China’s Real Estate Crisis: The Popping price bubble and incomplete houses

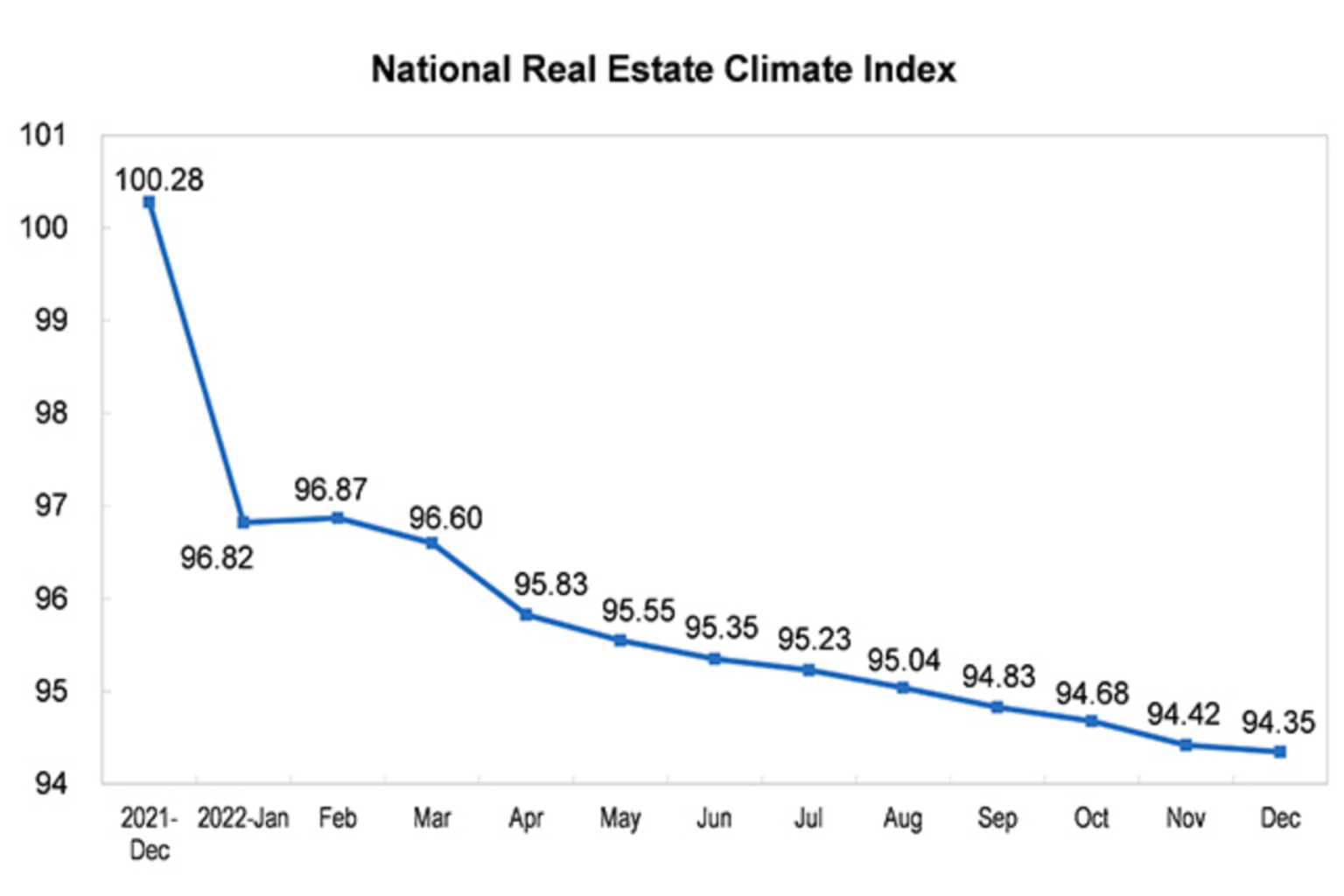

Amid rapidly rising real estate markets in many countries, it is shocking to read the news about the collapse of the real estate market in China. The world’s second-largest economy is under serious threat because of the real estate market crisis, which recently accounted for 30% of the country’s GDP. That said, the results of 2022, which were recently released, are disappointing.

