Developer and Buyer Activity is at Historically Low Levels. REALTING's Analysis and Trends of New Buildings in Finland

A high standard of living and a transparent legal framework played a key role in shaping the Finnish housing market. Over the past few years, the Finnish real estate market has demonstrated gradual and relatively predictable development. However, the measures introduced to control inflation led to an increase in the cost of lending, which, in turn, began to affect the fall in demand. How such measures affected the volume of construction, the number of transactions and the price level read in the latest REALTING analytics.

Recession in construction. What influenced this?

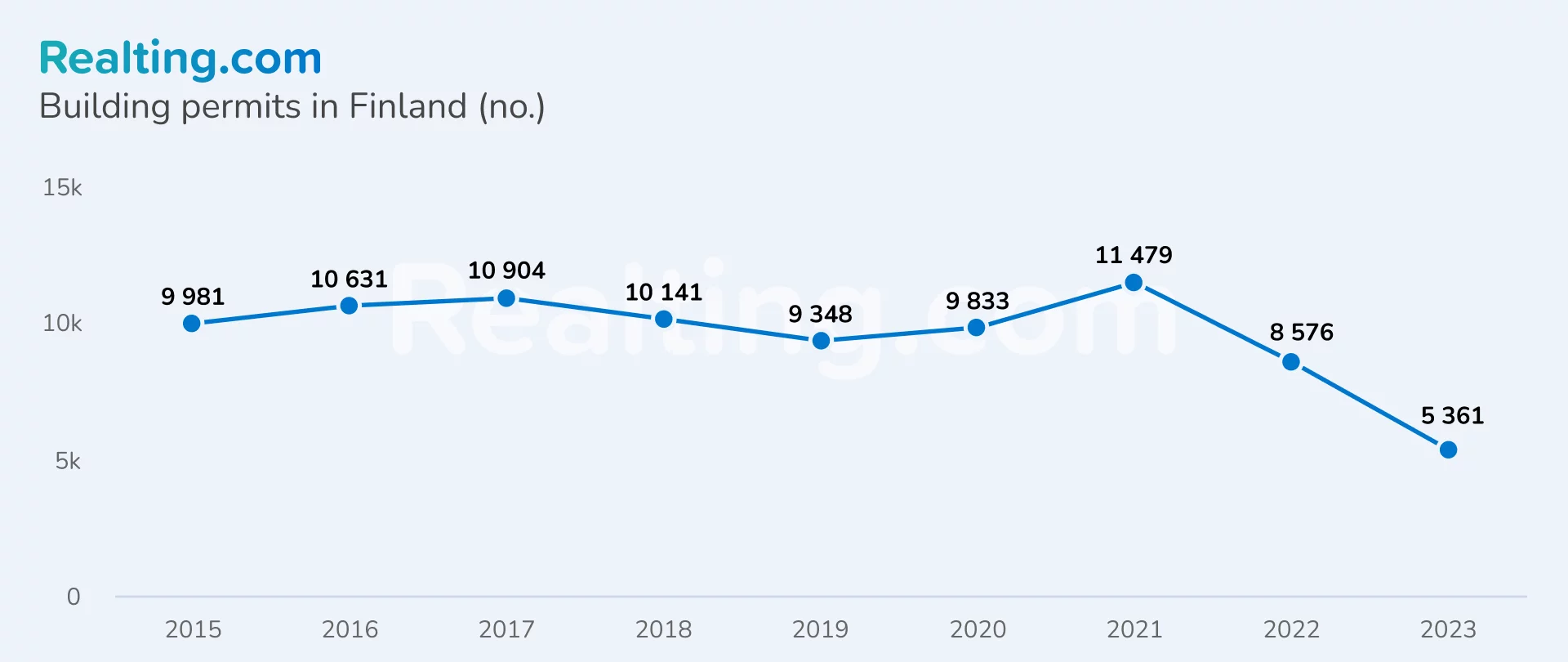

According to Statistics Finland, from 2015 to November 2023, more than 86 thousand permits were issued in Finland for the construction of detached, semi-detached and multi-family residential buildings* (including the construction of extensions, renovations and refurbishments comparable to the construction of a new building, building expansion or increase in area).

