Housing prices are falling, but the problem is not solved — the number of homeless people is rising. Analysis and trends in the Australian real estate market over 10 years. Analytics from REALTING

Australia’s real estate market has been dynamic and vibrant for 10 years. However, by the first quarter of 2023, most of the states are in recession. Is the real estate market in Australia facing a "black streak?" And how will it affect social problems?

Impact of the pandemic, legislation and public policies on the housing market

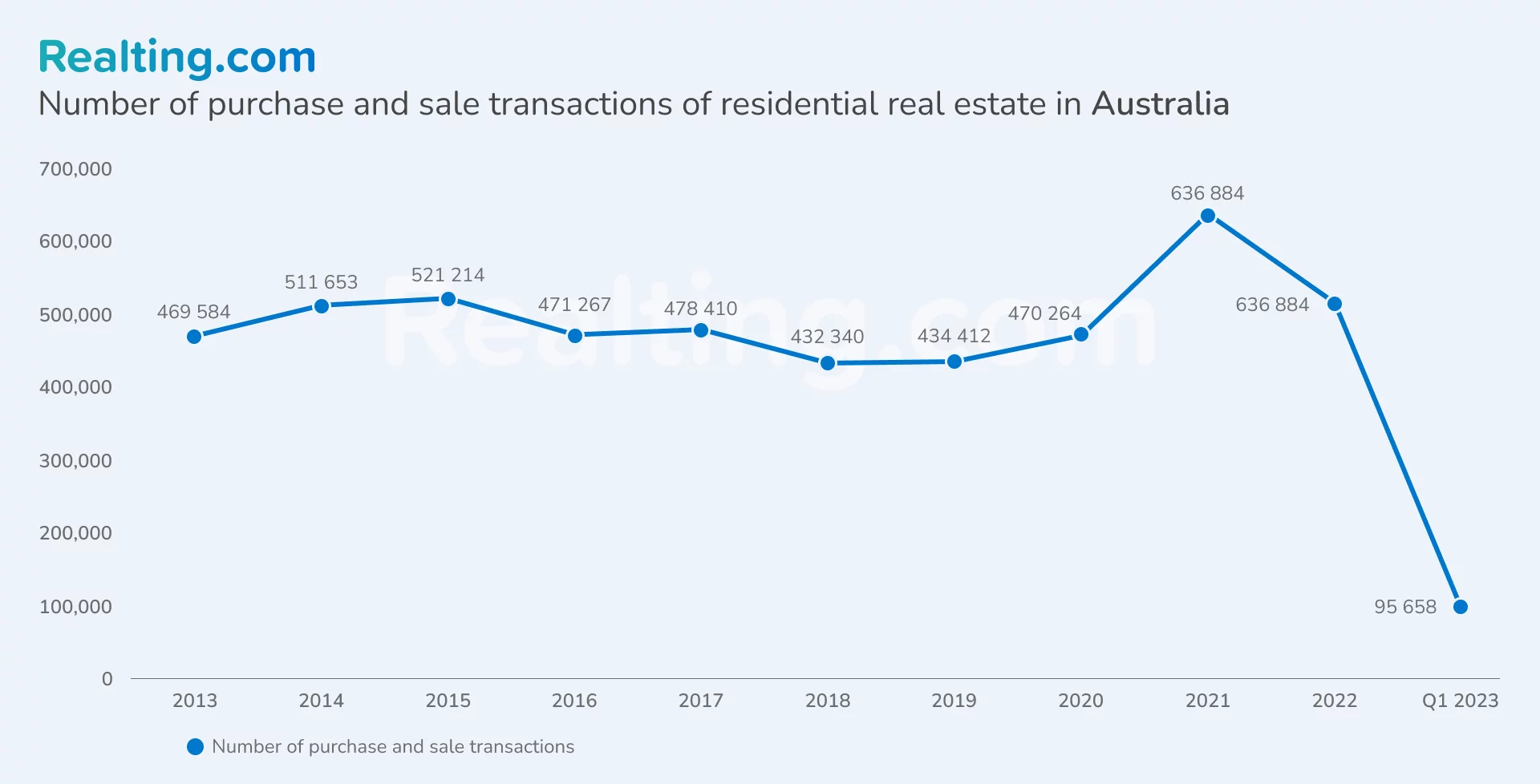

According to the Australian Bureau of Statistics, in the first quarter of 2023 there were more than 95 thousand transactions in residential real estate in Australia. In the first quarter of 2023, the Australian Bureau of Statistics reported more than 50,000 residential real estate transactions. The number of transactions in the current year exceeded the value of 1Q 2022 by 12%.

