There are no reasons for the market to revive yet. Analysis and trends of the UK property market. Analytics from REALTING

The UK is a country that offers a lot of opportunities: high-quality, internationally recognized education, career prospects, a favorable investment and business environment, and a multicultural society. It would seem that with all these advantages, buying property here is an ideal investment. However, the complex dynamics of economic and political factors have already had an impact on the entire real estate sector in the country since 2016. REALTING figured out whether it is profitable to invest in British real estate, what Brexit and the pandemic led to, and what to expect in the near future.

About the main events over 10 years: Brexit, the pandemic and is government support really that good?

According to the Office for National Statistics, from 2014 to 2022, at least 3 million transactions took place in England and Wales. The maximum was reached in 2021 – then the figure exceeded 4 million – 4,099,286 transactions per year.

It can also be noted that over 10 years, a significant increase in activity occurred only in 2014 and 2021 – by 25% and 35%, respectively, compared to previous periods. And from 2017 to 2020, there was a negative trend in the number of transactions: in 2017, activity immediately decreased by 7%, in the next 2 years the drop was not significant – by 1% and 3%, and in 2020 the decrease was already 11% from the previous level of the year.

There were many reasons for such fluctuations over the decade.

In 2013, after the global financial crisis that began in 2008, many countries, including the UK, began a gradual recovery. This led to the stabilization of the economy, which, in turn, contributed to an increase in the number of transactions in the real estate market.

Already in 2014, the market began to attract foreign investors: it is especially worth noting the interest of Asian residents in investing in UK residential real estate. The Chinese economy was growing rapidly, and many wealthy citizens were looking for opportunities to diversify their wealth outside the country. British property presented an attractive opportunity for them to invest in a stable and reliable asset with the potential for price growth. Chinese investors also saw British property as an opportunity to provide their children with an education in the UK. Apart from China, countries such as Hong Kong and Singapore, Japan, South Korea and Malaysia also represented a group of Asian investors interested in British property. They used the UK as a platform to maintain their capital in a stable and secure economy.

Also in 2014, the government program “Help to buy” had an impact on the real estate market. The purpose of the program: assistance in purchasing a first home using mortgage loans and increasing their purchasing power. The program consists of two main schemes: Help to Buy: Equity Loan and Help to Buy: Shared Ownership.

Help to Buy: Equity Loan provides buyers with the opportunity to obtain a government loan to purchase a new built home. Buyers can make a down payment of 5% of the home price and then receive a government loan for 20% (40% in London) of the home price. The remaining 75% (55% in London) buyers can take out a mortgage from a commercial bank. For the first five years, the share loan is not subject to interest payments. If the home is sold, the buyer must return to the government a share of the loan proportional to the current market value.

Help to Buy: Shared Ownership provides the opportunity to buy a share in a residential property (usually between 25% and 75%) and rent the remaining share. Buyers can start with a lower share of the home and gradually buy more shares when possible. Buyers can also purchase the entire residential property in the future.

“Help to buy” was discussed a lot and received a lot of criticism. The main discontent was related to rising housing prices. Since the rules allowed buyers to increase their purchasing power and make a smaller down payment, this led to an increase in demand, resulting in higher prices. Critics believed that this made it more difficult for general buyers to access housing. In addition to concerns about the development of a bubble in the real estate market, economists were concerned about the risks to public finances: if loans were not repaid, the state could face losses. As a result, a system was introduced to limit the prices of properties that can participate in the program: from £186 thousand (as of November 2023 ≈ $230 thousand) in North East England to £600 thousand (≈ $744 thousand) in London.

The program is currently closed to new applications except in Wales. The latest applications for the scheme in England were accepted until 31 October 2022, and home purchases had to be completed by 31 March 2023.

