What are the Trends in the Portuguese Residential Property Market in 2024? Market Analysis from REALTING

Situated on the Atlantic coast, Portugal is rightfully one of the most attractive countries in Europe for buying real estate. However, in 2023, a number of events had a negative impact on the Portuguese housing market. Let's consider how the market is doing in 2024 and what trends it is seeing.

Record Activity in 2021 and 2022, Falling Demand in 2023. What will We See in 2024?

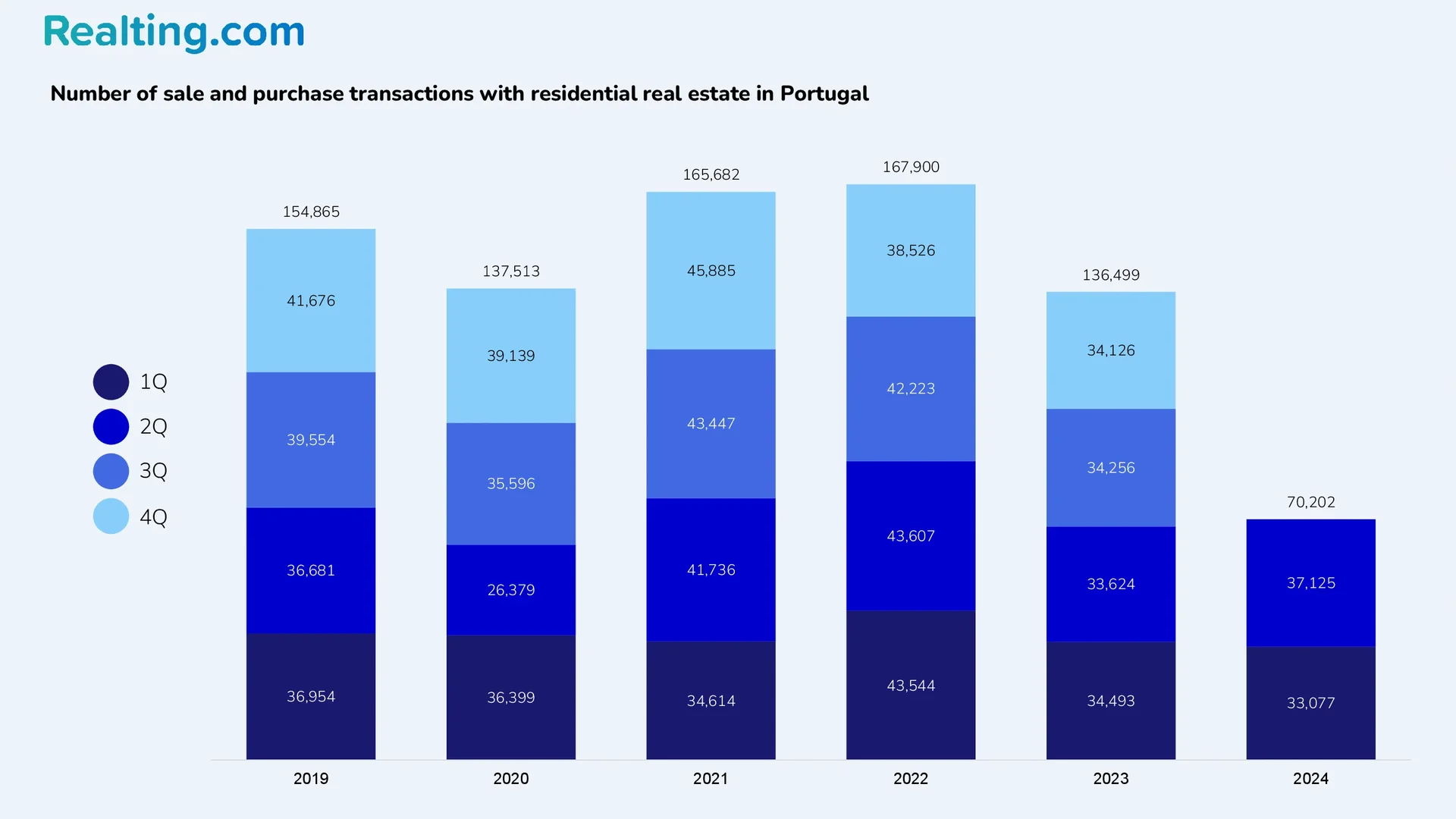

According to data from the Portuguese National Institute of Statistics (Instituto Nacional de Estatística), the number of residential property transactions in Portugal has been growing for more than ten years.

Thus, in 2013, 66,058 residential property purchase and sale transactions were registered in Portugal. And already in 2019 (that is, before the COVID-19 pandemic), 154,865 purchase and sale transactions were registered on the Portuguese housing market, which is 2.3 times more than in 2013. In 2020, due to the pandemic and the economic problems it led to, the number of housing transactions decreased by 11.2% compared to 2019 and amounted to 137,513.

The years 2021 and 2022 saw record numbers of residential property transactions, with 165,682 and 167,900 transactions, respectively. These impressive results for the Portuguese market were made possible by the following factors: measures aimed at economic recovery after the pandemic; the Golden Visa program in place at the time; and low interest rates on housing loans – all of which stimulated demand in Portugal residential property market.

This was followed by 2023, in which market activity was significantly reduced and was comparable to 2020, the year of the pandemic. In total, 136,499 transactions were registered in 2023, which is 18.7% less than in 2022. Throughout 2023, a number of events were observed that led to a drop in demand and market activity.