In general, the Australian real estate market can be characterized as active, with high demand for housing in cities such as Sydney, Melbourne, Brisbane.

It is worth noting the fall in the number of transactions in 2016 by 10% — then the reason for this was the introduction of restrictions on foreign investment in residential real estate. These restrictions included raising tax rates on rental income for foreign tenants, imposing limits on the number of new properties that can be purchased by foreign investors, and introducing a permit purchase system (Foreign Investment Application Fees), which requires foreign investors to pay an amount (from $4,200) for considering their real estate applications.

In 2017, there was a slight increase in sales by 2%, and in 2018, tighter credit terms led to a 10% decrease in real estate transactions. As a result, 2018 has delivered antiecord on the number of transactions made for 10 years. Slightly more than 432 thousand registered transactions of purchase and sale of housing.

The coronavirus pandemic has not had a negative impact on the number of transactions in the real estate market, and in 2020 the total number of transactions increased by 8%, while the structure of real estate demand has changed. The most obvious growth occurred not in large cities (such as Sydney, Melbourne, Brisbane, etc.), but in the rest of the states. Thus, the sales of private houses (Established house*) outside the major cities increased by 18%, and the sales of apartments (Attached dwellings**) by 15%.

*Established house – detached residential construction on private land plot.

**Attached dwellings – flats, units and apartments, as well as semi-detached houses, row houses and houses with terraces.

In 2021, the number of transactions increased significantly: +35% compared to the previous period, and, as a result, more than 630 thousand transactions per year and the highest figure for 10 years. The number of transactions in the Russian Federation increased.

Although the pandemic has not had a significant impact on Australia’s property market, the Australian Government has introduced a number of policies and incentives to support the real estate market to mitigate the effects of the pandemic. For example, the HomeBuilder program was launched to encourage owners to repair or build new homes. The essence of the program was to provide financial assistance for the repair of existing and construction of new housing, incl. equity construction.

Houses are more popular and more expensive, but in 2023 they decreased in price more than apartments

