How to Buy Real Estate in Germany: the Market Situation and the Process of the Transaction

Anyone can buy a house in Germany. The advantage for locals will be only in the case of a mortgage, as foreigners need to make a much larger deposit. In this material, we will tell you how much apartments in German cities cost, how you can buy them, and what associated costs to count on.

Summary of the Situation on the German Real Estate Market

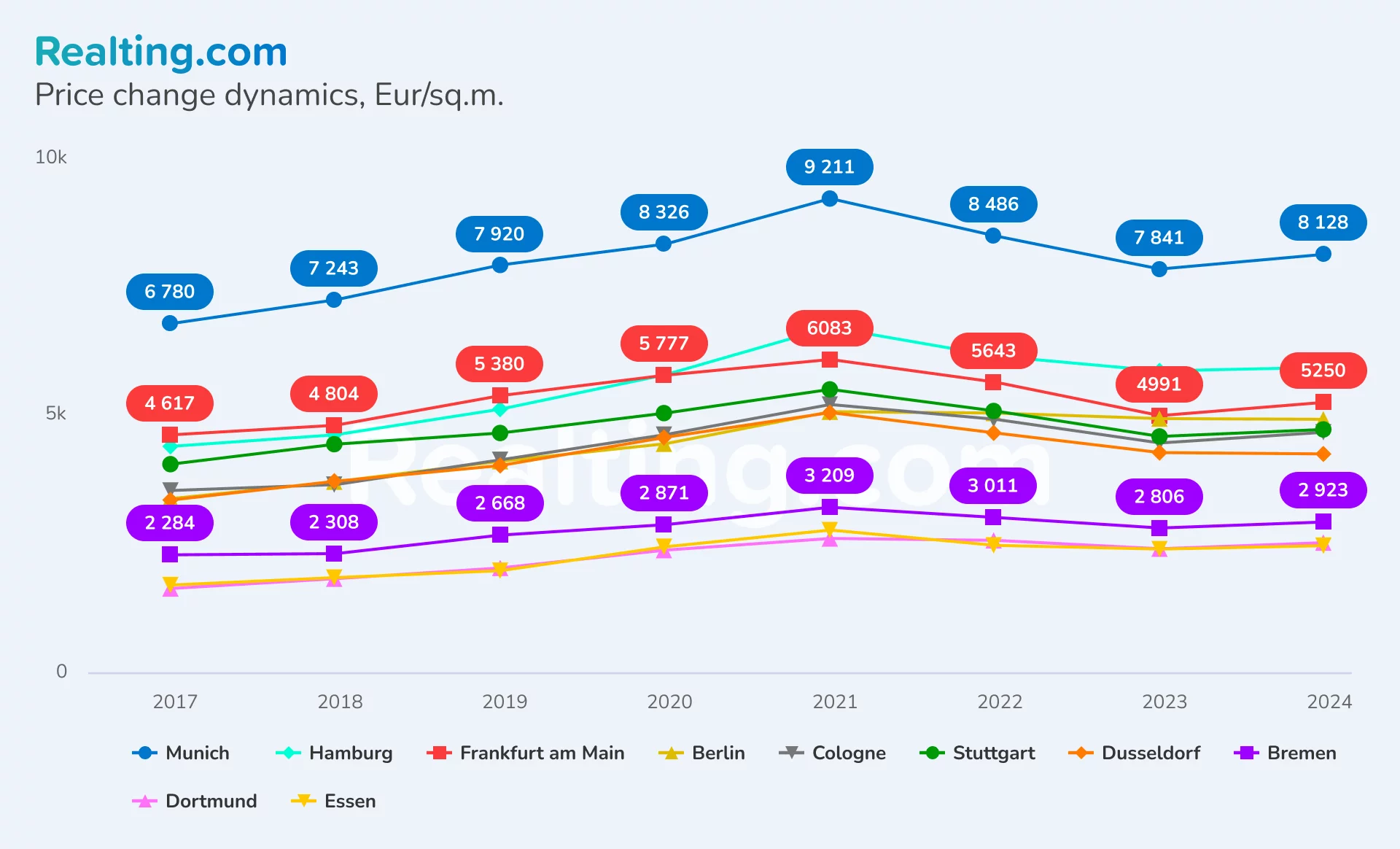

From the end of 2022 until the end of 2023, we have seen a drop in prices on the German real estate market. This was particularly pronounced in the major cities, where prices had been rising for many years. The reason for the fall was the massive increase in interest rates on the market.

