Analysis of the Italian Residential Real Estate Market. Profitable 2021 and 2022, Decline in 2023

The Italian residential property market has seen developments in recent years that are generally similar to those seen in other EU and Eurozone member states. In 2021 and 2022, low interest rates on housing loans and the recovery of the economies of the countries after the pandemic have led to the housing market in the EU countries showing an increase in the number of transactions and higher prices.

However, in 2023, the situation changed. Rising inflation led the European Central Bank to start raising its base rate from mid-2022 — together with rising house prices and general economic uncertainty, this led to a drop in demand and activity in the market. Let’s see how the Italian housing market is performing in 2024.

Results of Previous Years and 2024

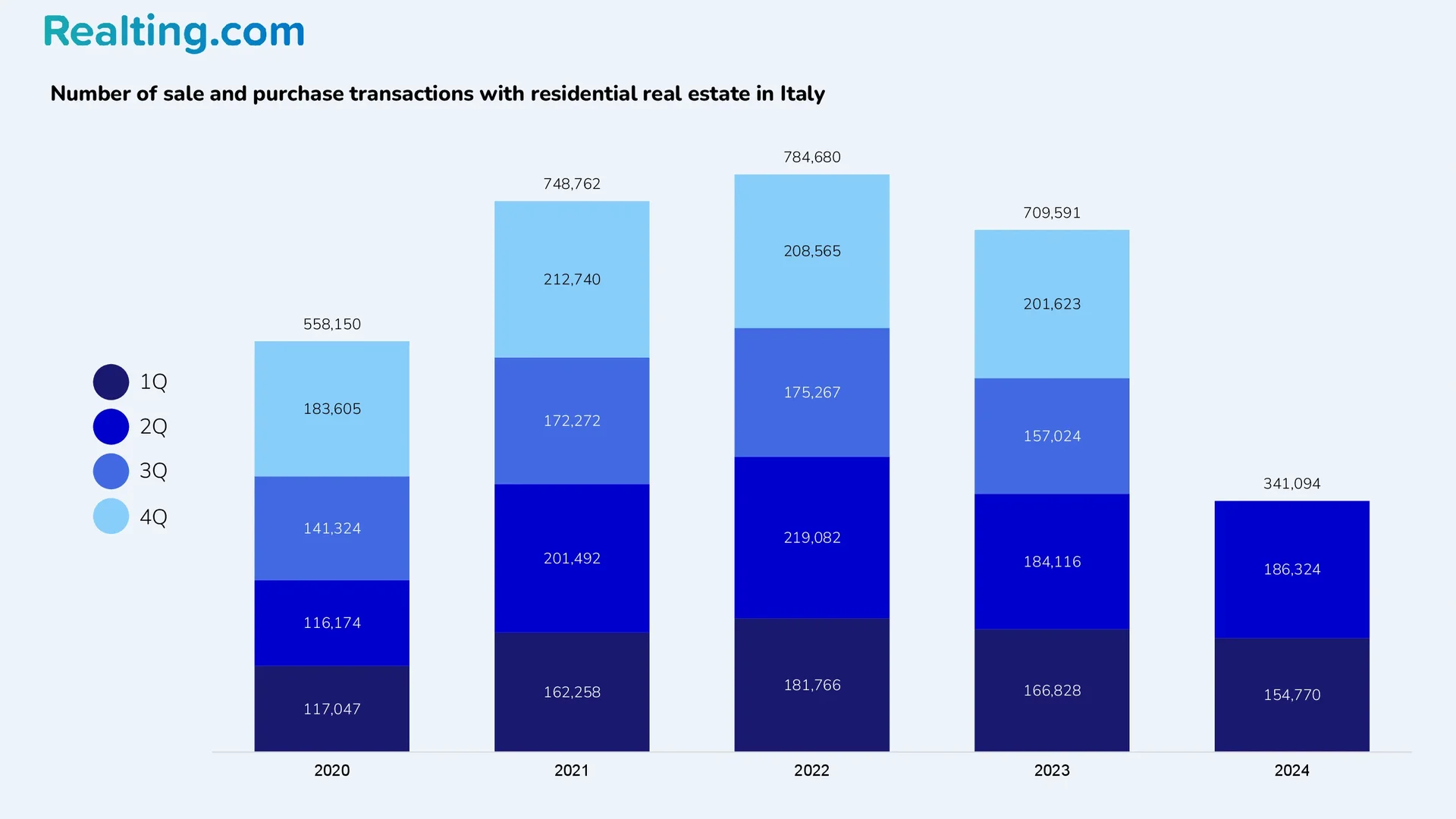

The Italian residential property market has shown high levels of activity and demand in 2021 and 2022. According to data from the Italian Revenue Agency (Agenzia delle Entrate), 748,762 residential real estate purchase and sale transactions were registered in 2021, and 784,680 transactions in 2022. The reasons for the high activity were low interest rates on housing loans and the economic recovery after the pandemic.

In turn, 2023 showed a noticeable decrease in market activity. According to the results of 2023, 709,591 transactions were registered, which is 9.6% lower than in 2022. The decrease in activity was caused by the increase in the cost of borrowed funds, which began in mid-2022, as well as an increase in real estate prices.

The latest data from the Italian Revenue Agency show that housing market activity in Q2 2024 increased slightly compared to the same period last year: 186,324 residential property sales and purchases were registered in the Italian residential property market in Q2 2024. Q2 2024 represents an increase of 20.4% compared to Q1 2024 and an increase of 1.2% compared to Q2 2023.

In total, 341,094 residential property transactions were registered on the Italian housing market in the first half of this year, which is 4.9% less than in the second half of 2023 and 2.8% less than in the first half of 2023.

