New buildings are much more expensive than secondary apartments. The decade results in the real estate market in Dubai. Analytics from REALTING

High profitability of enterprises, absence of corruption, economic stability attract investors from all over the world to the UAE. At the same time, one of the most popular investment destinations has become Dubai — a fabulous dream city. REALTING decided to look at how the real estate market of this city has developed over the decade. All the ups and downs of the "golden" square meter in the primary and secondary real estate markets of Dubai in our large analytic report.

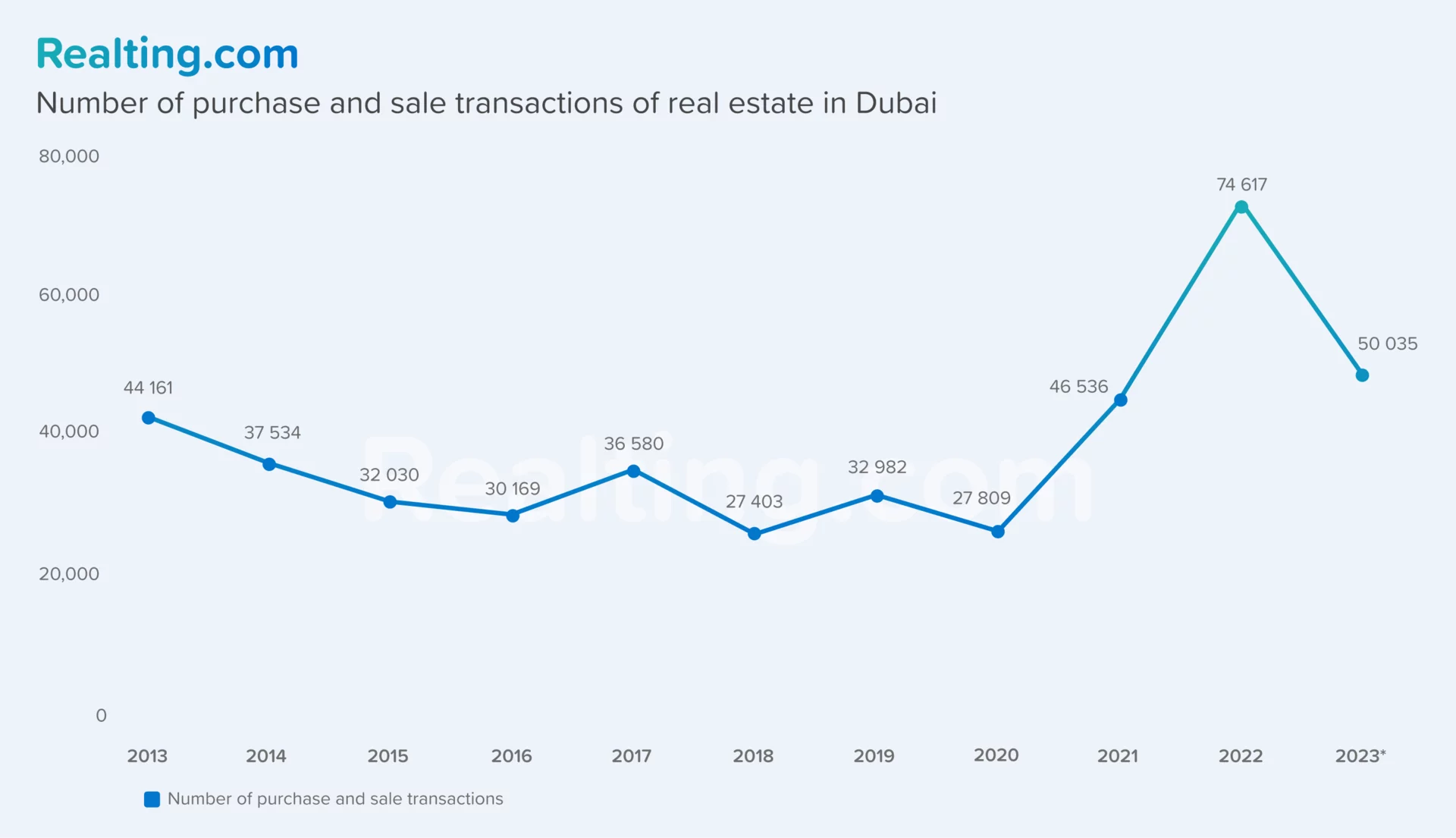

The number of deals in Dubai over 2023 has already surpassed the annual values for the last decade