The European Central Bank has raised the key interest rate several times since the summer of 2022 — this caused an increase in the cost of lending and led to a decrease in demand for real estate and then a decrease in prices for objects, as well as an increase in the number of offers.

As of the beginning of 2024, the German real estate market is experiencing a situation of stabilization and price correction. Many experts of the German market agree that such a trend will be observed throughout 2024 and up to 2025 (here it is important to take into account that the correction can be both upward and downward, depending on the influence of many factors). In turn, in the long term, prices are expected to rise gradually.

Therefore, despite the current decline, real estate in Germany is still considered a safe investment — this applies primarily to large cities.

And now about prices.

Apartment Prices in Major German Cities

House prices in major German cities (according to immowelt.de):

|

City |

Minimum price, Eur/sq.m* |

Average price, Eur/sq.m |

Maximum price, Eur/sq.m* |

|

Berlin |

2594 |

4919 |

9734 |

|

Hamburg |

3226 |

5929 |

11,858 |

|

Munich |

4901 |

8128 |

15,094 |

|

Cologne |

2427 |

4668 |

8921 |

|

Frankfurt am Main |

2498 |

5250 |

10,500 |

|

Düsseldorf |

2488 |

4246 |

8492 |

|

Stuttgart |

3057 |

4723 |

8379 |

|

Dortmund |

1461 |

2522 |

4806 |

|

Essen |

1274 |

2462 |

4925 |

|

Bremen |

1585 |

2923 |

5530 |

* The minimum and maximum limits are approximate, as the cost per square meter of housing depends greatly on the location, condition, age, and area of the apartment you need.

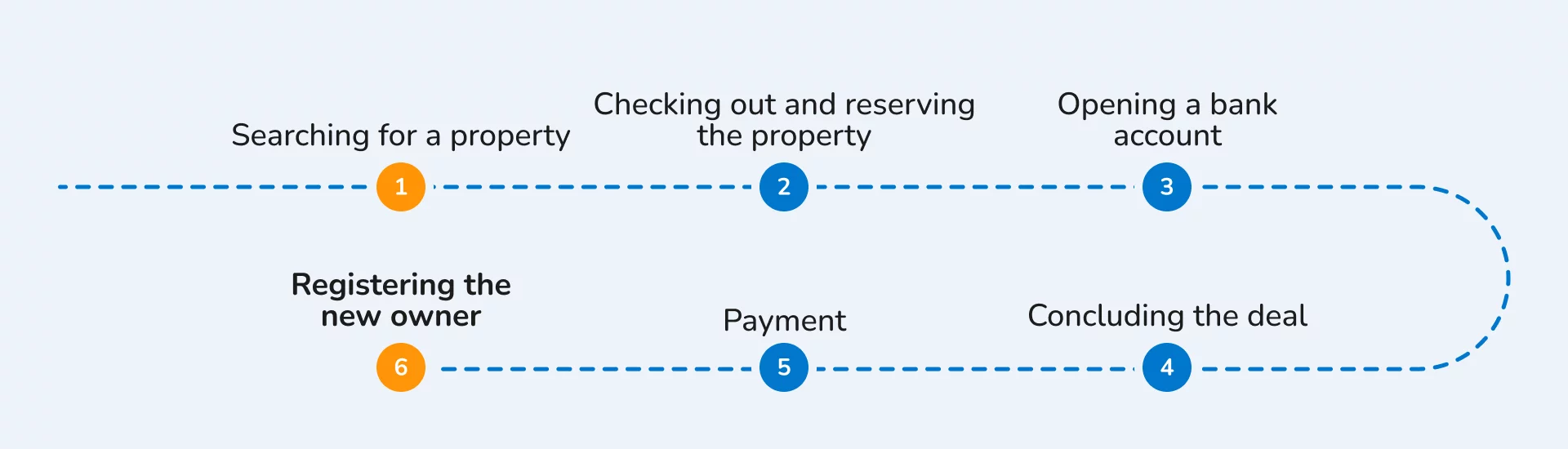

Step-by-Step Procedure for Buying Real Estate in Germany

The main condition for real estate transactions on the German market is the confirmation of the legal origin of the financial means used for the purchase of the object.

