Golden Visa and tax benefits — that’s it. Will the Portuguese real estate market remain as attractive? Analysis and trends of the Portuguese real estate market in analytics from REALTING

The Mediterranean climate, diverse nature and historical heritage make Portugal one of the most attractive places to buy property in Europe. Understanding all the advantages of the country, in order to recover from the crisis, the Portuguese government relied on attracting foreign capital, creating various benefits and special programs for this purpose. How this policy affected the number of transactions, prices and structure of the real estate market read in the latest REALTING analytics.

Over 10 years, the number of transactions has more than doubled. What influenced this?

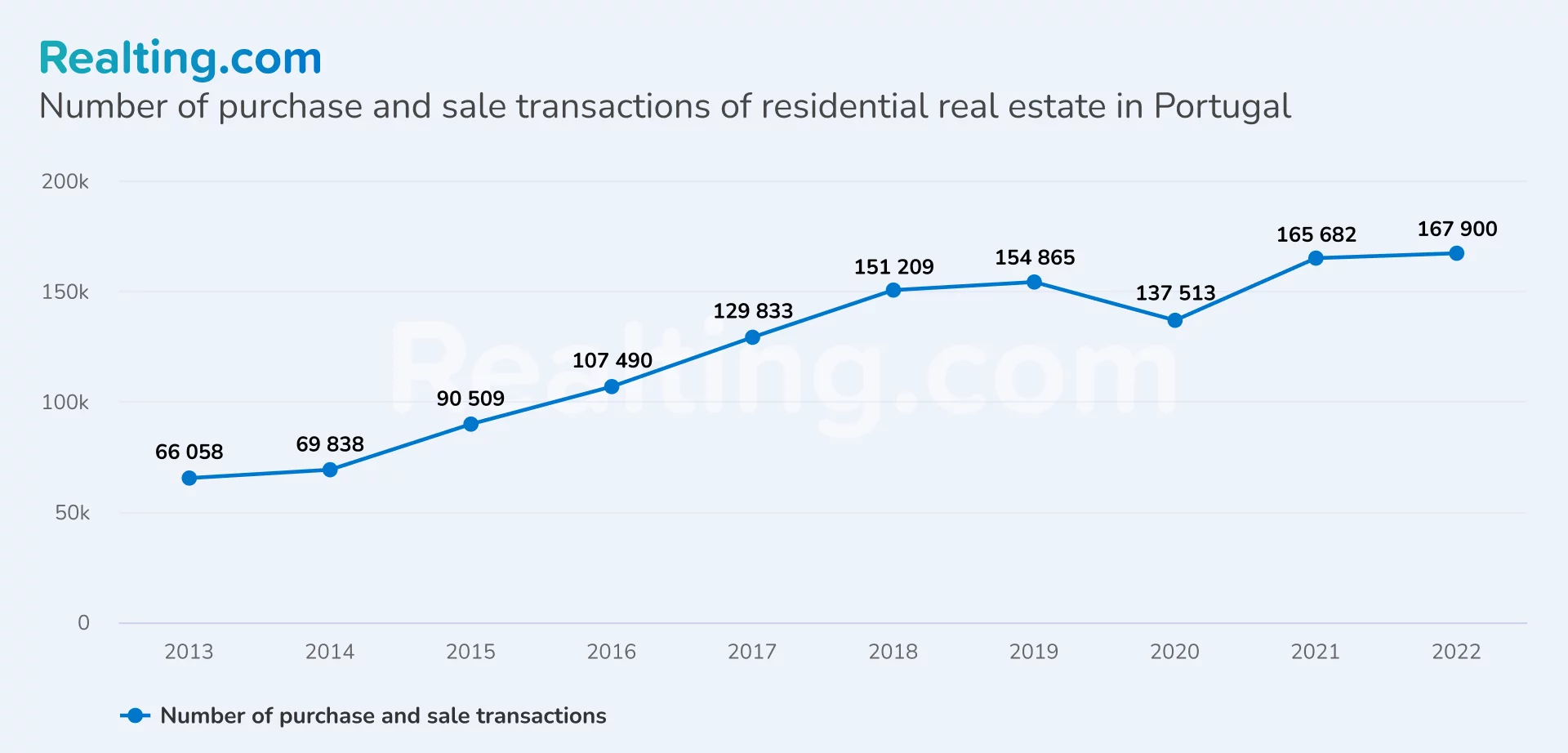

Since 2013, interest in residential real estate in Portugal has constantly increased, as evidenced by the number of purchase and sale transactions with residential real estate — according to the Instituto Nacional de Estatística, their number has increased 2,5 times over 9 years. At the end of 2022, almost 168 thousand transactions were registered in Portugal; for comparison, only 66 thousand were registered in 2013.

