French Housing Market 2024: Price Analysis, Mortgage Rates and Forecast for 2025

High mortgage rates, a decline in activity, and falling prices are the trends currently underway in the French housing market. The changes are particularly noticeable in Paris, where apartment prices have fallen by 6.1% in a year. In this article, we take a detailed look at the current state of the French housing market, analyze key trends, and present forecasts for 2025.

On the Decline in Activity

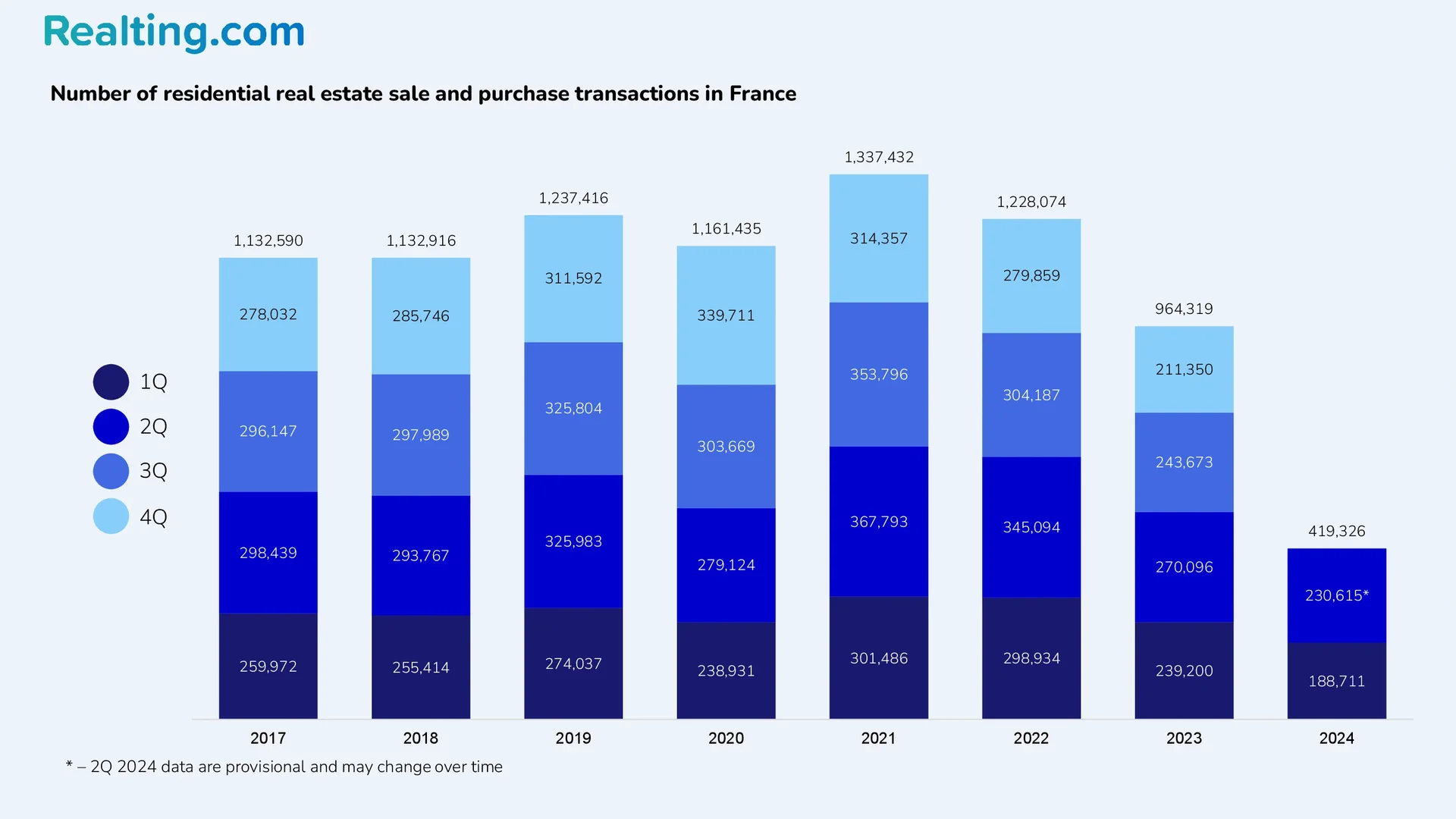

The peak of activity and demand in the French housing market occurred in 2021. According to data from the Statistical Office of the European Union, as of the results of 2021, 1,337,432 purchase and sale transactions with residential real estate were registered, which is the absolute maximum in the entire history of observations in the country's housing market.