Most real estate buyers and investors consider the UAE not only as one of the best vacation destinations, but also as an option for seasonal residence, as well as an option to move permanently. This was encouraged by the liberalization of laws in 2020. In addition, a constant growth in the cost of a square meter of housing, growing demand and the incredible development of the country's economy have turned Dubai into one of the most popular cities for investment.

High demand, of course, affects the activity of developers — real estate construction in Dubai is carried out around the clock. The major share of investments is of foreign origin, and apartments and villas here are owned by celebrities from all over the world.

Before buying real estate in Dubai, both for personal purposes and as an investment, you should carefully assess the features of the local market.

A record number of purchase and sale transactions with residential real estate was registered in 2022 — a total of 74.6 thousand transactions were made in four quarters. The figure exceeded the 2013 figure by 1.7 times (+69%) and the figure of the previous period by 1.6 times (+60%). This indicates that the Dubai real estate market, having overcome the recession in 2016-2019, as well as the coronavirus pandemic in 2020, is on the upswing. It should be noted that the Dubai real estate market is dependent on oil prices, the fall of which negatively affected all indicators in 2015-2016.

Increasing mobility in the world is boosting the local real estate market. According to Dubai Statistics Center from 2020 to 2022, 92% of the country's population are immigrants and only 8% are citizens.

The number of transactions for the first half of 2023: more than 50 thousand: has already exceeded the annual values for the last decade.

It is worth noting that the features of the real estate market in Dubai are information openness (transparency), high rates of turnover (a large number of transactions), structure (high demand for elite properties).

