The Cost of a Square Meter of Housing from $60 to $1800. Analysis and Trends in the Armenian real estate market

Armenia, a country with a rich history and beautiful nature, in 2022 began to attract not only tourists, but also expats and real estate investors. The real estate market is now experiencing a period of constant change and development due to government support measures and other legislative changes. Not the least role in identifying problems in the real estate market has played a wave of immigration into the country, exacerbating the problem of shadow renting, as well as making buying your own property in Armenia even more inaccessible for many citizens. REALTING analyzed how the housing market works in Armenia and what measures the government is taking in response to the dynamic changes.

Important: The analytics are based on data for 2017-2022. The situation has probably changed now, so it is even more interesting to understand how the market developed in previous years.

On High Mortgage Interest Rates and Lucrative Government Programs

According to the Statistical Committee of the Republic of Armenia, from 2017 to 2022, the number of real estate disposition* transactions in Armenia increased 1.5 times.

*Disposition—sale, gift, exchange, other.

In 2018, the number of such transactions increased by 20%, and in 2019 by another 13%. In addition to the improvement of the economic situation in the country and reduction of unemployment, changes in the program "Affordable Housing for Young Families" contributed to the growth of activity in the real estate market. The program, the essence of which is to provide soft loans to young families for the purchase or construction of their own housing, has existed since 2010 and in a few years began to need to update the conditions. In 2016, the government made the first changes: the maximum loan amount was increased—from AMD 16 million to AMD 25 million (as of January 2017, the amount increased ≈ from $33 thousand to $51.5 thousand), the total age of the spouses became 65 years old (while the age of each should not exceed 35 years), the down payment—10-30%.

Further in 2019, the terms of participation were made even more attractive: the maximum loan amount was raised to AMD 30 million (as of January 2019 ≈ $61.8 thousand), the loan term was increased from 20 to 30 years, and the down payment was reduced to 7.5% in the presence of other collateral real estate. The requirement that the age of each spouse must not exceed 35 years was eliminated. The main benefit of this program is a reduced interest rate: for primary market properties it is a maximum of 7.5%, for the secondary market - a maximum of 9.5%, another 2–4% (depending on the region) subsidized by the state.

By the way, despite the fact that in the last few years mortgage rates have been decreasing, they are hardly low, as for example in Spain or Lithuania, and the global practice of long-term rental is not in demand, which is confirmed by the dynamics of concluded rental agreements (from 2017 to 2022 the number of rental transactions increased by 12%). Therefore, the problem of housing provision is one of the most acute and topical, increasing the volume of issued housing loans. According to the data of the Central Bank of the Republic of Armenia, the monetary volume of issued mortgage loans for the purchase and construction of housing has increased by an average of 35% annually since 2017. In 2023, mortgage conditions on general terms are as follows: loan term up to 30 years, minimum down payment 10-30%, rates range from 9% to 19% per annum depending on the loan currency, bank and other conditions.

Since the beginning of 2018, there has also been an opportunity to refund income tax on mortgage payments. Such a program applies only to residential properties of the primary market and only for young families. The deduction can be used exclusively to repay the interest accrued on the mortgage loan, and a person can take advantage of such an opportunity only 1 time. It is possible to return no more than 1.5 million AMD per quarter (as of December 2022 ≈$3800). Moreover, already by the end of 2018, the government introduced a limit on the value of real estate—it can not exceed AMD 55 million (≈$114 thousand) due to the fact that such benefits have become a serious burden on the state budget of the country. For the same reason, another restriction was introduced in 2021—the program ceased to apply to the central districts of the capital, and by 2025 it will cease to apply to the entire territory of Yerevan. By the way, such tax incentives justify the expectations for the activation of the construction sphere.

Returning to the issue of the number of transactions in the real estate market, in 2020, as in many other countries, the Armenian real estate market was tested by the COVID-19 pandemic. Restrictions and uncertainty in the economy led to a decrease in demand and activity in the market. However, after a temporary lull, the market started to show signs of recovery from the second half of 2020 and into 2021. As a result, in 2021 the number of real estate transactions increased by 25%, in 2022 the market stabilized—+4% compared to the previous period.

By the way, in 2023, there was a probability that the activity in the Armenian real estate market would be influenced by the adoption of the bill on obtaining citizenship for investments. However, the program has not yet been approved.

