Buying Property in the UAE. How to Get a Golden Visa by Investment

The UAE is actively developing in the direction of creating additional investment opportunities. Now, purchasing property in the Emirates has many advantages, mainly the possibility of obtaining a Golden Visa through investment.

The Golden Visa program allows investors to obtain a long-term residence permit and the opportunity to live and work in the UAE, where there is no income tax for individuals and significant relaxation for legal entities.

In this article, let's look at how foreigners can buy property in the United Arab Emirates and highlight key aspects such as buying property in Dubai, the pros and cons of living there and more.

Pros and Cons of Buying Property in the UAE

Pros

- Tax benefits. One of the most significant advantages of buying property in the UAE is the absence of property taxes. There are no income taxes for individuals in the UAE. Legal entities with an annual turnover of less than AED 375,000 ($102,000) are also exempt from paying tax.

- High rental yields. The UAE, particularly Dubai, is known for offering high rental yields with annual rate of interest of about 5%.

- Robust legal protections. The UAE government offers strong legal protections for property buyers, including foreign investors, which helps ensure that investments are secure and rights are protected.

- Growing economy. The UAE's economy is diverse and is currently experiencing stable growth. The DGP, which is driven by factors beyond oil, including tourism, finance, and construction, has increased annually with a current state of 3.52%.

Cons

- Market volatility. The past decade has seen significant fluctuations in prices in areas such as Dubai, influenced by global economic conditions. The DGP experienced a decline of 4% during the geopolitical tensions and the oil production cuts in 2022.

- High initial investment. Property prices in premium locations can be high, and foreign buyers must often make a sizable down payment (typically at least 25%). The minimum investment required to obtain residency is AED 1 million ($272,000).

- Cost of living. While this does not directly affect the buying process, the cost of living in the UAE is high. Dinner at restaurants starts from 250 AED ($68) and goes up to 1000 ($272) AED per person.

- Regulatory changes. The legal and regulatory framework surrounding property ownership in the UAE can change, impacting market conditions and investment viability.

Who Can Buy Property in the UAE?

The only difference between a local and a foreign property buyer is that a local can buy homes throughout the UAE. At the same time, a foreigner can only buy in special zones.

Privileges belong to citizens and companies of the Gulf Cooperation Council (GCC). In their rights to purchase property, they are equal to residents of the UAE and, as in Dubai, have no territorial restrictions. In other emirates, such as Sharjah, they may require special authorisation from the emirate government.

Types of property ownership:

- Freehold. This is the right to indefinitely own the property. A freehold owner can sell, lease, or pass the property on to heirs and change the basic layout.

- Leasehold. This is the right to own property for a specified period, usually between 30 and 99 years. After the leasehold period expires, the ownership returns to the landowner. Matters such as remodeling, keeping pets, and other permissions require written approval from the freehold property owner.

- Joint ownership. The right for several individuals to co-own a property.

So, buying property in Dubai as a foreigner in freehold zones affords the same rights to property as those enjoyed by citizens.