* - excluding permits for the construction of residential buildings in which residents have a common kitchen, living room or sanitary facilities, and residential buildings for persons with disabilities.

The number of building permits reflects the activity of developers, who, in turn, quickly monitor and respond to the changing needs of buyers. Thus, the indicator allows us to judge trends in the real estate market in the country.

Thus, in the period from 2015 to 2017, there was a fairly high level of activity in the construction of new housing: the number of permits increased annually — by 7% in 2016 and by 3% in 2017. One of the reasons for the growth in these years was the agreement on land use, housing and transport, signed by the government back in 2012. The cooperation is aimed at improving the functionality and competitiveness of urban areas, which means the balanced development of urban infrastructure, land use, housing and logistics.

The program provides support such as state-subsidized housing construction, support for repair work, and the development of wooden housing construction.

It is also worth noting that local governments can levy property taxes on vacant land if it is located in an urban planning area and is not used for residential purposes or is not under construction. The tax rate in this case will vary from 2% to 6%.

Such agreements were also signed for 2016-2019 and 2020-2031, including new regions.

In addition to government regulation, there has been a trend towards innovation in housing design and layout, as well as modern and energy-efficient solutions in construction due to rising energy prices.

The pandemic and restrictions on movement have led to increased demand for suburban real estate in 2020 and 2021. As a result, the number of permits for the construction of private houses has increased.

The most active period was 2021 — 11,508 permits. Although already in 2022, the activity of developers decreased sharply — by 25%. And 2023 showed the worst indicator for the entire period under review — 5,361 permits for housing construction, which is 1.6 times less than in the previous year and more than 2 times less than in 2021. The drop in demand led not only to a decrease in construction volumes, but also to the bankruptcy of Finland’s largest developers.

It is worth noting another feature regarding the construction of new housing — the reduction in the area of apartments and houses. At the moment, the average size of a living space is 40-60 square meters, while about a decade ago the average area was 80-90 sq. m.