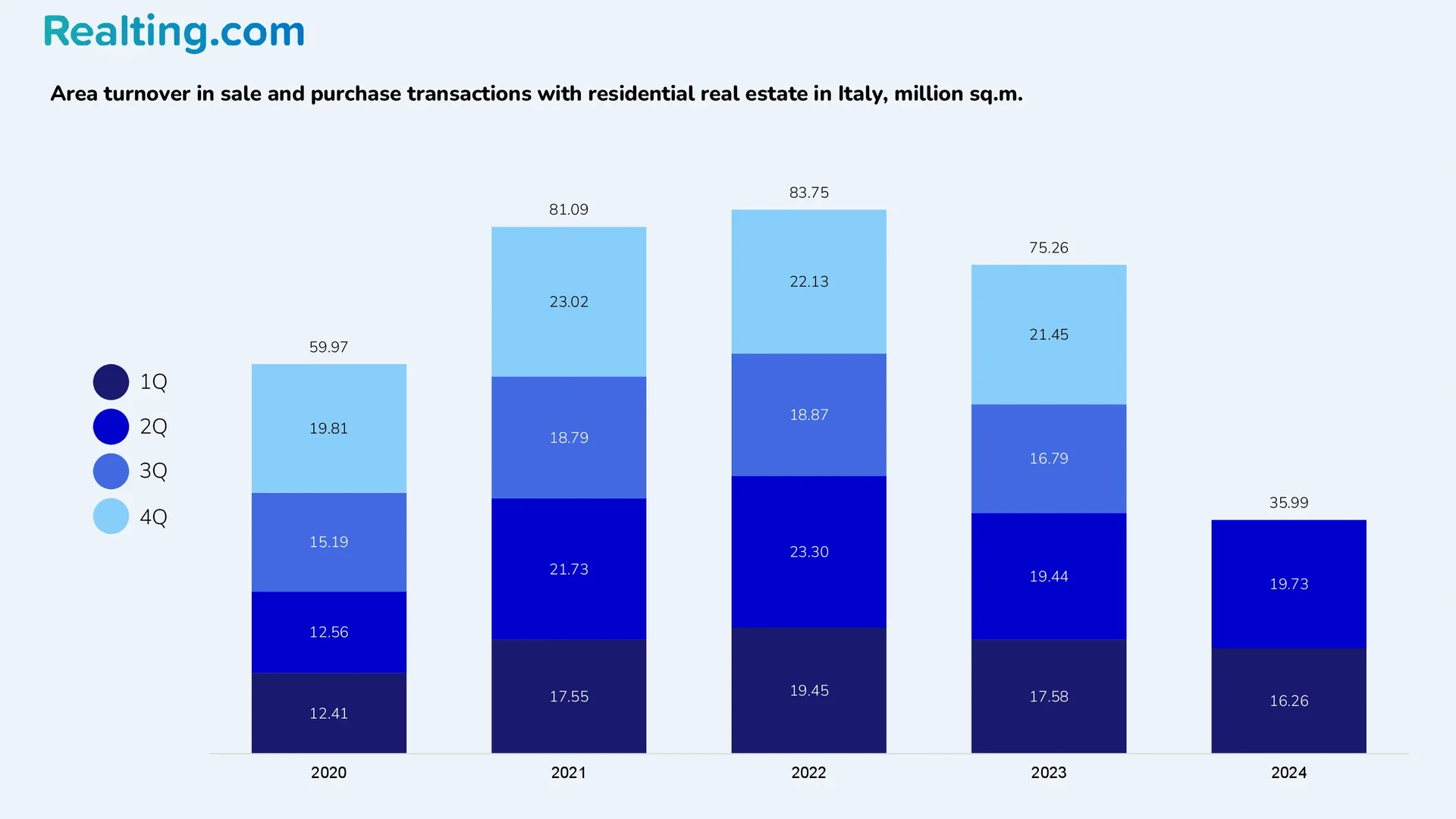

The total area turnover in residential real estate purchase and sale transactions in Q2 2024 amounted to 19.73 million square meters, which is 21.3% more than in Q1 2024 and 1.5% more than in Q2 2023.

According to the results of the 2nd quarter of 2024, the largest number of residential property purchase and sale transactions were registered in the North-West region of Italy — 63,966 transactions. This is 35% of the total number of housing transactions in the country. The following regions are located in descending order:

- Center — 37,775 transactions (20% of all transactions).

- North-East — 35,200 transactions (19% of all transactions).

- South — 32,035 transactions (17% of all transactions).

- Islands — 17,347 transactions (9% of all transactions).

