Real Estate in Norway: Everything About the Market, Prices, and Investments

The Norwegian real estate market finds itself in a paradoxical situation: demand is growing, prices are rising by 5–6% per year, but almost no new housing is being built. Developers face some of the strictest building standards in Europe, high financing rates, and expensive materials — as a result, fewer new projects are coming out than the market needs. The shortage of supply is pushing prices upward, especially in regions where the economy is growing faster than the capital.

In this material, we examine how the Norwegian market is structured, where to look for opportunities, and what investors should pay attention to in 2026.

State and Dynamics of the Norwegian Market

The Norwegian housing market is in a recovery phase after the stagnation of 2022–2023. In 2024, prices grew by 6.4%, in 2025 — by 5%, and in 2026 growth of 6% is expected. These forecasts are based on official data from Eiendom Norge (the largest industry organization) and Norges Bank (the central bank).

The average apartment price in December 2025 was about 374,000 euros (4,420,795 NOK). However, behind the overall figures hide significant regional differences, which is one of the features of the Norwegian market.

Regional Differences

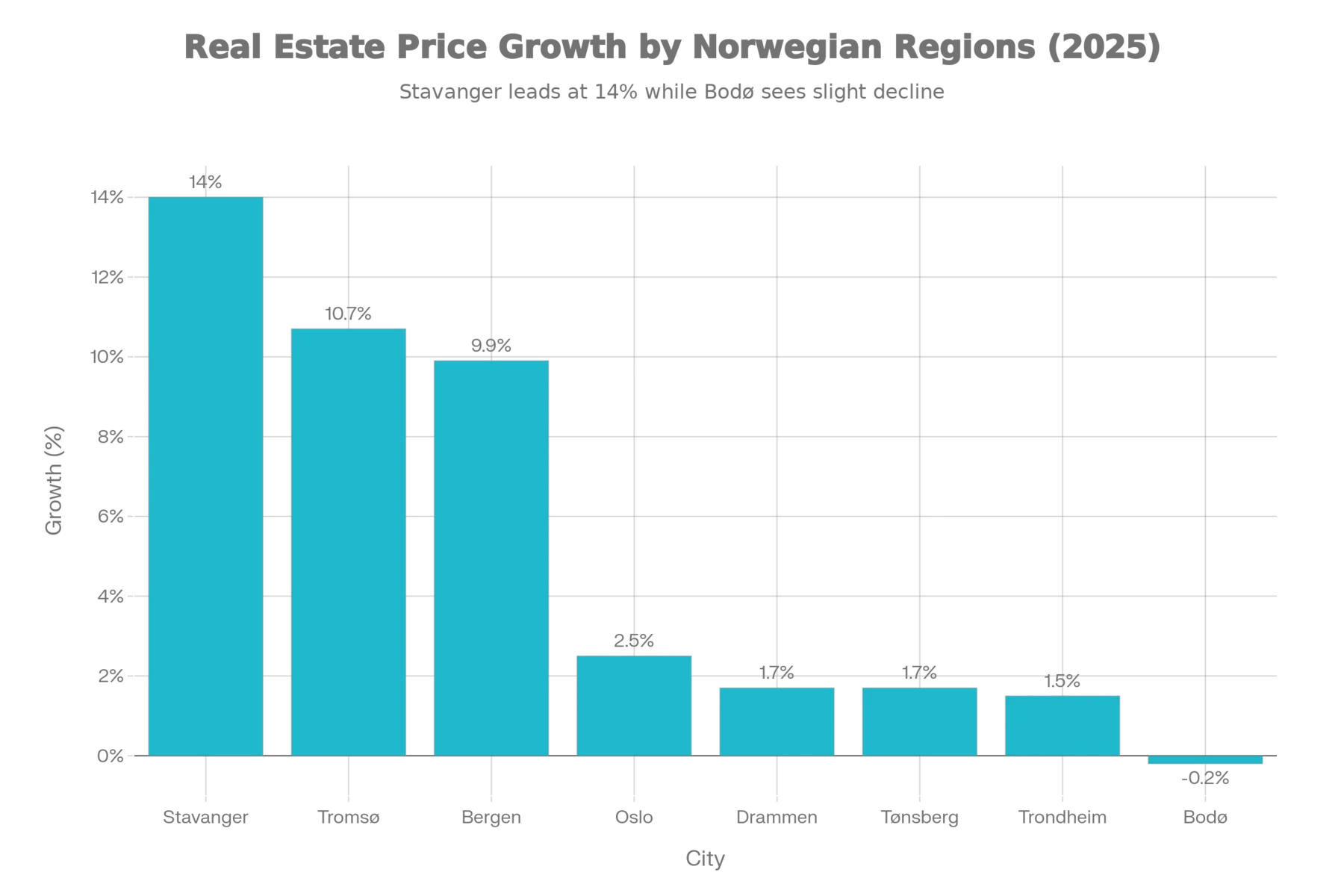

The most dynamic growth is observed in the western and northern regions.

Key indicators:

- Stavanger leads with growth of 14%. This is connected with the recovery of the oil and gas industry, which is the foundation of the local economy.

- Tromsø showed an increase of 10.7% thanks to the development of Arctic projects.

- Bergen grew by 9.9%.

- In Oslo, the economic center of the country, growth was only 2–3%.

- In Drammen and Tønsberg prices increased by 1.7% each.

- Trondheim grew by 1.5%.

- In Bodø, the northernmost city, prices decreased by 0.2%.

This trend shows that investors are rethinking the geography of their investments. Smaller cities with developing infrastructure and specialized economies are becoming increasingly attractive.

Pricing in Oslo: Detailed Analysis

Oslo remains one of the most expensive markets in Europe. The average apartment price in the city center was NOK 106,000 (almost 9000 euros) per square meter as of June 2025.

Table of prices by districts:

|

Type of district |

Price per m² (NOK) |

Typical 2-room apartment (NOK) |

|

Premium (Frogner, Aker Brygge) |

200,000–300,000+ |

12–16 million |

|

Central districts (Grünerløkka, Majorstuen) |

100,000–150,000 |

6–8 million |

|

Developing (Løren, Sørenga) |

80,000–120,000 |