Rising interest rates and decreasing number of transactions

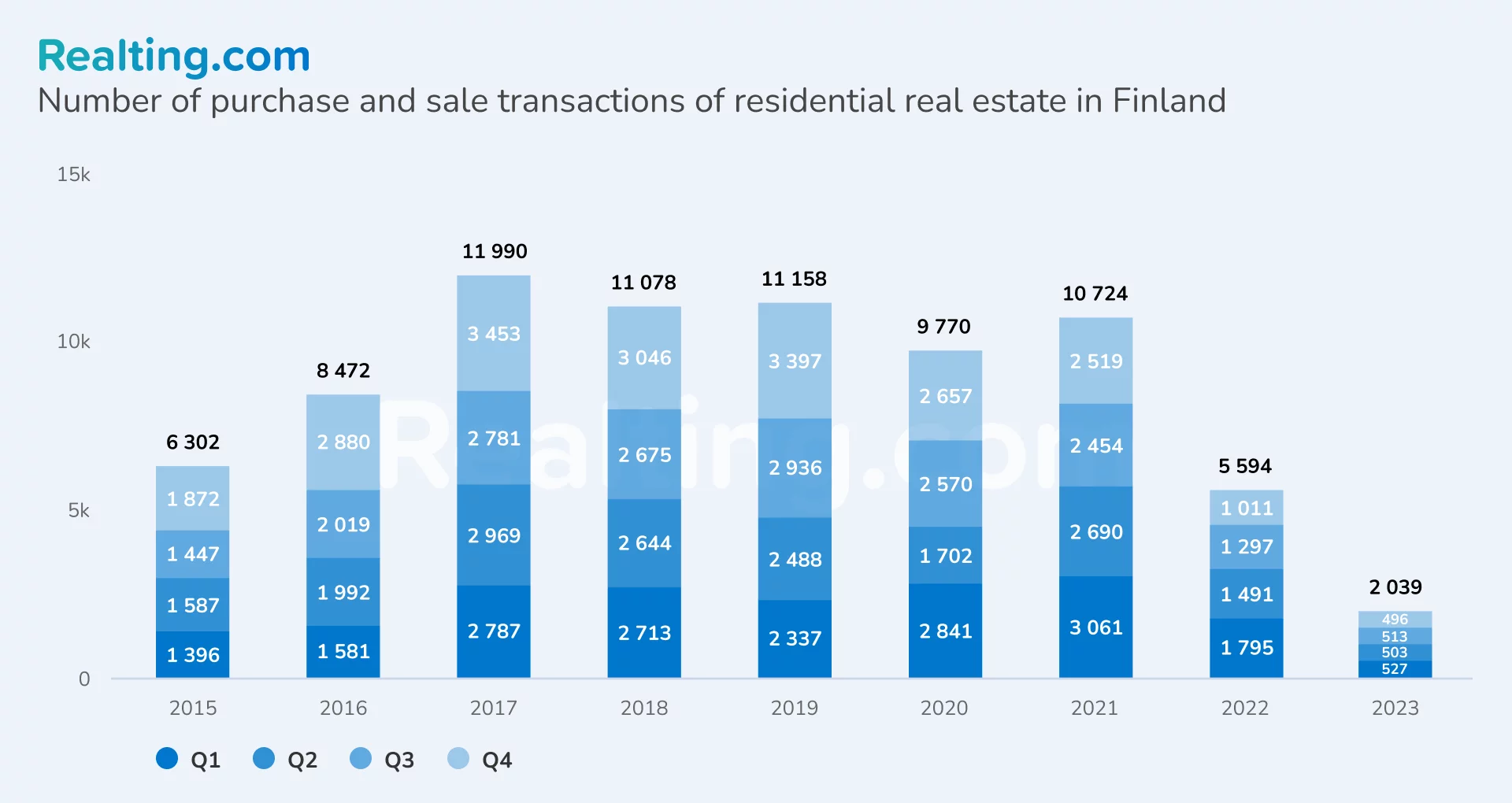

The period from 2016 to 2017 is characterized by an increase in buyer activity: the number of transactions with new buildings increased by 34% and 42%, respectively, and compared to 2015, the figure increased by 1.9 times. Before the 2020 pandemic, the market stabilized — the number of transactions remained at a high level — at least 11 thousand per year. Restrictions due to COVID-19 led to a decrease in the number of transactions by 12%. However, 2021 approached the level of the pre-Covid period — 10,724 sales transactions.

In 2022, there was a sharp decline in activity — people began to buy almost 2 times less housing in new buildings. And in 2023, the worst indicator was recorded for the number of purchase and sale transactions — only 2,039 transactions on the primary market, which is 2.7 times lower than in 2022 and more than 5 times lower than in 2021. The main reason for this: rising inflation and, as a consequence, changes in interest rates.

