Lithuanian Real Estate Market in 2024: Recovery from Recession

During 2022 and 2023, the Lithuanian residential real estate market showed a downward trend in demand and activity, accompanied by an increase in the cost of housing loans. At the same time, prices for the purchase of residential real estate continued to rise, which further affected activity. Let’s consider what situation is observed in the Lithuanian housing market in the outgoing 2024 and whether there are signs of market recovery.

The Market is Recovering

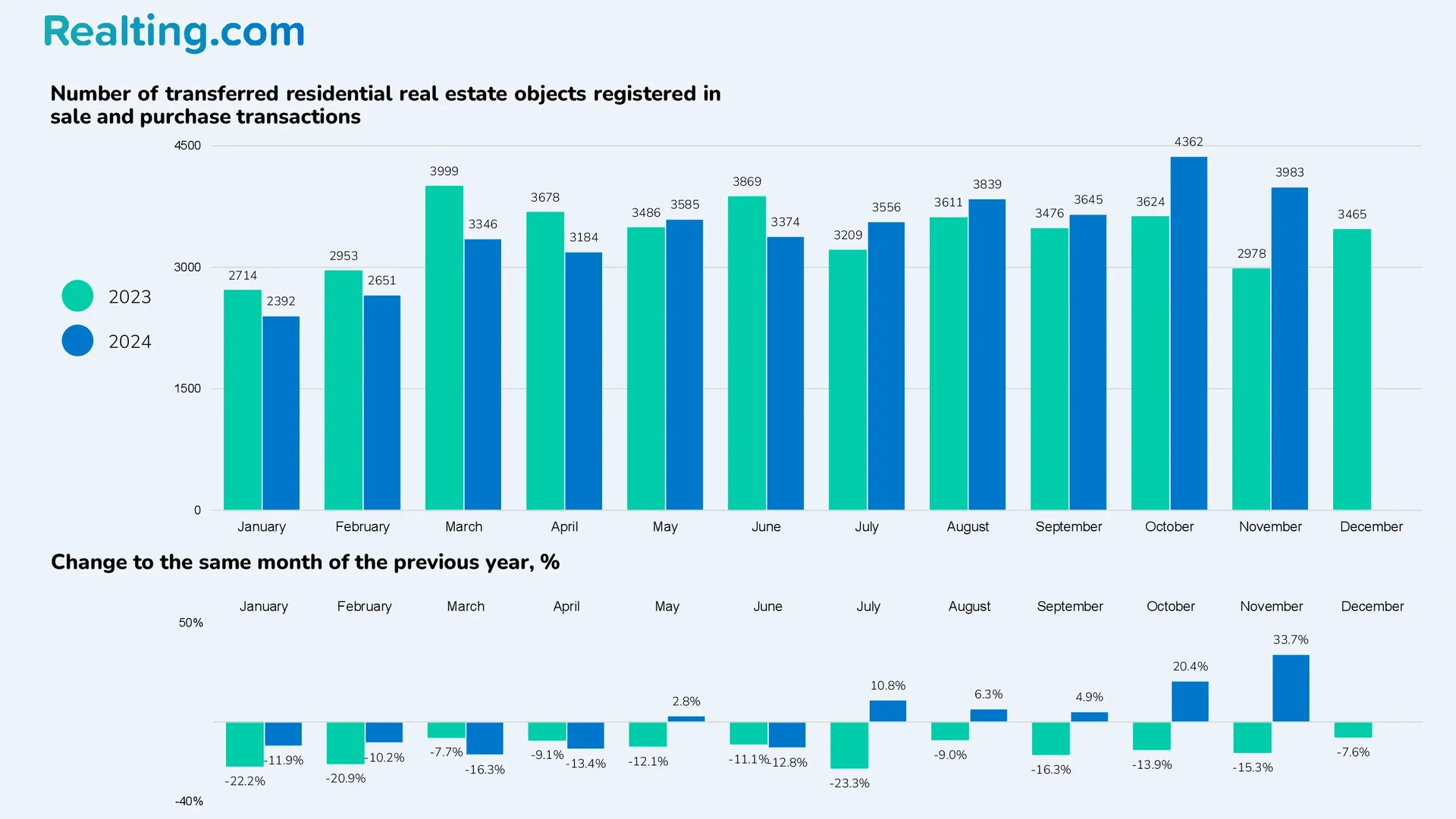

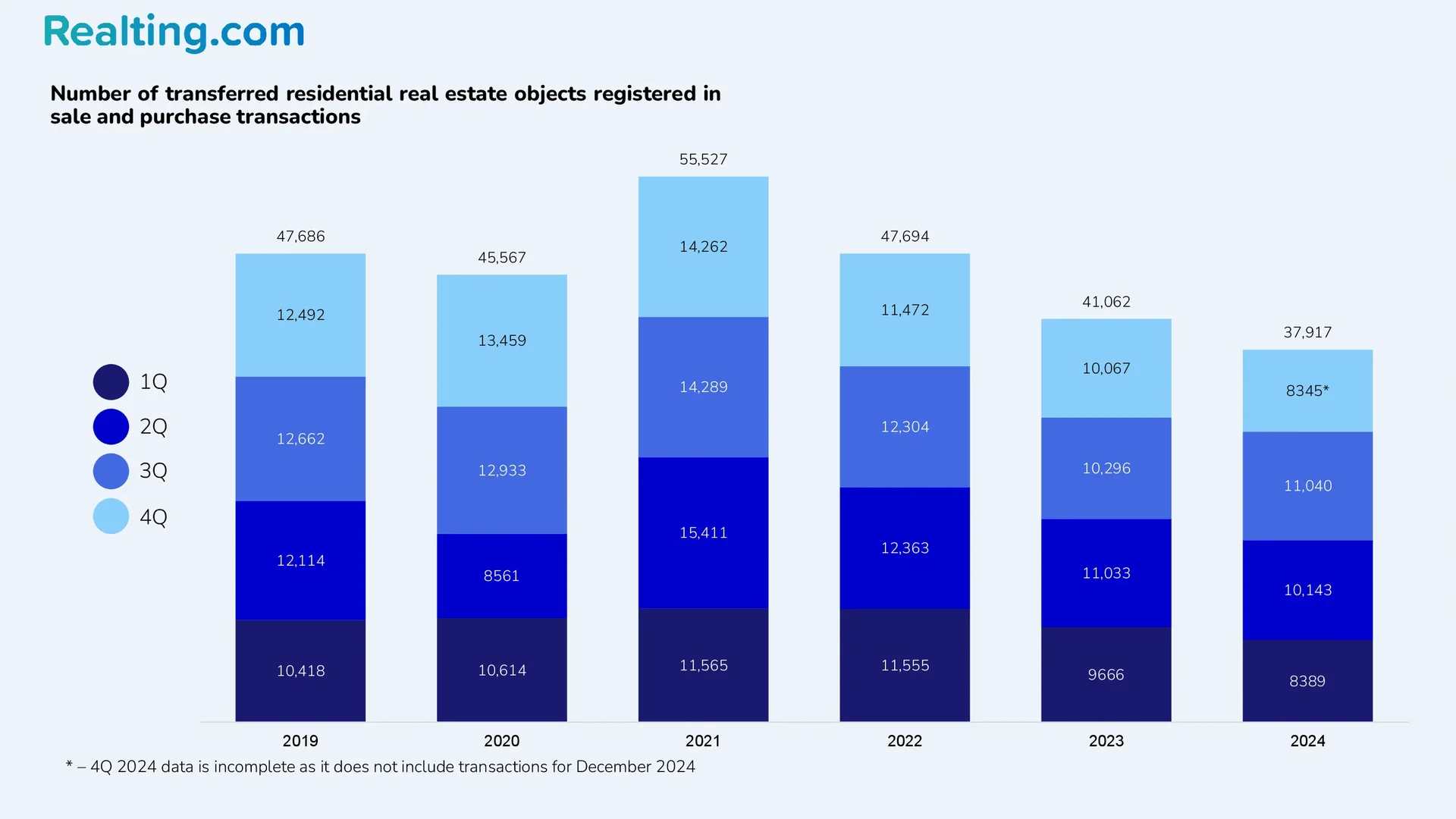

Over the past 11 months of 2024, 37,917 residential properties were sold as a result of purchase and sale transactions, according to data from Lithuania State Enterprise Center of Registers. This is only 0.9% more than it was for the same period in 2023.

It is important to note that from January to June 2024, the housing market continued to show a downward trend in the number of properties sold in purchase and sale transactions compared to the same month last year. This trend began in March 2022, and since then the monthly number of properties sold has only decreased compared to the same month of the previous year.

However, in July 2024, this trend stopped and for five months now, positive dynamics have been observed, when the number of residential properties sold in purchase and sale transactions per month has grown in comparison with the same month last year.

Speaking about quarterly data, the situation is as follows: in the 1st and 2nd quarters of 2024, the number of residential properties in purchase and sale transactions was 8,389 and 10,143, which is 13.2% and 8.1% less than in the same quarters of 2023. According to the results of the 3rd quarter of 2024, the number of properties registered in transactions was 11,040, which is 7.2% more than in the 3rd quarter of 2023.

It is too early to talk about the final number for the 4th quarter of this year, but it is worth saying that 8,345 residential properties were sold in October-November, which is 26.4% more than in October-November 2023. It can be assumed that the final number of residential properties transferred in purchase and sale transactions at the end of the 4th quarter of 2024 will exceed the figures for the same quarter last year.

Overall, the Lithuanian residential property market is currently showing recovery after two years of falling demand and activity.