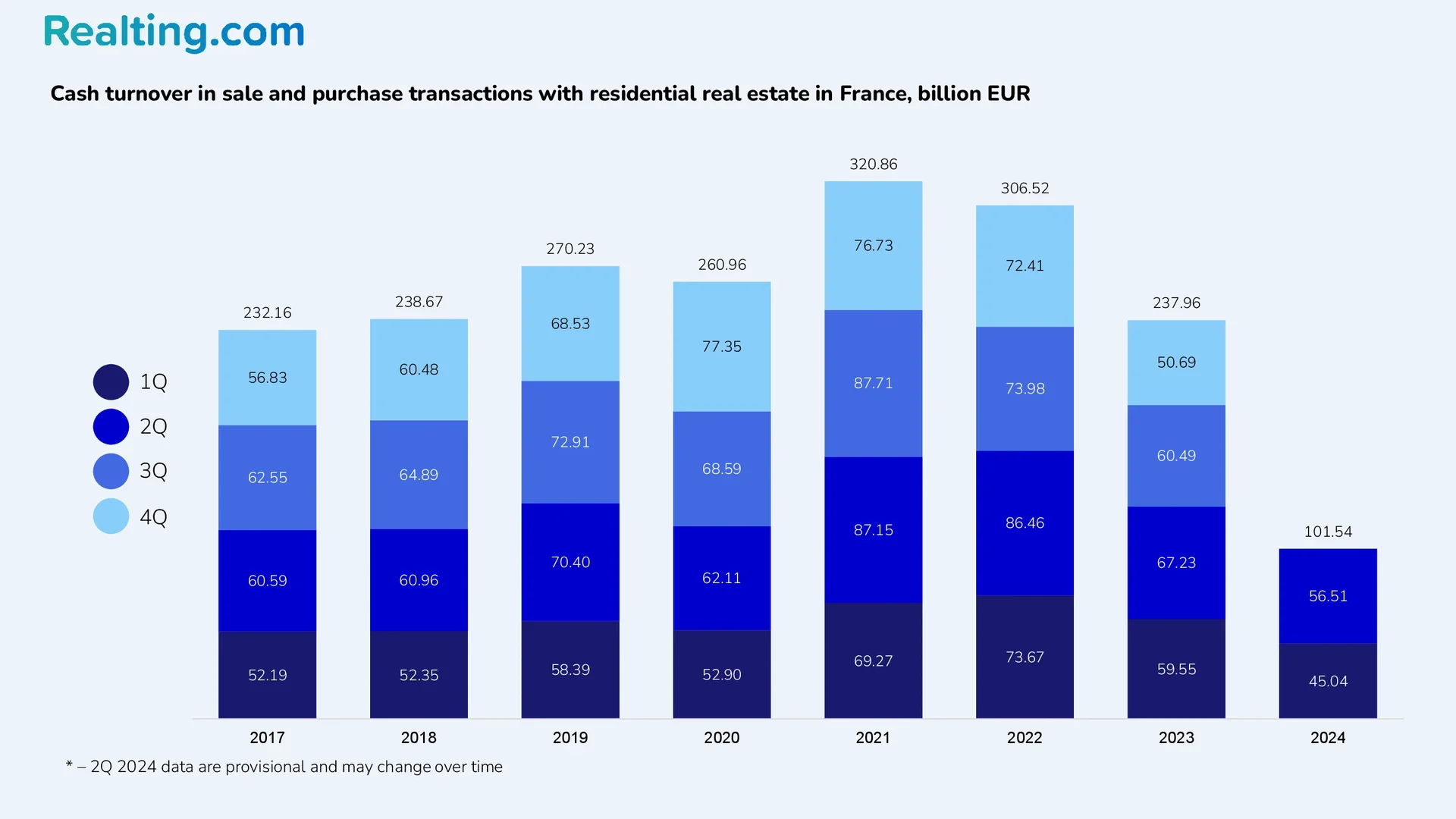

Specifically, 15.2% more residential property transactions were registered in 2021 than in 2020. Compared to pre-Covid 2019, the growth was 8.1%. It is worth mentioning that before 2021, the record for the number of transactions was in 2019. The cash turnover in residential property purchase and sale transactions at the end of 2021 amounted to EUR 320.86 billion, which is 23.0% more than in 2020.