Freehold Properties for Sale in Dubai

|

Apartments |

Apartments and villas |

Villas |

||||

|

Arjan |

Dubai Residence Complex (Dubailand) |

The Views |

Al Barari |

Dubailand |

Tilal Al Ghaf |

Arabian Ranches |

|

Barsha Heights |

Remraam |

Al Furjan |

International City |

Town Square |

Arabian Ranches 2 |

|

|

Bluewaters Island |

Dubai Science Park |

The Greens |

Al Khail Heights |

Jumeirah |

Wadi Al Safa 2 |

Arabian Ranches 3 |

|

Business Bay |

Emaar Beachfront |

Al Warsan |

Jumeirah Golf Estates |

Expo City |

Emirates Hills |

|

|

Culture Village |

Jumeirah Beach Residence |

DAMAC Hills |

Jumeirah Village Circle |

Jumeirah Islands |

||

|

Discovery Gardens |

DAMAC Hills 2 |

Meydan City |

Jumeirah Park |

|||

|

Downtown Dubai |

Jumeirah Heights |

DAMAC Lagoons |

Mohammad Bin |

Palm Jebel Ali |

||

|

Dubai Creek Harbour |

Liwan |

Dubai Islands |

Rashid City |

Reem |

||

|

Dubai Harbour |

Jumeirah Lake Towers |

Dubai Festival City |

Motor City |

The Lakes |

||

|

Dubai International Financial Centre |

Madinat Jumeirah Living |

Dubai Hills Estate |

Mudon |

The Meadows |

||

|

Mirdif Hills |

Dubai Silicon Oasis |

Palm Jumeirah |

The Springs |

|||

|

Dubai Investment Park |

Mirdif Tulip |

Dubai South |

Sobha Hartland |

The Sustainable City |

||

|

Dubai Marina |

Old Town |

Dubai Sport City |

Sobha Hartland II |

The Valley |

||

|

Dubai Production City |

Park Gate Residences |

Dubai Waterfront |

The World Islands |

The Villa |

||

Dubai Real Estate Market Overview

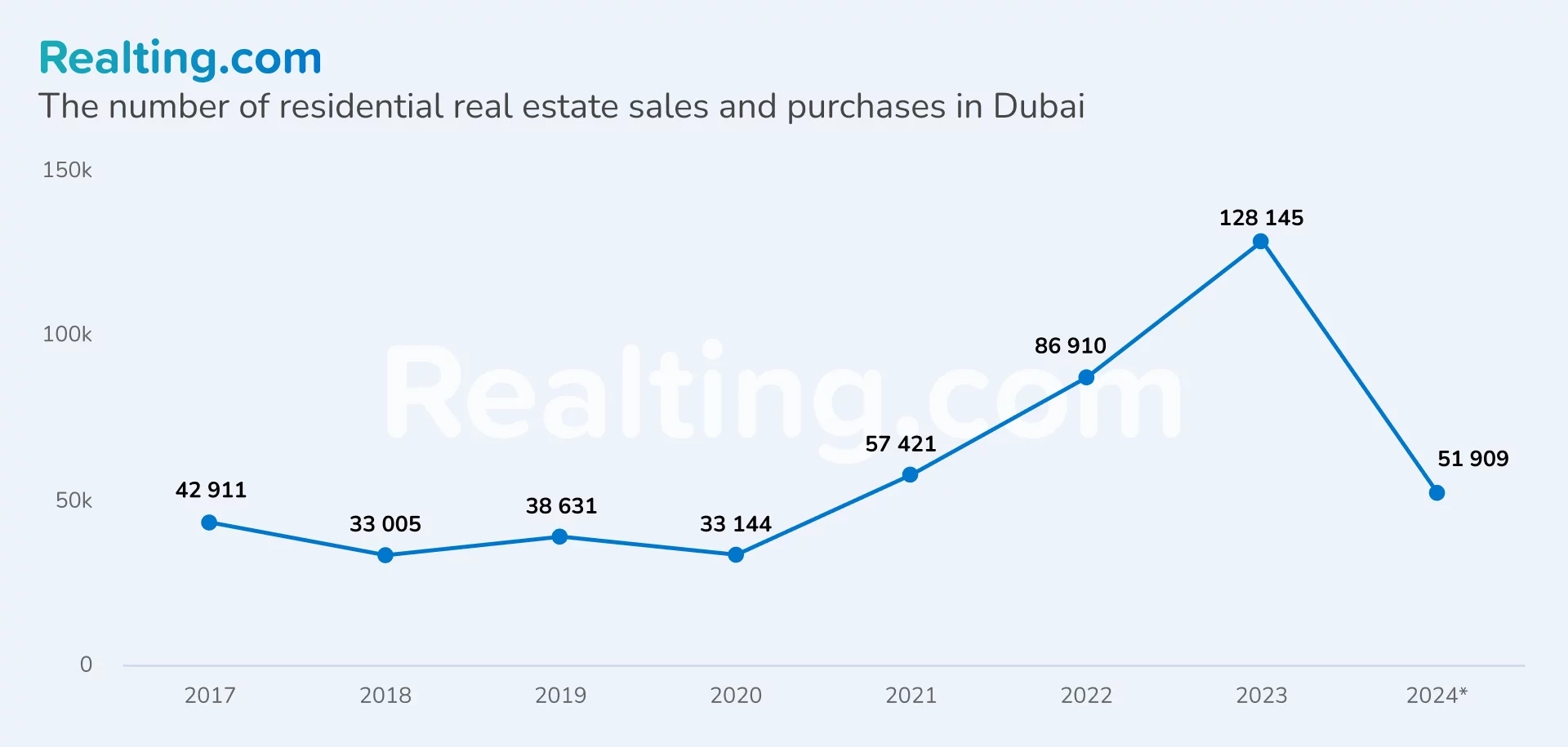

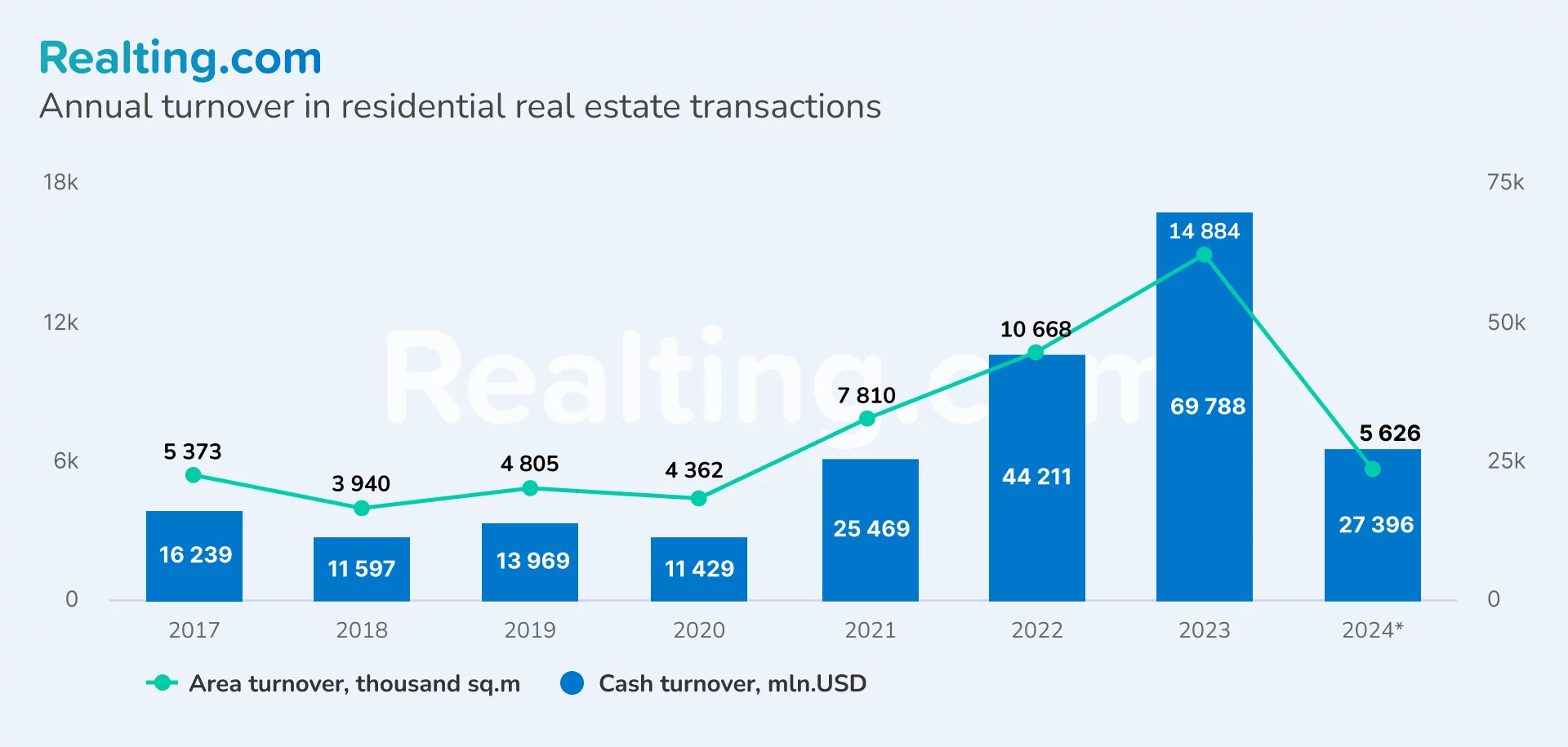

The residential real estate market in Dubai, the most prominent emirate within the UAE, is a fast-growing and constantly evolving market. This is evidenced by the growing number of transactions over the past three years.

Thus, in 2023, more than 128 thousand residential real estate transactions were completed in Dubai, which is almost 4 times more than in 2020.

* data are presented as of May 6, 2024 — date of analysis

As of May 6, 2024, about 52 thousand residential real estate transactions have already been completed in Dubai, which is an excellent start for the current year.