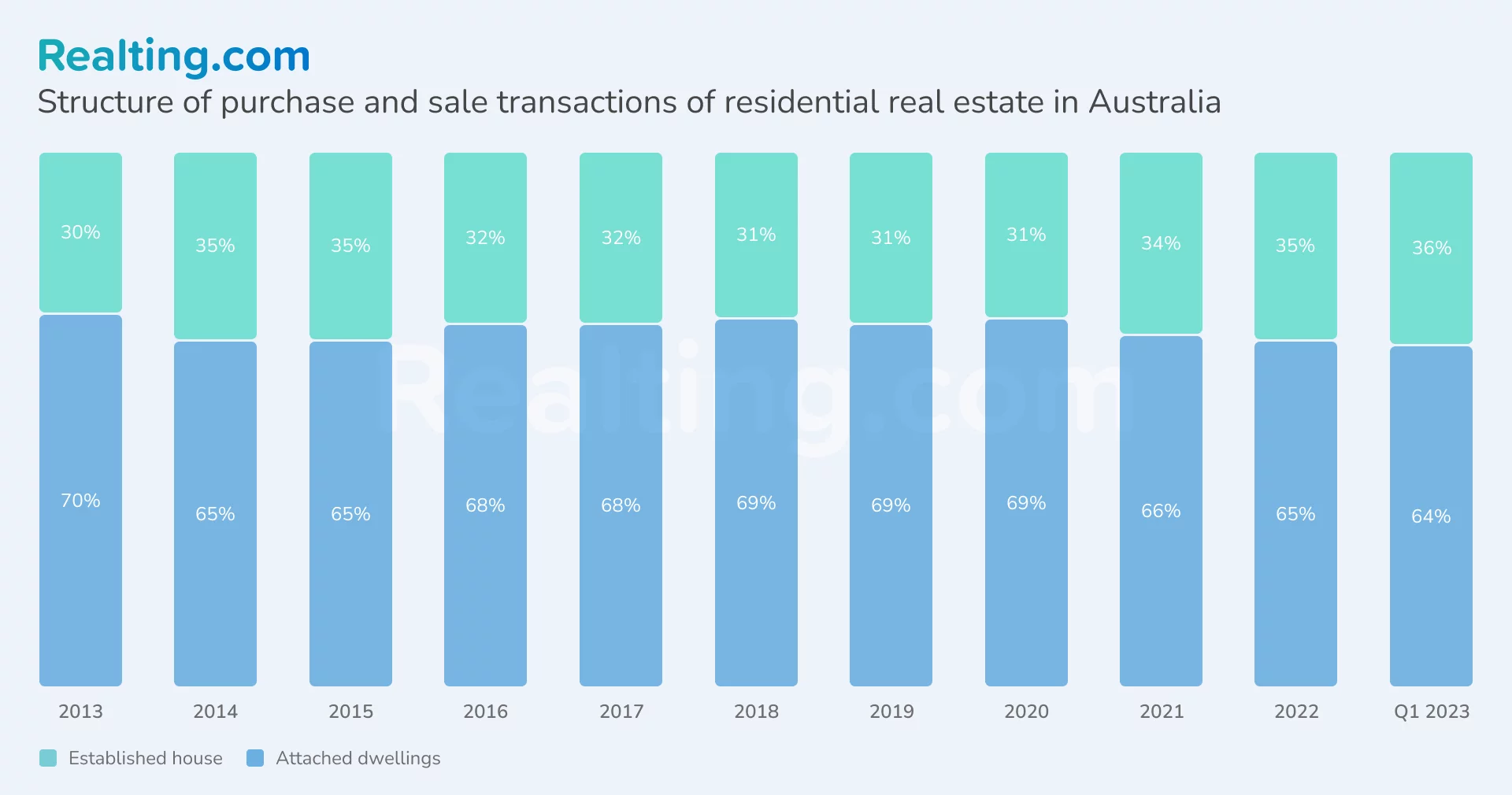

Considering the structure of the housing market by type of property for 10 years, buyers more often preferred private houses. At the same time, since 2021 more people began to buy apartments — the difference was on average 3 percentage points.

