How to buy property in Thailand: a detailed guide for investors

The number of real estate transactions in Thailand has increased by almost 50% in 2023 year-to-year. For which properties has the demand grown especially noticeably? Read about the turnover of transactions, forms of ownership, and value of real estate in different Thai cities, as well as promising areas for investment, in our large guide with analysis and expert commentary.

Forms of ownership in Thailand

In Thailand, foreigners can own property in two forms: Freehold (full ownership) and Leasehold (long-term rental). And here there are nuances: in full ownership (Freehold), a foreigner can buy an apartment only in the condominium (in this case, each apartment has its owner, but the common area is in joint shared ownership), but if we are talking about buying an apartment in an apartment building, then foreigners are only available for long-term lease (Leasehold).

If there is a goal to buy a villa with land, a foreigner can fully own only the house (structure). Land can be registered by a foreign individual only in the form of a long-term lease for an average period of up to 90 years.

To own the land, you can create a company in Thailand, as they are allowed to own plots. The foreign share in the company must be 49% or less.

And another option: foreigners can invest at least 40 million baht ($1,127,714) in a project approved by the Board of Investment. This will give them the right to buy up to 1600 square meters of land.

Number of transactions and real estate costs in Thailand

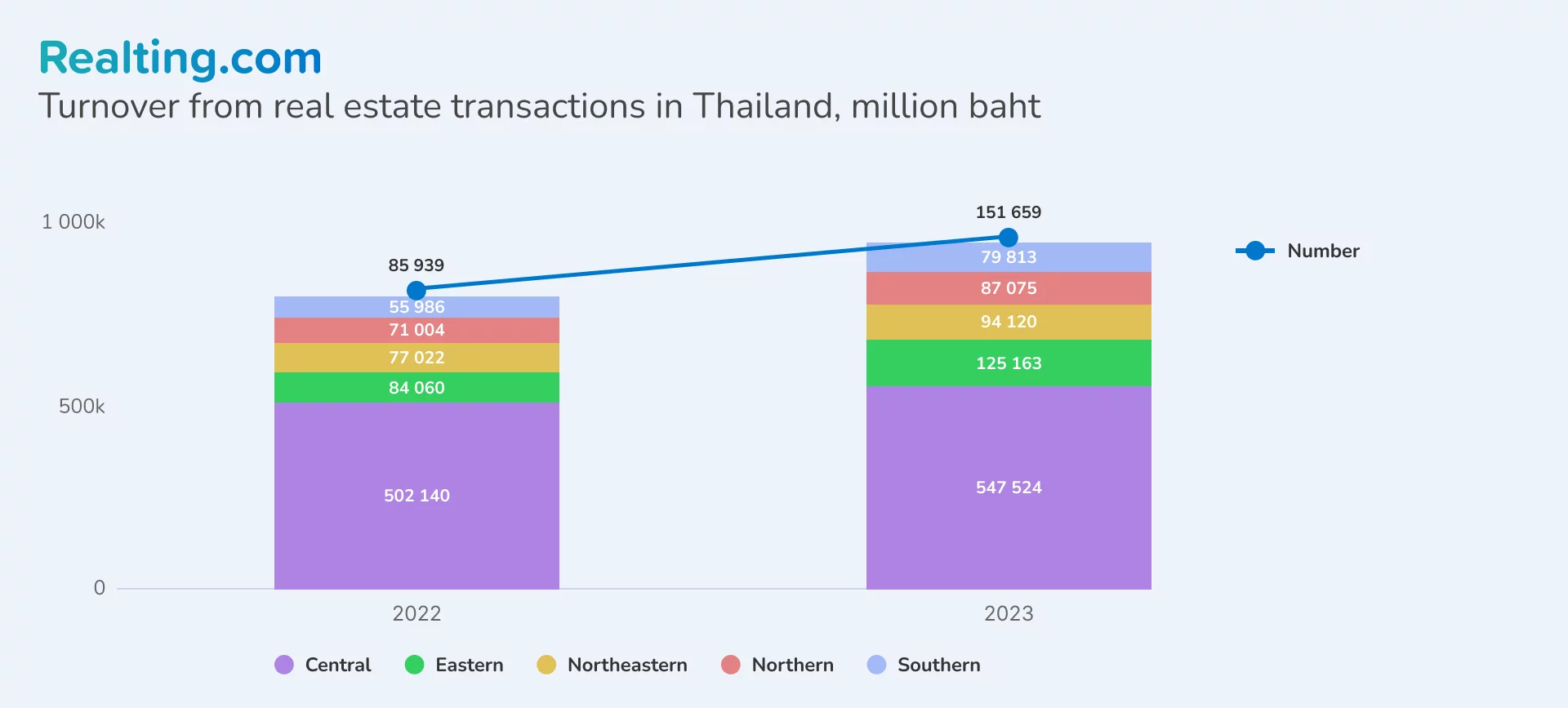

According to the Bank of Thailand, in 2023 in Thailand, the money turnover from real estate sales and purchases amounted to 951,540.99 million baht ($26.6 billion), an increase of 20% compared to the previous year. The maximum cash turnover was recorded in the country's central region, and the greatest growth occurred in the East — 1.5 times.