5–7 million |

|

Oslo suburbs |

60,000–80,000 |

4–6 million |

|

Affordable outskirts (Stovner, Grorud) |

60,000–80,000 |

3–4 million |

|

Average segment |

106,000 |

7–9 million |

Premium locations in Oslo cost 2.4–2.8 times more than the average, which is comparable to prices in the centers of London or Amsterdam. An average apartment (50–70 m²) in the city center will cost 5–8 million NOK (approximately €500,000–750,000).

Reasons for the Growth of Housing Prices

One of the key reasons for price growth is the acute shortage of new homes. In recent years, the volume of housing construction remains at a record low level, starting from the late 1980s.

Annually, Oslo needs approximately 5000 new apartments, but the current pace of construction threatens to create a deficit of several thousand units annually. This mismatch between demand and supply supports price growth even with high interest rates.

The economy of housing construction in Norway is one of the most difficult in Europe. Construction costs have risen sharply due to:

-

Strict standards (TEK 17), which significantly exceed the standards of neighboring countries.

-

Rising prices for materials due to energy crises and fluctuations in the Norwegian krone exchange rate.

-

High interest rates: in 2023–2024, loans for developers became the most expensive.

All this has led to a housing shortage and growth in prices for already existing apartments.

Financial Accessibility and Interest Rates

The average mortgage rate in Norway in September 2025 decreased to 5.35%, which is noticeably lower than the peak of 5.73% in March 2024.

Evolution of the key rate of Norges Bank in 2025:

-

June: 4.25%.

-

September: 4.0%.

-

December 2025: 4.0% (no change).

Forecasted decrease in rates (Norges Bank):

|

Period |

Policy rate |

Mortgage rate |

|

2026 |

3.9% (1-2 decreases) |

~5.2% |

|

2027 |

3.5% |

~4.8% |

|

2028 (end) |

~3.2% |

slightly above 4.5% |

Norges Bank stated that it is in no hurry to lower rates, emphasizing the need to maintain a tight monetary policy until the target inflation level of 2% is achieved.

Financial Burden on Norwegian Households

The financial burden on households reached a critical level during the peak of rate growth. The dynamics show the following:

|

Year |

% of households (≥15% of income on mortgage) |

|

2022 |

4.2% (low burden) |

|

2023 |

14.5% (peak burden) |

|

2025E |

~11% (improvement due to rate decrease) |

Although the expected rate decrease will ease the situation, housing prices remain at historical highs, which puts first-time buyers in a disadvantaged position.