In 2013, the Portuguese property market was in a recovery phase after the economic crisis, which led to a significant decrease in demand. Despite this, during 2013 signs of improvement in the real estate market began to appear. There was also an increase in interest from foreign investors.

Back in 2009, the Portuguese government took measures to stimulate the economy and the real estate market — a special NHR (Non-Habitual Resident) tax regime was introduced. This program aimed to attract foreign citizens and investors by encouraging them to move and reside in Portugal.

NHR offers favorable tax conditions for 10 years for several categories of residents. First, non-residents receiving income from abroad are not taxed at all. Secondly, for pensioners who are not tax residents of Portugal, the pension tax rate is only 10% and is flat. For comparison, for pensioners with permanent resident status, the tax is calculated on a progressive scale and reaches 48%.

The situation is similar with non-residents employed in Portugal — the tax rate for them is fixed at 20%. In the case of citizens, the rate reaches 48% depending on income level. This program has been a key aspect of Portugal’s appeal to those considering moving to the country. By attracting new residents, the NHR program stimulates the development of the real estate market and helps increase demand for real estate in the country.

At the moment, the fate of the program has not been definitively determined, but it is absolutely certain that new rules will come into force in January 2024.

However, the recovery in the real estate sector is also a consequence of the strong performance of Portugal’s tourism sector, which has prompted many investors to purchase properties to meet the growing demand for tourist accommodation.

The period from 2015 to 2018 can be noted as the most active in the Portuguese real estate market. In 2015, the number of purchase and sale transactions increased by 30%, then from 2016 to 2018 the growth averaged 20% annually. Foreign investment in real estate continued to remain significant and the country continued to attract the attention of investors from various regions of the world. This contributed to further development of the market and contributed to the stabilization of the real estate sector as a whole.

High activity initially slowed in 2019, before the pandemic triggered an 11% decline in 2020. 2022 is still the record holder for completed transactions — 167 900.

