How is the Canadian Real Estate Market Doing in 2024?

The Canadian real estate market has undergone significant changes since 2020. From record sales in 2020-21 to slower activity in 2022-23. In 2024, the market shows signs of recovery but remains in a holding pattern. In this analysis, we will look at the current state of the market, home prices in major cities, rental market trends, and the impact of immigration on the Canadian housing sector.

Retrospective: Canadian Real Estate Market 2020–2023

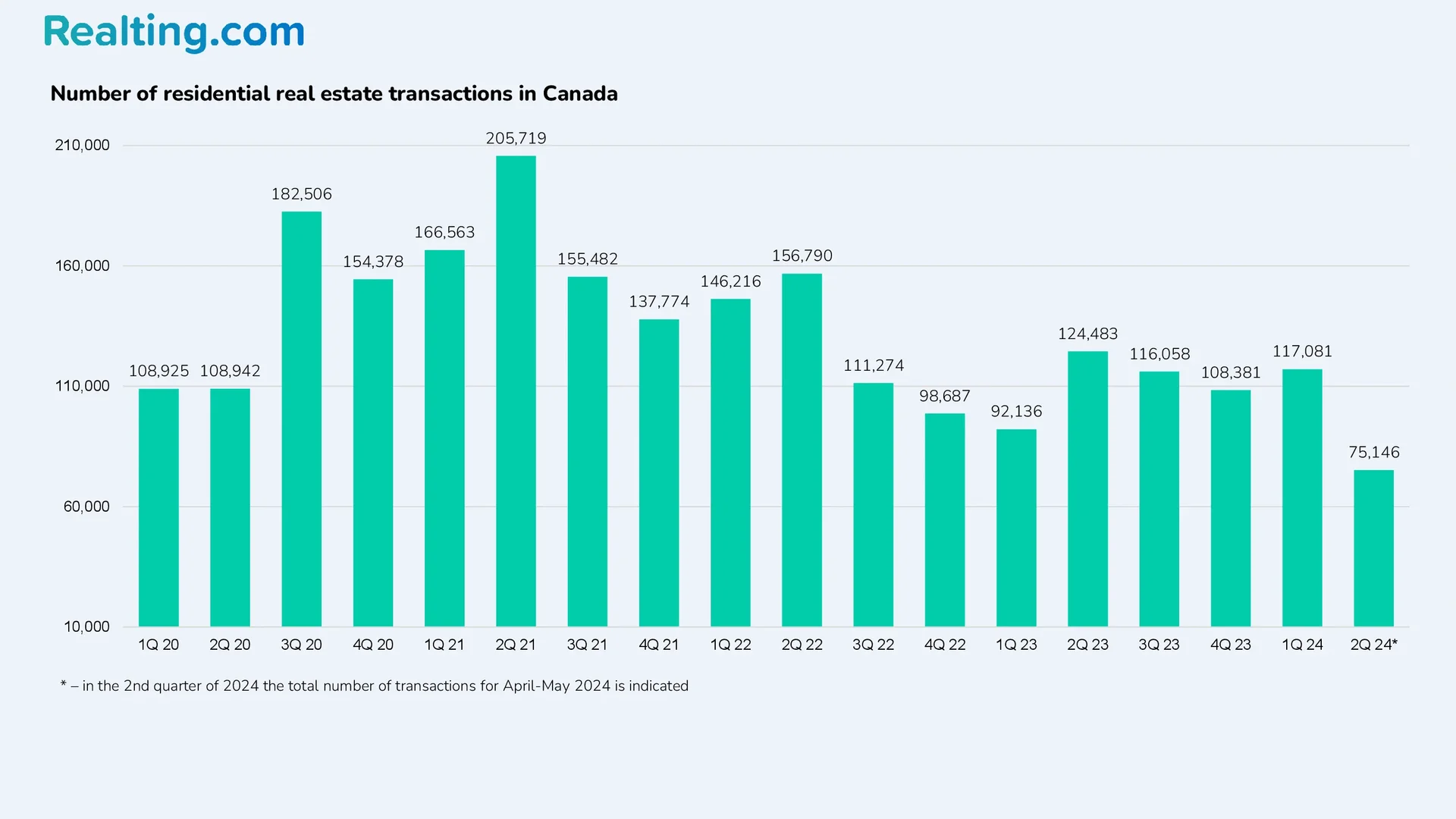

In 2020, the Canadian real estate market set a record for the number of purchase and sale transactions with residential real estate, and in 2021, it broke it. In 2020, more than 550 thousand transactions with residential real estate were completed in the Canadian housing market (14–15 transactions per thousand inhabitants), and by the end of 2021, almost 665,538 housing transactions were registered in the country (in terms of one thousand inhabitants, this is 17–18 transactions).

There were several reasons for the record market performance, but the main one was the decline in interest rates. In March 2020, the Central Bank of Canada lowered the interest rate three times in a row: if at the beginning of March it was 1.75%, then at the end it was already 0.25%, and this was a historical minimum. Such drastic measures by the bank were aimed at overcoming the economic consequences due to the COVID-19 pandemic that began in December 2019, as well as a sharp drop in world oil prices (and Canada’s economic well-being is largely dependent on energy exports).

Record low interest rates caused an unprecedented boom in the real estate market — loans became much more accessible, which led to an increase in investment in the real estate market and an increase in purchasing activity. And high demand stimulated supply in the market.

However, as the pandemic came to an end, inflation began to rise in Canada, and the economic fallout from the pandemic gained momentum. Inflation reached its peak in the summer of 2022 and amounted to 8.1%. In order to keep it at an acceptable level, the Central Bank of Canada began to increase the interest rate. Over a short period — from March 2022 to July 2023 — the Central Bank increased the interest rate to 5%. This is the highest value since 2001.

