Investment in commercial real estate in Europe is falling: Analysis and trends for the first half of 2023

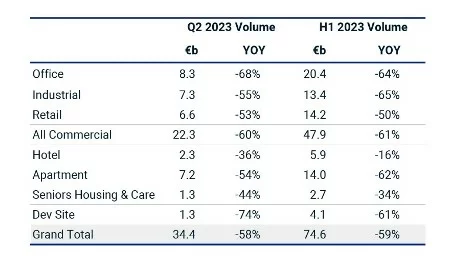

According to the latest Europe Capital Trends report from MSCI Real Assets, commercial real estate investment in Europe fell significantly in the first half of 2023 to €34.4 billion, a 59% year-on-year decline. What factors contributed to this, and how are the markets in individual countries doing?

Of course, the decline in investor activity was affected by the rise in interest rates on loans. Demand for office space also fell by 68% year-on-year as a huge number of professionals switched to hybrid working arrangements (which in turn were triggered by the pandemic). As a result, the office sector posted its lowest sales volume (€8.3 billion) since 2007, when MSCI started reporting.

Tom Leahy, an expert at MSCI, notes: “In these extremely challenging market conditions, the office sector is proving to be the hardest hit by the effects of higher interest rates and tenants moving to hybrid working. There is a significant gap in price expectations between sellers and buyers.”

The hotel sector has shown relative resilience to the overall downturn. The slow recovery in tourism following the COVID-19 pandemic led to a 16% year-on-year decline in transactions to €5.9 billion. The largest deal was the purchase of the Westin Paris Vendome hotel in Paris for €650 million.

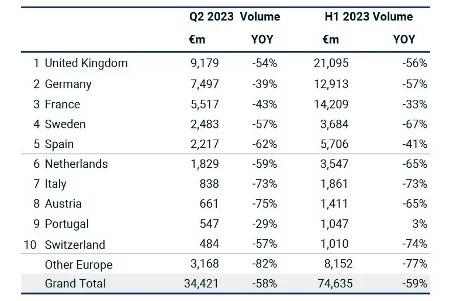

Let's dwell more on the peculiarities of different European countries in terms of investment in commercial real estate.

France

France was no exception and also experienced a decline in investment volumes in the second quarter of 2023—down to €5.5 billion, a drop of 43%. However, Paris continues to strengthen its position as a leading investment destination—five of the six largest deals in Europe took place in the French capital.

UK

In the second quarter of 2023, the UK experienced a 54% year-on-year decline in investment volumes. Despite this, London still ranks second only to Paris as the top destination for investors. In the first half of the year, €7.3 billion worth of real estate was sold, down 59% from the previous year.

However, Manchester showed a positive trend, ranking sixth among the largest European markets. Investment in the city rose by 25% to €1.5 billion, driven by major deals such as the acquisition of Blackstone Trafford Park and Heywood Distribution Park.

Germany

In the second quarter of 2023, Germany experienced a 39% drop in investment to €7.5 billion. This figure was the lowest since 2010. The first half of the year was also marked by a decline in the number of large deals, reflecting the challenging market environment.

Netherlands

In the Netherlands, investment fell 65% to €3.5 billion in the first half of 2023. Amsterdam, the country's largest city, ranked only 12th in the ranking of European investment destinations. This decline is due, among other things, to reforms in the tax system.

Nordic countries

Nordic real estate markets experienced a notable decline in investment in the second quarter of 2023, down as much as 75% year-on-year. Sweden, as the region's largest market, also suffered significant losses, with investment down 67%.

Author

I am responsible for editorial work. I write expert interviews and guides.