Falling demand, rising prices and mortgage rates in Lithuania. Analysis and trends of the Lithuanian real estate market. Analytics from REALTING

The Lithuanian housing market has shown smooth and stable growth for several years. But inflation policies have made adjustments: loans have become more expensive, demand has begun to decline. At the same time, the capital of Lithuania remains one of the most inaccessible locations for the purchase of an apartment, and the price gap between primary and secondary real estate in some cities reaches 2.5 times. REALTING learned how the housing and land market in Lithuania developed and what affects it in 2023.

Subsidies from the government for the development of agricultural activities. How does this affect the real estate market?

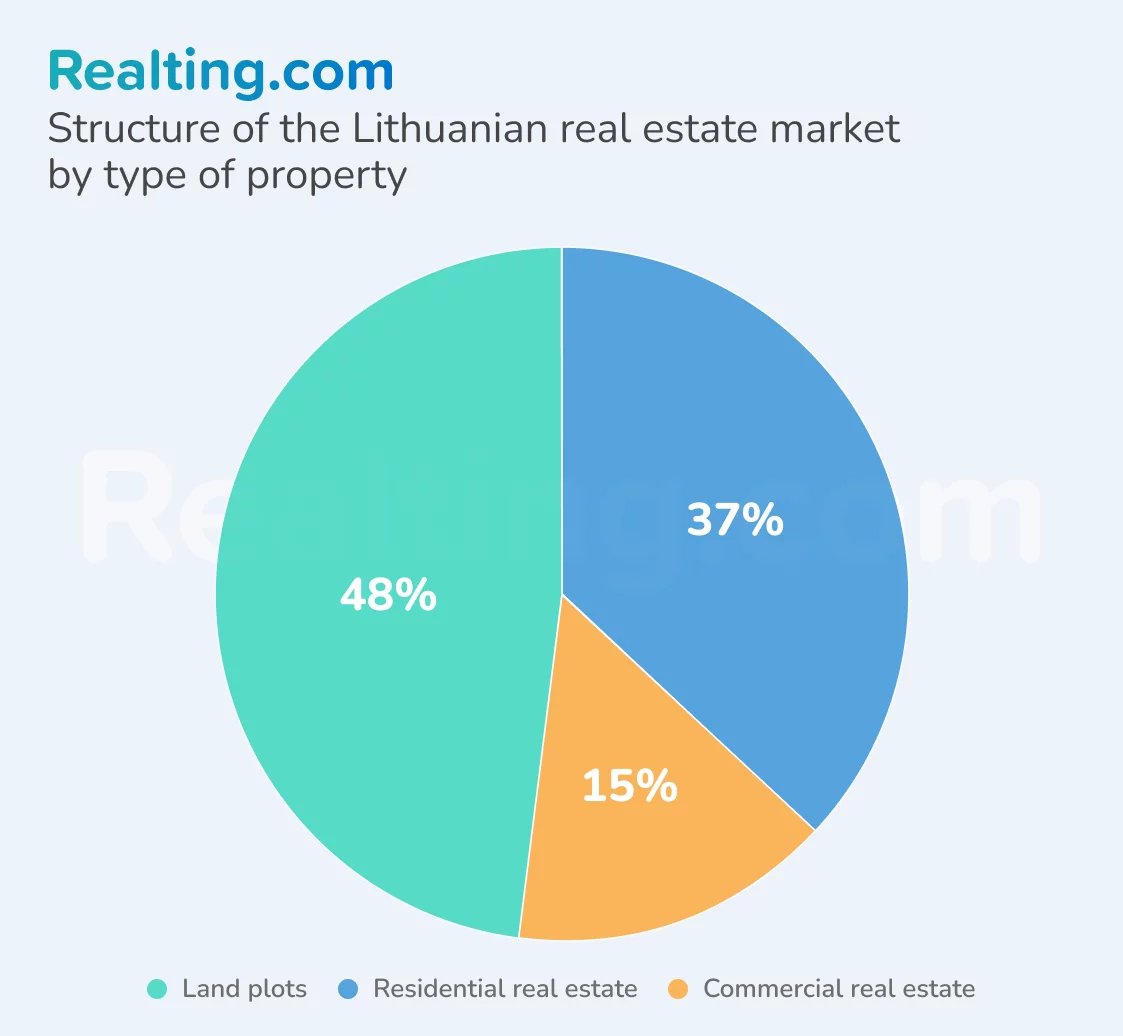

Considering the real estate market of Lithuania as a whole, the most developed segments for the 7 months of 2023 can be attributed to the residential real estate market and the land market. According to Lithuania State Enterprise Centre of Registers, the share of properties that have changed their owners as a result of a sale transaction of these types is 37% and 48% respectively, and non-residential real estate accounts for 16% of all properties in transactions. This distribution has been maintained since 2017.

It is likely that the popularity of land is explained by several objectives of buyers:

- Firstly, it is the purchase of a land plot for investment - for example, land in a production zone in Lithuania is usually located near large cities and have well developed transport infrastructure, access to energy and water. This provides convenience for enterprises and easy access to markets and, consequently, opportunities for business growth and development in promising industries. Recreational land can be used by owners to develop tourism in the country. And the demand for land for housing construction is actively shaped by developers.

- Secondly, the construction of an individual residential building.