Structure of the Italian Market

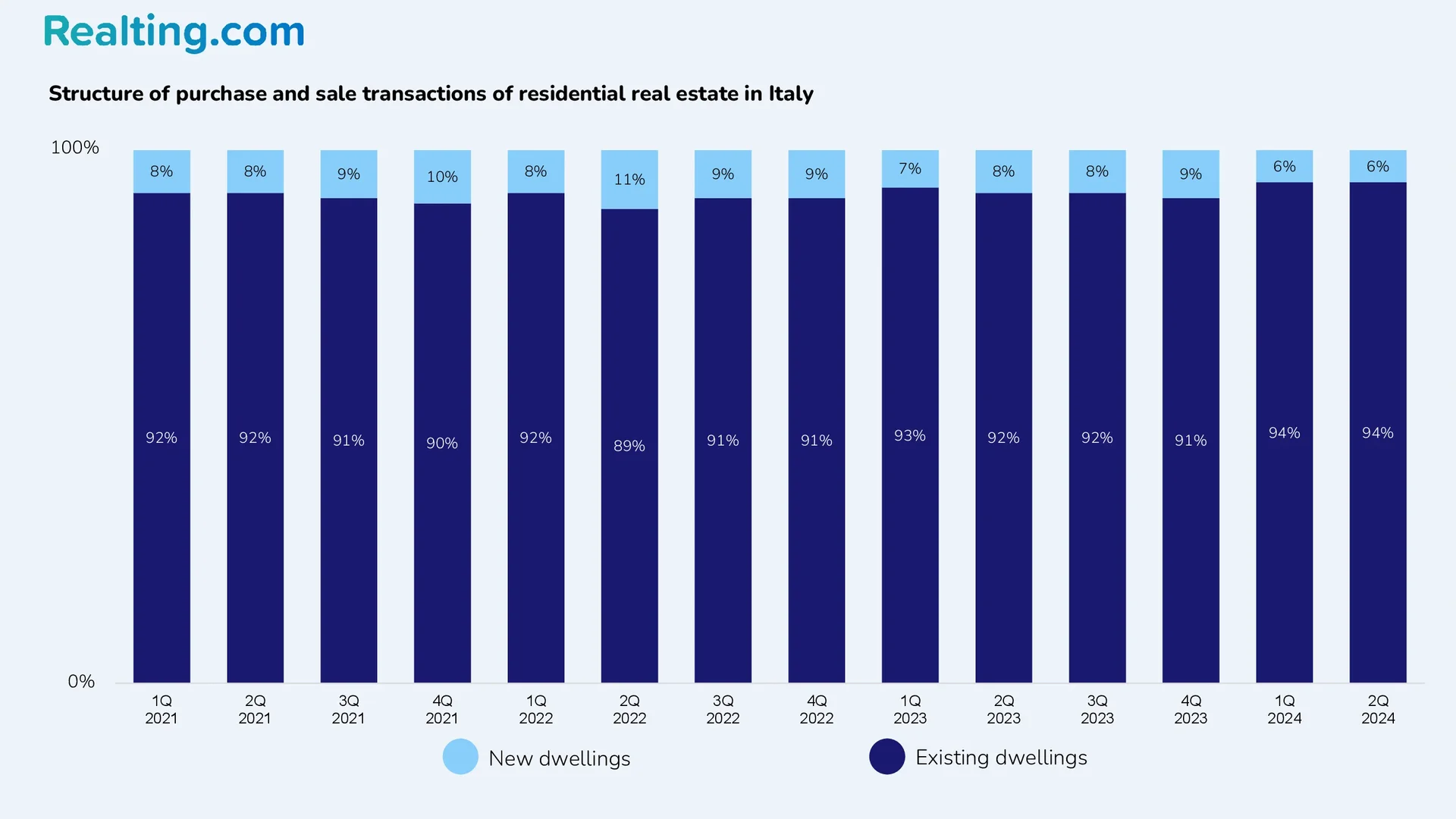

From Q1 2021 to Q4 2023, the share of transactions with new housing varied from 7 to 11%. In Q1 2024, the share of transactions with new housing was 6%, decreasing by 3 percentage points compared to Q4 2023. In Q2 2024, the share of new housing in purchase and sale transactions remains at the previous period’s level.

In Q2 2024, 177,157 purchase and sale transactions were made by individuals, which is about 95% of the total number of purchase and sale transactions. On average, 95–96% of housing purchase transactions are made by individuals every quarter.