To purchase residential or commercial real estate in Germany, a potential buyer should present the following documents:

- A copy of an identity document (for individuals), or an extract from the commercial register (for legal entities).

- A certificate from the bank about the state of the account, confirming the availability of sufficient funds and the seriousness of intentions to purchase the selected property. This certificate is required at the stage of reservation of the object.

The process of buying German real estate is as follows:

1. Searching for a property

The competition in the real estate market in Germany is very high, and the choice of properties is small. So, have patience and plan enough time to find the right property for you.

2. Checking out and reserving the property

Before buying a property, you should look at the land registry (Grundbuch)—there you can see who owned the property before and who owns it now, if there are any encumbrances, etc. It is recommended to look at the following documents: the articles of incorporation, minutes of meetings of owners, the economic plan, and the calculation of utilities.

After a thorough check, reserve the property by making an offer to the seller to buy it.

3. Opening a bank account

It is possible to pay for the transaction either from a German or any other foreign account*.

* At the moment, it is difficult for Russians and Belarusians to buy real estate in Europe, especially in Germany. However, it is possible under the following conditions:

- If the buyer does not have a residence permit in Europe, but has an account in a European bank with sufficient funds to buy real estate and pay for related expenses, he can buy housing or commercial property in Germany. In this case, he is free to dispose of the money in the account, if his accounts are not frozen due to sanctions.

- With an indefinite residence permit in the EU, the buyer can transfer unlimited amounts, take loans in German banks, invest in shares, and make any other transactions on a par with citizens of this country.

- If the account is opened in a non-EU country (Turkey, Georgia, etc.), German banks are likely to refuse to open it because of difficulties in verifying the origin of funds. However, if Russians and Belarusians have transparent sources of income, the probability of opening an account in a German bank is about 50%.

For Ukrainian citizens, the problem is withdrawal of money from local banks.

4. Concluding the deal

You have to go to a notary to sign all contracts. Immediately after signing the sales contract, the notary sends an application to the local court (Grundbuchamt) for the preliminary registration of the buyer as the new owner.

5. Payment

In Germany, there are two popular methods of payment: payment directly to the seller or through a notary public trust account. In the second case, the notary creates a special escrow account that is tied to a specific transaction. Once the buyer transfers the full amount there, the notary redirects it to the seller.

In all payment options, the seller receives the money only after the notary confirms that all necessary conditions for the purchase have been met. These conditions include pre-registering the title in favor of the buyer, obtaining a certificate from the bank authorizing the removal of encumbrances (if any), and obtaining permission from the home manager to sell and buy.

6. Registering the new owner

After receiving the full amount, the notary sends the application to the Land Court for the final registration and, at the same time, the removal of the provisional.

All data is stored in the electronic cadastre (land register). The owner has the right to request an extract from the registry at any time.

It usually takes two to four months to complete the transaction.

Additional Costs When Buying Real Estate in Germany

Ancillary fees are a significant expense when buying a property in Germany. They can amount to about 10% (or even more) of the purchase price of the property. Let's list these associated costs.

Property transfer tax (Grunderwerbssteuer)

This tax is usually between 3.5% and 6.5% of the purchase price. The exact rate will vary depending on the region in which you purchase the property. Berlin, for example, has a rate of 6%, and Munich has a rate of 3.5%.

Notary fees and property registration

The approximate cost of notary fees and registration of ownership in the land registry is 1.5–2% of the purchase price of the property.

Real estate agent's fee (Maklerprovision)

Real estate buyers in Germany can pay no more than 50% of the fee intended for the agent. This rule has been in effect in the country since December 2020, when a new law came into force.

The amount of the real estate agent fee in Germany is not clearly specified, but on the local market, there is a tacit rule that the maximum amount should be 7.14%. This means that you, the buyer, will not have to pay more than 3.57%.

Buying a House in Germany with a Mortgage

Foreigners can take out a mortgage to buy a house in Germany, but they will need to make a larger deposit than residents. It is desirable to have 20–30% of the property value as equity.

Mortgage processing in Germany takes about a month, and the loan is usually granted for an average of 20 years.

The interest rate on a mortgage in Germany is now 3.5%.

Author

I am responsible for editorial work. I write expert interviews and guides.