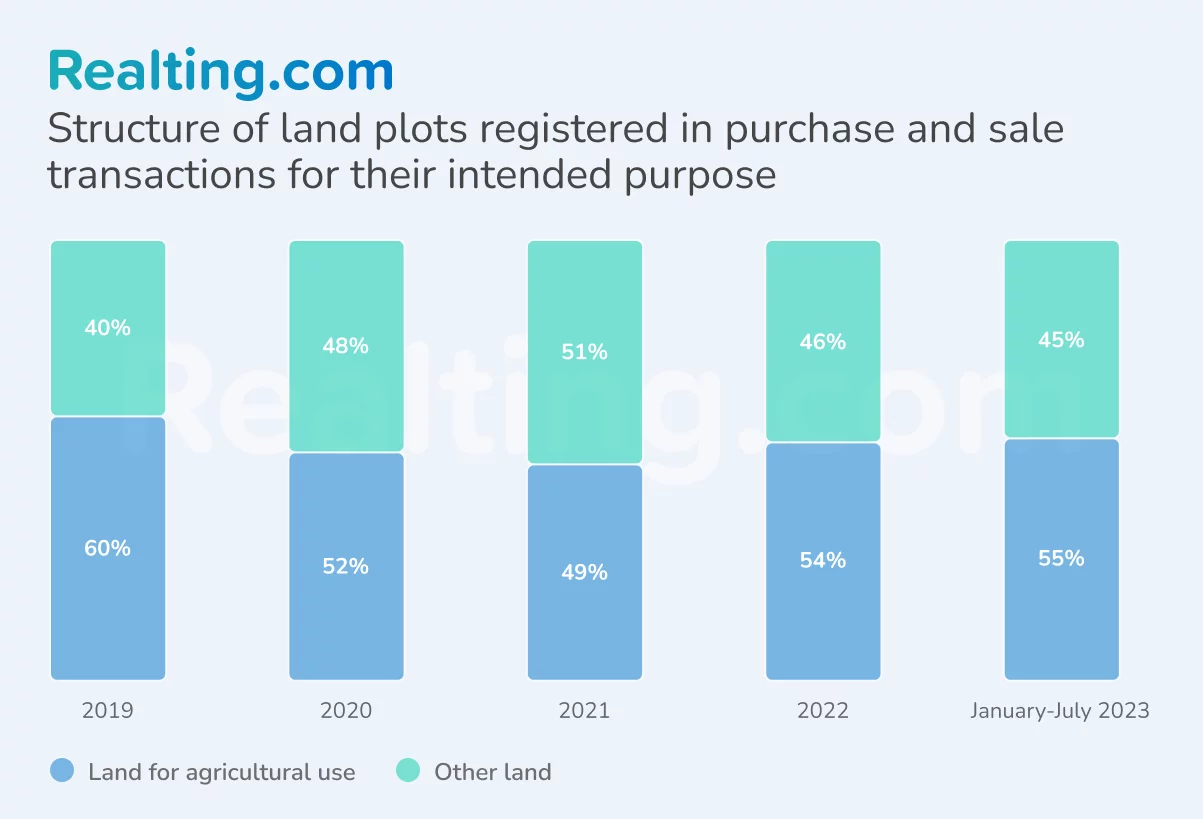

It is worth noting agricultural land. In 2023, more than half of the land plots (55%) registered in sales transactions had an agricultural purpose (incl. forest, water and conservative use), the rest belong to a different purpose. Apart from the interest in the development of agriculture, which is an important sector of the Lithuanian economy, this distribution is also due to the active support of the government — agricultural subsidies are provided as part of the national policy, as well as within the framework of European Union programmes to stimulate and support, improve the infrastructure and competitiveness of the agricultural sector. Financial support is provided for land acquisition, equipment upgrades, new technologies, productivity improvements, exhibitions, fairs, advertising, training and counseling.

In accordance with the budget plan of the Ministry of Finance of Lithuania in 2022, €1.203 million was spent on food, agriculture, rural development and fisheries, veterinary medicine and land management.

In 2023, 10 percent less was allocated to this area of government - €1.083 million, 53 per cent of which was earmarked for direct payments from the European Union budget and 40 per cent for food production, agriculture and rural development.

By the way, agricultural land was more often registered in sales transactions and in 2019-2021 and 2022, the exception was only 2021. However, the decline in the share of agricultural plots in transactions began in 2020, probably due to changes in legislation. From 2020, foreign investors must obtain prior permission to acquire land in Lithuania, which is issued in accordance with national interests and criteria established by legislation. Also, if several persons have applied for the acquisition of the same land parcel, preference is given to Lithuanian citizens and natural persons from other member countries of the European Union.

Stricter requirements for the use of land have also been introduced: when buying land for agricultural purposes, the buyer must provide a plan for the use of the land and evidence of its ability to farm.

