How is the Turkish Housing Market Doing? Analysis from REALTING

From 2020 to 2022, the Turkish residential real estate market showed record activity. During this period, the annual number of residential real estate purchase and sale transactions almost reached 1.5 million. However, the events of 2023 led to a drop in market activity. Our analytical material is devoted to the state of the Turkish housing market in 2024.

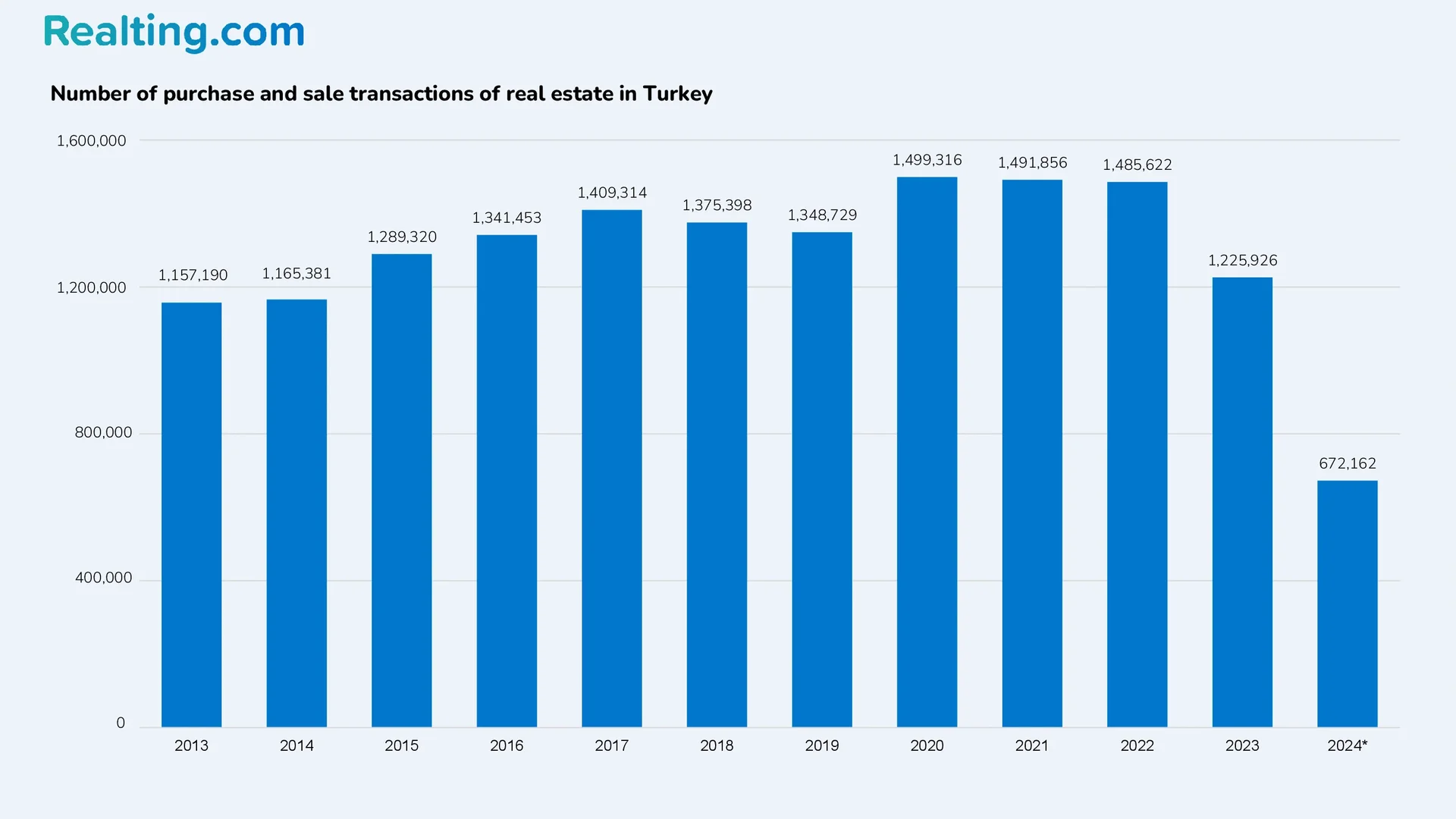

According to the Turkish Statistical Institute, more than 1 million residential property purchase and sale transactions have been carried out annually in the Republic of Turkey since 2013. The peak of activity occurred between 2020 and 2022: during this period, the annual number of purchase and sale transactions reached almost 1.5 million.

However, the events of 2023 have made their own adjustments to the Turkish residential real estate market:

- In February 2023, a destructive earthquake claimed the lives of tens of thousands of people and destroyed or damaged, according to various estimates, more than 150 thousand buildings. In the most affected provinces, housing market activity fell by 1.5–2.2 times by the end of 2023. The earthquake exposed problems in the Turkish construction industry: after it, buildings were checked for seismic resistance throughout the country.

- Turkey has been experiencing high inflation for a long time. Throughout 2023, the Central Bank of Turkey raised the key rate to combat it. During 2023, the key rate increased several times, which led to an increase in the cost of loans, followed by a decrease in market activity.

As a result, 2023 showed one of the worst results in the Turkish housing market — 1.23 million residential property purchase and sale transactions, which is 17.5% less than in 2022.