The process of leaving the European Union, which began in 2016, remained one of the main factors affecting the real estate market until 2019. Uncertainty about the economic impact of the exit has caused caution among buyers and sellers. Brexit has led to a decrease in interest from foreign investors in British real estate. Many have decided to postpone their investment decisions while awaiting clearer prospects. Brexit has also led to uncertainty in the construction industry. Many developers have decided to delay or cancel new projects due to concerns about economic uncertainty and a potential decline in housing demand. And changes in immigration rules have affected the demand for real estate from European citizens who previously could freely work and live in the UK. Eurozone citizens must now meet new criteria to live and work in the UK - they must obtain a visa under the new "Points-Based System" (the applicant must achieve sufficient points based on parameters such as English language proficiency, education, job offer and other factors) or use one of the special visa programs. Unskilled workers can no longer qualify for most work visas, with some exceptions such as the seasonal scheme for agriculture or unskilled work visas in some low-employment industries. EU students are also at a disadvantage as they require visas to study in the UK. However, there are special categories of visas for students, such as higher education visas and long-term course visas.

The outbreak of the pandemic at the end of 2019 significantly affected the real estate market. The introduction of quarantine measures and restrictions in 2020 interrupted operations on the market, and the number of transactions became comparable to the level of 2013.

In 2021, vaccinations and easing of restrictions, the realization of pent-up demand and government stimulus measures have led to a decade-high residential property transaction value in England and Wales.

In 2021, the First Homes program became popular, which was implemented by the government as support measures. As part of First Homes, a participant can buy a property on the primary market at 30-50% cheaper. The price of the property cannot exceed £250 thousand (≈ $310 thousand) or £420 thousand (≈ $520 thousand) in London after the discount is applied. Buyers must also live in the property – it cannot be used as an investment.

It can be said that in 2022, activity in the property market in England and Wales has stabilized and, after a peak in 2021, has returned to the level of 2017-2019. And the 1st quarter of 2023 shows rather sad values – compared to the same period in 2022, the number of transactions decreased by 26%. When compared with the first quarters of the entire decade, the number of transactions is on average 20% lower.