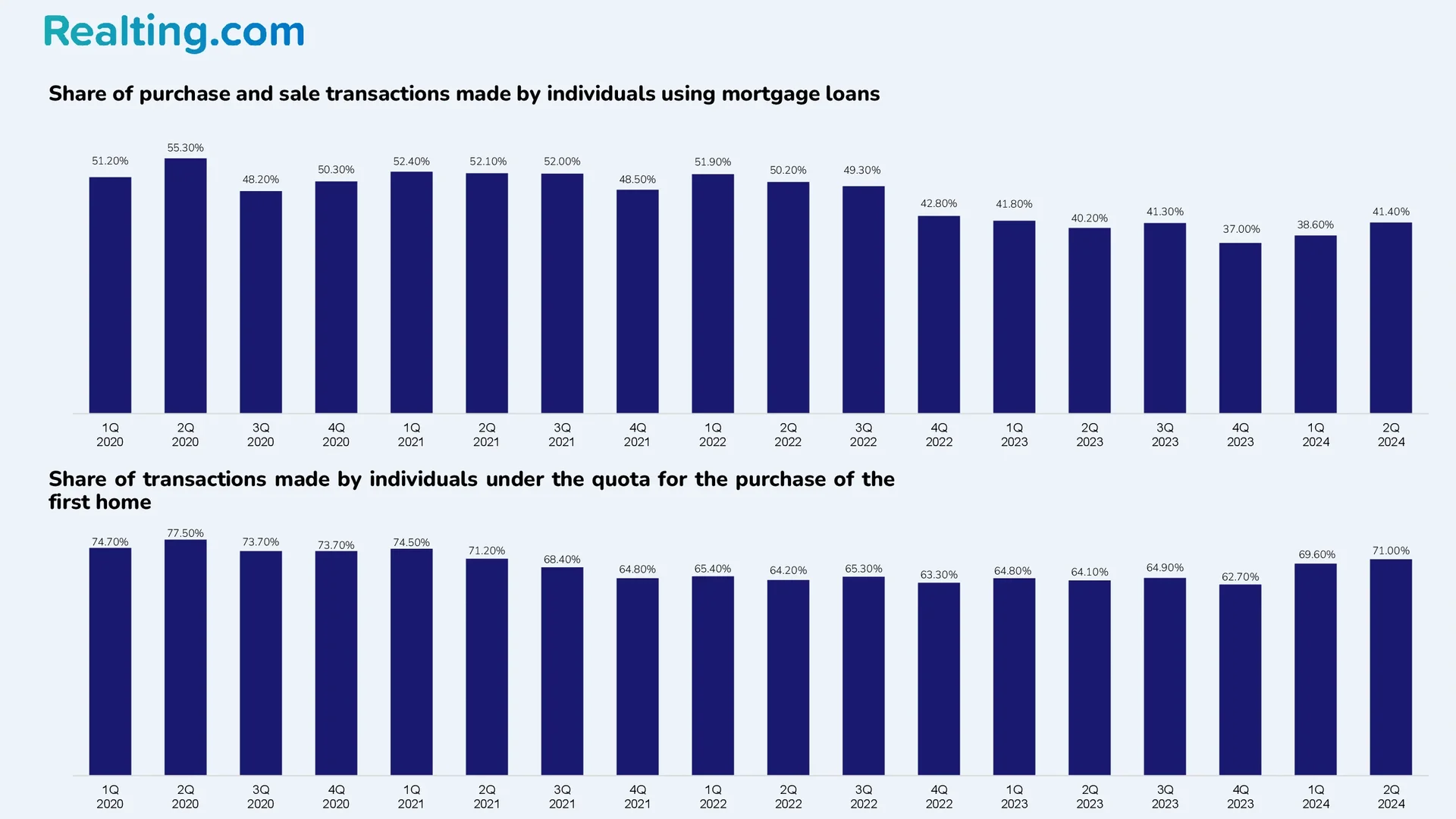

The share of purchase and sale transactions made by individuals using mortgage lending in the 2nd quarter of 2024 amounted to 41.4%, which is 2.8 percentage points more than in the 1st quarter of this year.

It is worth noting the following: when interest rates on loans were at a fairly low level, and this was 2021 and the first half of 2022, the share of transactions involving mortgage lending reached 50% or more. From the second half of 2022, when interest rates on loans began to rise, the share of transactions involving loans began to decline, reaching a minimum in the 4th quarter of 2023, when the share of such transactions was 37%.

In the 2nd quarter of 2024, 71% of transactions made by individuals were under the quota for the purchase of a first home. This figure was recorded for the first time in 2 years. Before this, the share of transactions under the quota for the purchase of a first home did not reach 70% over 2 years.

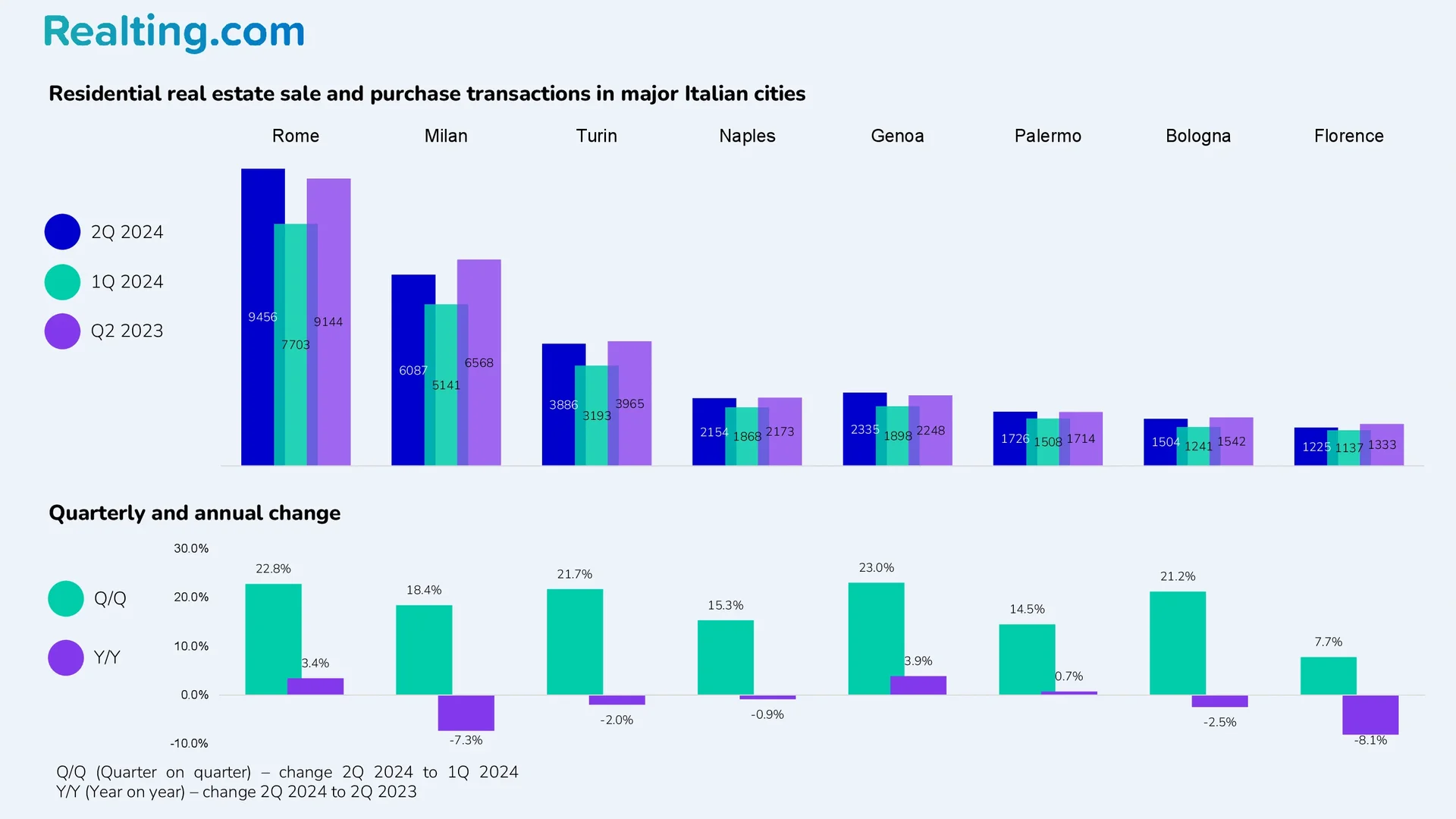

Among the largest cities in Italy, Rome traditionally registered the largest number of housing transactions — 9456 transactions, which is 22.8% more than in Q1 2024 and 3.4% more than in Q2 2023. About half of the housing transactions in Rome were made with the help of mortgage lending, and the share of new housing in purchase and sale transactions was 8.7%.