How public support has affected the housing market

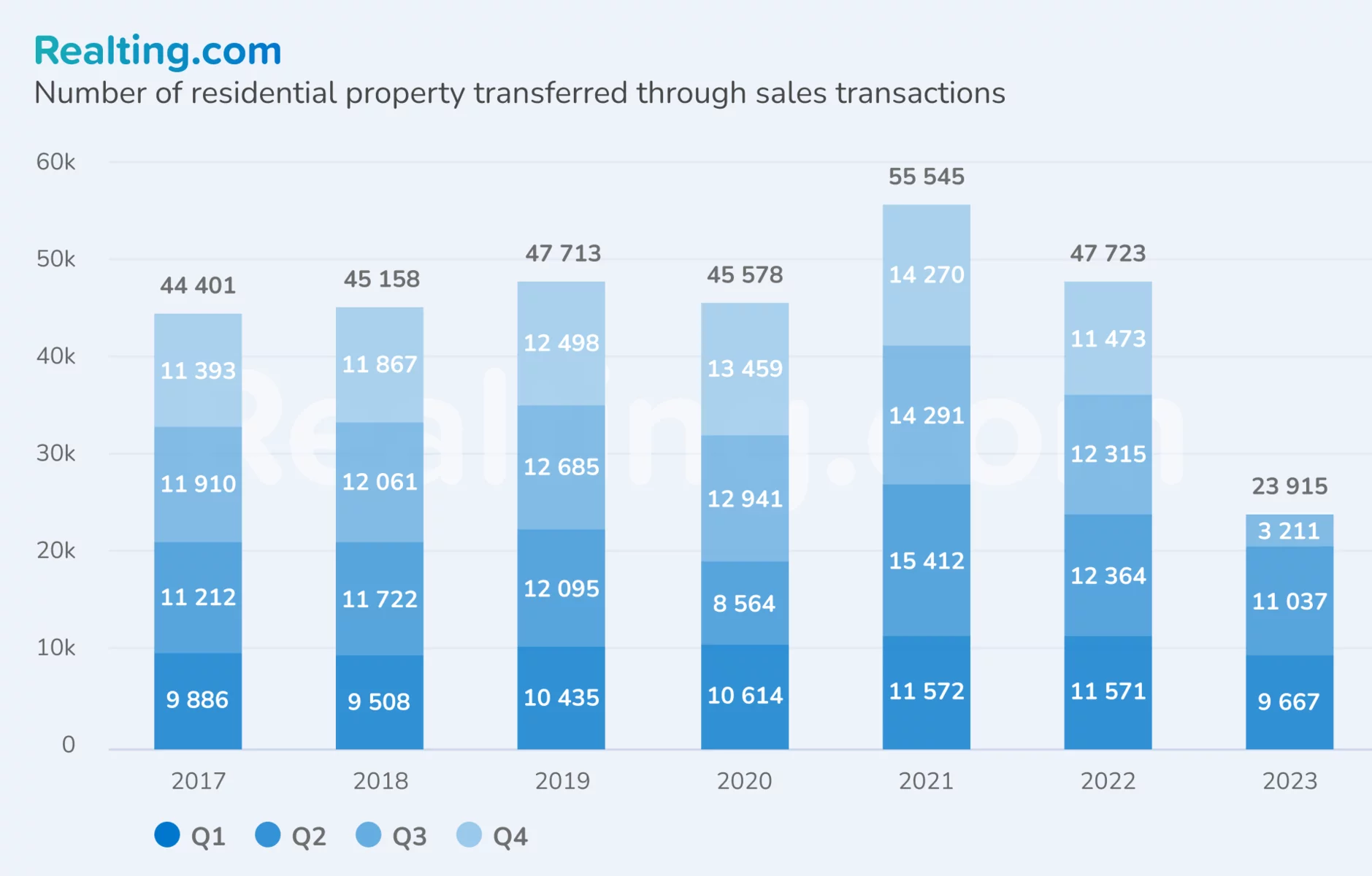

For 7 months of 2023 almost 24 thousand residential properties participated in sales in Lithuania. In comparison, this is 15% less than in the same period in 2022. At the moment, demand for real estate continues to fall, which began in 2022 — then in transactions were registered 14% less real estate compared to the previous year.

In general, since 2017, the number of properties registered in transactions was at a relatively stable level — at least 44 thousand properties changed their owners annually. Even the pandemic could not have a significant impact on the activity in the Lithuanian real estate market — the number of objects in transactions in 2020 decreased by no more than 5%. This was largely due to measures to mitigate the impact of COVID-19 on the real estate market: some rules and procedures related to real estate transactions were relaxed. For example, they allowed online meetings and signed documents remotely, which simplified the transaction process.

And in 2021, the Lithuanian real estate market experienced a peak of activity — more than 55 thousand properties were registered in transactions during the year. Growth compared to last year was 22%. This effect was achieved due to the stimulating measures for the support of the real estate market by the Government of Lithuania:

- "The First House" program (Lt. - "Pirma Būstas"), which is a subsidy of interest on mortgage loans for young families purchasing the first housing, was expanded in 2021. The increase in the grant and the expansion of coverage have boosted demand.

- The Lithuanian Government has begun to provide subsidies for energy-efficient repairs of residential buildings. This allowed property owners to reduce energy costs and improve the condition of their housing, making it more attractive to buyers.

- Also the program "Rent for purchase" (lita. - "Nuoma su oishijimo teise") was expanded, in which tenants pay a monthly rent and can use the option of purchase at the end of a certain lease term, and some of the lease payments can be credited as a down payment. In 2021 there was a decrease in the initial payment and an increase in the choice of real estate available under the program.

What also influenced buyers' activity is that, at a time of uncertainty caused by the pandemic, many preferred to invest in real estate as a stable and long-term asset.

