Rising Prices, Demand and Too High Risks of Being Evicted. Analysis and Trends of the Real Estate Market in Spain. Analytics from REALTING

Spain is one of those European countries where the majority of residents own real estate, and the country is open to international investors in real estate. Low mortgage rates have encouraged people to buy property in spite of the disadvantageous terms of banks pursuing their own interests. Legislative changes in 2019 brought fairness to this process. The real estate market then faced political factors, a pandemic, and rising inflation. REALTING learned how the housing market in Spain coped with the challenges of the decade and what was happening in 2023.

Legislative Changes, Protests and "Gold Visa" — Everything over 10 Years

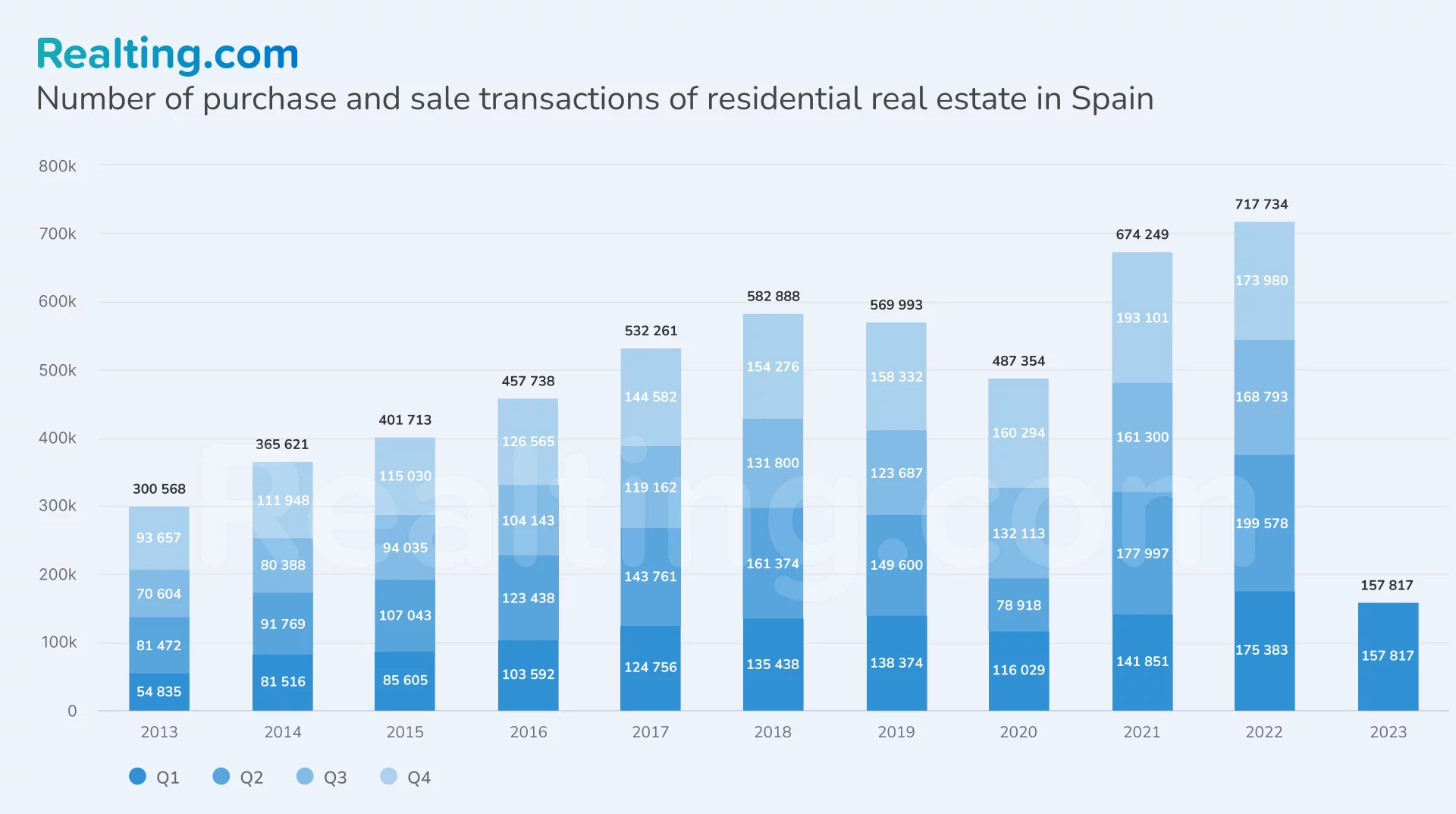

According to data from Ministerio de Transportes, Movilidad y Agenda Urbanas from 2013 to 2018, the number of residential real estate transactions in Spain has steadily increased — the most significant increase occurred in 2014: +22% compared to the previous period. The increase in the number of transactions was due to the growth of the economy (which began in 2013) and purchasing power of the population, low mortgage interest rates (according to the Instituto Nacional de Estadística average for 2014 - 3.8%) as well as the growing demand from foreign investors through the "Golden Visa" program introduced in late 2013. The program allowed foreigners to obtain residence permits in Spain in exchange for investments. Most investors preferred to buy real estate worth more than 500 thousand. euros, although the program also offered the possibility of investing more than 1 million euros in shares of Spanish companies or opening an account with a Spanish bank for the same amount.