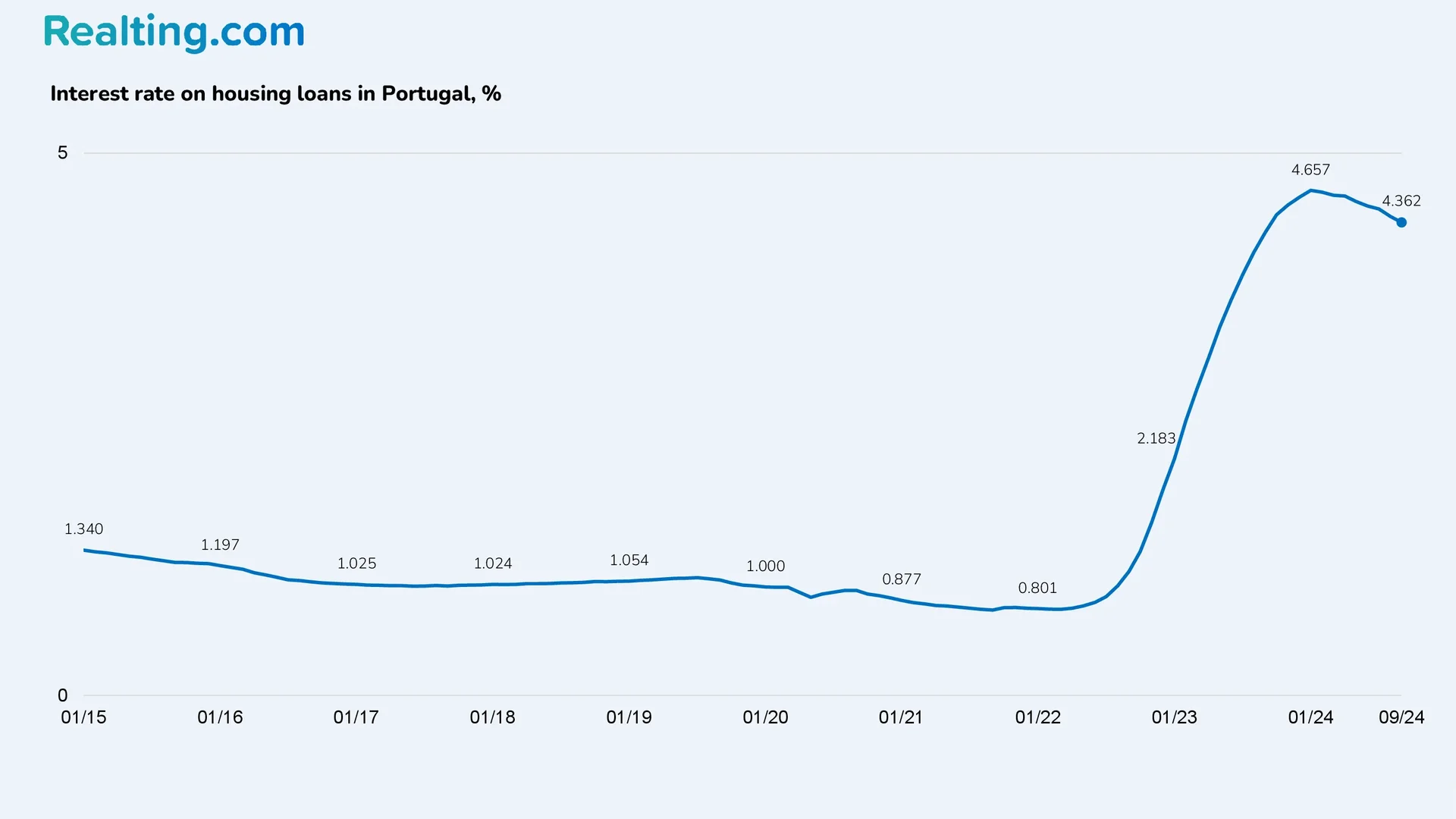

Starting from the 2nd quarter of 2022, Portugal gradually began to increase interest rates on housing loans, so if in January 2022 the interest rate on housing loans, according to the National Institute of Statistics of Portugal, was 0.801%, then a year later (in January 2023) it was 2.183%, and by the end of 2023 it was 4.593%.

Other factors that have influenced the decline in demand and activity in the housing market in 2023 include rising real estate prices and a slowdown in economic growth in the country.

Some experts point out that the closure of the Golden Visa program could also have had an impact. But it is worth saying that the Golden Visa program officially ended on October 7, 2023, that is, at the end of the year, so it is unlikely to have had a significant impact.

It is also worth noting that in 2023, 10,391 residential property purchase and sale transactions were made by foreign citizens, while in the record year of 2022 there were 10,722 transactions, which is only 3% more than in 2023. This proves that the drop in demand in the market was observed precisely from Portuguese citizens.

According to current data from the National Institute of Statistics of Portugal, 37,125 residential property purchase and sale transactions were registered in Q2 2024, which is 12.2% more than in Q1 of this year and 10.4% more than in Q2 2023. In total, 70,202 purchase and sale transactions were registered in H1 2024, which is 3% more than in the same period last year.

In Q2 2024, transactions were distributed by region as follows:

- North: this region holds the record for the most residential transactions (and it holds the record on an ongoing basis) with 10,995 transactions (29.6% of the total number of transactions in the quarter).

- Greater Lisbon (Grande Lisboa). The region that includes the capital of Portugal – Lisbon. In this region, 7031 transactions were registered (18.9% of all transactions).

- Center (Centro) – 5885 transactions (15.9% of all transactions).

- Setúbal Peninsula (Península de Setúbal) – 3523 transactions (9.5% of all transactions).

- West and Tagus Valley (Oeste e Vale do Tejo) – 3475 transactions (9.4% of all transactions).

- Algarve – 2836 transactions (7.6%).

- Alentejo – 1945 transactions (5.2%).

- Autonomous Region of Madeira (Região Autónoma da Madeira). An island territory of Portugal, which is a popular resort, 836 transactions (2.3%) were registered here in Q2 2024.

- The Autonomous Region of the Azores (Região Autónoma dos Açores) is also an island territory of the country; according to the results of the 2nd quarter, 599 transactions (1.6%) were registered here.

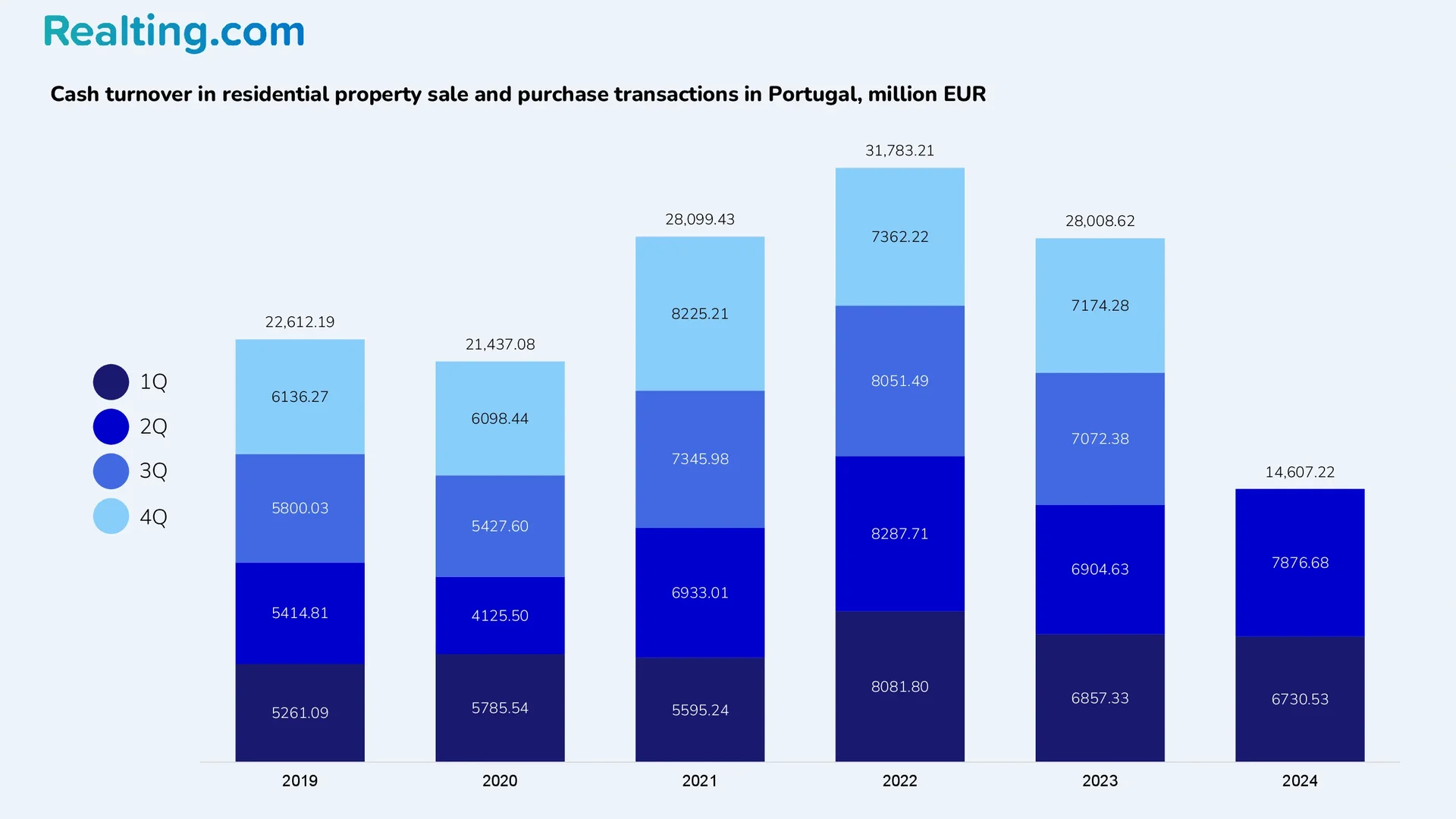

The cash turnover in residential real estate purchase and sale transactions in Q2 2024 amounted to EUR 7876.68 million, which is 17% more than in Q1 of the current year and 14.1% more than in Q2 2023.

