Hottest Real Estate Market Trends 2025: All You Need to Know

The real estate industry is undergoing significant changes in 2025. Building new properties has become significantly harder and more expensive; money is flowing differently, and being environmentally friendly is no longer just a nice-to-have — it’s essential for saving money. At the same time, the demand for data centers is exploding, while traditional offices and retail stores are struggling.

This guide explains global property market trends: why it’s harder to build, where capital is going, and how regions differ — with current data and examples.

Why There’s a Building Shortage in 2025

The problem: building new commercial properties has hit a wall across North America and Europe. Two main issues are causing this:

- Expensive loans: interest rates are high, making it costly for developers to borrow money for new projects.

- Rising construction costs: building materials and labor keep getting more expensive, and these high costs aren’t coming down.

What this means: most developers are putting their building plans on hold or canceling projects entirely because they can’t make the math work. This is creating a shortage of new commercial buildings. JLL notes that supply shortages in in-demand segments are a defining feature of the 2025 market.

The big exception: data centers’ real estate demand is getting very popular

(the massive buildings that house computer servers for the internet and AI).

Recent major deals:

- UK: Blackstone got approval to build a £10 billion data center campus in northern England and quickly secured £250 million from a university pension fund.

- US: in Virginia, one company secured over $1.2 billion in construction loans to build four massive data center campuses with enough power to run a small city.

The Early Bird Gets the Worm (And It’s Still Early)

Here’s something unusual about 2025: the window for smart investors to get in early is staying open longer than normal. Usually, when real estate markets start recovering, the best deals disappear quickly. But this time, the recovery is happening slowly and unevenly, giving patient investors more time to find good opportunities.

JLL’s Q2 2025 data show that direct transaction volumes were:

- Americas Q2: US$99 billion (+18% YoY).

- EMEA Q2: US$49 billion (+6% YoY).

- Asia-Pacific Q2: US$31 billion (+15% YoY).

|

Region |

Transaction volume Q2 |

Growth YoY |

Key opportunities |

Main challenges |

|

Americas |

US$99 billion |

+18% |

Data centers, warehouses, apartments, near-shoring. |

Secondary offices, WFH impact. |

|

EMEA |

US$49 billion |

+6% |

Certified offices, life sciences, Southern European hotels. |

Building shortages limiting new supply. |

|

Asia-Pacific |

US$31 billion |

+15% |

Japanese residential, Indian logistics, Southeast Asia flexible workspace |

China’s office stress, land/power constraints. |

Why this matters: historically, investors who buy during the early stages of a recovery have earned strong returns — often in the high single digits to low double digits annually. Because this recovery is taking longer than usual, there’s still time to get in before prices fully bounce back.

Go Green or Go Broke

Being environmentally friendly and integrate green buildings in real estate isn’t just about feeling good anymore — it’s about saving money and staying competitive. Here’s why:

The financial reality:

- Energy costs keep rising

- New regulations require buildings to be more efficient

- Tenants increasingly want modern, efficient spaces

- Old, inefficient buildings are losing value faster

Real example: major companies like KPMG are choosing the most efficient, modern buildings for their offices, even paying premium rents, because the total costs (including energy) are actually lower.

The bottom line: buildings that don’t modernize and become more efficient are becoming obsolete and losing value rapidly.

Regional Real Estate Forecasts 2025 (Americas, EMEA, Asia-Pacific)

Let’s inspect the situation around the world.

Americas (North and South America)

The good: investment activity is strongest here, with lots of interest in data centers, warehouses, and apartment buildings. Mexico is benefiting as companies move manufacturing closer to the US.

The challenge: older office buildings in secondary cities continue to struggle as work patterns have permanently changed.

Europe, the Middle East, and Africa (EMEA)

The good: investment is up 6% from last year, focused on environmentally certified offices, life sciences buildings, and hotels in recovering Southern European markets.

The situation: there’s still a shortage of new buildings being built, which is keeping rents high for the best properties.

