"The risks that real estate will depreciate are extremely small". Expert on country risk premium for Cyprus

Before buying a property in Cyprus (as, indeed, in any other country), an experienced investor will always examine the relevant indicators of the country risk premium. For Cyprus, the annual country risk premium fell from 9% to 1.9%. Read more in the article.

Division of Cyprus caused an economic recession, but the situation is improving

The Republic of Cyprus is an island State in the eastern Mediterranean. About a third of it was proclaimed about half a century ago by the Turkish Republic of Northern Cyprus, recognized only by Turkey. Since 2004, there has been a United Nations plan to unite the Cypriot republics into a single state. The capital of both is the city of Nicosia, divided by the so-called green zone, which is a border almost free to cross. The Republic of Cyprus joined the European Union and the euro zone, but did not enter the Schengen area.

The division of the Greek-speaking and Turkish-speaking parts of the island has caused an economic recession that is now being effectively addressed. Recent financial reports show steady growth in key indicators, stability and successful development. The Republic of Cyprus has chosen to grant foreign investors the right to obtain Cypriot citizenship as one of the solutions to its economic and financial problems. A resident of any country and a representative of any religion can easily invest in real estate in Cyprus. Investment in real estate in Cyprus can generate income on a monthly basis when rented out, as well as a net gain

Unlike most European and Middle Eastern countries, the Republic of Cyprus has demonstrated stability and successful development.

Country Risk Premium for Cyprus

One indicator of a country’s investment attractiveness is the country risk premium (CRP), usually calculated on the basis of the yield of government securities on the world markets. The Government of the Republic of Cyprus issues long-term government bonds maturing on April 13, 2033, denominated in United States dollars. These «Eurobonds» are successfully listed on all stock markets.

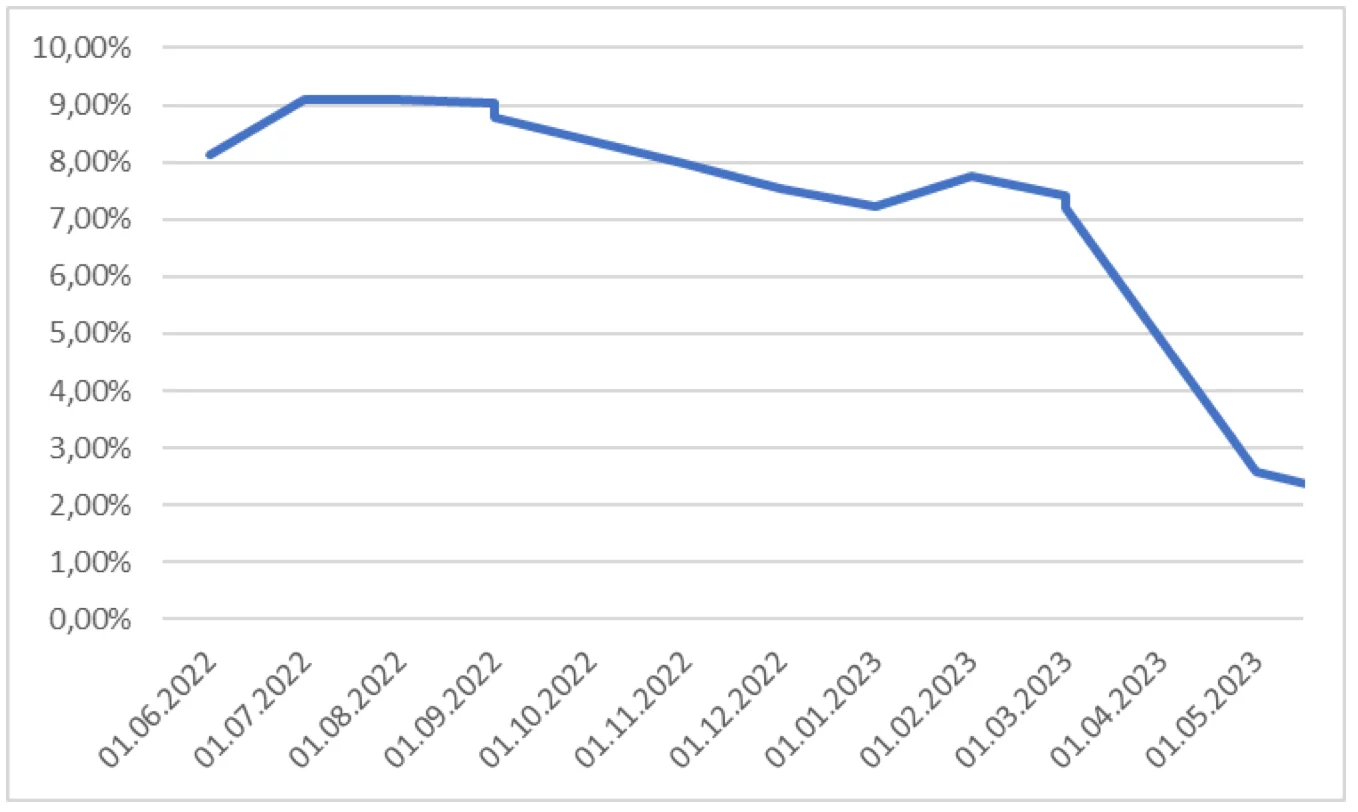

The calculation of the country risk of the Republic of Cyprus was based on information about their profitability. The figures for the country risk premium of the Republic of Cyprus for the last year are shown in the graph below. The values show a steady downward trend. As of 1 August 2023 for Cyprus:

CRP = 1,90%.

This is a very low value of country risk, with a very low probability that the property will lose its value (wholly or partly) as a result of economic, financial and socio-political factors in this country regardless of the property type.

Author

Prof. Nikolai Trifonov is the Fellow of Royal Institution of Chartered Surveyors, the Full Member of the International Academy of Engineering, the Foreign Member of the Russian Academy of Engineering, the Honorary Appraiser of the Republic of Kazakhstan, teaches real estate appraisal at the Belarusian State Economic University, the author of manuals "The Valuation Theory" and "Comprehensive Real Estate Valuation". In 1994, he founded the Belarusian Real Estate Guild, which united the largest private and state participants in the real estate market and privatization. In 1996, Nikolai created and headed the public association "Belarusian Society of Valuers", which is a member of International Valuation Standards Council (IVSC). In the period 1998-2005 Nikolai was elected and reelected as Board Member of European Real Estate Society (ERES), Director at Large – Responsible for Central & Eastern Europe.