What’s going on in China’s real estate market

The results of 2022 are disappointing: Profits of the largest developers in China declined by more than 90%, consumer demand continues to fall, followed by the cost of apartments.

According to the report, investment in national real estate development in 2022 amounted to 13,289.5 billion yuan (about €1,799 billion), 10% less than the previous year. Among them, investment in housing was 10,064.6 billion yuan, down 9.5%.

In 2022, the area of residential development was 6,396.96 million square meters, down 7.3% from the previous year. The commissioned area of residential buildings was 862.22 million square meters, a decrease of 15%.

According to WSJ, apartment sales across the country by the country’s largest developers have declined annually for 13 months in a row. As a result, millions of apartments that were announced to buyers have not entered the market — in a growing crisis, some construction projects have not been completed. Part of the mortgage debtors were going to stop paying on the loan, because it is absolutely unclear whether their apartment will be completed.

As for the segment of luxury real estate, and here everything does not look good. At the end of 2022, sales of luxury homes worth more than 50 million yuan ($7.3 million) fell by 40% in China compared to the previous year. The secondary luxury real estate market worth more than 150,000 yuan per square meter «sagged» by 52%, and sales of homes worth more than 10 million yuan ($1.5 million) fell to the 2017 level and almost halved compared to 2021.

There are also problems in the commercial real estate market. In 2022, the commercial housing area was 1,358.37 million square meters, down 24.3% from the previous year. Commercial housing sales totaled 1,330.8 billion yuan (about €1,803 billion), down 26.7%.

At the same time, the amount of supply of commercial real estate in the market is growing. At the end of 2022, commercial housing for sale totaled 563.66 million square meters, up 10.5% from the previous year.

What caused the crisis?

According to some experts, the cause of this crisis was the excessive regulation of the market by the authorities. The fact is that just a few years ago in China there was a sharp increase in demand for real estate, which provoked the same rapid rise in prices. As a result, the country’s government decided to «cool» the market by adopting in 2020 the law «three red lines» which eventually became unaffordable for most developers. The basis of the law was three limits for construction companies that borrowed money: the debt-to-assets ratio must be at least 70%, the debt-to-capital ratio must be at least 100%, and cash and its equivalents to short-term debt must be at least one.

As a result, more than 30 major construction companies (including the «giant» China Evergrande Group) defaulted on their international debt. The problems grew like a snowball: the buyers, learning about the problems of developers, stopped buying apartments in new buildings, thereby provoking a new wave of crisis.

The main reasons for the decline in the market of luxury real estate are limited supply and a reduction of the investment attractiveness of such purchases in general. According to China Real Estate Information, last year only 5 percent of buyers of luxury real estate were investors. There were fewer buyers aged 30 to 40 and more aged 45 and older.

Then came the Covid-19 lockdown, which put already frozen construction projects on hold and further reduced the flow of outside investment. It seemed that even nature was against construction companies — in July 2021, China experienced the heaviest rains, causing flooding in parts of the country.

What is the market outlook?

The beginning of the year was marked by a decrease in the cost per square meter of housing. Now home prices in 45 percent of Chinese cities with more than 1 million people are less than 10,000 yuan (about $1476) per square meter.

According to the central bank’s quarterly survey, the number of Chinese people intending to buy homes at the beginning of the year has fallen to about a six-year low, since there are more of those who think prices will fall than those who think they will rise.

Until recently, central government policymakers have refrained from any broad assistance to the real estate sector, explaining that «houses are for the living, not for speculation» In the summer of 2022, however, some city governments did announce the creation of bailout funds for construction companies. All this was supposed to solve the urgent difficulties of broken funding chains of developers and alleviate social problems and possible systemic financial risks caused by mortgage boycotts and the suspension of construction of housing projects.

On December 21, housing authorities in Nanjing in eastern China announced a series of policy changes, including a reduction in the down payment ratio. In addition, Zhengzhou, a city of nearly 13 million people, announced in mid-December that college students could enjoy the same preferential policy as local residents. Finally, Xiamen and Foshan in southern China lowered their restrictions in early December.

Experts believe that the real estate market may gradually stabilize, but homebuyer confidence has not yet been restored. However, the confidence rate should continually strengthen as the economy stabilizes. If demand support from the government continues, there is a chance that the real estate market will not begin to «revive» until the second quarter of 2023.