:

CRP = 3,39%.

This is a low level of country risk, with little likelihood of real estate loss (total or partial) as a result of general economic, financial and socio-political factors, present in this country regardless of the property.

Author

Prof. Nikolai Trifonov is the Fellow of Royal Institution of Chartered Surveyors, the Full Member of the International Academy of Engineering, the Foreign Member of the Russian Academy of Engineering, the Honorary Appraiser of the Republic of Kazakhstan, teaches real estate appraisal at the Belarusian State Economic University, the author of manuals "The Valuation Theory" and "Comprehensive Real Estate Valuation". In 1994, he founded the Belarusian Real Estate Guild, which united the largest private and state participants in the real estate market and privatization. In 1996, Nikolai created and headed the public association "Belarusian Society of Valuers", which is a member of International Valuation Standards Council (IVSC). In the period 1998-2005 Nikolai was elected and reelected as Board Member of European Real Estate Society (ERES), Director at Large – Responsible for Central & Eastern Europe.