Rental Market and Investment Prospects

Rental markets in Norwegian cities are recovering thanks to ongoing urbanization. Oslo remains the most expensive city for rent with prices over €26 per m², which amounts to about 15,000–16,000 NOK per month for a 50 m² apartment in the center.

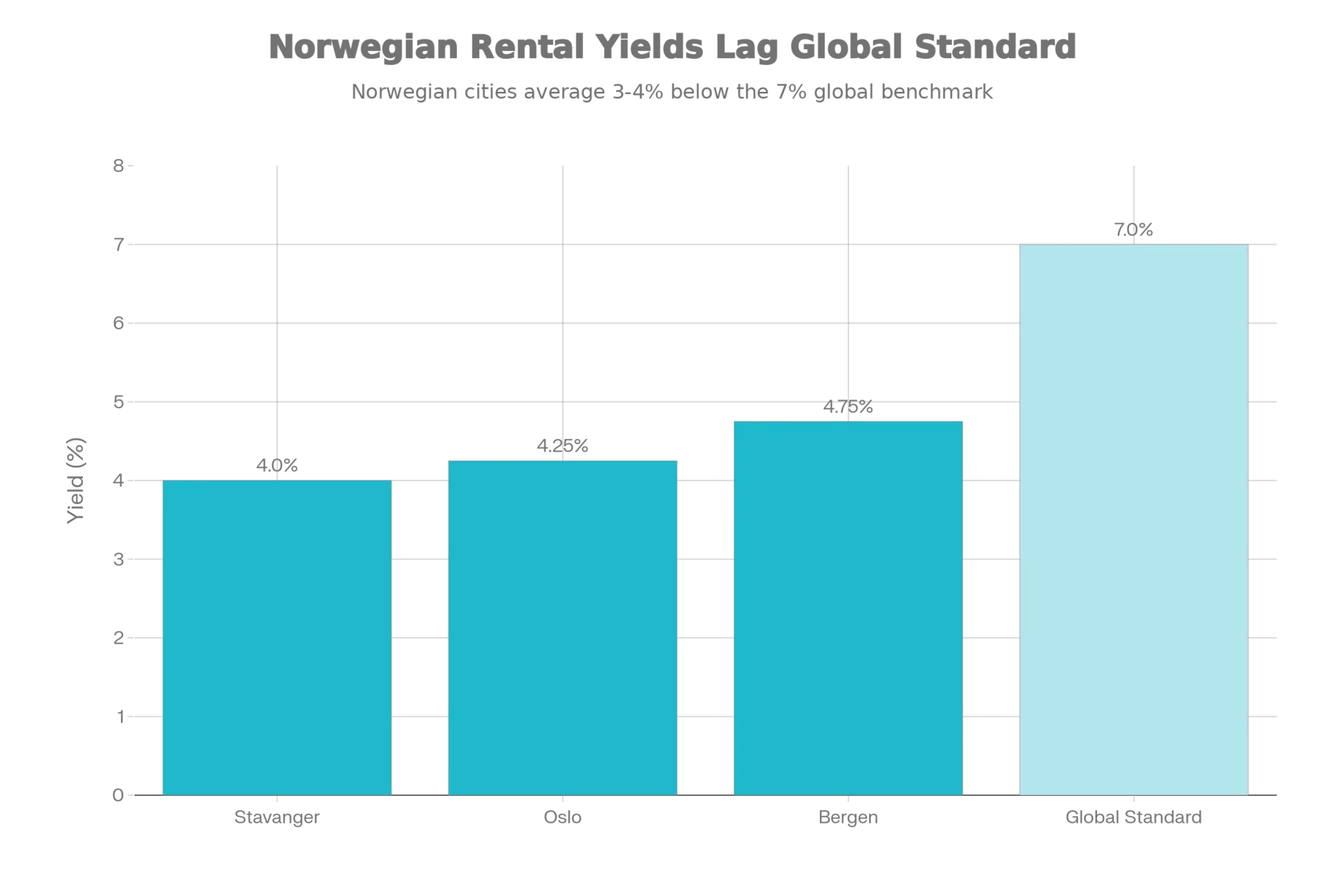

Gross rental yields by cities:

|

City |

Gross yield |

Characteristic |

|

Stavanger |

3.5–4.5% |

Depends on the oil and gas industry |

|

Oslo |

3.5–5% |

High prices, stable demand |

|

Bergen |

4–5.5% |

Recovering market |

|

Global standard |

6–8% |

Developing markets |

Norwegian rental yields are significantly lower than global standards. This is connected with the maturity and safety of the market, and not with its profitability. This indicator is important for investors focused on current income.