Structure of the Portuguese Market

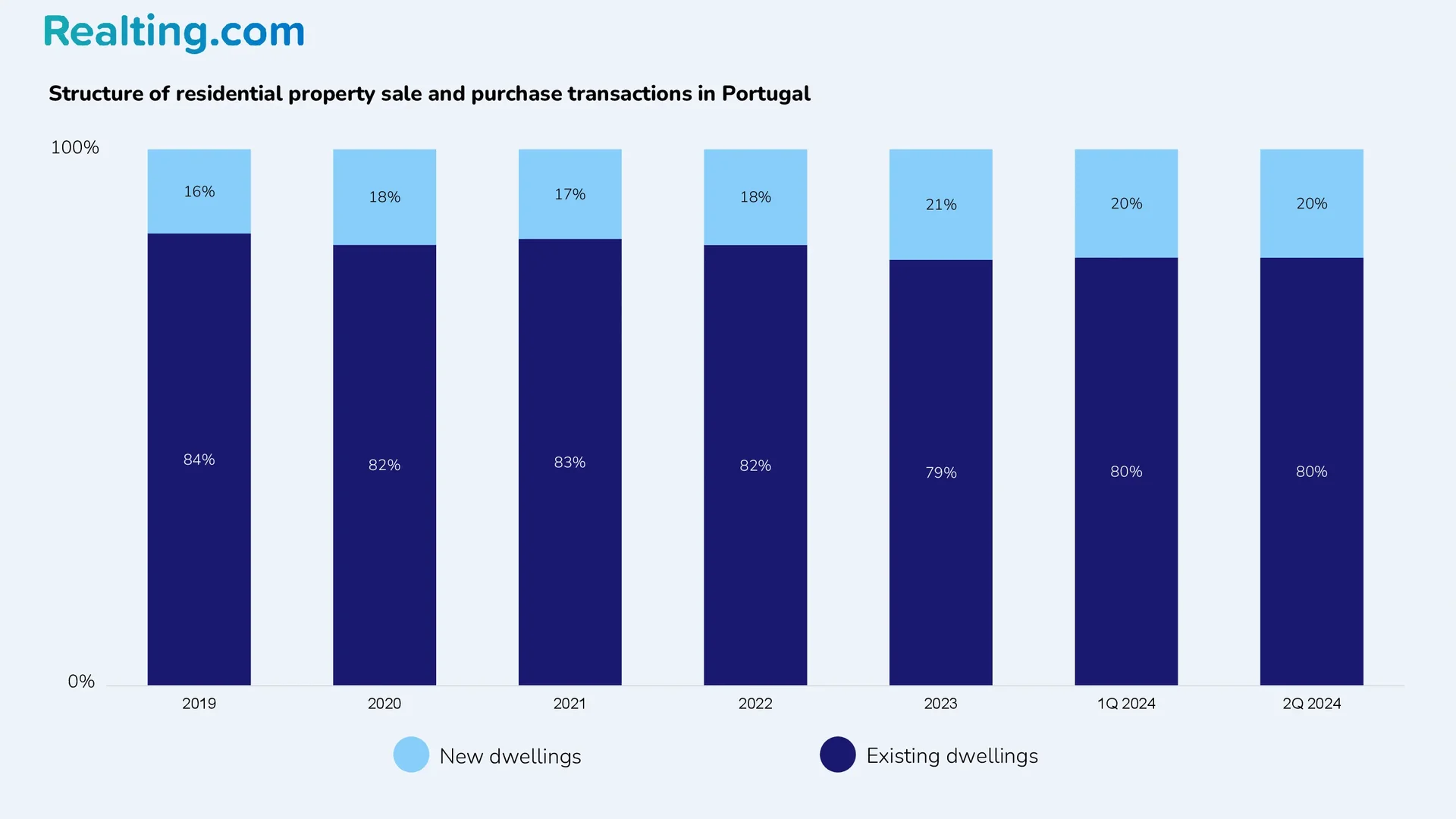

In Portugal, from 2016 to 2022, the share of new housing in sales transactions varied from 16% to 19%, and by the end of 2023 it was 21%. In the second quarter of 2024, the share of new housing in transactions was 20%, which is similar to the previous quarter.

Most often, transactions with new residential real estate were carried out in the regions: North (Norte) — 26% of all housing transactions in the region, Madeira (Região Autónoma da Madeira) — 22% of all housing transactions in the region.

The least frequent transactions involving new housing were in the regions of Alentejo and the Setúbal Peninsula (Península de Setúbal) – 12% and 15% of all housing transactions, respectively.