How 2022 has changed mortgages and what buyers are ready to do to buy a property

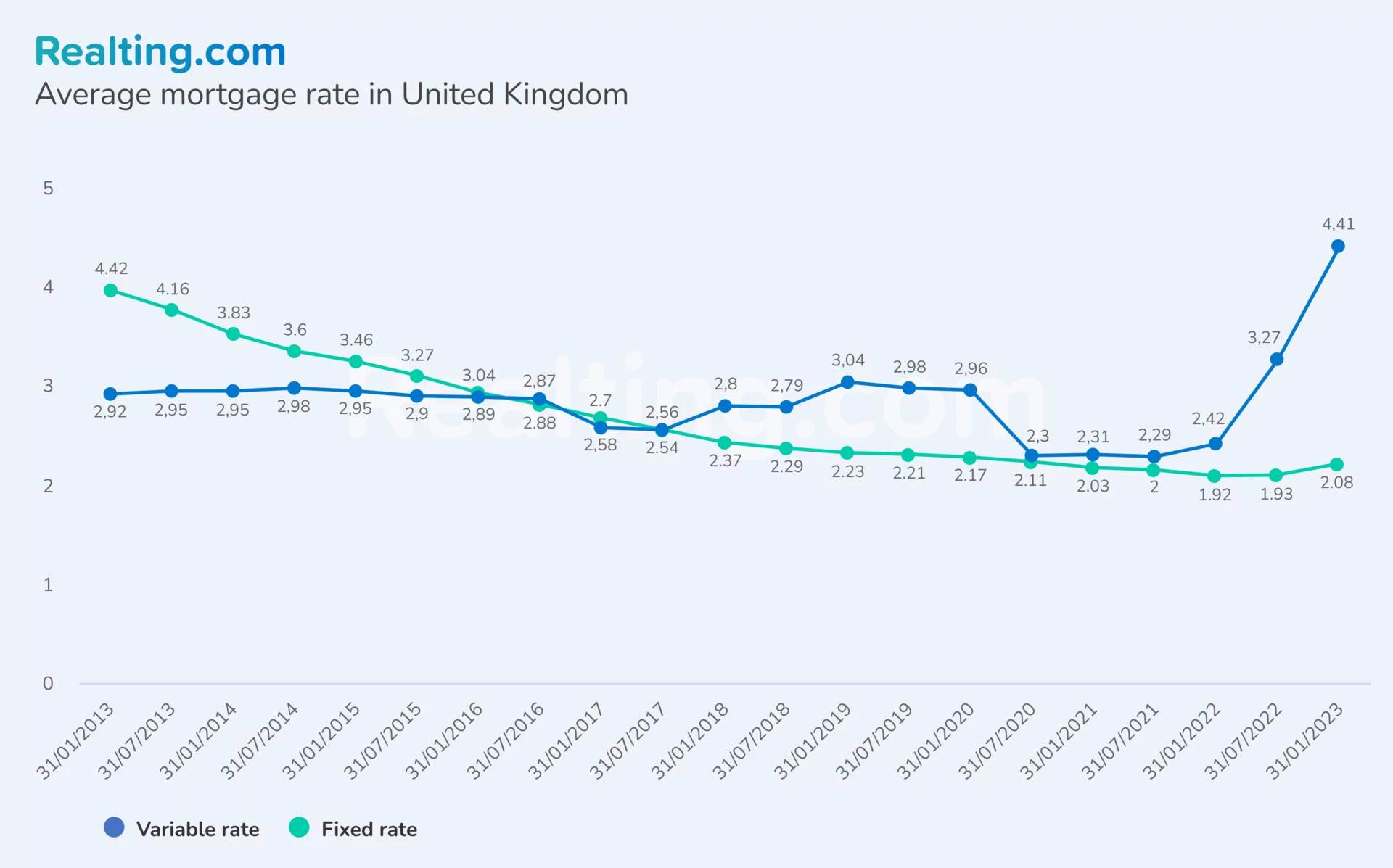

When considering the dynamics of transactions, it is worth considering an important factor, which is often the driver of the real estate market - mortgage rates. According to the Office for National Statistics, between 2013 and 2021, fixed mortgage rates in the UK averaged no more than 3%. Since the beginning of 2022, the Bank of England has increased the bank rate in order to contain and return inflation to the level of 2% (as of November 2023, inflation is 4.6%). As a result, the bank rate increased by 3.25 percentage points. (as of November 2023, the bank rate is 5.25%), which affected interest rates on variable rate mortgages, which also increased during 2022, reaching record levels over the past decade. This trend has a negative impact on housing affordability and significantly reduces demand. The forecast for the near future can also hardly be called favorable - due to persistent inflation, the Bank of England is ready to continue raising interest rates, and borrowers often take extreme measures.

Buyers value privacy and housing with “history”