Below is a summary table with data on the number of residential real estate purchase and sale transactions, the share of new housing in transactions, and the share of transactions involving mortgage lending in the largest cities of Italy based on the results of the 2nd quarter of 2024.

|

City |

Number of transactions in Q2 2024 |

Share of new residential real estate transactions |

Share of transactions involving mortgage lending |

Share of transactions under the quota for the purchase of first homes |

|

Rome |

9456 |

8.70% |

49.90% |

83.10% |

|

Milan |

6087 |

12.60% |

43.10% |

66.60% |

|

Turin |

3886 |

2.80% |

36.70% |

71.00% |

|

Naples |

2154 |

1.90% |

37.00% |

67.80% |

|

Genoa |

2335 |

0.40% |

37.80% |

77.70% |

|

Palermo |

1726 |

1.60% |

36.20% |

65.20% |

|

Bologna |

1504 |

4.70% |

41.30% |

71.00% |

|

Florence |

1225 |

8.10% |

43.20% |

69.70% |

Prices for Residential Property in Italy

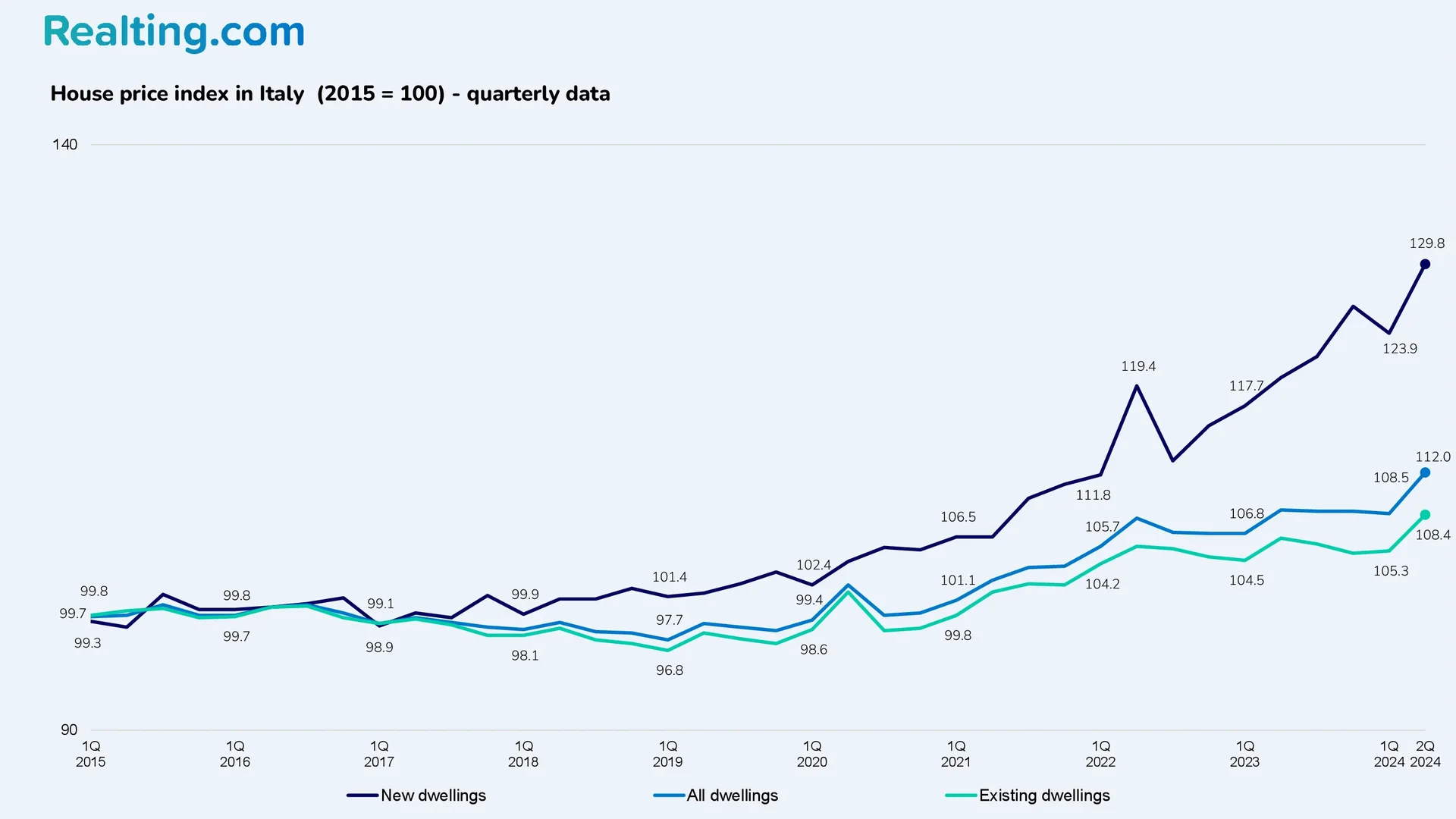

According to data from the Statistical Office of the European Union, Italy is the second EU country where the residential property price index shows the smallest increase since 2015. At the end of the 2nd quarter of 2024, the residential property price index in Italy was at 112 points, which is 3.2% more than in the 1st quarter of this year. The change compared to 2015 is +12%.

Only Finland is ahead of Italy in this indicator, where the housing price index has increased only a few points since 2015.

Based on the results of the 2nd quarter of 2024, price indices for new and existing housing were set at the following levels:

- The existing residential property price index settled at 108.4 points. Quarterly growth is 2.9%; annual growth is 1.9%.

- The new home price index settled at 129.8 points, with quarterly growth of 4.8% and annual growth of 8.1%.