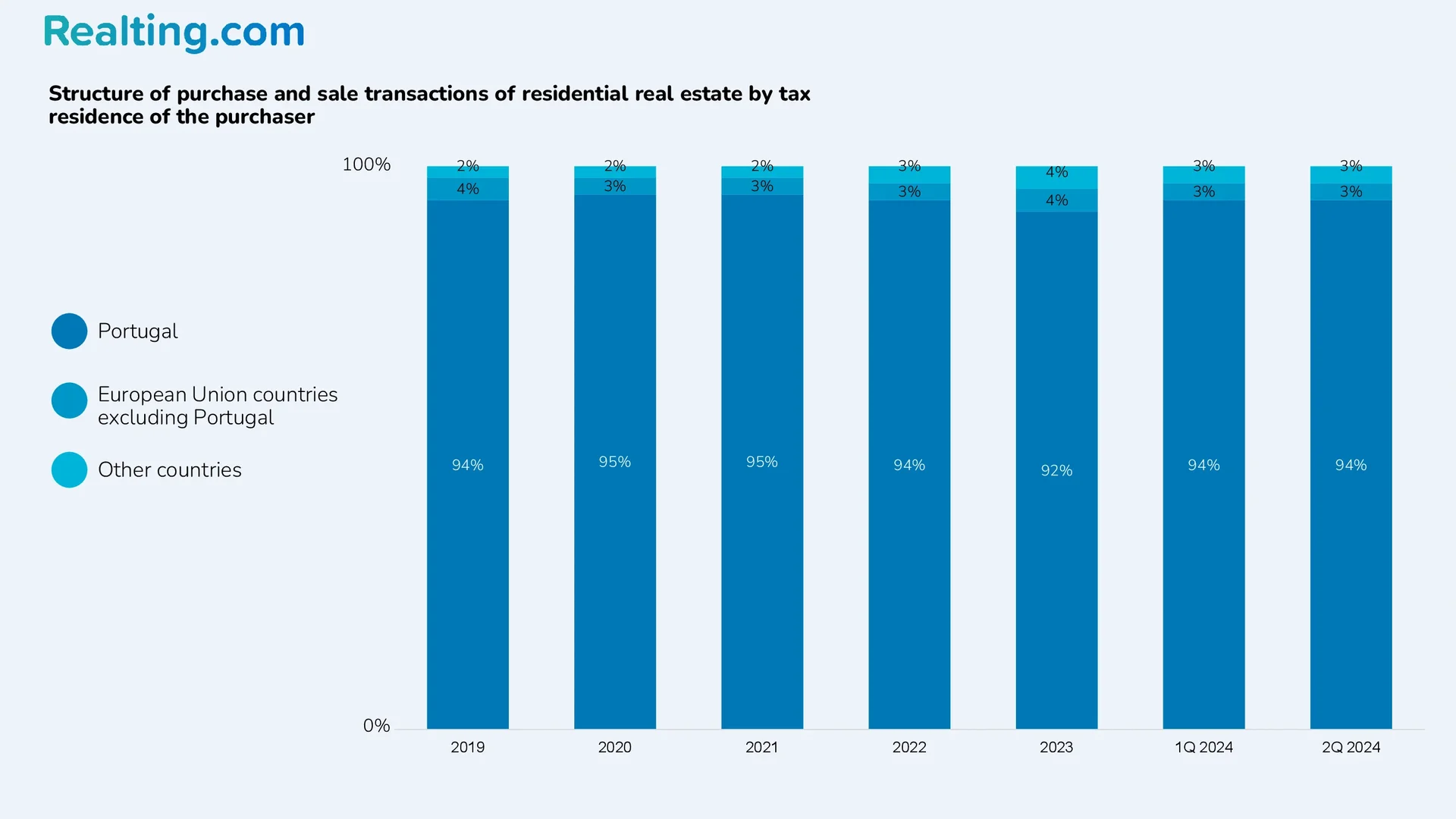

In Q2 2024, 94% of all residential property transactions were made by Portuguese residents, 3% by EU citizens (excluding Portugal), and 3% by citizens of other countries. This trend has been ongoing for the past 5 years.

Prices on the Residential Property Market in Portugal

According to data from the Statistical Office of the European Union, Portugal rounds out the top five EU countries where the residential property price index has shown the greatest increase since 2015.

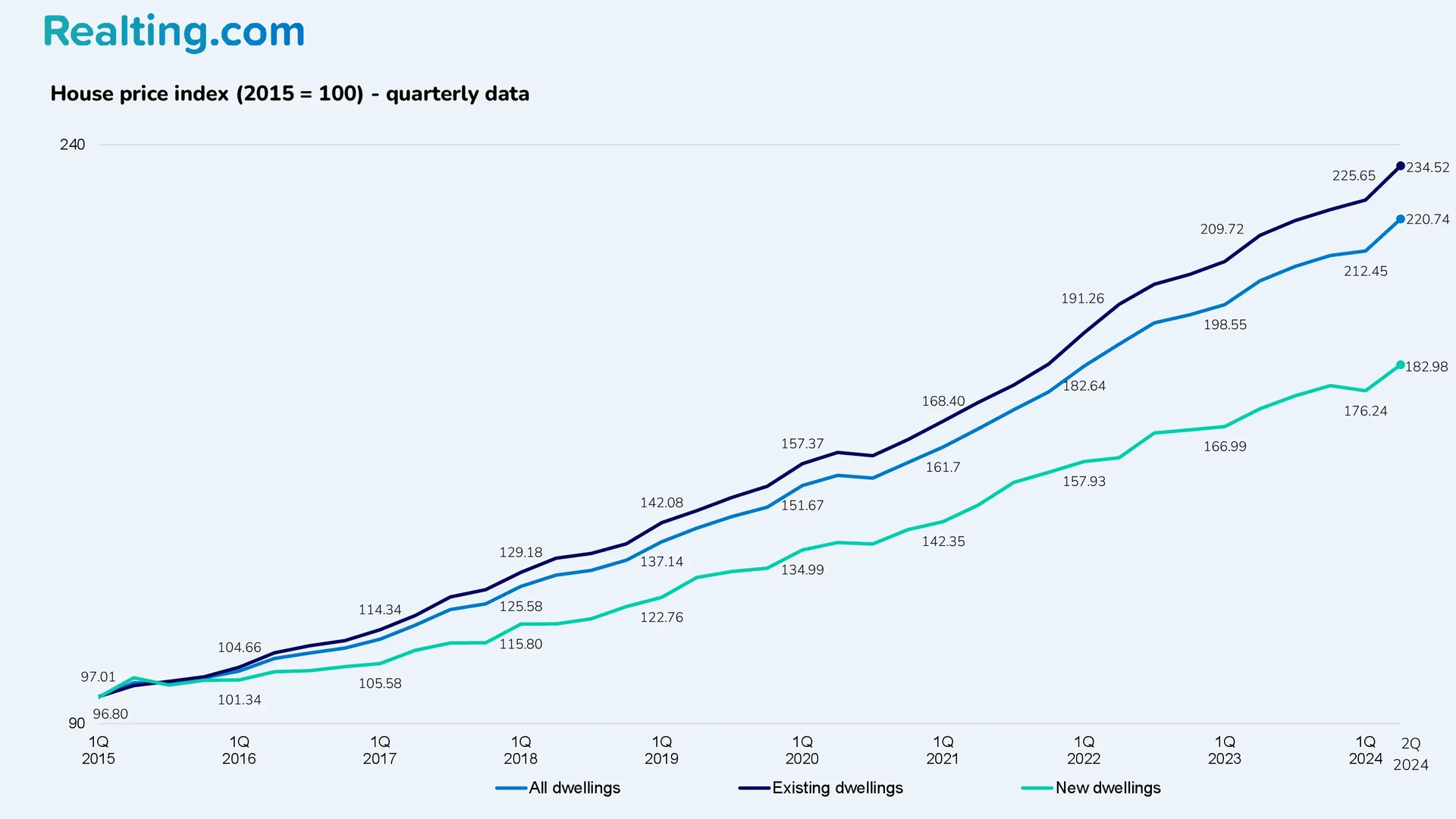

According to the National Institute of Statistics, the residential property price index for the second quarter of 2024 increased by 3.9% compared to the first quarter of 2024 and by 7.8% compared to the second quarter of 2023.

Indexes for new and existing housing:

- The existing residential property price index in Q2 2024 was set at 234.52, up 3.9% from the previous period and up 8.3% from Q2 2023.

- The new home price index was 182.98, up 3.8% from Q1 this year and up 6.6% from Q2 last year.

Let's take a closer look at the level of residential property prices in various regions of Portugal as of the second quarter of 2024.

According to the Portuguese National Institute of Statistics, the median sale price is used to analyze prices, a value that divides the total of all residential property transactions into two equal halves.

Unlike the average price, the median price does not take into account extreme values that may distort the real situation on the market. The National Institute of Statistics also identifies the 1st (Q1) and 3rd (Q3) quartile value of the housing sale price: the 1st quartile (Q1) is a value below which 25% of all residential real estate transactions will be, and 75% will be above it; the 3rd quartile (Q3) is a value above which 25% of all housing transactions will be.

First, let's look at the prices of residential property in the regions of Portugal. The table below shows the median sale price, the 1st and 3rd quartile value of the sale price of housing in Q2 2024, as well as the change in the median sale price compared to Q1 2024 and Q2 2023.

|

Region |

1st quartile value of the selling price, EUR/sq.m |

Median sales price, EUR/sq.m |

3d quartile value of the selling price, EUR/sq.m |

Change by Q1 2024 |

Change by Q2 2023 |

|

North |

945 |

1512 |

2164 |

+4.8% |

+8.8% |

|

Center (Centro) |

500 |

1027 |

1609 |

+8.1% |

+7.9% |

|

West and Tagus Valley (Oeste e Vale do Tejo) |

697 |

1238 |

1739 |

+4.1% |

+7.8% |

|

Greater Lisbon (Grande Lisboa) |

2116 |

2801 |

4000 |

+0.2% |

+1.4% |

|

Setúbal Peninsula |

1664 |

2048 |

2531 |

+3.1% |

+9.0% |

|

Alentejo |

428 |

841 |

1392 |

+4.1% |

+3.2% |

|

Algarve |

2037 |

2735 |

3541 |

+2.6% |

+5.9% |

|

Azores Islands (Região Autónoma dos Açores) |

747 |

1209 |

1786 |

+9.5% |

11.4% |

|

Madeira (Região Autónoma da Madeira) |

1225 |

2080 |

2947 |

+1.7% |

+8.6% |

Let's consider what prices for residential real estate have been established in the capital of Portugal - Lisbon and in the 6 largest cities of the country.