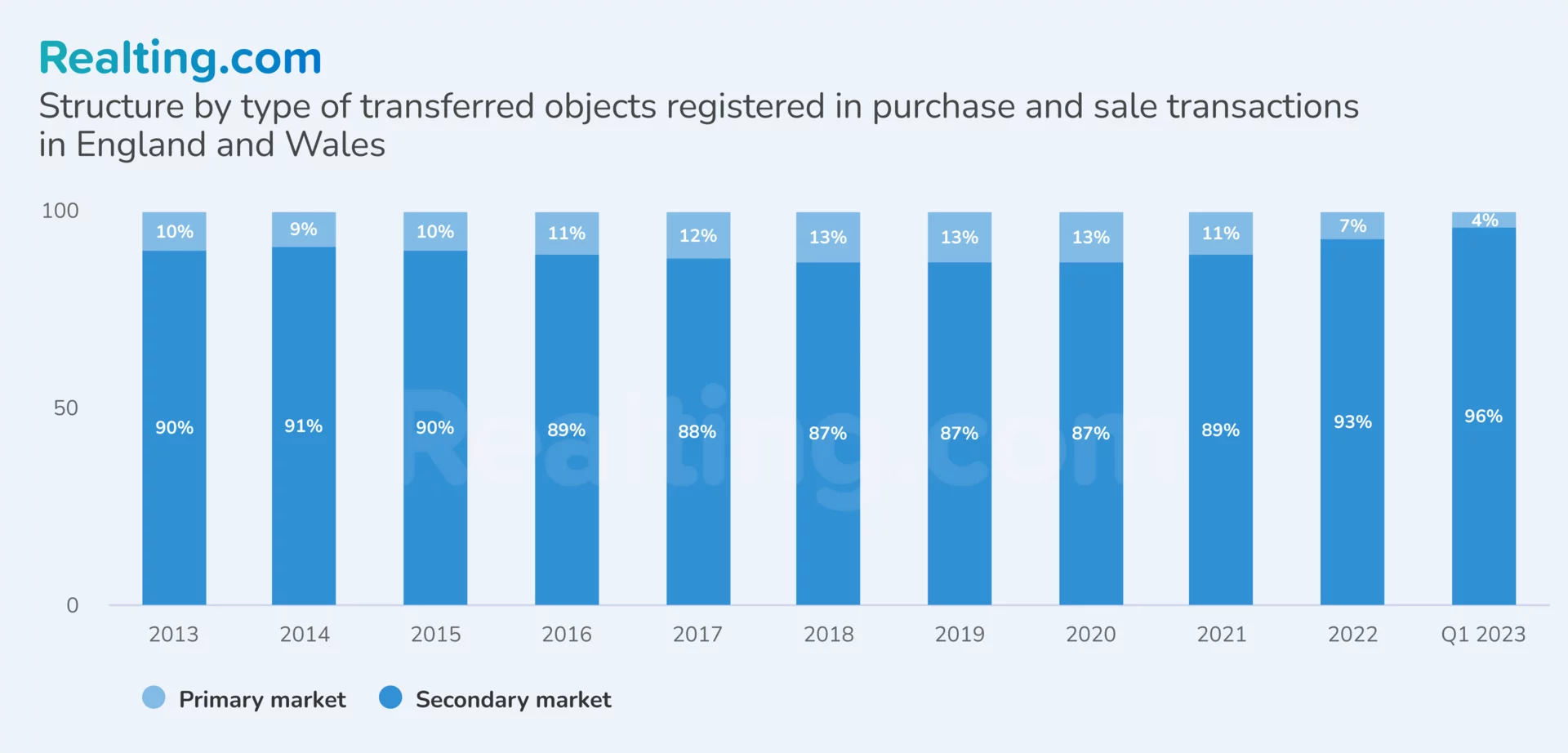

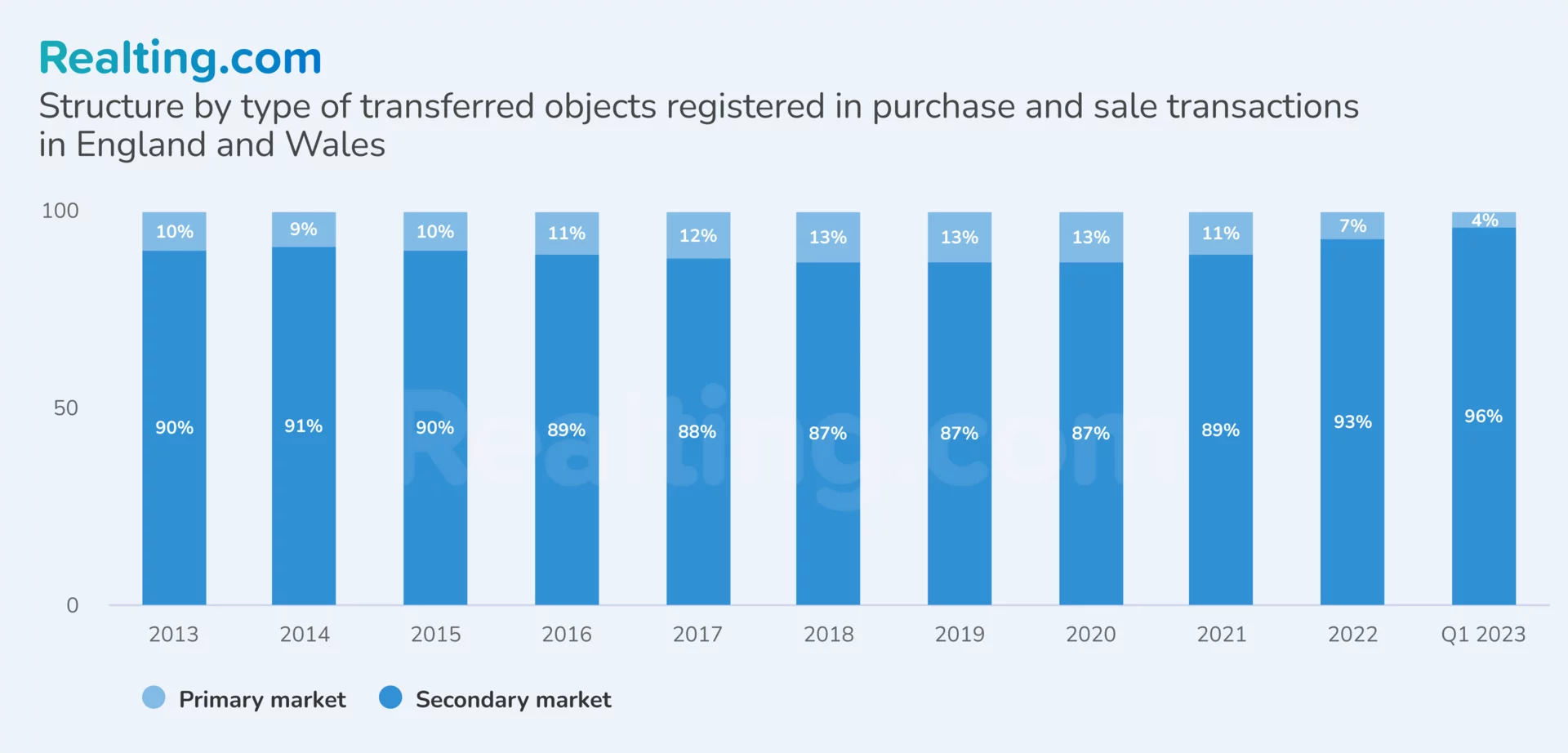

Since 2013, secondary real estate has invariably dominated the structure of purchase and sale transactions. From 2016 to 2021, the share of transactions with secondary real estate did not exceed 90%, but already from 2022 the share of the primary market began to decrease. At the end of the 1st quarter of 2023, only 4% of all purchase and sale transactions of residential real estate were completed with primary market objects.

This situation has arisen because many buyers prefer to purchase housing in areas with developed infrastructure and a variety of amenities. Not the least of which is that resale properties often have a unique history and “character” that attracts people looking for historic homes that are not available in new buildings. The primary market offers a relatively limited selection compared to the secondary market. Developers often offer various incentives for purchase, however, long waits when participating in shared construction, as well as fairly high prices, force buyers to choose in favor of existing properties.

Considering the structure of the residential real estate market by type of property, we can say that over 10 years, buyers more often gave preference to detached residential buildings and semi-detached houses - they accounted for more than 50% of all real estate transactions over the course of the decade. Next in popularity are townhouses and only then apartments - in the 1st quarter of 2023, 29% and 18% of transactions were made with such objects, respectively. The UK owes its popularity of detached houses and townhouses instead of apartments to several important factors. Firstly, there is space, privacy and cultural preference - the UK has a long historical tradition of living in private houses. Many people strive to own their own home with their own plot of land, especially in the suburbs and rural areas. Secondly, investment opportunities. Due to the fact that land is a limited resource, and the demand for such objects is always present, prices for this type of private property only increase over time.

Without sharp jumps and minimal difference between primary and secondary properties. Prices for 10 years

In accordance with the methodology of the Office for National Statistics, the median price is used to analyze prices - a value that divides the totality of all real estate transactions into two equal halves. Unlike the average price, the median does not take into account extreme values, which can significantly distort the result.