We made these conclusions based on the data (National Institute of Statistics of Italy).

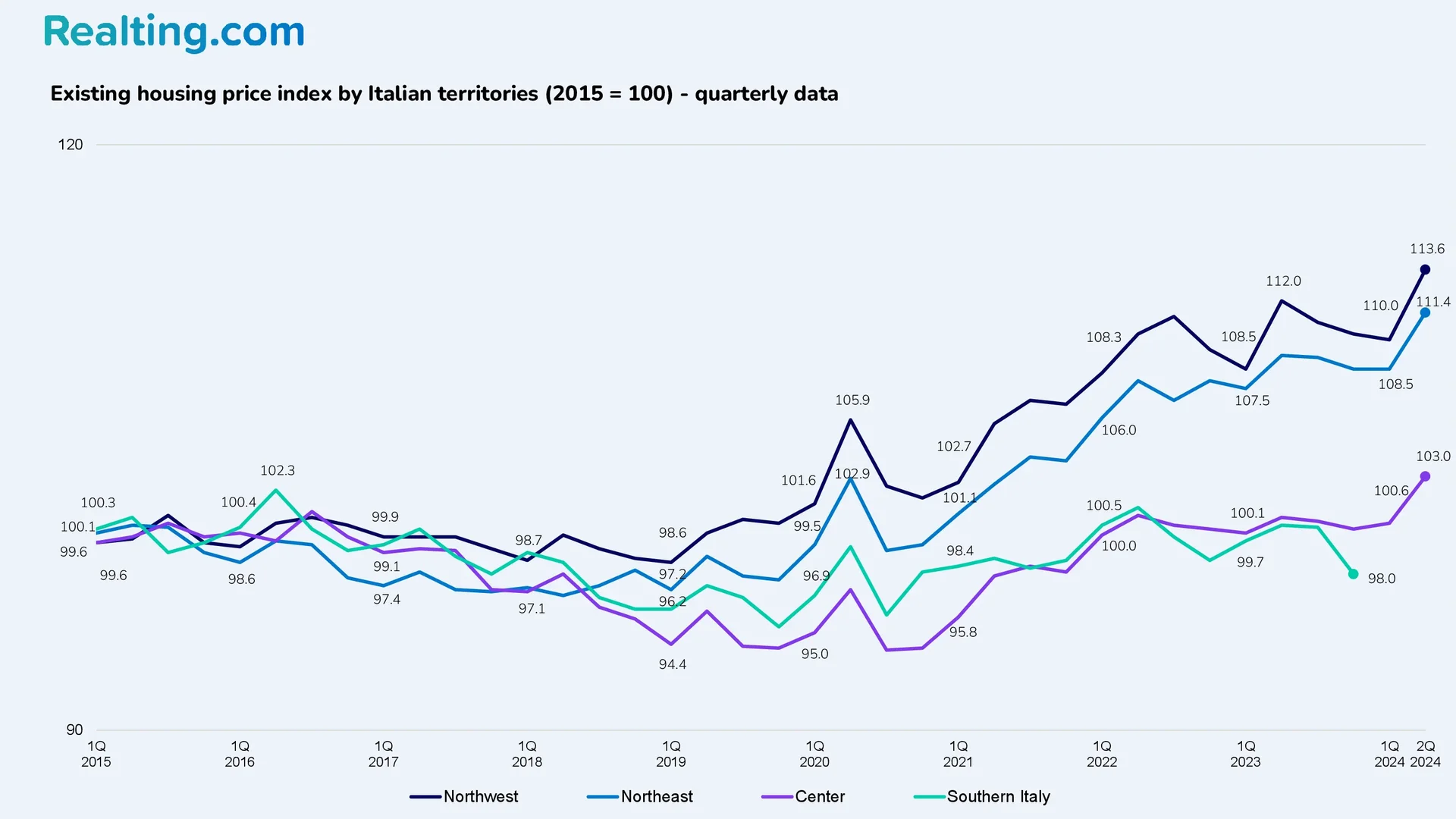

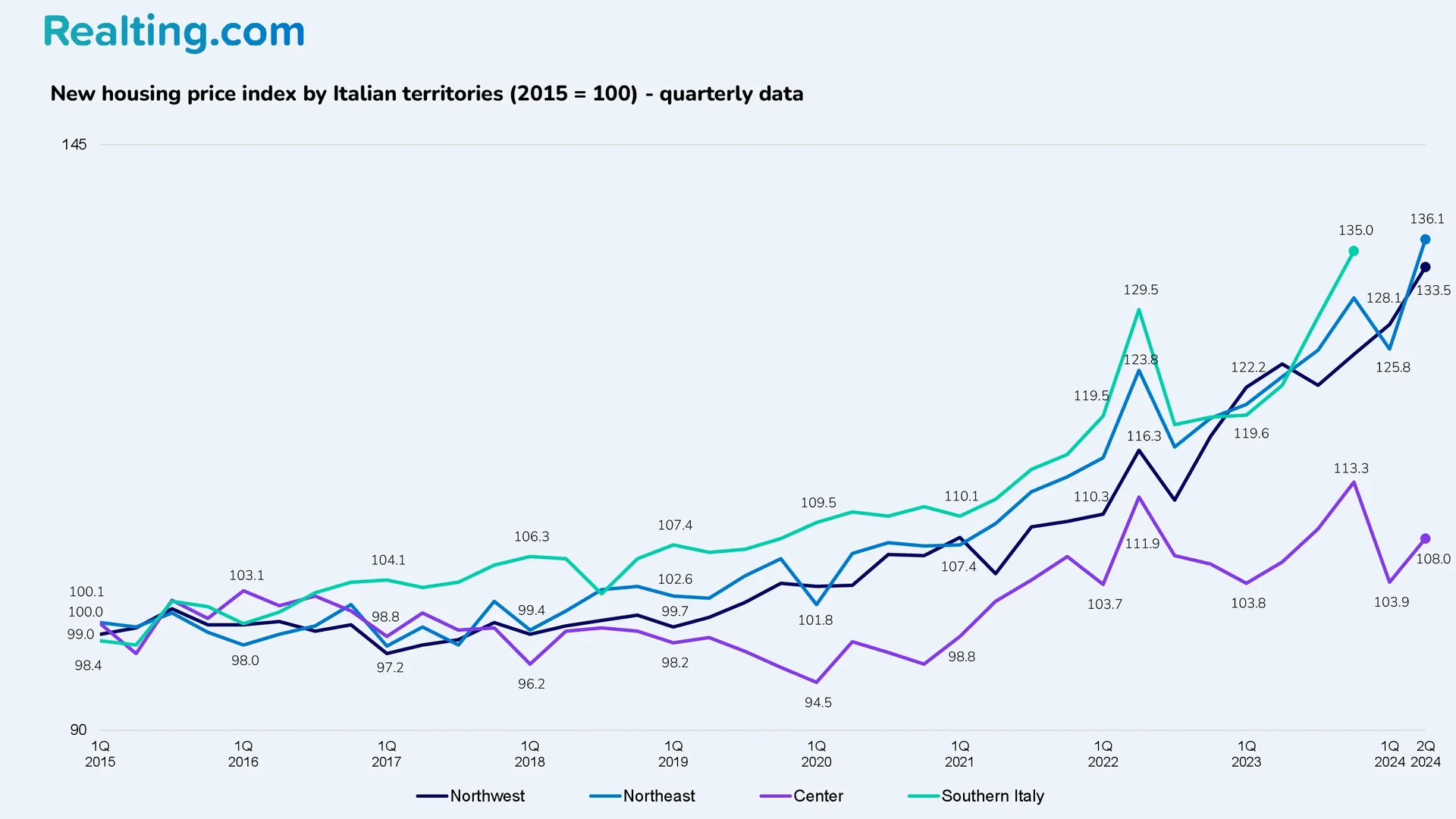

Below are graphs of changes in the price index for existing and new residential properties depending on the region of Italy.

According to the House Price Index, house prices in Italy are rising, but at a much slower rate than in other European countries.