About the "Golden Visa", and why it is no longer possible to "buy" citizenship

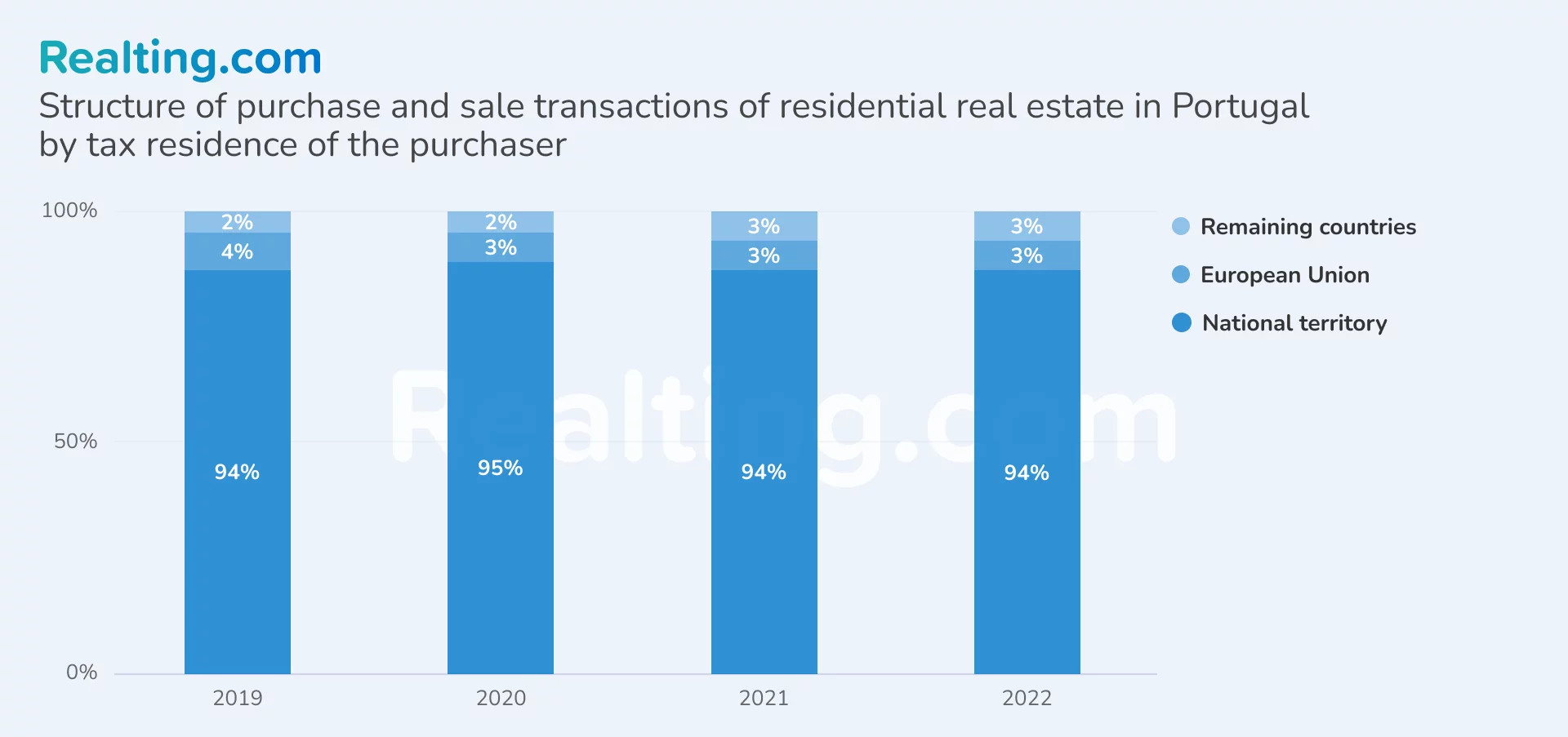

In 2022, 94% of residential property buyers were tax residents of Portugal, the remaining 6% was equally divided between tax residents of the European Union and tax residents of the rest of the countries. This trend in the structure of buyers has continued since 2019.

It is worth saying that in addition to the tax benefits described above, interest in Portuguese real estate was also maintained thanks to the Golden Visa program. The program was launched by the Portuguese government in 2012 with the aim of attracting foreign investment to recover from the crisis.

The conditions for obtaining a residence permit through the purchase of real estate were among the most affordable and profitable in Europe — investments had to be at least 250 thousand, and to maintain a residence permit one had to be in the country for at least 7 days a year. After 5 years, the program participant had the right to apply for Portuguese citizenship.

One of the key advantages of the Golden Visa program in Portugal is that once a residence permit is obtained, its holders have the opportunity to move freely throughout most countries of the European Union. In addition, participants gain access to the education and health care systems in Portugal.

However, despite such attractive conditions for foreigners, the program was much criticized. One of the main problems was the unaffordability of housing: rising prices in some regions of Portugal have exacerbated the housing problem for local residents. The program was also criticized by the government of the European Union, which was concerned about money laundering, tax evasion, and security issues — offenders can move freely within the EU. As a result, it is no longer possible to obtain a Portuguese residence permit through real estate investments from October 2023.

Secondary properties are more popular among buyers, however, new buildings have an undoubted benefit