Even a year before the pandemic, the number of transactions began to decline in 2019, the fall was 2%. The reasons for the decrease in demand were as follows:

The first is changes in mortgage legislation. Since 2019, Spanish mortgage legislation has led to common European rules for home purchases. Although the process of obtaining a mortgage and its repayment has accumulated many problems, and changes in legislation were expected, potential buyers of real estate have many questions about new rules and conditions. What has changed now? It should be said at the outset that all the changes were mainly aimed at protecting the interests of borrowers, not banks. So, since June 2019, the participation of a notary in the transaction became mandatory, which after studying all documents issued by the bank and risk assessment, could recommend deferring the purchase of housing in mortgage. Also, banks have become more careful to check the solvency of the borrower, assessing not only current, but also expected future income. This is particularly important for those who will continue to repay the loan after retirement. The changes also affected the remuneration of bank employees — banks have been prohibited from paying a commission to their employees for mortgages. Because often mortgages were made too "easily", which entailed litigation. By the way, almost all the costs of the mortgage, according to the updated legislation, is covered by the bank. Early repayment has also become cheaper for the buyer of the property, and the period of eviction has increased. One of the most important changes was the elimination of the minimum interest rate: until 2019, the bank could set a minimum rate on the loan and in case of a fall below the agreed interest rates, the bank did not have to reduce the rates of borrowers. The client was thus at a disadvantage.

Second, from October 2019 to the end of the year, protests were held in Catalonia in support of convicted politicians and the independence movement of the autonomous community, which also influenced the activity in the real estate market.

The third reason for the decrease in the number of transactions was the change of legislation in the field of real estate leasing—many investors who want to receive a return from real estate leasing have abandoned the plans. In some regions of Spain, it has been decided to introduce rent price controls that set maximum limits on price indexation to limit rent increases. These measures were applied locally and depended on the specific characteristics of the rental market in each region.

In 2020, Spain’s real estate market was hit hard by the COVID-19 pandemic and related restrictions: -14% of transactions a year. Tightening of credit conditions, lack of tourist flow especially negatively affected the activity of buyers in 2 and 3 quarters. The fourth quarter of 2020 showed a recovery - the number of transactions slightly increased (1% compared to the same period of the previous year). This is due to the easing of restrictions, the holding of deferred deals, as well as the desire to buy real estate as an investment - unstable financial markets and low mortgage rates (2.3% on average in 2020) have made housing a stable and safe asset.

In 2021, the number of transactions exceeded 650 thousand, compared to 2020 "covid" year growth amounted to almost 40%. When compared to 2019, the growth is also significant - almost 20%. Such high activity was unexpected - forecasts for this year were relatively negative. An important role in 2021 was played by the beginning of vaccination, as well as the possibility of virtual inspections of real estate and preparation for the transaction remotely.

The year 2022 has so far set a record in the number of transactions completed - more than 717 thousand. Nevertheless, the last quarter began to show signs of slowdown, compared to the 4th quarter of 2021, the number of transactions decreased by 10%. High inflation throughout the eurozone has reduced the purchasing power of the population, and the European Central Bank’s systematic interest rate hike, which has led to a rise in mortgage prices, acts as an additional drag on demand.

The 1st quarter of 2023 also demonstrated a fairly modest indicator — 157 thousand. The difference with the same period in 2022 is 10%. Measures to prevent inflation are likely to put pressure on real estate activity and the number of transactions in the current year will be lower than in 2022.

About Pitfalls and Modern Mortgage Conditions

As in Lithuania, mortgage lending is one of the most popular instruments for buying housing. However, prior to the legislative changes described earlier in 2019, there were problems related to the lack of transparency and legal aspects of leveraging transactions. Many banks used difficult and disadvantageous conditions in contracts. As a result, there has been an increase in the number of legal proceedings between banks and borrowers in which the latter have sought to prove the illegality of certain terms of the loan agreement. This trend had a negative impact on the interest in buying a home in pledge. The irresponsible practice of borrowing ceased after 2019, when responsibility for the non-payment of mortgage debt was placed not only on the debtor, but also on the bank.

The problem also affected immigrants. Many became participants in mortgages under which two buyers (often strangers) guaranteed each other’s loans. In such cases, if one person could not repay the loan, the interests of all other participants in the loan agreement were automatically affected.

Actively promoted the possibility of making a mortgage and real estate agencies that facilitated the search for a guarantor — often it was a stranger who agreed to such a "role" for a monetary reward.

What are the conditions for obtaining a mortgage in Spain?