The reaction of the real estate market was as follows: a decrease in activity and, consequently, a decrease in the flow of investments into the residential real estate market, as well as a drop in construction volumes. At the end of 2023, activity in the Canadian residential real estate market amounted to 11 transactions per thousand people.

Current Situation: Canadian Housing Market in 2024

Based on the results of the first half of 2024, we can say that there have been positive developments in the Canadian real estate market, but the market itself can be characterized by the phrase “in standby mode.” It is worth adding that at the beginning of June, the Central Bank of Canada reduced the interest rate from 5% to 4.75% — what impact this will have on the Canadian real estate market and whether rates will be reduced further will become known only at the end of the 3rd and 4th quarters.

According to the WOWA.CA portal, in the first 5 months of 2024, 192,227 transactions were completed in the Canadian housing market, which is 9.1% more than in the first 5 months of 2023. On a quarterly basis, there were 117,081 residential real estate transactions in Canada in Q1 2024, up 8% from Q4 2023 and 27.1% from Q1 2023.

Review of Real Estate Prices by Province

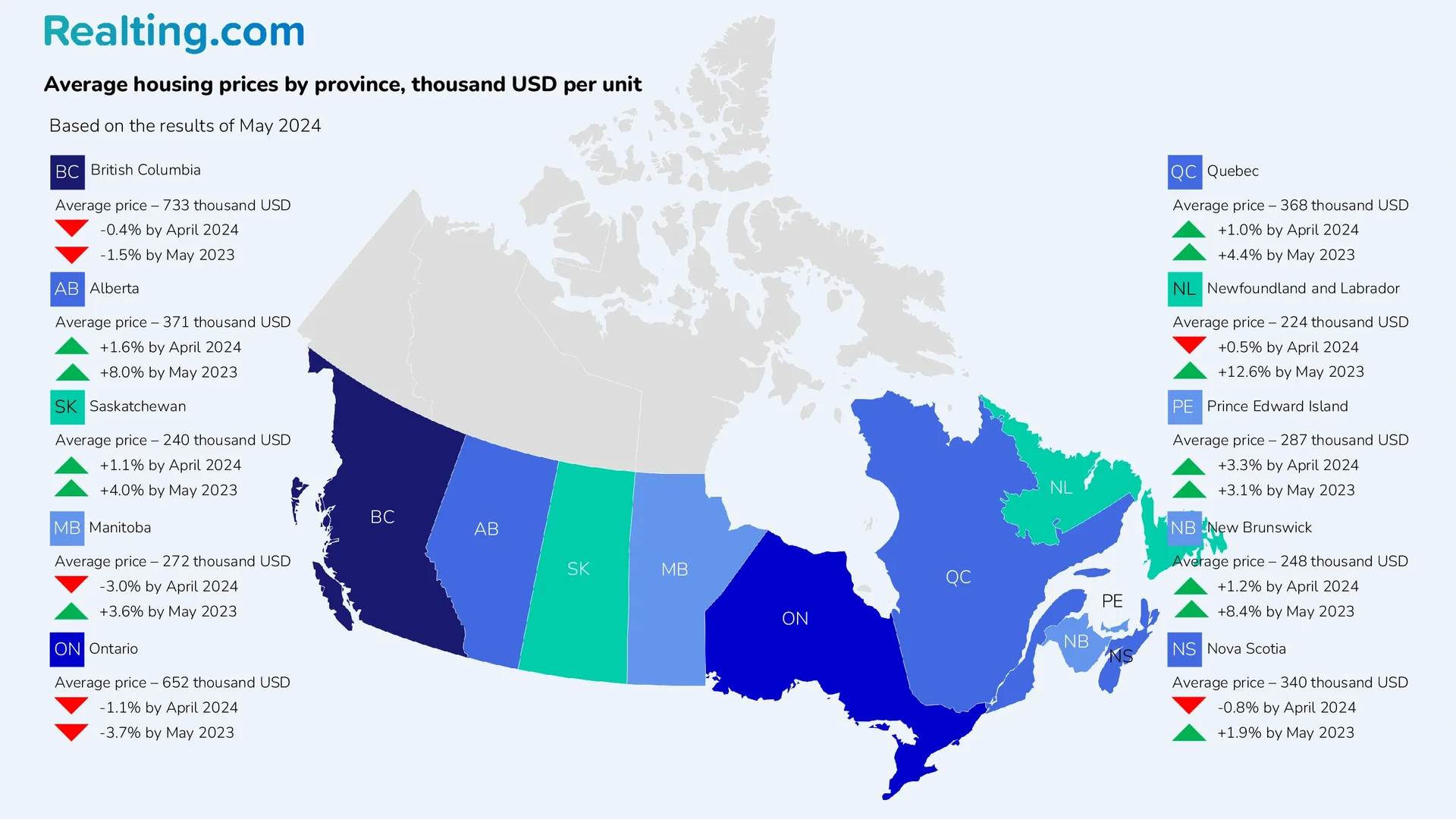

Let's look at current prices on the Canadian residential real estate market by province and 5 major cities. All prices will be shown in United States dollars (USD) per unit.

At the end of May 2024, average prices for purchasing housing increased in almost all provinces when compared with prices a year ago. Such conclusions can be drawn based on data published on the WOWA.CA portal. The greatest growth was noted in the provinces of Newfoundland and Labrador (+12.6%), New Brunswick (+8.4%), and Alberta (+8.0%). In the provinces of British Columbia and Ontario, prices decreased by 1.5% and 3.7%, respectively.