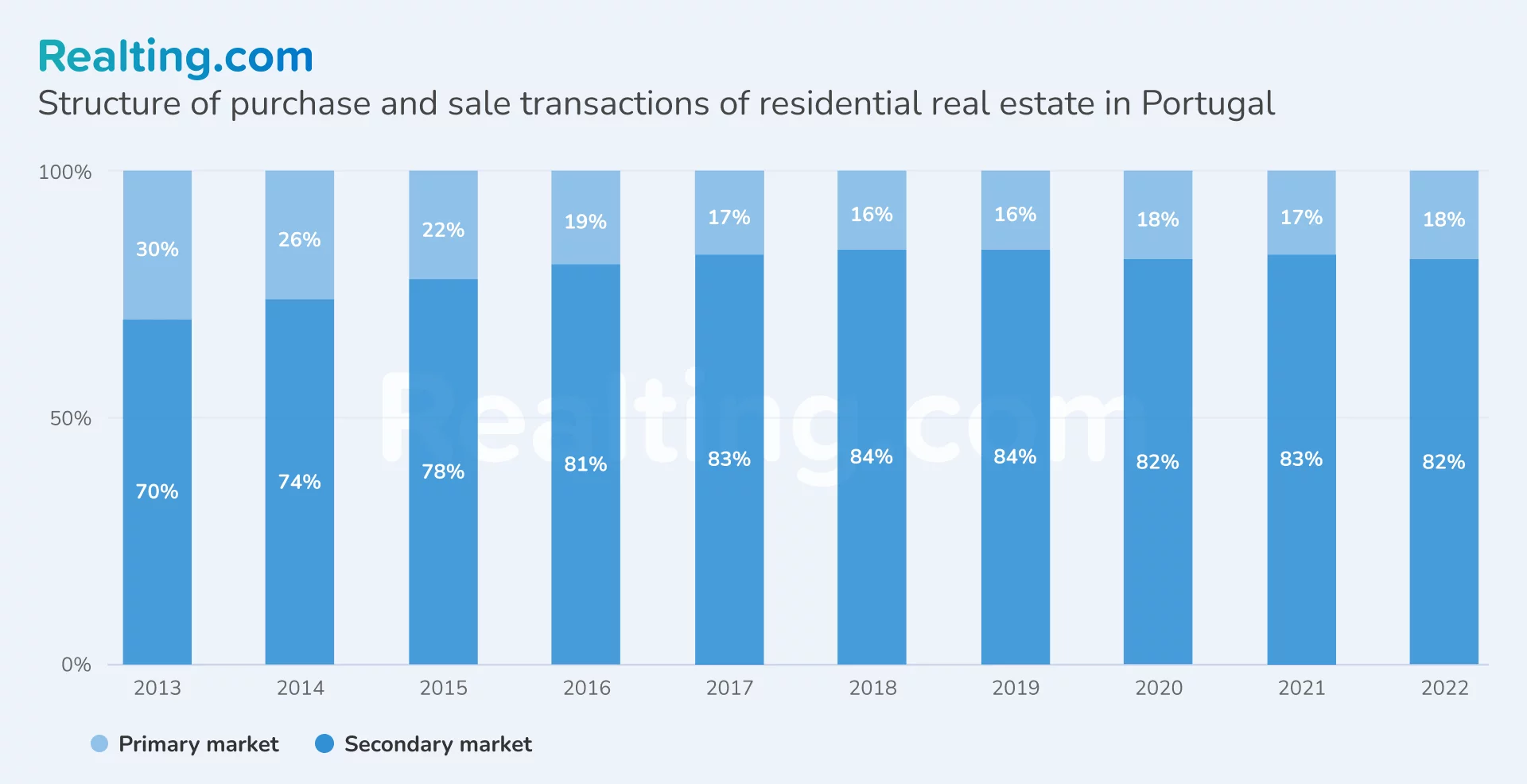

For 10 years, secondary real estate has dominated the structure of purchase and sale transactions. 2013 set a record for transactions concluded on the primary market — 30% of housing was purchased directly from developers. However, subsequently the share of transactions with new housing constantly decreased — in 2014, 26% of all transactions with residential real estate were made with new buildings, in 2015 — 22%. From 2016 to 2022, the share of transactions in the primary market did not exceed 20%.

On the one hand, when choosing a completely new home, the buyer receives an apartment in a building built to the most modern standards and using the latest materials, which means that maintenance of such a facility will cost less in the long run. New housing always meets strict energy standards, which will reduce energy costs. By the way, Portugal was recently able to provide the entire country with energy using exclusively renewable sources. However, the most important and undeniable advantage of the new building is the 5-year warranty on new structures.

On the other hand, resale properties are often located in older city centers, historic areas or coastal regions, offering an authentic living experience. Such an investment may have greater potential for subsequent resale or rental.