The housing market for 2022 showed a decrease of 8.2% compared to the previous year: as a result, 1,228,074 purchase and sale transactions, which is still an excellent result. The money turnover for this year amounted to 306.52 billion EUR, which is 4.5% less than in the previous year.

Then came 2023, which saw a decline in market activity. The number of residential property transactions fell by 21.5% compared to 2022. For the first time since 2016, the French housing market failed to reach the 1 million purchase and sale transactions mark: 964,319 transactions were registered in 2023, which is comparable to 926,602 transactions in 2015.

It is also worth noting the fact that if in 2022 the average quarterly number of purchase and sale transactions was 307,019, then in 2023 this value decreased to 241,080 purchase and sale transactions.

The factors that stimulated the French housing market in 2021 and 2022 were low interest rates on housing loans, the general economic recovery, and the growth of real incomes of the population. All these factors are characteristic not only of the French residential real estate market but also of other EU countries (for example, Italy, Lithuania, Portugal), which show similar trends in the housing markets of their countries.

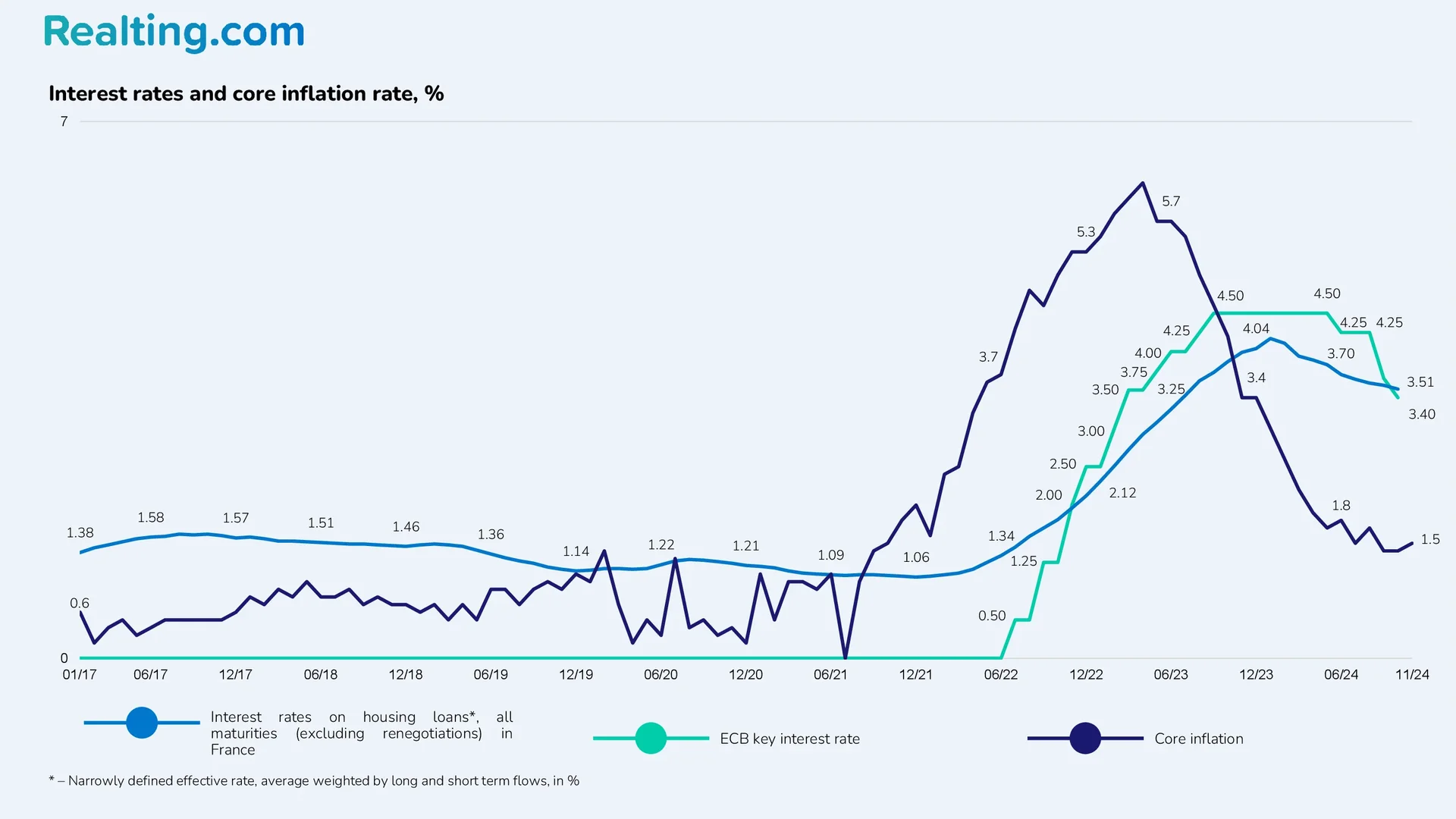

In turn, the decline in activity in the housing market in 2023 was caused by the following events: rising inflation led to the European Central Bank starting to raise its base rate from mid-2022, after which the Central Bank of France began to raise its lending rates.

By the beginning of 2024, interest rates on housing loans had increased threefold compared to interest rates in 2021. Also, the fact that the economic well-being of the population was declining during this period did not add optimism to the market. It is worth noting here that the events described in this paragraph are typical not only for France but also for the member countries of the European Union and the Eurozone.

In 2024, the French residential real estate market still shows relatively low numbers of purchase and sale transactions, and Q1 2024 showed the lowest number of purchase and sale transactions since 2015 — 188,711 purchase and sale transactions were registered in Q1 2024. According to the results of Q2 of this year, 230,615 residential transactions were registered in France, which is 22.2% more than in Q1 of this year and 14.6% less than in Q2 last year. At this time, there is no preliminary data on the number of transactions for Q3 and Q4.

About Loans And What to Expect on the Market Next

Since January 2016, housing loan rates in France have been gradually falling, reaching their minimum in December 2021, according to the Central Bank of France the weighted average interest rate on housing loans in January 2016 was 2.27%, and by December 2021 the rate had dropped to 1.06%.