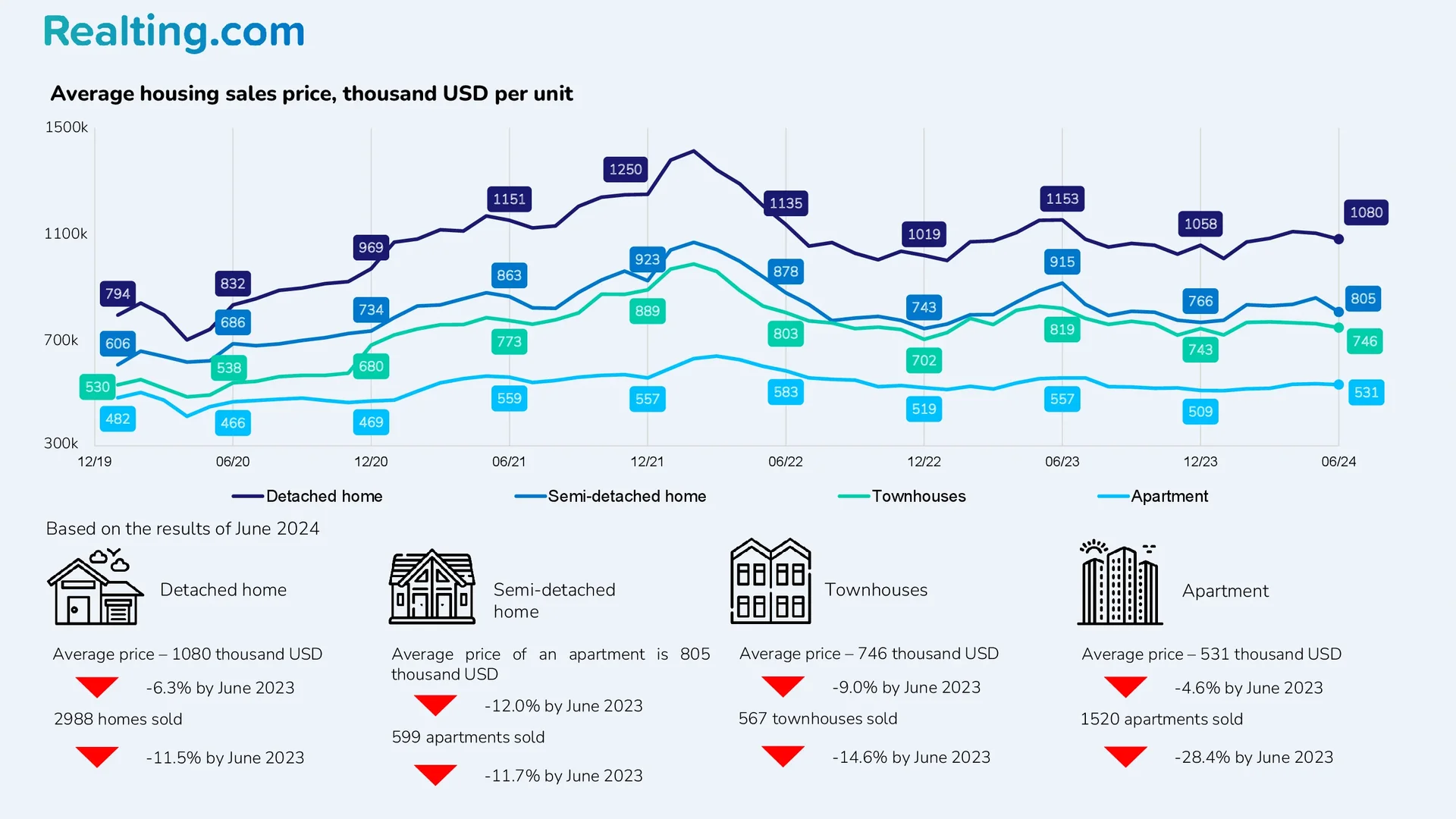

Before moving directly to the cost of housing in cities, we will outline the types of residential real estate that can be purchased in Canada.

The WOWA.CA portal distinguishes 5 types of residential real estate:

- Detached house (house for one family) is a detached residential building intended for single-family residence. Legally, such a house is a single residential unit.

- Semi-detached house (two-apartment house) is a residential-detached house, which consists of two apartments separated by a common wall. Each apartment in such a house has its own entrance and local area. The market analysis will indicate the cost of an apartment in such a building.

- Townhouses are complexes of low-rise residential buildings with several apartments, the houses are interconnected by a common wall. Each apartment in townhouses has its own separate entrance, as well as a local area. The market analysis will indicate the price of a townhouse apartment.

- Condo apartments are apartments in condominiums. These are residential complexes with common areas such as corridors, parking lots, stairwells, elevators, and so on. Different residential complexes may have different common areas: for example, modern residential complexes may include gyms, bicycle storage areas, and a landscaped local area with various activities.

- Plexes are multi-story buildings with several separate blocks, usually one for each floor. Entry to each block is usually accessible through an external entrance, and the upper floors are connected by staircases. The market analysis indicates the cost of an apartment block in such a building.