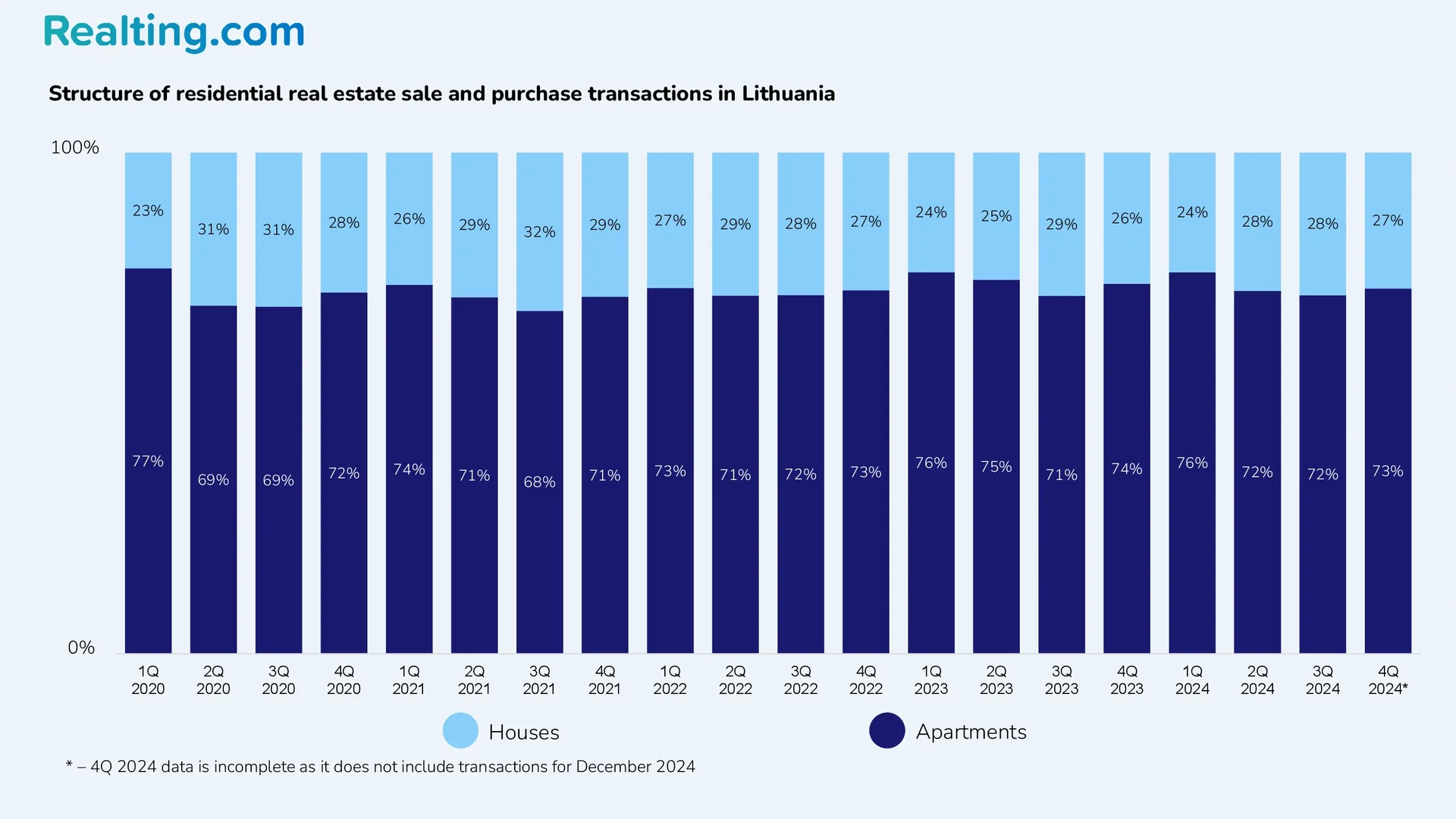

Apartments predominate in the structure of residential real estate purchase and sale transactions — their share amounted to 72% at the end of the 3rd quarter of 2024. The share of houses in the structure of transactions most often varies in the range from 23-24% to 28-29%, but there were periods when the share exceeded 30%, such as in the 3rd quarter of 2021 — then the share of houses in purchase and sale transactions amounted to 32%.

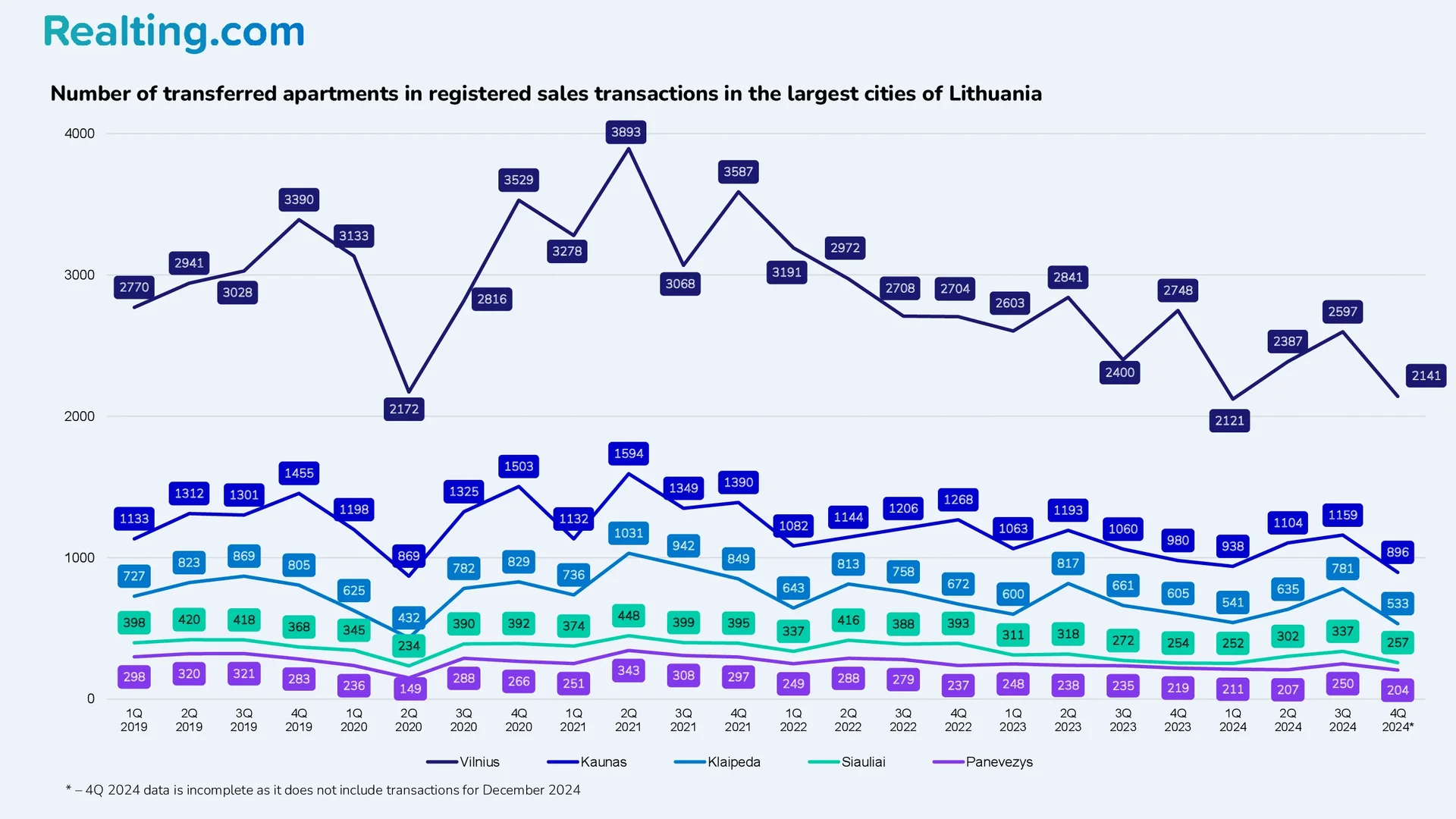

Below is a table with data on the number of apartments transferred in purchase and sale transactions based on the results of the 3rd quarter and the incomplete 4th quarter of 2024.

