What will happen to the economy and real estate prices in Greece in 2023? Economic Outlook

Not so long ago we wrote that Athens is the cheapest capital of Europe in terms of housing costs. It is interesting that for a long time, the cost of housing in Greece was nominally growing, but the inflation rate «ate up» the real growth, and as a result, we saw not an increase in prices per square meter of housing, but their decline. That is why it is interesting to see the economic outlook for Greece: what is going on now with the economy of the country, which since the 2000s has already gone through two crises.

What happened to the Greek economy in 2022

In the first half of 2022, Greece was showing fairly rapid economic growth — about 7.8%. However, by the end of the year, the situation had changed, and the growth of the economy slowed down significantly. The main reason for this slowdown is considered to be high inflation and rising energy prices. The government has already developed an economic recovery and support plan, which includes large-scale government support measures. This should mitigate the impact of high inflation on businesses and the real disposable income of households. Such support will be in place until the end of 2023.

Despite rising inflationary pressures and a lingering energy crisis, the economy showed a solid growth rate of 7.8% in the first half of the year compared to the same period last year. The buoyant tourist season and exports of services contributed to the growth. The good news was that merchandise exports continued to grow despite the difficult international environment. The labor market continued to create jobs, but at a slower pace, with the unemployment rate dropping to 12.2% in August.

Greece’s economic outlook for 2023-2024

Experts believe that exports of goods in Greece will slow down in 2023, but a similar situation will be observed in the European and global economies. However, tourism will remain resilient, as this sector is expected to continue to benefit significantly from high-income countries. Overall, real GDP growth is projected at 6.0% in 2022 and 1.0% in 2023.

As the external environment slowly improves and inflation declines, the Greek economy is expected to show stable growth in the second half of 2023. The outlook for 2024 is similarly optimistic, with the Greek economy expected to grow moderately (up to 2%). This state of affairs will be facilitated by a gradual recovery of private consumption and improved external demand.

At the same time, the abandonment of pandemic restrictions and the gradual recovery of the economy will reduce the overall government deficit to 4.1% in 2022. It is expected to fall to 1.8% of GDP in 2023.

What’s going on in the Greek real estate market

Statistics from the EU administration have shown that Greece has set an anti-record in the real estate market. Between 2010 and mid-2022, the cost of housing in the country fell by 22.5%.

