Real estate hype in Turkey has come to an end? Number of transactions in June decreased by 44.4%

According to the Turkish Statistical Committee, the number of transactions in the country’s real estate market has fallen by almost half. At the same time, the number of transactions with foreign buyers decreased by 69.6% compared to the same month of the previous year. What else has changed in the Turkish real estate market over the past six months read in the article.

Immersion in context. Briefly about the most important aspects

High demand for real estate in Turkey has led to a significant rise in prices and an acute shortage of supply in the market. As a result, the local population has become unable to buy an apartment or house in Turkey, and even to rent housing in the most popular areas. As a result, last summer, the Turkish authorities decided to close some areas in the most popular locations, thereby trying to stabilize the market.

By the end of 2022, the country began a wave of refusals of residence permits, and it turned out that there is no clear system in this matter and regulations in the country.

Nevertheless, demand and Turkish property prices continued to rise. As for the cost of real estate in Turkey, its annual growth as of March 2023 was 154% in lira. The average price per square meter was 17,573 Turkish lira ($905), and the payback period for housing investment was 20 years.

The most popular Turkish regions in March were Istanbul, Ankara and Antalya. In Istanbul, the annual rise in home sales was 144% with an average price per square of 27,004 Turkish lira ($1,391).

In May 2023, Turkey held presidential elections, and many foreign investors then took a wait-and-see approach. There are really many questions at that time: what will happen to the prices for apartments in Turkey? Will foreigners be forbidden to buy property in the country? What will happen next with the real estate market in general?

After the elections in Turkey and the introduction of a new Interior Minister, many market players waited for news of the possible opening of closed areas in Turkey, as well as changes in the issuance of residence permits for foreigners. However, this did not happen. Moreover, there was a possibility of expanding the list of closed areas.

Above everything, Turkey’s country risk premium remains at a very low level, which is why investors are still interested in the country.