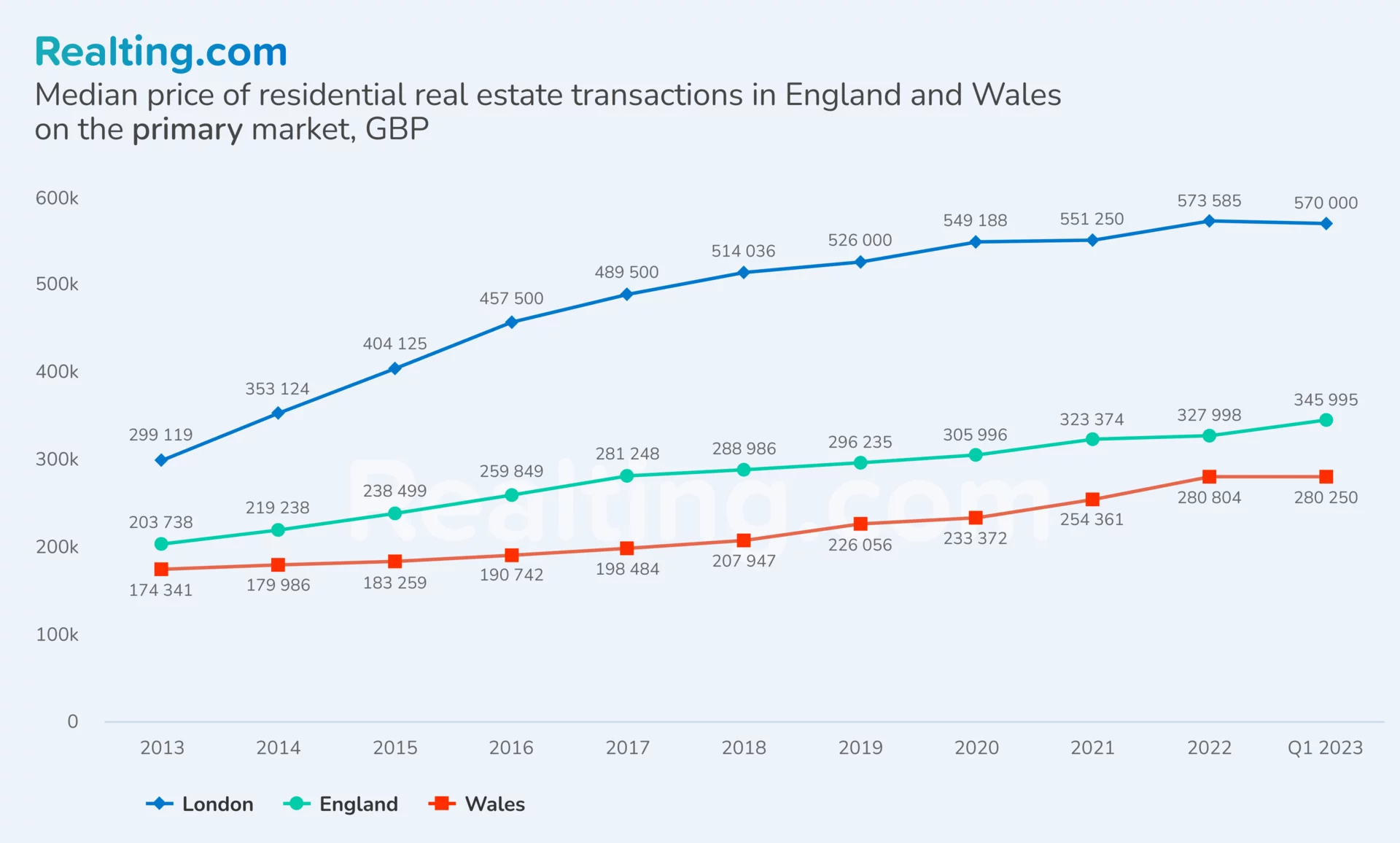

The highest median prices for primary real estate are traditionally in the capital - over 10 years, the median price in London grew actively until 2016 - by an average of 15% per year. In 2017, the price increased by 7%, and then the increase did not exceed 5%. At the end of the 1st quarter of 2023, the median price for new housing was set at £570 thousand (as of March 2023, ≈ $701 thousand) and remained virtually unchanged compared to the end of 2022. Over 10 years, residential real estate in London has increased in price by 1.9 times.