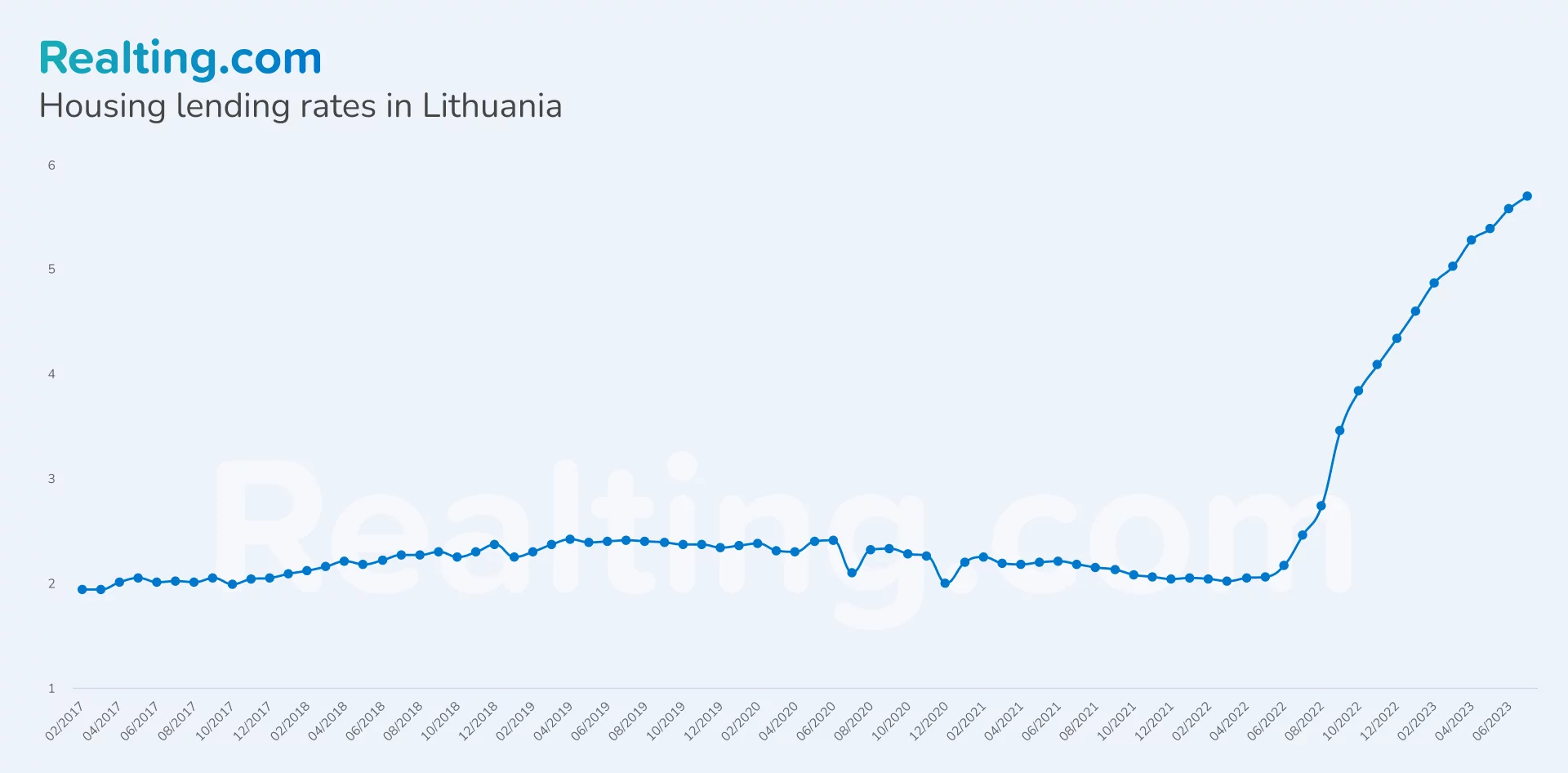

Mortgage interest rate increase in Lithuania

Low mortgage interest rates are one of the key factors stimulating the stable demand for real estate in Lithuania. From 2017 to June 2022, mortgage rates ranged from 1.94% to 2.42%. In July 2022, the European Central Bank decided to raise interest rates in order to "cool" the economy and reduce both inflation expectations and inflation itself. As a result, according to official data in July 2023, the mortgage rate was 5.7%. It is worth noting that the annual inflation rate in the country has been steadily decreasing since September 2022, and in August 2023 it was 6.2%.