Turkey's Housing Market in 2024

According to data from the Turkish Statistical Institute, 672,162 residential property purchase and sale transactions were registered in Turkey from January to July 2024, which is comparable to the same period last year and 18.1% less than in January to July 2022.

The largest number of transactions were made in Istanbul – 112,099 (about 17% of the total number of transactions in the country). In 2nd place was Ankara – 58,896 transactions (9%), then Antalya – 37,703 (6%), Izmir – 36,771 (5%), and Bursa – 24,974 (4%).

* - January-July 2024

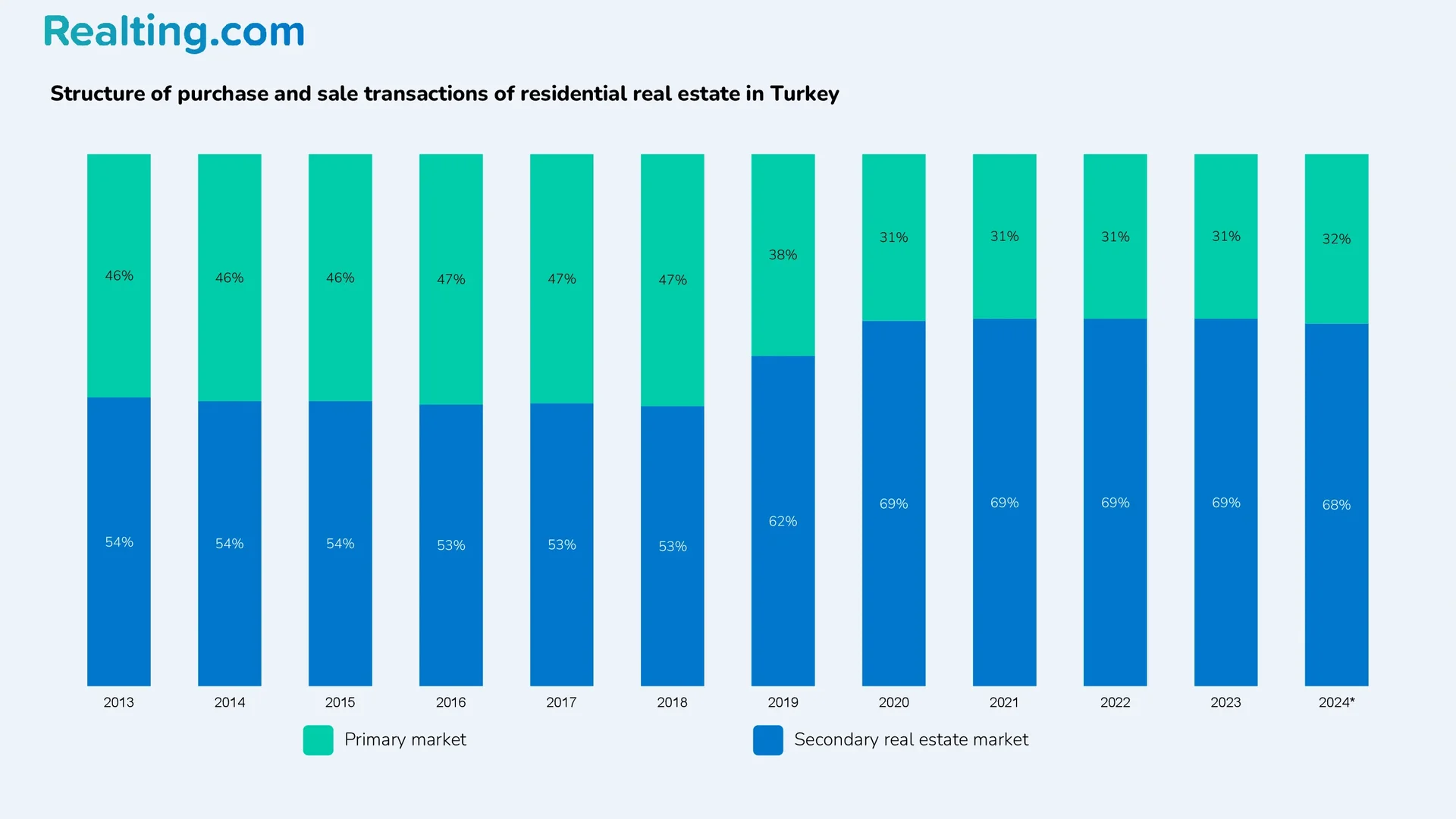

The share of the primary market in residential real estate purchase and sale transactions for the period from January to July 2024 was 32% (214,108 transactions). This is comparable to what was observed in previous years: since 2020, the share of the primary market in Turkey has been 31% of the total number of transactions per year.