Toronto

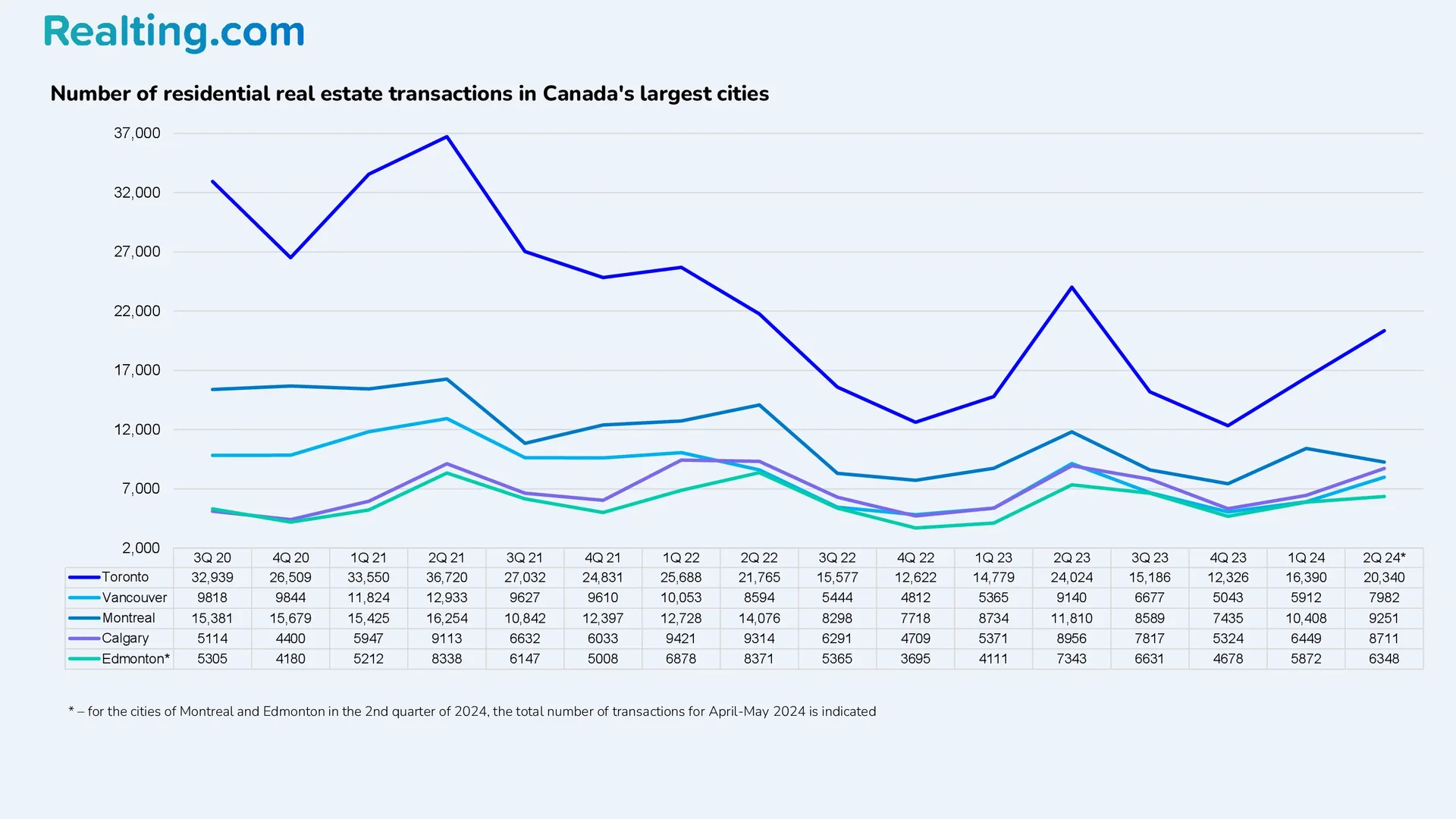

At the end of June 2024, according to WOWA.CA, 6213 residential real estate purchase and sale transactions were completed in the Toronto real estate market — this is 11.4% less than in the previous month and 16.9% less than in June last year.

Thus, in June 2024, 17,964 new listings were put up for sale, and the monthly ratio of sold properties to new listings was 35% (last month it was 38%). This downward movement indicates that demand is growing more slowly than the supply of available homes for sale on the market. If the ratio of sold properties to new offers in a market is below 40%, then such a market is a buyer's market.