During the same period, the number of transactions increased by 43% and exceeded 150 thousand. The structure of transactions is dominated by residential real estate, which accounts for 93% of the total number of real estate transactions. However, it is worth noting the increased demand for commercial properties — transactions with them were made 7.6 times more often than in 2022. The number of transactions with land plots also increased — more than twice over the year.

Demand in the Thai real estate market is formed by Russians and investors from mainland China and Hong Kong. Also, major investors are natives of the United States, Singapore, Taiwan, Japan, and the United Kingdom.

The prices of Thai real estate, using three cities as examples, are as follows:

|

Bangkok |

฿ per 1 sq.m | $ per 1 sq.m * | |

|

In the city's center |

193,043 |

5411 |

|

|

Outside the center |

88,894 |

2492 |

|

|

Nonthaburi |

In the city's center |

97,500 |

2733 |

|

Outside the center |

100,000 |

2803 |

|

|

Pattaya |

In the city's center |

63,833 |

1789 |

|

Outside the center |

42,400 |

1188 |

|

as of 15.03.2024

Source: Numbeo.

Buying property in Thailand by the steps

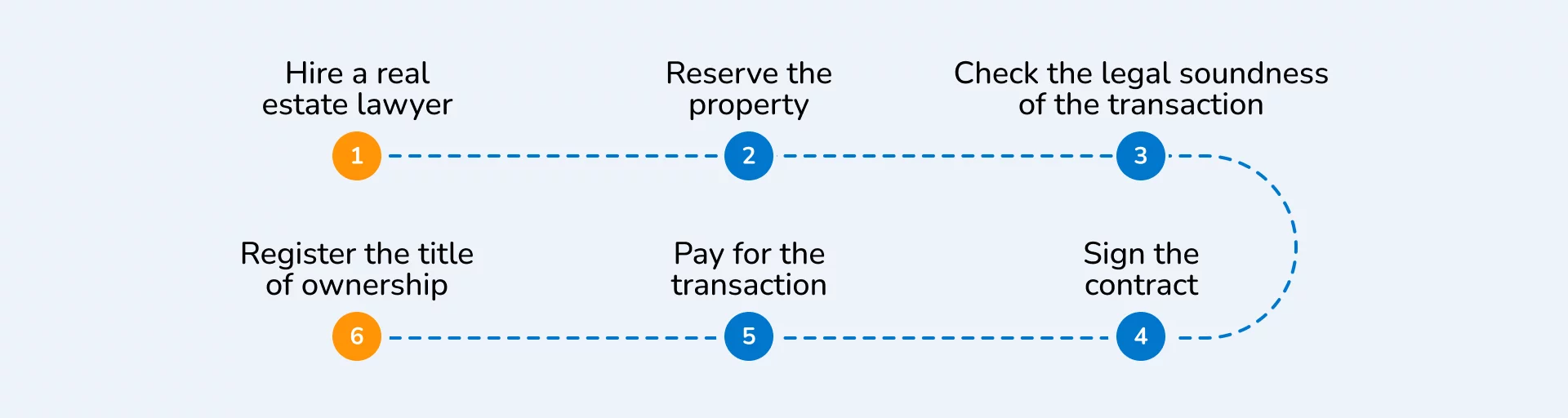

Here's what you need to do step by step to buy real estate in Thailand:

1. Hire a real estate lawyer.

Since this industry is still unregulated in the country, a lawyer will be able to provide you with more security than just a real estate agent.

2. Reserve the property.

The reservation agreement contains detailed information about the parties to the transaction, important data about the property, as well as details of the parties and the dates of payment.

The buyer pays 1% of the object's value as a deposit to the seller, which causes the object to be temporarily withdrawn from sale. The deposit can be paid in cash or transferred to the seller's account.

3. Check the legal soundness of the transaction.

This is where a certified attorney comes in handy. He will check the following aspects: the builder, the condition of the property, the presence of encumbrances, arrests, pledges, and the rights of third parties.

4. Sign the contract.

Shortly after making the deposit, it is time to get acquainted with the contract of sale. It includes the following information: the conditions of the purchase of the property and the way of its registration; the costs associated with the transaction and the subsequent maintenance of the property; and the penalties for breach of contract.

5. Pay for the transaction.

In Thailand, there are two ways to pay for a transaction:

- When buying a new building, payment can be made by transferring funds to the developer's account as specified in the contract. You can do this from an account in any country, provided that the account is registered in the name of the buyer. It is also possible to pay from the account of a legal entity where the buyer is the founder.

- When buying on the secondary market, you need to open an account in one of the banks in Thailand and transfer the money to it from your account in any other country. At registration of the property at the Land Department, the buyer gives the seller a check for the specified amount.

Important: When registering property in full ownership (freehold), it is important that the funds come from abroad. This fact is verified by the Land Department at the time of the registration of the transaction. In the case of the registration of the property in the form of a leasehold, payment can be made in any available way.

