Property Prices in Oman: Complete Overview by Cities and Types

The Oman real estate market in 2025 demonstrated a sharp reversal: after a year of decline in 2024, prices grew by 17.3% year-over-year by the end of the third quarter. Three consecutive quarters of positive dynamics — this is not a random spike, but a steady recovery trend. At the same time, Oman remains one of the most affordable markets in the Persian Gulf region. Below is a detailed analysis of the dynamics by segments, prices in different governorates, and conclusions about what is happening in the market after a two-year correction.

Price Dynamics in Oman for Residential and Commercial Properties

Over the year, the real estate price index in Oman grew by 17.3% – such data is provided by the National Centre for Statistics and Information of Oman (NCSI) for the 3rd quarter of 2025. Quarterly growth in the 3rd quarter of 2025 amounted to 6.4%.

The commercial real estate price index in the 3rd quarter of 2025 increased by 14.6% year-over-year and by 6.6% quarter-over-quarter. The annual growth in commercial real estate prices was driven by the rise in prices for land plots intended for commercial purposes – over the year, prices for such plots increased by 19%, and compared to the previous quarter, the growth was 9.5%. Prices for industrial land plots in Oman by the end of the 3rd quarter of 2025 grew by 5.5%, while prices for retail real estate decreased by 8.5%.

The residential real estate price index in the 3rd quarter of 2025 increased by 18.7% compared to the 3rd quarter of 2024 and by 6.4% compared to the 2nd quarter of 2025. It is worth noting that throughout the three quarters of 2025, housing prices in Oman showed growth, while throughout the entire 2024 year there was a decline.

If we talk in more detail about the price changes for different types of residential real estate in Oman, the situation is as follows:

- The largest price change was recorded in the apartment segment – over the year, apartment prices in Oman increased by 22.4%, quarterly growth amounted to 7.1%.

- Villas in the 3rd quarter of 2025 became more expensive by 16.5% compared to the 3rd quarter of 2024 and by 3.1% compared to the 2nd quarter of 2025.

- Prices for land plots for residential development increased by 19.6% year-over-year and by 7.4% quarter-over-quarter.

- Prices for other types of residential real estate by the end of the 3rd quarter of 2025 showed a slight decrease compared to the same quarter of 2024 (-0.5%), and a decrease was also recorded compared to the 2nd quarter of 2025 (-1.5%).