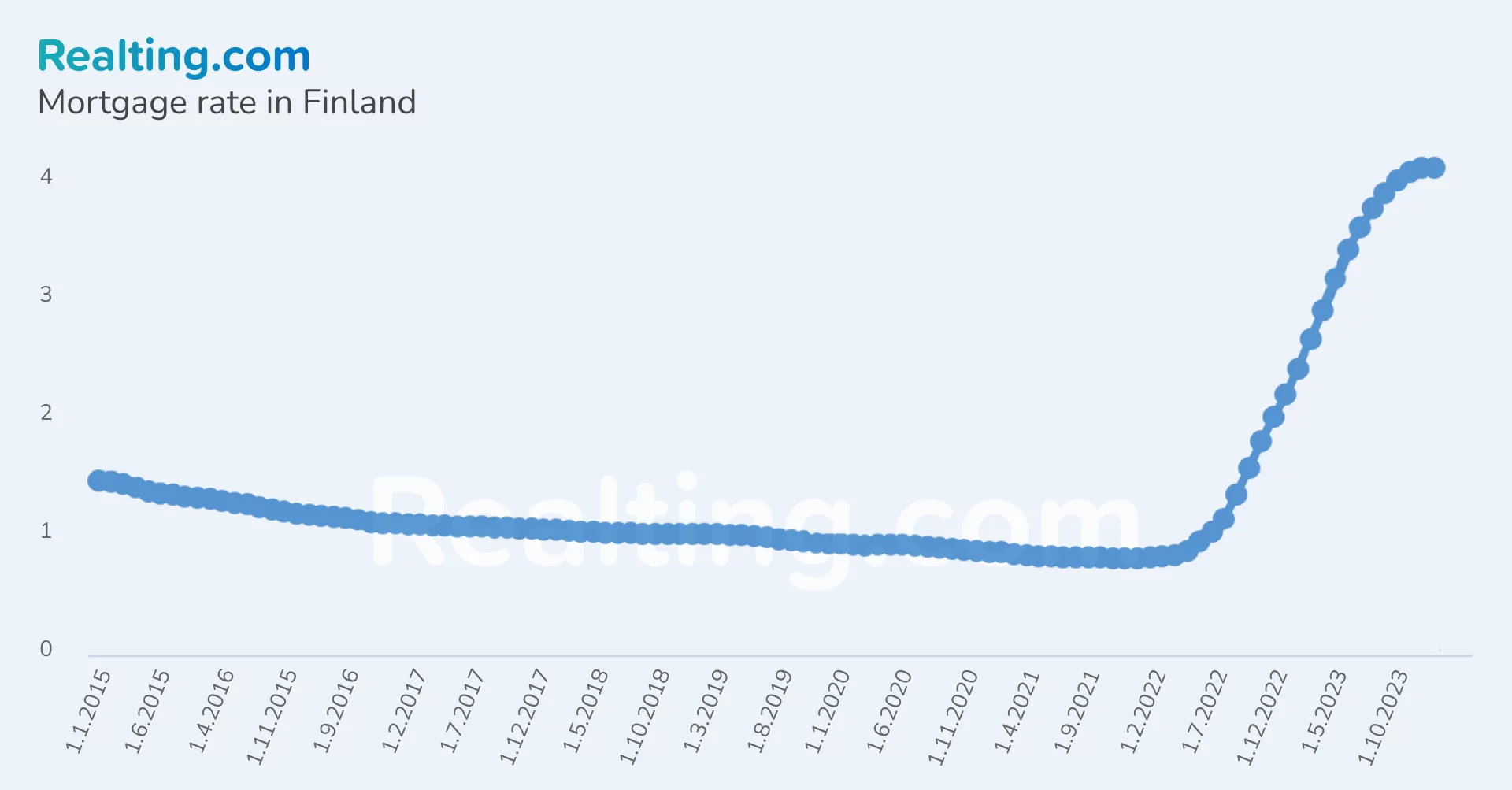

Rising interest rates since mid-2022 have significantly increased the cost of borrowing for consumers. Thus, in December 2023, the mortgage rate was at 4.1%; for comparison, since 2017, the interest burden has not exceeded 1%.

Touching on the topic of mortgages, it is worth saying that the conditions for lending for the purchase of a home in Finland are standard: the down payment ranges from 5% to 20% of the value of the property, the loan term is 25-30 years. The bank also evaluates the value of the property to ensure that the requested loan amount corresponds to the market value of the property.