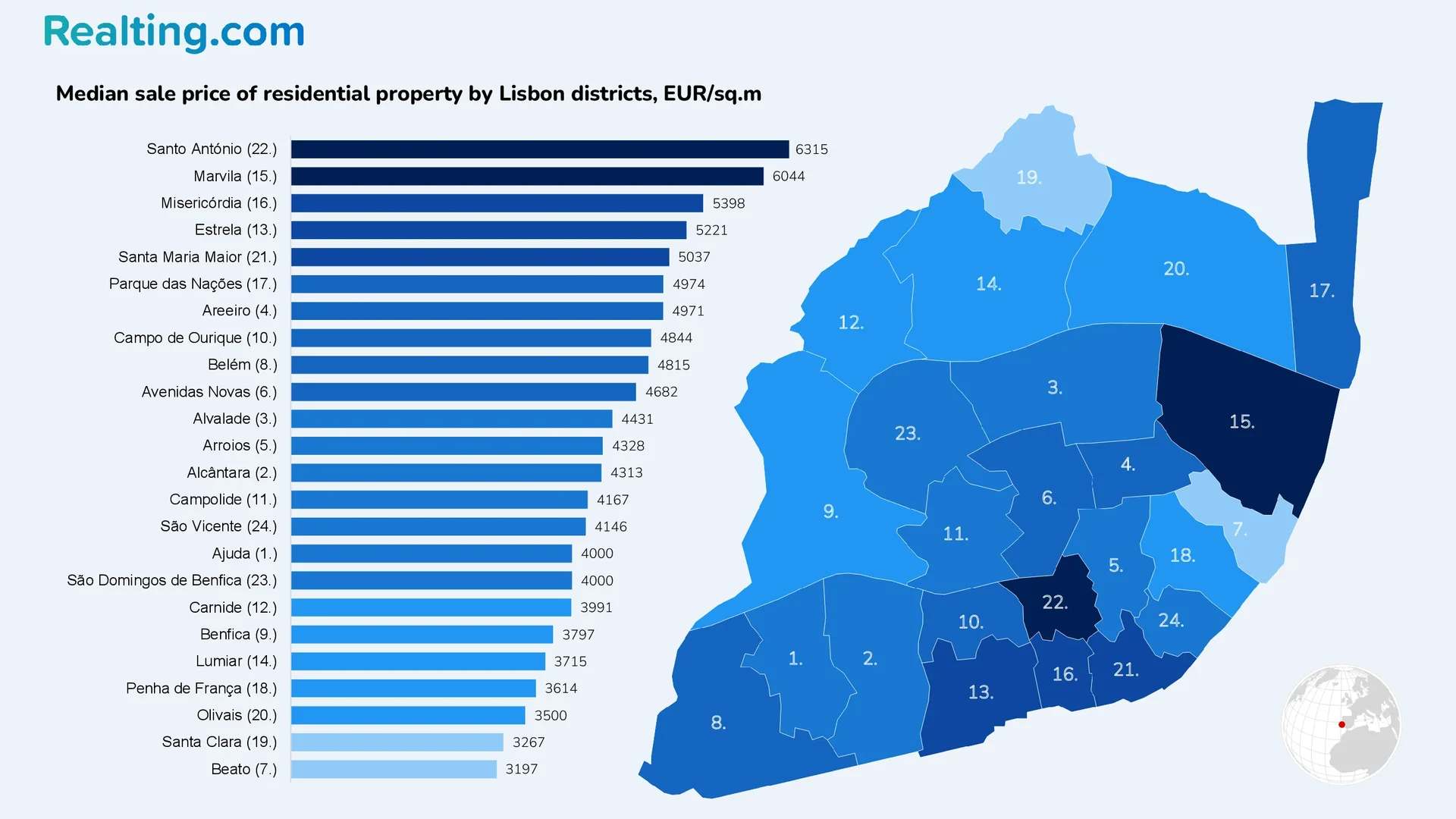

In Q2 2024, the median price of residential property in Lisbon was set at 4203 EUR/sq.m, 3% more than in Q1 of this year and 0.4% more than in Q2 of last year.

For new and existing properties, the median price is as follows:

- The median sales price per square meter in existing real estate transactions in Q2 2024 was EUR 4,004/sq.m, up 3.7% from Q1 2024 and up 0.6% from Q2 2023.

- The median sales price per square meter in new real estate transactions in Q2 2024 was EUR 5,405/sq.m, which is 6.2% more than in Q1 2024 and 3.6% more than in Q2 2023.

The areas with the highest price per square metre in Lisbon are the Santo António and Marvila areas, with median prices per square metre in these areas being 6,315 EUR/sq.m and 6,044 EUR/sq.m respectively.

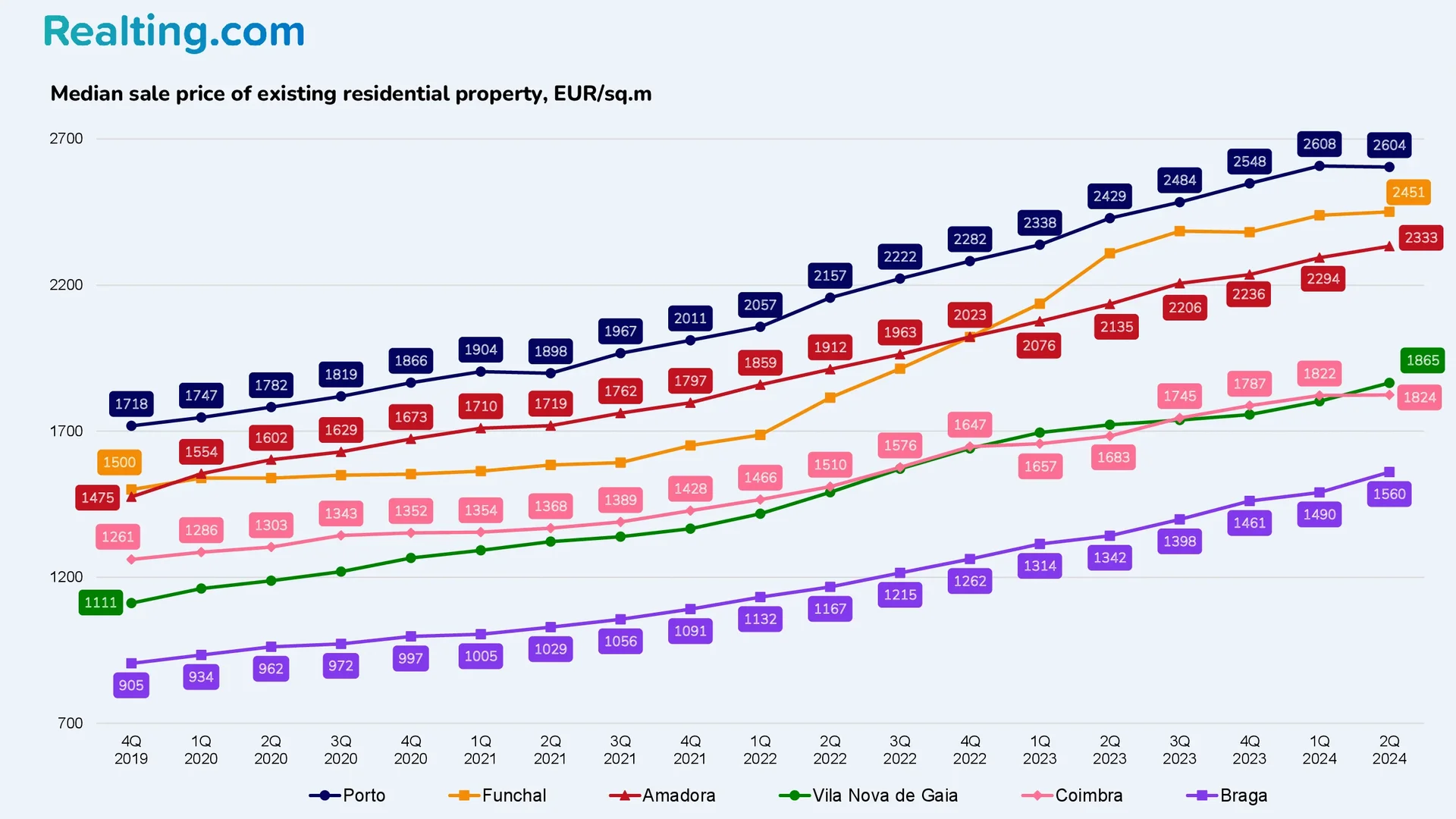

The largest cities in Portugal after the capital are Porto, Vila Nova de Gaia, Amadora, Braga, Coimbra, and Funchal.