* - January-July 2024

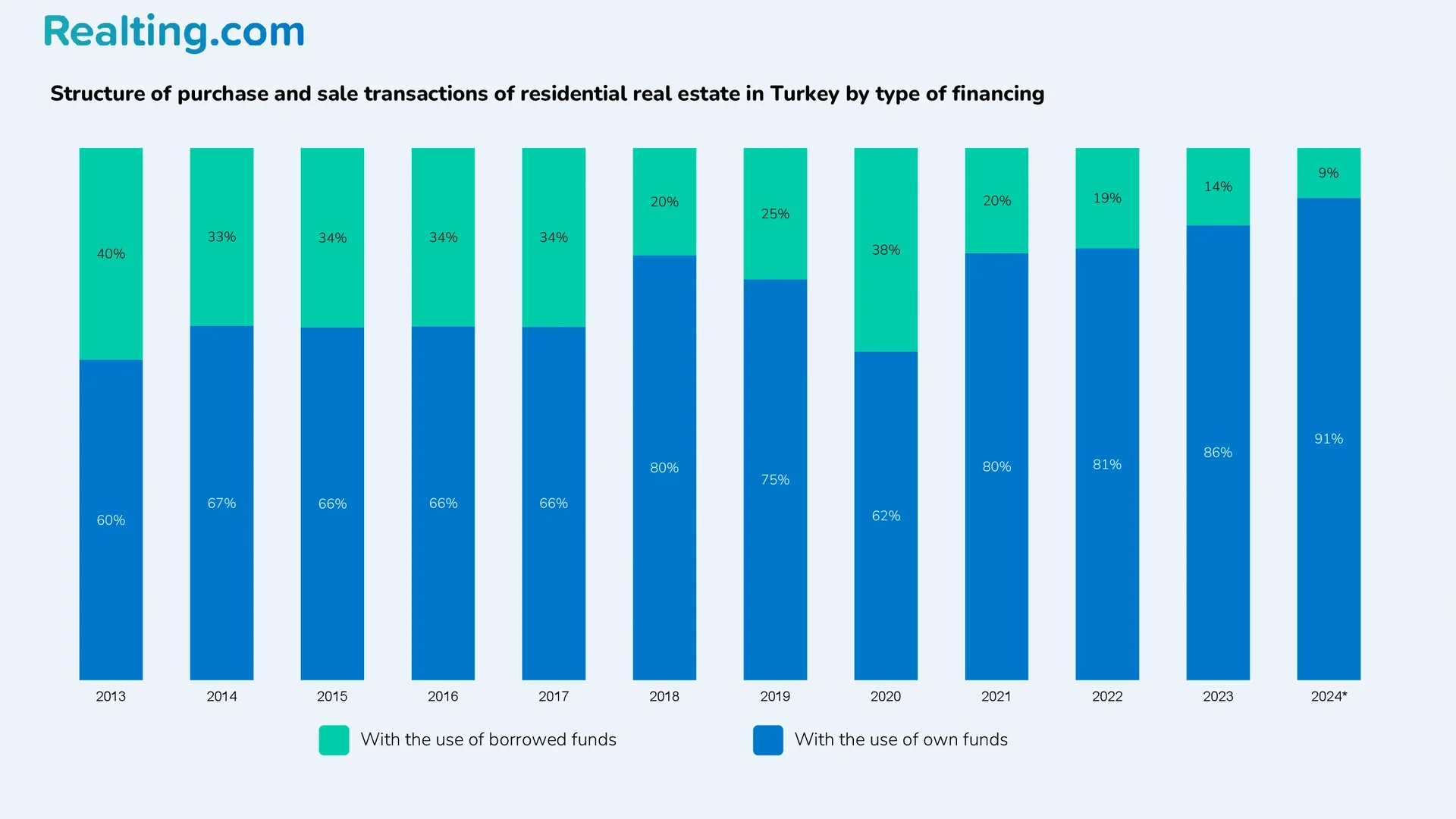

Since 2020, the share of transactions with borrowed funds has been decreasing in Turkey. Over the past 7 months of 2024, only 9% of transactions were concluded with borrowed funds, which is 11 percentage points less than in the same period last year (in January-July 2023, 20% of transactions were concluded with borrowed funds).

* - January-July 2024

The reason for the lack of interest of the population in housing loans is the high cost of these loans. Thus, according to data from the Central Bank of the Republic of Türkiye, the average weighted interest rates on bank loans for the purchase of housing in 2023 increased almost twofold.

Such a sharp increase in interest rates on loans occurred because, in order to combat the high level of inflation (which has been observed in Turkey in recent years), the Central Bank raised the key rate throughout 2023: in 2023, it increased several times, and as of August 2024, it remains at 50%.

It is worth noting here that the Central Bank's anti-inflation policy is bearing fruit. Thus, for the period from January to August 2023, the average monthly inflation growth rate was 4.63%, and for the same period in 2024, the growth rate was 3.54%.

What about the prices?