Lisbon and Algarve are among the top most expensive locations

According to the Instituto Nacional de Estatística, price analysis uses the median price — a value that divides the population of all real estate transactions into two equal halves. Unlike the average price, the median does not take into account extreme values, which can significantly distort the result.

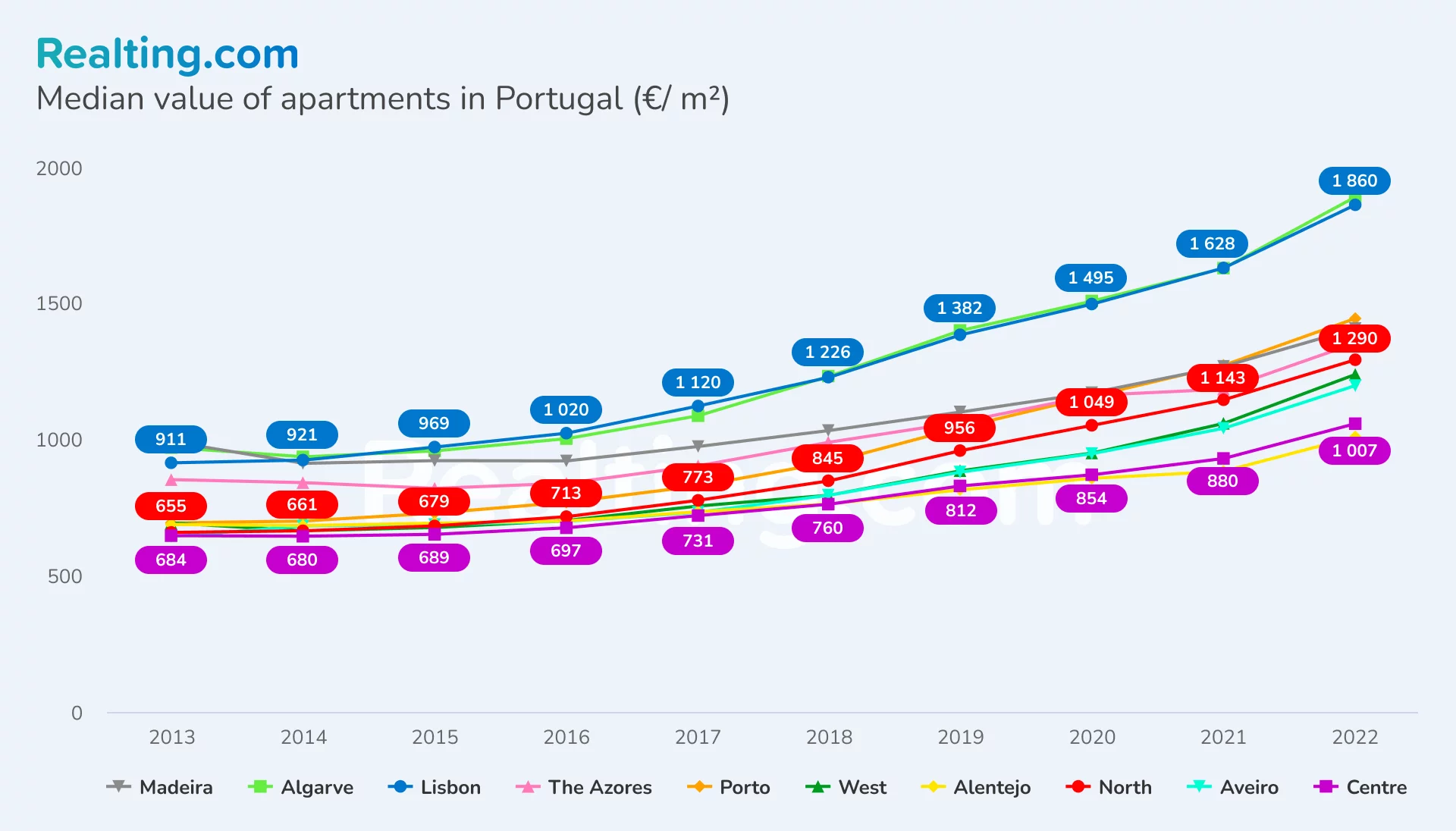

Considering the median cost per square meter of apartments according to the bank, it is immediately worth saying that since 2013, most regions of Portugal have seen a double increase. In general, the trends in the apartment segment are similar throughout Portugal.