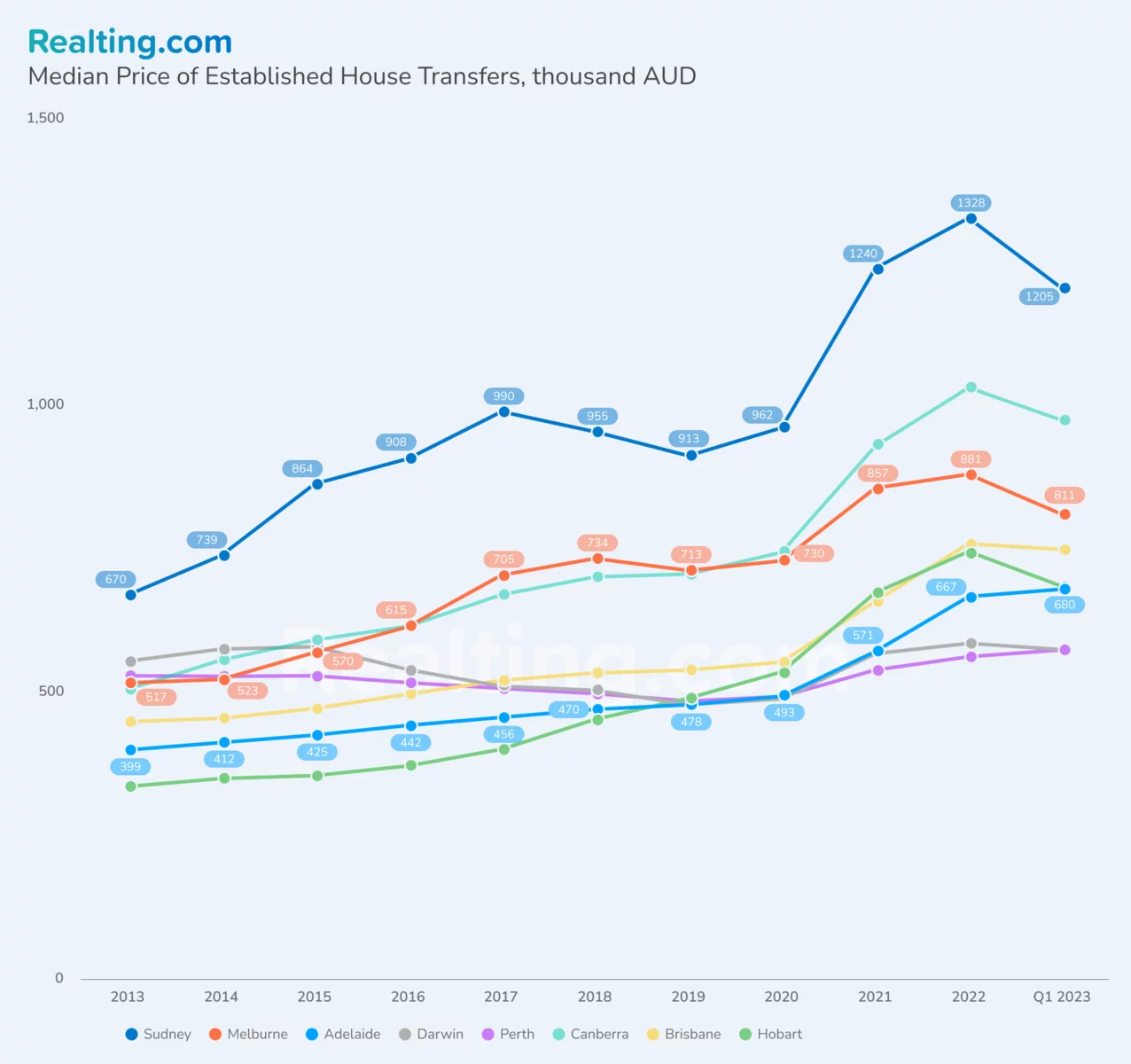

The highest average transaction price in the private sector among Australia’s eight largest cities in the first quarter of 2023 was $1,205,000 AUD (or $808,796 USD at the Reserve Bank of Australia rate of 31 March 2023). The average price fell by 9% compared to 2022, and compared to 2013, the average price rose by 1.8 times.

The capital of Australia, Canberra, takes the second place in the high cost of private housing. On average, the property here will cost $975 thousand. AUD ($654 thousand. USD). The average price for 10 years here has increased by 1.9 times. Hobart alone has shown more than double the increase over this period. At the same time, Hobart by the cost of 8 cities remains only in 7th place, and the TOP-3 closes Brisbane with an average cost of a private house of 750 thousand AUD ($503 thousand. USD).

It is possible to note the downward trend in the average price in the first quarter of 2023 in almost all major cities: the average price of private houses decreased most noticeably in Melbourne and Hobart — in both cities by 8%, and as a result, $811 thousand AUD ($544 thousand USD) and $685 thousand AUD (459 thousand) per property respectively. Brisbane and Darwin lost an average home price of about two percent, while Perth and Adelaide showed a slight 2 percent increase.

The most stable cities in the private housing segment are Darwin and Perth, with a 10-year price change of 4% and 8% respectively.

Private homes in state capitals are significantly more expensive than in the rest of the cities: in the first quarter of 2023, buying a house in New South Wales outside Sydney would be 42% cheaper, and buying a house outside Adelaide in South Australia was 44% cheaper. Victoria, Queensland, Tasmania, and Western Australia are on average 30% cheaper than their capitals. The smallest difference in the average price per house in the Northern Territory — the capital Darwin is 14% more expensive than other cities.

