Prices are rising too fast. Singapore doubles property tax for foreigners

Singapore has doubled the property tax for foreigners. The rate hike comes into effect today.

The Singapore government is increasing the stamp duty for property buyers. For foreigners buying any home, the tax rate is doubled to 60% (from 30%).

Brandon Lee, an analyst at Citigroup Inc., said the rate hike for foreign buyers is “draconian,” but the measures were not a surprise. “We expect it to have a negative impact on homebuilder stocks.”

The additional stamp duty will also be increased:

- for Singapore citizens purchasing a second home, from 17% to 20%;

- for citizens purchasing a third or subsequent home, as well as permanent residents purchasing a second residential property—from 25% to 30%;

- for legal entities or trusts purchasing residential property, excluding home developers—from 35% to 65%.

Singapore is increasing property purchase taxes to reduce the heat of the housing market as the influx of wealth into the city-state affects the affordability of housing for locals and Singapore's competitiveness as a financial center.

During the pandemic, supply shortages and rising construction costs drove up prices and rents. By the end of last year, Singapore had overtaken New York City in the rate at which rents were rising and ranked first in the world. Over the year, the cost of rent rose by 43%.

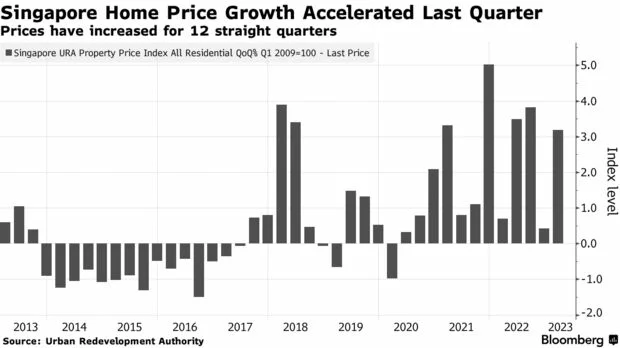

Note that earlier, in December 2021, Singapore had already raised taxes and, in September 2022, tightened limits on home loans. The effect of these measures has been seen, but last quarter saw “new signs of acceleration” in prices amid stable demand. In addition, earlier this year, the government raised taxes on luxury property buyers.

According to Citigroup, the rate of price growth will eventually slow to 2% but won't go down as long as the labor market is stable. In the first quarter, home prices rose 3.2%.

Author

I am responsible for editorial work. I write expert interviews and guides.