Commercial Real Estate and Investments

For the first nine months of 2024, the volume of investments in Norwegian real estate amounted to 54.5 billion Norwegian kroner (NOK). Distribution of investments by sectors:

- Office sector: 40% or 21.8 billion NOK — including elite assets in the center of Oslo.

- Industry and logistics: 27% or 14.7 billion NOK.

- Retail and others: 33% or 17.9 billion NOK.

Domestic investors dominated the market, closing 80% of transactions by volume, which indicates the preference of Norwegian funds and pension funds for local assets.

The office real estate market stabilized in 2025. Prime yields:

- CBD (city center): 4.5% yield.

- Peripheral spaces: 5.5% yield.

The improvement is due to the activity of pension funds, although new supply remains limited.

Macroeconomic Context

Economic growth of Norway:

|

Indicator |

2024 |

2025E |

|

GDP (total) |

2.1% |

~2.5% |

|

Mainland |

0.6% |

~1.7% |

Inflation:

|

Period |

Level |

|

2024 |

3.1% (CPI) |

|

December 2025 |

3.2% (core inflation) |

|

Norges Bank target |

2.0% |

Inflation is gradually approaching the target level. It is expected to reach 2% by 2027–2028.

Norges Bank maintains the key rate at 4.0% since December 2025. The forecast indicates 1-2 decreases in 2026 and further reductions in 2027-2028.

Demography

Norway faces rapid population aging, with a median age of 40.9 years. However, significant immigration inflow compensates for the natural decline in population. The urbanization rate reaches 85.9%, which is one of the highest rates in the world.

This demographic dynamic stimulates demand for urban housing, especially in large metropolises — Oslo, Bergen, and Stavanger.

Tax Environment and Regulatory Framework

Property tax (eiendomsskatt)

- Rate: 0.1–0.7% of the estimated value.

- For housing maximum: 0.4%.

- Tax base: 70% of market value for residential premises.

Capital gains tax

- Primary housing: full exemption from tax upon sale.

- Investment and non-residential real estate: 22% of profit.

Wealth tax

-

Applies to assets worth more than NOK 1.7 million (since 2024).

Such a tax system stimulates the purchase of primary housing, but creates significant expenses for investors.

Foreign Investments

Norway offers liberal conditions for foreign buyers:

- Citizens of EEA countries can freely purchase residential and commercial real estate.

- Citizens of other countries must obtain municipal approval, which is usually granted without problems.

- For the purchase of agricultural land, residence on the territory (boplikt) may be required.

These favorable conditions make Norway attractive for foreign investors.

Conclusion and Prospects for 2026

The Norwegian real estate market in 2025–2026 demonstrates paradoxical dynamics: overall growth of 5% in 2025 and expected 6% in 2026 hides significant regional differences. In energy regions (Stavanger — 14%, Tromsø — 10.7%, Bergen — 9.9%) significant growth is observed, while Oslo is developing more restrainedly (2–3%).

The main driving force of price growth remains the housing shortage caused by high construction costs and strict regulatory requirements. Even despite some slowdown in the economy, this shortage continues to put pressure on the market.

Investors are recommended to:

- Carefully select regions for investments (cities with growth potential).

- Prepare for long-term investments (10 years and more).

- Expect modest returns.

Norway with its liberal regulatory environment, political stability, and strong state remains attractive for conservative investors who are looking for a safe haven in Scandinavia.

Sources of information: Eiendom Norge (January 5, 2026), Investropa (June 2025), Norges Bank (December 17–18, 2025), Statistics Norway (February 2025), Norges Bank (November–December 2025), CBRE (Q1–Q3 2024), Skatteetaten (2024–2025), Global Property Guide (2025).

Author

I am responsible for editorial work. I write expert interviews and guides.