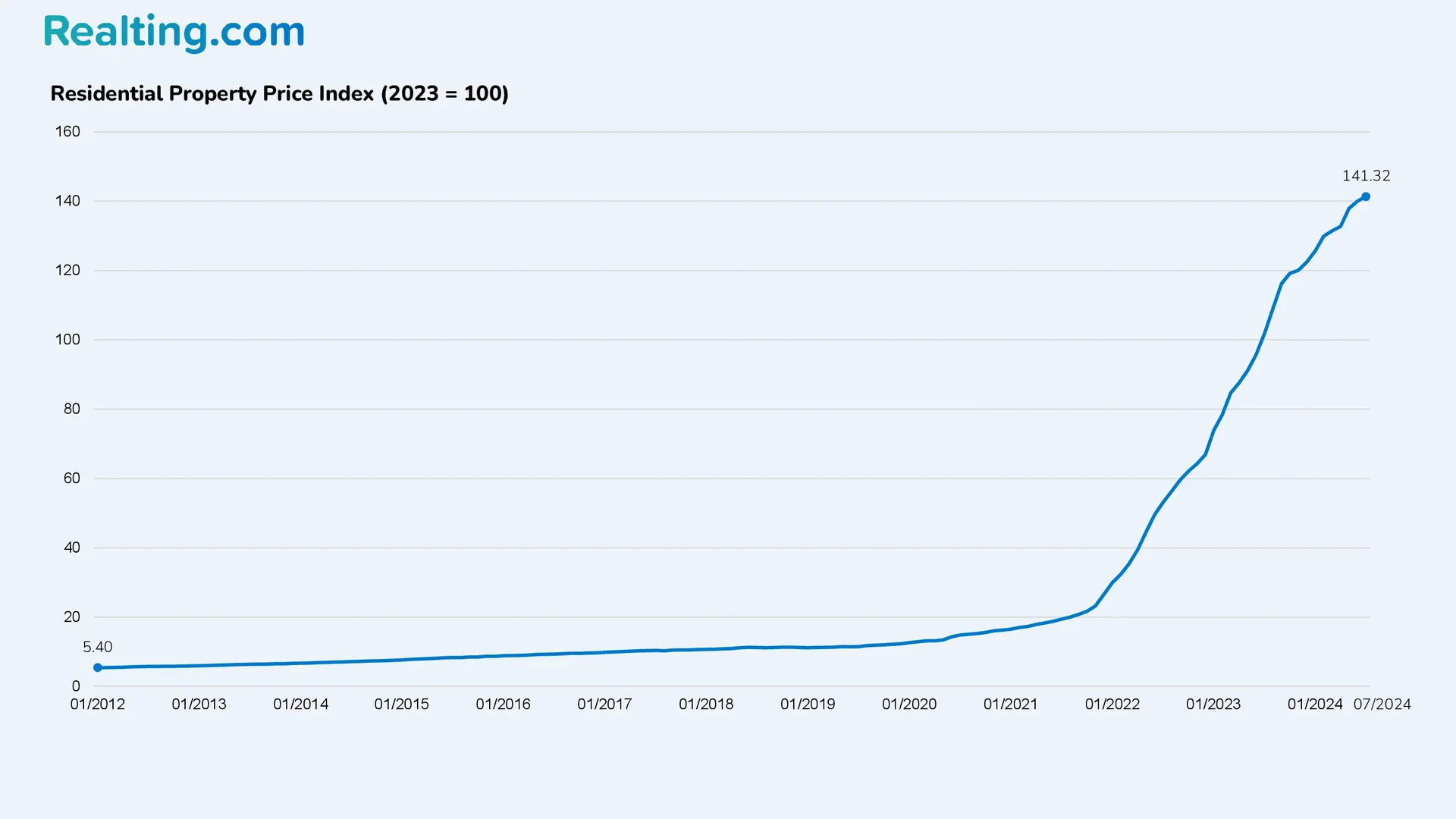

According to the Central Bank of Turkey, the residential property price index (2023=100), which measures the change in house prices in Turkey, was 141.32 points in July 2024, up 0.9% from the previous month.