The median “primary” price in England is higher than in Wales, and since 2013, these regions of the UK have not seen such significant changes as in London. The median price of residential property has increased 1.7 times in England and 1.6 times in Wales over 10 years. Price dynamics in England are in many ways similar to London - until 2017, the price grew more actively - by an average of 8% per year. In 2021, the price added 6% compared to the previous period amid the market revival after the easing of quarantine. The result of the first three months of 2023 is £346 thousand (≈ $426 thousand) per property.

The price of primary housing in Wales has been growing gradually over 10 years - until 2018, the change was no more than 5% per year. More active growth began in 2019 – +9%, which was interrupted by the pandemic. 2021 and 2022 can be called periods of active growth in this region - the price increased by 9% and 10%, respectively. There were no changes in the 1st quarter and the median price remained at the 2022 level – £280 thousand (≈ $344 thousand).

It is also worth mentioning about the most expensive types of development on the primary market: in 2023 these are detached private houses - the median price for them reached £394 thousand (≈ $485 thousand), followed by apartments - £373 thousand (≈ $459 thousand .). Semi-detached houses and terraced houses are in the same price range - £273 thousand (≈ $326 thousand) and £265 thousand (≈ $460 thousand), respectively.

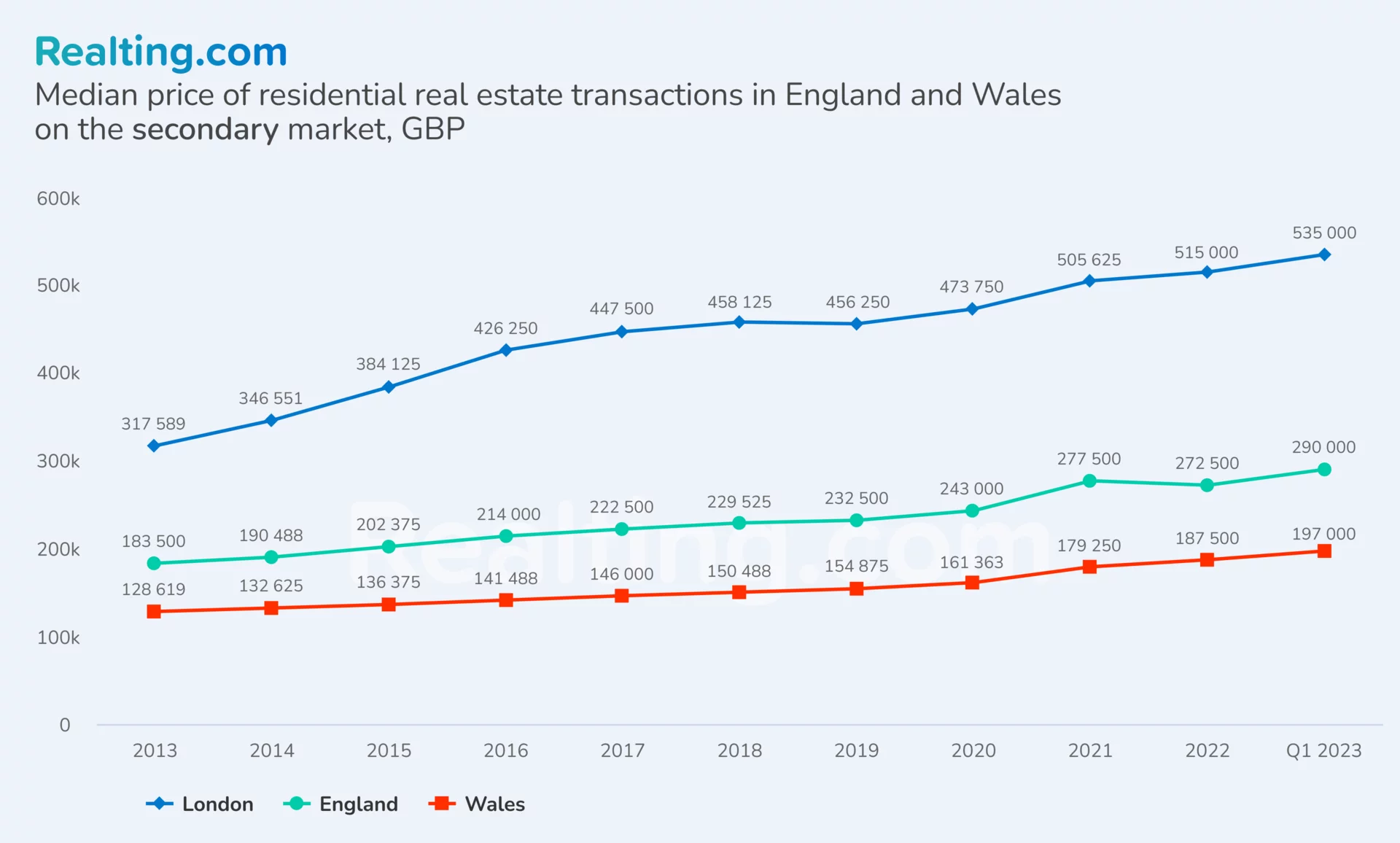

Trends in the secondary market have much in common with primary real estate: London offers the most expensive properties - £535 thousand (≈ $658 thousand), but over 10 years the price in the capital has not changed so much - 1.7 times. The secondary market, in principle, is characterized by a fairly moderate increase in prices - in England and Wales over 10 years, median prices changed by 1.6 and 1.5 times, respectively, and settled at £290 thousand (≈ $357 thousand) and £197 thousand ( ≈ $242 thousand). And over 10 years in these regions, significant growth was observed only in 2021 - more than 10% in each. As mentioned earlier, activity was stimulated by low interest rates, high demand after quarantine restrictions, as well as government support. Not the least role of this rise in prices in the secondary market was played by the fact that after the “Covid” year, the shortage of new properties worsened due to restrictions in construction and postponed plans for the implementation of new projects.