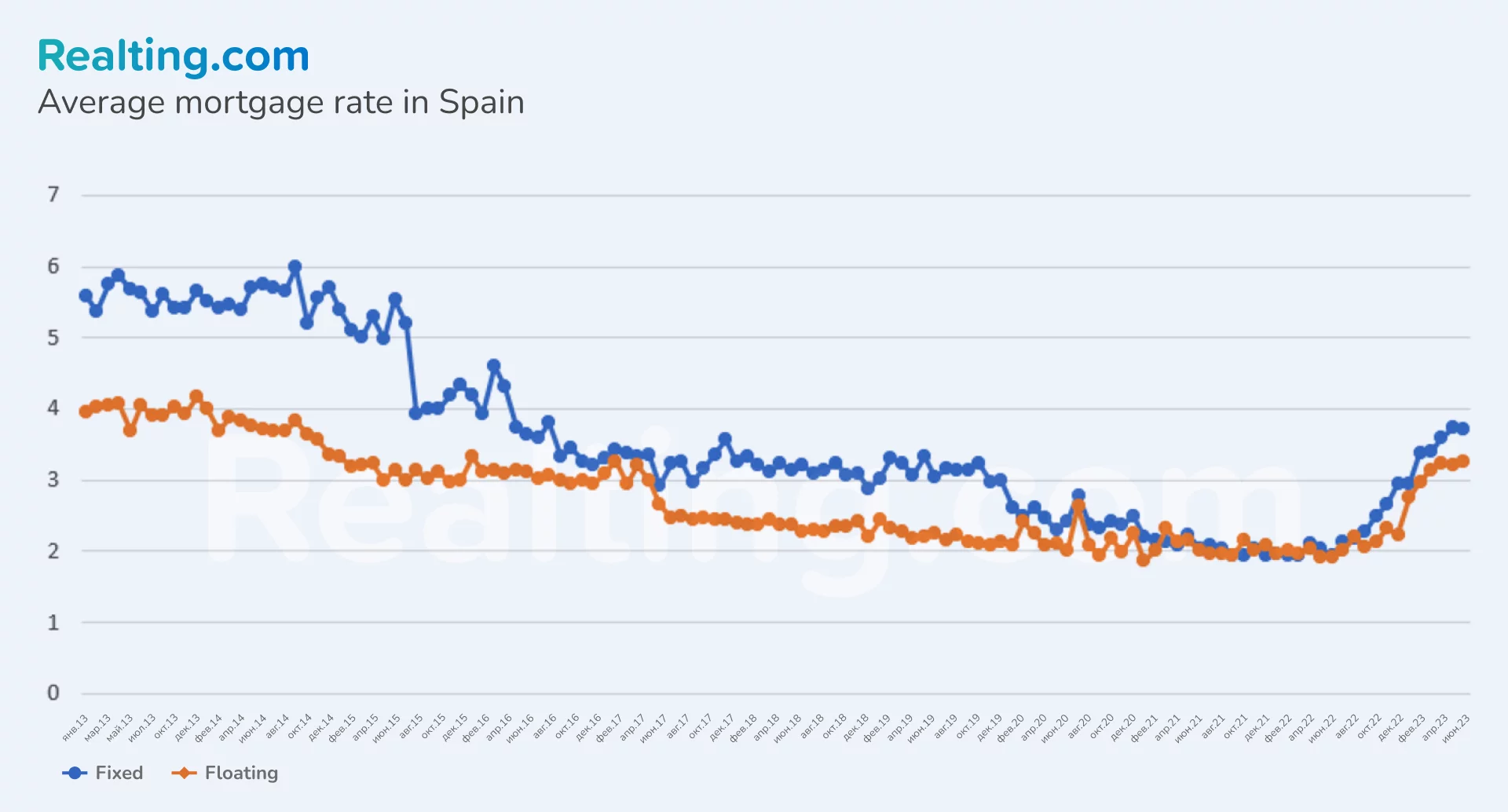

Since July 2022, the mortgage rate has been increasing. In June 2023, the fixed average mortgage rate was 3.7% and the floating rate was 3.2%. In 11 months, interest rates rose on average by 1.4 p.m. And until the European Central Bank reaches its inflation target, it is clear that a fixed rate is more profitable for borrowers.

By the way, since July 2015 the difference between a fixed and a floating rate is not more than 1 p.p., on average — 0.5 p.p. The remaining conditions are as follows: loan term up to 25 years, minimum initial contribution 30%, monthly contributions must not exceed 35% of income. For non-residents, the conditions are stricter: financing is usually not more than 60% of the value of the property, and the loan term is up to 20 years; The interest rate (both fixed and floating) is higher than for citizens or residents. Incidentally, changes in the mortgage law in 2019 allowed non-residents to convert debt into currency other than the euro æ in other words, to get credit in foreign currency. For this reason, many commercial banks in Spain stopped lending to non-residents.