Low interest rates encouraged the population to take more active actions in the housing market: buying a first home; buying a new home to improve housing conditions; investing in residential real estate to generate income from it in the future. The volume of housing loans issued at this time grew, which is a logical consequence of low interest rates.

In 2021, a record year for the real estate market, housing loans worth €244 billion were issued to households in France. Interest rates on housing loans began to gradually increase in January 2022, but the growth of rates accelerated significantly from June 2022. While in the first half of 2022, housing loan rates grew by an average of 4% per month, in the second half of this year, rates grew by 8% per month. Loan rates continued to grow until the beginning of 2024: in January 2024, the weighted average interest rate on loans was 4.17%, which is almost 4 times more than in January 2022.

The rise in interest rates was triggered by inflation and measures aimed at combating it. In the outgoing 2024, the French government managed to bring inflation under control: according to the data from National Institute of Statistics and Economic Research of France (INSEE) the core inflation rate at the end of November 2024 was 1.5% (in November 2023, core inflation was 3.4%, and in November 2022 — 5.3%).

The Central Bank of France reports that maintaining inflation at a level not exceeding 2% is crucial to ensuring monetary stability and economic prosperity in the Eurozone. The Bank of France also predicts growth in the country's GDP and a gradual recovery of the population's purchasing power.

Starting from February 2024, interest rates on loans are decreasing. Rates have been decreasing every month, and by October the average weighted interest rate had dropped to 3.51% — this is still a very high level of rates, and the slow pace of decrease will not allow purchasing power to be restored quickly in the market.

However, it is worth noting the following: since the beginning of 2024, an increase in the number of loans issued has been recorded. If in January of this year, housing loans worth 9.8 billion euros were issued, then in October — 12.4 billion euros. This is still several times less than in the same periods of 2021 and 2022, but such positive trends add optimism.

It is now possible to say that the French residential real estate market will see a stabilization process by the end of 2024. Most likely, the final sales volume for 2024 will be even lower than in 2023 — this will be the end of the decline, after which a gradual recovery will begin.

The French housing market has suffered a huge downturn, and the recovery process will be long, as it requires the population to regain purchasing power and for lending rates to fall to acceptable levels, which will take some time.

About Residential Property Prices in France

The decline in demand and activity in the residential property market and the rise in mortgage rates have forced residential property sellers to lower prices or take a wait-and-see approach. This is because, under the current conditions, sellers would simply not be able to find a buyer for their property.