Also note that in Thailand you can legally buy housing even for cryptocurrency.

6. Register the title of ownership.

After all payments under the contract are made, the title or right to a long-term lease is registered at the Land Department. The registration process is necessarily attended by representatives of the developer (seller) and the buyer.

Closing the deal usually takes 30 to 60 days.

Related costs when buying property in Thailand

- Transfer fee: 0.01%-2.00% (paid by buyer).

- Real estate agent's fee: 3%–5% (paid by seller).

- Withholding tax: 1% of the advertised amount or the appraised value of the property, whichever is higher (paid by the seller). The rate may vary depending on the type of property and the circumstances of the sale.

- Stamp duty is 0.50% (paid by the seller). It is charged upon registration of the transaction and can be paid by either the buyer or the seller, depending on the terms of the contract.

- A special business tax is charged to the seller at about 3.30% of the property value. This tax applies if the property is sold less than 5 years after purchase. In addition, a municipal tax of 10% of the amount of the special tax is added.

- Registration fee, 2% (usually paid by the buyer).

- The cost of legal services is negotiable.

Buying a home in Thailand with a mortgage

Until recently, Thai banks rarely offered mortgages to foreigners, but now it is possible. It is worth considering that the chances are much higher if you meet the following criteria:

- work legally in Thailand for at least 1–2 years before applying for a mortgage and have a stable income of between THB 80,000 and THB 140,000 (€2,153-3,768);

- have dual citizenship, one of which is Thai;

- the advantage will also be the presence of a Thai residence permit.

At the same time, the down payment usually ranges from 30% to 40% of the value of the property, and the remaining 70% to 60% can be taken as a loan from a bank.

The interest rate on a mortgage in Thailand for 20 years with a fixed rate is 5.41%. It may vary depending on the economic situation and individual conditions of the borrower.

There is also an option of registration of installments from the developer: during construction, it will be interest-free, and then it will already go 3-5% per annum on the balance of the debt.

Thailand's promising regions for investment

The director of "Zhilfond," Alexander Chernokulsky, informed us that investors are becoming more and more interested in mainland real estate in Thailand.

— Thailand is interesting from the point of view of investment due to the stable growth of real estate prices. If you invest in condos at the construction stage, you can expect an average increase in value of up to 50% by the time of delivery of the object.

— Thailand is interesting from the point of view of investment due to the stable growth of real estate prices. If you invest in condos at the construction stage, you can expect an average increase in value of up to 50% by the time of delivery of the object.

But also, after renting out the property or buying a secondary property, investors can earn money on rent. The rental market in Thailand is highly profitable, although not homogeneous. Thus, the profitability of rental real estate in Phuket is high in season and low in the off-season. In major cities — Bangkok, Pattaya, Chiang Mai — seasonality is not so pronounced: in season here, you can rent an apartment for a long term for 20 thousand baht per month (about $560), and out of season — about 15 thousand baht ($420), simply because the market has released more options.

In Phuket, rental yields in Q4 2023 range from 5.45% to 6.45% depending on location and property size, with an average of 5.87%, according to Global Property Guide research. In Bangkok, rental yields range from 2.19 to 9.52% (average 4.88%), Pattaya from 3.24 to 10.04% (average 6.25%), and Chiang Mai from 5.5 to 7.28% (average 6.32%).

According to our forecasts, in 2024, the most demanded destinations for investors will be cities, especially resort cities like Pattaya. The city is actively developing, while the real estate market here is still significantly democratic in terms of prices.

In 2026, near Pattaya, it is planned to complete the construction of the airport — there will be a transportation hub, which will relieve Bangkok and strengthen the tourist flow in Pattaya. Also, between Pattaya and Bangkok, which is only 150 km away, a railroad is being built, which will allow people to get from city to city in just 30 minutes. This will certainly affect the price per m² in the long term, which increases the investment attractiveness of real estate here.

The dynamics of the redistribution of demand from the island part of Thailand to the mainland were noticeable as early as 2023. According to the Bank of Thailand, in the first 10 months of 2023, the total transaction volume for real estate purchases in the central region (Bangkok, Ayutthaya, Kanchanaburi), which accounts for about 60% of demand, increased by 17.7% year-on-year.

The northeast region (Amnat Charoen, Buriram) saw transaction volume increase by 25% over the same period; the northern region (Chiang Mai, Lamphun, Lampang) by 26.4%; the southern region (Phuket Island, Samui) by 46.3%; and the eastern region (Chachoengsao, Chonburi, Rayong) by 63%.

FAQ on buying real estate in Thailand

What are the forms of real estate ownership in Thailand?

What additional costs may be incurred when buying a property in Thailand?

What taxes do I have to pay when buying and owning Thai real estate?

Can I take out a mortgage or installment loan in Thailand to buy a home?

What are the most promising areas for real estate investment in Thailand?

What is the yield from renting out real estate in popular cities in Thailand?

Author

I am responsible for editorial work. I write expert interviews and guides.

Co-author

Providing readers with quality analysis on global trends in the real estate market.