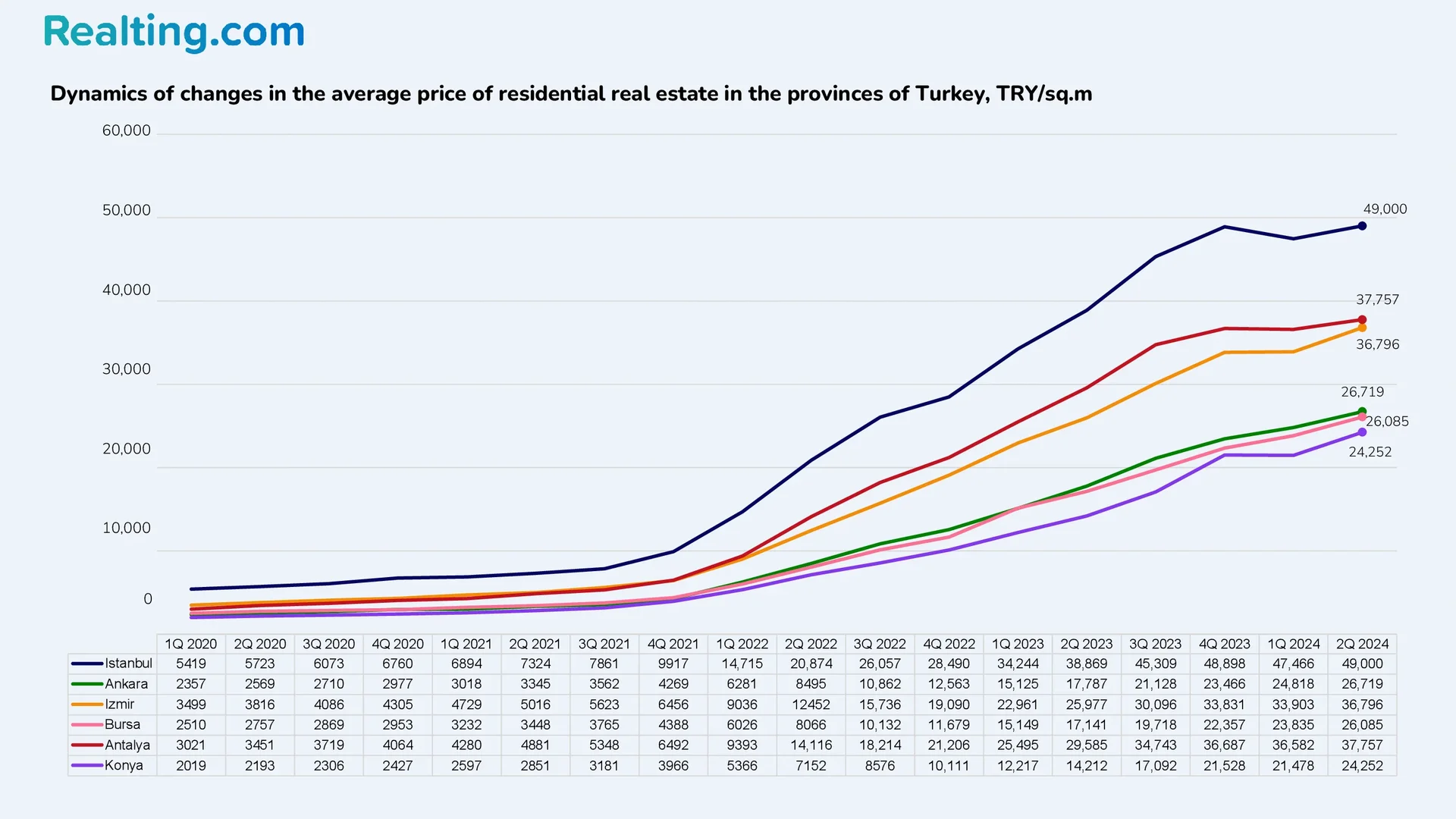

According to the results of the 2nd quarter of 2024, the Central Bank of Turkey cites the following average housing prices in the Turkish provinces: Istanbul — 49,000 TRY/sq.m (Turkish lira per square meter), Ankara — 26,719 TRY/sq.m, Izmir — 36,796 TRY/sq.m, Bursa — 26,085 TRY/sq.m, Antalya — 37,757 TRY/sq.m, Konya — 24,252 TRY/sq.m.

Below are summary tables showing the average price per square meter and the price change compared to Q1 2024 and Q2 2023 in the six largest provinces of Turkey.