Most Deals are on Secondary Market, Social Housing is Less and Less Popular

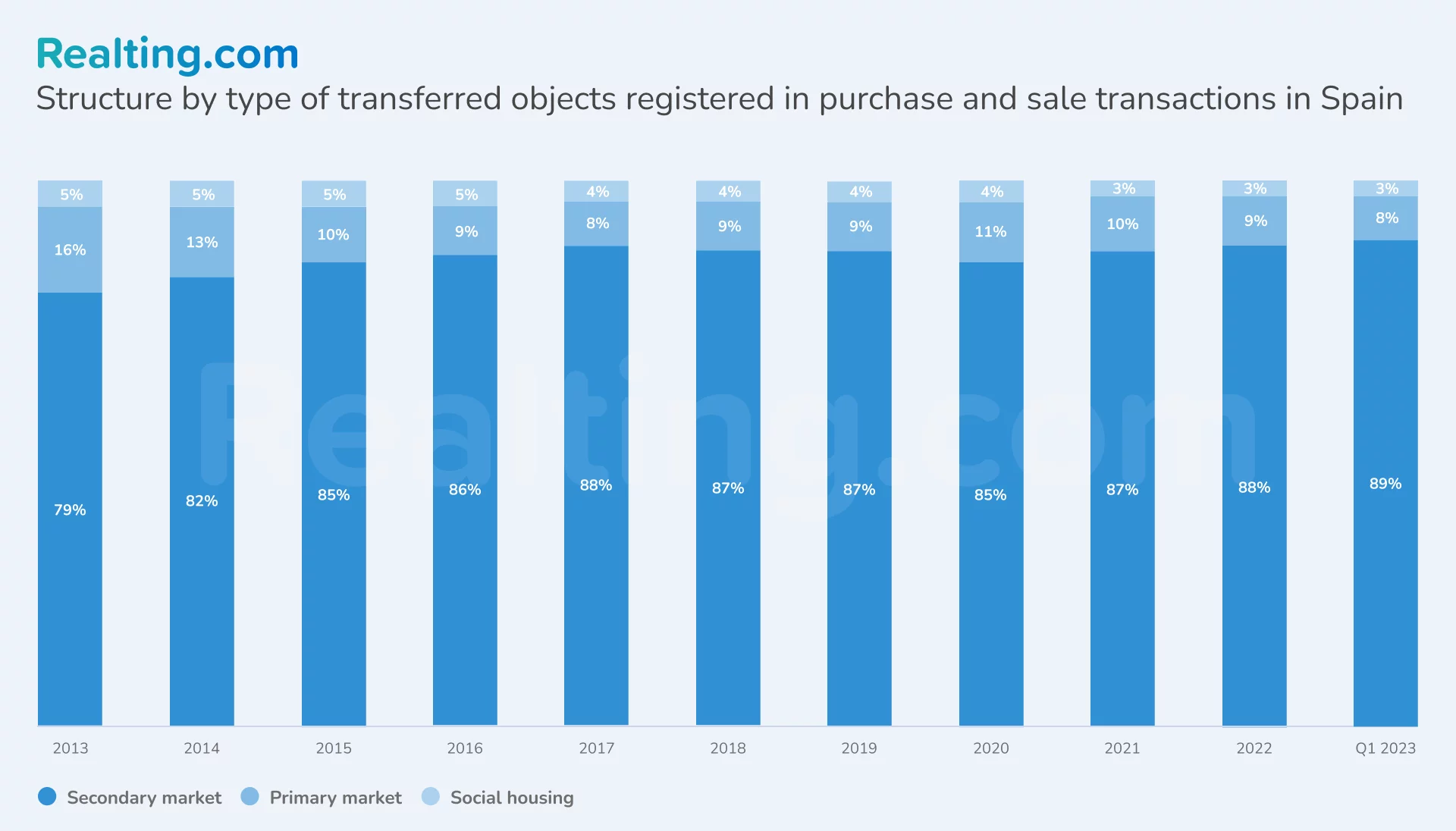

Secondary housing transactions have dominated the structure of all residential real estate transactions for 10 years - up to 89 percent in recent years, 8 to 10 percent in the primary market. After the 2008 financial crisis, housing construction in Spain declined significantly. This impact on the real estate market continued after 2013: the projects already started continued to be implemented, but the decline in real estate activity, as well as problems of obtaining financing for construction, hampered the development of the primary real estate market in Spain. Prior to the pandemic, construction growth had been moderate and had not reached pre-2008 levels.

We can not say about the advantages of new buildings — first, it is flexibility in payment for the purchase of housing at the construction stage. Usually the buyer pays an advance of 10% of the cost of the house, and the mortgage loan contract is concluded after the facility has been put into operation. The second is construction in accordance with energy efficiency legislation. As a result, reducing heating and light costs. Also, new buildings in Spain are ready for settlement, and residential complexes offer well-developed infrastructure.

It is worth saying about the difference in the tax rate when buying new buildings and secondary housing. VAT will be 10% for new houses (i.e. purchased directly from the developer), and in secondary housing transactions the buyer is obliged to pay a transfer tax, which will range from 6 to 10% of the property value depending on the region.

Transactions with social housing have not exceeded 3 percent since 2021, and since 2013 it can be noted that their share is gradually decreasing. "Vivienda protegida" or protected/social housing in Spain is a property that is offered under special conditions for families or people with low incomes, as well as other criteria set by the government. There are several types of such housing, but the general characteristic is this: These are apartments built by developers who conclude an agreement with the state and receive public funding. The difference between the value of official protective housing and the value that would be on the market is covered by the State.

The type of real estate that a participant can claim depends on many factors, but the maximum can not exceed 150 sq.m, and also has a maximum authorized sales value.

The program also includes rental housing, incl. with subsequent right of purchase. Within the framework of such conditions, the maximum monthly/annual rent is determined, and the area of housing cannot exceed 150 sq.m. There are options to rent housing with the right of purchase and for young people: for persons under 35 years of age, with the determination of the maximum annual rent and the area of an apartment or house not exceeding 70 square meters.