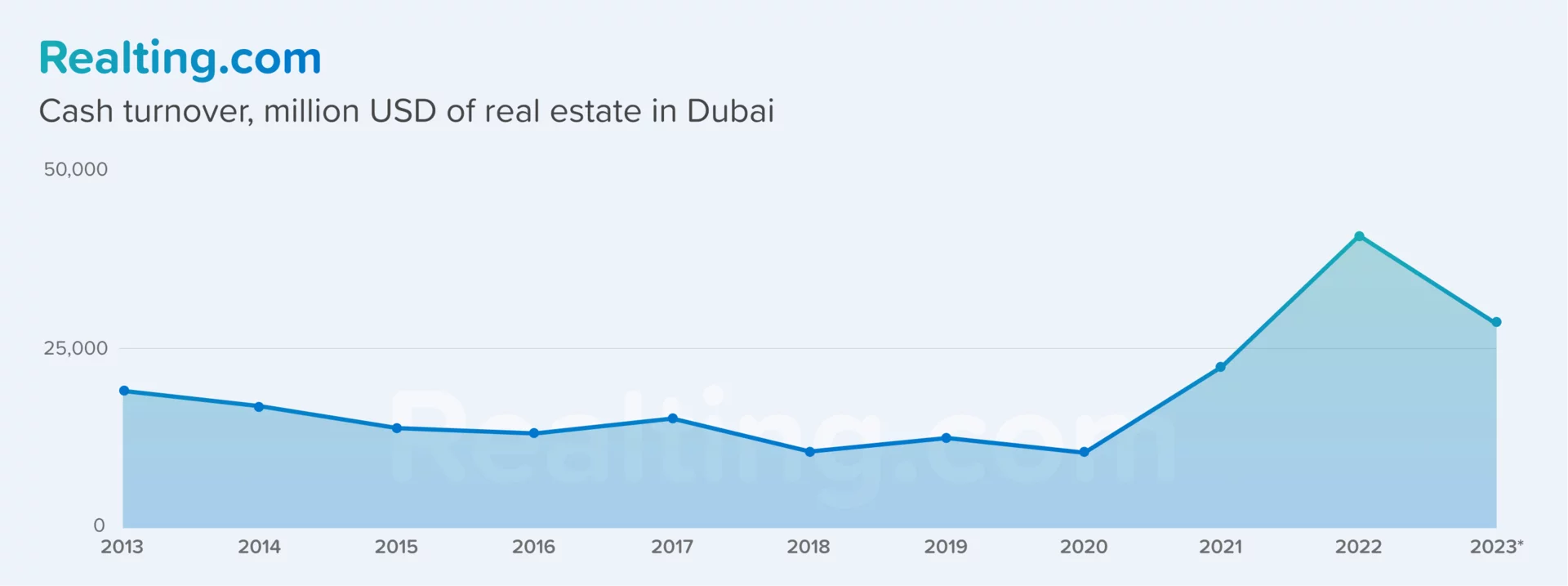

A total of 6,831.1k sqm was sold in the first half of 2023, with a cash turnover of $28678.7 million. In monetary terms, this is 70% more than in the same period last year. Nevertheless, 2022 is still the leader in 10 years in terms of both number of transactions and money.

The growth of money turnover more than 2 times occurred in 2021 — back then $22673.7 million was invested in real estate.

The increasing attractiveness of Dubai is also associated with the construction of social and transportation infrastructure and investments in the construction of commercial facilities.