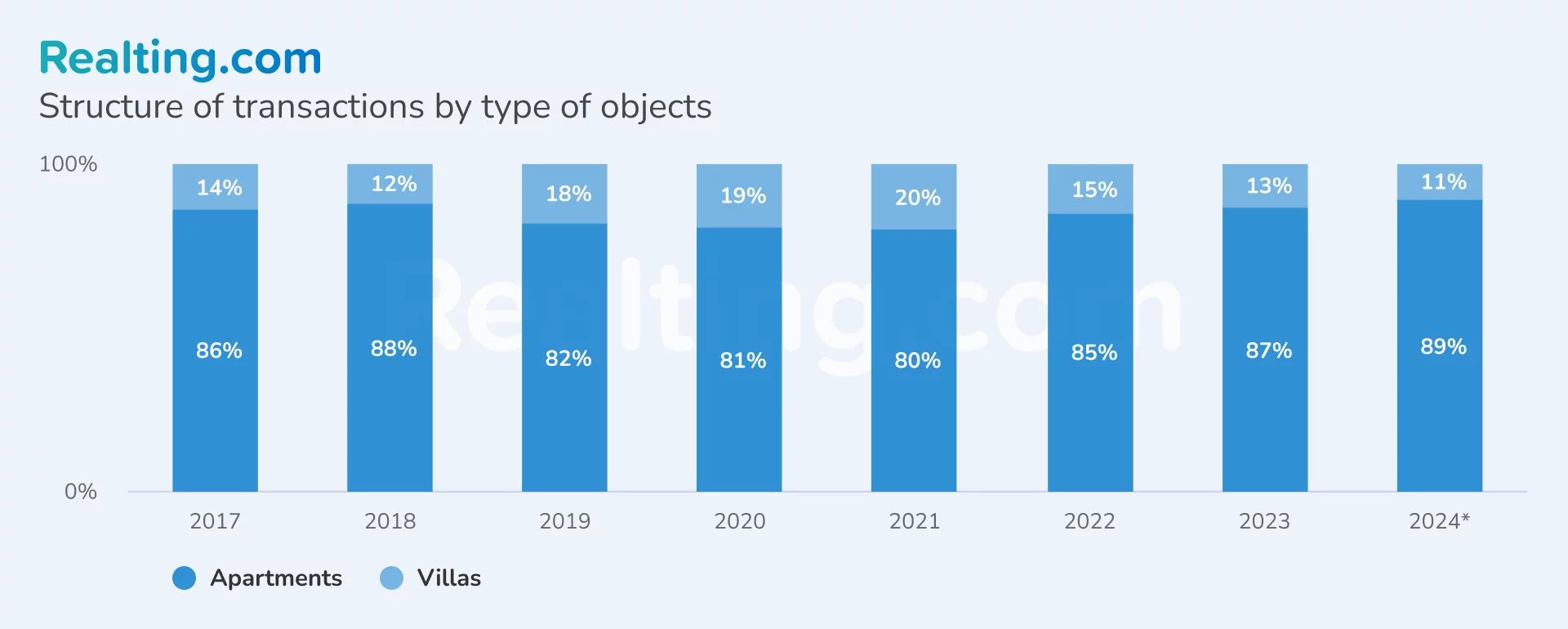

The structure of residential real estate transactions is dominated by apartments — their share as of the beginning of May 2024 amounted to 89%; accordingly, the share of villas — 11%.

* data are presented as of May 6, 2024 — date of analysis

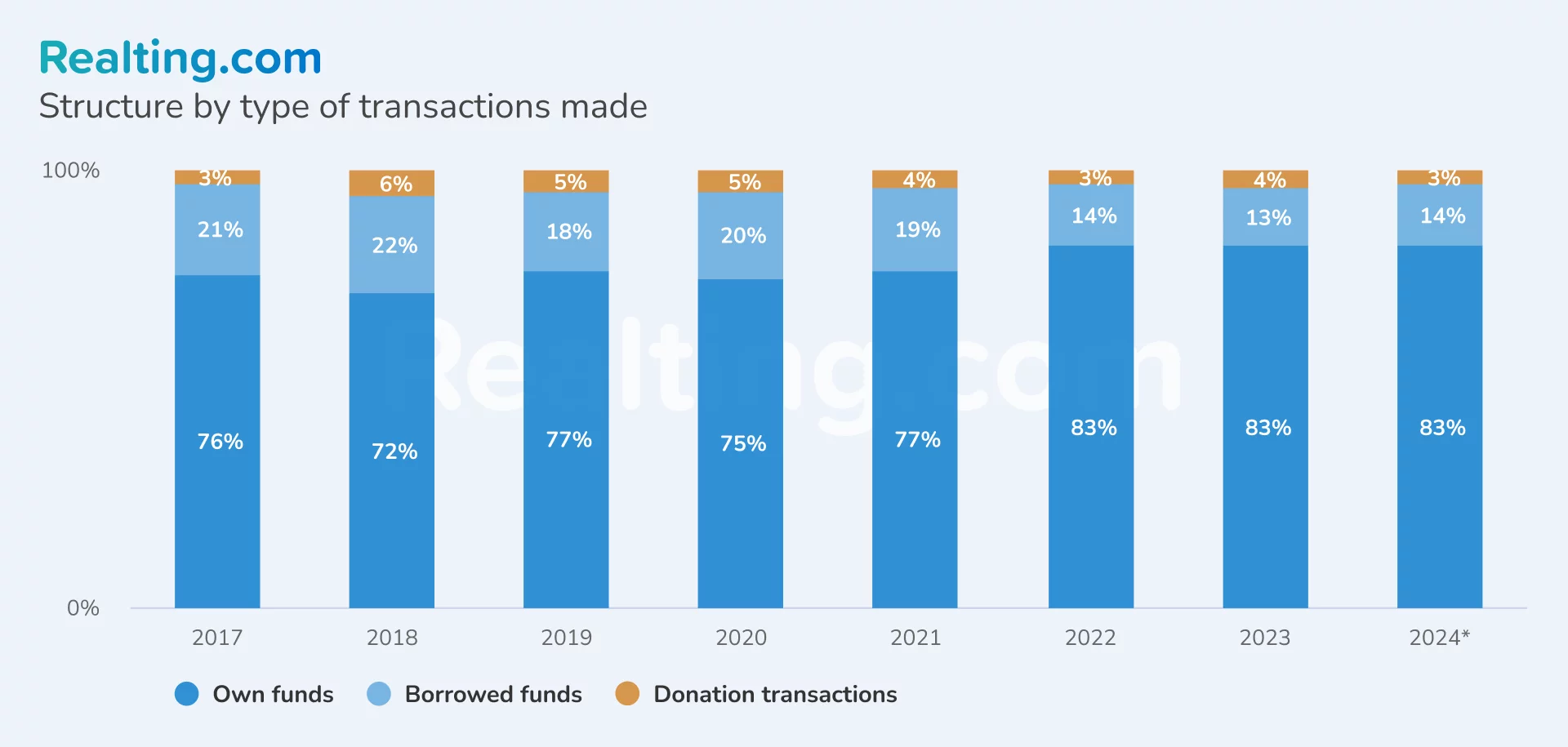

The structure by type of transactions is as follows: 83% — sale and purchase transactions using own funds, 14% — transactions with attraction of borrowed funds; 3% are transactions on donation of real estate objects.

* data are presented as of May 6, 2024— date of analysis

It should be noted that transactions with borrowed funds are more often made when buying villas — about one-third of all transactions with this type of residential real estate. In turn, in transactions with apartments, the share of borrowed funds is about 13%.