Asia-Pacific

The good: showing the strongest growth (up 15%), with international investors particularly interested in Japanese apartments and data centers, plus rapid growth in logistics and flexible workspace in India and Southeast Asia.

The challenge: parts of China’s office market are still under stress.

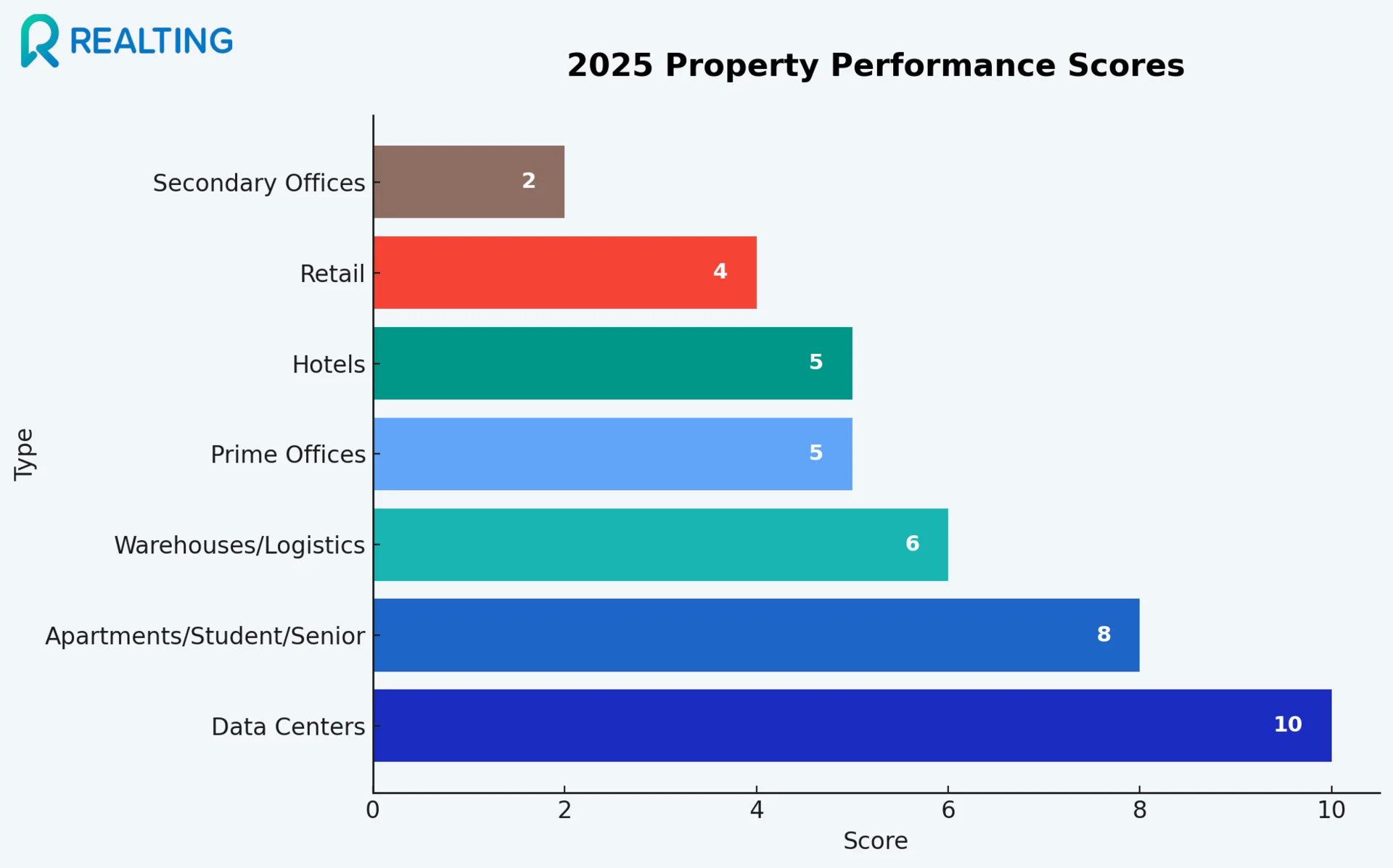

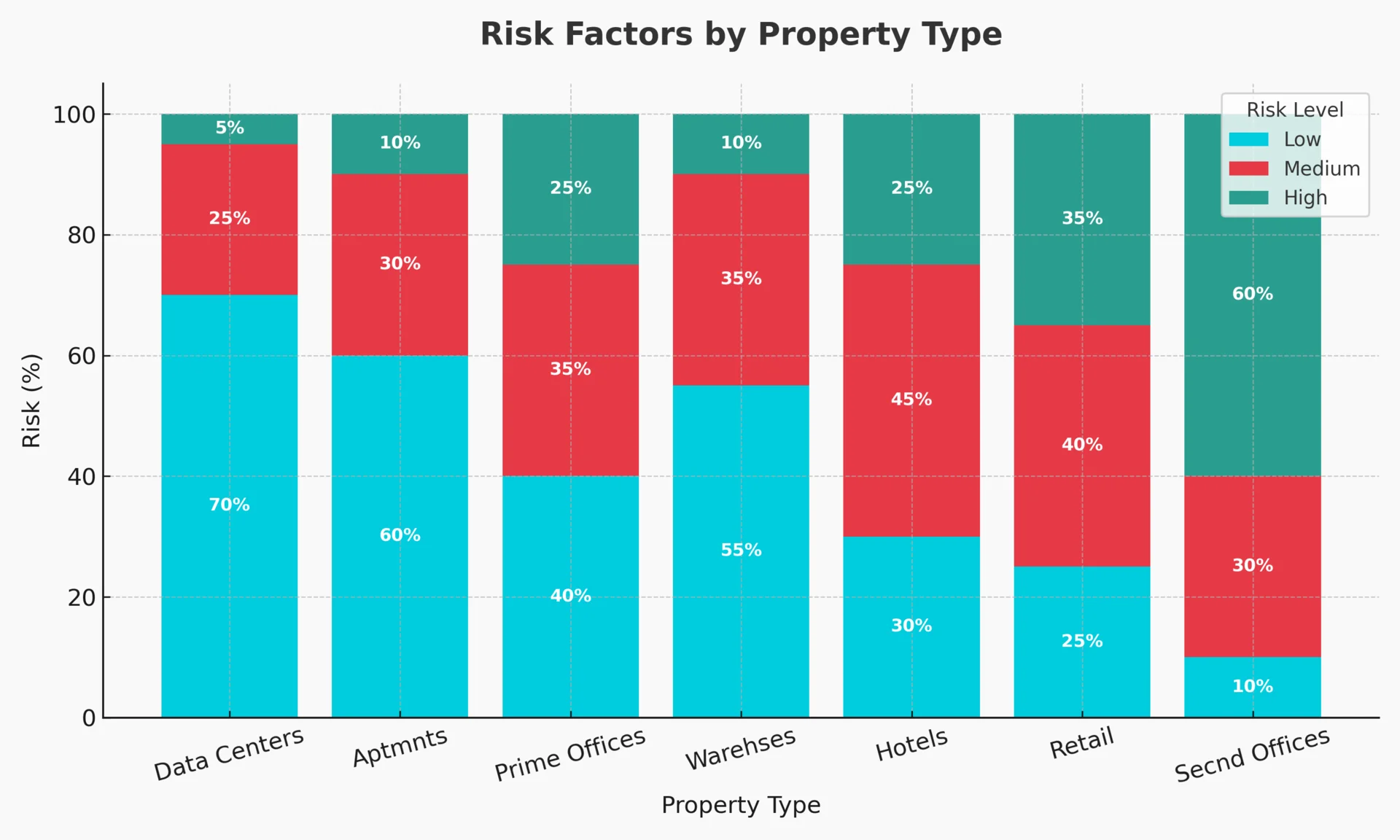

Which Property Types are Winning and Losing

Key takeaway: the market is heavily divided between winners and losers. Success comes from focusing on the best properties in each category while avoiding anything old, inefficient, or poorly located.