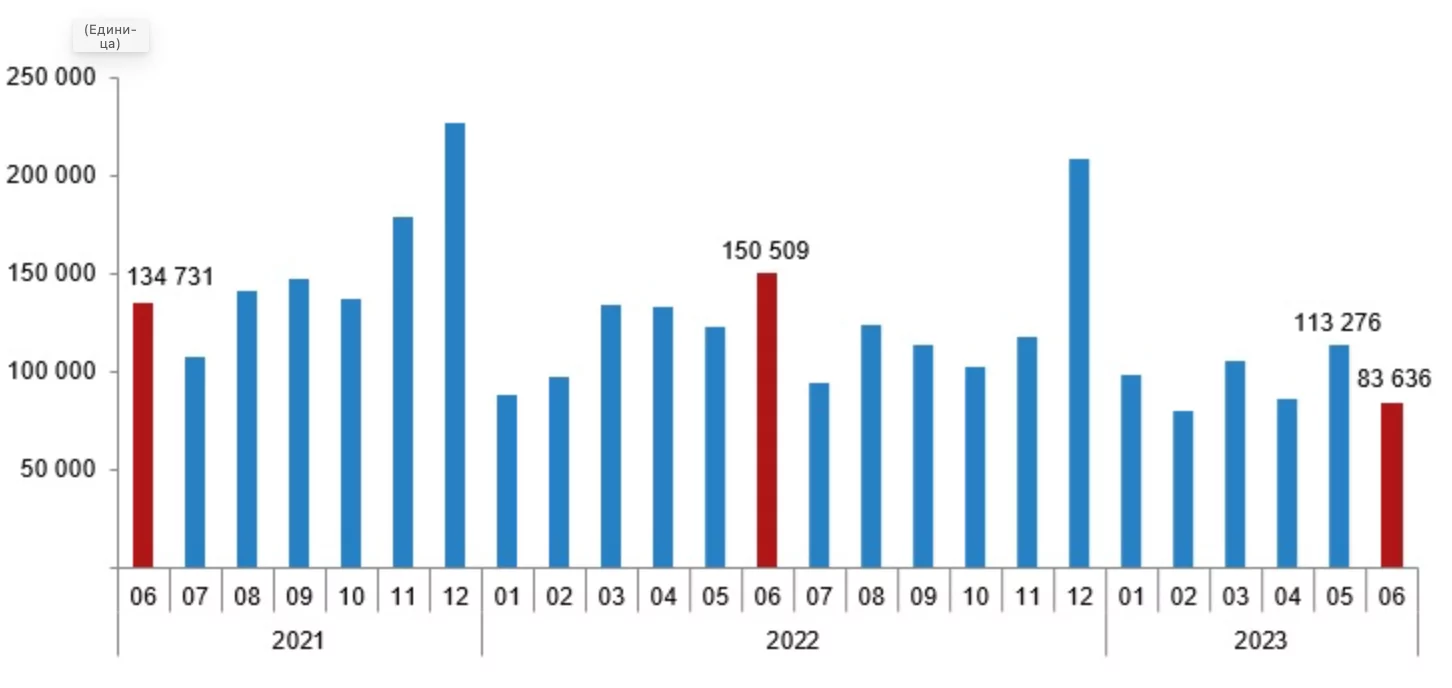

Real Estate Sales Statistics in Turkey

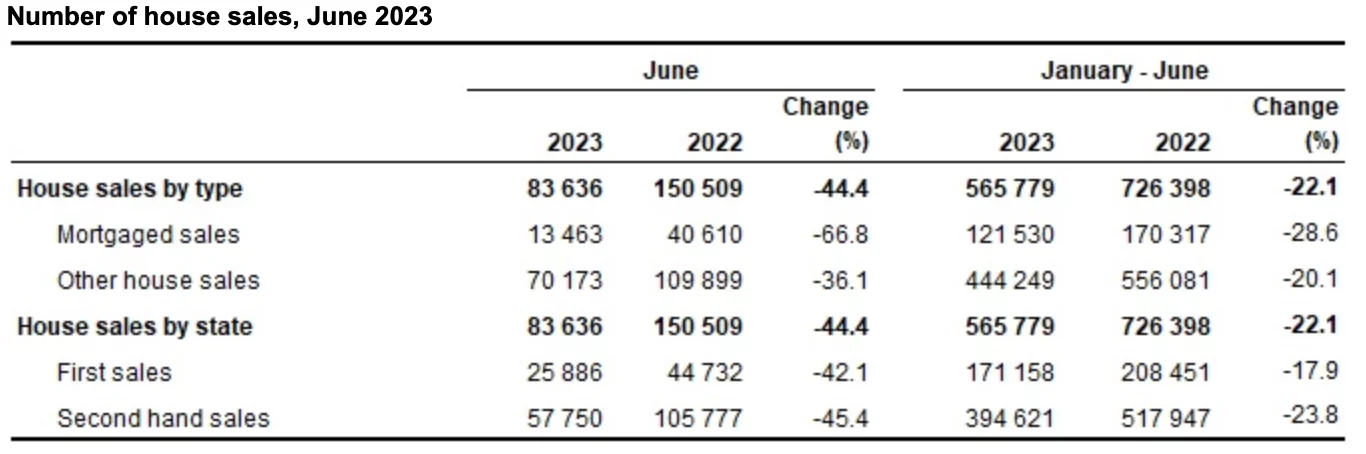

In Turkey, home sales in June decreased by 44.4% compared to the same month of the previous year to 83,636 properties. The highest share in Istanbul is 16.2% and 13.578 properties. The followers of Istanbul became Ankara with sales of houses amounted to 7325 properties and Antalya with 4503 properties with shares of 8.8% and 5.4%, respectively.

In the January-June period house sales decreased by 22.1% compared to the same period last year and amounted to 565 thousand 779.