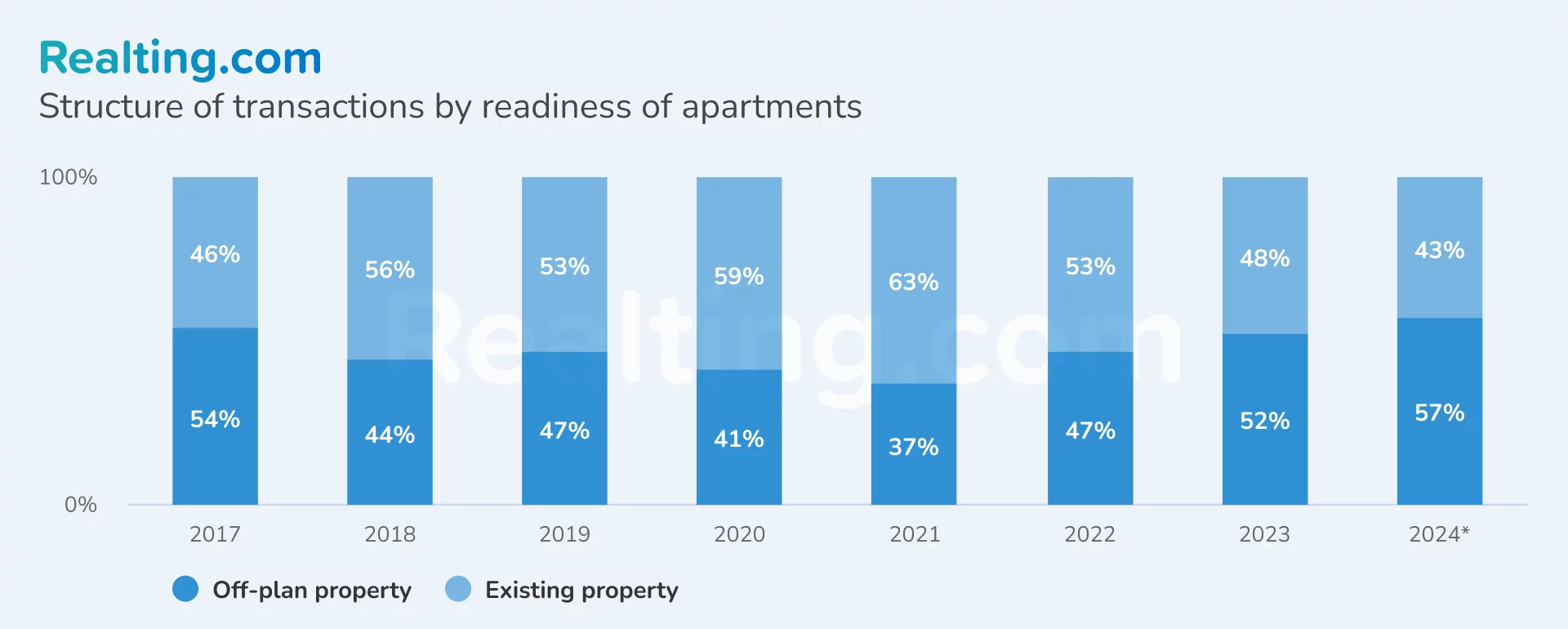

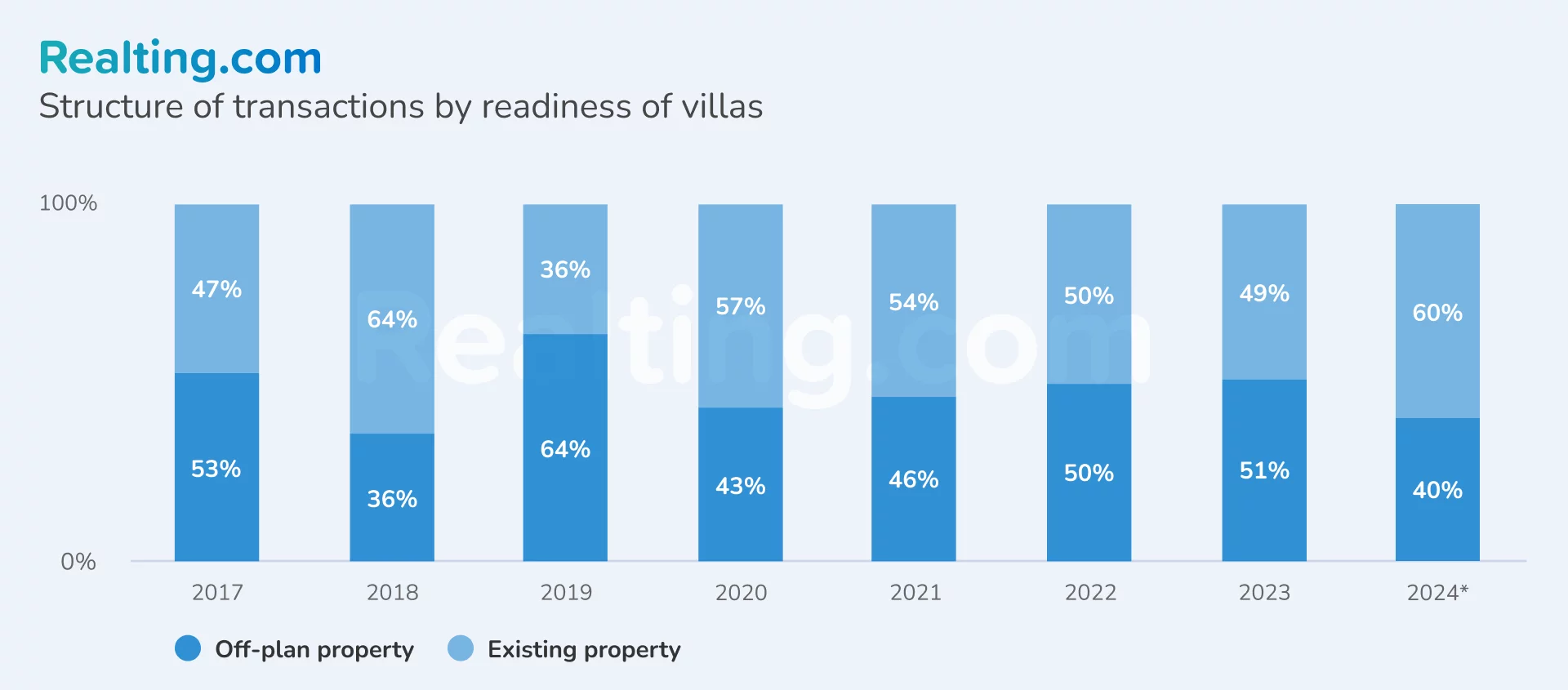

Structure of transactions by readiness of housing as of May 6, 2024:

- In transactions with apartments at the date of analysis, the share of transactions with existing properties (Existing Properties) amounted to 43%, with Off-Plan properties — 57%;

- in transactions with villas, the share of transactions with Existing Properties amounted to 60%, with Off-Plan properties — 40%.