Buyers more often choose apartments in Vilnius

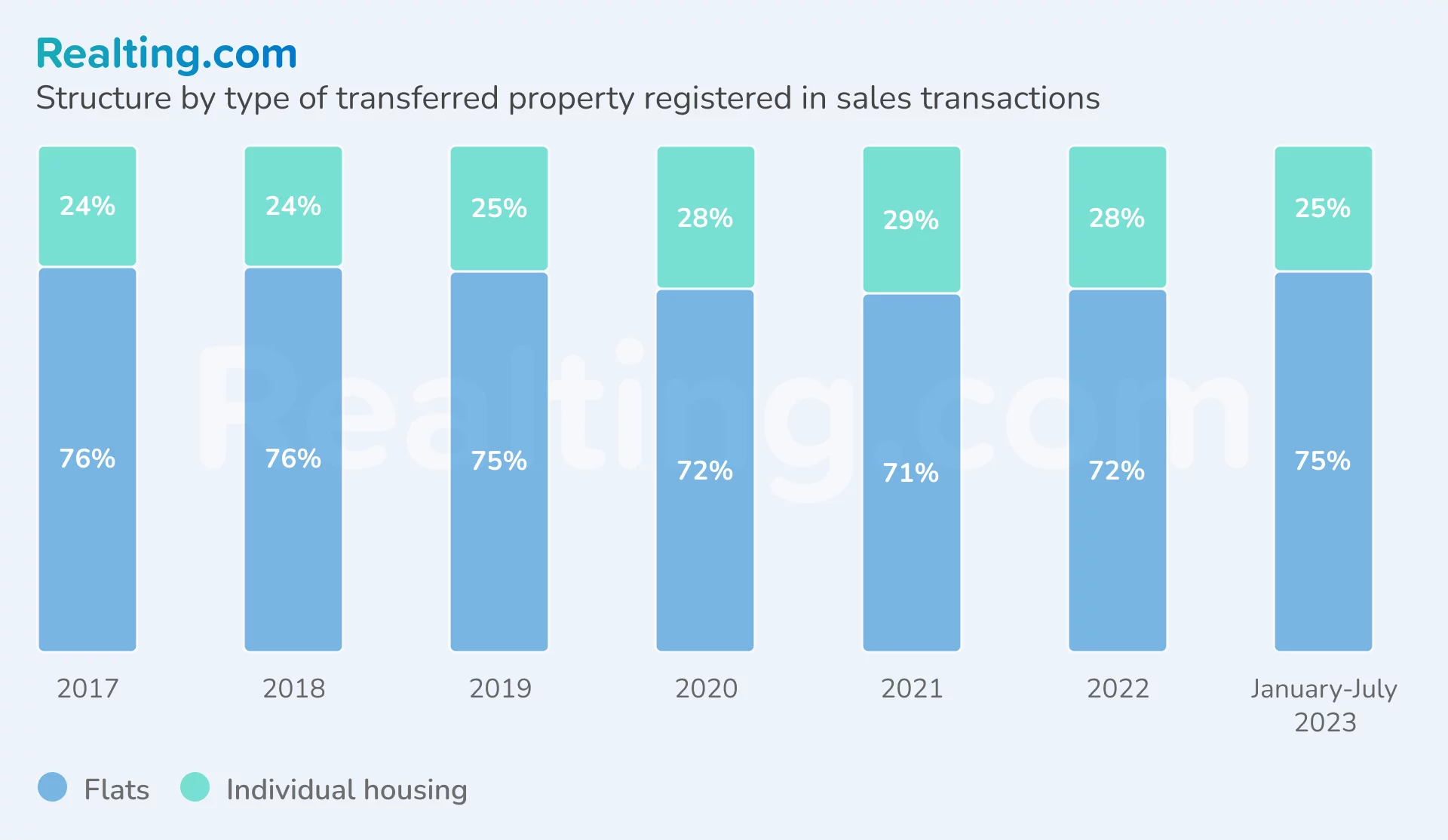

Considering the structure of the housing market by property type since 2017, it can be said that buyers more often preferred apartments. In 2020, however, the pandemic had little impact on the distribution of demand, with a slight increase in individual home purchases. According to a total of 7 months of 2023, 25% of houses and 75% of apartments participate in the transactions which is similar to the situation on the market until 2020.

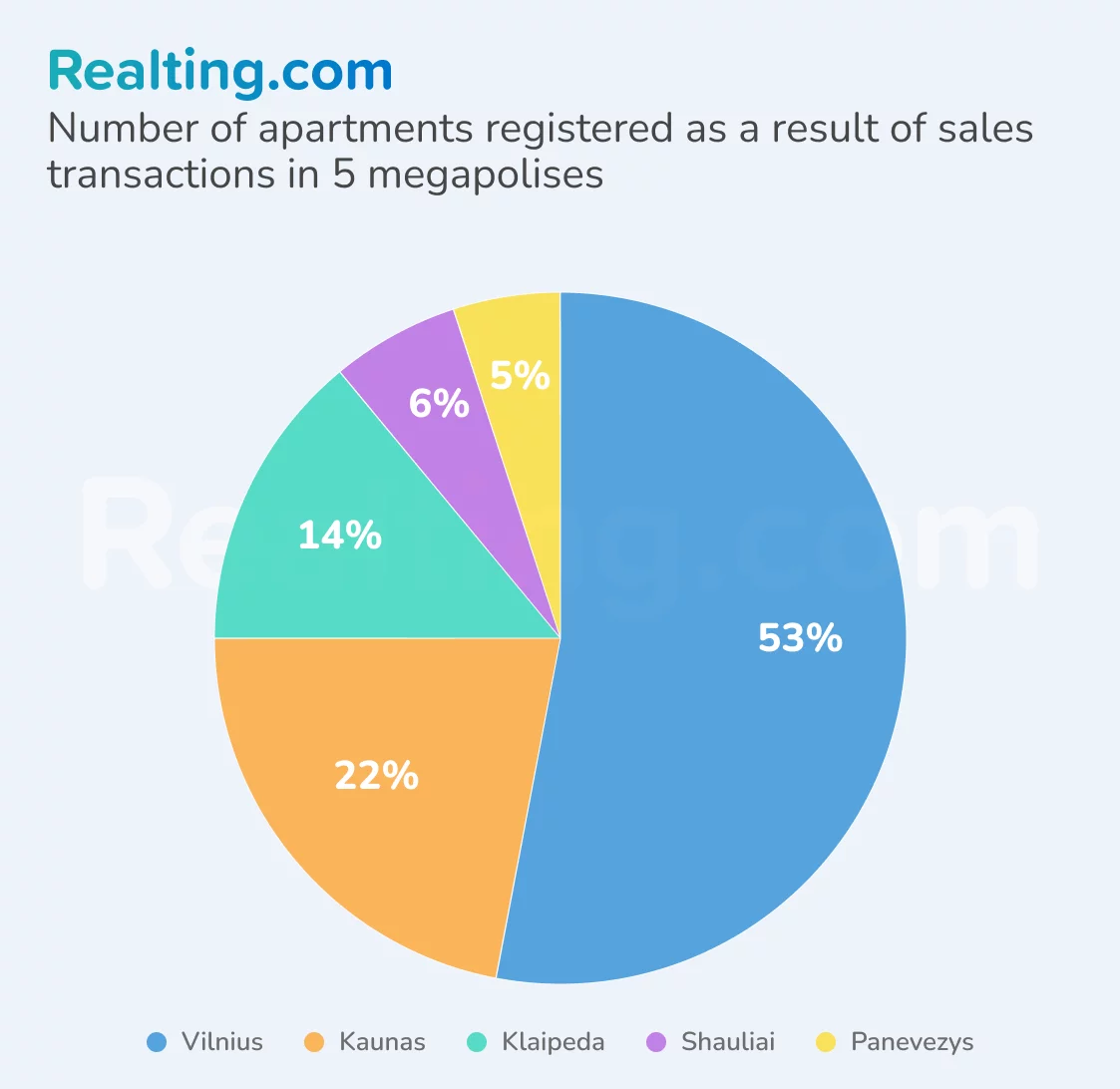

The most popular city to buy an apartment is Vilnius — 53% of all the apartments involved in the deals in 2023 were in the capital. Next in popularity follow Kaunas and Klaipėda — 22% and 14% of apartments respectively. The smallest share of apartments are sold in Šiauliai and Panevežys.