In the segment of secondary real estate, detached residential buildings are the most expensive objects - the median price of an object is £435 thousand (≈ $535 thousand). Semi-detached houses, terraced houses and apartments differ minimally in price - £267 thousand (≈ $329 thousand), £230 thousand (≈ $283 thousand) and £225 thousand (≈ $276 thousand), respectively.

By the way, primary real estate in England and Wales has been more expensive than secondary properties for a decade. In London, the same trend can be noted with the exception of 2013 – then “primary” was 6% cheaper.

The largest price gap between secondary and primary real estate is observed in Wales - a difference of 1.5 times was recorded in 2022, and in 2023 it is 42%. On average, from 2013 to 2020, “primary” was 40% more expensive.

There is practically no significant difference between new buildings and old buildings in London - in the capital the highest prices are recorded throughout the country, the difference between which is approximately 10% in favor of the “primary”.

Buying a new home in England will be about 20% more expensive.

Over the course of a decade, the UK property market has developed quite smoothly and predictably. There is no need to count on incredibly high returns on flipping. However, British property remains a stable and reliable asset, and a strong legal system provides a favorable investment environment. It is also worth noting that, even despite leaving the Eurozone, high demand for rentals is maintained by local residents, numerous students and migrants. Therefore, taking into account financial goals and risk tolerance, real estate in the UK should rather be considered as a tool for long-term capital preservation. It should also be taken into account that a further increase in mortgage rates is likely to lead to a more significant correction in prices in the real estate market in all segments.

Frequently asked questions

What properties are popular in the UK?

What is the price of an apartment in London?

Where is the cheapest place to buy a property in the UK?

What are the mortgage rates in the UK?

Is it profitable to invest in UK property?

Author

Providing readers with quality analysis on global trends in the real estate market.