In order to be eligible for social housing, the applicant must be registered in the State register of applicants for housing in the autonomous community in which he or she is registered. The applicant cannot own any other real estate. Nor can he receive any public assistance for the last 10 years. The applicant’s financial situation is further assessed: it is considered that the applicant’s family income cannot exceed 5.5 times the IPREM (Indicator Publico de Renta de Efectos Multiples), an index used in Spain as a reference for the provision of assistance, subsidies or unemployment benefits. In 2023 the annual IPREM is 7200€.

An important limitation is that the acquired social housing can be sold freely only after 10 years from the date of its purchase after obtaining a permit from the public authorities, and all the funds obtained for the purchase of an apartment must be returned.

Only COVID-19 is Able to Disrupt the Plans of Foreigners to Buy Spanish Property

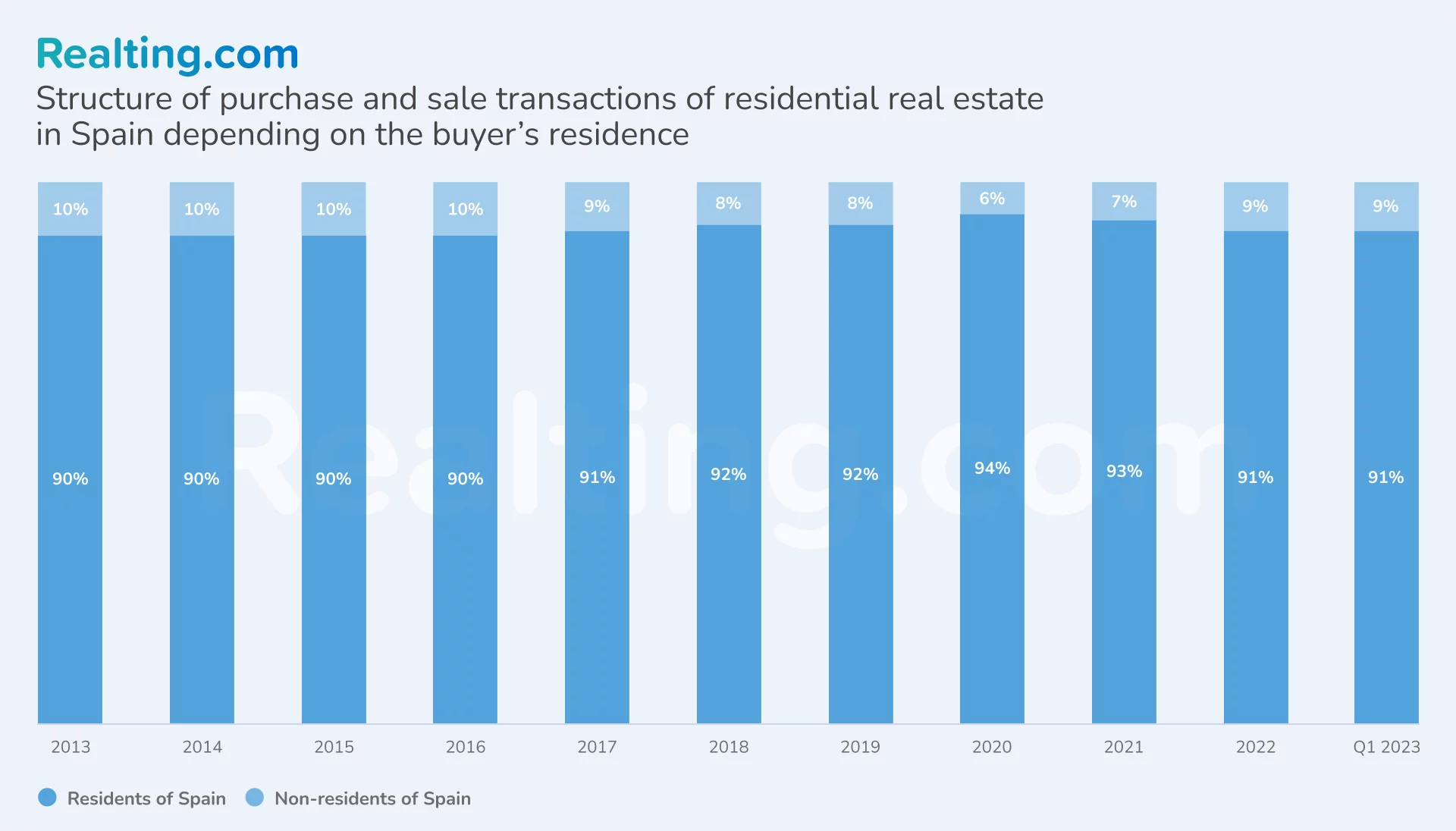

Demand for real estate in Spain from non-residents has remained stable since 2013 — almost 10% of all sales were made with the participation of non-residents in Spain. The trend was reversed only during the pandemic — restrictions on movement, a falling economy and increasing uncertainty affected real estate demand. As a result, the share of transactions with non-residents became 6%.