Apartment prices are constantly rising in all cities and all segments, houses demonstrate uncertainty

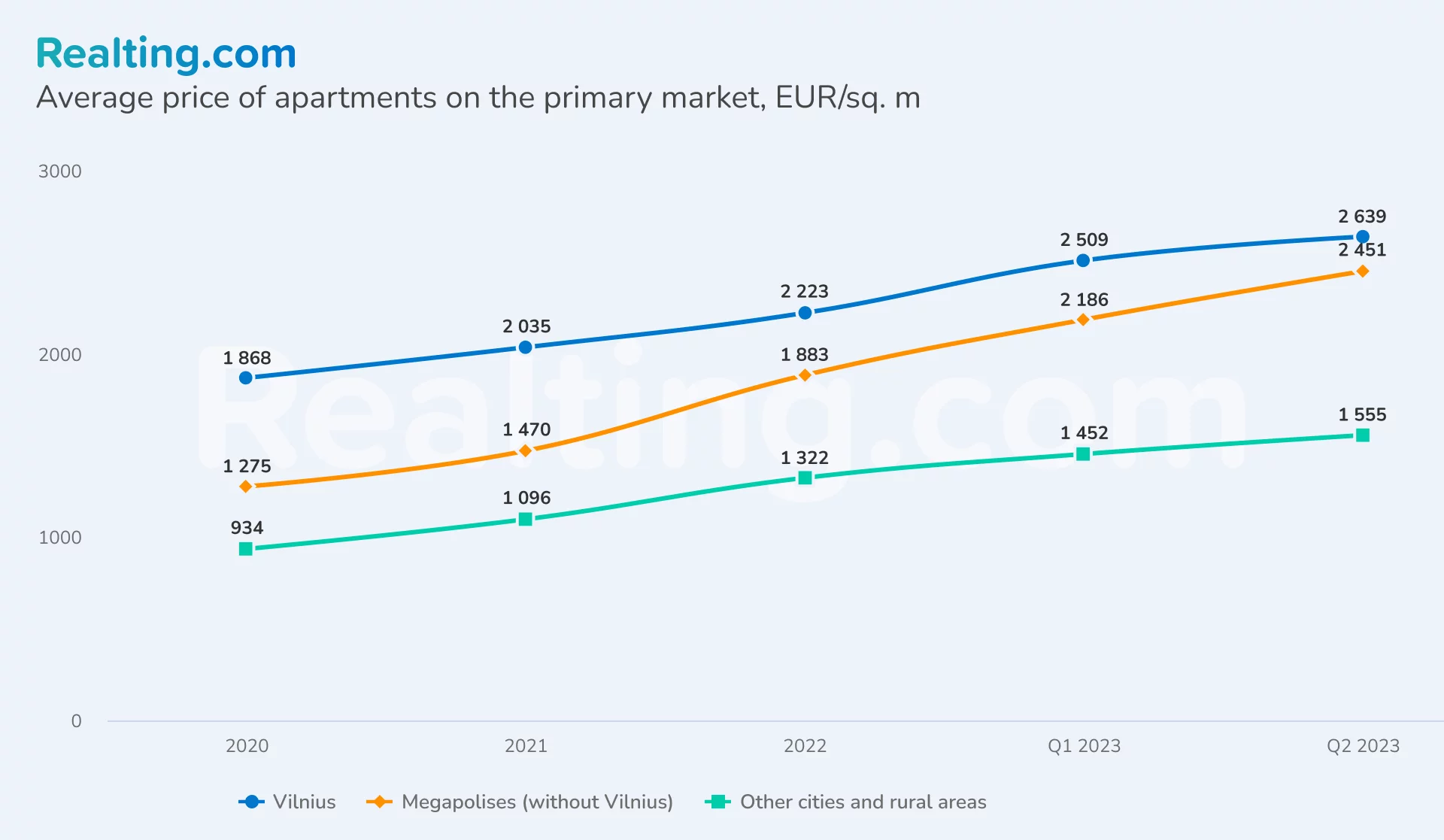

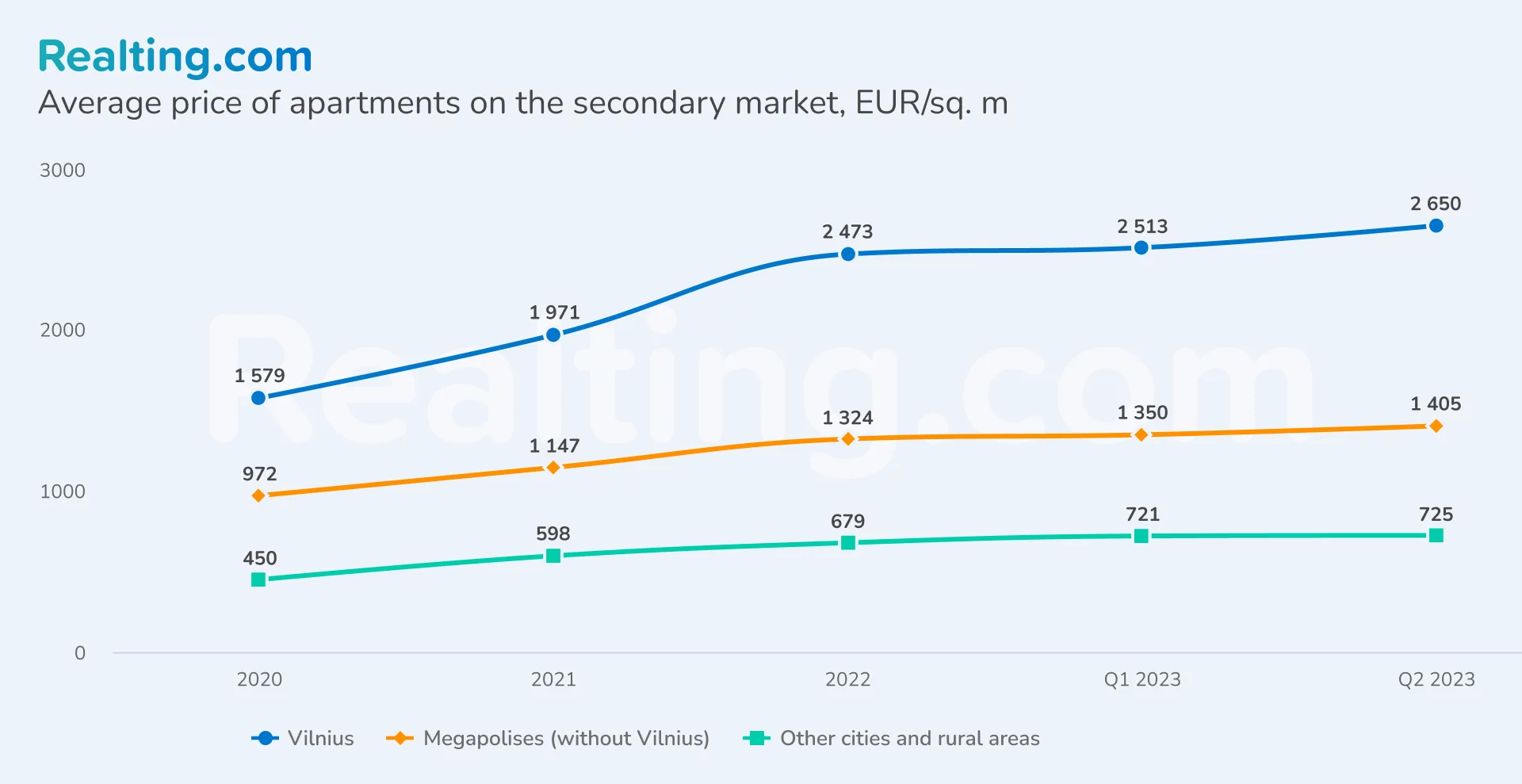

As a result of two quarters of 2023, the most expensive properties for sale were apartments in Vilnius, and both on the primary*, and on the secondary markets — the average price per sq. m exceeds €2600/sq.m. It is worth noting that in 2023 the prices for apartments in the capital of Lithuania on the primary and secondary markets equaled.

*- In accordance with the Lithuania State Enterprise Centre of Registers, transactions concluded with properties not older than 2 years after putting into operation are included in the primary market.

The price of new apartments in Vilnius increased by almost 20% in six months, and compared to 2020 the increase was just over 40%.

In the remaining megapolises, the average price of new apartments since 2020 increased almost 2 times and amounted to €2,451/sq.m. On Tuesday, the average price per meter for the second quarter of 2023 was €1,405/sq. m - +44% from 2020.

The lowest prices for apartments in other Lithuanian cities and rural areas are €1,555/sq. m for apartments in new buildings and €725/sq. in old stock — growth in 3 years was more than 60%. By the way, in other cities and rural areas in 2023, it is possible to note the largest difference in price between apartments in the primary and secondary markets which is more than twice. The same trend was observed in 2020.