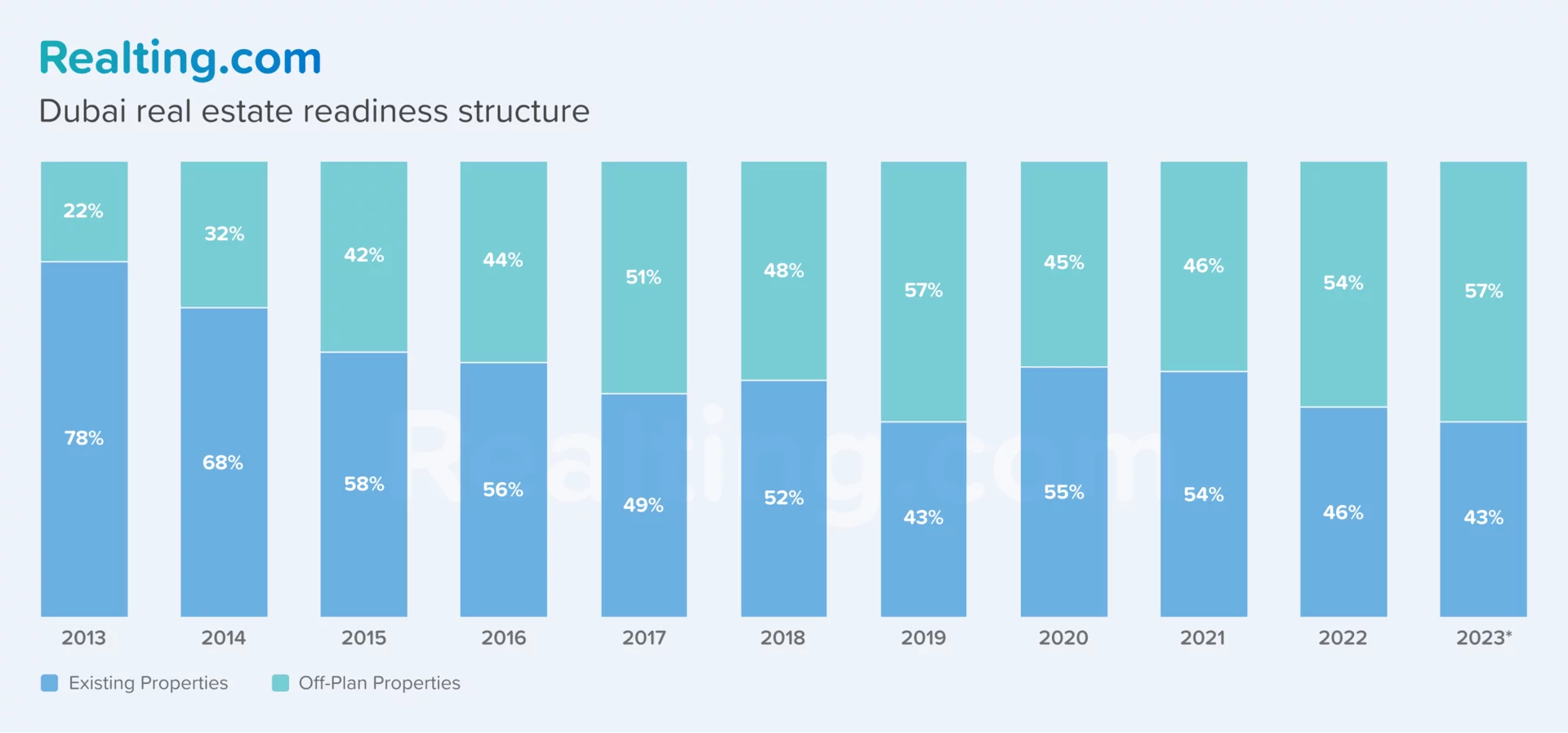

If we talk about the structure of the market by readiness of the property, since 2013 there has been a tendency to reduce the number of transactions with completed real estate - in 10 years, buyers more often preferred real estate at the construction stage. This is due to the rapid growth of construction activity. Moreover, the percentage of vacant space currently remains at a minimum level. Thus, in 2022 and 2023. 54% and 57% of sales transactions respectively were made with Off-plan properties. In 2013, only 22% of transactions were made with these properties.

Existing apartments are more affordable

A total of 42,394 transactions with apartments were made in the first half of 2023: 85% of the total number of transactions. Most frequently people bought one-room and two-room apartments (43% and 27% of all transactions with apartments respectively), as well as studios (18%). Such a trend has been maintained for 10 years.