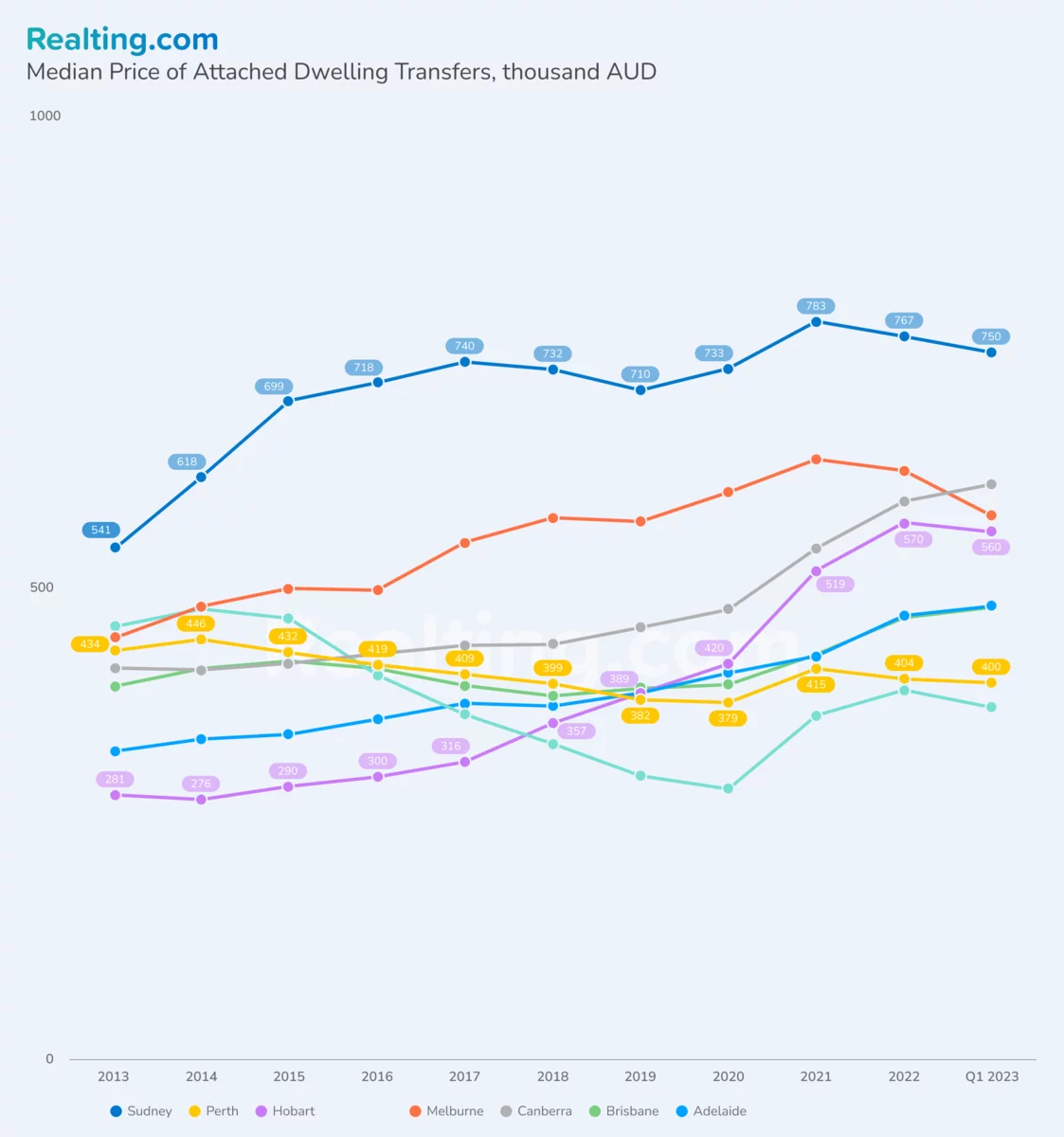

Buying an apartment in Australia – a cheaper option than a private home – on average 30%. The most expensive cities to purchase an apartment:

- Sydney $750,000. AUD ($503,000. USD),

- Canberra $610,000. AUD ($409,000. USD),

- Melbourne $577,000. AUD ($387,000. USD).

Average prices in this segment for Q1 2023 also have a downward trend: the largest drop in Melbourne - 8% and in Darwin - 5%.

Perth and Darwin - cities in which the average price for an apartment for 10 years has decreased. The fall in Darwin is more significant - by 19%, in Perth - by 8%. In the rest of the cities there is a growth, and the most noticeable in Hobart - 2 times, the average price for the total of 1 quarter of 2023 reached $560 thousand AUD ($375 thousand USD).