Property Cost in the United Arab Emirates

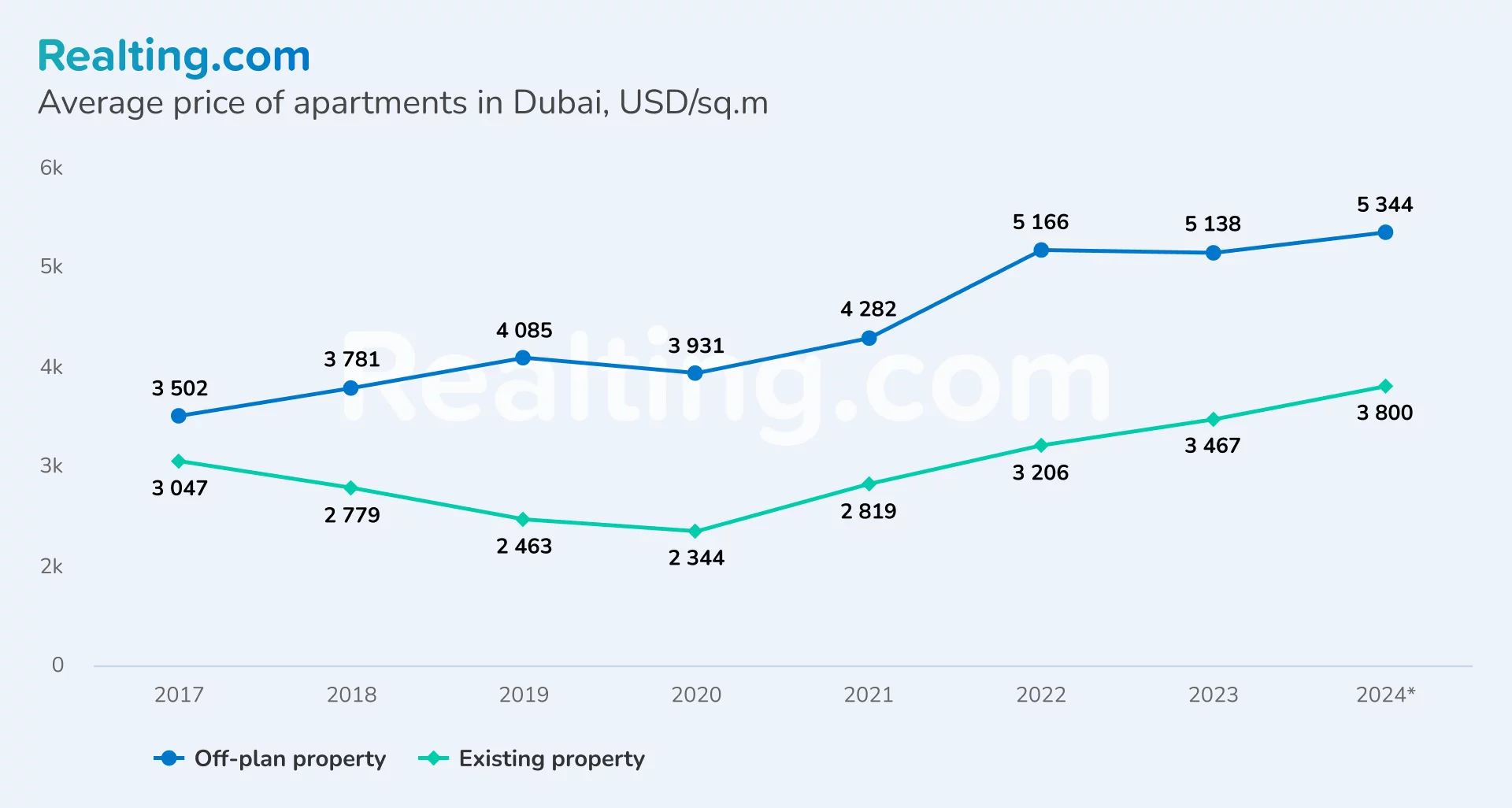

As of the analysis date (May 6, 2024), the following apartment prices have been established in Dubai:

- The average price of completed apartments (Existing Properties) was 3,800 USD/sq.m, an increase of 10% from 2023. Apartment prices in Dubai have been increasing since 2020 (the change to 2020 was about +62% per square meter) and we now see this trend continuing in 2024.

- The average price of apartments under construction/under construction (Off-Plan Properties) has settled at 5344 USD/sq.m, which is 4% higher than in 2023.

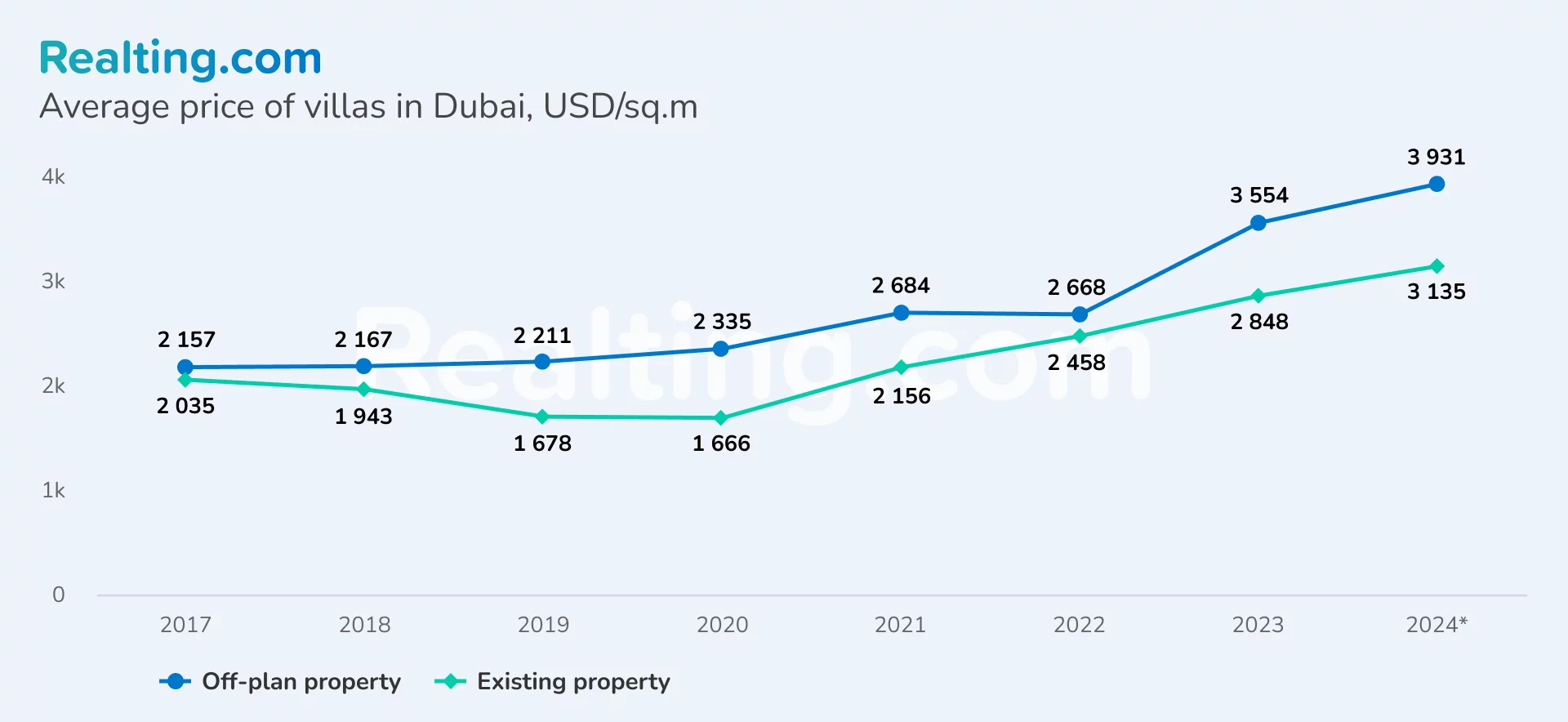

The price situation in the villa segment is as follows:

- The average price per square meter in an already built villa as of the date of analysis is 3135 USD/sq.m, which is 10% higher than in 2023. In the villa segment, as well as in the apartment segment, there is an increase in prices from 2020.