One of the reasons for foreigners to buy real estate in Spain is to obtain a residence permit in Spain under the program "Golden visa". However, in 2023, a political party proposed that the program be abolished or radically changed because of rising housing prices.

The Price Gap Between Primary and Secondary Markets is Growing, and the Islands Have Seen a Threefold Increase in Value

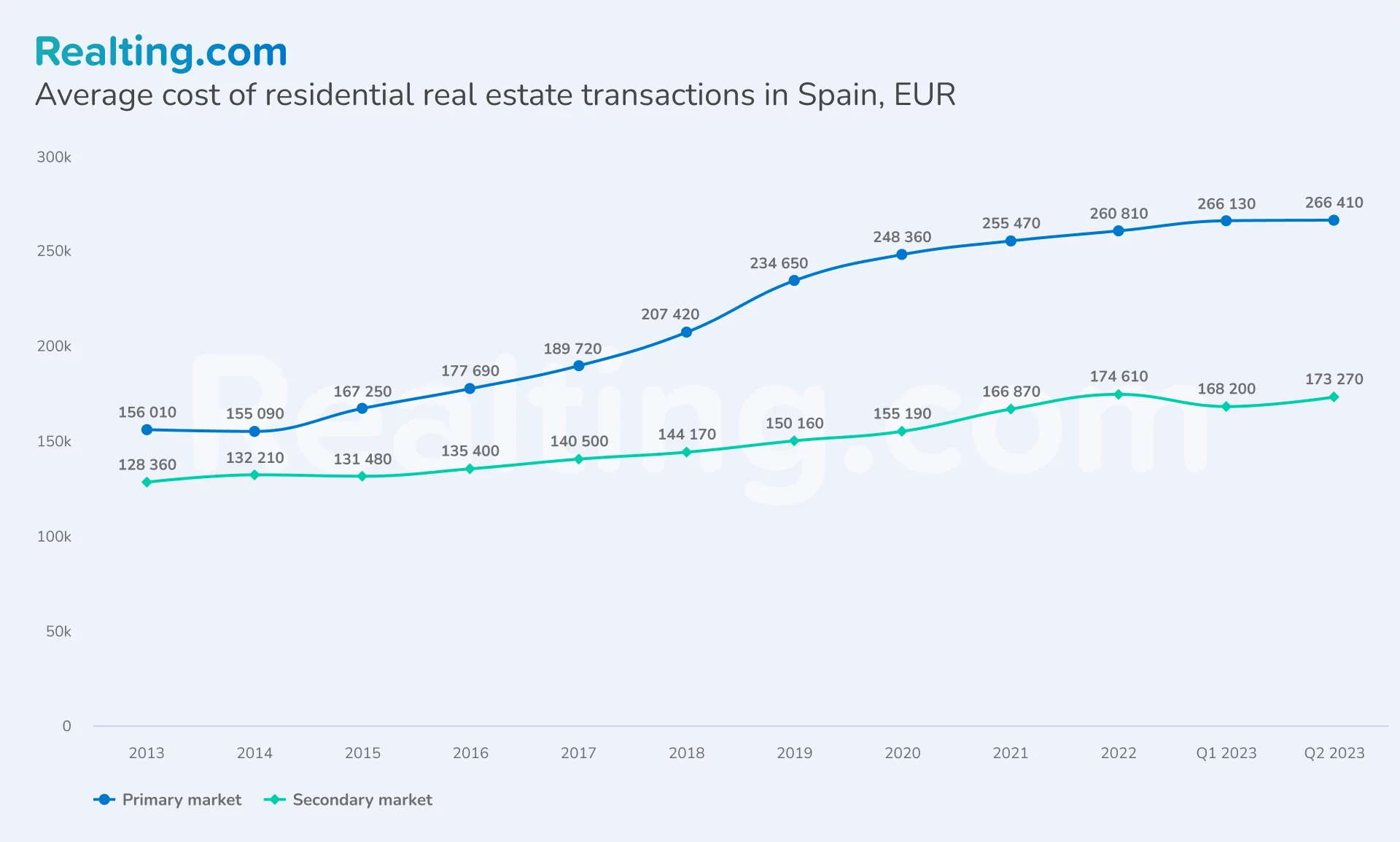

The average cost of primary real estate in Spain over the past 10 years has always been higher than in the secondary market. Moreover, this difference was constantly increasing: in 2013–2014. It averaged around 20 percent, reaching a maximum of 60 percent in 2020. The new buildings have shown stable growth in value for 10 years. Compared to 2022, the cost in the total of the first half of 2023 increased by 2% and amounted to more than €266 thousand. per facility; and since 2013, the cost has increased 1.7 times. In addition to the already mentioned advantages of new housing, it is worth saying that this increase in cost occurs against the background of increased demand for modern buildings with convenient layouts, finishes and equipment, because all this makes the purchase of real estate a profitable investment.

In the secondary housing market in 10 years the cost has increased by 35%, which in comparison with new buildings does not seem so impressive. Since 2022, the cost fluctuates within 5% and in total for the first half of 2023 amounted to 173 thousand.