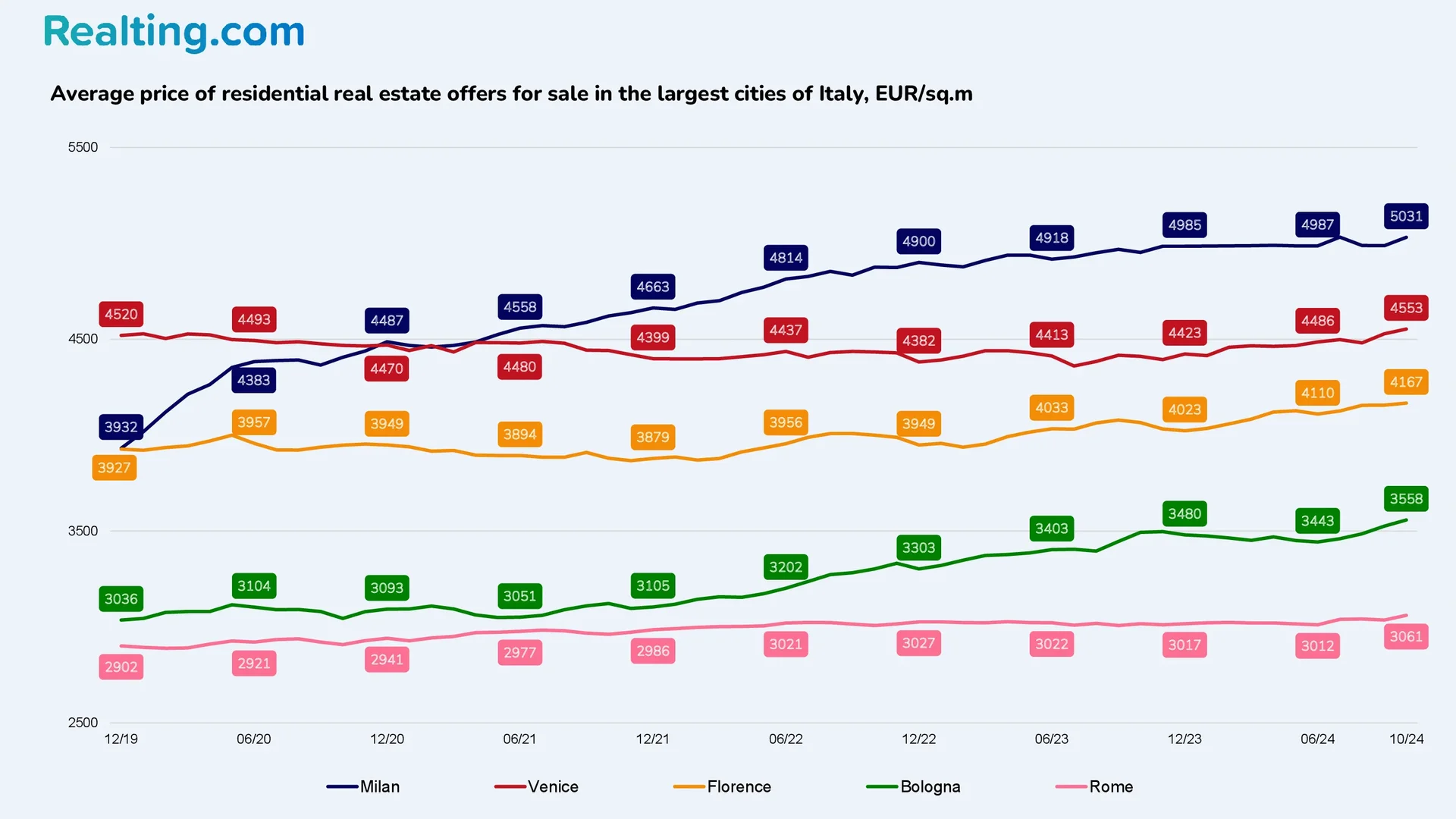

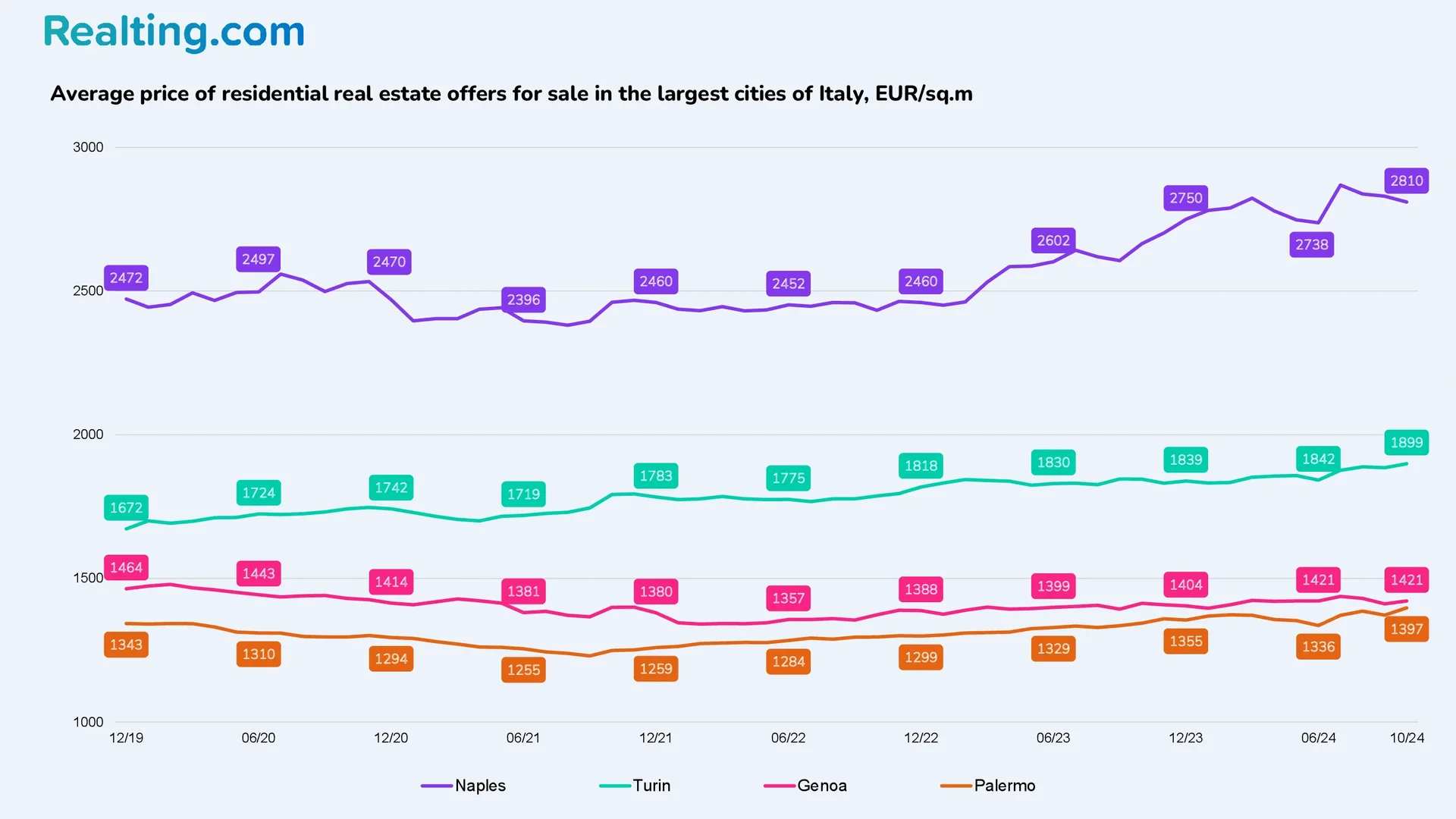

Let’s look at how average asking prices for housing in the largest cities of Italy have changed over the past five years, according to data from the listing portal Idealista.

The largest Italian city with the most expensive square meter is Milan: here, according to the results of October 2024, the average price per square meter in residential real estate offers was 5031 EUR/sq.m, which is 1.6% more than a year ago.

Following Milan in descending order by price per square meter are Venice, Florence, Bologna, Rome, Naples, Turin, Genoa, and Palermo. Rome rounds out the top five Italian cities with the most expensive square meters: the average asking price for housing in the capital in October 2024 was 3,061 EUR/sq.m, which is 1.5% more than in October 2023.

The Italian residential property market has been subject to the same changes in recent years as the housing markets of other EU and Eurozone countries. However, national housing markets have their own distinctive features.

One of the main features of the Italian housing market is that housing prices here are growing much more slowly than in other EU countries, second only to Finland. Another feature is that the Italian residential real estate market is a market of existing real estate, the lion’s share of which is old housing stock. According to the results of the 2nd quarter of 2024, only 6% of transactions were made with new residential real estate. In cities such as Turin, Naples, Genoa, and Palermo, the share of transactions with new housing by the end of the quarter did not exceed 2%.

It is still too early to say what 2024 will be like for the Italian residential property market. However, given the fact that the European Central Bank is reducing interest rates on loans and the population is showing an increase in interest in mortgages (as evidenced by data for the first and second quarters of 2024), we can talk about a situation in which the market will show a recovery from the decline noted in 2023. In turn, housing prices will continue to rise moderately.