Two-room apartments are most often purchased

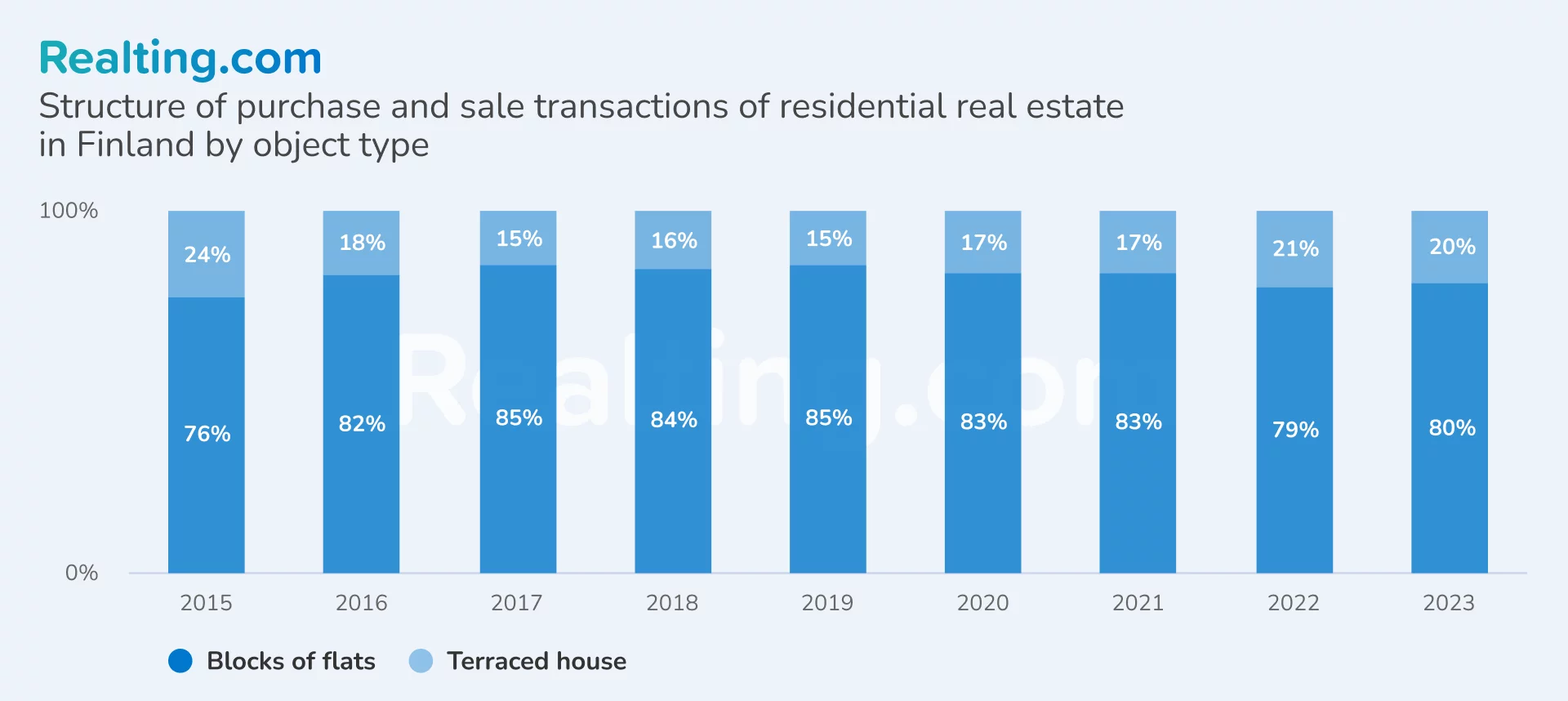

Considering the structure of transactions in the primary real estate market by type of property, we can say that since 2015, buyers have more often given preference to housing in multi-apartment residential buildings. The share of apartments in transactions was above 80% throughout the entire period under review, with the exception of 2015 and 2022 — then 24% and 21% of all transactions in the primary market were made with private houses, respectively.

By the way, most often two-room apartments were bought in new buildings in 2023 — they accounted for 42% of all transactions with apartments on the primary market. Next come three-room apartments — 33%, followed by one-room apartments — 25% of all primary transactions.

Firstly, owning a private house in Finland includes not only ownership of the building itself, but also the land on which it is located. Owners are required to maintain their property and comply with building codes and land use regulations.

Secondly, ownership of an apartment in an apartment building in Finland is usually carried out through housing joint stock companies. When purchasing an apartment, the future owner actually acquires shares that give the right to use a specific apartment. Owners are required to pay monthly fees for the maintenance and repair of common premises and infrastructure. They also have the right to vote at shareholder meetings, where issues of management and operation of the house are decided.