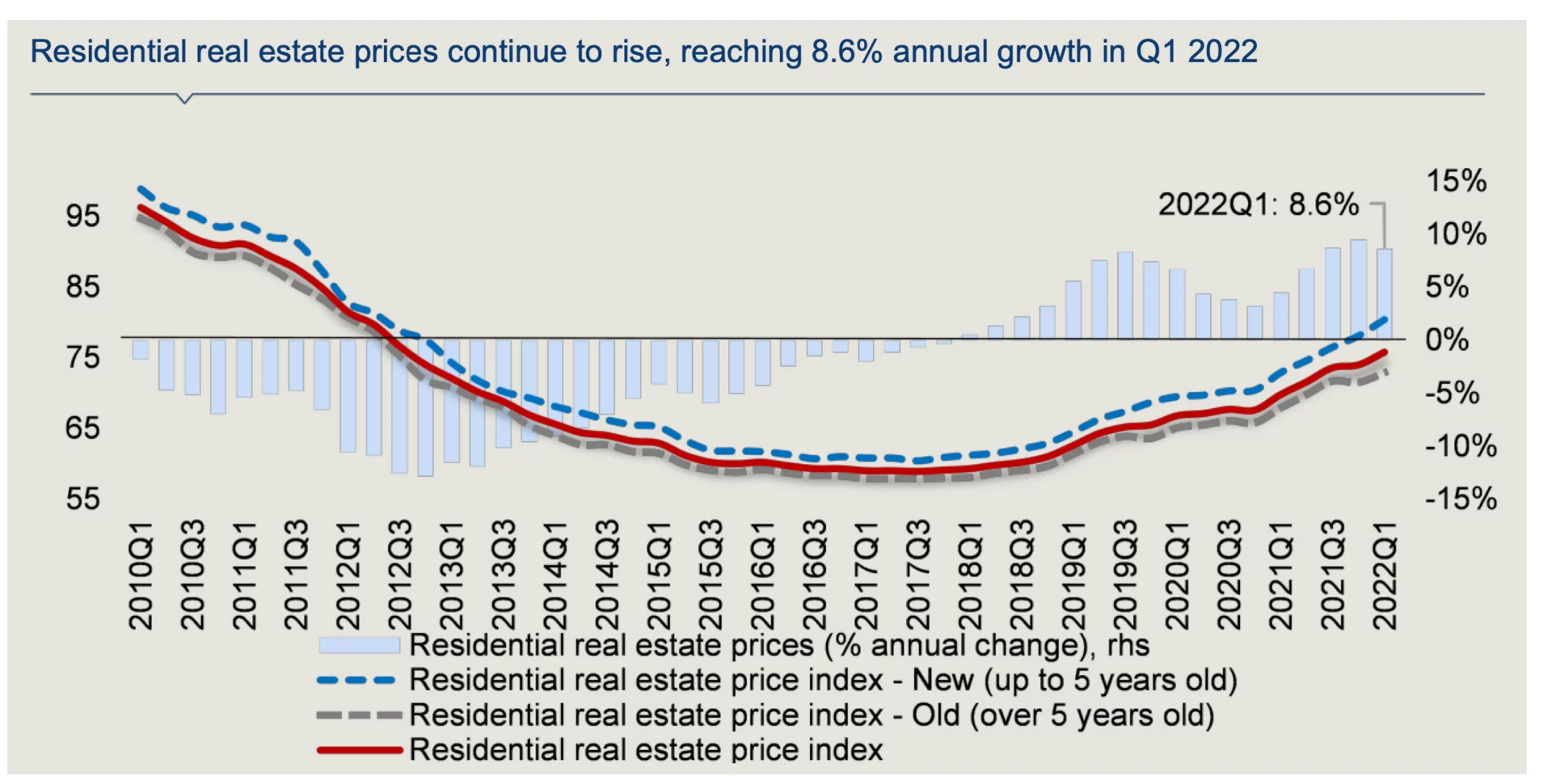

According to the Bank of Greece, the fall in real estate prices slowed in 2017, and already in 2018, the growth in the cost of a square meter was about 1.8% (compared to 2017). Over the next two years, the real estate market rose, even despite the Covid-19 pandemic.

Fighting inflation and rising interest rates have led to a steady rise in real estate prices in Greece since 2021. Over 2022 the cost of a square meter in the country increased by about 8-10%.

Preliminary data Alpha Bank for the first quarter of 2022 gives a positive picture of the domestic real estate market. Real annual growth in housing investment was 18.6%, and nominal residential real estate prices were up 8.6% year over year.

The cost of a square meter in different cities of Greece according to the portal Numbeo.com:

- Athens — on average €2,400-2,480.

- Crete — €2,500-2,750.

- Rhodes — €1,670-2,330.

- Corfu — €1,1660-1,830.

- Thessaloniki — €1,600-2,200.

- Corinth — €600-720.

According to the Central Bank, the share of foreign investors in the real estate market in 2022 has increased by 60% compared to the same period last year (investment amount of about 1.28 billion euros).