As in the segment of private houses, buying an apartment in the capital will cost more than in the rest of the state. The exception here is only Queensland - the capital of Brisbane in 2023 is on average 12% cheaper, a trend observed since 2018. It is also worth noting South Australia and Adelaide - the capital is more than twice as expensive - the average price of an apartment in the state is $240 thousand AUD ($161 thousand USD).

Mortgage in Australia — its features and impact on the market

Both in the segment of private houses and in the segment of apartments it is worth noting a significant increase in average prices in 2021. This is due to low mortgage rates as part of measures to mitigate the economic impact of the COVID-19 pandemic. This stimulated demand for housing, making mortgages more affordable and attractive to buyers.

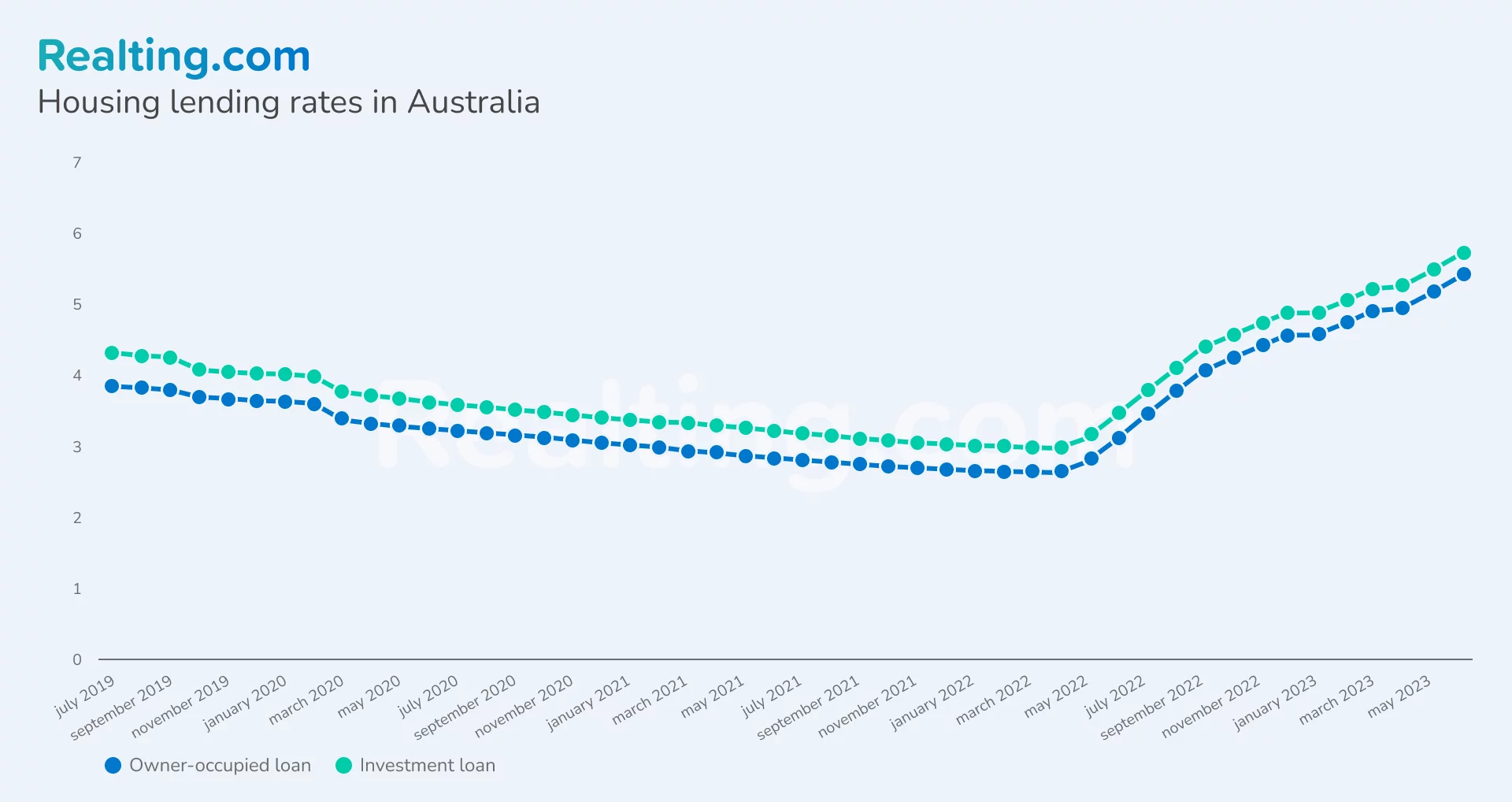

According to the Reserve Bank of Australia, below are rates on housing loans based on monthly declarations collected by APRA from banks and registered financial corporations since July 2019. These indicators are indicative and are likely to be reviewed regularly.

Until May 2022, mortgage rates were falling monthly due to the monetary policy of the Central Bank of Australia in response to the pandemic and its negative impact on the economy.

By the way, one of the features of mortgage in Australia is the purpose of the purchased real estate. Loans granted for the acquisition of real estate for the purpose of residence by the owner usually have more favorable conditions: mortgage rates are lower than in the case of investment real estate (since 2019 the difference is on average 0.36 p.p.), and the initial contribution is less (from 10%). Investment loan involves the acquisition of real estate for the purpose of renting it out and earning income.

The application process is similar in both cases: the bank carefully checks the solvency of the potential debtor, and in the case of investment real estate takes into account the income from leasing the property on which the money is borrowed, as well as the likelihood of an increase in its real estate value. Minimum amount: $100,000. AED, maximum term: 30 years. Lenders consider investment loans to be more risky and more stringent, respectively.

In casethe owner decides to rent out his housing, for which the mortgage is still paid, he is obliged to report this to the bank. In this case, the status of the loan will be changed to investment. Withholding of information can have potentially serious consequences.

Foreign citizens can also apply for a mortgage in Australia, but it is worth considering: a higher interest rate (from 8%), an initial contribution of at least 30% and that there is a restriction on the use of foreign income to repay the loan. You will also need approval from FIRB.