|

City |

Q3 2024 |

Change by Q3 2023 |

Q4 2024* |

|

Vilnius |

2597 |

+8.2% |

2141 |

|

Kaunas |

1159 |

+9.3% |

896 |

|

Klaipeda |

781 |

+18.2% |

533 |

|

Siauliai |

337 |

+23.9% |

257 |

|

Panevezys |

250 |

+6.4% |

204 |

* — data for Q4 2024 is incomplete as it does not include transactions for December 2024

Interest Rates for Housing Loans

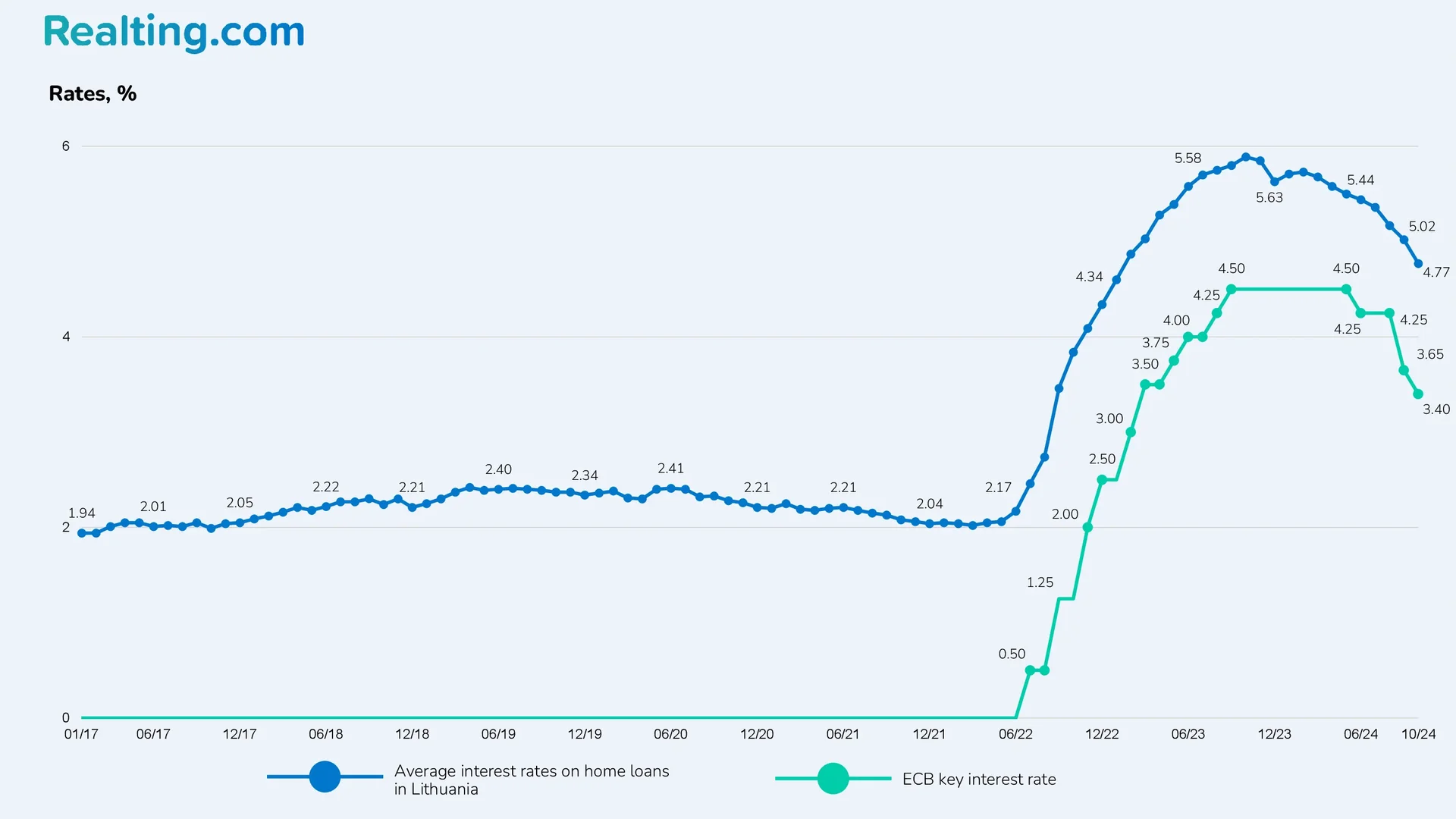

Housing loans play a significant role in shaping demand and activity in the residential real estate market. Low interest rates are one of the key factors stimulating stable demand for residential real estate. From 2017 to June 2022, average interest rates on housing loans in Lithuania ranged from 1.94% to 2.42%, according to Central Bank of the Republic of Lithuania.

Then interest rates on loans began to rise rapidly. Thus, if in July 2022 the rate was 2.46%, then a year later it was 5.58%. Over the year, the interest rate on housing loans in Lithuania has more than doubled, which, in turn, forced many potential home buyers to pause the purchase.

It is important to note the following: Lithuania is a country that is part of the European Union and the Eurozone, and therefore its interest rates are linked to the base rate of the European Central Bank (ECB). Therefore, when the ECB began to raise the base rate in June 2022, rates in Lithuania also began to rise. In turn, the decline in demand in the residential real estate market in 2023 occurred not only in Lithuania but also in many other member states of the European Union and the Eurozone.