Sourse: Alpha Bank

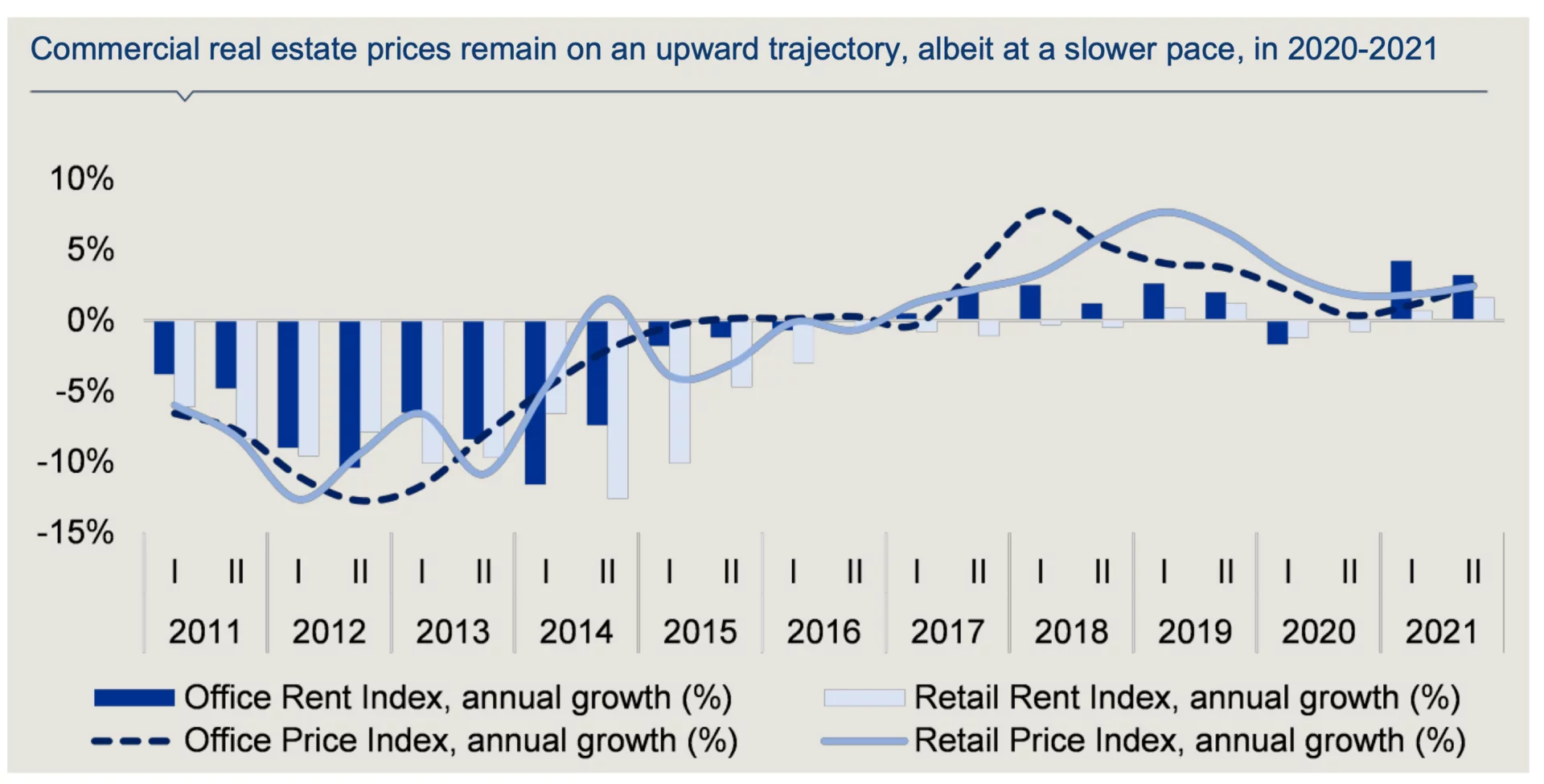

As for luxury commercial real estate, according to Alpha Bank, price growth has continued over the past two years, albeit at a slower pace compared to the period before the pandemic began. Interestingly, since the commercial real estate market began its recovery from 2017-2020, luxury office price growth has outpaced rent growth. In 2021, this trend reversed as office rent growth (3.7%) outpaced office price growth.

Sourse: Alpha Bank

Market experts at the same time emphasize the positive trend of growth, which became evident in 2022.

— The prognosis for further developments in the Greek real estate market is only optimistic. Local residents have noted that the standard of living in Greece has improved markedly over the past 3 years (after a protracted crisis within the country). We have seen a surge in demand for land and real estate in Greece. But at the same time, you should remember that prices are constantly going up. If you want to make a profitable investment, you need to make a decision in time and buy a profitable property, — says real estate agent Kara Manukyan.