Market structure

| Housing type | Sales and purchase transactions | Sales offers |

|---|---|---|

| Detached house | 53% | 48% |

| Semi-detached house | 10% | 8% |

| Townhouse | 10% | 10% |

| Apartments | 27% | 33% |

Montreal

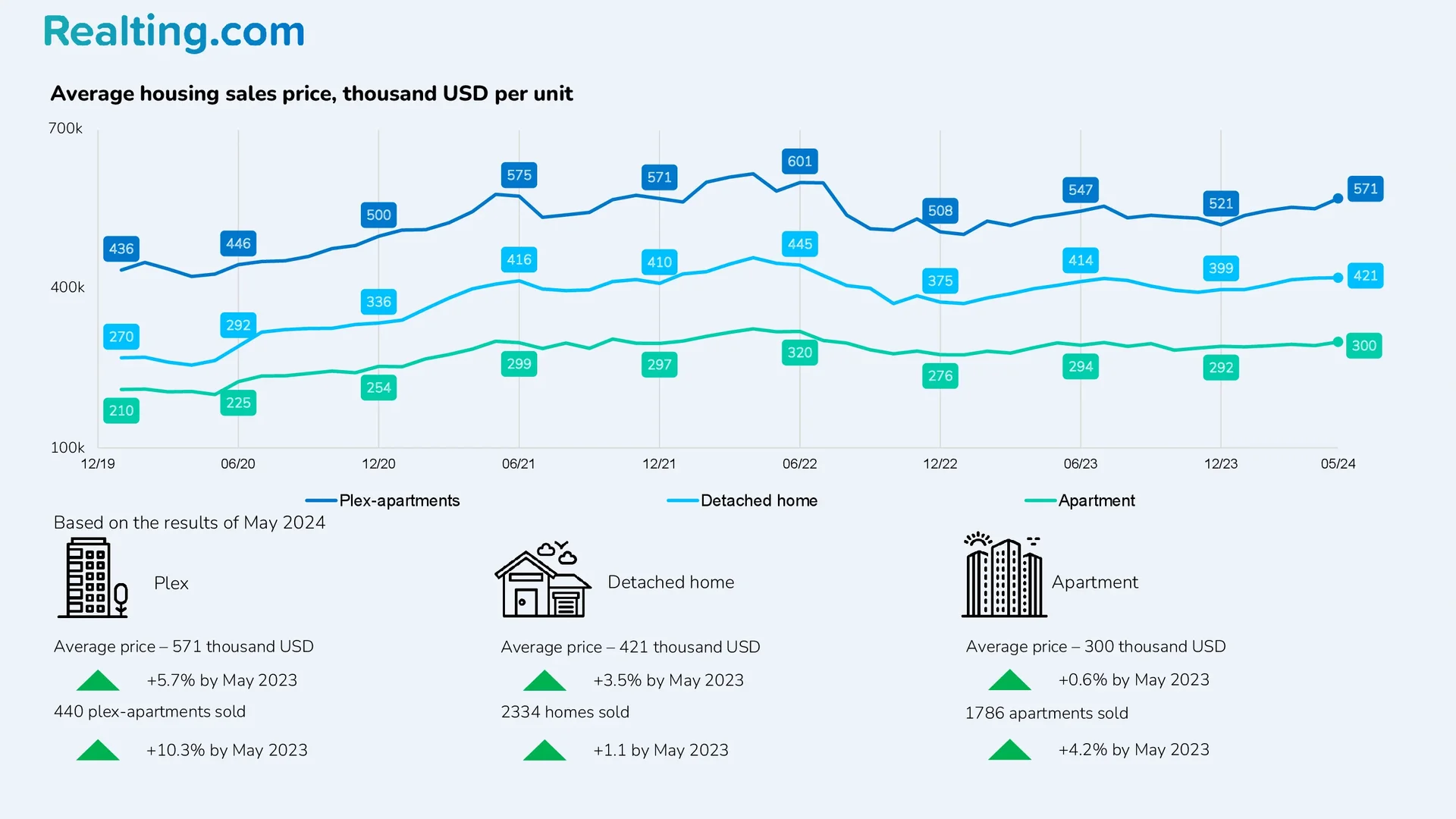

At the end of May 2024, 4563 residential real estate transactions were registered in Montreal, which is 2.7% less than in April of this year and 3% more than in May 2023.

There were 7005 new residential real estate listings in the Montreal market in May. The monthly ratio of sold properties to new offers was 65%. If the monthly ratio of sold properties to new offers is more than 60%, then the market can be called a sellers' market.

Market structure

| Housing type | Sales and purchase transactions |

|---|---|

| Detached houses | 51% |

| Apartments | 39% |

| Plexes | 10% |

Calgary

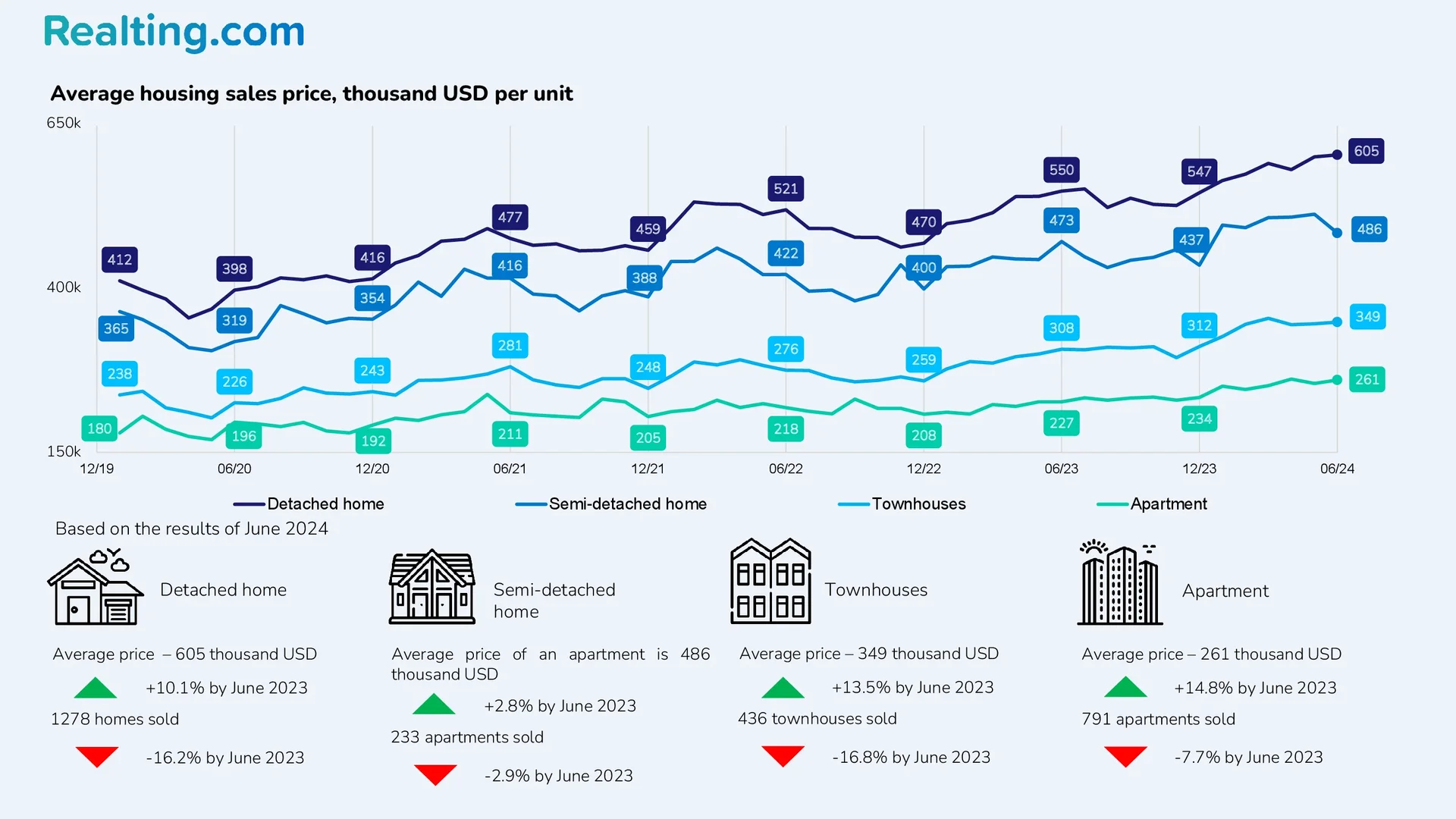

At the end of June 2024, 2,738 sales transactions were completed in the Calgary residential real estate market, which is 11.4% less than the previous month and 13.0% less than in June last year.