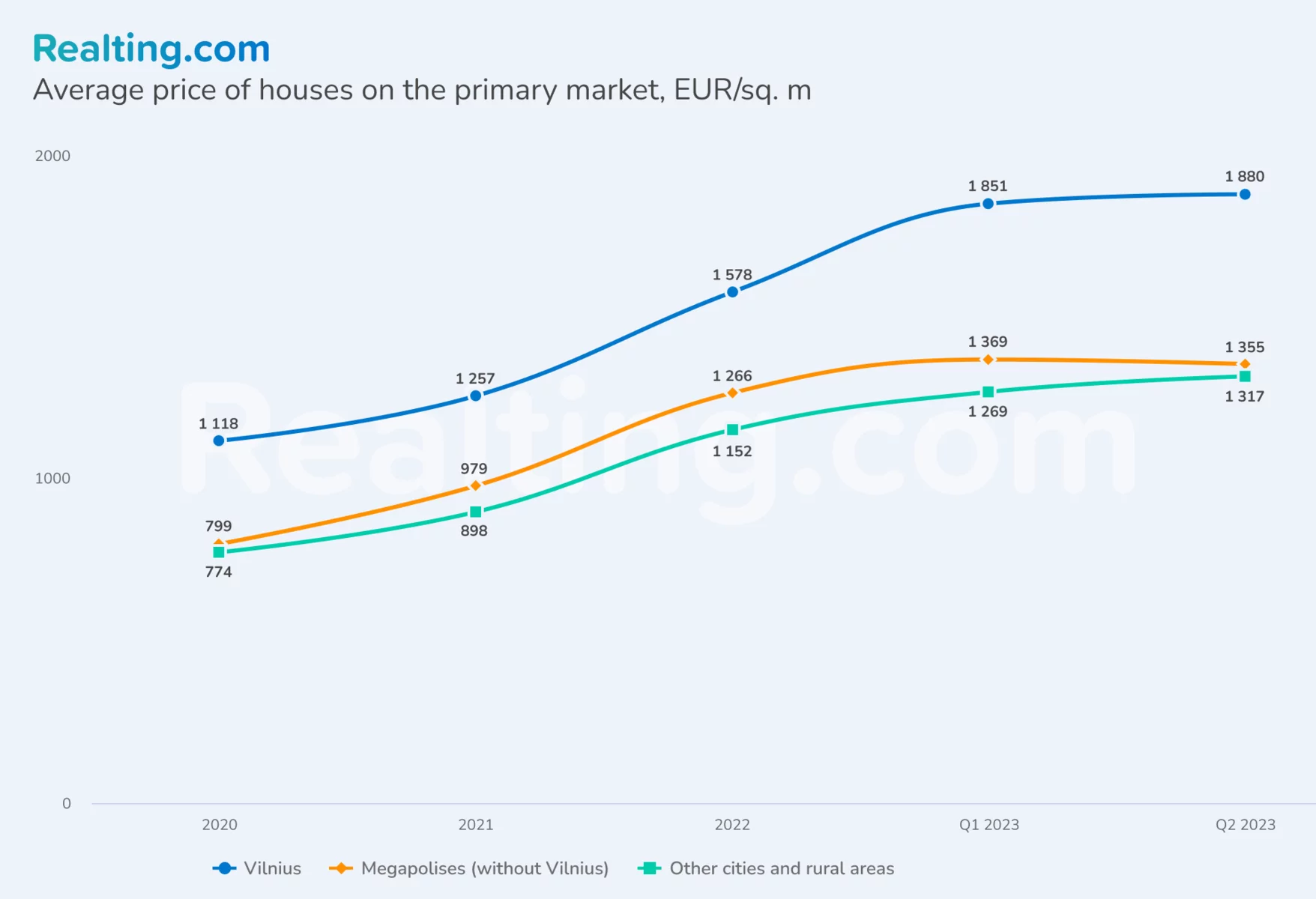

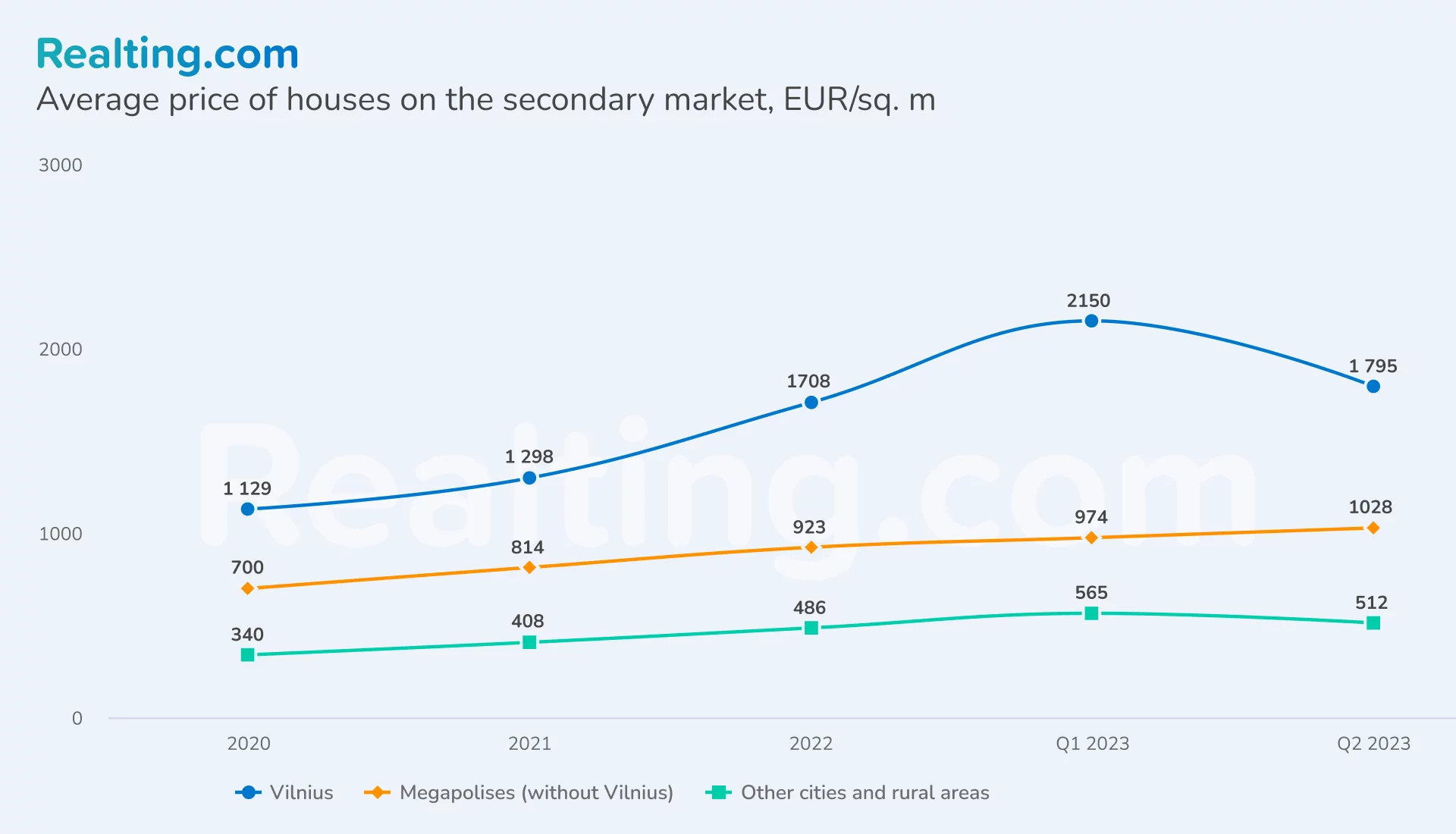

In the segment of private houses, the highest average price per meter was set in Vilnius for new houses — €1880/sq. m, growth has slowed considerably since the beginning of the year. In Vilnius there was a significant decrease in the price of the houses on Tuesday: -17% and, as a result, €1795/sq.m.

Lithuanian megapolises have been growing for 3 years, homes on the primary market added almost 30% in price annually in 2021 and 2022. At the moment, the price per meter has stabilized and is at the level of €1,355/sq.m. On the secondary market of houses in megacities, the situation is more calm — the price per meter is 2 square meters. 2023 is slightly more than a thousand euros - €1,028/sq.m., and has grown by 1.5 times since 2020.

At the moment, the most affordable housing option in Lithuania is the secondary market segment of houses in other cities and rural areas - €512/sq.m. Over the last quarter the price here has decreased by 9%. The difference in price is 2.5 times compared to new houses in the same areas. While this trend has been observed since 2020, it is a record price gap.

In 2023, Lithuania kept relatively affordable prices for the European real estate market, while in the segment of apartments, the price increase slowed down, and for private houses prices began to fall. Most likely, the adjustment and stabilization of housing prices is taking place at this stage. It is undeniable that the Lithuanian real estate market was strongly influenced by the justified measures of the European Central Bank to reduce inflation. However, it is not worth expecting a reduction in interest rates, because the target for inflation in the eurozone has not yet been achieved, which means that new loans will be expensive, and floating-rate loans will also be more expensive. The Lithuanian housing market is likely to follow European trends and slow down in the near future, and demand will be supported by citizens' desire to own property.

Author

Providing readers with quality analysis on global trends in the real estate market.