Average price per square meter in Turkish lira

|

Provinces |

Average price, TRY/sq.m |

Change by Q1 2024 |

Change by Q2 2023 |

|

Istanbul |

49,000 |

+3% |

+26% |

|

Ankara |

26,719 |

+8% |

+50% |

|

Izmir |

36,796 |

+9% |

+42% |

|

Bursa |

26,085 |

+9% |

+52% |

|

Antalya |

37,757 |

+3% |

+28% |

|

Konya |

24,252 |

+13% |

+71% |

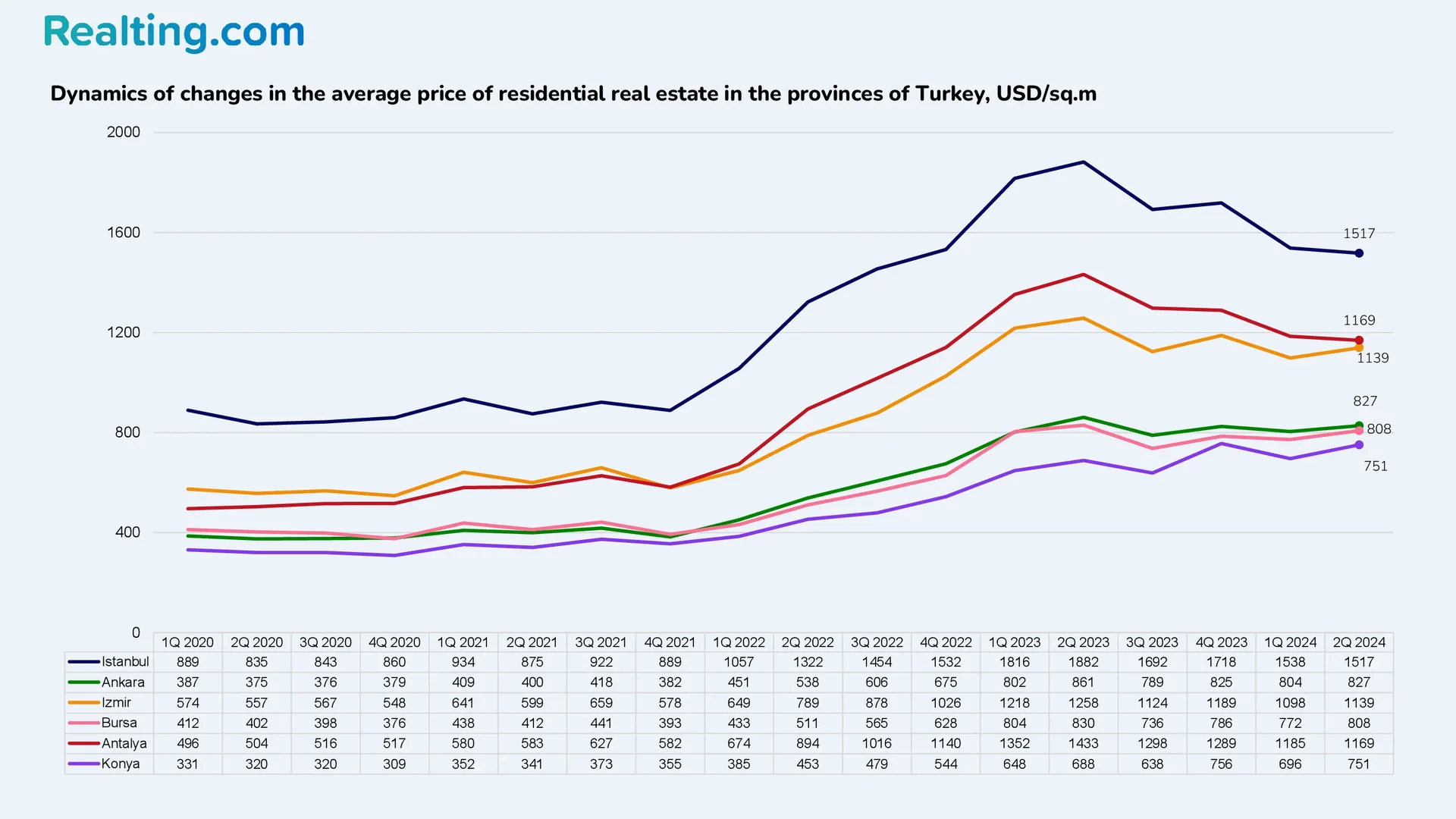

Average price per square meter in US dollars

|

Provinces |

Average price, USD/sq.m |

Change by Q1 2024 |

Change by Q2 2023 |

|

Istanbul |

1517 |

-1% |

-19% |

|

Ankara |

827 |

+3% |

-4% |

|

Izmir |

1139 |

+4% |

-9% |

|

Bursa |

808 |

+5% |

-3% |

|

Antalya |

1169 |

-1% |

-18% |

|

Konya |

751 |

+8% |

+9% |

Due to high inflation, house prices in local currency terms increased in all six provinces. In turn, house prices in dollar terms decreased in five of the six provinces over the year, indicating that real house prices are declining.