In June of this year, there were 3,798 new residential property listings in Calgary. The monthly ratio of sold properties to new offers was 72%, which characterizes the market as a seller's market.

Market structure

| Housing type | Sales and purchase transactions | Sales offers |

|---|---|---|

| Detached houses | 48% | 47% |

| Semi-detached houses | 8% | 8% |

| Townhouses | 15% | 16% |

| КвApartments | 29% | 29% |

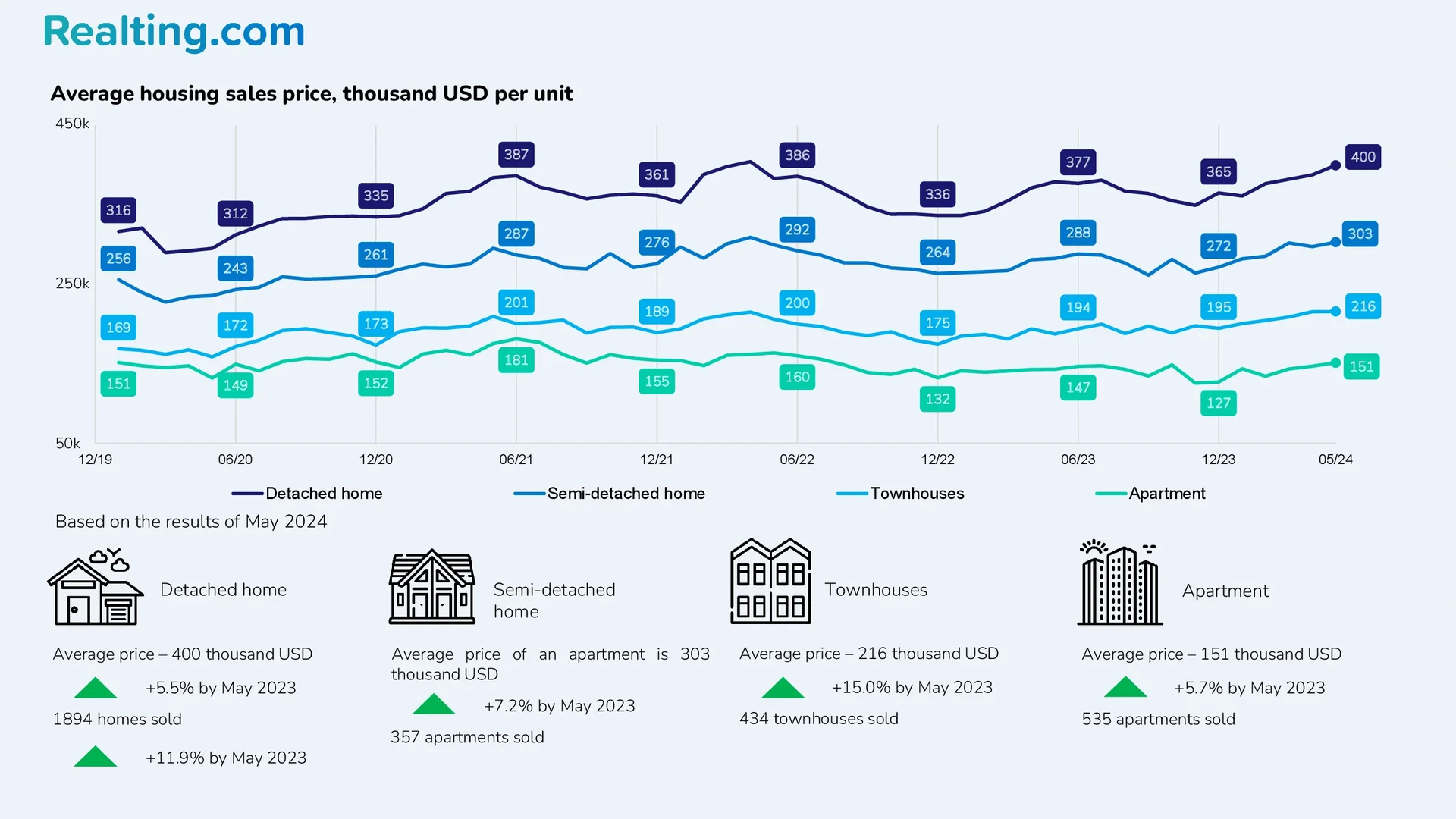

Edmonton

In May, 3,220 residential properties were sold in Edmonton, up 2.9% from April of this year and 18.4% more than last May. The monthly ratio of properties sold to new listings was 74% in May, indicating that the Montreal residential real estate market is a seller's market.