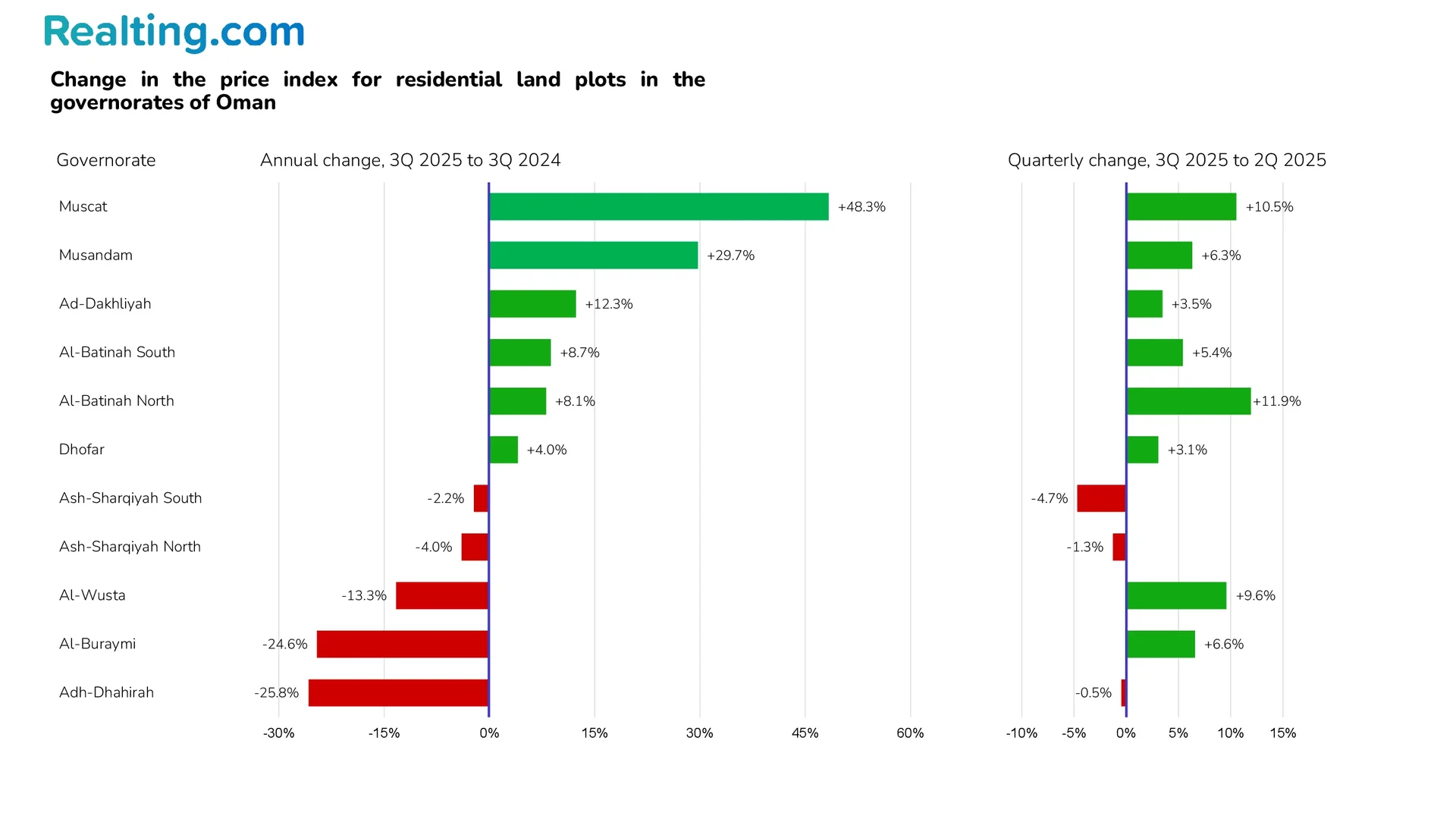

In addition to the general price index for land plots for residential development in Oman, NCSI also publishes statistics for each of the eleven governorates of Oman.

How Much Does it Cost to Buy Housing in Oman?

The Numbeo database provides the following price levels for apartments in Oman:

1. For the whole country

|

Category |

Price range, USD/sq.m |

Average price, USD/sq.m |

|

Price per square meter when buying an apartment in the city center |

from 1170.06 to 3172.17 |

2175.76 |

|

Price per square meter when buying an apartment outside the city center |

from 806.04 to 1790.19 |

1367.21 |

in National Currency - Omani Rial (OMR)

|

Category |

Price range, OMR/sq.m |

Average price, OMR/sq.m |

|

Price per square meter when buying an apartment in the city center |

from 450.00 to 1220.00 |

836.79 |

|

Price per square meter when buying an apartment outside the city center |

from 310.00 to 688.50 |

525.82 |

2. For Muscat

|

Category |

Price range, USD/sq.m |

Average price, USD/sq.m |

|

Price per square meter when buying an apartment in the city center |

from 1560.08 to 3172.17 |

2660.81 |

|

Price per square meter when buying an apartment outside the city center |

from 1193.46 to 1790.19 |

1554.59 |

in National Currency - Omani Rial (OMR)

|

Category |

Price range, OMR/sq.m |

Average price, OMR/sq.m |

|

Price per square meter when buying an apartment in the city center |

from 600.00 to 1220.00 |

1023.33 |

|

Price per square meter when buying an apartment outside the city center |

from 459.00 to 688.50 |

597.89 |

The price levels shown above are Numbeo portal data. However, if you look at Omani portals specializing in posting real estate sales and rental listings (in particular BAYUT.OM), you can see that the actual price range in the country is significantly wider.

Thus, according to current housing sale listings on the BAYUT.OM portal, the average price level in the country looks as follows:

- Apartments, whole Oman. Average price range for apartments – from 45,000 to 160,000 OMR or from 117,000 to 416,000 USD. Per square meter – from 800 to 1300 OMR/sq.m or from 2080 to 3380 USD/sq.m.

- Apartments, Muscat. Average price range for apartments – from 70,000 to 200,000 OMR or from 182,000 to 520,000 USD. Per square meter – from 1200 to 1700 OMR/sq.m or from 3120 to 4420 USD/sq.m.

- Villas, whole Oman. Price range – from 150,000 to 300,000 OMR or from 390,000 to 780,000 USD

- Villas in Muscat. Price range – from 220,000 OMR to 420,000 OMR or from 572,000 to 1,092,000 USD.

It should be noted that villas are a specific type of real estate, many of which belong to the elite segment, and elite real estate often has no clear upper price limit.

Bottom Line

In 2025, the Oman real estate market broke the two-year downward trend and demonstrated confident growth: the overall price index grew by 17.3% over the year, residential real estate became more expensive by 18.7%, and apartments recorded a record increase of 22.4%. The most active growth was shown by land plots for residential and commercial development — this indicates that investors are betting on the long-term development of the market. With average prices of $2080–3380 per square meter across the country and $3120–4420 in Muscat, Oman remains more affordable than neighboring UAE, but more expensive than Saudi Arabia.

Three consecutive quarters of positive dynamics indicate the sustainability of the trend, not a short-term spike. For investors, this means that the market has exited the correction phase and is entering a growth cycle that, judging by the activity in the land segment, may last several years. However, it is worth considering the volatility of individual segments: retail real estate in the 3rd quarter lost 8.5%, which indicates the unevenness of the recovery. The residential sector remains the most stable and promising direction at the same time.