«Potential is higher than in European capitals». Country risk premium in Turkey

The Turkish real estate market for a few months seemed to be frozen — both buyers and sellers were waiting for the results of the presidential election. However, even now, when the election is over, the number of transactions is not growing that fast. It is important for most foreign investors to understand what forecast can be made on the market, and one of the most important indicators here is the country risk premium.

Nikolai Trifonov is a full member of the International Academy of Engineering, a foreign member of the Russian Academy of Engineering, an Honorary Appraiser of the Republic of Kazakhstan, Ph.D. in Physics and Mathematics, teaches real estate appraisal at the Belarusian State Economic University, the author of manuals "The Valuation Theory» and «Comprehensive Real Estate Valuation». In 1994, he founded the Belarusian Guild of Real Estate Specialists, which united the largest private and state participants in the real estate market and privatization. In addition, he was one of the founders of the Western Real Estate Exchange. In 1996, Nikolai created and headed the public association "Belarusian Society of Valuers".

Nikolai Trifonov is a full member of the International Academy of Engineering, a foreign member of the Russian Academy of Engineering, an Honorary Appraiser of the Republic of Kazakhstan, Ph.D. in Physics and Mathematics, teaches real estate appraisal at the Belarusian State Economic University, the author of manuals "The Valuation Theory» and «Comprehensive Real Estate Valuation». In 1994, he founded the Belarusian Guild of Real Estate Specialists, which united the largest private and state participants in the real estate market and privatization. In addition, he was one of the founders of the Western Real Estate Exchange. In 1996, Nikolai created and headed the public association "Belarusian Society of Valuers".

«In the coming weeks, pent-up demand is expected to implement»

The Republic of Turkey with its unique geographical location, and climatic and political conditions is of great interest for the purchase of real estate by foreigners, especially Europeans. In the spring there were various shocks in this country: firstly the devastating earthquakes in the south, and then the long-term two-round presidential elections. All this has slowed down all economic processes. According to data from the Turkish Statistical Institute TÜİK, in the first quarter of 2023, the number of home sales to foreigners decreased by 35.1% and amounted to 13,483.

But the period of uncertainty in real estate associated with the presidential election is over, the Turkish economic portal Emlakkulisi recently pointed out. In an interview published there, Omer-Faruk Akbal, Chairman of the Board of Directors of the International Association for the Promotion of the Real Estate GİGDER, analyzed the post-election situation of the sale of residential property to foreigners. He noted an increase in sales transactions and stated that the GİGDER experts expect in the coming weeks to realize the «pent-up demand», which will be expressed in $1.5 billion to Turkey as a result of these transactions.

Omer-Faruk Akbal also noted that the «premium» housing potential of cities such as Istanbul, Izmir, Ankara and Bursa (the latter being the fifth-largest settlement in the country in terms of housing transactions) is in fact higher than that of well-known European capitals such as Paris, London, and Berlin, which contributes to the growing interest in the residential real estate segment throughout Turkey.

Country Risk Premium in Turkey

One of the indicators of the investment attractiveness of the country is the country risk premium (CRP), usually calculated on the basis of the yield of government securities in world markets. The Government of the Republic of Turkey issues a wide range (more than 40) of long-term government bonds, with maturities ranging from July 2023 to May 2047. These «Eurobonds» are successfully listed on all stock exchanges.

Since the purpose of the study is to assess the investment attractiveness of real estate, the most long-lived securities were selected for the calculations so that their life was comparable to the economic life of real estate.

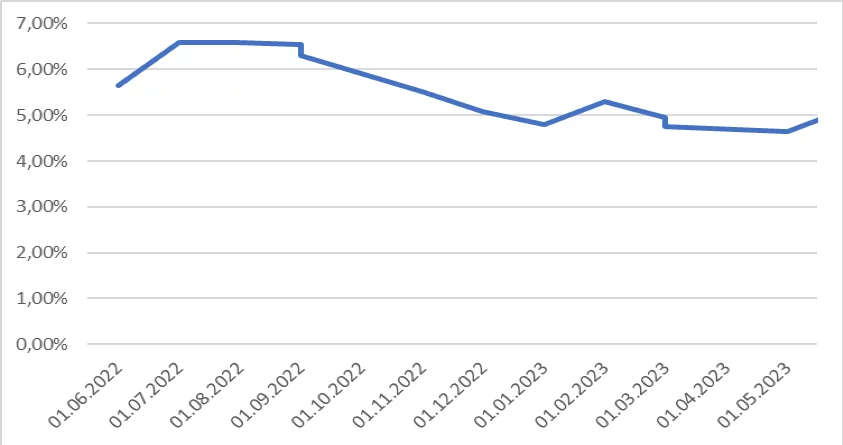

The calculations were based on the yields of the government bonds of the Republic of Turkey with maturities of April 16, 2043, February 17, 2045, and May 11, 2047, which are denominated in U.S. dollars. Data on Turkey’s country risk over the past year are shown below. The resulting values are quite low — around 5-6%, and they are trending downward. As of June 1, 2023 Turkey:

CRP = 5.12%.

This is a low value of country risk, characterizing the low probability of property loss value (full or partial) due to general economic, financial, and socio-political factors present in the country, regardless of the property.