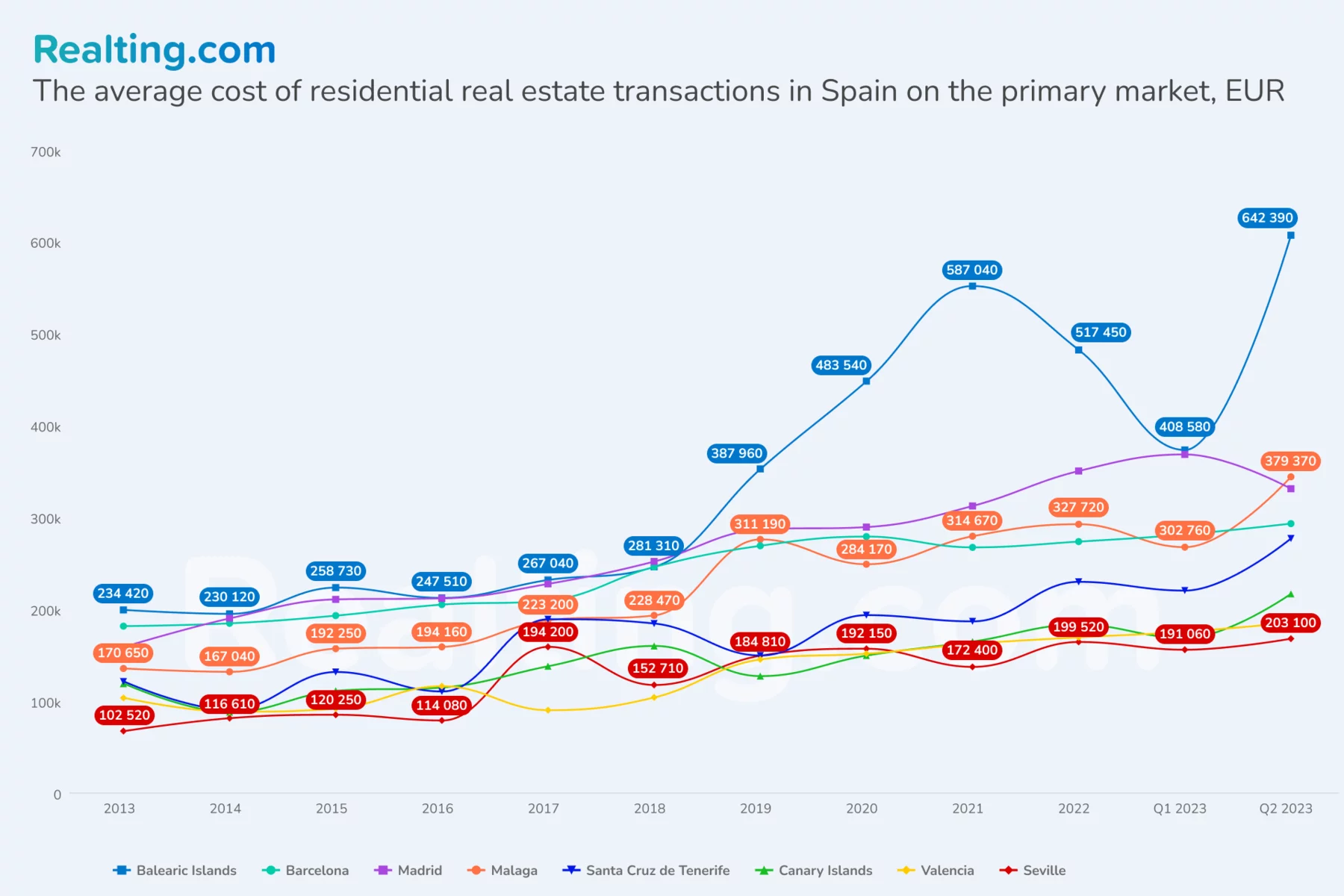

Considering the average value of real estate on the primary market should highlight the most popular tourist destinations in Spain: Balearic Islands, Malaga and Tenerife. The cost here in the last 10 years has doubled for Málaga and Tenerife, and for the group of islands, the most famous of which are Mallorca and Ibiza, the difference was 2.7 times. Primary property in the Balearic Islands will cost an average of €642 000. It will become the most expensive territory in the country. More budget options for buying real estate on the islands can be found in Málaga and Tenerife — at €379 and €312 thousand respectively. High tourist demand and popularity of these places create favorable conditions for buying real estate as an investment.

Seville also showed significant growth — the average cost of housing has doubled since 2013. More moderate growth in the Canary Islands, as well as in cities such as Barcelona and Valencia.

It is worth allocating the capital of Spain Madrid, despite the two-fold growth for the entire period under analysis, it is the only city in which this year there is a drop in prices. As a result of the first quarter of 2023, it was possible to record a 5% growth, and at the end of the second quarter the average price decreased by 9%.