Market structure

| Housing type | Sales and purchase transactions |

| Detached houses | 59% |

| Semi-detached houses | 11% |

| Townhouses | 13% |

| Apartments | 17% |

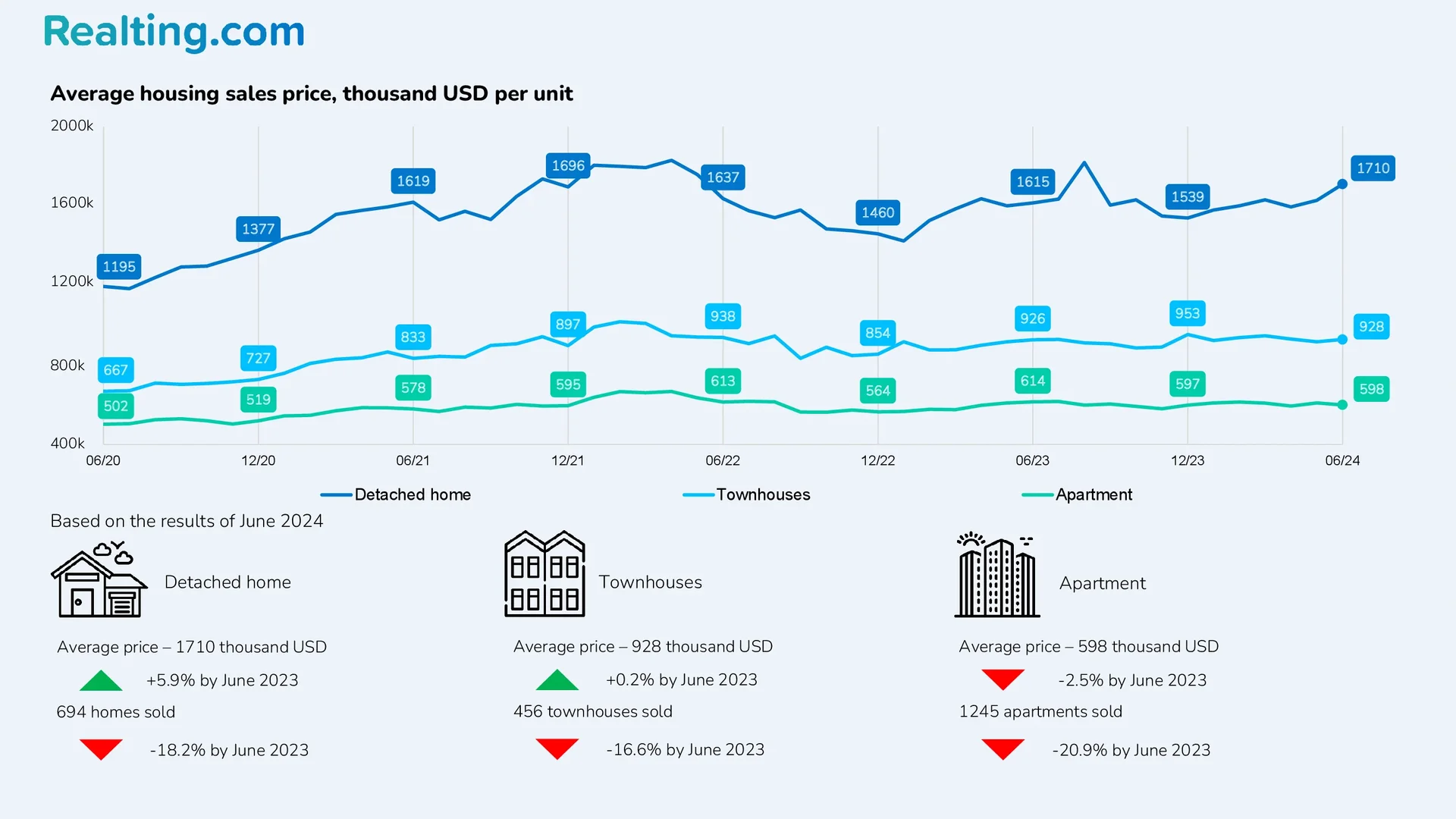

Vancouver

In June, 2418 residential real estate purchase and sale transactions were completed in Vancouver, which is 11.5% less than in May of this year and 19.1% less than in June last year.

The number of new home sales listings in June was 5723, and the monthly ratio of properties sold to new listings in June was 42%. This characterizes the Vancouver residential real estate market as a balanced market.