- The average price per square meter in an off-plan villa on the date of analysis is set at 3931 USD/sq.m, which is 11% higher than in 2023.

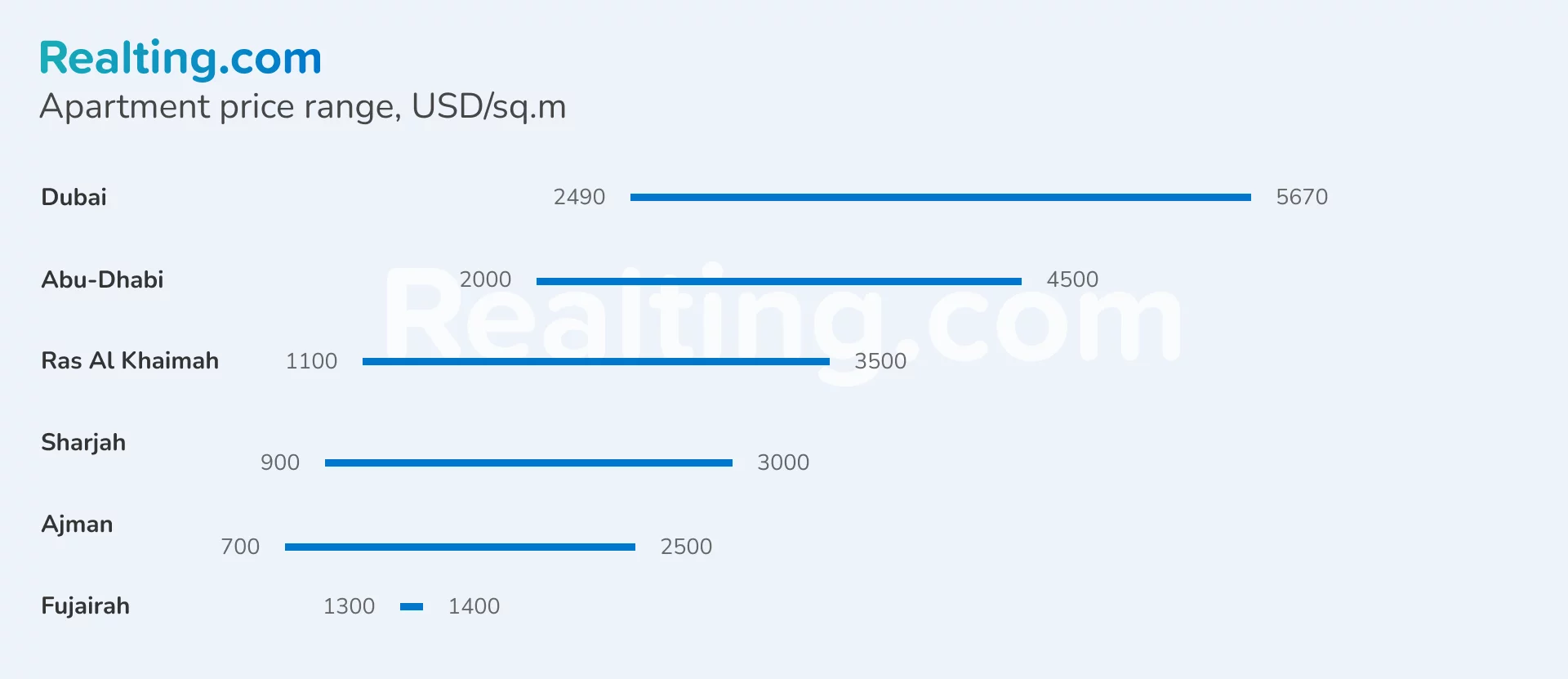

It should be borne in mind that the rising price tags on Dubai real estate are pleasing investors, but potential buyers may wonder whether they should look for more suitable options in other regions of the United Arab Emirates.

Below is a table summarizing housing costs in other emirates of the UAE, as well as a chart with the price range of apartments by emirate. It is worth noting here that the United Arab Emirates is a federal state consisting of several absolute monarchies, and the emirates of Dubai and Abu Dhabi are the most open in terms of the availability of information and data on the real estate market.

|

Name of Emirate |

Abu Dhabi |

Ras Al Khaimah |

Sharjah |

Ajman |

Umm Al Quwain |

Fujairah |

|

Briefly about the Emirate |

Capital of the United Arab Emirates; political, industrial, commercial and cultural center. Population of about 1.5 million (80% expats) |

The northernmost emirate of the UAE, famous for its beaches; it is developing as a tourist center. Population of about 370,000 (60% expats) |

The cultural capital of the Arab world, the most conservative emirate of the UAE, suitable for a quiet family vacation. It is distinguished by relatively low real estate prices and developed infrastructure. Population 1.8 million people (89% are foreigners) |

The smallest emirate, a developing destination for beach vacations. The population is about 411,000, most of them expats |

A provincial and quiet town - this is how tourists describe this emirate. It is probably the least known of all the emirates, as there is little information about it. It can be judged that Umm El Qaiwain is not interesting from the point of view of buying a home or potential investments. |

The youngest emirate within the UAE. The emirate is more suitable for a quiet family vacation than for investment or purchase of housing. Data on the economic state and investment climate are practically absent in open sources |

|

Average cost of apartments |

2000-4500 USD/sq.m |

1100-3500 USD/sq.m |

900-3000 USD/sq.m |

700-2500 USD/sq.m |

- |

1300-1400 USD/sq.m |

|

Dynamics of apartment prices for the year |

+2% |

+11% |

+5% |

+12% |

- |

- |

|

Average cost of villas |

0.4-1.6 mln USD for a three-bedroom villa 0.5–2.6 mln USD for a four-bedroom villa |

0.38–0.6 mln USD for a three-bedroom villa 1.0–2.2 mln USD for a four-bedroom villa |

0.35–0.45 mln USD for a three-bedroom villa 0.5–1.1 mln USD for a four-bedroom villa |

0.3–0.9 mln USD for a villa with three to five bedrooms |

- |

- |

|

Dynamics of prices for villas for the year |

+3% |

+4% |

+1% |

+5% |

- |

- |

|

Average profitability of real estate |

6-8% |

6-8% |

3-7% |

7–9% |

- |

- |

|

Popular neighborhoods |

Yas Island; Saadiyat Island; Al Reem Island; Al Raha Beach; Al Reef; Masdar City |

Al Marjan Island; Al Hamra; Mina Al Arab |

Al Nahda; Al Majaz; Al Taawun; Muwaileh |

Al Zorah; Ajman Downtown; Al Nuaimiya; Al Rashidiya; Al Amerah; Al Yasmeen; Al Zahya; Al Rawda |

- |

- |

|

General information |

In the first half of 2023 in Abu Dhabi registered 10 thousand real estate transactions worth 12.61 billion USD. This is twice as much as a year earlier. |

In the first half of 2023, 2.1 thousand transactions totaling 277 million USD were registered, which is 42% more than the same period of 2022. |

In the first nine months of 2023, $2.5 billion worth of real estate was sold in Sharjah, up 18.9% from a year earlier. |

At the end of the first half of 2023 in Ajman concluded 5.3 thousand real estate transactions with a total value of $1.9 billion. This is 15% more than a year earlier. |

- |

- |

* - Data taken from prian.ru

Buy property in UAE quickly and legally with WeTrade exchange — a UAE check manager for real estate brokers and agencies. We provide fast and efficient large transactions and minimize banking costs. We provide No Objection Certificate (NOC) upon request of seller or developer to confirm the legality and transparency of the transaction. Lead time is 1-2 working days.