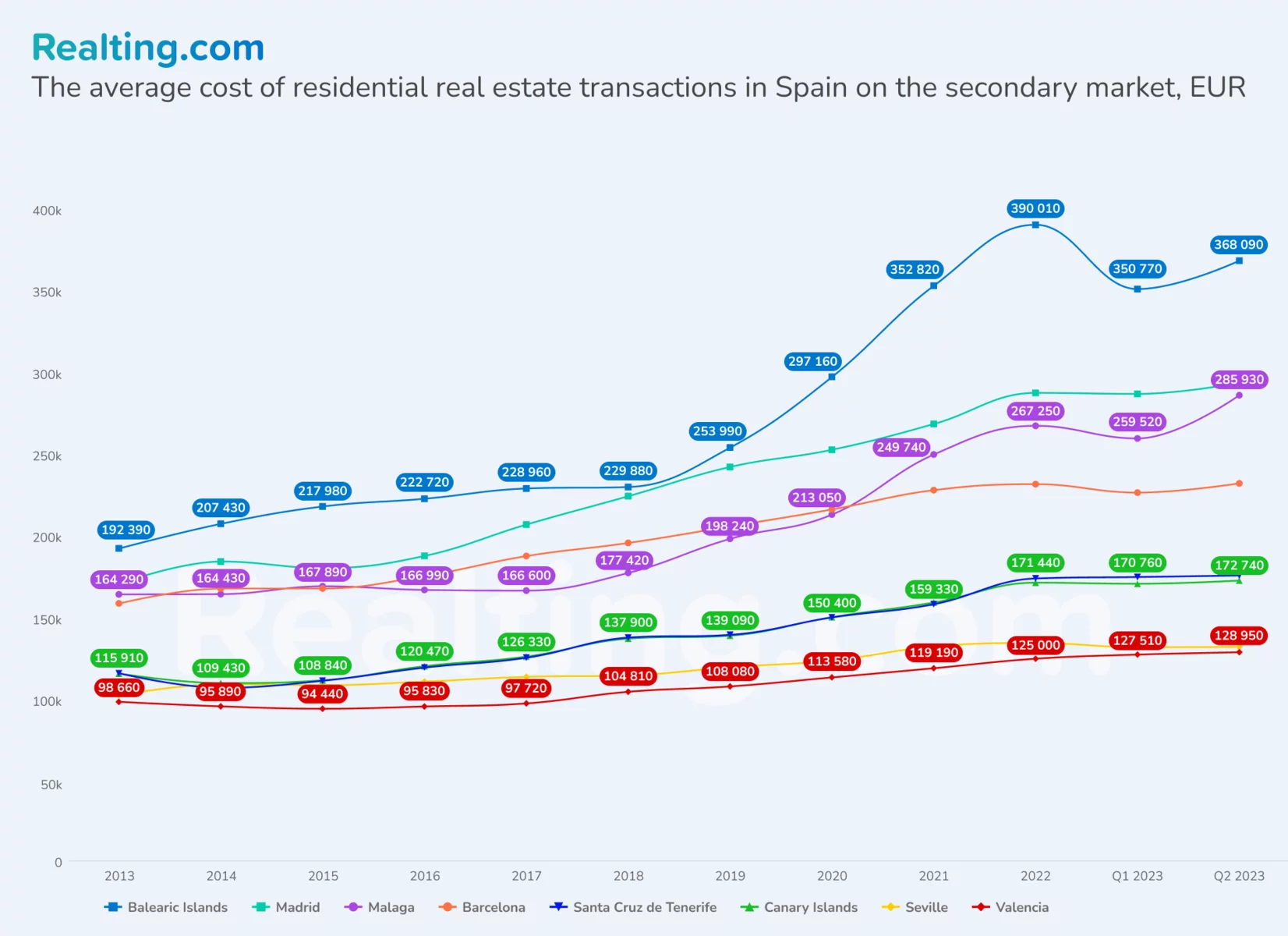

The situation in the secondary market of Spanish real estate can be characterized as more calm - a significant increase in value can be observed only in the capital and in Malaga — 70% and in the Balearic Islands — 90%. The highest average prices are also recorded in these regions: the Balearic Islands became the record holder — €368 thousand, Madrid — €293 thousand. and Malaga — almost 296 thousand.

The secondary market is traditionally more flexible — the correction of prices is much faster than in the primary market. For example, in the first quarter of 2023, compared to 2022, most of the regions under review showed a negative trend. The exceptions were the islands of Tenerife, Madrid, Valencia and the Canary Islands — there was no negative change, and the average price adjusted within 2%. The Balearic Islands lost the most — at once 10%, Malaga — 3%, Seville and Barcelona — 2%. However, in the second quarter of this year there was no decrease in the average value in any of the cities.

At present, the Spanish real estate market, like any other European real estate market, is experiencing the effects of measures to reduce inflation. In 10 years, only COVID-19 was able to negatively affect the number of transactions, and prices remained stable even during this period, which creates the impression of the Spanish real estate market as a reliable and stable system. Negative dynamics in early 2023 is not able to compensate for the impressive growth since 2013, and the thriving tourism industry of Spain attracts a large number of foreign tourists, creating a high demand for rent, which is the driver for a rapid increase in the cost of buying real estate on the islands and, as a result, creating large price gaps with less popular cities. Developed tourism industry, high European standard of living, as well as the development of the economy will support high demand for residential real estate in the country, so it is likely that significant price hikes or changes in activity in the near future will not be observed.

Author

Providing readers with quality analysis on global trends in the real estate market.