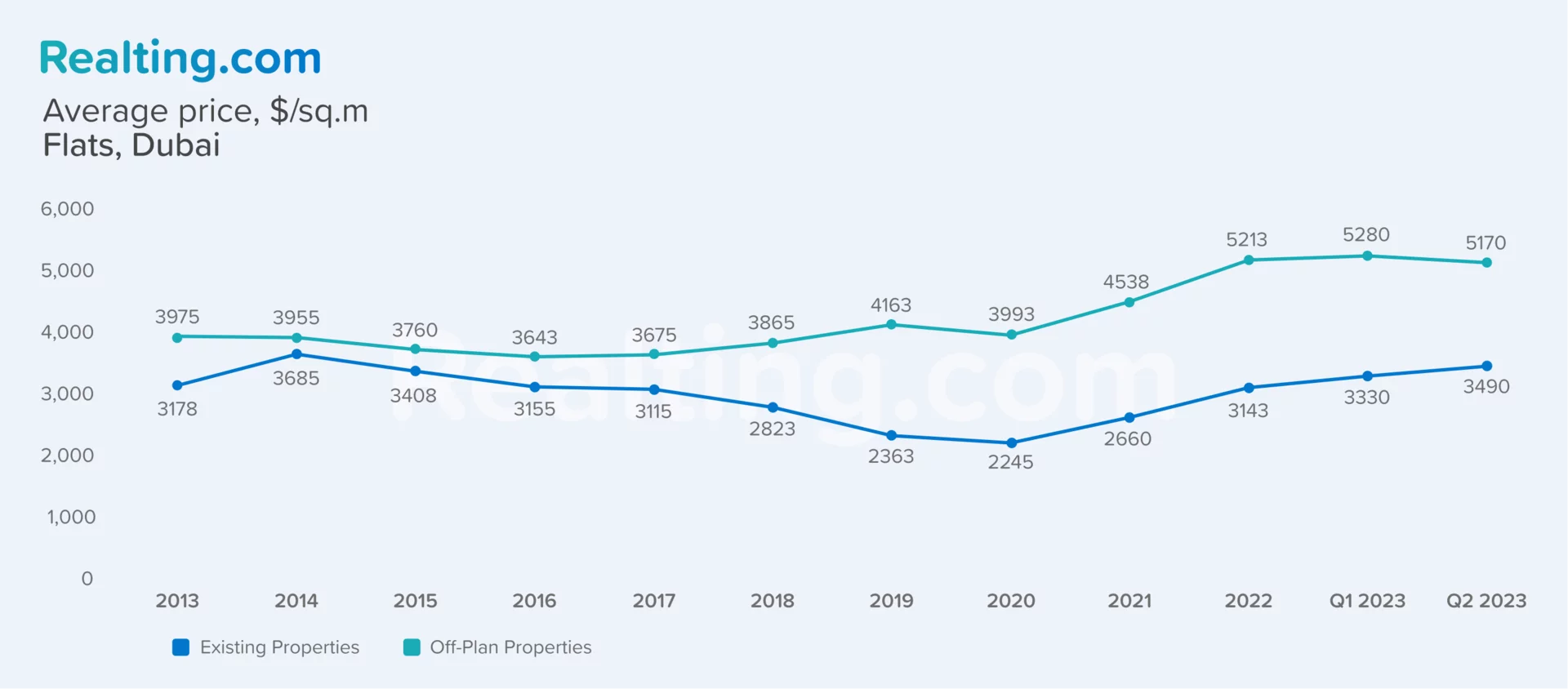

It can be said that existing apartments are more affordable in comparison with off-plan facilities. So, from 2013 to 2018 finished apartments are cheaper on average by 15%, and from 2019: on average by 40%. This is due to the fact that buyers despite the difference in price increasingly choose modern and comfortable options, and the secondary market is dominated by apartments from the older housing stock. In addition, one of the main differences and advantages compared to shared construction in other countries is that in Dubai the owner buys an apartment fully finished.

|

$5 170/sq.m. |

|---|

$5 170/sq.m. — average price per sq.m. in Off-Plan apartments, which was established at the end of the 2nd quarter of 2023. Compared to the 1st quarter, there was a slight fluctuation in the average price by 2%. Although Off-plan apartments are currently the most expensive segment of residential real estate in Dubai, more than half (59%) of sales transactions involving apartments were carried out with them.

Also, the most expensive and popular projects under construction (in terms of number of executed transactions) in the 2nd quarter of 2023 are following:

- SEAPOINT – $12 870 /sq.m. — 366 deals;

- Bluewaters Bay – $11 140 /sq.m. — 262 deals;

- DAMAC Bay – $11 140 /sq.m. — 661 deals.

The average price per square meter for completed apartments was set at $3,490/sqm. Compared to the 1st quarter of 2023, the price increased by 5%. Since 2021 there is a stable positive dynamics of the average price: +18% compared to 2020 and another +18% at the end of 2022.

The minimum price for 10 years was set for finished properties at the end of 2019: $2 360/sqm. Then the drop amounted to 16%.

Every 7th transaction in Dubai is a villa purchase

In the first half of 2023, 7,641 transactions were carried out with villas and townhouses: 15% of the total number. Most often bought three- and four-bedroom options (41% and 26% of all transactions with villas, respectively). Just as in the apartment segment, buyers have not changed their preferences for 10 years.