UAE Property Taxes

UAE property tax for foreigners is relatively lenient, particularly in the absence of personal income tax. However, certain taxes and fees apply when buying and owning property, although there is no annual property tax.

VAT

Since 2018, the UAE has introduced Value Added Tax (VAT) at a rate of 5%.

Property transfer tax

It is 4% (2% in Abu Dhabi) of the property's value. The buyer and seller usually pay this in half.

Additional fees

- Administrative fee is AED 580 for apartments and offices, AED 430 for land, and AED 40 for off-plan property.

- Registration fee for properties valued at less than AED 500 thousand is AED 2 thousand ($550). For properties valued at more than AED 500 thousand, the fee is AED 4 thousand ($1090).

- Duty for the certificate of ownership is payable at AED 250 ($68).

- UAE law requires transactions to be mediated by realtors. The fee for this service is 2% of the property's value.

Mortgages and Installments

In the Arab Emirates, there is an opportunity to utilize loans and installments to purchase real estate. It is worth noting that foreign investors may find it easier to secure a bank willing to cooperate if they have a larger amount to cover the property's cost.

For instance, a mortgage loan can be obtained without significant issues if the applicant can demonstrate the ability to cover at least 50% of the property value. If the amount is less than 20% of the property value, the bank considers such investors to be high-risk.

Eligibility and requirements

Typically, UAE banks offer mortgage loans to residents with an interest rate ranging from 2% to 5% annually. Residents must provide proof of income, employment status, and other financial commitments.

Foreign investors can also secure mortgages, although the requirements might be stricter, including higher down payments (often around 25% to 50% of the property's value) and proof of income from their home country.

Types of mortgages

- Fixed-rate mortgages. The interest rate remains constant throughout a specified loan term period, protecting borrowers from interest rate fluctuations.

- Variable-rate mortgages. The interest rates are adjusted based on the UAE Central Bank's rates, which fluctuate based on economic conditions.

Loan-to-Value (LTV) ratios

For first-time buyers, the LTV ratio can be up to 80% for properties worth less than AED 5 million. For properties above this value, the LTV ratio drops to 70%. The required down payment is generally higher for second and subsequent properties or for off-plan properties.

Mortgage duration

Mortgages in the UAE can be extended up to 25 years, allowing substantial flexibility in terms of repayment.

Islamic financing

For those seeking Sharia-compliant financing options, many banks in the UAE offer Islamic mortgages that adhere to Islamic banking principles. These mortgages avoid interest in favor of profit-sharing or lease-to-own structures.

Developer financing

Some UAE developers offer buyers direct financing, which can sometimes be more flexible than bank mortgages. These installment plans often come with lower initial down payments and are spread out over the property's construction period.

Impact of credit score

The UAE now implements a credit scoring system, and obtaining a mortgage requires a good credit score. To determine eligibility, banks assess financial behavior, including existing loans and credit card payments.

Pre-approval process

Obtaining pre-approval for a mortgage is advisable as it gives an estimate of the loan amount one can receive, helping to budget for the property purchase and enhancing credibility with sellers.

Developer installments

Buying real estate in Dubai from the developer, as well as throughout the UAE, offers flexible installment terms. The payment is divided into two parts: the first one is paid during the construction of the object, and the second one is paid when it's finished. A mandatory condition is an initial payment of 10% to 20% of the cost of the object.

Real estate Insurance

Property insurance in the UAE is an important aspect of owning and managing property. It provides protection against various risks, such as fire, flood, theft, and other unexpected events.

Types of property insurance:

- Building insurance. It covers damage from fire, explosions, natural disasters, and other emergencies.

- Content insurance. Covers damage to or loss of furniture, electronics, clothing, and other personal items due to theft, fire, or natural disasters.

- Third-party liability insurance. It includes compensation for damage to neighboring property or injury to third parties on your property.

- Loss of rent insurance. Compensation for lost income if the property becomes uninhabitable or unfit for rent due to a covered event.

Property Maintenance Cost in UAE

Maintaining property in the UAE involves several expenses that owners must consider to ensure their property remains in good condition and retains its value. Here's a detailed breakdown of what to expect regarding property maintenance costs in the UAE:

- Service charges. These charges cover the maintenance of common areas, security, waste management, and other communal services. In Dubai, for instance, service charges for apartments can range from AED 3 to AED 30 per square foot per year, depending on the location and amenities provided.

- Utility bills. Monthly electricity and water bills can range from AED 500 to AED 1500 for an average family apartment.

- Repairs and renovations. Regular maintenance such as plumbing, electrical, and HVAC system checks are necessary to ensure everything functions correctly. Annually, setting aside 1–2% of the property's value for repairs and maintenance is a common guideline.

- Cleaning and pest control. Regular cleaning services, if not personally managed, can cost between AED 100 and AED 400 ($30–$110) per session, depending on the property size and the extent of cleaning required.

- Insurance. Annual premiums generally cost from 0.1% to 0.5% of the property value, though this can vary based on the coverage extent. So, after buying a home in Dubai for $200,000, there will be an additional $200–$500 to pay annually.

UAE Golden Visa by Investment in Property

The Golden Visa UAE is a long-term residence program introduced by the UAE government to attract investors and talented professionals. And if we talk about Dubai, the golden visa requirements will be the same. The program offers various pathways for obtaining a residence visa, one of which is through investment in Emirates real estate.

Eligibility Criteria

Investors must purchase a property worth at least AED two million ($544,000). Buyers must retain investment for at least three years to qualify for the Golden Visa.

The investment can be in one or multiple properties if the total investment meets the minimum threshold. Both completed properties and off-plan purchases from approved developers are eligible.

The investment must be made outright and not through financing. If the property is mortgaged, at least 50% equity (paid-up value) is required.

Application Process

The application process commences upon the completion of the property purchase and the availability of the requisite documentation. Retaining all relevant documentation is crucial in case the state authorities conduct further inspections.

- Complete the purchase of qualifying property or properties in the UAE.

- Apply for the Golden Visa in the relevant emirate through the Federal Authority for Identity and Citizenship (ICA) or the General Directorate of Residency and Foreigners Affairs (GDRFA).

- Submit all required documents, including proof of property ownership, passport copies, current visa (if applicable), and other legal documents.

- Undergo a medical examination and a security background check.

- The Golden Visa UAE will be issued upon approval, allowing the holder to enjoy long-term residency there.

Citizenship

The UAE government does not readily grant citizenship to foreigners, and owning property is not a sufficient reason itself. However, there is a way to obtain temporary United Arab Emirates citizenship through investment.

Main ways to acquire UAE citizenship:

- Naturalization. Legally live and work in the UAE for at least 30 years.

- Descent. If both parents are UAE citizens, the child obtains the same citizenship regardless of birthplace.

- Marriage (women only). Marry a UAE citizen.