From 2013 to 2015, Portugal felt the effects of the financial crisis and the property market was in recovery. Apartment prices were low due to the abundance of properties for sale and the general economic downturn.

In 2014, median prices per sq. m remained at the level of the previous year — fluctuations were no more than 4% and, depending on the region, ranged from €641/sq. m to €933/sq. m. Only Madeira can be singled out — here the median price decreased by 8% and settled at €909/sq. m.

Since 2015, there has been steady growth in the real estate market, especially in major cities such as Lisbon and Porto. This period was characterized by increased demand from international investors.

At the end of the 2010s, apartment prices continued to rise steadily — throughout Portugal, the median price per square meter grew by 10% annually. And in 2020, despite restrictions due to the COVID-19 pandemic, the market showed resilience: prices increased by 5-11% in all analyzed regions and ranged from 854/sq. m in the Alentejo region to €1506/sq. m. in the Algarve.

In 2022, the most active growth in 10 years began. Median prices increased in all regions: from 11% in Madeira to 17% in the West of Portugal.

The highest median prices per square meter of apartment were found in Lisbon and the Algarve region — €1860/sq. m and €1889/sq. m, respectively. Over 10 years, prices here have almost doubled.

Lisbon, as the capital of Portugal, has a rich cultural heritage and is a center for commercial and administrative activities, which attracts the attention of both local and international investors, creating high demand for housing. The Algarve is known for its beaches, mild and sunny climate, which attracts beach lovers and active lifestyles. The Algarve’s climate makes it one of the best European golf destinations, with an extensive network of courses for fans of the sport. The capital and one of the main resort regions attracts many tourists. And the shortage of housing and the preference for accommodation in properties with «history» put pressure on real estate prices.

The most affordable apartments are located in the north of the country and in Alentejo — a meter here will cost €1055/sq. m and €1007/sq. m, respectively. Although Alentejo offers a variety of tourism opportunities, it is also an important region for agriculture, especially in the production of wine, olive oil and cheese, which creates its economic importance. However, the presence of rural areas reduces the investment attractiveness of this region.