Currently, there is a slowdown in the decline in prices, which can generally be called stabilization. It is not worth expecting that prices will go from decline to growth in the near future since this requires that purchasing power is restored first (which will lead to an increase in the number of transactions).

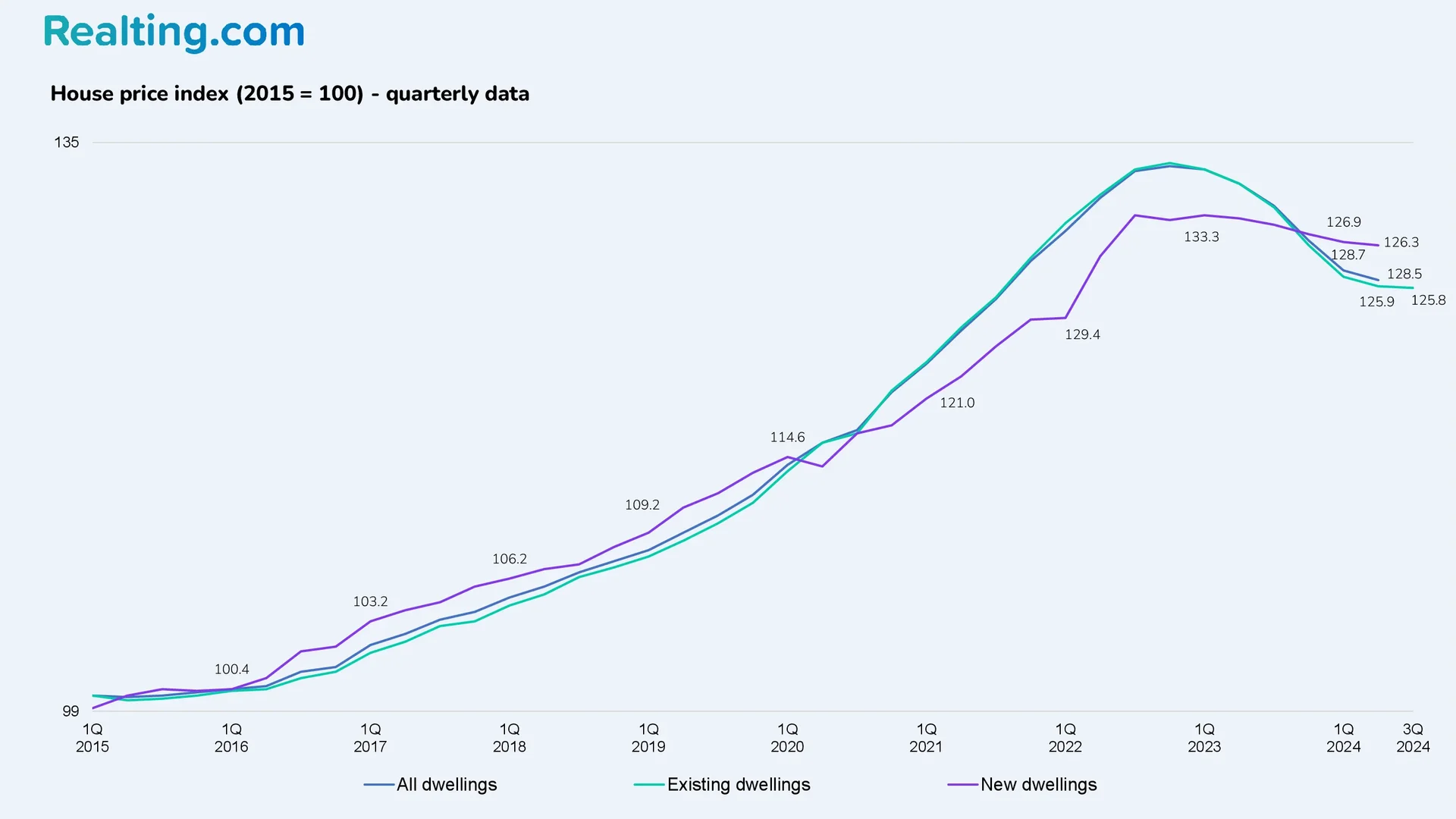

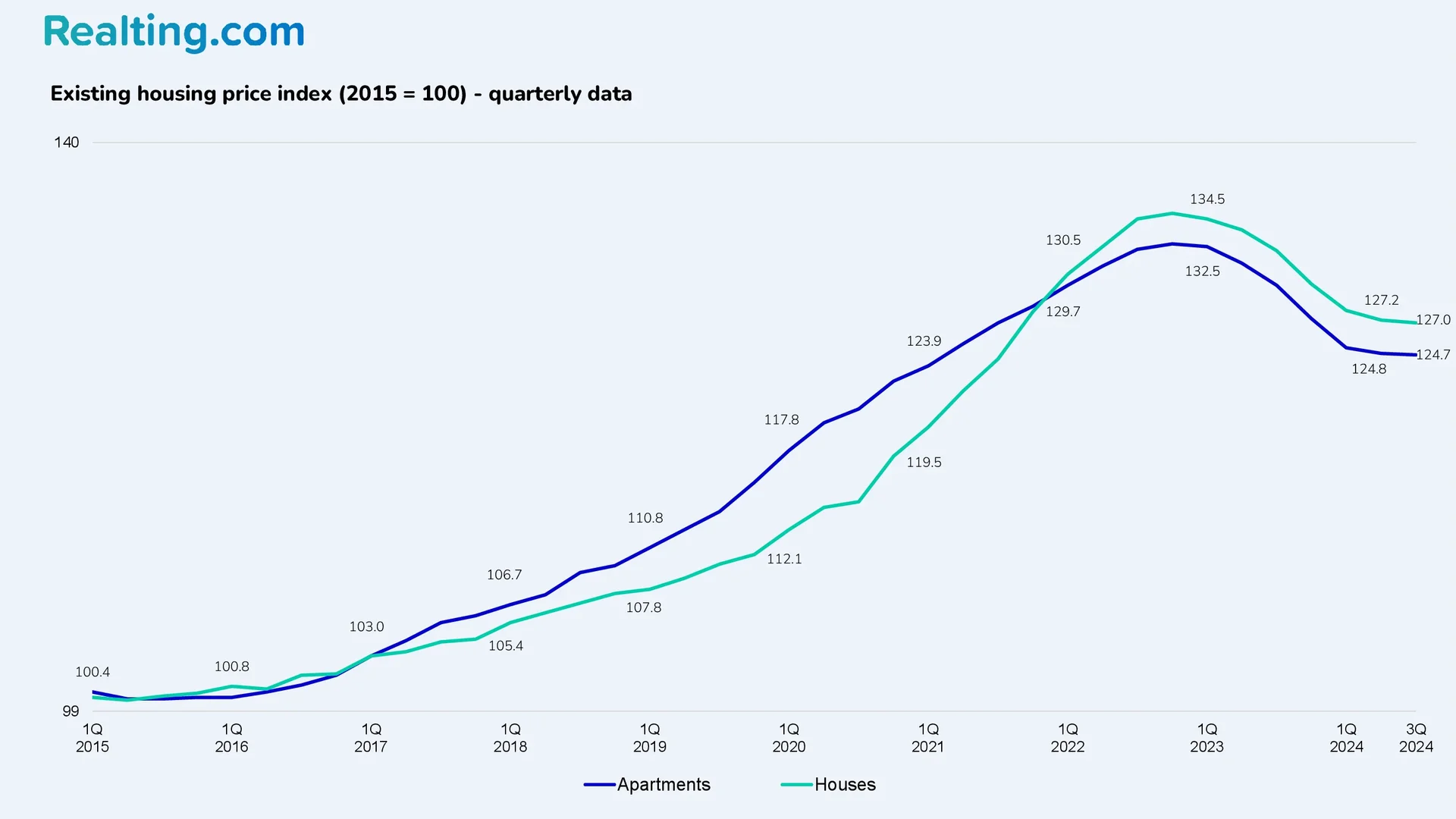

According to data from INSEE, the housing price index in France has fallen for the sixth consecutive quarter. The country has established the following housing price indices:

- French Residential Property Price Index for Q2 2024 was set at 126.3, which is 0.5% less than in the 1st quarter of 2024 and 4.6% less than in the 2nd quarter of last year.

- The new home price index for Q2 2024 was 128.5, down 0.2% from the previous quarter and down 1.3% from the same period in 2023.

- In terms of existing residential real estate, INSEE provides data for the 3rd quarter of 2024. The price index for existing residential real estate in the 3rd quarter, the second quarter of 2024 was 125.8, which is 0.1% less than in the second quarter of this year and 3.9% less than in the third quarter of 2023.