Agricultural Plots are Most Popular, Private Houses in Penultimate Place

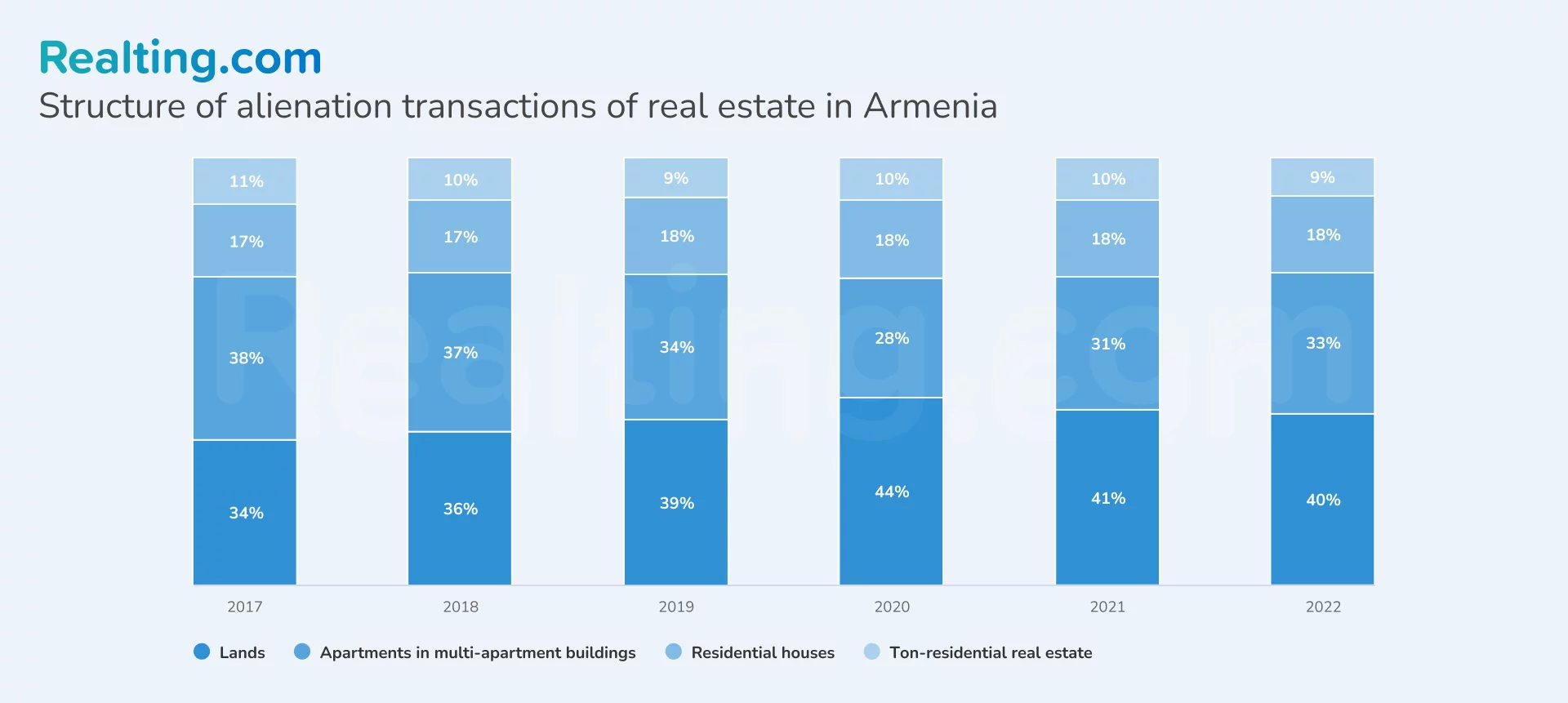

Land plots and apartments prevail in the structure of real estate alienation transactions. And for 5 years the share of land plots has become much larger—in 2017 34% of transactions were made with this type of properties, in 2022 already 40%. It is worth mentioning that more than half (58%) of land transactions were with agricultural land plots.

Apartments have become less popular over 5 years—as a result—minus 5 p.p. Private houses and non-residential real estate have the lowest number of transactions—18% and 9% respectively in 2022.