Interest rates are still high compared to what they were before, but they are gradually coming down: as of October this year, the average interest rate on home loans was 4.77%. An average interest rate of 4.77% is still quite a high level of interest rates compared to what it was before, but in the new environment it is becoming acceptable, and together with the pent-up demand for home purchases, this is stimulating the market.

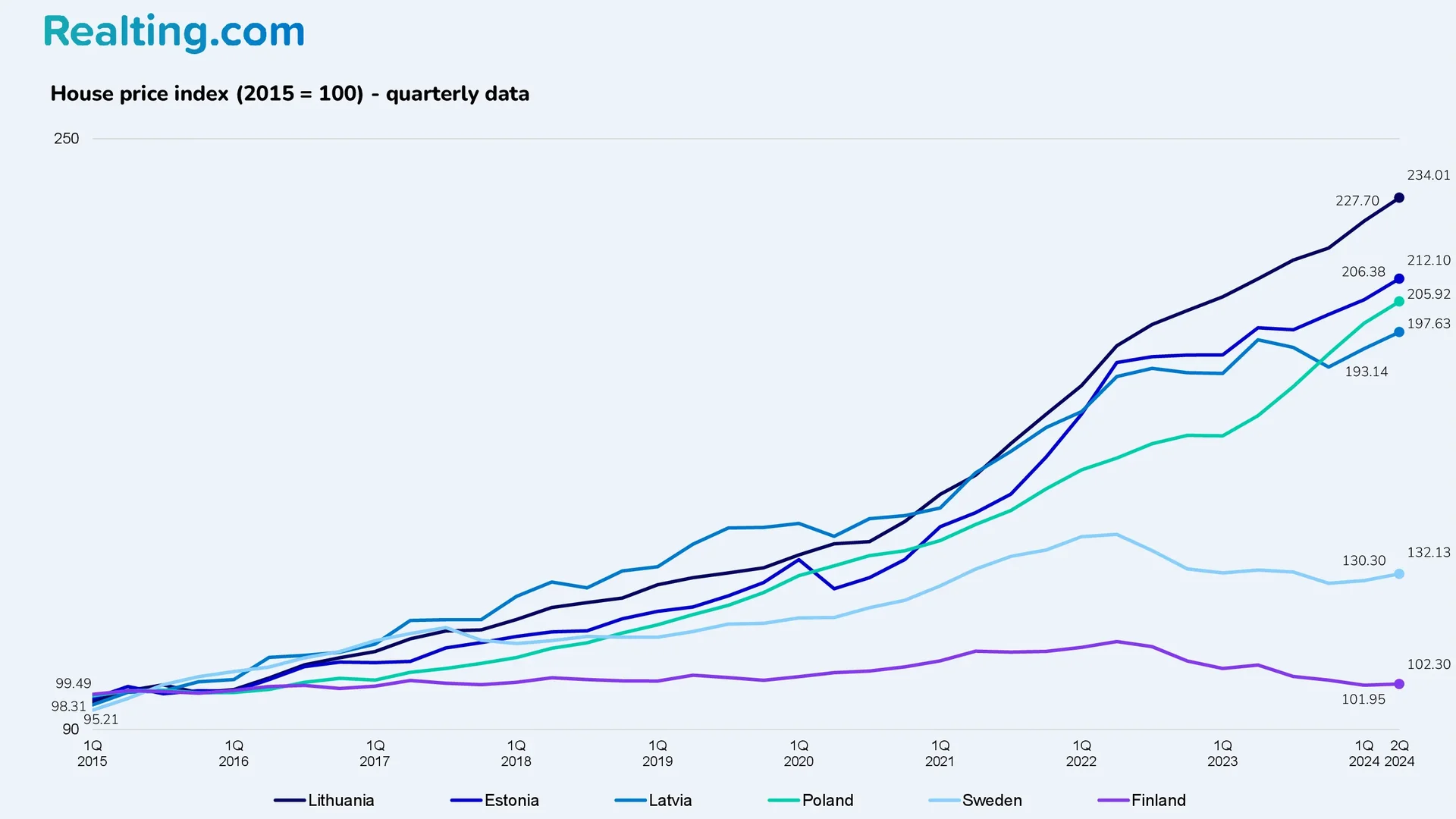

Housing Prices

According to the Statistical Office of the European Union, Lithuania ranks second among EU countries where the house price index shows the highest growth since 2015. According to the results of the 2nd quarter of 2024, the house price index in Lithuania was set at 234.01 points, which is 2.8% more than in the previous quarter and 10.4% more than a year ago.

The country with the highest residential property price index in the EU is Hungary: according to the results of the 2nd quarter of 2024, the house price index there was 298.05.

Residential Property Price Indices by Housing Type Based on Data Department of Statistics of Lithuania:

|

Type of housing |

House Price Index Q2 2024 |

Change by Q1 2024 |

Change by Q2 2023 |

|

Apartments on the primary market |

229.28 |

+2.4% |

+14.4% |

|

Apartments on the secondary market |

232.67 |

+2.4% |

+8.3% |

|

One- and two-apartment houses on the primary market |

281.72 |

+2.6% |

+7.4% |

|

Single and double apartment houses on the secondary market |

221.43 |

+4.4% |

+11.9% |

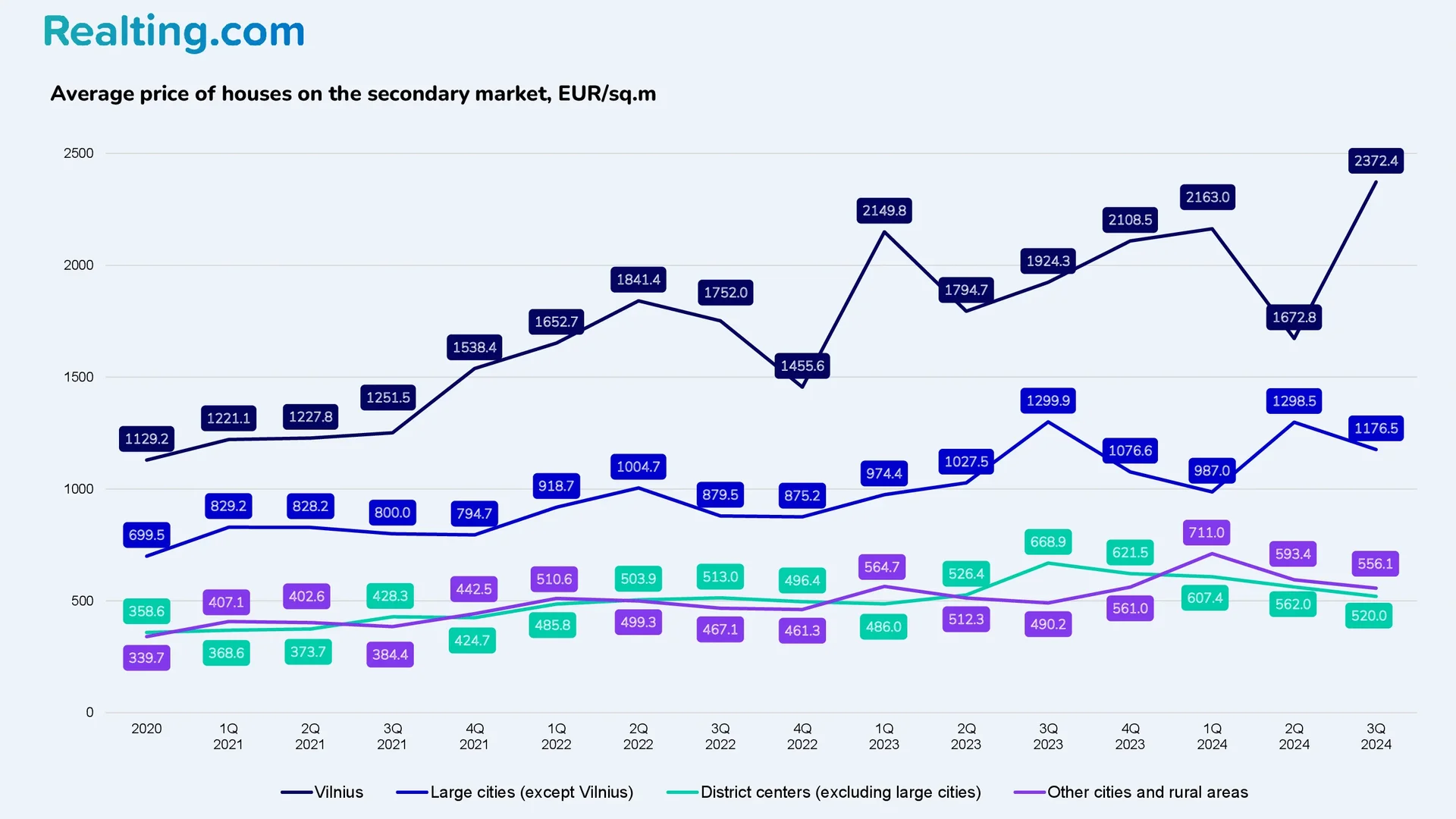

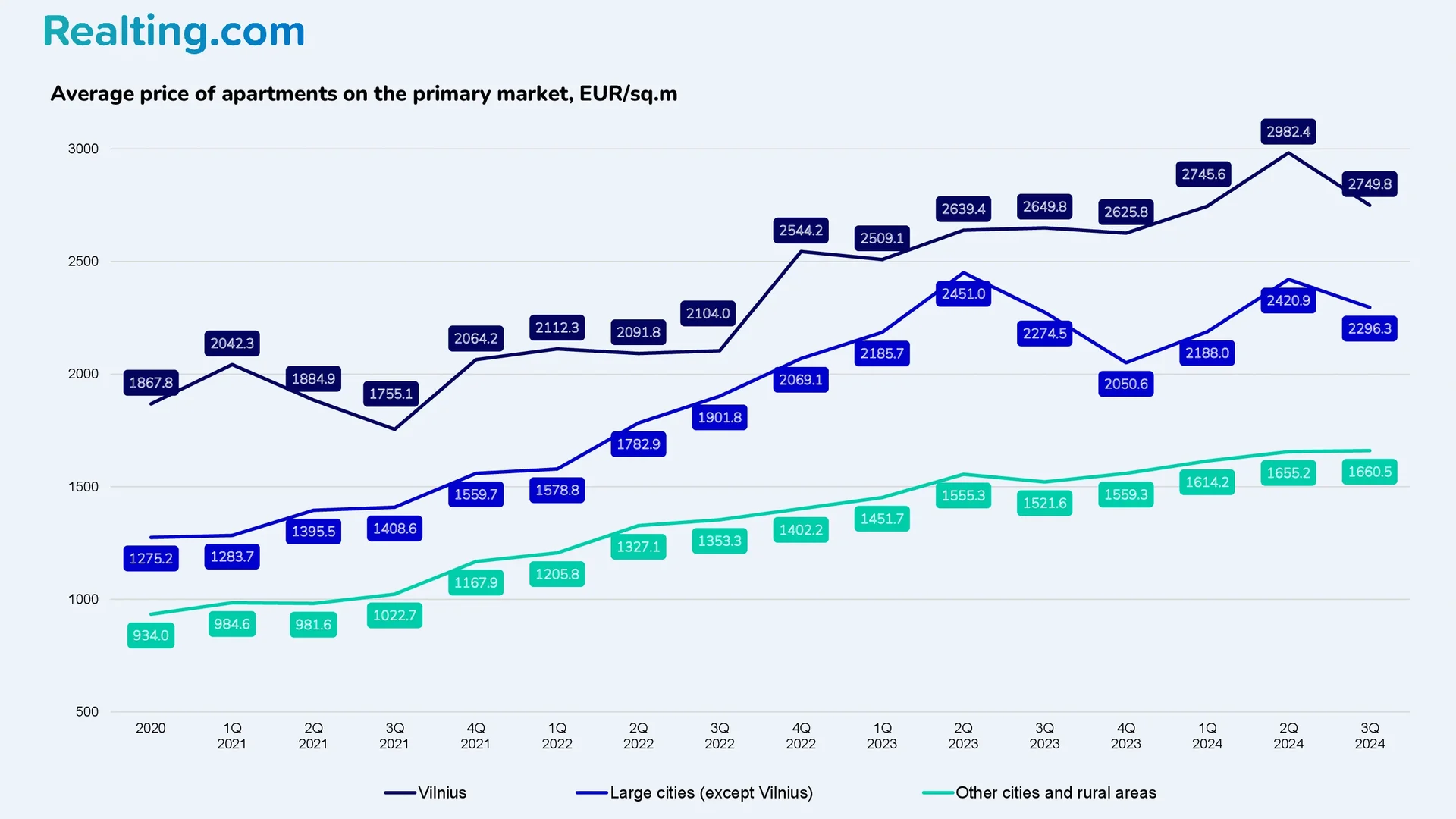

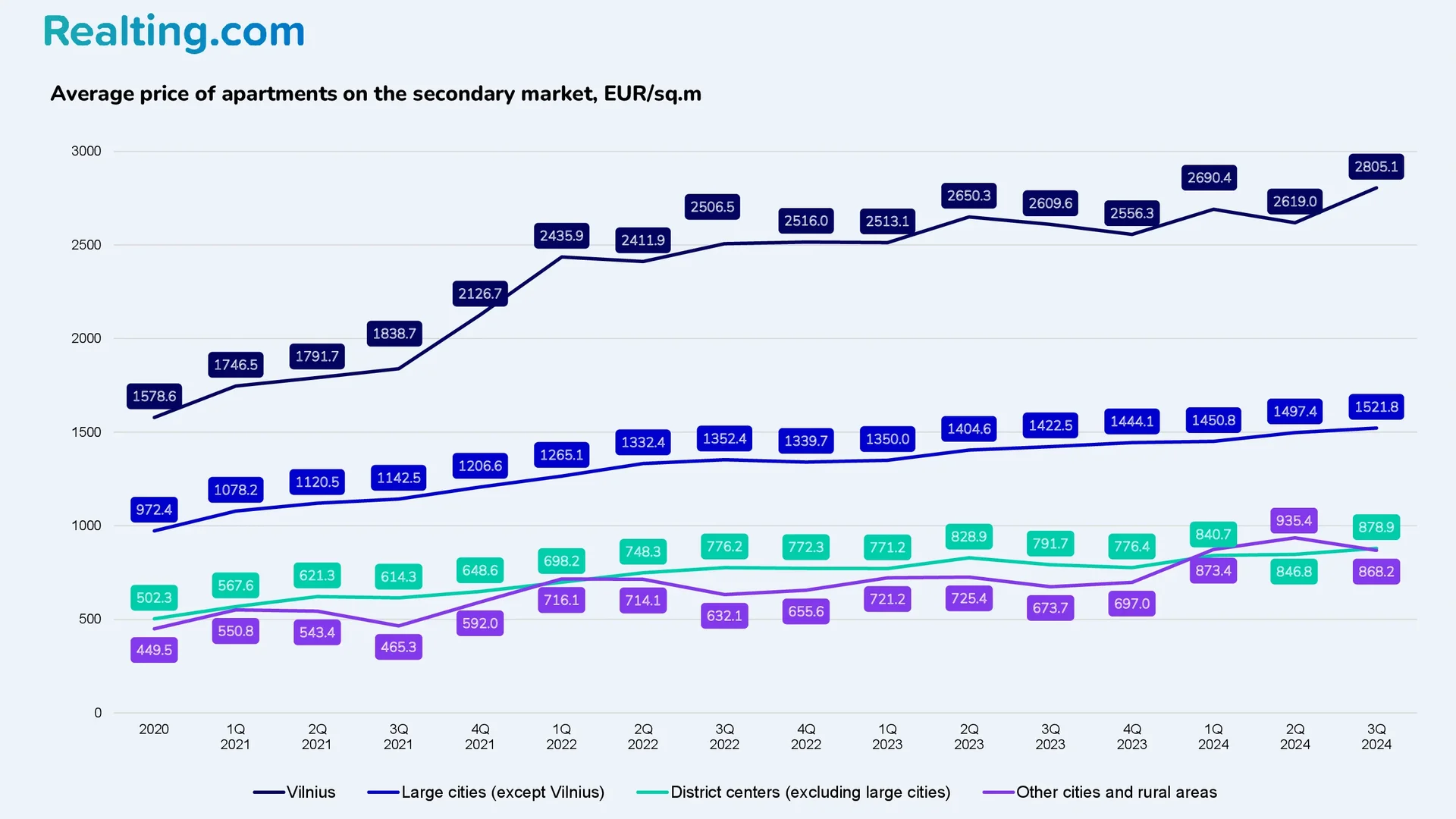

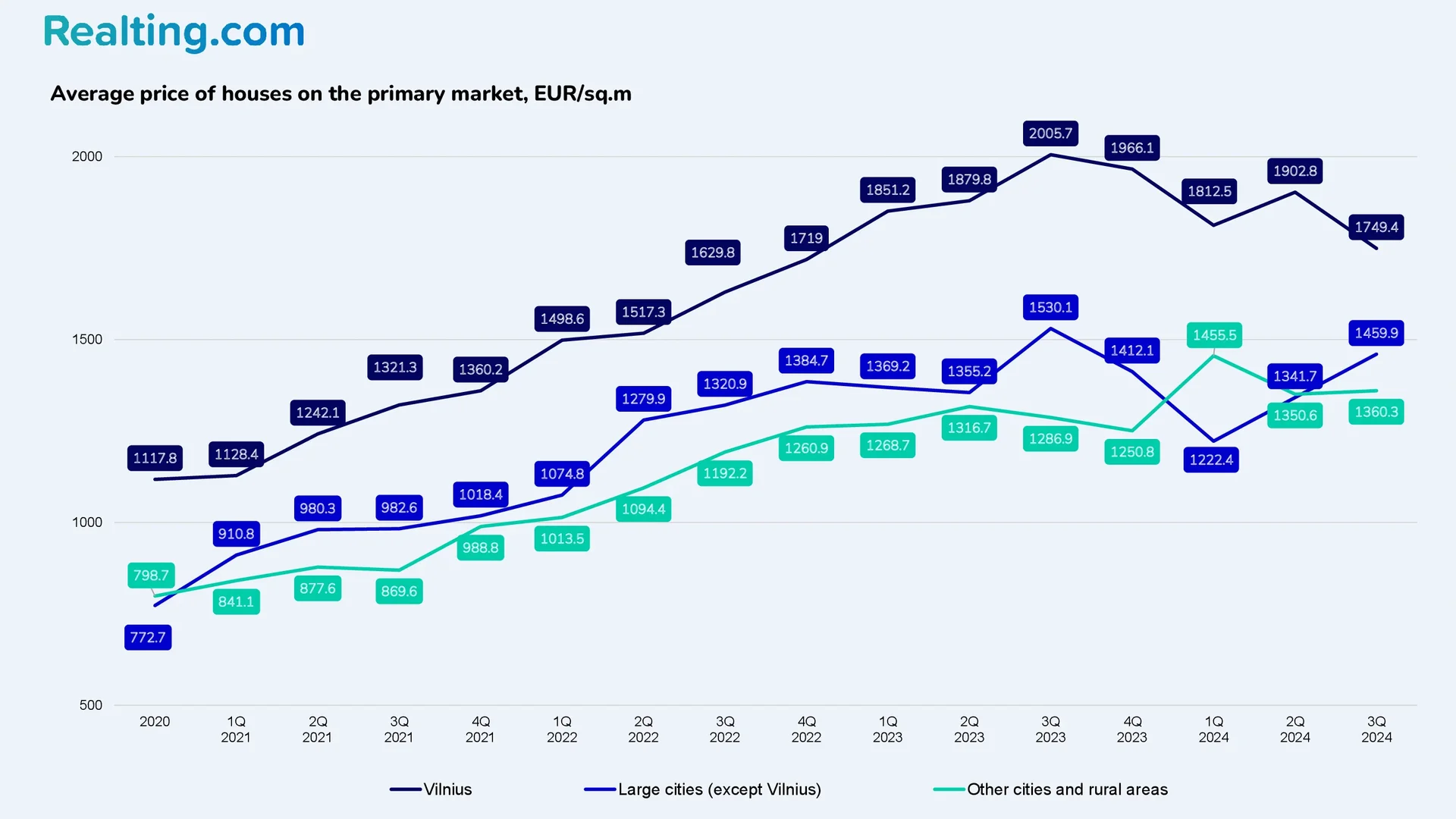

Below are tables with average prices in EUR for apartments and houses on the primary* and secondary markets depending on location, as well as graphs with price dynamics from 2020 to Q3 2024 according to the Lithuania State Enterprise Centre of Registers.