- Investments. Investors with substantial capital and a certain residency duration can apply for Dubai permanent residency by investment. The UAE government considers each application individually, and the necessary thresholds for residency duration and investment are not publicly disclosed.

- For Talents and Specialists. This applies to doctors, scientists, inventors, and artists who have made significant and widely recognized contributions in their fields (research, scientific work, implementation of innovative approaches, international awards). Doctors and scientists must also have lived and worked in the UAE for at least ten years.

As you can see, acquiring UAE citizenship by investing in property is not the easiest way.

The Process of Buying UAE Real Estate

So, how to buy real estate in Dubai or other parts of the UAE? The process involves several key steps that ensure the legality and security of the transaction. Here is a detailed guide on how to navigate this process:

Preliminary contract

This initial contract is crucial as it secures the buyer's interest in the property and establishes a legal obligation for both the buyer and the seller to proceed with the transaction under agreed conditions.

Signing a sale agreement

A sale agreement is drafted detailing the terms of the sale, including price, payment schedule, and other conditions like a deposit (often 10% of the purchase price).

Obtainment of No Objection Certificate (NOC)

The seller must apply for an NOC from the developer or the community management to prove that the property has no outstanding dues.

Procedure of Title Deed registration

All necessary documents must be submitted to the Dubai Land Department (DLD) or the relevant authority in other emirates. Fees must be paid with the registration of the title deed in the UAE. Once all fees have been paid and documents have been submitted, the DLD will issue the title deed verification in the UAE in the buyer's name.

In the case of buying an apartment in Dubai that is still under construction (off plan), it's essential to register the transaction with the Oqood system. Using Oqood, the Dubai Land Department facilitates the pre-registration of off-plan property sales.

Documents for buying property in the UAE as a foreigner:

- A clear copy of the buyer's passport.

- If the buyer is a resident of the UAE, a copy of the residency visa is required.

- No Objection Certificate (NOC).

- Evidence of payments made towards the purchase of the property.

- Sale Agreement.

- Online property purchasing

In the case of property online buying in Dubai or other emirates, buyers can sign and send documents through a notary or a special agency that deals with real estate registration at a distance.

How to Avoid Problems when Buying Property in Dubai and other UAE Regions?

Foreigners can invest in UAE real estate, but it has complexities and considerations. To navigate the process smoothly and avoid potential pitfalls, consider the following strategies:

Conduct thorough research

Before making any investment, understand the local market conditions. Research the area's current property trends, price fluctuations, and future development plans. Use reputable sources like government publications, credible real estate analysts, and established local real estate agencies.

Verify the developer and property's legal status

Ensure that the developer has a reliable track record. Check if they have completed previous projects successfully and on time. Verify the legal status of the property by checking if it's free from disputes and encumbrances. The Dubai Land Department provides services to check property status and developer credibility, which helps in buying a property in Dubai.

Secure financial pre-approval

If you're financing your purchase with a mortgage, get pre-approval before shopping for property. This clarifies your budget and makes you a more attractive buyer, which can be crucial in competitive markets.

Use a reputable real estate agent

Don't hurry when someone says that he knows everything about how to invest in Dubai real estate. Work only with a certified real estate agent with extensive UAE real estate market knowledge.

They can provide valuable insights, help navigate the legalities, and negotiate the best deal on your behalf. Ensure the agent is registered with the Real Estate Regulatory Agency (RERA) in Dubai or equivalent authorities in other emirates.

Understand the total cost of ownership

Beyond the purchase price, factor in additional costs such as Dubai Land Department fees, real estate agent commissions, legal fees, registration fees, and ongoing maintenance or service charges. Knowing these costs upfront can help you budget effectively and avoid surprises.

Review the sales agreement carefully

Have a legal expert review the sales agreement to ensure it protects your interests, particularly clauses related to penalties, payment schedules, and handover processes. Make sure all verbal agreements are documented in writing.

Plan for the long-term

Consider your long-term investment goals and how the property fits into these plans. Think about resale value, potential rental income, and the economic stability of the UAE region where you're buying.

Regularly communicate with stakeholders

Stay in regular contact with your real estate agent, lender, and developer throughout the buying process. Regular updates can help ensure any issues are quickly addressed and the transaction proceeds smoothly.

Where to Buy Real Estate in UAE

The most common question «How to buy an apartment in Dubai?» concentrates on just one Emirate. However, the UAE offers diverse opportunities for real estate investment across its various emirates, each with unique characteristics and potential drawbacks. Here's a look at some major areas:

Dubai

Dubai is known for its high rental yields, luxury properties, and status as a global business hub. Areas like Dubai Marina, Downtown Dubai, and Palm Jumeirah are popular for their amenities and lifestyle. Downtown Dubai is considered the best place to invest in Dubai, with an annual rate of interest of about 5%.

The risks of buying property in Dubai are tailored to fluctuations in property prices, which are sensitive to global economic conditions.

While buying property in Dubai, the pros and cons will stay the same. But due to the influx of expatriates, rental yields in Dubai are often higher than in many other global cities. Living expenses are among the highest in the UAE but the lifestyle is very liberal compared to other emirates.

Abu Dhabi

As the capital of the UAE, Abu Dhabi offers stability and growth, especially in areas like Yas Island and Saadiyat Island, known for their upscale developments and cultural attractions.

However, property prices tend to be high, reflecting the premium nature of many developments. The market can also be less liquid than Dubai, potentially affecting resale times.

Sharjah

Known for more affordable housing options than Dubai and Abu Dhabi, Sharjah appeals to families and those looking for a more cultural and conservative atmosphere.

However, Sharjah has stricter regulations on alcohol and nightlife, which might not appeal to everyone For example, the sale and consumption of alcohol are prohibited. Additionally, traffic congestion can be significant, especially for commuters to Dubai.

Ras Al Khaimah

Offers attractive prices with potential for appreciation. The Emirate is known for its natural landscapes and quieter lifestyle.

It's further away from the UAE's main economic hubs, which can disadvantage those working in cities like Dubai or Abu Dhabi. Moreover, Ras Al Khaimah's economy is smaller, and its public transportation systems are less developed than those of larger emirates.

Ajman

Ajman offers some of the most affordable real estate in the UAE, with lower entry points for investment.

Economic activities are less diverse, and the Emirate has a smaller expatriate market, which may influence rental demand and property values.

|

Prices comparison |

|||

|

City/Emirate |

Sq. m in the centre |

sq. m in other districts |

Average flat price (USD) |

|

Dubai |

7000–10,000 |

5000–7000 |

300,000–500,000 |

|

Abu Dhabi |

6000–8500 |

4500–6500 |

250,000–450,000 |

|

Sharjah |

3000–4500 |

2000–3000 |

150,000–250,000 |

|

Ras Al Khaimah |

2500–3500 |

1500–2500 |

120,000–200,000 |

|

Ajman |

2000–2800 |

1200–1800 |

100,000–180,000 |

Frequently Asked Questions About Buying Real Estate in the UAE

Can foreigners buy property in Dubai or other parts of the UAE?

Is it worth investing in the UAE real estate?

Do you get residency if you buy a house or apartment in Dubai?

Is now a good time to buy property in Dubai?

Author

I write informative articles about real estate, investments, job opportunities, taxes, etc.