The Cost of a Square Meter in the Whole Armenia is Growing—in the Regions Faster than in the Capital City

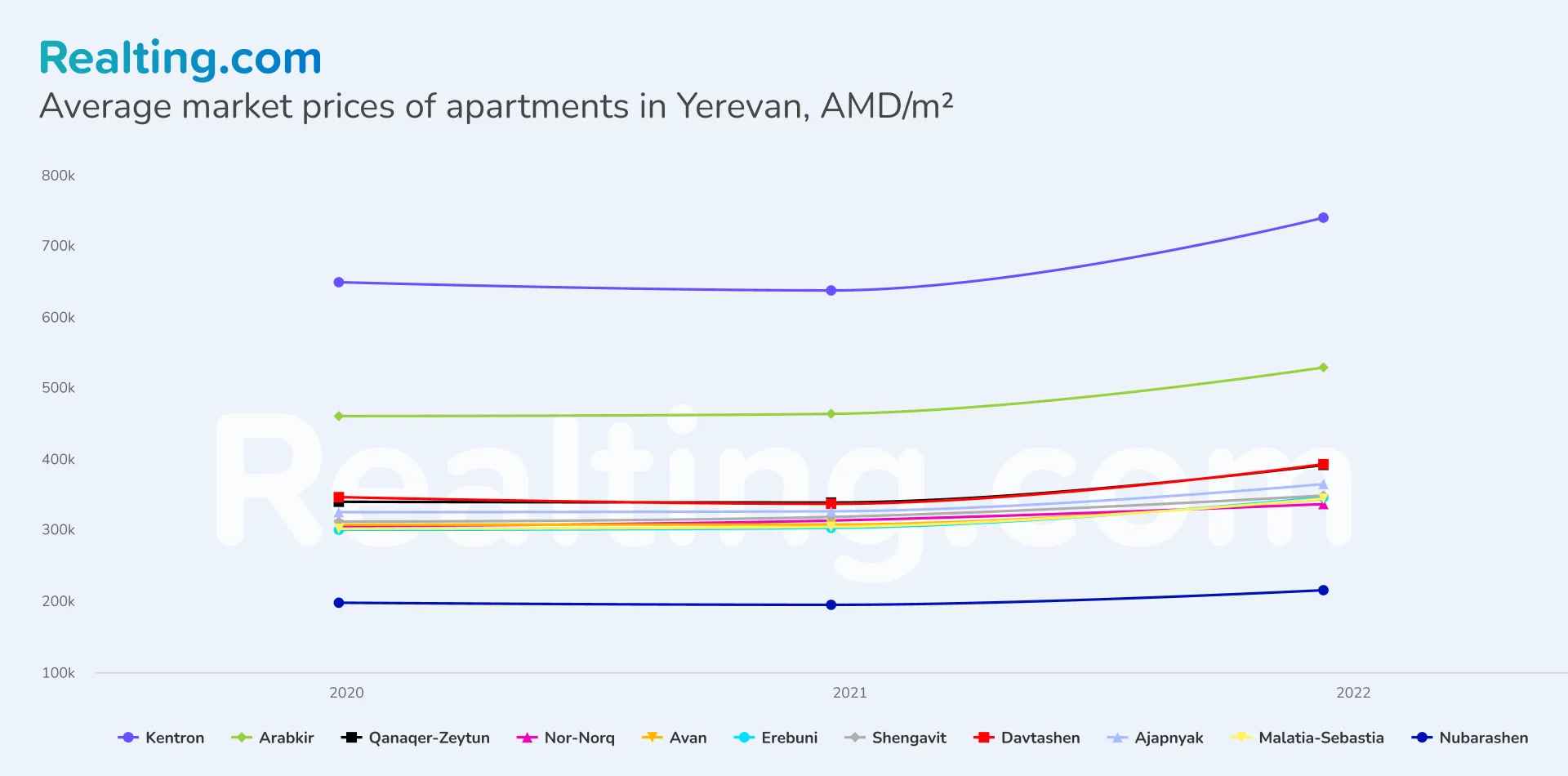

The spread of prices per square meter of apartment in Yerevan is quite large - the difference between the most expensive and the cheapest district in 2022 is 3.7 times. Moreover, such a gap between prices has only increased since 2020.

The most expensive districts are located in the center of the capital—Kentron and Arabkir—the cost of a meter in 2022 AMD 738 thousand and AMD 522 thousand respectively (as of December 2022 ≈$1880 and $1330 respectively). This gap is due to the reputation of these areas of the capital: Kentron is a historically significant part of the city with many attractions, Arabkir is a residential area with a loose building, well-developed infrastructure and an airport.