Porto is the second largest city in Portugal, located in the northern part of the country on the banks of the Douro River. The city is an important economic and industrial center of the country, as well as a popular tourist destination.

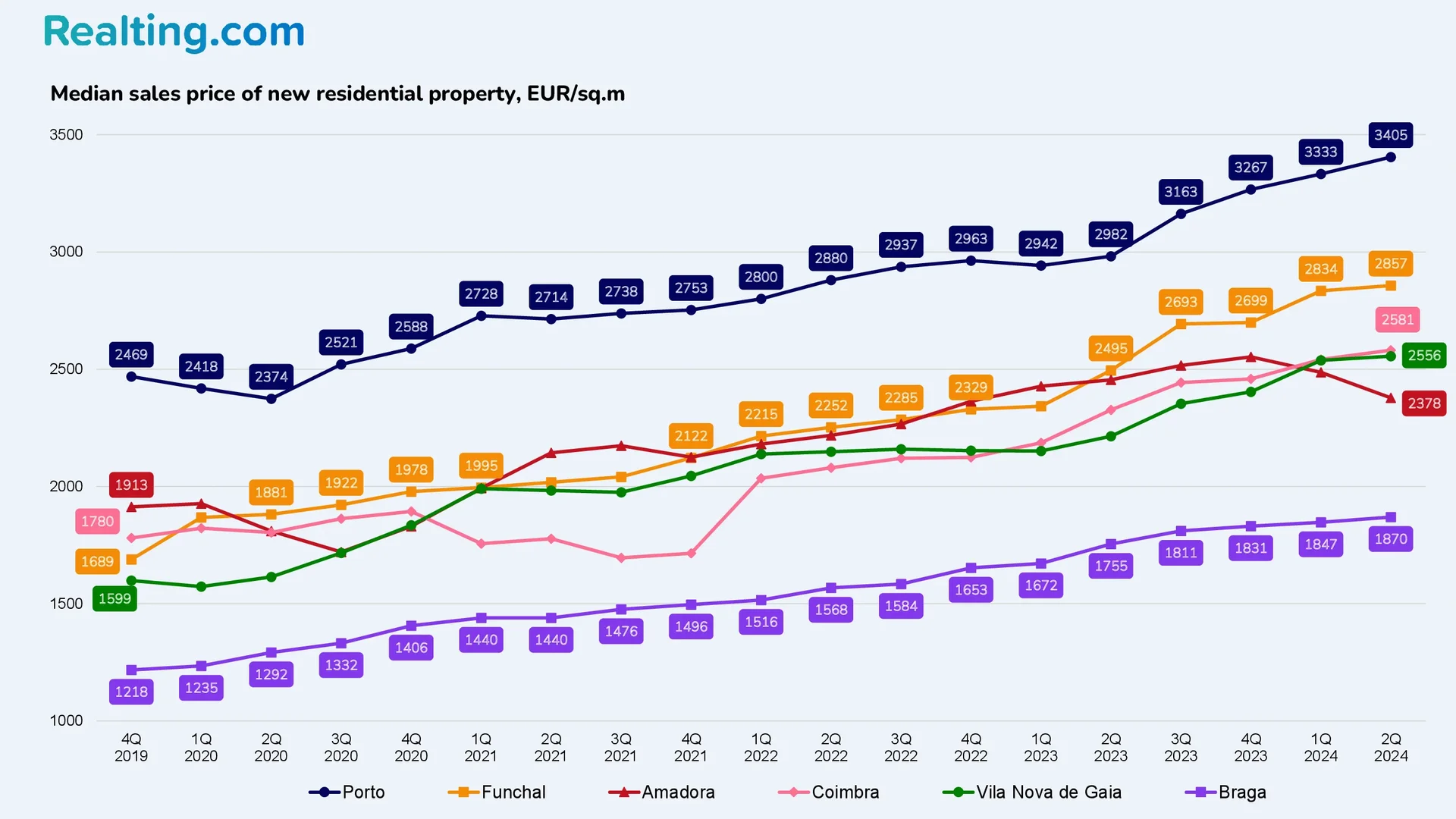

Median house prices in Porto

|

Type of residential property |

Median sales price in transactions, EUR/sq.m |

Change by Q1 2024 |

Change by Q2 2023 |

|

All residential properties |

2992 |

+1.7% |

+11.5% |

|

New residential real estate |

3405 |

+2.2% |

+14.2% |

|

Existing residential property |

2604 |

-0.2% |

+7.2% |

Vila Nova de Gaia is the third largest city in Portugal. Vila Nova de Gaia is located on the opposite bank of the Douro River from Porto. It is connected to Porto by the Luis I Bridge. Vila Nova de Gaia, like Porto, is an important economic and tourist center of the country.

Median house prices in Vila Nova de Gaia

|

Type of residential property |

Median sales price in transactions, EUR/sq.m |

Change by Q1 2024 |

Change by Q2 2023 |

|

All residential properties |

2153 |

+2.9% |

+16.4% |

|

New residential real estate |

2556 |

+0.7% |

+15.4% |

|

Existing residential property |

1865 |

+3.5% |

+8.3% |

Amadora is located a few kilometers northwest of Lisbon. Amadora is essentially a suburb of Lisbon, its public transport is fully integrated with the Lisbon public transport network.

Median home prices in Amadora

|

Type of residential property |

Median sales price in transactions, EUR/sq.m |

Change by Q1 2024 |

Change by Q2 2023 |

|

All residential properties |

2343 |

+1.3% |

+8.8% |

|

New residential real estate |

2378 |

-4.4% |

-3.1% |

|

Existing residential property |

2333 |

+1.7% |

+9.3% |

Braga is one of the oldest cities in Portugal. Known as the "Portuguese Rome," the city has preserved many architectural monuments, buildings and structures from various historical periods. The city combines historical, cultural and religious traditions.

Median house prices in Braga

|

Type of residential property |

Median sales price in transactions, EUR/sq.m |

Change by Q1 2024 |

Change by Q2 2023 |

|

All residential properties |

1631 |

+2.4% |

+12.3% |

|

New residential real estate |

1870 |

+1.2% |

+6.6% |

|

Existing residential property |

1560 |

+4.7% |

+16.2% |

Coimbra is a city located on the banks of the Mondego River, this city was once the first capital of the Kingdom of Portugal, and for many years it was the residence of the monarchs of Portugal. It is also famous for being the oldest university in the country.