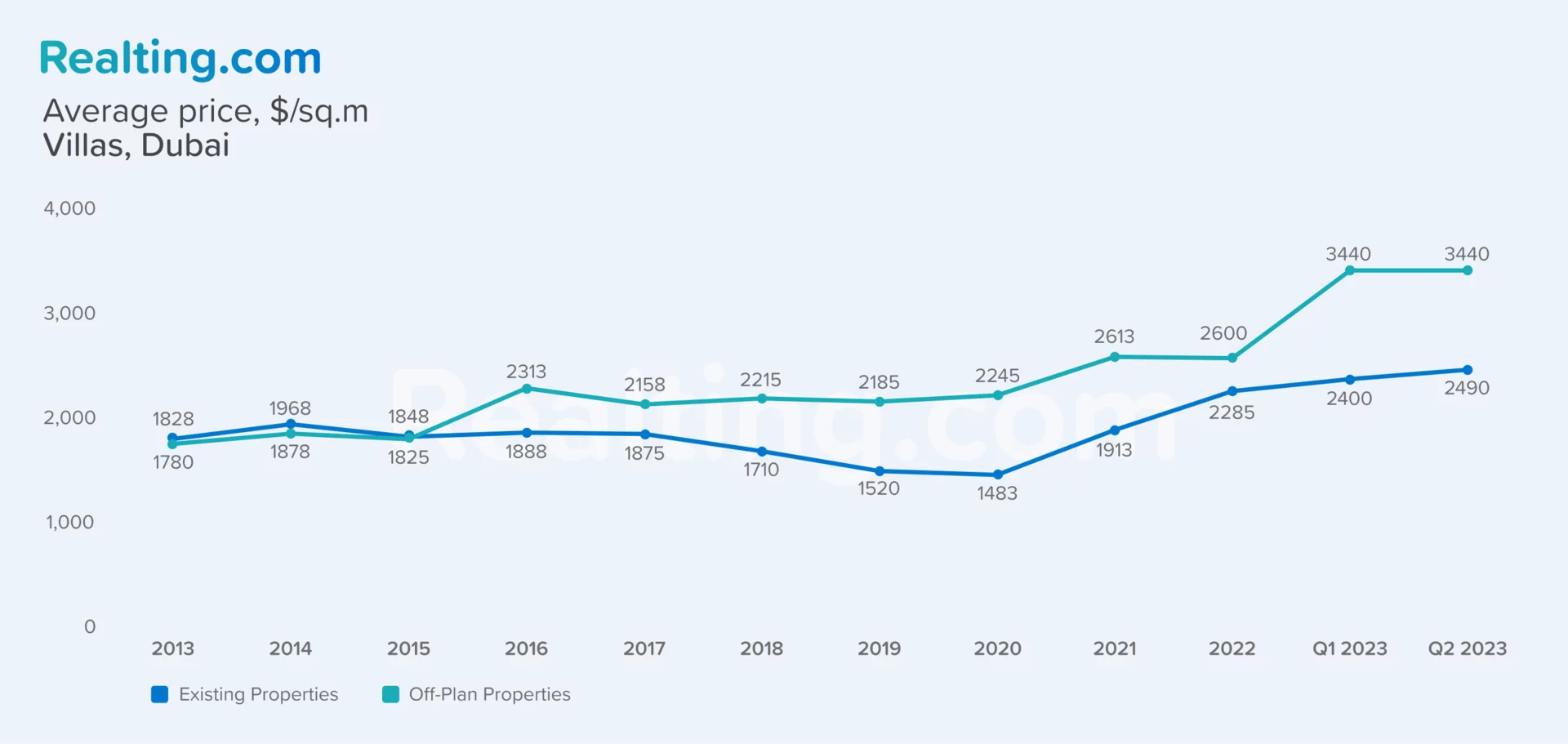

In the 1-3 quarters of 2013, the minimum number of transactions was made with villas under construction (from 8 to 62), and the average price of off-plan properties in 2013 and 2014 was lower than finished properties by an average of 4%. In 2015, it settled at the same level. And from 2016 onwards, villas under construction started to sell more expensive than finished properties: the biggest difference is observed in 2019-2021 — by 44% on average (i.e. almost 1.5 times).

Compared to the 1st quarter of 2023 Off-plan villas price remained at the same level: $3,440/sq.m, in the Existing segment, there was an increase of 4% ($2490/sq.m).

Since 2020, prices for both apartments and villas have started to recover. This is mainly due to the easing of restrictions imposed because of a coronavirus pandemic. While popular tourist destinations have banned crossing their borders, international air travel has been resumed in Dubai. And as of November 2022, all entry requirements and precautions related to COVID-19 have been removed in the UAE.

Not the least role in increasing interest in Dubai was the Expo 2020 exhibition, which became a kind of advertising for the city. During the entire period of the event, more than 20 million people from all over the world visited the exhibition.

The most popular areas for buying real estate in 2023 are:

- Al Barsha South Fourth – 5 866 deals – average price $3070 /sq.m.

- Marsa Dubai – 4 823 deals – average price $7670 /sq.m.

- Business Bay – 3 512 deals – average price $5380 /sq.m.