|

Property type |

2025 trend |

Main risks |

Best opportunities |

|

Data сenters |

Explosive growth |

Power/land shortages |

AI campuses, edge computing |

|

Apartments/Student/Senior housing |

Strong demand |

Affordability concerns |

Demographic growth areas |

|

Warehouses/logistics |

Cautious but stable |

Trade/tariff issues |

Near-shoring, urban locations |

|

Prime offices |

Top buildings resilient |

Obsolescence risk |

Green renovations, pre-leasing |

|

Hotels |

Tourism recovering |

Travel disruptions |

Southern Europe, resort areas |

|

Retail |

Prime locations stable |

Legacy mall decline |

Mixed-use, dining/entertainment |

|

Secondary offices |

Major struggles |

Work-from-home impact |

Conversion to other uses |

Learning from Past Real Estate Cycles

Looking at past market cycles:

- 2009-2014 (after the financial crisis): investors who bought early in the recovery earned strong returns as the market recovered.

- 2020-2022 (after COVID): warehouses and apartments performed best; offices struggled.

- 2023-2024: high interest rates slowed everything down and made new construction much harder.

- 2025: activity is slowly picking up, but unevenly across different property types and regions.

Global Real Estate Scenarios for 2026–2030

The optimistic scenario of the future of real estate (10–12% annual returns possible):

- Interest rates start coming down faster.

- New construction methods make building cheaper and faster.

- Environmentally friendly buildings command premium prices.

- Data centers continue to experience rapid expansion.

The cautious scenario (4–6% annual returns):

- Interest rates stay high longer.

- Climate disasters increase risks for some properties.

- Only the best, most efficient buildings in great locations perform well.

- Wider gap between winners and losers.

This information reflects prevailing market-forecast ranges from major asset managers (e. g., PGIM, Savills).

Practical Advice for Investors, Developers, and Tenants

Let’s talk about real estate investment strategies 2025 for different types of participants on the market.

For investors:

Focus on climate-resilient properties and overweight data centers, apartments, and warehouses in markets with good power, land availability, and supportive policies.

For developers:

Make buildings more environmentally friendly and tech-enabled. Use new construction methods to control costs and build faster.

For policymakers:

Provide clear planning rules, incentives for building upgrades, and invest in infrastructure to attract private investment.

For tenants:

Choose efficient, flexible, environmentally friendly spaces to reduce operating costs and attract better employees.

The Bottom Line

The real estate market in 2025 is all about quality, efficiency, and adaptability. The days of “property in any location” are over. Success now requires focusing on the best properties in the best locations, with modern systems and environmental efficiency.

While there are challenges and risks in the real estate market 2025 — high construction costs, expensive financing, and climate risks — there are also significant opportunities for those who understand the new rules of the game. The key is being selective, thinking long-term, and prioritizing properties that can adapt to our changing world.

The recovery is happening, but it’s favoring those who embrace change rather than fight it.

Key Questions About Real Estate Outlook 2025

Is the global real estate market improving in 2025?

Yes, but unevenly. Investment is growing across all regions, yet the recovery is gradual. Data centers, apartments, and warehouses are leading the rebound.

What are the best investment opportunities in 2025?

The strongest opportunities are in data centers, green-certified offices, apartments, and logistics properties in growth markets.

What risks should investors consider in 2025?

High financing costs, stricter environmental regulations, and climate risks are the main challenges. Obsolete buildings lose value quickly.

Why are green buildings critical for the real estate market?

Because of rising energy costs, regulatory requirements, and tenant demand, sustainable buildings maintain higher value and rental yields.

Which regions are most attractive for real estate investment?

- Americas: strongest overall activity.

- EMEA: growing demand for certified offices and hotels.

- Asia-Pacific: fastest growth, led by Japan, India, and Southeast Asia.

Author

I am responsible for editorial work. I write expert interviews and guides.