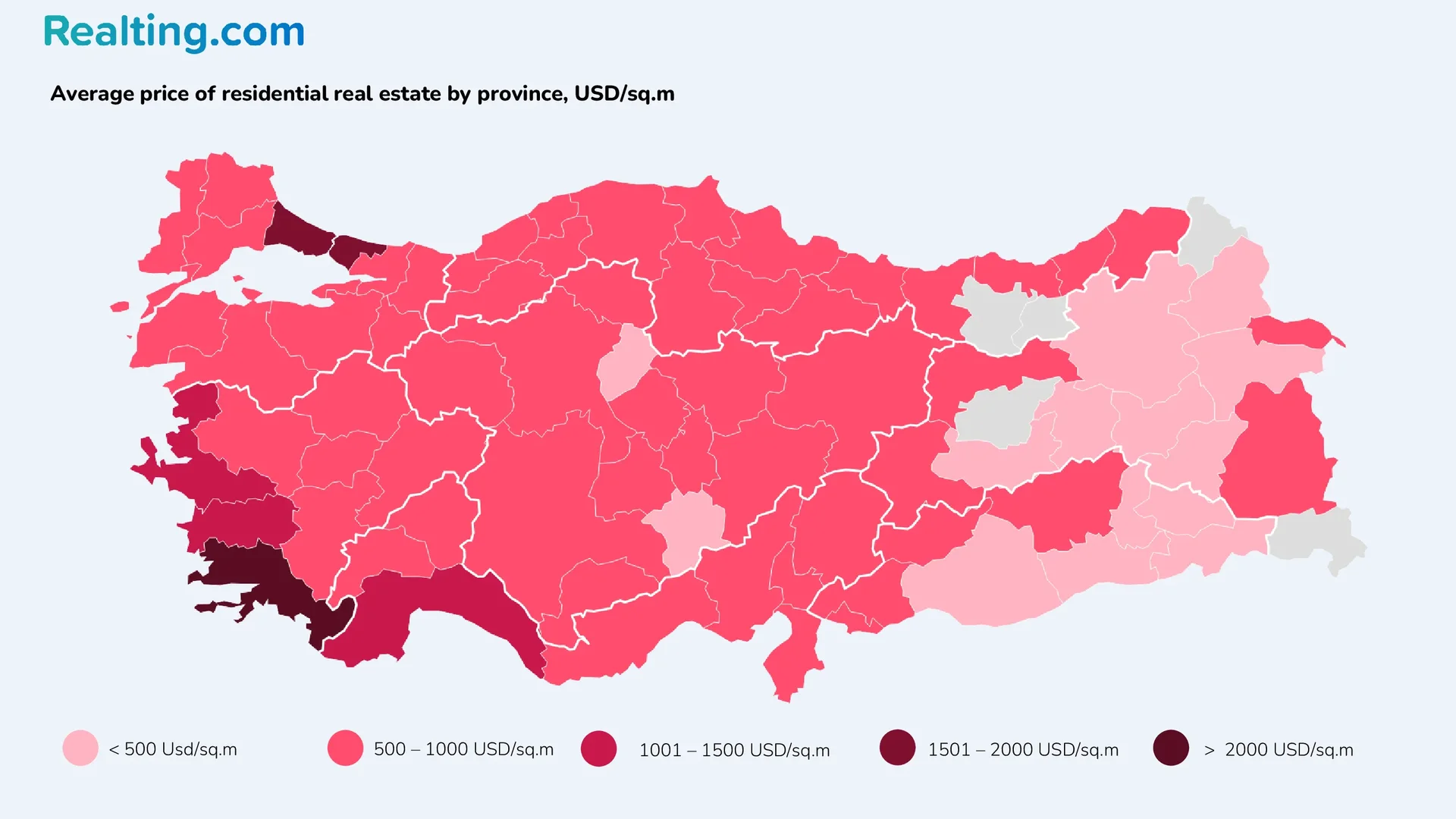

Below is a map showing the average price per square meter of residential property by province.

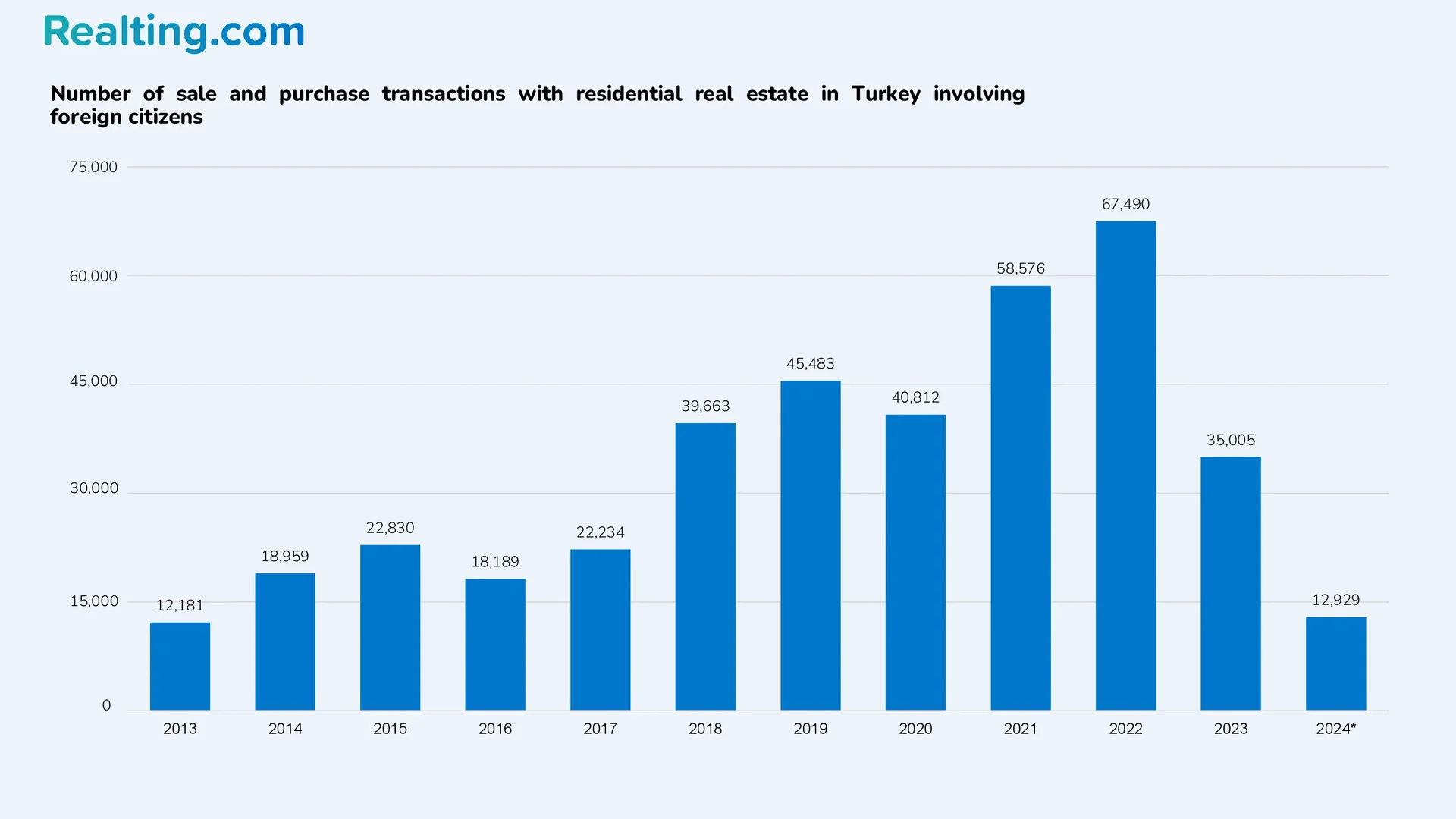

Foreign Buyers

From January to July 2024, 12,929 residential real estate purchase and sale transactions were completed with the participation of foreigners, which is 2% of the total number of transactions for this period. If we compare with the same periods of previous years, we can say that in 2024, demand from foreigners decreased. Thus, in January–July 2023, 22,076 transactions were completed with the participation of foreigners (3.3% of the total), and in January–July 2022, 39,322 transactions (4.8%).