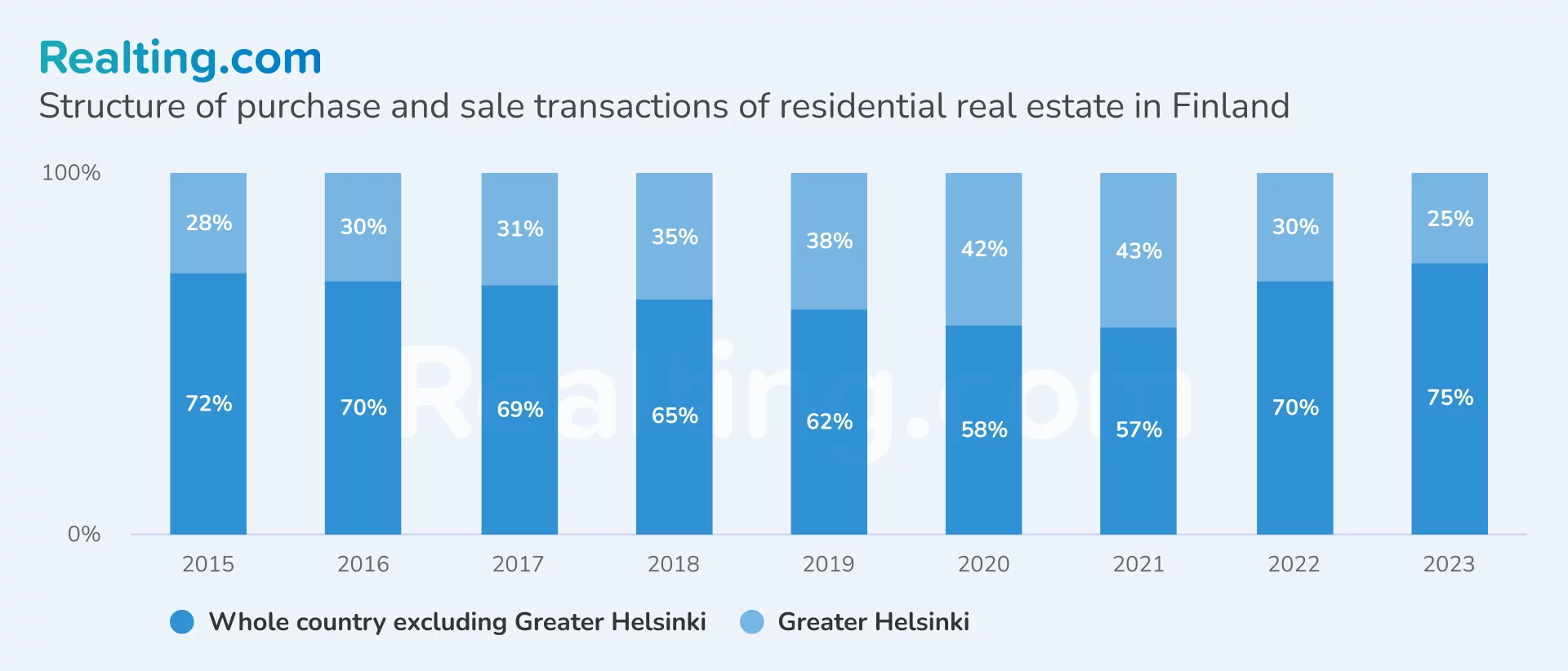

In 2020, real estate in the Helsinki region was in greatest demand — 42% of all transactions on the primary market. Subsequently, the share of transactions in this territory has steadily declined, reaching a minimum of 25% in 2023. The decline in the share of transactions in the capital region is due to several factors.

Firstly, looking ahead, we can say that Helsinki is the most expensive city in Finland in terms of housing. High prices discourage buyers, which leads to a decrease in the share of transactions.

Secondly, there is market saturation: the housing market in Helsinki has probably faced saturation after a period of intensive construction and development under the already mentioned government program. And the development of other regions stimulates activity outside the capital.

Changing preferences are also playing a role: there is a trend towards living in less congested and more affordable areas outside of major cities, especially in the context of the increased popularity of remote work.