The districts of Kanaker-Zeytun, Nor-Nork, Avan, Erebuni, Shengavit, Davtashen, Ajapnyak, Malatia-Sebastia can be combined into one group—the average price of a meter ranges from 325 thousand AMD to 381 thousand AMD (≈from $830 to $970). The prices here are influenced by the peculiarities of each neighborhood: Avan, for example, is known for its comfortable neighborhoods, well-maintained parks and mountain views, although due to its location in the northern part many people note harsher weather conditions. Kanaker-Zeytun retains an authentic Armenian style, and also attracts with amusement parks, a botanical garden and quiet residential neighborhoods, but there are no subway stations. And Erebuni is famous for its historical sights. The Erebouni neighborhood is home to the fortress and museum of the same name. This neighborhood combines historical heritage with the modern look of the city, although industrial enterprises spoil the impression of this part of Yerevan.

The cheapest apartment is in Nubarashen—a meter in 2022 cost AMD 201 thousand (≈$510) on average. The reputation of the district is spoiled by the prison combined with a landfill and production facilities.

In 2021, compared to the "covid" 2020, prices in all districts of Yerevan fluctuated within 3%, and already in 2022 they increased noticeably—by 14% on average throughout the city.

Average prices per meter of housing vary greatly in the rest of Armenia. The lowest price since 2020 was maintained in Tumanyan, where no more than 2 thousand people live—in 2022 the price per meter was AMD 23 thousand (≈$60). Vardenis, Alaverdi, Tashir - cities where the apartment will also be very affordable - a meter is sold on average for 53-55 thousand AMD (≈$135-140). In Sevan, Vanadzor, Ararat, Armavir, Gyumri and Delezian real estate is more expensive - from 107 to 157 thousand AMD (≈$270-400) per meter respectively. The most expensive meter is in Tsakhkadzor—370 thousand AMD (≈$940). The high price, as in some districts of Yerevan, is due to the proximity to the capital—the city is located 50 km from the main city of Armenia.

The most significant price increase in the whole of Armenia occurred, as in Yerevan, in 2022—the maximum increase amounted to almost 30% in Vanadzor and Gavar. In other cities, the average price per meter became more expensive by 20%. The minimum changes compared to 2021 occurred in Meghri, Martini, Talin, Hayrum and Kapan - the increase amounted to 2%—10%, while in 2021 in all these cities except Kapan the prices tended to decrease.

This increase in prices across the country is obviously due to the increasing number of expats in Armenia, who have created an increased demand for residential real estate rentals. Yields for owners have increased during these periods, and there are more people willing to invest using the same model.

Changes in Tax Legislation—You will Have to Pay More, but not Immediately

Separately, it is worth mentioning the taxation of real estate in Armenia. Two things are interesting here.

Firstly, income received by individuals from renting out immovable property is subject to taxation. An individual is obliged to pay 10% of the income received from renting out real estate. And if the rental income exceeds AMD 60 million per year (as of December 2022 ≈ $153 thousand), then additionally will have to pay another 10% of the amount exceeding this threshold. However, in order to avoid paying this tax, not all lease agreements are registered officially. This is confirmed by the dynamics of rental transactions in the graph above—it is obvious that in 2022 the rental market should have become much more active due to the wave of immigration to Armenia. For this reason, changes in the Tax Legislation are likely to come into effect in 2024: in case of shadow renting, a fine of 5% of the cadastral value of housing will be imposed, and in case of repeated violation—10%. It is not yet clear what specific measures will be implemented to fix the fact of unofficial rental of real estate.

Second, in 2020 there were changes in the tax code, which are likely to increase the tax burden on citizens. Thus, property tax will be calculated based on the market value of property rather than the cadastral value (the market value of real estate in Armenia is several times higher than the cadastral value). The rates will remain at the same level—from 0.05% to 1%. The implementation of this mechanism will be carried out within 6 years: in 2021 the tax base was 25% of the market value and every next year will be increased by another 25% (i.e. the market value of the property in 2021 was multiplied by 25%, in 2022—by 50% and the final tax amounts were calculated from these amounts).

Given its economic development, tourism appeal and improved infrastructure, Armenia has the potential for growth in the real estate market. Government support plays a significant role in shaping and developing the industry. And the government of the country promptly responds to changes and problems in the real estate sector by adopting legislative changes aimed mainly at protecting the interests of citizens of certain categories, rather than investors. It is also worth noting the government's desire to stimulate activity in the real estate market in the territories outside Yerevan, which is the most developed and dynamic region in the country—the high demand for real estate is due to the availability of jobs, educational institutions, shopping and business centers, cultural facilities. The capital city is now restricted or excluded from many preferential programs.

With all of the above in mind, it is particularly interesting to see how 2023 will further impact the Armenian real estate market.

Author

Providing readers with quality analysis on global trends in the real estate market.