Market structure

| Housing type | Sales and purchase transactions |

|---|---|

| Detached houses | 29% |

| Semi-detached houses | 19% |

| Apartments | 52% |

Canadian Rental Market: Trends and Prices

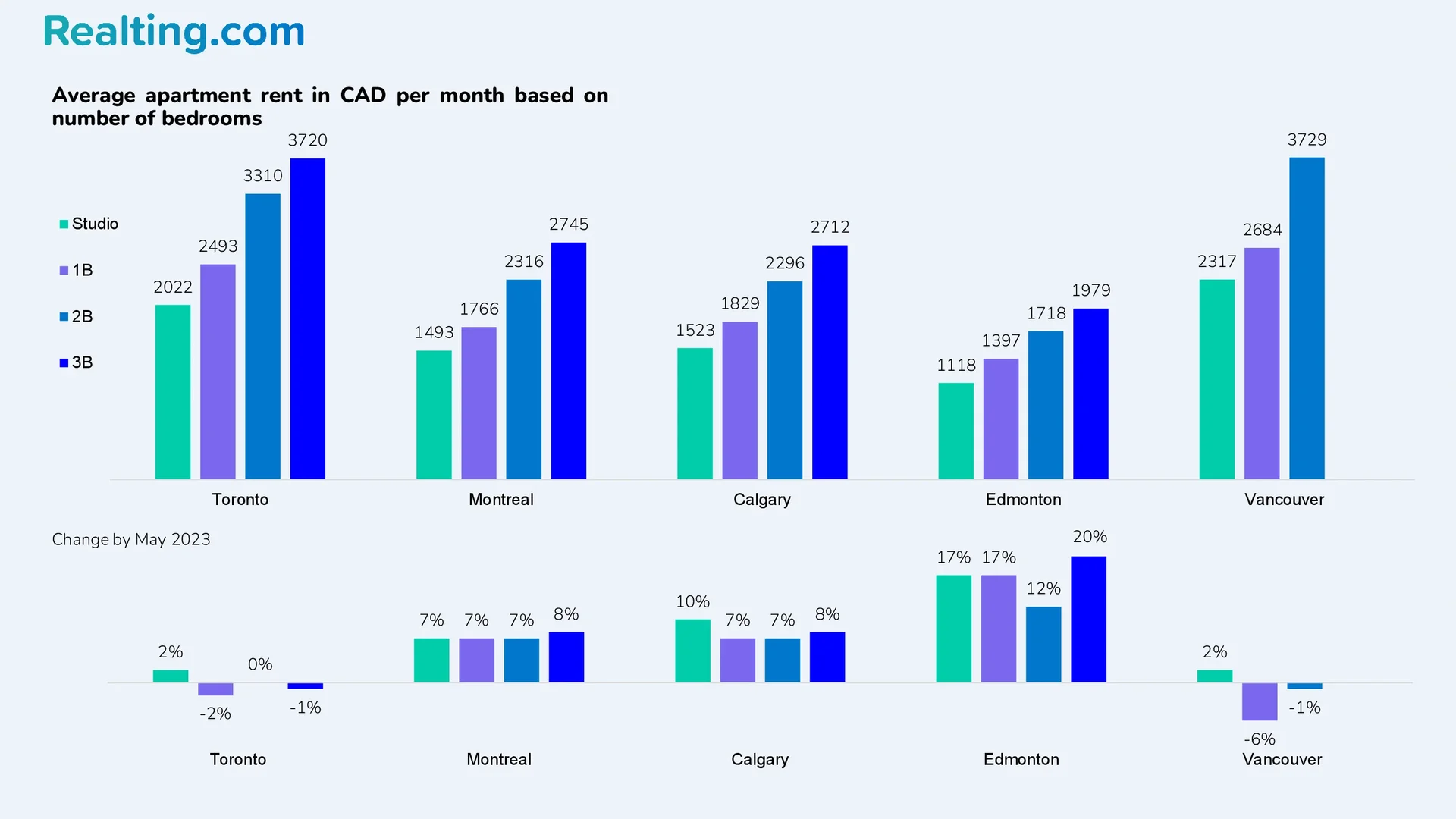

Let’s take a closer look at the current rental price in Canada in May 2024 based on the same 5 cities in which purchase prices were considered.

Data on the rental price were taken from the RENTALS.CA portal. Rents and rent changes are presented in Canadian dollars (CAD). According to the Central Bank of Canada, in May 2024, 1 Canadian dollar was equal to 0.7315 US dollars.

The rent is presented per apartment in CAD, depending on the number of bedrooms:

- 1B – apartment with 1 bedroom.

- 2B – apartment with 2 bedrooms.

- 3B – apartment with 3 bedrooms.

Immigration and Its Impact on the Canadian Real Estate Market

Statistics Canada reported that as of January 1, 2024, Canada's population reached 40,769,890 residents, an increase of 1.27 million from January 1, 2023. For comparison, it is worth saying that in 2020, Canada had a little over 38 million inhabitants. The statistics agency also said that this is the highest annual population growth (+3.2%) in Canada since 1957 (then +3.3%).

This high population growth was achieved through temporary immigration. Without temporary immigration, relying solely on permanent immigration and natural increases, Canada's population growth would be almost three times less (+1.2%), Statistics Canada reports.

Throughout 2023, almost all population growth was achieved through international migration (permanent and temporary): it amounted to 97.6%, and the remaining 2.4% was natural growth.

Immigration, Refugees and Citizenship Canada reports that in 2023, 471,711 permanent immigrants have chosen Canada as their new home. It was also reported that permanent immigration increased in all Canadian provinces and territories except Nova Scotia and Quebec.

In 2023, the population increased by an additional 804,901 people who were non-permanent residents of Canada. Most are temporary workers who supply the Canadian labor market; followed by foreign students. It is reported that 1 in 10 non-permanent residents is an asylum seeker.

Population estimates state that there were 2,661,784 non-residents living in Canada as of January 1, 2024, 88% of whom were Canadian Resident Permit holders and their dependents; the remaining 12% are asylum seekers with or without a work/study permit.

The rate of population growth is bound to impact the housing market. Thus, the Ministry of Immigration, Refugees and Citizenship of the country states that the rate of population growth in Canada, ensured by immigration, exceeds the growth in the number of affordable housing units.

This is particularly reflected in the rental housing market, with immigration playing an important role in driving demand for this market in Canada's major cities. Increased demand in conditions of limited supply inevitably leads to an increase in rental rates.

The impact of immigration is also noticeable on the home buying and selling market. In many Canadian cities, where the number of residents is growing every year due to new migrants, there is an increased demand for housing, which significantly exceeds supply.

It is also worth noting that now in Canada, the pace of construction and commissioning of new housing is lower than in previous periods, and it is expected that they will decline until the end of the year. The improvement of the situation in the construction sector is predicted only in the next 2 years. Increased demand and a possible shortage of new housing lead to rising prices, and high interest rates on loans only aggravate the current situation.

However, it is worth adding that immigration and increased demand for housing are attracting investment in Canadian real estate. Many foreigners consider Canada a safe place to invest their money, which is certainly true. However, when borrowing rates are high, the construction sector is constantly faced with bureaucratic delays, and the labor market faces labor shortages, this raises concerns about how quickly a given construction project will be implemented and how quickly the investments will begin to pay for themselves.

Canadians themselves react to increased immigration in different ways. Three in four Canadians say rising immigration is worsening the housing crisis and is also putting pressure on the health care system, according to a CBC News poll. Almost two-thirds of those surveyed believe that the influx of new migrants increases the burden on the education system.

About three-quarters of respondents agreed that rising immigration contributes to cultural diversity, and 63% of those surveyed said flows of young migrants are helping to shape the workforce and tax base.

It is worth saying that investment in residential real estate in Canada by foreigners is a rather limited income. Foreigners can invest in real estate, but buying homeownership is prohibited for them. The exception is for foreigners who are authorized to work in Canada, are students, are applying for refugee status, and meet certain criteria.