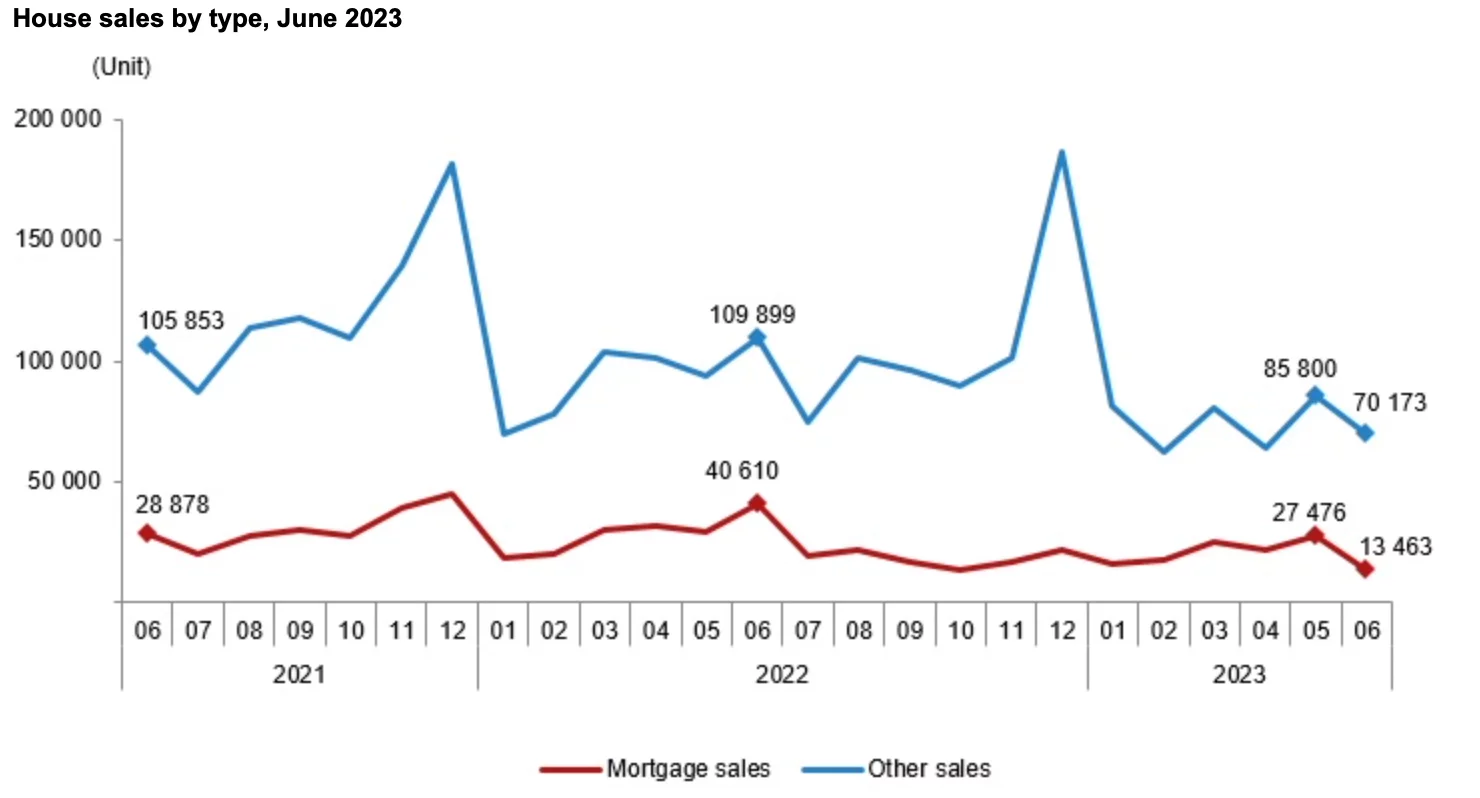

Real estate mortgage sales in June decreased by 66.8% compared to the same month of the previous year and amounted to 13,463. Real estate mortgage sales accounted for 16.1% of all transactions. In January-June, mortgage house sales decreased by 28.6% compared to the same period of the previous year and amounted to 121,530.

On the primary market, the number of transactions in June decreased by 42.1% compared to the same month of the previous year and amounted to 25,886. Transactions on the primary market accounted for 31% of all housing sales. In January-June, new building sales in Turkey decreased by 17.9% compared to the same period last year and amounted to 171,158.

The number of transactions on the secondary market in June decreased by 45.4% compared to the same month of the previous year to 57.750. In January-June sales on the secondary market decreased by 23.8% compared to the same period last year and amounted to 394,621.