The price indices for existing housing in terms of apartments and houses based on the results of the 3rd quarter of 2024 are as follows:

- The existing home price index fell 0.1% to 124.7 in Q2 2024 — compared to the 3rd quarter of last year, the decrease was 3.9%;

- The existing home price index fell 0.2% from Q2 2024 to 127.0 — compared to the 3rd quarter of last year, the decrease was 3.9%.

- Below is data on the level of housing prices in various cities and regions of France.

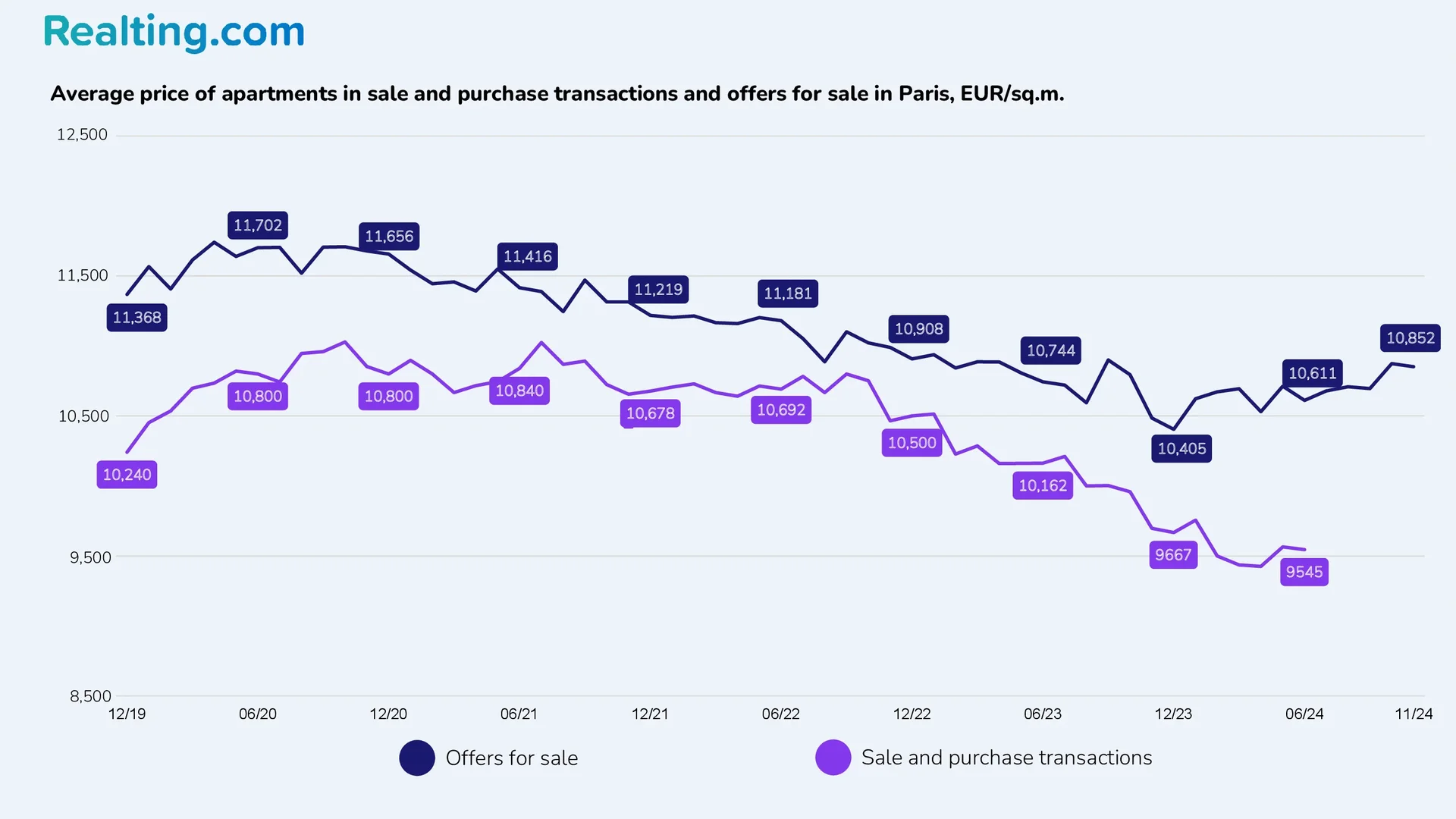

According to the platform data.gouv.fr, the average price per square meter of an apartment in purchase and sale transactions in Paris was 9,545 EUR/sq.m as of June 2024, a 6.1% decrease over the year.