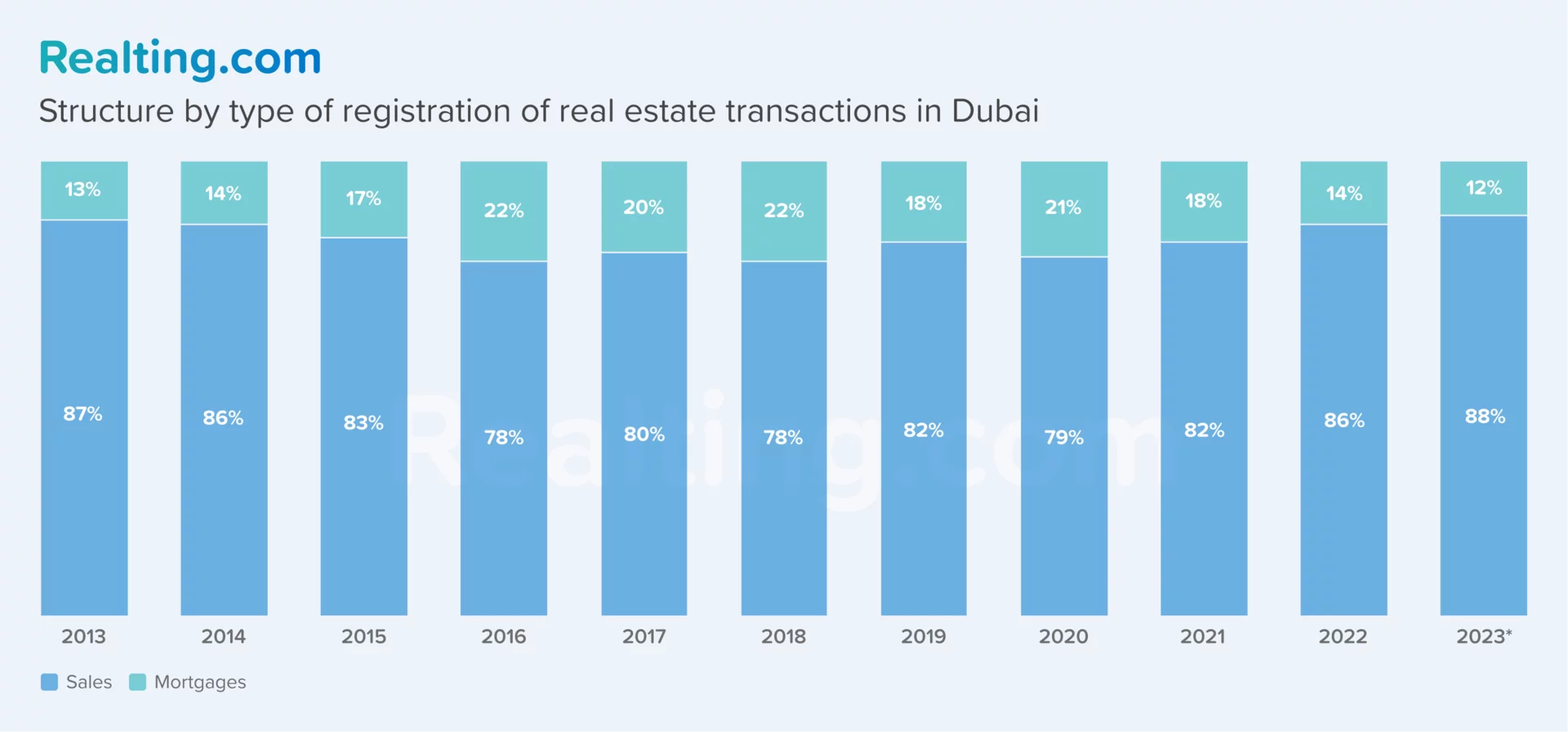

For 10 years, an average of 80% of transactions occurred with the use of buyers' own funds, the remaining 20% - with the use of borrowed funds. It is worth saying that in order to obtain a positive decision on the mortgage in Dubai buyers must meet quite a few conditions: the status of the buyer in the country, age, income and employment, the presence of property in the country, the stage of construction of the property are considered. Also, the mortgage involves additional costs for the bank's review of the application, as well as insurance of the transaction. The obvious advantage of the UAE resident status is lower interest rates on loans.

The trust in real estate investment in Dubai is growing every day and it is likely that 2023 will set a new record in the emirate's real estate market. Prices for villas and apartments are showing strong growth and are at historically high levels, which indicates a bold and active behavior of buyers, as well as sellers and developers.

The database of real estate sale and purchase transactions in Dubai is formed based on the information of Dubai Land Department.

Author

Providing readers with quality analysis on global trends in the real estate market.