Expert: Emirati country risk premium increased slightly, but remains low

The country risk award reflects how high the risks of acquiring real estate in a given country are in the current situation. According to the latest information, in the UAE, the country risk premium increased slightly.

The United Arab Emirates as a state includes seven emirates, in terms of real estate development, the most interesting Abu Dhabi and Dubai. The United Arab Emirates has put in place a robust legislative framework to protect investments. The volume of foreign direct investment (FDI) in the UAE is increasing, according to the United Nations Conference on Trade and Development (UNCTAD), in 2021, the UAE ranked 15th (and 1st among Arab countries) in terms of FDI inflows.

One indicator of a country’s investment attractiveness is the country risk premium (country risk premium, CRP), usually calculated on the basis of the yield of government securities on the world markets. The UAE issues long-term government bonds that are highly traded on all stock markets. Moody’s and Fitch established long-term issuer ratings of "Aa2"" and ""AA-"" for the UAE government, respectively. This rating level characterizes high quality bonds with low credit risk. Since the aim is to assess the investment attractiveness of real estate, the exchange data on the yield of the longest-lived UAE government securities denominated in US dollars (maturing in October 2061) were used to calculate the returns so that her life span was as close as possible to the economic life of real estate.

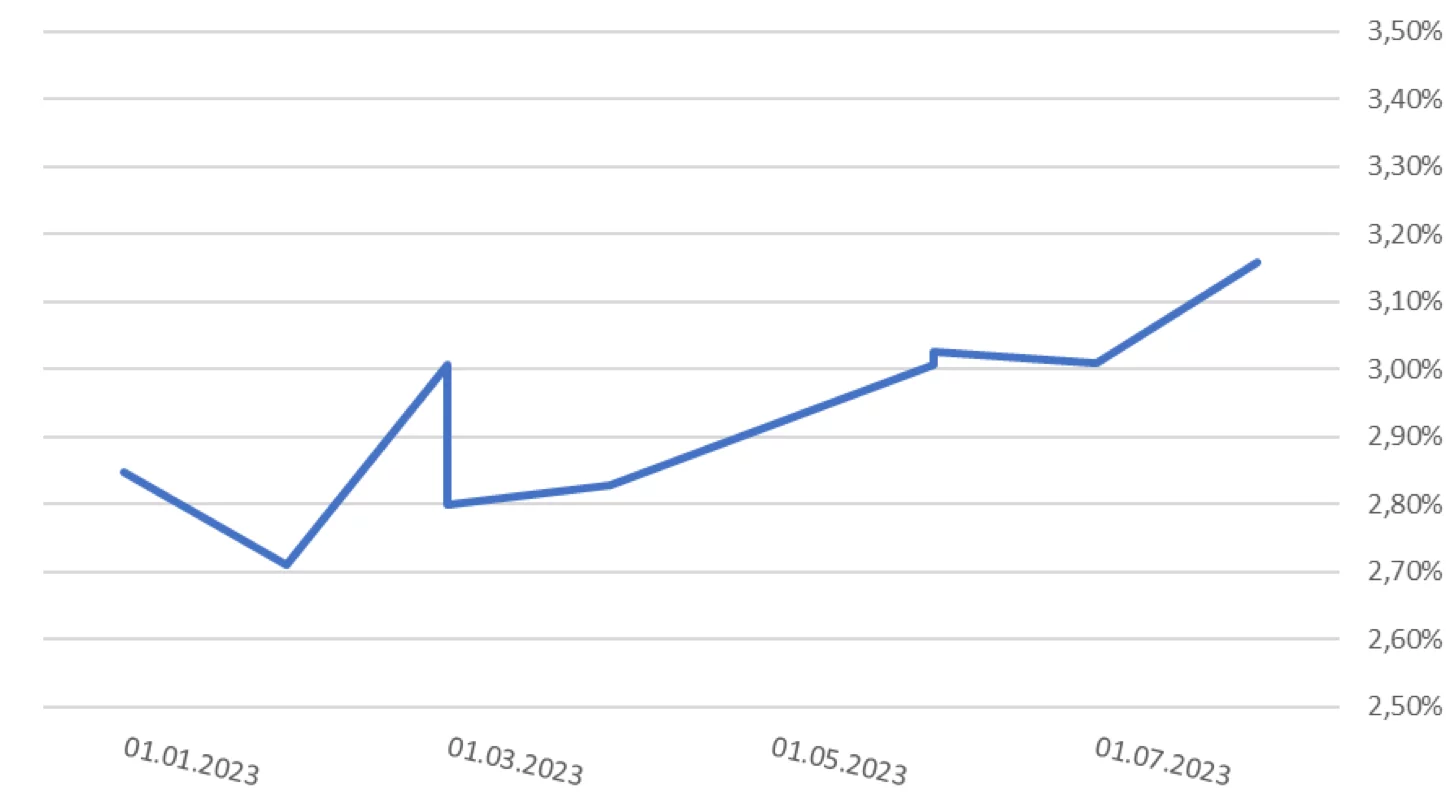

Data on the UAE country risk since the beginning of the year are shown in the graph below. The resulting values are low, they fluctuated until summer around 2.8%, then began to rise slightly. As of August 31, 2023 for the UAE

CRP = 3,16%.

This is a low level of country risk, with little likelihood of real estate loss (total or partial) as a result of general economic, financial and socio-political factors, present in this country regardless of the property.

Author

Prof. Nikolai Trifonov is the Fellow of Royal Institution of Chartered Surveyors, the Full Member of the International Academy of Engineering, the Foreign Member of the Russian Academy of Engineering, the Honorary Appraiser of the Republic of Kazakhstan, teaches real estate appraisal at the Belarusian State Economic University, the author of manuals "The Valuation Theory" and "Comprehensive Real Estate Valuation". In 1994, he founded the Belarusian Real Estate Guild, which united the largest private and state participants in the real estate market and privatization. In 1996, Nikolai created and headed the public association "Belarusian Society of Valuers", which is a member of International Valuation Standards Council (IVSC). In the period 1998-2005 Nikolai was elected and reelected as Board Member of European Real Estate Society (ERES), Director at Large – Responsible for Central & Eastern Europe.