The average asking price for apartments as of November 2024 is 10,852 EUR/sq.m, which is 3.5% more than in November last year. Data on the average asking price for apartments is provided by the portal immobilier.lefigaro.fr.

The National Real Estate Federation of France (FNAIM) provides the following median home sales prices as of November 1, 2024.

|

Largest cities |

||||||

|

Average selling price, EUR/sq.m |

Change |

|||||

|

Paris |

9764 |

9730 |

- |

+1.5% |

-3.1% |

-6.2% |

|

Marseilles |

3237 |

2878 |

5165 |

+0.4% |

-2.8% |

+18.6% |

|

Lyon |

4470 |

4423 |

- |

+0.3% |

-6.0% |

-1.6% |

|

Toulouse |

3356 |

3298 |

3600 |

+1.3% |

-3.2% |

+6.4% |

|

Nice |

5055 |

4797 |

- |

-0.1% |

+1.5% |

+22.5% |

|

Nantes |

3488 |

3324 |

4187 |

-0.4% |

-8.0% |

-1.1% |

|

Strasbourg |

3652 |

3662 |

- |

+1.5% |

-4.9% |

+17.4% |

|

Montpellier |

3310 |

3162 |

4387 |

+1.8% |

-3.6% |

+10.1% |

|

Bordeaux |

4551 |

4399 |

5084 |

+1.1% |

-4.0% |

-0.2% |

|

Lille |

3522 |

3786 |

2664 |

+0.2% |

-1.3% |

+12.3% |

|

Regions of France |

||||||

|

Average selling price, EUR/sq.m |

Change |

|||||

|

Auvergne-Rhone-Alpes |

2739 |

2985 |

2502 |

-0.6% |

-2.3% |

+13.5% |

|

Burgundy-Franche-Comté |

1552 |

1629 |

1511 |

-0.3% |

-1.6% |

+12.1% |

|

Brittany |

2455 |

2890 |

2286 |

-1.2% |

-1.1% |

+32.9% |

|

Center Val de Loire |

1723 |

2018 |

1616 |

-1.2% |

-1.1% |

+12.1% |

|

Corsica |

3399 |

3224 |

3561 |

-0.8% |

-2.6% |

+14.3% |

|

Grand Est |

1776 |

2008 |

1604 |

-0.3% |

-2.4% |

+13.8% |

|

Upper France |

1852 |

2209 |

1715 |

-2.0% |

-1.8% |

+8.9% |

|

Ile-de-France |

5522 |

6094 |

3940 |

-1.0% |

-3.5% |

-0.2% |

|

Normandy |

2059 |

2283 |

1952 |

-2.3% |

-1.3% |

+18.6% |

|

New Aquitaine |

2306 |

2880 |

2078 |

-1.0% |

-3.2% |

+14.0% |

|

Occitania |

2309 |

2551 |

2163 |

+0.3% |

-1.6% |

+14.5% |

|

Pays de la Loire |

2412 |

2910 |

2218 |

-1.9% |

-2.7% |

+19.0% |

|

Provence-Alpes-Cote d'Azur |

3813 |

3694 |

4170 |

-0.1% |

-0.6% |

+19.0% |

Interesting fact

The portal “Notaries of France” provides interesting statistics on the age of sellers who most often sell residential real estate. Thus, the portal reports that from 2019 to 2023, the distribution of housing sales depending on the age of the seller remained virtually unchanged: elderly people accounted for approximately every second housing sale on the market. However, since the beginning of 2024, their share has increased, and by the end of the 2nd quarter of 2024, it amounted to 56%.

The Notaries of France portal reports that the average age of a seller at the end of the second quarter of 2024 was 61 years old — a year ago, the average age was 59 years and 10 months.

Share of existing residential sales by seller age in France in Q2 2024 and change over the year:

- Under 30 years old – 2%.

- From 30 to 39 years old – 12% (-2 percentage points per year).

- From 40 to 49 years old – 14% (-1 p.p. per year).

- From 50 to 59 years old – 16% (-1 percentage point per year).

- From 60 to 69 years old – 23% (+1 percentage point per year).

- 70 years and older – 33% (+3 p.p. per year).