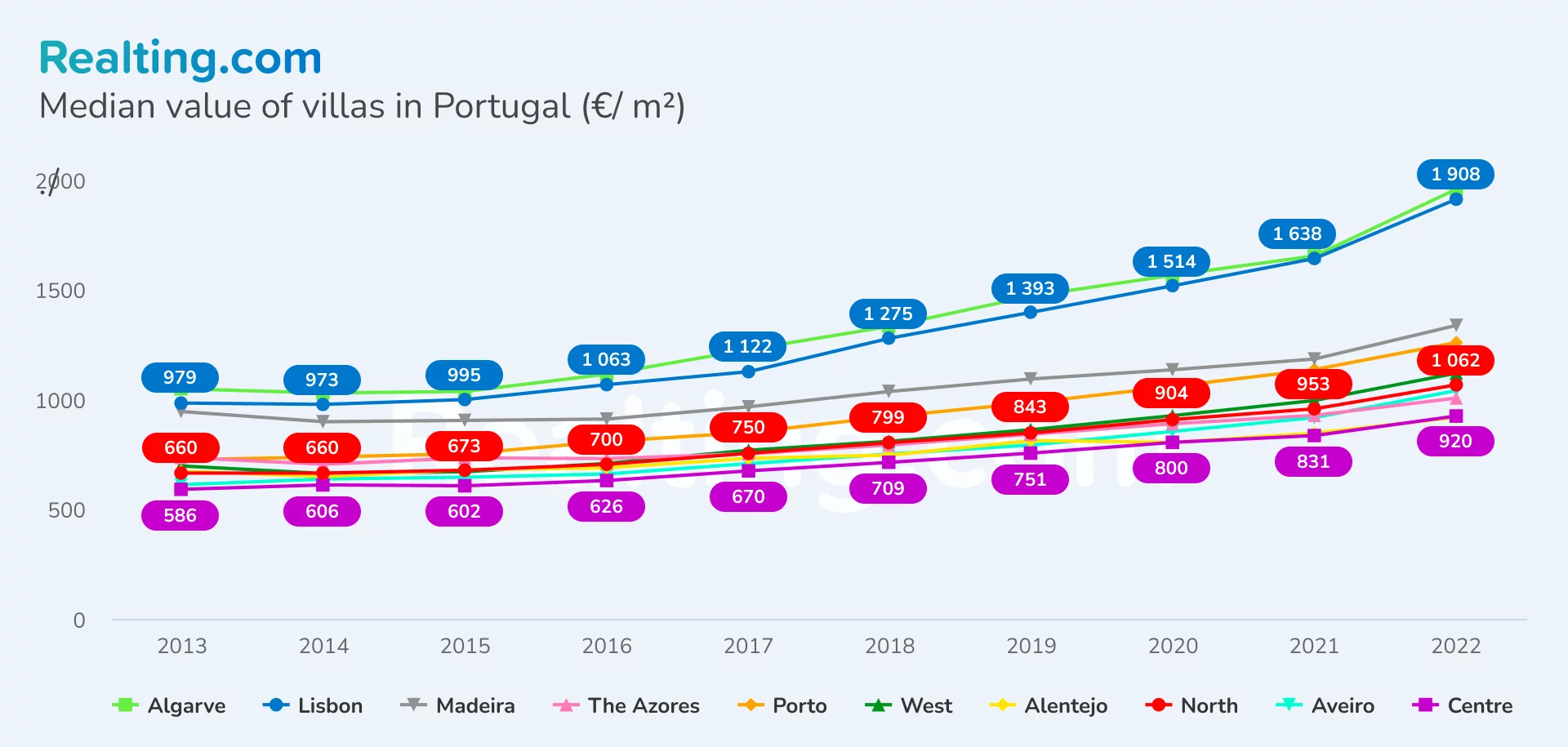

The situation in the villa segment in Portugal can be described as similar to that in the apartment segment. However, price growth over 10 years is not so intense here — the most significant changes occurred in Lisbon and the Algarve. Prices increased by 2 and 1,9 times, respectively, and at the end of 2022 were fixed at €1908/sq. m and €1954/sq. m, setting a maximum in all of Portugal.

Madeira, the Azores and Alentejo, by contrast, have seen modest growth, up just 40% on average since 2013.

It is worth saying that villas are a rather specific and less liquid type of real estate that attracts a narrow segment of buyers, such as high-income international investors or those looking for premium residential premises. Apartments are more affordable for a wide range of buyers, including young families and those who need more compact housing.

Price dynamics are also affected by the fact that villas often require a lot of effort and expense to manage and maintain. For investors wishing to subsequently resell their asset, it is important to consider that the exposure period of a private house is usually longer than for apartments due to limited demand and higher prices. Potential buyers are considering options and making decisions more thoroughly, which slows down the sales process.

By the way, for those who are now deciding to invest in real estate in Portugal for the purpose of resale, it is important to take into account changes in tax legislation. From January 2023, the rules for paying capital gains tax on the sale of real estate have changed: now non-residents are taxed in the same way as residents and are required to pay capital gains tax according to a progressive scale from 14,5% to 48%. 50% of the profit is subject to taxation, and when owning a property for more than 2 years, an inflation benefit is applied. Before the changes, non-residents were taxed at 28% on all capital gains realized from these purchases.

There are 2 ways to «avoid» the tax: by reinvesting the proceeds into a new primary home and by reinvesting into retirement savings. You can claim both types of benefits, which can be beneficial if you want to downsize your home.

New housing must be purchased within 36 months after the sale of the first property or 24 months before.

The changes that are sweeping Portugal in 2023 will undoubtedly affect the activity of foreign investors. The removal of the golden visa and tax benefits will likely lead to a reduction in demand from expats, but these changes will not be as significant as the share of transactions with non-residents for several years did not exceed 6%. There are no prerequisites for a sharp drop in prices or a critical decline in activity at the moment, but there are definitely enough of them for a slowdown in the market.

Author

Providing readers with quality analysis on global trends in the real estate market.