One out of every 200 people is homeless. What measures has the government taken?

Despite relatively affordable mortgages and various housing finance programs, Australia has long had a homelessness problem (these include people living in makeshift housing, tents or out-of-home accommodation, people living in specialized housing for the homeless, people living in temporary accommodation with other families, and people living in "heavily" overcrowded housing).

According to the Australian Bureau of Statistics in 2021, more than 122,000 people were homeless. Of these, 14% were under 12 years of age. The number of people in this status in Australia is steadily increasing. Compared to 2016, the number of homeless people increased by 5%, and compared to 2006 - by 37%.

The growing number of homeless people is a serious problem in Australia. The main cause of this problem is the inaccessibility of housing due to its high cost, both for purchase and for rental. In addition to the high cost, the reasons include insufficient social housing, as well as family and mental health problems. The lifting of restrictions following the pandemic has contributed to an increase in the number of migrant workers in the country, putting pressure on the rental market and triggering price increases. It is therefore likely that the problem of homelessness only worsened in 2022.

The First Home Owner Grant (FHOG) program, which consists of a lump sum payment of up to $10,000. AED for the purchase or construction of the first real estate, is not able to influence the solution of the problem of homeless people. The Australian government is currently developing the National Housing and Homelessness Plan, which will provide a 10-year housing policy strategy. The plan already includes measures such as: a 15% increase in payments to help low-income tenants, the construction of 30 thousand social and affordable homes (the budget of $10 billion AED), the provision of additional $67.5 million AED to states and territories, etc.

Australia’s real estate market has been growing steadily for 10 years. At the moment, Australian real estate is more affordable, however, it is still quite expensive. Extremely low mortgage rates in response to the pandemic have lowered borrowing costs and triggered a rapid market upturn. However, the May 2022 interest rate hike by the National Bank of Australia led to a downturn in the real estate market in all states of the country. It is obvious that mortgages have become more unaffordable, and that the fall in prices is not enough to solve the housing problem of many citizens. It is likely that the housing market will become more active as interest rates stabilize.

Author

Providing readers with quality analysis on global trends in the real estate market.