* — in accordance with the Lithuania State Enterprise Centre of Registers, the primary market includes transactions concluded with objects no older than 2 years after commissioning.

Average price of apartments on the primary market in Q3 2024

|

Location |

Average price, EUR/sq.m |

Change to Q2 2024 |

Change to Q3 2023 |

|

Vilnius |

2749.8 |

-7.8% |

+3.8% |

|

Large cities (except Vilnius) |

2296.3 |

-5.1% |

+1.0% |

|

Other cities and rural areas |

1660.5 |

+0.3% |

+9.1% |

Average price of apartments on the secondary market in Q3 2024

|

Location |

Average price, EUR/sq.m |

Change to Q2 2024 |

Change to Q3 2023 |

|

Vilnius |

2805.1 |

+7.1% |

+7.5% |

|

Large cities (except Vilnius) |

1521.8 |

+1.6% |

+7.0% |

|

Regional centers (except large cities) |

878.9 |

+3.8% |

+11.0% |

|

Other cities and rural areas |

868.2 |

-7.2% |

+28.9% |

Average price of homes on the primary market in Q3 2024

|

Location |

Average price, EUR/sq.m |

Change to Q2 2024 |

Change to Q3 2023 |

|

Vilnius |

1749.4 |

-8.1% |

-12.8% |

|

Large cities (except Vilnius) |

1459.9 |

+8.8% |

-4.6% |

|

Other cities and rural areas |

1360.3 |

+0.7% |

+5.7% |

Average price of existing homes in Q3 2024

|

Location |

Average price, EUR/sq.m |

Change to Q2 2024 |

Change to Q3 2023 |

|

Vilnius |

2372.4 |

+41.8% |

+23.3% |

|

Large cities (except Vilnius) |

1176.5 |

-9.4% |

-9.5% |

|

Regional centers (except large cities) |

520.0 |

-7.5% |

-22.3% |

|

Other cities and rural areas |

556.1 |

-6.3% |

+13.4% |