Median house prices in Coimbra

|

Type of residential property |

Median sales price in transactions, EUR/sq.m |

Change by Q1 2024 |

Change by Q2 2023 |

|

All residential properties |

1921 |

-1.2% |

+4.3% |

|

New residential real estate |

2581 |

+1.5% |

+10.9% |

|

Existing residential property |

1824 |

+0.1% |

+8.4% |

Funchal is the capital of the autonomous region of Madeira. Funchal is famous for its festivals, including the Flower Festival, the Fireworks Festival, and the Wine Festival. The city is an important resort and tourist center of the country.

Median house prices in Funchal

|

Type of residential property |

Median sales price in transactions, EUR/sq.m |

Change by Q1 2024 |

Change by Q2 2023 |

|

All residential properties |

2639 |

+1.5% |

+12.4% |

|

New residential real estate |

2857 |

+0.8% |

+14.5% |

|

Existing residential property |

2451 |

+0.5% |

+6.1% |

Above are statistics on the median price per square meter in Portugal based on data on sales transactions provided by the Portuguese Tax and Customs Authority to the National Institute of Statistics of Portugal.

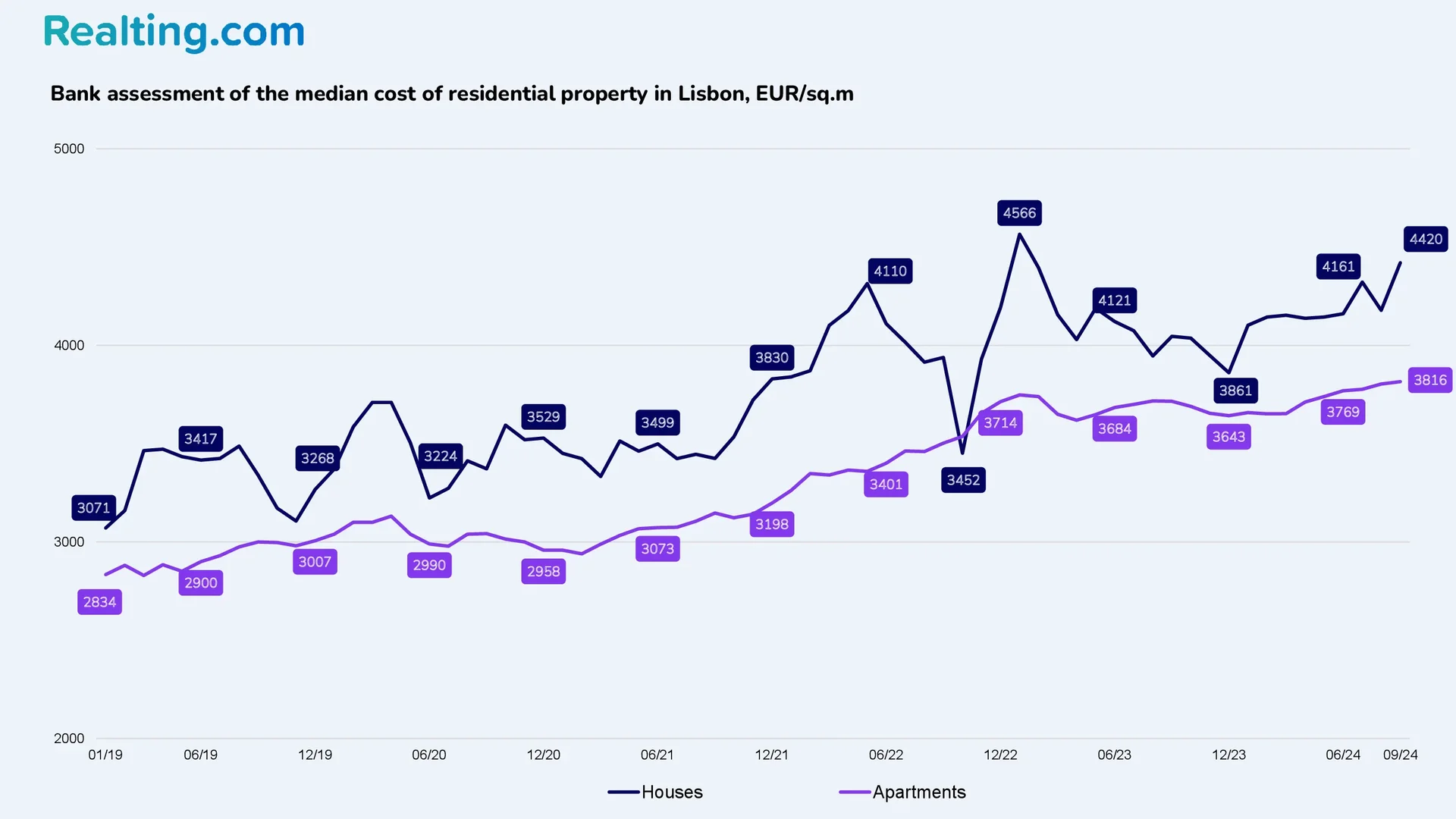

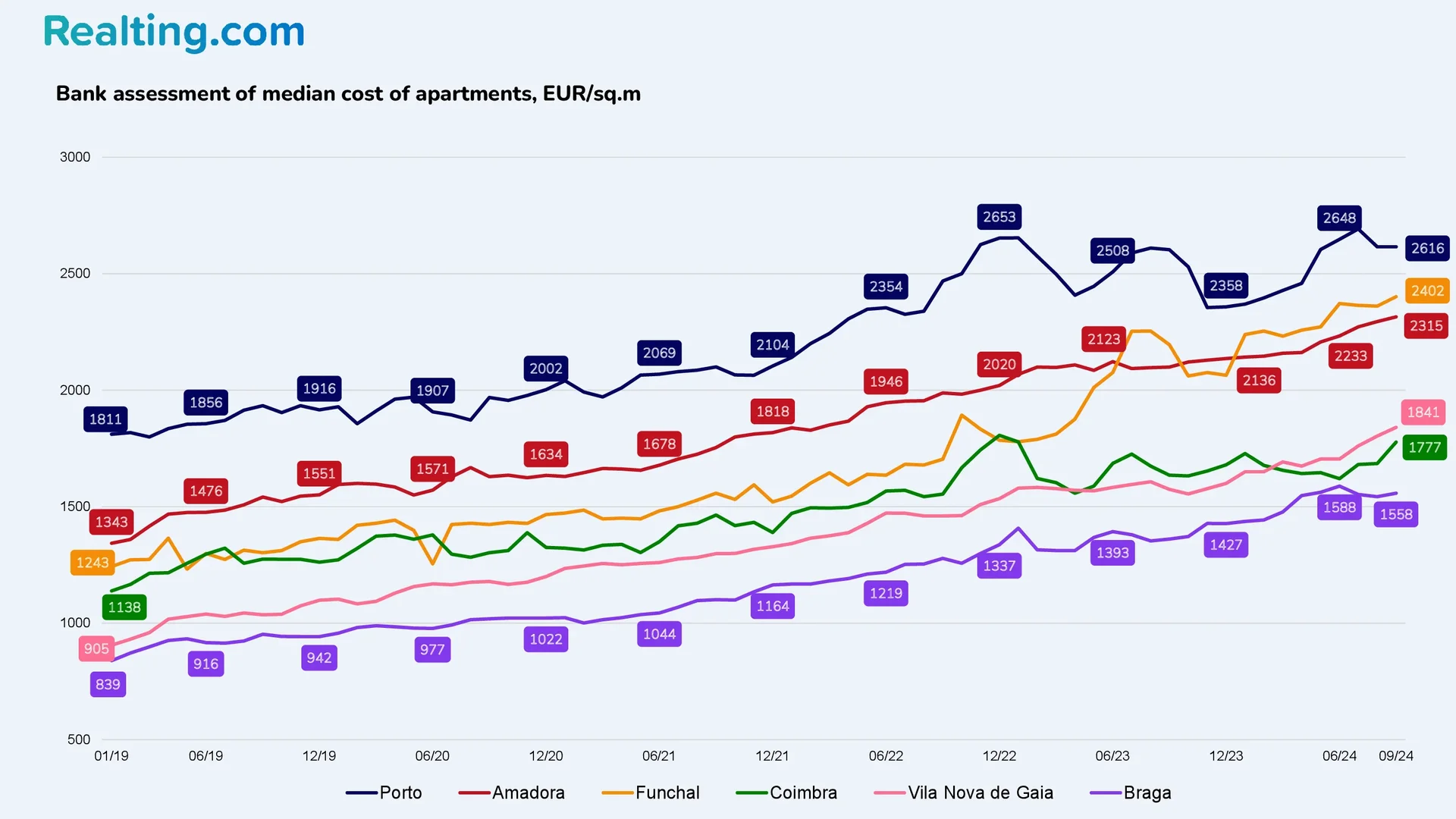

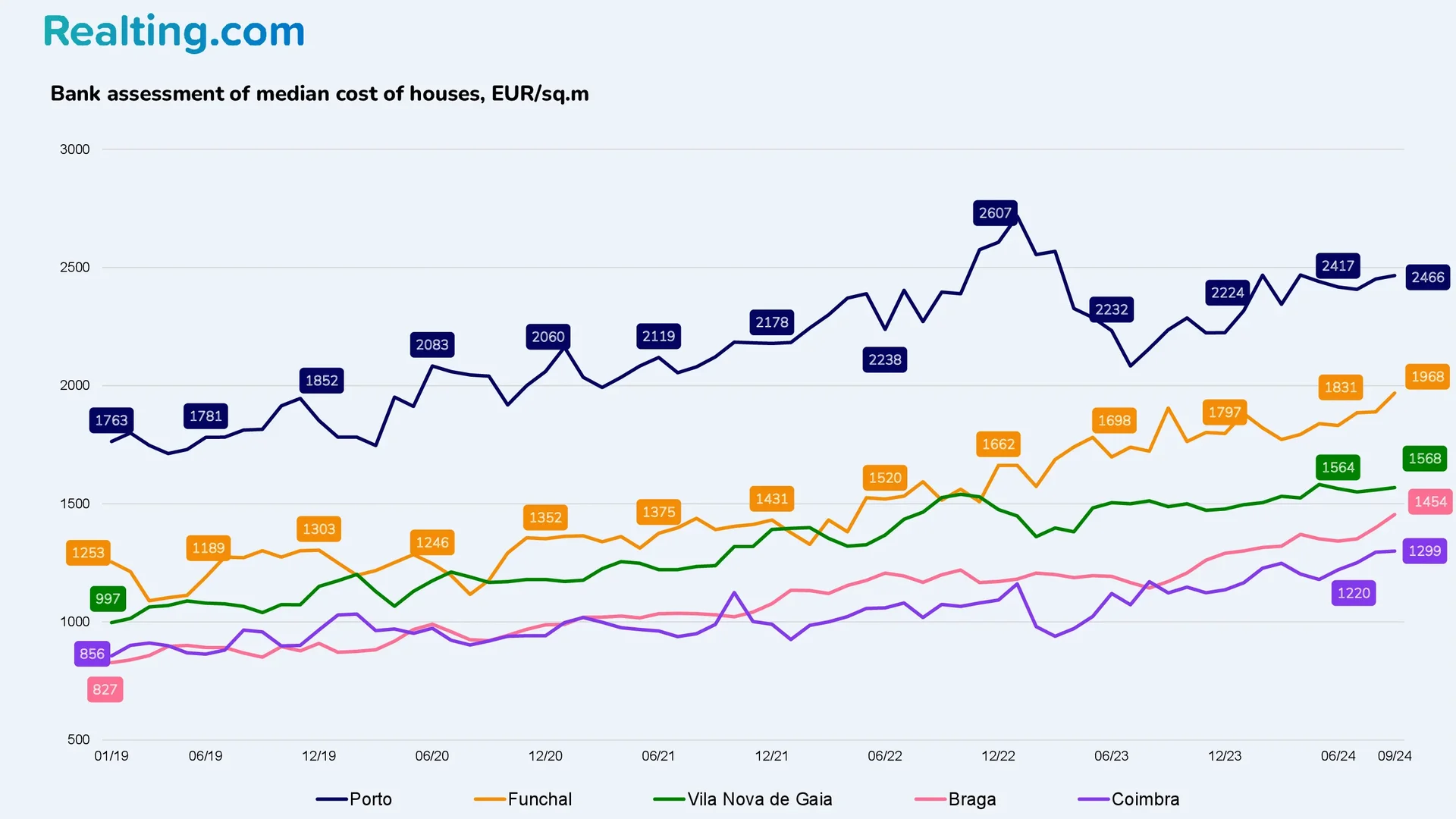

Also in Portugal, information is collected on the bank valuation of the median value of residential property, which is based on the data of bank valuations by financial institutions that provide loans for the purchase of housing. The bank valuation of the median value of housing is the median value of residential property for the purchase of which banks have provided loans. Let's consider what prices for residential property in terms of apartments and houses have been established in the largest cities of Portugal according to bank valuations of housing.

According to the National Institute of Statistics, the median value of bank valuations of housing in Lisbon at the end of September 2024 reached the following values:

- For apartments, the median price was 3816 EUR/sq.m, which is 0.3% more than in August this year and 2.7% more than in September last year.

- The average price of a house was 4420 EUR/sq.m., which is +5.8% compared to August of this year and +9.2% compared to September of last year.

