What are the risks? Expert on the values of country risk for real estate in Dubai

Before investing in this or that country, a competent investor always calculates the country risks. Nikolai Trifonov, an academician of the International Academy of Engineering, told about what it means and why the premium for country risk can be useful not only for investors but also for ordinary buyers of real estate.

Nikolai Trifonov is a full member of the International Academy of Engineering, a foreign member of the Russian Academy of Engineering, an Honorary Appraiser of the Republic of Kazakhstan, Ph.D. in Physics and Mathematics, teaches real estate appraisal at the Belarusian State Economic University, the author of manuals "The Valuation Theory» and «Comprehensive Real Estate Valuation». In 1994, he founded the Belarusian Guild of Real Estate Specialists, which united the largest private and state participants in the real estate market and privatization. In addition, he was one of the founders of the Western Real Estate Exchange. In 1996, Nikolai created and headed the public association "Belarusian Society of Valuers".

Nikolai Trifonov is a full member of the International Academy of Engineering, a foreign member of the Russian Academy of Engineering, an Honorary Appraiser of the Republic of Kazakhstan, Ph.D. in Physics and Mathematics, teaches real estate appraisal at the Belarusian State Economic University, the author of manuals "The Valuation Theory» and «Comprehensive Real Estate Valuation». In 1994, he founded the Belarusian Guild of Real Estate Specialists, which united the largest private and state participants in the real estate market and privatization. In addition, he was one of the founders of the Western Real Estate Exchange. In 1996, Nikolai created and headed the public association "Belarusian Society of Valuers".

UAE has a long-term issuer rating of «AA-»

The United Arab Emirates as a state includes seven emirates, but in terms of real estate development Abu Dhabi and Dubai are the most interesting. The UAE has a solid legal framework to protect investment. The volume of foreign direct investment (FDI) in the UAE is constantly growing, according to the UN Conference on Trade and Development (UNCTAD), in 2021 the UAE ranked 15th in the world (and 1st among the Arab countries) by the amount of attracted FDI.

One of the indicators of a country’s investment attractiveness is the country risk premium (CRP), usually calculated on the basis of the yield of government securities on world markets. The UAE issues long-term government bonds that are highly listed on all stock exchanges. Moody’s and Fitch have assigned the UAE government a long-term issuer rating of «Aa2» and «AA-» respectively. This rating level characterizes bonds of high quality with extremely low credit risk.

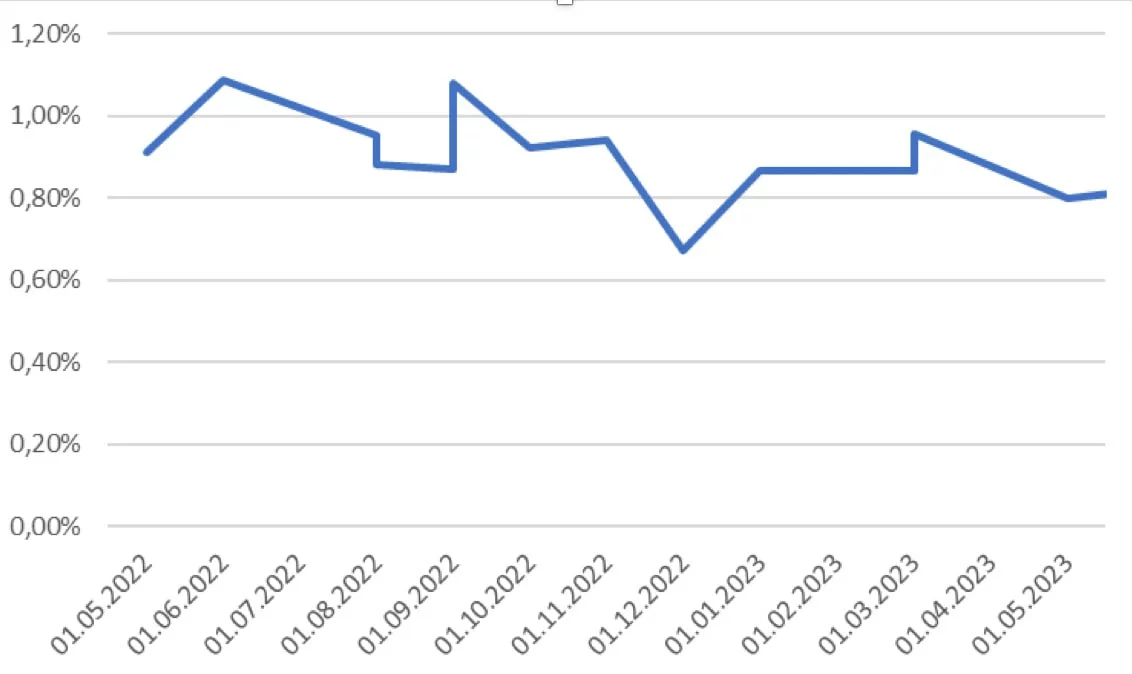

UAE country risk data for the last year

The financial center of the state is located in Abu Dhabi, where the international stock exchange, the financial futures exchange, the clearing house, and other financial institutions of the UAE are located. Based on all this, Abu Dhabi bonds were chosen to calculate the UAE country risk premium. Since the goal is to assess the investment attractiveness of real estate, the longest-lived securities were selected for the calculation so that their life span is comparable to the economic life span of real estate.

The study was based on the yield of the Abu Dhabi bond, issued in 2007 and maturing September 2, 2070 (!), which is denominated in U.S. dollars. Its Fitch rating is very high: AA.

The UAE’s country risk data for the past year are shown in the chart below. The resulting values are low, on the order of 1%, and tend to fall even further. As of May 1, 2023, for the UAE: CRP = 0.80%.

This is an extremely low value of country risk, characterizing the low probability of loss of property value (full or partial) as a result of general economic, financial, and socio-political factors present in the country, regardless of the property.