* - January-July 2024

The peak of foreign buyer activity in the Turkish housing market occurred in 2022: then 67,490 purchase and sale transactions were concluded with the participation of foreigners — this is 4.5% of the total number of transactions.

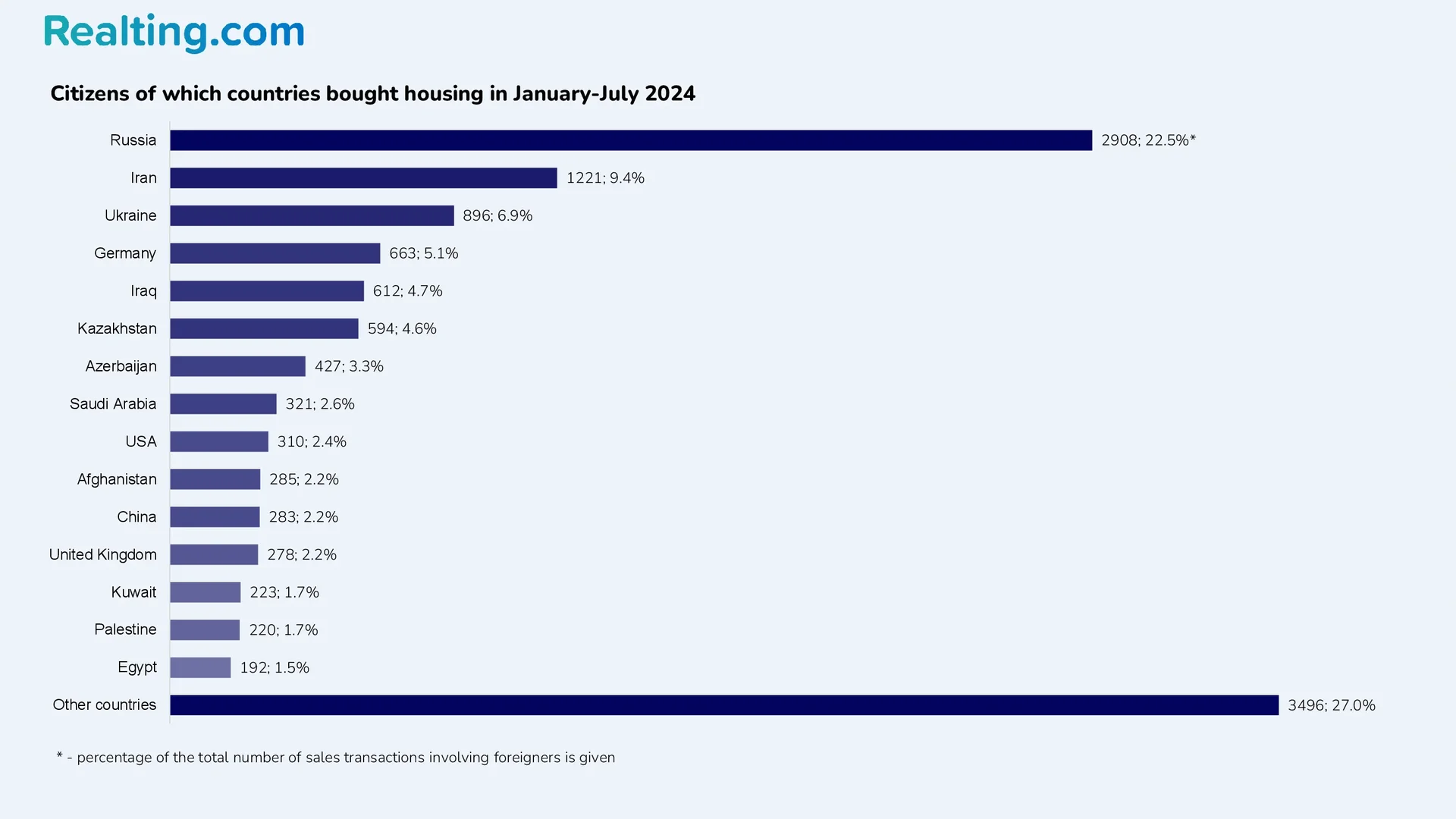

Analyzing the data of the Turkish Statistical Institute on housing sales to foreign citizens, it can be said that most often residential real estate in January–July 2024 was purchased by citizens of Russia, Iran, Ukraine, and Germany.

It is worth noting that Russian citizens have been leaders in purchasing housing since 2022 — before that, for a long period, the leaders in purchasing housing were citizens of Iraq and Iran.

In January–July 2024, foreign citizens most often bought housing in the provinces of Antalya, Istanbul, Mersin, Ankara, and Yalova. The provinces of Antalya and Istanbul are traditionally the most popular areas for foreigners to buy housing.

Results

As January-July 2024 showed, there is still low activity on the Turkish market from buyers. The reasons for the low activity are the persistent high inflation rate, high interest rates on loans, and the general economic situation in the country — all this reduces interest in the Turkish market and forces one to take a wait-and-see attitude.

However, it is worth noting that against the backdrop of high inflation in the country and rising prices in the national currency, real property prices are declining. In general, buying residential property in Turkey can be a good investment, as Turkey is still a popular tourist destination as well as a state that has great potential for investors with assets in stable currencies.