For the cities of Porto, Vila Nova de Gaia, Amadora, Braga, Coimbra, Funchal, the bank estimates of the median value of residential property are as follows:

Bank valuation of the median price of apartments in September 2024

|

City |

Bank valuation of the median cost of apartments, EUR/sq.m |

Change from the previous month |

Change per year |

|

Porto |

2616 |

0% |

+0.5% |

|

Vila Nova de Gaia |

1841 |

+2.1% |

+17.0% |

|

Amadora |

2315 |

+0.9% |

+10.3% |

|

Braga |

1558 |

+1.0% |

+14.5% |

|

Coimbra |

1777 |

+5.5% |

+8.7% |

|

Funchal |

2402 |

+1.7% |

+9.4% |

Bank estimates of median home value in September 2024

|

City |

Bank valuation of median house value, EUR/sq.m |

Change from the previous month |

Change per year |

|

Porto |

2466 |

+0.6% |

+10.3% |

|

Vila Nova de Gaia |

1568 |

+0.6% |

+5.4% |

|

Braga |

1454 |

+3.9% |

+24.2% |

|

Coimbra |

1299 |

+0.3% |

+15.8% |

|

Funchal |

1968 |

+4.2% |

3.3% |

Based on the results of the past two quarters of 2024, it can be said that the Portuguese residential real estate market is experiencing activity similar to last year. In the context of high interest rates for the Portuguese housing market, as well as constantly rising prices for residential real estate, demand in the market is not decreasing but is showing a small, but still growth.

In the near future, the Portuguese housing market is expected to experience favorable changes — growth in demand in the market and increased activity in purchase and sale transactions. The incentive to buy housing will be cheaper loans (for the first time in 2 years, interest rates on loans began to decrease), the country's economic growth, and, consequently, the growth of the population's income. It is worth noting that under such conditions, one should not expect a decrease in housing prices.

The Portuguese residential property market shows stability and the ability to grow and develop, which will have a positive impact on the inflow of investments. The market itself is quite multifaceted and can offer potential buyers a huge choice — from resort and luxury properties on the Atlantic coast and the island of Madeira to traditional residential properties in various parts of the country.