Over 8 years, prices for real estate in the capital have increased by 32%

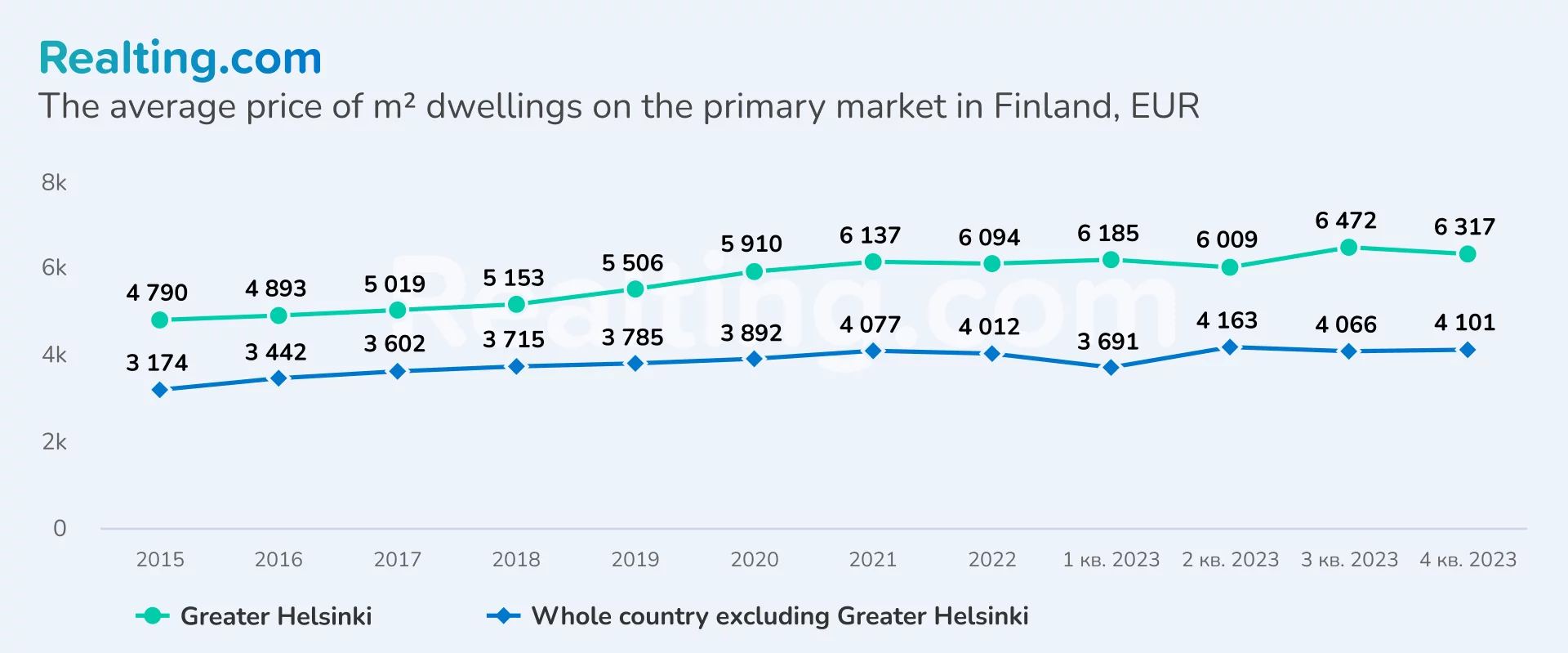

Throughout the period under review, the capital of Finland and its suburbs retain their status as the most expensive location in the country for purchasing housing. The price of primary real estate in Helsinki tended to increase until 2022.

At the end of 2022, there was a slight decrease of 1%, and the price settled at €6,094/sq.m. Fluctuations within 3% occurred until the 3rd quarter of 2023, then an increase of 8% was recorded. The result of the 4th quarter of 2023 is €6317/sq.m. Over 8 years, prices for real estate in the capital have increased by 32%.

The trends in the rest of the country until 2022 are in many ways similar to those in the capital. Since 2022, the regions have shown greater instability, especially in the 1st half of 2023. Thus, according to the results of the 1st quarter of 2023, the price decreased by 8%, and in the second quarter it increased by 13%. In the 4th quarter of 2023, the price of primary real estate in Finland excluding Helsinki was at €4,101/sq.m. Since 2015, the growth has been 29%.

It is important to understand that the increase in prices for primary real estate reflects not only the level of demand, but also the overall increase in construction costs, including materials and labor.

The primary market in Finland showed high sensitivity to the availability of financing — measures to reduce inflation, which led to higher borrowing costs, put strong pressure on both buyers and developers. High interest rates have already impacted the number of transactions, and the decline in housing construction activity may have an ambiguous effect on the market in the long term due to deteriorating housing affordability. And this will lead to an increase in the cost of both purchasing and renting housing.

Author

Providing readers with quality analysis on global trends in the real estate market.